Professional Documents

Culture Documents

State of Florida: Substitute Form W-9

State of Florida: Substitute Form W-9

Uploaded by

Tabitha HowardCopyright:

Available Formats

You might also like

- Business EINDocument2 pagesBusiness EINMrz Garrett50% (2)

- Ein Letter Glenn L CartonDocument2 pagesEin Letter Glenn L Cartontylermichael912No ratings yet

- Astm A370 2020Document50 pagesAstm A370 2020امين100% (1)

- FEIN Assignment LetterDocument2 pagesFEIN Assignment LetterKealamākia Foundation0% (1)

- BMI-Africa IRS EIN #Document3 pagesBMI-Africa IRS EIN #Joseph VillarosaNo ratings yet

- Locate Real Estate LLC EinDocument2 pagesLocate Real Estate LLC Einapi-32562269No ratings yet

- WWW - Irs.gov Pub Irs-PDF f4506tDocument2 pagesWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezNo ratings yet

- IRS Recognition LetterDocument2 pagesIRS Recognition LetterSpartanEconNo ratings yet

- Ein - Techcyrus, LLC (2414058)Document2 pagesEin - Techcyrus, LLC (2414058)mayajain1No ratings yet

- Cp575notice 1353009329267Document2 pagesCp575notice 1353009329267api-198173331No ratings yet

- Audio Information and MediaDocument2 pagesAudio Information and Mediajosefalarka75% (4)

- F 3949 ADocument3 pagesF 3949 Aiamsomedude100% (3)

- The New IRS Form 3949 A Revised in March 2014Document3 pagesThe New IRS Form 3949 A Revised in March 2014Freeman Lawyer100% (1)

- Read The Instructions On The Reverse Side Before Completing This FormDocument2 pagesRead The Instructions On The Reverse Side Before Completing This FormTabitha HowardNo ratings yet

- Sec - gov-EIN Formation BylawsDocument4 pagesSec - gov-EIN Formation BylawsДмитрий КалиненкоNo ratings yet

- Newmass w9Document4 pagesNewmass w9Tabitha HowardNo ratings yet

- Colorado Feedlot Horses Fein PapersDocument3 pagesColorado Feedlot Horses Fein Papersapi-270147093No ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- CP575 1369930125343Document3 pagesCP575 1369930125343Luc BookNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099kmufti7No ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationMd HumayunNo ratings yet

- US TaxRefunds Short NewJerseyDocument11 pagesUS TaxRefunds Short NewJerseyKeziah Cyra PapasNo ratings yet

- Instructions For Filling PF Withdrawal FormDocument1 pageInstructions For Filling PF Withdrawal Formpachi_annuNo ratings yet

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- Instructions For Form 940: Future DevelopmentsDocument12 pagesInstructions For Form 940: Future DevelopmentsAldrianNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- Statement by Unincorporated Association Ua-100Document3 pagesStatement by Unincorporated Association Ua-100Seasoned_SolNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNo ratings yet

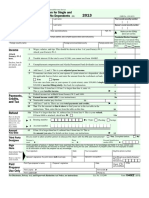

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- Cryptocurrency Tax Reporting For FBAR and FATCADocument22 pagesCryptocurrency Tax Reporting For FBAR and FATCAvimal poddarNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (6)

- Tinkable: Tinkable Finance My Treatment Plan. Pre-Application Check ListDocument4 pagesTinkable: Tinkable Finance My Treatment Plan. Pre-Application Check ListnikowawaNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnBilboDBaggins100% (1)

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- US Internal Revenue Service: p967 - 2005Document7 pagesUS Internal Revenue Service: p967 - 2005IRSNo ratings yet

- 2012 Federal ReturnDocument1 page2012 Federal Return24male86No ratings yet

- LuxNova US LLC Employer Identification Number LetterDocument2 pagesLuxNova US LLC Employer Identification Number LetterAlbert GallagherNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- Application For Employment: 1557 NE 164th Street Ste 201 North Miami Beach, FL 33162Document6 pagesApplication For Employment: 1557 NE 164th Street Ste 201 North Miami Beach, FL 33162russt2No ratings yet

- Special Application For AB540 Students Under The California Dream ActDocument6 pagesSpecial Application For AB540 Students Under The California Dream ActJesse RosaNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Midwest Protouch CleaningDocument3 pagesMidwest Protouch CleaningalisellsrealestateNo ratings yet

