Professional Documents

Culture Documents

Official List of Proposals Special Election - February 25, 2014

Official List of Proposals Special Election - February 25, 2014

Uploaded by

pkampeCopyright:

Available Formats

You might also like

- Association of Engineers Hand BookDocument178 pagesAssociation of Engineers Hand BookAnwar HussainNo ratings yet

- Statuta PSSIDocument112 pagesStatuta PSSIjlbNo ratings yet

- Chapter 7 OutlineDocument2 pagesChapter 7 Outlineapi-301988522No ratings yet

- Props May23Document6 pagesProps May23WDIV/ClickOnDetroitNo ratings yet

- Allegan County May ElectionsDocument5 pagesAllegan County May ElectionsWXMINo ratings yet

- Nov 7 2023 Official List of Proposals - 202309050814187517Document4 pagesNov 7 2023 Official List of Proposals - 202309050814187517Daniel MichelinNo ratings yet

- Van Buren May Elections - ProposalsDocument4 pagesVan Buren May Elections - ProposalsWXMINo ratings yet

- Newaygo May ElectionsDocument2 pagesNewaygo May ElectionsWXMINo ratings yet

- Kalamazoo County Ballot Proposals May 2023Document2 pagesKalamazoo County Ballot Proposals May 2023WXMINo ratings yet

- Initiative Constitutional Amendment and StatuteDocument5 pagesInitiative Constitutional Amendment and StatutelaschoolreportNo ratings yet

- Cass County May 2023 Ballot ProposalsDocument3 pagesCass County May 2023 Ballot ProposalsWXMI100% (1)

- Charlotte Ballot Language ExplanationDocument1 pageCharlotte Ballot Language ExplanationWILX Krystle HollemanNo ratings yet

- Chapter Notes: Chapter 1: Finance Definitions and Property Tax InformationDocument13 pagesChapter Notes: Chapter 1: Finance Definitions and Property Tax Informationapi-309968003No ratings yet

- Montcalm County August Ballot ProposalsDocument4 pagesMontcalm County August Ballot ProposalsWXMINo ratings yet

- St. Joseph County ProposalsDocument1 pageSt. Joseph County ProposalsWXMINo ratings yet

- FY14 BRA Draft Print (Final)Document32 pagesFY14 BRA Draft Print (Final)Susie CambriaNo ratings yet

- 12-13-16 Quarterly Deficit District ReportDocument9 pages12-13-16 Quarterly Deficit District ReportDetroit Free PressNo ratings yet

- Watertown City School District - Budget ResultsDocument3 pagesWatertown City School District - Budget ResultsNewzjunkyNo ratings yet

- Scott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformDocument7 pagesScott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformSarah LittleRedfeather KalmansonNo ratings yet

- Quarterly Deficit District Report December 2015Document10 pagesQuarterly Deficit District Report December 2015Detroit Free PressNo ratings yet

- Unit 4 Sales Tax Fact SheetDocument2 pagesUnit 4 Sales Tax Fact SheetJohn TuringNo ratings yet

- Measure J WordingDocument7 pagesMeasure J WordingLivermoreParentsNo ratings yet

- SRS Settlement RecommendationsDocument12 pagesSRS Settlement RecommendationsaugustapressNo ratings yet

- Senate Bill No. 73: Legislative Counsel's DigestDocument11 pagesSenate Bill No. 73: Legislative Counsel's DigestSouthern California Public RadioNo ratings yet

- Fy10 Budget Summary: TaxesDocument4 pagesFy10 Budget Summary: TaxesRichard100% (1)

- 2012 SB24 Jacob WerblowDocument8 pages2012 SB24 Jacob WerblowrealhartfordNo ratings yet

- Ad Valorem Taxes: Notie LansfordDocument8 pagesAd Valorem Taxes: Notie Lansfordwinblacklist1507No ratings yet

- State Deficit Districts 12.6.12Document9 pagesState Deficit Districts 12.6.12Alan BurdziakNo ratings yet

