Professional Documents

Culture Documents

Topic 2

Topic 2

Uploaded by

vedugptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 2

Topic 2

Uploaded by

vedugptaCopyright:

Available Formats

Submitted to Prof.

Navin Rego

Submitted by Archana Adsul (7301 Pranita !uvat"ar (73 #ee$ali Salun"e (7330 Shil$a shete (733%

CONCEPT S CAPITAL BUDGETING &a$ital budgeting is the $rocess of generating' evaluating' selecting and follo(ing) u$ on ca$ital e*$enditure $ro+ects. ,he term &a$ital budgeting is used interchangeably (ith ca$ital e*$enditure decision' ca$ital e*$enditure management - long)term investment decision. ,he methods em$loyed to evaluate the (orth of ca$ital e*$enditure $ro$osals are "no(n as ca$ital budgeting techni.ues .,he $o$ular methods are) (a Average rate of return (b Pay bac" $eriod (c Net $resent value (d /nternal rate of return (e Profitability inde* ,he follo(ing are the basic features of ca$ital budgeting) Potentially large antici$ated benefits A relatively high degree of ris" A relatively long time $eriod bet(een the initial outlay - the antici$ated return

0*$lain the follo(ing conce$ts (ith e*am$les i. Internal rate of return ,he discount rate (hich e.uates the $resent values of an investment1s cash inflo(s and outflo(s is its internal rate of return Acceptance rule Acce$t if /RR 2 " Re+ect if /RR 3 " Pro+ect may be acce$ted if /RR 4 "

5erits #emerits &onsiders all cash inflo(s Re.uires estimates of cash flo(s (hich is atedious tas" ,rue measure of $rofitability 6ased on the conce$t of time #oes not hold the value additivity $rinci$le value of money 7enerally consistent (ith (ealth At times fails to indicate correct choice bet(een mutually e*clusive $ro+ects ma*imisation $rinci$le At times yields multi$le rates Relatively difficult to com$ute

Illustration

ii. Profitability in e! ,he ratio of the $resent value of the cash flo(s to the initial outlay is $rofitability inde* or benefit cost ratio ./t is also referred to as 6enefit cost ratio Acceptance rule Acce$t if P/ 2 1.0 Re+ect if P/ 3 1.0 Pro+ect may be acce$ted if P/ 4 1.0 5erits #emerits &onsiders all cash flo(s Re.uires estimates of the cash flo(s (hich is a tedious tas" Recognises the time value of money At times fails to indicate correct Relative measure of $rofitability choice bet(een mutually 7enerally consistent (ith the (ealth e*clusive $ro+ects ma*imisation $rinci$le

/llustration

iii. Net present "alue ,he difference bet(een P8 of cash flo(s and P8 of cash outflo(s is e.ual to NP8' the firm1s o$$ortunity cost of ca$ital being the discount rate . Acce$tance rule Acce$t if NP8 2 0 (i e. NP8 is $ositive Re+ect if NP8 3 0 (i.e. .NP8 is negative Pro+ect may be acce$ted if NP84 0 5erits #emerits &onsiders all cash inflo(s Re.uires estimates of cash flo(s (hich is a tedious tas" ,rue measure of $rofitability com$utation of the 6ased on the conce$t of time Re.uires o$$ortunity 'cost of ca$ital (hich value of money $ossess $ractical difficulties consistent (ith (ealth Sensitive to discount rates ma*imisation $rinci$le Satisfies the value additively $rinci$le

/llustration

i". Accountin# rate of return An average rate of return is found by dividing the average $rofit by the average investment . Acceptance rule Acce$t if ARR 2 minimum rate

Re+ect if ARR 3 minimum rate 5erits #emerits 9ses accounting data (ith (hich /gnores the time value of money e*ecutives are familiar #oes not use cash flo(s 0asy to understand and calculate 7ives more (eightage to future reci$ts No ob+ective (ay to determine the minimum acce$table rate of return /llustration