- Department of The Treasuryein ConfirmationDocument1 pageDepartment of The Treasuryein ConfirmationMikeDouglasNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument3 pagesIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンNo ratings yet

- Government Form 1310Document3 pagesGovernment Form 1310EmilyNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- YMCA of Marion and Polk Counties 2013 Charity ReportDocument56 pagesYMCA of Marion and Polk Counties 2013 Charity ReportStatesman JournalNo ratings yet

- LLC_TOPDocument3 pagesLLC_TOPatprivate55No ratings yet

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- E Trade ApplicationDocument4 pagesE Trade Applicationtunlinoo100% (1)

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Vidas L. Monocytogenes Xpress (LMX) Ultra Performance SummaryDocument11 pagesVidas L. Monocytogenes Xpress (LMX) Ultra Performance SummaryTabitha HowardNo ratings yet

- Future With Be Going To - Quiz 1 - Schoology2Document2 pagesFuture With Be Going To - Quiz 1 - Schoology2Tabitha HowardNo ratings yet

- Rice Farming Education and TechnologyDocument1 pageRice Farming Education and TechnologyTabitha HowardNo ratings yet

- Like Vs Would Like Exercise - GrammarBankDocument2 pagesLike Vs Would Like Exercise - GrammarBankTabitha HowardNo ratings yet

- Will vs. Be Going To Quiz 5: Prev NextDocument3 pagesWill vs. Be Going To Quiz 5: Prev NextTabitha HowardNo ratings yet

- Future With Be Going To - Quiz 1 - SchoologyDocument2 pagesFuture With Be Going To - Quiz 1 - SchoologyTabitha HowardNo ratings yet

- Https Videos MMM EnglhisDocument2 pagesHttps Videos MMM EnglhisTabitha HowardNo ratings yet

- PornerDocument2 pagesPornerTabitha HowardNo ratings yet

- Present Continuous Tense - Quiz 2 - SchoologyDocument2 pagesPresent Continuous Tense - Quiz 2 - SchoologyTabitha HowardNo ratings yet

- Terms Definitions: Keyboard ShortcutsDocument10 pagesTerms Definitions: Keyboard ShortcutsTabitha HowardNo ratings yet

- Browse Similar Products: ACQ Series Ampoule Ultrasonic Washing MachineDocument2 pagesBrowse Similar Products: ACQ Series Ampoule Ultrasonic Washing MachineTabitha HowardNo ratings yet

- Natamicina PDFDocument2 pagesNatamicina PDFTabitha HowardNo ratings yet

- E & Thiele Graphical Method: NormalDocument1 pageE & Thiele Graphical Method: NormalTabitha HowardNo ratings yet

- Oliver P. John: EducationDocument24 pagesOliver P. John: EducationTabitha HowardNo ratings yet

- REVITDocument2 pagesREVITTabitha HowardNo ratings yet

- Blackberry Quick Tips: 1. Ringer AdjustmentDocument10 pagesBlackberry Quick Tips: 1. Ringer AdjustmentTabitha HowardNo ratings yet

- BB Student InstructionDocument2 pagesBB Student InstructionTabitha HowardNo ratings yet

- BBL DWPDocument5 pagesBBL DWPTabitha HowardNo ratings yet

- Rope PDFDocument19 pagesRope PDFBenjamin van DierenNo ratings yet

- SPECALOG Hitachi Ex2600-6Document7 pagesSPECALOG Hitachi Ex2600-6andrefilthNo ratings yet

- CCC-BMG MOON 3-2 - Within Dwarvenholm v2.0Document30 pagesCCC-BMG MOON 3-2 - Within Dwarvenholm v2.0MarianoNo ratings yet

- 38 Parasrampuria Synthetics LTD 20 Sot 248Document5 pages38 Parasrampuria Synthetics LTD 20 Sot 248Chanakya ReddyNo ratings yet

- Front Office Section-ReceptionDocument33 pagesFront Office Section-ReceptionRishina CabilloNo ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- Gcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Document5 pagesGcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Daniel McDermottNo ratings yet