- A Analyze The Effects of The Following Transactions On The: Unlock Answers Here Solutiondone - OnlineDocument1 pageA Analyze The Effects of The Following Transactions On The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- 6-22-22 Gov McMaster Veto Message R-271 H. 5150 FY 2022-23 Appropriations ActDocument15 pages6-22-22 Gov McMaster Veto Message R-271 H. 5150 FY 2022-23 Appropriations ActLive 5 NewsNo ratings yet

- SB 24 OLR Analysis: Draft RevisionDocument51 pagesSB 24 OLR Analysis: Draft RevisionPatricia DillonNo ratings yet

- SB 213: Bill Draft ChangesDocument5 pagesSB 213: Bill Draft ChangesSenator Mike JohnstonNo ratings yet

- Legislative Session Wrap June 6Document25 pagesLegislative Session Wrap June 6Roxi MackensNo ratings yet

- 2012Document3 pages2012maustermuhleNo ratings yet

- 2006 Ptax CodesDocument87 pages2006 Ptax CodescameronNo ratings yet

- Kent County May ElectionsDocument3 pagesKent County May ElectionsWXMINo ratings yet

- Illinois Grand Bargain OutlineDocument12 pagesIllinois Grand Bargain OutlineKennethDeneauJr.No ratings yet

- Bond Recommendation PresentationDocument24 pagesBond Recommendation PresentationJim ParkerNo ratings yet

- Senate Constitutional Amendment No. 5Document30 pagesSenate Constitutional Amendment No. 5Southern California Public RadioNo ratings yet

- Fiscal Planning and The New Maintenance of Effort Law: Companion Document For Council PresentationDocument39 pagesFiscal Planning and The New Maintenance of Effort Law: Companion Document For Council PresentationParents' Coalition of Montgomery County, MarylandNo ratings yet

- Transportation Funding Brochure July 2015Document7 pagesTransportation Funding Brochure July 2015KOLD News 13No ratings yet

- Memo On Daugaard's Education PlanDocument4 pagesMemo On Daugaard's Education PlanDana FergusonNo ratings yet

- Marion County BallotDocument1 pageMarion County BallotKTLO NewsNo ratings yet

- Articles-of-Agreement With CoverDocument10 pagesArticles-of-Agreement With CoverrersrsrNo ratings yet

- FAQ Facilities Bond IssueDocument6 pagesFAQ Facilities Bond IssueWKYC.comNo ratings yet

- C L C S: Olorado Egislative Ouncil TaffDocument12 pagesC L C S: Olorado Egislative Ouncil TaffCircuit MediaNo ratings yet

- EspLost Special Election NoticeDocument3 pagesEspLost Special Election Noticesavannahnow.comNo ratings yet

- Sun City, AZ - 1974 - "Study of Alternative Forms of Government"Document155 pagesSun City, AZ - 1974 - "Study of Alternative Forms of Government"Del Webb Sun Cities Museum100% (1)

- IDC School Mandate Relief ReportDocument8 pagesIDC School Mandate Relief ReportRich AzzopardiNo ratings yet

- Law About Additional Funds To SchoolsDocument10 pagesLaw About Additional Funds To SchoolsAnonymous X3NoCINo ratings yet

- The Eaton School District Engaged in The Following Transactions DuringDocument1 pageThe Eaton School District Engaged in The Following Transactions Duringtrilocksp SinghNo ratings yet

- 2013 Session AccomplishmentsDocument10 pages2013 Session AccomplishmentsLegitSlaterNo ratings yet

- Robbinsdale Area Schools: Independent School District #281 New Hope, MinnesotaDocument51 pagesRobbinsdale Area Schools: Independent School District #281 New Hope, MinnesotaEli KramerNo ratings yet

- Levy Brochure 2013-15 WebDocument2 pagesLevy Brochure 2013-15 WebldearmoreNo ratings yet

- UCC Summary of The May Revise 2019-20 5.9.19 PDFDocument11 pagesUCC Summary of The May Revise 2019-20 5.9.19 PDFalishaNo ratings yet