". Pay bac$ perio ,he number of years re.uired to recover the initial outlay of the investment is called $aybac" Acce$tance rule Acce$t if P6 3 Standard $ay bac" Re+ect if P6 2 Standard $ay bac" 5erits #emerits 0asy to understand and com$ute and /gnores the time value of money ine*$ensive to use /gnores the cash flo( occurring after 0m$hasises li.uidity the $ay bac" $eriod Not a measure of $rofitability 0asy and crude (ay to co$e (ith ris" No ob+ective (ay to determine the $ay bac" 9ses cash flo( information /llustration

"i. Discounte cas% flo& 'et%o s ,he methods of a$$raising ca$ital e*$enditure $ro$osals can be classified into t(o broad categories : 1. 9nso$histicated or traditional ;. So$histicated or time ad+usted ,he latter are more $o$ularly "no(n as discounted cash flo( techni.ues as they ta"e the time factor into account ./n this method all cash flo(s are e*$ressed in terms of their $resent values ./t recognises that cash flo( streams at different time $eriods differ in value - can be com$ared only (hen they are e*$ressed in terms of a common denominator i.e.' $resent values. ,he follo(ing are the various discounted cash flo( techni.ues : /. /. //. Net $resent value /nternal rate of return Profitability inde*

CAPITAL (ATIONING ,he ca$ital rationing refers to the situation in (hich the firm has more acce$table investments re.uiring a greater amount of finance than is available (ith the firm ./t is concerned (ith the selection of a grou$ of investment $ro$osals acce$table under the acce$t)re+ect decision .Ran"ing of the investments $ro+ect is em$loyed in ca$ital rationing .Pro+ects can be ran"ed on the basis of some $re determined criterion such as the rate of return .,he $ro+ect (ith the highest return is ran"ed first and the $ro+ect (ith the lo(est acce$table return last .,he $ro+ects are ran"ed in the descending order of the rate of return .

NP) "*s I(( ,he follo(ing are the various dissimilarities bet(een NP8 and /RR : Si<e dis$arity $roblem NP8 and /RR method give different ran"ing to $ro+ects (hen the initial investment in $ro+ects under consideration i.e.' mutually e*clusive $ro+ects is different .,he cash outlay of some $ro+ects is larger than that of others. ,iming of cash flo(s ,he most commonly found condition for the conflict bet(een the NP8 and /RR methods is the difference in the timing of cash flo( Pro+ects (ith une.ual lives Another situation in (hich the /RR and NP8 methods (ould give a conflict ran"ing to mutually e*clusive $ro+ects is (hen the $ro+ects have different e*$ected lives. T(ADITIONAL )*S DC+ ,ET-ODS ,raditional method ,he traditional method are also referred to as unso$histicated or non discounted cash flo( method ,hese method is "no(n as non #&= because they do not ta"e time factor into consideration ,hese are the various Non #&= methods : /. Pay bac" $eriod //. Accounting rate of return #&= method ,he discounted cash flo( method are also "no(n as so$histicated or time ad+usted methods ,his are "no(n as #&= method because it ta"e time factor into account ,he follo(ing are the various #&= methods : /. Net $resent value //. /nternal rate of return ///. Profitability inde*

/n case of re$lacement decision (hat is the im$lication >

T%eory .uestions

/. Different 'et%o s of e"aluation of a pro0ect Ans&er1

&a$ital budgeting is the $rocess of generating' evaluating' selecting and follo(ing) u$ on ca$ital e*$enditure $ro+ects. ,he methods of a$$raising ca$ital e*$enditure $ro$osals can be classified into t(o broad categories : In"est'ent criteria #iscounted cash flo( method 1. Net $resent value ;. /nternal rate of return 3. 6enefit cost ratio 1 /nternal rate of return ,he discount rate (hich e.uates the $resent values of an investment1s Non discounted cash flo( 1. Accounting rate of return ;. Pay bac" $eriod

cash inflo(s and outflo(s is its internal rate of return Acceptance rule Acce$t if /RR 2 " Re+ect if /RR 3 "