- Understanding Nuances and Commonalities of Job DesDocument10 pagesUnderstanding Nuances and Commonalities of Job DesAmrezaa IskandarNo ratings yet

- Kalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDocument1 pageKalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDenis AkingbasoNo ratings yet

- Conceptual FrameworkDocument4 pagesConceptual FrameworkEustass KiddNo ratings yet

- 84501-9200-9L-008 Rev-0 Technical Inspection Services Company Final Documentation RequirementsDocument7 pages84501-9200-9L-008 Rev-0 Technical Inspection Services Company Final Documentation RequirementsPeni M. SaptoargoNo ratings yet

- Genuine Eaton Vicker HidrauDocument28 pagesGenuine Eaton Vicker HidrauJenner Volnney Quispe ChataNo ratings yet

- EN Subiecte Locala 19-20 GIMNAZIU 5-8 A-BDocument16 pagesEN Subiecte Locala 19-20 GIMNAZIU 5-8 A-BSpiridon AndreeaNo ratings yet

- AKAR - Gearless Permanent Magnet Synchronous MotorDocument22 pagesAKAR - Gearless Permanent Magnet Synchronous MotordepolisdooNo ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Mapeh GR9 First Quarter ReviewerDocument8 pagesMapeh GR9 First Quarter ReviewerRalph Emerson SantillanNo ratings yet

- WhatsApp v. Union of India Filing VersionDocument224 pagesWhatsApp v. Union of India Filing VersionVinayNo ratings yet

- UpsDocument31 pagesUpsThuyaNo ratings yet

- A Picture Is Worth A Thousand Words: The Benefit of Medical Illustration in Medical PublishingDocument6 pagesA Picture Is Worth A Thousand Words: The Benefit of Medical Illustration in Medical PublishingSinisa RisticNo ratings yet

- OpenFOAM编程指南Document100 pagesOpenFOAM编程指南Feishi XuNo ratings yet

- OptiMix - Manual - EN - Rev.03.05 (Mixer)Document89 pagesOptiMix - Manual - EN - Rev.03.05 (Mixer)Đức Nguyễn100% (2)

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- Nemo Complete Documentation 2017Document65 pagesNemo Complete Documentation 2017Fredy A. CastañedaNo ratings yet

- VIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFDocument83 pagesVIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFOsamaAliMoussaNo ratings yet

- (LN) Orc Eroica - Volume 01 (YP)Document282 pages(LN) Orc Eroica - Volume 01 (YP)FBINo ratings yet

- Reading Test 1: Questions 1-5 Refer To The Following ArticleDocument14 pagesReading Test 1: Questions 1-5 Refer To The Following ArticletrucNo ratings yet

- Bar Bending Schedule: Title: Commercial BLDG Cutting ListDocument22 pagesBar Bending Schedule: Title: Commercial BLDG Cutting ListJet ArcaNo ratings yet

State of Florida: Substitute Form W-9

State of Florida: Substitute Form W-9

Uploaded by

Tabitha HowardOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State of Florida: Substitute Form W-9

State of Florida: Substitute Form W-9

Uploaded by

Tabitha HowardCopyright:

Available Formats

STATE OF FLORIDA

SUBSTITUTE FORM W-9

PART #: $en%or Information

IRS *a+e &as s!o,n on -our inco+e ta. return(

Mail or fax to: Chief Financial Officer Department of Financial Services Bureau of Accounting, 200 East Gaines Street Ta a!assee, F" #2#99-0#$% P O!E: &'$0( %)#-$$)9 FA": &'$0( %)#-$$$0

1it-

Business *a+e/ 0oing Business As &0BA( Primar& A%%ress 'A%%ress (here Form #)** sho+l% ,e maile%Attention of In 1are of

Street A22ress

34O4 Bo. State53ro6ince

1ountr- ; 3osta 1o2e, if ot!er t!an U4S4

7i8 1o2e &9% if :no,n(

PART .: Taxpa&er I%entification !+m,er 'TI!Enter -our TI* !ere/ (DO NOT USE DASHES)

Ta.8a-er I2entification T-8e &c!ec: a88ro8riate <o.(/

Fe2era E+8 o-er I2entification *u+<er &FEI*(

OR

Socia Securit- *u+<er &SS*(

PART /: 0+siness Desi1nations 'Select onl& oneIf 0+siness Desi1nation (ith Asteris2s ' 3- is selecte%4 please ans(er 5+estion ,elo(:

S 1or8oration = Go6ern+enta EntitIn2i6i2ua *onresi2ent A ien

3artners!i8 = Foreign 1or8oration or EntitSo e 3ro8rietor *ot for 3rofit

1 1or8oration Trust or Estate *on-cor8orate Renta Agent In2ian Tri<a Go6ern+ent

"i+ite2 "ia<i it- 1o+8an- &""1(/ 0isregar2e2 Entit1or8oration S 1or8oration = 3artners!i8 = 1

PART 6: Certification Statement

Un2er 8ena ties of 8er>ur-, I certif- t!at/ )4 T!e nu+<er s!o,n on t!is for+ is +- correct ta.8a-er infor+ation &or I a+ ,aiting for a nu+<er to <e issue2 to +e( A!D 24 OR I a+ su<>ect to <ac:u8 ,it!!o 2ing I a+ not su<>ect to <ac:u8 ,it!!o 2ing <ecause/ a( I a+ e.e+8t fro+ <ac:u8 ,it!!o 2ing <( I !a6e not <een notifie2 <- t!e Interna Re6enue Ser6ice &IRS( t!at I a+ su<>ect to <ac:u8 ,it!!o 2ing as a resu t of fai ure to re8ort a interest or 2i6i2en2s, OR c( t!e IRS !as notifie2 +e t!at I a+ no onger su<>ect to <ac:u8 ,it!!o 2ing A!D I a+ a U4S4 citi?en or ot!er U4S4 8erson &inc u2ing U4S4 resi2ent a ien(

#4

Certification Instr+ctions: To certif& the statement a,ove4 si1n an% complete &o+r information ,elo( as preparer 7 Preparer8s !ame 'Please PrintPreparer8s Title 're5+ire% for ,+siness entities 9 Please PrintSi1nat+re Email 'if availa,leDate Telephone !+m,er

Florida Substitu t e Form W- 9 Instructions

Rev. 12/2011

T!e State of F ori2a +ust o<tain -our correct ta.8a-er infor+ation t!at ,i <e use2 to 2eter+ine ,!et!er -ou ,i recei6e a For+ )099 for 8a-+ents +a2e to -ou <- an agenc- of t!e State of F ori2a4 T!is ta.8a-er infor+ation is co ecte2 on t!e F ori2a Su<stitute For+ W-9, an2 inc u2es a Ta.8a-er I2entification *u+<er &TI*(, IRS *a+e, an2 ot!er re ate2 infor+ation4 T!e infor+ation 8ro6i2e2 on t!is for+ +ust +atc! t!e infor+ation on fi e ,it! t!e Interna Re6enue Ser6ice &IRS( for Fe2era inco+e ta. re8orting an2 ,i <e 6erifie2 t!roug! t!e IRS TI* Matc!ing 3rogra+4 IRS regu ations re@uire t!e State of F ori2a to ta:e <ac:u8 ,it!!o 2ing fro+ future 8a-+ents +a2e to -ou if -ou fai to 8ro6i2e t!e infor+ation re@ueste24 All vendors doing business with the State of Florida must complete the Substitute Form W !. "ue to specific re#uirements on Florida$s Substitute Form W !% an &RS Form W ! will not be accepted. 'endors located outside the (nited States that do not have a )&* issued b+ the (.S. ,overnment should contact the 'endor -anagement Section at ./001 213 001!. NOTE This form can only be used if you do not have intern e t or e- mail access. Other than this excep tion, all Substitu t e Form - !s should be filed electronically by visitin" the #endor $ortal %ebsite at https4//flvendor.m+floridacfo.com . $art &' #endor (nform a t ion 1. IRS Name: )his should be the name as it appears on +our Federal income ta5 return% and ma+ be either an individual name or a business name. Do not abbre vi a t e names unless the+ are registered that wa+ with the &RS. 2. Business Name: Doing Business s !DB ": 6ist an+ 7"oing 8usiness As9 names that will be doing business with the State of Florida. &f +ou do not have "8As% leave this field blan:. #. $rimar% ddress: )his is the address where Form 10!!s and an+ other related correspondence should be mailed. $art )' Taxpay e r (dentifica tion Numbe r *T(N+ and Type 1. &nter 'our (IN: ;nter either +our Social Securit+ *umber .individuals1 or +our Federal ;mplo+er &dentification *umber .F;&*1. Do Not include dashes. 2. (a)*a%e r Identi+ica tion (%*e: Select the appropriate bo5 to indicate whether the )&* +ou have provided is +our SS* or F;&*. $art ,' -usiness .esi"na tions 1. Business Designa tion: Select the appropriate bo5. &f +ou are unsure of which bo5 to chec:% contact +our income ta5 preparer for assistance. $art /' 0ertifica tion Stat e m e n t 1. ,erti+ication State m e n t : Select the appropriate bo5 regarding bac:up withholding. <ou should chec: 7& am sub=ect to bac:up withholding 9 onl% if +ou have been notified b+ the &RS that +ou are sub=ect to bac:up withholding or +ou have been notified b+ the State of Florida that +our )&* on file is incorrect and the State will perform bac:up withholding on future pa+ments. >a+ers must generall+ withhold 2/? of ta5able interest% dividends and certain other pa+ments to a pa+ee that is sub=ect to bac:up withholding. &f +ou are unsure of +our bac:up withholding status% contact +our ta5 advisor for assistance. 2. $re*ar e r -s Nam e: Fill in the preparer$s name% title% signature% email address .if available1% date and phone number. )he preparer should be an e5ecutive of the organi@ation and someone who can answer #uestions that ma+ arise relating to the Substitute Form W !. -ail or fa5 the completed form to4 Ahief Financial Bfficer Florida "epartment of Financial Services 8ureau of Accounting / 'endor -anagement Section 200 ;ast ,aines Street )allahassee% F6 323!! 0302 >hone4 ./001 213 001! Fa54 ./001 213 0000 Rev. 12/2011