- Evaluating School Funding ProposalsDocument8 pagesEvaluating School Funding ProposalspublicschoolnotebookNo ratings yet

- Palo Alto Unified School District (PAUSD) Final Project List For Measure A (2008)Document15 pagesPalo Alto Unified School District (PAUSD) Final Project List For Measure A (2008)wmartin46No ratings yet

- School Districts in Michigan With DeficitsDocument11 pagesSchool Districts in Michigan With DeficitsDetroit Free PressNo ratings yet

- Who Pays NC Teachers?Document13 pagesWho Pays NC Teachers?Gordon SmithNo ratings yet

- 2012 Budget Letter 3 22 12Document3 pages2012 Budget Letter 3 22 12Nick ReismanNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Rochester Community Schools Issues Notice of Impending LayoffsDocument1 pageRochester Community Schools Issues Notice of Impending LayoffspkampeNo ratings yet

- Michael Boyd Arrest and Traffic ReportDocument14 pagesMichael Boyd Arrest and Traffic ReportpkampeNo ratings yet

- Gravel Roads BillDocument6 pagesGravel Roads BillpkampeNo ratings yet

- Developer of Assisted Living Facility Sues Oakland TownshipDocument68 pagesDeveloper of Assisted Living Facility Sues Oakland TownshippkampeNo ratings yet

- Rochester Parking Fee MapDocument2 pagesRochester Parking Fee MappkampeNo ratings yet

- Automation Alley Technolgy Industry ReportDocument13 pagesAutomation Alley Technolgy Industry ReportpkampeNo ratings yet

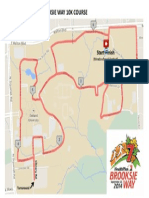

- Brooksie Way 10K CourseDocument1 pageBrooksie Way 10K CoursepkampeNo ratings yet

- Rochester Hills Oil and Gas Drilling Ordinance DraftDocument13 pagesRochester Hills Oil and Gas Drilling Ordinance DraftpkampeNo ratings yet

- Homeowners Guide To Phragmites ControlDocument2 pagesHomeowners Guide To Phragmites ControlpkampeNo ratings yet

- Vinzons-Chato v. COMELECDocument2 pagesVinzons-Chato v. COMELECAntonio BartolomeNo ratings yet

- Apportionment and Voting: Time AllotmentDocument6 pagesApportionment and Voting: Time AllotmentGenevieve Baguhin EngalanNo ratings yet

- Wring 1997Document14 pagesWring 1997Urednik StraniceNo ratings yet

- Ramachandran Homeland Security Testimony - 01.20.22Document21 pagesRamachandran Homeland Security Testimony - 01.20.22The Brennan Center for JusticeNo ratings yet

- Kraken Lawsuit - Motion To Exclude TestimonyDocument251 pagesKraken Lawsuit - Motion To Exclude TestimonyLaw&CrimeNo ratings yet

- Managing Meetings1Document51 pagesManaging Meetings1Hazel KeithNo ratings yet

- The Draft Constitution of Umutu Mixed Secondary SchoolDocument14 pagesThe Draft Constitution of Umutu Mixed Secondary SchoolEmeke ChegweNo ratings yet

- 053 132 ... Bar Council Rules 1Document80 pages053 132 ... Bar Council Rules 1MeowMeowNo ratings yet

- Javellana v. Executive SecretaryDocument17 pagesJavellana v. Executive SecretaryMARIBETH BROWN-OLIVERNo ratings yet

- Liloan, CebuDocument2 pagesLiloan, CebuSunStar Philippine NewsNo ratings yet

- GR 222236 Abayon vs. HRET DigestDocument2 pagesGR 222236 Abayon vs. HRET DigestCyril Llamas100% (2)

- Conduct MeetingDocument32 pagesConduct MeetingRon TeeNo ratings yet

- West Bengal Waqf Rules 2022Document66 pagesWest Bengal Waqf Rules 2022MOSTAFIJUR RAHMANNo ratings yet