Pro+ect may be acce$ted if /RR 4 " 5erits #emerits &onsiders all cash inflo(s Re.uires estimates of cash flo(s (hich is a tedious tas" ,rue measure of $rofitability 6ased on the conce$t of time #oes not hold the value additively $rinci$le value of money 7enerally consistent (ith (ealth At times fails to indicate correct choice bet(een mutually e*clusive $ro+ects ma*imi<ation $rinci$le At times yields multi$le rates Relatively difficult to com$ute

Net $resent value ,he difference bet(een P8 of cash flo(s and P8 of cash outflo(s is is is

e.ual to NP8' the firm1s o$$ortunity cost of ca$ital being the discount rate . Acceptance rule Acce$t if NP8 2 0 (i e.NP8 is $ositive Re+ect if NP8 3 0 (ie.NP8 is negative Pro+ect may be acce$ted if NP84 0 5erits #emerits &onsiders all cash inflo(s Re.uires estimates of cash flo(s (hich is a tedious tas" ,rue measure of $rofitability com$utation of the 6ased on the conce$t of time Re.uires o$$ortunity 'cost of ca$ital (hich value of money $ossess $ractical difficulties consistent (ith (ealth Sensitive to discount rates ma*imisation $rinci$le Satisfies the value additively $rinci$le

3 Profitability inde* ,he ratio of the $resent value of the cash flo(s to the initial outlay is $rofitability inde* or benefit cost ratio ./t is also referred to as 6enefit cost ratio

Acceptance rule Acce$t if P/ 2 1.0 Re+ect if P/ 3 1.0 Pro+ect may be acce$ted if P/ 4 1.0 5erits #emerits &onsiders all cash flo(s Re.uires estimates of the cash flo(s (hich is a tedious tas" Recognises the time value of money At times fails to indicate correct Relative measure of $rofitability choice bet(een mutually 7enerally consistent (ith the (ealth e*clusive $ro+ects ma*imisation $rinci$le

Non iscounte cas% flo& 1 Average rate of return An average rate of return is found by dividing the average $rofit by the average investment . Acceptance rule Acce$t if ARR 2 minimum rate Re+ect if ARR 3 minimum rate 5erits #emerits 9ses accounting data (ith (hich /gnores the time value of money e*ecutives are familiar #oes not use cash flo(s 0asy to understand and calculate 7ives more (eightage to future recei$ts No ob+ective (ay to determine the minimum acce$table rate of return ; Pay bac" $eriod ,he number of years re.uired to recover the initial outlay of the investment is called $aybac"

Acce$tance rule Acce$t if P6 3 Standard $ay bac" Re+ect if P6 2 Standard $ay bac" 5erits #emerits 0asy to understand and com$ute and /gnores the time value of money ine*$ensive to use /gnores the cash flo( occurring after 0m$hasises li.uidity the $ay bac" $eriod Not a measure of $rofitability 0asy and crude (ay to co$e (ith ris" No ob+ective (ay to determine the $ay bac" 9ses cash flo( information

/ Discuss t%e ifferent 'et%o s of capital bu #etin# Ans&er1

&a$ital budgeting is the $rocess of generating' evaluating' selecting and follo(ing) u$ on ca$ital e*$enditure $ro+ects ..,he methods of a$$raising ca$ital e*$enditure $ro$osals can be classified into t(o broad categories : In"est'ent criteria #iscounted cash flo( method %. Net $resent value ?. /nternal rate of return @. 6enefit cost ratio 1 /nternal rate of return ,he discount rate (hich e.uates the $resent values of an investment1s Non discounted cash flo( 1. Accounting rate of return ;. Pay bac" $eriod

cash inflo(s and outflo(s is its internal rate of return Acceptance rule Acce$t if /RR 2 "

Re+ect if /RR 3 " Pro+ect may be acce$ted if /RR 4 " 5erits #emerits &onsiders all cash inflo(s Re.uires estimates of cash flo(s (hich is a tedious tas" ,rue measure of $rofitability 6ased on the conce$t of time #oes not hold the value additively $rinci$le value of money 7enerally consistent (ith (ealth At times fails to indicate correct choice bet(een mutually e*clusive $ro+ects ma*imisation $rinci$le At times yields multi$le rates Relatively difficult to com$ute