You might also like

- Business EINDocument2 pagesBusiness EINMrz Garrett50% (2)

- Ein Letter Glenn L CartonDocument2 pagesEin Letter Glenn L Cartontylermichael912No ratings yet

- Astm A370 2020Document50 pagesAstm A370 2020امين100% (1)

- FEIN Assignment LetterDocument2 pagesFEIN Assignment LetterKealamākia Foundation0% (1)

- BMI-Africa IRS EIN #Document3 pagesBMI-Africa IRS EIN #Joseph VillarosaNo ratings yet

- Locate Real Estate LLC EinDocument2 pagesLocate Real Estate LLC Einapi-32562269No ratings yet

- WWW - Irs.gov Pub Irs-PDF f4506tDocument2 pagesWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezNo ratings yet

- IRS Recognition LetterDocument2 pagesIRS Recognition LetterSpartanEconNo ratings yet

- Ein - Techcyrus, LLC (2414058)Document2 pagesEin - Techcyrus, LLC (2414058)mayajain1No ratings yet

- Cp575notice 1353009329267Document2 pagesCp575notice 1353009329267api-198173331No ratings yet

- Audio Information and MediaDocument2 pagesAudio Information and Mediajosefalarka75% (4)

- F 3949 ADocument3 pagesF 3949 Aiamsomedude100% (3)

- The New IRS Form 3949 A Revised in March 2014Document3 pagesThe New IRS Form 3949 A Revised in March 2014Freeman Lawyer100% (1)

- Read The Instructions On The Reverse Side Before Completing This FormDocument2 pagesRead The Instructions On The Reverse Side Before Completing This FormTabitha HowardNo ratings yet

- Sec - gov-EIN Formation BylawsDocument4 pagesSec - gov-EIN Formation BylawsДмитрий КалиненкоNo ratings yet

- Newmass w9Document4 pagesNewmass w9Tabitha HowardNo ratings yet

- Colorado Feedlot Horses Fein PapersDocument3 pagesColorado Feedlot Horses Fein Papersapi-270147093No ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- CP575 1369930125343Document3 pagesCP575 1369930125343Luc BookNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099kmufti7No ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationMd HumayunNo ratings yet

- US TaxRefunds Short NewJerseyDocument11 pagesUS TaxRefunds Short NewJerseyKeziah Cyra PapasNo ratings yet

- Instructions For Filling PF Withdrawal FormDocument1 pageInstructions For Filling PF Withdrawal Formpachi_annuNo ratings yet