- Research - Election Law - Inclusion and Exclusion of VotersDocument3 pagesResearch - Election Law - Inclusion and Exclusion of VotersJunnieson BonielNo ratings yet

- Cef17404140 27350914202106982418Document10 pagesCef17404140 27350914202106982418oguiniandc19No ratings yet

- p2.Lg Comea 2023Document66 pagesp2.Lg Comea 2023Riz Echija0% (1)

- AZ-Gov McLaughlin & Associates For RAGA (Oct. 2014)Document9 pagesAZ-Gov McLaughlin & Associates For RAGA (Oct. 2014)Daily Kos ElectionsNo ratings yet

- Tobias Vs AbalosDocument1 pageTobias Vs AbalosMoairah LaritaNo ratings yet

- Fox Feb 2018 Topline February 15 ReleaseDocument26 pagesFox Feb 2018 Topline February 15 ReleaseFox News100% (2)

- Omnibus Election CodeDocument25 pagesOmnibus Election CodeEdmarjan ConcepcionNo ratings yet

- Batanes - MunDocument13 pagesBatanes - MunireneNo ratings yet

- Pippa Norris The Concept of Electoral Integrity Forthcoming in Electoral StudiesDocument33 pagesPippa Norris The Concept of Electoral Integrity Forthcoming in Electoral StudiesjoserahpNo ratings yet

- Research Paper On Online Voting SystemDocument5 pagesResearch Paper On Online Voting Systemnidokyjynuv2100% (1)

- Condominium Governance FormDocument5 pagesCondominium Governance Formapi-311201132No ratings yet

- Govt 2305 AssignmentDocument4 pagesGovt 2305 AssignmentBrandynne CintadoNo ratings yet

- Booster BylawsDocument32 pagesBooster Bylawsapi-284309282No ratings yet

- PARTY SYMBOLS (Revised) PDFDocument40 pagesPARTY SYMBOLS (Revised) PDFelinzolaNo ratings yet

Official List of Proposals Special Election - February 25, 2014

Official List of Proposals Special Election - February 25, 2014

Uploaded by

pkampeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Official List of Proposals Special Election - February 25, 2014

Official List of Proposals Special Election - February 25, 2014

Uploaded by

pkampeCopyright:

Available Formats

OFFICIAL LIST OF PROPOSALS SPECIAL ELECTION FEBRUARY 25, 2014

CLAWSON PUBLIC SCHOOLS COUNTY OF OAKLAND STATE OF MICHIGAN SCHOOL IMPROVEMENT BOND PROPOSITION Shall the Clawson Public Schools, County of Oakland, State of Michigan, borrow the sum of not to exceed Nine Million Nine Hundred Eighty Thousand ($9,980,000) Dollars and issue its general obligation unlimited tax bonds therefor, in one or more series, for the purpose of paying for the cost of the following projects: -Remodeling, equipping, re-equipping, furnishing, re-furnishing school buildings and other facilities to enhance security and for other purposes; and -Preparing, developing and improving sites at school buildings and other facilities? YES _______ NO _______ The maximum number of years the bonds may be outstanding, exclusive of refunding, is not more than twenty (20) years; the estimated millage that will be levied to pay the proposed bonds in the first year is 0 mills (which is equal to $0.00 per $1,000 of taxable value); and the estimated simple average annual millage that will be required to retire the bonds over twenty (20) years is 3.33 mills annually ($3.33 per $1,000 of taxable value). If approved by the voters, the bonds will be guaranteed by the State under the School Bond Qualification and Loan Program (the Program). The School District currently has $19,635,000 of qualified bonds outstanding and $0 of qualified loans outstanding under the Program. The School District expects to borrow from the Program to pay debt service on these bonds. The estimated total principal amount of additional borrowing is $7,751,500 and the estimated total interest thereon is $9,525,290. The estimated duration of the millage levy associated with the bonds is 26 years and the estimated computed millage rate for such levy is 7.18 mills. The estimated computed millage rate to be levied to pay the proposed bonds may change in the future based on changes in certain circumstances. (Pursuant to State law, expenditure of bond proceeds must be audited, and the proceeds cannot be used for teacher, administrator or employee salaries, repair or maintenance costs or other operating expenses.) WEST BLOOMFIELD SCHOOL DISTRICT COUNTY OF OAKLAND STATE OF MICHIGAN OPERATING MILLAGE RENEWAL PROPOSAL This proposal, if approved by the electors, will allow the West Bloomfield School District to continue to levy the number of operating mills required for the School District to receive revenues at the full per pupil foundation allowance permitted by the State of Michigan.