Net $resent value ,he difference bet(een P8 of cash flo(s and P8 of cash outflo(s is is is

e.ual to NP8' the firm1s o$$ortunity cost of ca$ital being the discount rate . Acceptance rule Acce$t if NP8 2 0 (i e.NP8 is $ositive Re+ect if NP8 3 0 (ie.NP8 is negative Pro+ect may be acce$ted if NP84 0 5erits #emerits &onsiders all cash inflo(s Re.uires estimates of cash flo(s (hich is atedious tas" ,rue measure of $rofitability com$utation of the 6ased on the conce$t of time Re.uires o$$ortunity 'cost of ca$ital (hich value of money $ossess $ractical difficulties consistent (ith (ealth Sensitive to discount rates ma*imisation $rinci$le Satisfies the value additivity $rinci$le

3 Profitability inde* ,he ratio of the $resent value of the cash flo(s to the initial outlay is $rofitability inde* or benefit cost ratio ./t is also referred to as 6enefit cost ratio

Acceptance rule Acce$t if P/ 2 1.0 Re+ect if P/ 3 1.0 Pro+ect may be acce$ted if P/ 4 1.0 5erits #emerits &onsiders all cash flo(s Re.uires estimates of the cash flo(s (hich is a tedious tas" Recognises the time value of money At times fails to indicate correct Relative measure of $rofitability choice bet(een mutually 7enerally consistent (ith the (ealth e*clusive $ro+ects ma*imisation $rinci$le

Non iscounte cas% flo& 1 Average rate of return An average rate of return is found by dividing the average $rofit by the average investment . Acceptance rule Acce$t ifARR 2 minimum rate Re+ect if ARR 3 minimum rate 5erits #emerits 9ses accounting data (ith (hich /gnores the time value of money e*ecutives are familiar #oes not use cash flo(s 0asy to understand and calculate 7ives more (eightage to future reci$ts No ob+ective (ay to determine the minimum acce$table rate of return ; Pay bac" $eriod ,he number of years re.uired to recover the initial outlay of the investment is called $aybac"

Acce$tance rule Acce$t if P6 3 Standard $ay bac" Re+ect if P6 2 Standard $ay bac" 5erits #emerits 0asy to understand and com$ute and /gnores the time value of money ine*$ensive to use /gnores the cash flo( occuring after 0m$hasises li.uidity the $ay bac" $eriod Not a measure of $rofitability 0asy and crude (ay to co$e (ith ris" No ob+ective (ay to determine the $ay bac" 9ses cash flo( information

/. Discuss t%e p%ases of Capital Bu #etin#2 Ans&er1

&a$ital budgeting is a com$le* $rocess is (hich may be divided in to follo(ing $hasesA /dentification of $otential investment o$$ortunities Assembling of $ro$osed investments #ecision ma"ing Pre$aration of ca$ital budgeting and a$$ro$riations /m$lementation Performance revie( I entification of potential in"est'ent opportunities ,he ca$ital budgeting $rocess begins (ith the identification of $otential investment o$$ortunities. ,y$ically the $lanning body develo$s the estimates of future sales' (hich serves as the basis for setting $roduction target. ,his information in turn is hel$ful in identifying re.uired investments in $lant and e.ui$ment.

=or imaginative identification of investment ideas it is hel$ful to

i ii iii iv 5onitor e*ternal environment regularly to scout investment o$$ortunities' =ormulate a (ell defined cor$orate strategy based on a through analysis of strengths' (ea"nesses' o$$ortunities and threats' Share cor$orate strategy and $ros$ective (ith $erson (ho are involved in the $rocess of ca$ital budgeting and' 5otivate em$loyees to ma"e suggestions.