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- Instructions For Form 940: Future DevelopmentsDocument12 pagesInstructions For Form 940: Future DevelopmentsAldrianNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- Statement by Unincorporated Association Ua-100Document3 pagesStatement by Unincorporated Association Ua-100Seasoned_SolNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNo ratings yet

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- Cryptocurrency Tax Reporting For FBAR and FATCADocument22 pagesCryptocurrency Tax Reporting For FBAR and FATCAvimal poddarNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (6)

- Tinkable: Tinkable Finance My Treatment Plan. Pre-Application Check ListDocument4 pagesTinkable: Tinkable Finance My Treatment Plan. Pre-Application Check ListnikowawaNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnBilboDBaggins100% (1)

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- US Internal Revenue Service: p967 - 2005Document7 pagesUS Internal Revenue Service: p967 - 2005IRSNo ratings yet

- 2012 Federal ReturnDocument1 page2012 Federal Return24male86No ratings yet

- LuxNova US LLC Employer Identification Number LetterDocument2 pagesLuxNova US LLC Employer Identification Number LetterAlbert GallagherNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- Application For Employment: 1557 NE 164th Street Ste 201 North Miami Beach, FL 33162Document6 pagesApplication For Employment: 1557 NE 164th Street Ste 201 North Miami Beach, FL 33162russt2No ratings yet

- Special Application For AB540 Students Under The California Dream ActDocument6 pagesSpecial Application For AB540 Students Under The California Dream ActJesse RosaNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Midwest Protouch CleaningDocument3 pagesMidwest Protouch CleaningalisellsrealestateNo ratings yet

- Department of The Treasuryein ConfirmationDocument1 pageDepartment of The Treasuryein ConfirmationMikeDouglasNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument3 pagesIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンNo ratings yet

- Government Form 1310Document3 pagesGovernment Form 1310EmilyNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- YMCA of Marion and Polk Counties 2013 Charity ReportDocument56 pagesYMCA of Marion and Polk Counties 2013 Charity ReportStatesman JournalNo ratings yet

- LLC_TOPDocument3 pagesLLC_TOPatprivate55No ratings yet

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- E Trade ApplicationDocument4 pagesE Trade Applicationtunlinoo100% (1)

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Vidas L. Monocytogenes Xpress (LMX) Ultra Performance SummaryDocument11 pagesVidas L. Monocytogenes Xpress (LMX) Ultra Performance SummaryTabitha HowardNo ratings yet

- Future With Be Going To - Quiz 1 - Schoology2Document2 pagesFuture With Be Going To - Quiz 1 - Schoology2Tabitha HowardNo ratings yet

- Rice Farming Education and TechnologyDocument1 pageRice Farming Education and TechnologyTabitha HowardNo ratings yet

- Like Vs Would Like Exercise - GrammarBankDocument2 pagesLike Vs Would Like Exercise - GrammarBankTabitha HowardNo ratings yet

- Will vs. Be Going To Quiz 5: Prev NextDocument3 pagesWill vs. Be Going To Quiz 5: Prev NextTabitha HowardNo ratings yet

- Future With Be Going To - Quiz 1 - SchoologyDocument2 pagesFuture With Be Going To - Quiz 1 - SchoologyTabitha HowardNo ratings yet

- Https Videos MMM EnglhisDocument2 pagesHttps Videos MMM EnglhisTabitha HowardNo ratings yet

- PornerDocument2 pagesPornerTabitha HowardNo ratings yet

- Present Continuous Tense - Quiz 2 - SchoologyDocument2 pagesPresent Continuous Tense - Quiz 2 - SchoologyTabitha HowardNo ratings yet

- Terms Definitions: Keyboard ShortcutsDocument10 pagesTerms Definitions: Keyboard ShortcutsTabitha HowardNo ratings yet

- Browse Similar Products: ACQ Series Ampoule Ultrasonic Washing MachineDocument2 pagesBrowse Similar Products: ACQ Series Ampoule Ultrasonic Washing MachineTabitha HowardNo ratings yet

- Natamicina PDFDocument2 pagesNatamicina PDFTabitha HowardNo ratings yet

- E & Thiele Graphical Method: NormalDocument1 pageE & Thiele Graphical Method: NormalTabitha HowardNo ratings yet