Shall the limitation on the total amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, situated within the West Bloomfield School District, County of Oakland, State of Michigan, be increased as provided in the Michigan Constitution, in the amount of 18 mills ($18.00 on each $1,000 of taxable valuation), and against all principal residences and other property not exempted by law, by 5 mills ($5.00 on each $1,000 of taxable valuation), both millages to be for a period of ten (10) years, from January 1, 2015 through December 31, 2024, inclusive with 17.8597 mills of the above 18 mills and the above 5 mills (which is a reduction from the 5.1603 mills previously authorized by the electors) being a renewal of authorized millages which would otherwise expire on December 31, 2014 and .1403 mills of the above 18 mills being a restoration of millage lost as a result of the reduction required by the Michigan Constitution? These operating millages if approved and levied, would provide estimated revenues to the School District of Eleven Million Two Hundred Thousand ($11,200,000) Dollars during the 2015 calendar year, to be used for general operating purposes. SALEM-SOUTH LYON DISTRICT LIBRARY Library Millage Proposal Shall the Salem-South Lyon District Library, be authorized to levy an additional tax up to an amount not to exceed 0.495 mills ($0.495 on each $1,000 dollars of taxable value) against all property subject to ad valorem taxation within the Salem-South Lyon Library District for a period of twenty years, 2014 to 2033, inclusive, for the purpose of providing funds for all district library purposes authorized by law; and shall the Salem-South Lyon District Library levy such millage for said such purpose? The estimated revenue of the Salem-South Lyon Library will collect if the millage is approved and levied by the Library in the 2014 calendar year is approximately $310,103 inclusive of all properties located within the Salem-South Lyon Library District. Additionally, it is estimated that the revenue collected by the South Lyon Downtown Development Authority District, as required by law, from all properties within the South Lyon Downtown Development Authority District would be $3,978.

You might also like

- Association of Engineers Hand BookDocument178 pagesAssociation of Engineers Hand BookAnwar HussainNo ratings yet

- Statuta PSSIDocument112 pagesStatuta PSSIjlbNo ratings yet

- Chapter 7 OutlineDocument2 pagesChapter 7 Outlineapi-301988522No ratings yet

- Props May23Document6 pagesProps May23WDIV/ClickOnDetroitNo ratings yet

- Allegan County May ElectionsDocument5 pagesAllegan County May ElectionsWXMINo ratings yet

- Nov 7 2023 Official List of Proposals - 202309050814187517Document4 pagesNov 7 2023 Official List of Proposals - 202309050814187517Daniel MichelinNo ratings yet

- Van Buren May Elections - ProposalsDocument4 pagesVan Buren May Elections - ProposalsWXMINo ratings yet

- Newaygo May ElectionsDocument2 pagesNewaygo May ElectionsWXMINo ratings yet

- Kalamazoo County Ballot Proposals May 2023Document2 pagesKalamazoo County Ballot Proposals May 2023WXMINo ratings yet

- Initiative Constitutional Amendment and StatuteDocument5 pagesInitiative Constitutional Amendment and StatutelaschoolreportNo ratings yet

- Cass County May 2023 Ballot ProposalsDocument3 pagesCass County May 2023 Ballot ProposalsWXMI100% (1)

- Charlotte Ballot Language ExplanationDocument1 pageCharlotte Ballot Language ExplanationWILX Krystle HollemanNo ratings yet