Asse'blin# of in"est'ent proposals /nvestment $ro$osal identified by the $roduction de$artment and other de$artment is usually submitted in a standardi<ed ca$ital investment $ro$osal firm. 7enerally' most of the $ro$osals before they reach the ca$ital budgeting committee or somebody (ho is assembles them are routed through several $ersons. ,he $ro$ose of routing a $ro$osal through several $ersons is a $rimarily to ensure that the $ro$osal is vie(ed from different angels. /t also hel$s in creating a climate for bringing about co)ordination of interrelated activities. /nvestment $ro$osals are usually classified into various categories for a facilitating decision : ma"ing budgeting and control. Decision3'a$in# A system of ru$ee gate(ay usually categori<es ca$ital investment decision) ma"ing. 9nder this system' e*ecutives are vested (ith the $o(er to B.C. investment $ro$osals to certain limits. =or e*' in one com$any the $lant su$erintendent can B.C investment outlays u$to Rs. ;00000 the (or"s manager u$to. Rs. ?00000 and

the managing director u$to Rs. ;000000. /nvestment re.uiring higher outlays needs the a$$roval of the board directors. Preparation of capital bu #et an appropriation Pro+ect involving smaller outlays and (hich e*ecutives at lo(er levels can decide are often covered by a blan"et a$$ro$riation for e*$editious action. Pro+ect involving larger outlays are included in ca$ital budget after necessary a$$rovals. 6efore underta"ing such $ro+ect a$$ro$riation order is usually re.uired. ,he $ur$ose of this chec" is mainly to ensure that the funds $osition of the firm is satisfactory at the time of im$lementation. =urther' $rovided an o$$ortunity to revie( the $ro+ect at the time of im$lementation. I'ple'entation. ,ranslating an investment $ro$osal into a concrete $ro+ect is a com$le*' time consuming and ris")fraught tas". #elays in im$lementation' (hich are common' can lead to substantial cost : overruns. =or e*$editious im$lementation at reasonable cost' the follo(ing are hel$ful. Adequate formulation of project the ma+or reason for delay is inade.uate formulation of $ro+ects. Put differently' in necessary home(or" in terms of $reliminary studies and com$rehensive and detail formulation of the $ro+ects is not done. 5any sur$rises and shoc"s are li"ely to s$ring on the (ay. Dence the need for ade.uate formulation of the $ro+ect cannot be overem$hasi<ed. Use of the principal of responsibilities accounting Assigning s$ecific res$onsibility to $ro+ect managers for a com$leting a $ro+ect (ithin a define time frame and cost limit is hel$ful for e*$editious e*ecution and cost control.

Use of network techniques for $ro+ect $lanning and control several net(or" techni.ues li"e P0R, ($rogram 0valuation Revie( ,echni.ue and &P5 (&ritical $ath 5ethod are available. Eith the hel$ of these techni.ues monitoring becomes easier. Perfor'ance (e"ie& Performance revie(' $ost com$letion audit' is a feedbac" device it is a menace for com$aring actual $erformance (ith $ro+ect $erformance. /t may be conducted' most a$$ro$riately' (hen the o$erations of the $ro+ect have established. /t is useful in several (aysA 1. /t thro(s the light on ho( realistic (ere the assum$tions underlying the $ro+ect. ;. /t $rovides a documented log of e*$erience that is highly valuable for decision ma"ingF 3. /t hel$s in uncovering +udgmental biasesF %. /t includes a desired caution among $ro+ect s$onsors.

You might also like

- Corporate Finance Solution Manual by Ross, Westerfield and JordernDocument12 pagesCorporate Finance Solution Manual by Ross, Westerfield and JordernBabar AdeebNo ratings yet

- VZ-30 Service ManualDocument32 pagesVZ-30 Service ManualJimmy Mayta100% (1)

- BEC 0809 AICPA Newly Released QuestionsDocument22 pagesBEC 0809 AICPA Newly Released Questionsrajkrishna03100% (1)

- Sage X3 - User Guide - HTG-Customer Search PDFDocument16 pagesSage X3 - User Guide - HTG-Customer Search PDFcaplusincNo ratings yet