- Oliver P. John: EducationDocument24 pagesOliver P. John: EducationTabitha HowardNo ratings yet

- REVITDocument2 pagesREVITTabitha HowardNo ratings yet

- Blackberry Quick Tips: 1. Ringer AdjustmentDocument10 pagesBlackberry Quick Tips: 1. Ringer AdjustmentTabitha HowardNo ratings yet

- BB Student InstructionDocument2 pagesBB Student InstructionTabitha HowardNo ratings yet

- BBL DWPDocument5 pagesBBL DWPTabitha HowardNo ratings yet

- Rope PDFDocument19 pagesRope PDFBenjamin van DierenNo ratings yet

- SPECALOG Hitachi Ex2600-6Document7 pagesSPECALOG Hitachi Ex2600-6andrefilthNo ratings yet

- CCC-BMG MOON 3-2 - Within Dwarvenholm v2.0Document30 pagesCCC-BMG MOON 3-2 - Within Dwarvenholm v2.0MarianoNo ratings yet

- 38 Parasrampuria Synthetics LTD 20 Sot 248Document5 pages38 Parasrampuria Synthetics LTD 20 Sot 248Chanakya ReddyNo ratings yet

- Front Office Section-ReceptionDocument33 pagesFront Office Section-ReceptionRishina CabilloNo ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- Gcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Document5 pagesGcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Daniel McDermottNo ratings yet

- Understanding Nuances and Commonalities of Job DesDocument10 pagesUnderstanding Nuances and Commonalities of Job DesAmrezaa IskandarNo ratings yet

- Kalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDocument1 pageKalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDenis AkingbasoNo ratings yet

- Conceptual FrameworkDocument4 pagesConceptual FrameworkEustass KiddNo ratings yet

- 84501-9200-9L-008 Rev-0 Technical Inspection Services Company Final Documentation RequirementsDocument7 pages84501-9200-9L-008 Rev-0 Technical Inspection Services Company Final Documentation RequirementsPeni M. SaptoargoNo ratings yet

- Genuine Eaton Vicker HidrauDocument28 pagesGenuine Eaton Vicker HidrauJenner Volnney Quispe ChataNo ratings yet

- EN Subiecte Locala 19-20 GIMNAZIU 5-8 A-BDocument16 pagesEN Subiecte Locala 19-20 GIMNAZIU 5-8 A-BSpiridon AndreeaNo ratings yet

- AKAR - Gearless Permanent Magnet Synchronous MotorDocument22 pagesAKAR - Gearless Permanent Magnet Synchronous MotordepolisdooNo ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Mapeh GR9 First Quarter ReviewerDocument8 pagesMapeh GR9 First Quarter ReviewerRalph Emerson SantillanNo ratings yet

- WhatsApp v. Union of India Filing VersionDocument224 pagesWhatsApp v. Union of India Filing VersionVinayNo ratings yet

- UpsDocument31 pagesUpsThuyaNo ratings yet

- A Picture Is Worth A Thousand Words: The Benefit of Medical Illustration in Medical PublishingDocument6 pagesA Picture Is Worth A Thousand Words: The Benefit of Medical Illustration in Medical PublishingSinisa RisticNo ratings yet

- OpenFOAM编程指南Document100 pagesOpenFOAM编程指南Feishi XuNo ratings yet

- OptiMix - Manual - EN - Rev.03.05 (Mixer)Document89 pagesOptiMix - Manual - EN - Rev.03.05 (Mixer)Đức Nguyễn100% (2)

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- Nemo Complete Documentation 2017Document65 pagesNemo Complete Documentation 2017Fredy A. CastañedaNo ratings yet

- VIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFDocument83 pagesVIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFOsamaAliMoussaNo ratings yet

- (LN) Orc Eroica - Volume 01 (YP)Document282 pages(LN) Orc Eroica - Volume 01 (YP)FBINo ratings yet

- Reading Test 1: Questions 1-5 Refer To The Following ArticleDocument14 pagesReading Test 1: Questions 1-5 Refer To The Following ArticletrucNo ratings yet

- Bar Bending Schedule: Title: Commercial BLDG Cutting ListDocument22 pagesBar Bending Schedule: Title: Commercial BLDG Cutting ListJet ArcaNo ratings yet