- Chapter Notes: Chapter 1: Finance Definitions and Property Tax InformationDocument13 pagesChapter Notes: Chapter 1: Finance Definitions and Property Tax Informationapi-309968003No ratings yet

- Montcalm County August Ballot ProposalsDocument4 pagesMontcalm County August Ballot ProposalsWXMINo ratings yet

- St. Joseph County ProposalsDocument1 pageSt. Joseph County ProposalsWXMINo ratings yet

- FY14 BRA Draft Print (Final)Document32 pagesFY14 BRA Draft Print (Final)Susie CambriaNo ratings yet

- 12-13-16 Quarterly Deficit District ReportDocument9 pages12-13-16 Quarterly Deficit District ReportDetroit Free PressNo ratings yet

- Watertown City School District - Budget ResultsDocument3 pagesWatertown City School District - Budget ResultsNewzjunkyNo ratings yet

- Scott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformDocument7 pagesScott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformSarah LittleRedfeather KalmansonNo ratings yet

- Quarterly Deficit District Report December 2015Document10 pagesQuarterly Deficit District Report December 2015Detroit Free PressNo ratings yet

- Unit 4 Sales Tax Fact SheetDocument2 pagesUnit 4 Sales Tax Fact SheetJohn TuringNo ratings yet

- Measure J WordingDocument7 pagesMeasure J WordingLivermoreParentsNo ratings yet

- SRS Settlement RecommendationsDocument12 pagesSRS Settlement RecommendationsaugustapressNo ratings yet

- Senate Bill No. 73: Legislative Counsel's DigestDocument11 pagesSenate Bill No. 73: Legislative Counsel's DigestSouthern California Public RadioNo ratings yet

- Fy10 Budget Summary: TaxesDocument4 pagesFy10 Budget Summary: TaxesRichard100% (1)

- 2012 SB24 Jacob WerblowDocument8 pages2012 SB24 Jacob WerblowrealhartfordNo ratings yet

- Ad Valorem Taxes: Notie LansfordDocument8 pagesAd Valorem Taxes: Notie Lansfordwinblacklist1507No ratings yet

- State Deficit Districts 12.6.12Document9 pagesState Deficit Districts 12.6.12Alan BurdziakNo ratings yet

- A Analyze The Effects of The Following Transactions On The: Unlock Answers Here Solutiondone - OnlineDocument1 pageA Analyze The Effects of The Following Transactions On The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- 6-22-22 Gov McMaster Veto Message R-271 H. 5150 FY 2022-23 Appropriations ActDocument15 pages6-22-22 Gov McMaster Veto Message R-271 H. 5150 FY 2022-23 Appropriations ActLive 5 NewsNo ratings yet

- SB 24 OLR Analysis: Draft RevisionDocument51 pagesSB 24 OLR Analysis: Draft RevisionPatricia DillonNo ratings yet

- SB 213: Bill Draft ChangesDocument5 pagesSB 213: Bill Draft ChangesSenator Mike JohnstonNo ratings yet

- Legislative Session Wrap June 6Document25 pagesLegislative Session Wrap June 6Roxi MackensNo ratings yet

- 2012Document3 pages2012maustermuhleNo ratings yet

- 2006 Ptax CodesDocument87 pages2006 Ptax CodescameronNo ratings yet

- Kent County May ElectionsDocument3 pagesKent County May ElectionsWXMINo ratings yet

- Illinois Grand Bargain OutlineDocument12 pagesIllinois Grand Bargain OutlineKennethDeneauJr.No ratings yet

- Bond Recommendation PresentationDocument24 pagesBond Recommendation PresentationJim ParkerNo ratings yet

- Senate Constitutional Amendment No. 5Document30 pagesSenate Constitutional Amendment No. 5Southern California Public RadioNo ratings yet

- Fiscal Planning and The New Maintenance of Effort Law: Companion Document For Council PresentationDocument39 pagesFiscal Planning and The New Maintenance of Effort Law: Companion Document For Council PresentationParents' Coalition of Montgomery County, MarylandNo ratings yet