- Cruise PerformanceDocument23 pagesCruise PerformanceÁlvaro Arroyo ParejoNo ratings yet

- Financial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CDocument7 pagesFinancial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CQueenielyn TagraNo ratings yet

- Advanced MGT Accounting Paper 3.2Document242 pagesAdvanced MGT Accounting Paper 3.2Noah Mzyece DhlaminiNo ratings yet

- Net Present Value and Other Investment Rules: Mcgraw-Hill/IrwinDocument34 pagesNet Present Value and Other Investment Rules: Mcgraw-Hill/Irwinveronica1085No ratings yet

- Capital BudgetingDocument48 pagesCapital Budgetingkingword84% (19)

- Revision 2 - Investment Appraisal: Topics ListDocument35 pagesRevision 2 - Investment Appraisal: Topics ListKashif MehmoodNo ratings yet

- 9 Capital BudgetingDocument6 pages9 Capital BudgetingRavichandran SeenivasanNo ratings yet

- Evaluate The Acceptability of An Investment Project Using The Internal Rate of Return MethodDocument6 pagesEvaluate The Acceptability of An Investment Project Using The Internal Rate of Return MethodjaneperdzNo ratings yet

- Profitability Analysis L-3Document32 pagesProfitability Analysis L-3trko5354No ratings yet

- Corporate FinanceDocument13 pagesCorporate FinanceAditya BajoriaNo ratings yet

- Chapter 12 - Capital Expenditure Decisions: Estimating The Initial Cash PaymentDocument3 pagesChapter 12 - Capital Expenditure Decisions: Estimating The Initial Cash Paymentmaxwell maingiNo ratings yet

- Account FinanceDocument28 pagesAccount FinanceOblivionOmbreNo ratings yet

- Capital Budgeting-Theory and NumericalsDocument47 pagesCapital Budgeting-Theory and Numericalssaadsaaid50% (2)

- Capital BudgetingDocument14 pagesCapital BudgetingD Y Patil Institute of MCA and MBANo ratings yet

- 5 Evaluating A Single ProjectDocument32 pages5 Evaluating A Single ProjectImie CamachoNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingKhushbu PriyadarshniNo ratings yet

- Chapter 08Document18 pagesChapter 08Tam NguyenNo ratings yet

- Chapter 3Document173 pagesChapter 3Maria HafeezNo ratings yet

- Topic 7. Cash Flows From Investment Activity ProcessDocument8 pagesTopic 7. Cash Flows From Investment Activity ProcessDaniela CaraNo ratings yet

- Chapter - 8: Capital Budgeting DecisionsDocument45 pagesChapter - 8: Capital Budgeting DecisionsNirmal ThomasNo ratings yet

- Capital BudgetingDocument3 pagesCapital Budgetinganandh30No ratings yet

- CH 10Document23 pagesCH 10Junaid JamshaidNo ratings yet

- Topic 7. Cash Flows From Investment Activity ProcessDocument8 pagesTopic 7. Cash Flows From Investment Activity ProcessCristina LupascuNo ratings yet

- Capital Budgeting: 1. Discounted Cash Flow Criteria (Time Adjusted Methods)Document7 pagesCapital Budgeting: 1. Discounted Cash Flow Criteria (Time Adjusted Methods)Vinoth KarthicNo ratings yet

- Investment Decision Analysis-2Document42 pagesInvestment Decision Analysis-2wisam alkhooryNo ratings yet

- Capital Budgeting: Time-Value of MoneyDocument39 pagesCapital Budgeting: Time-Value of MoneydanielNo ratings yet

- What Is The Difference Between Independent and Mutually Exclusive Projects?Document8 pagesWhat Is The Difference Between Independent and Mutually Exclusive Projects?9492860119No ratings yet

- CH 28 Applied Engineering EconomicsDocument15 pagesCH 28 Applied Engineering EconomicsAhmed AssafNo ratings yet

- Capital Inv Appraisal Questions Notes PDFDocument6 pagesCapital Inv Appraisal Questions Notes PDFtaridanNo ratings yet