- Transportation Funding Brochure July 2015Document7 pagesTransportation Funding Brochure July 2015KOLD News 13No ratings yet

- Memo On Daugaard's Education PlanDocument4 pagesMemo On Daugaard's Education PlanDana FergusonNo ratings yet

- Marion County BallotDocument1 pageMarion County BallotKTLO NewsNo ratings yet

- Articles-of-Agreement With CoverDocument10 pagesArticles-of-Agreement With CoverrersrsrNo ratings yet

- FAQ Facilities Bond IssueDocument6 pagesFAQ Facilities Bond IssueWKYC.comNo ratings yet

- C L C S: Olorado Egislative Ouncil TaffDocument12 pagesC L C S: Olorado Egislative Ouncil TaffCircuit MediaNo ratings yet

- EspLost Special Election NoticeDocument3 pagesEspLost Special Election Noticesavannahnow.comNo ratings yet

- Sun City, AZ - 1974 - "Study of Alternative Forms of Government"Document155 pagesSun City, AZ - 1974 - "Study of Alternative Forms of Government"Del Webb Sun Cities Museum100% (1)

- IDC School Mandate Relief ReportDocument8 pagesIDC School Mandate Relief ReportRich AzzopardiNo ratings yet

- Law About Additional Funds To SchoolsDocument10 pagesLaw About Additional Funds To SchoolsAnonymous X3NoCINo ratings yet

- The Eaton School District Engaged in The Following Transactions DuringDocument1 pageThe Eaton School District Engaged in The Following Transactions Duringtrilocksp SinghNo ratings yet

- 2013 Session AccomplishmentsDocument10 pages2013 Session AccomplishmentsLegitSlaterNo ratings yet

- Robbinsdale Area Schools: Independent School District #281 New Hope, MinnesotaDocument51 pagesRobbinsdale Area Schools: Independent School District #281 New Hope, MinnesotaEli KramerNo ratings yet

- Levy Brochure 2013-15 WebDocument2 pagesLevy Brochure 2013-15 WebldearmoreNo ratings yet

- UCC Summary of The May Revise 2019-20 5.9.19 PDFDocument11 pagesUCC Summary of The May Revise 2019-20 5.9.19 PDFalishaNo ratings yet

- Evaluating School Funding ProposalsDocument8 pagesEvaluating School Funding ProposalspublicschoolnotebookNo ratings yet

- Palo Alto Unified School District (PAUSD) Final Project List For Measure A (2008)Document15 pagesPalo Alto Unified School District (PAUSD) Final Project List For Measure A (2008)wmartin46No ratings yet

- School Districts in Michigan With DeficitsDocument11 pagesSchool Districts in Michigan With DeficitsDetroit Free PressNo ratings yet

- Who Pays NC Teachers?Document13 pagesWho Pays NC Teachers?Gordon SmithNo ratings yet

- 2012 Budget Letter 3 22 12Document3 pages2012 Budget Letter 3 22 12Nick ReismanNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Rochester Community Schools Issues Notice of Impending LayoffsDocument1 pageRochester Community Schools Issues Notice of Impending LayoffspkampeNo ratings yet

- Michael Boyd Arrest and Traffic ReportDocument14 pagesMichael Boyd Arrest and Traffic ReportpkampeNo ratings yet

- Gravel Roads BillDocument6 pagesGravel Roads BillpkampeNo ratings yet

- Developer of Assisted Living Facility Sues Oakland TownshipDocument68 pagesDeveloper of Assisted Living Facility Sues Oakland TownshippkampeNo ratings yet

- Rochester Parking Fee MapDocument2 pagesRochester Parking Fee MappkampeNo ratings yet

- Automation Alley Technolgy Industry ReportDocument13 pagesAutomation Alley Technolgy Industry ReportpkampeNo ratings yet

- Brooksie Way 10K CourseDocument1 pageBrooksie Way 10K CoursepkampeNo ratings yet

- Rochester Hills Oil and Gas Drilling Ordinance DraftDocument13 pagesRochester Hills Oil and Gas Drilling Ordinance DraftpkampeNo ratings yet

- Homeowners Guide To Phragmites ControlDocument2 pagesHomeowners Guide To Phragmites ControlpkampeNo ratings yet

- Vinzons-Chato v. COMELECDocument2 pagesVinzons-Chato v. COMELECAntonio BartolomeNo ratings yet

- Apportionment and Voting: Time AllotmentDocument6 pagesApportionment and Voting: Time AllotmentGenevieve Baguhin EngalanNo ratings yet

- Wring 1997Document14 pagesWring 1997Urednik StraniceNo ratings yet

- Ramachandran Homeland Security Testimony - 01.20.22Document21 pagesRamachandran Homeland Security Testimony - 01.20.22The Brennan Center for JusticeNo ratings yet

- Kraken Lawsuit - Motion To Exclude TestimonyDocument251 pagesKraken Lawsuit - Motion To Exclude TestimonyLaw&CrimeNo ratings yet

- Managing Meetings1Document51 pagesManaging Meetings1Hazel KeithNo ratings yet

- The Draft Constitution of Umutu Mixed Secondary SchoolDocument14 pagesThe Draft Constitution of Umutu Mixed Secondary SchoolEmeke ChegweNo ratings yet

- 053 132 ... Bar Council Rules 1Document80 pages053 132 ... Bar Council Rules 1MeowMeowNo ratings yet

- Javellana v. Executive SecretaryDocument17 pagesJavellana v. Executive SecretaryMARIBETH BROWN-OLIVERNo ratings yet

- Liloan, CebuDocument2 pagesLiloan, CebuSunStar Philippine NewsNo ratings yet

- GR 222236 Abayon vs. HRET DigestDocument2 pagesGR 222236 Abayon vs. HRET DigestCyril Llamas100% (2)

- Conduct MeetingDocument32 pagesConduct MeetingRon TeeNo ratings yet

- West Bengal Waqf Rules 2022Document66 pagesWest Bengal Waqf Rules 2022MOSTAFIJUR RAHMANNo ratings yet

- Research - Election Law - Inclusion and Exclusion of VotersDocument3 pagesResearch - Election Law - Inclusion and Exclusion of VotersJunnieson BonielNo ratings yet

- Cef17404140 27350914202106982418Document10 pagesCef17404140 27350914202106982418oguiniandc19No ratings yet

- p2.Lg Comea 2023Document66 pagesp2.Lg Comea 2023Riz Echija0% (1)

- AZ-Gov McLaughlin & Associates For RAGA (Oct. 2014)Document9 pagesAZ-Gov McLaughlin & Associates For RAGA (Oct. 2014)Daily Kos ElectionsNo ratings yet

- Tobias Vs AbalosDocument1 pageTobias Vs AbalosMoairah LaritaNo ratings yet

- Fox Feb 2018 Topline February 15 ReleaseDocument26 pagesFox Feb 2018 Topline February 15 ReleaseFox News100% (2)

- Omnibus Election CodeDocument25 pagesOmnibus Election CodeEdmarjan ConcepcionNo ratings yet

- Batanes - MunDocument13 pagesBatanes - MunireneNo ratings yet

- Pippa Norris The Concept of Electoral Integrity Forthcoming in Electoral StudiesDocument33 pagesPippa Norris The Concept of Electoral Integrity Forthcoming in Electoral StudiesjoserahpNo ratings yet

- Research Paper On Online Voting SystemDocument5 pagesResearch Paper On Online Voting Systemnidokyjynuv2100% (1)

- Condominium Governance FormDocument5 pagesCondominium Governance Formapi-311201132No ratings yet

- Govt 2305 AssignmentDocument4 pagesGovt 2305 AssignmentBrandynne CintadoNo ratings yet

- Booster BylawsDocument32 pagesBooster Bylawsapi-284309282No ratings yet

- PARTY SYMBOLS (Revised) PDFDocument40 pagesPARTY SYMBOLS (Revised) PDFelinzolaNo ratings yet