- Financial Management Chapter 09 IM 10th EdDocument24 pagesFinancial Management Chapter 09 IM 10th EdDr Rushen SinghNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- Ital Budgeting: Budgeting Refers To Any Technique Used To Determine The Financial Wisdom of A LongDocument2 pagesItal Budgeting: Budgeting Refers To Any Technique Used To Determine The Financial Wisdom of A LongHazem El SayedNo ratings yet

- Ratio Analysis FormulaDocument7 pagesRatio Analysis FormulaHozefadahodNo ratings yet

- Year, Financial Management: Capital BudgetingDocument9 pagesYear, Financial Management: Capital BudgetingPooja KansalNo ratings yet

- Capital Budgeting: Navigation SearchDocument16 pagesCapital Budgeting: Navigation SearchVenkat Narayana ReddyNo ratings yet

- Net Present Value - NPV: Capital BudgetingDocument4 pagesNet Present Value - NPV: Capital BudgetingCris Marquez100% (1)

- 3 Present, Annual, and Future Value, Rate of Return and Brbak - Even Analysis PDFDocument102 pages3 Present, Annual, and Future Value, Rate of Return and Brbak - Even Analysis PDFRiswan RiswanNo ratings yet

- According To Terminology Committee of ACIPADocument3 pagesAccording To Terminology Committee of ACIPAKabit AgarwalNo ratings yet

- Unit 2 Capital BudgetingDocument24 pagesUnit 2 Capital BudgetingShreya DikshitNo ratings yet

- Course 3: Capital Budgeting AnalysisDocument20 pagesCourse 3: Capital Budgeting Analysisjimmy_chou1314No ratings yet

- A. The Importance of Capital BudgetingDocument16 pagesA. The Importance of Capital BudgetingManish ChaturvediNo ratings yet

- Taking A Calculated RiskDocument56 pagesTaking A Calculated RiskKalou BoniNo ratings yet

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Document31 pagesCapital Budgeting Decision Rules: What Real Investments Should Firms Make?mkkaran90No ratings yet

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnDocument55 pagesMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienNo ratings yet

- Assignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsDocument3 pagesAssignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsashishthecoolNo ratings yet

- Financial Management Case Study-2 The Investment DetectiveDocument9 pagesFinancial Management Case Study-2 The Investment DetectiveSushmita DikshitNo ratings yet

- IB - 3.8.investment AppraisalDocument9 pagesIB - 3.8.investment AppraisalGreta FernándezNo ratings yet

- Understanding TWR Vs IRR Return Calculation Methodologies in Performance Reporting SoftwareDocument11 pagesUnderstanding TWR Vs IRR Return Calculation Methodologies in Performance Reporting Softwarewilliam_davison1873No ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Gs 502 Lec 11 NPV JuDocument38 pagesGs 502 Lec 11 NPV Jumd shohagul islamNo ratings yet

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Document24 pagesDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanNo ratings yet

- SM Chapter 04Document59 pagesSM Chapter 04mfawzi010No ratings yet

- CHAPTER 2 - Investment AppraisalDocument19 pagesCHAPTER 2 - Investment AppraisalMaleoaNo ratings yet

- L-4 Project AppraisalDocument9 pagesL-4 Project Appraisalattitudefirstpankaj8625No ratings yet

- NPV, Irr, ArrDocument9 pagesNPV, Irr, ArrAhsan MubeenNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Swarozgar Credit CardDocument3 pagesSwarozgar Credit CardvedugptaNo ratings yet

- What Are The Associated WithDocument6 pagesWhat Are The Associated WithvedugptaNo ratings yet

- On SSFDocument5 pagesOn SSFvedugptaNo ratings yet

- The Foreign Exchange MarketDocument27 pagesThe Foreign Exchange MarketvedugptaNo ratings yet

- A Report On "Corporate Taxation, Inflation and Its Implications On Corporate Financing"Document10 pagesA Report On "Corporate Taxation, Inflation and Its Implications On Corporate Financing"vedugptaNo ratings yet

- Annexure CDocument1 pageAnnexure CvedugptaNo ratings yet

- Presented by Abhishek Gupta 32 Uddhav Chitre 17Document11 pagesPresented by Abhishek Gupta 32 Uddhav Chitre 17vedugptaNo ratings yet

- JagrutiDocument14 pagesJagrutivedugptaNo ratings yet

- AdvertismentDocument10 pagesAdvertismentvedugptaNo ratings yet

- Cholistan Water Relief Project: Presented By: Zohaib Nishad Muhammad Mohsin Mansur Ahsan Zahid Ghazala Baraki Iqra AbidDocument11 pagesCholistan Water Relief Project: Presented By: Zohaib Nishad Muhammad Mohsin Mansur Ahsan Zahid Ghazala Baraki Iqra AbidMansoor SaeedNo ratings yet

- ALB067 Albeo ALV2 Series LED Low Bay Industrial Luminaire Spec SheetDocument4 pagesALB067 Albeo ALV2 Series LED Low Bay Industrial Luminaire Spec SheetsamuelNo ratings yet

- FINAL EXAM 201820192 - Draf (270319)Document13 pagesFINAL EXAM 201820192 - Draf (270319)YuthishDheeranManiamNo ratings yet

- Material Property Data For Engineering MaterialsDocument35 pagesMaterial Property Data For Engineering Materialspraving76No ratings yet

- EC506 Wireless Gateway User Manual ENGDocument48 pagesEC506 Wireless Gateway User Manual ENGcy5170No ratings yet

- Sardar JokesDocument5 pagesSardar JokesblpsimhaNo ratings yet

- Apurba MazumdarDocument2 pagesApurba MazumdarDRIVECURENo ratings yet

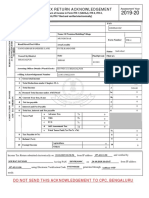

- Acknowledgement ItrDocument1 pageAcknowledgement ItrSourav KumarNo ratings yet

- Confirmation For Booking ID # 843643049Document1 pageConfirmation For Booking ID # 843643049cindy brigitaNo ratings yet

- Recent Advances in Enhanced Flooded Battery For Smart Mild Hybrid Power TrainsDocument29 pagesRecent Advances in Enhanced Flooded Battery For Smart Mild Hybrid Power Trains3 GamerNo ratings yet

- 1800 Mechanical Bender: Instruction ManualDocument42 pages1800 Mechanical Bender: Instruction ManualPato Loco Rateria100% (1)

- S. Ivo Alla Sapienza and Borrominis Sym PDFDocument25 pagesS. Ivo Alla Sapienza and Borrominis Sym PDFClaudio CastellettiNo ratings yet

- Laura Su ResumeDocument1 pageLaura Su Resumeapi-280311314No ratings yet

- March/April 2016 Cadillac Area Business MagazineDocument16 pagesMarch/April 2016 Cadillac Area Business MagazineCadillac Area Chamber of CommerceNo ratings yet

- Group DynamicsDocument27 pagesGroup DynamicsJoyce Angelica MendigorinNo ratings yet

- Ibps RRB Clerk Prelims Model Paper PDF Set 9Document29 pagesIbps RRB Clerk Prelims Model Paper PDF Set 9Raj KNo ratings yet

- Tutorial TransformerDocument2 pagesTutorial TransformerMohd KhairiNo ratings yet

- Gracie Royce - Gracie Charles - Brazilian Jiu-Jitsu Self-Defense TechniquesDocument245 pagesGracie Royce - Gracie Charles - Brazilian Jiu-Jitsu Self-Defense TechniquesPedro MarizNo ratings yet

- Wealth Management AssignmentDocument2 pagesWealth Management AssignmentHimanshu BajajNo ratings yet

- Introduction To Mineral Processing 2010Document24 pagesIntroduction To Mineral Processing 2010elmonemNo ratings yet

- Design Furnishings V Zen Path TRO ExtensionDocument11 pagesDesign Furnishings V Zen Path TRO ExtensionEric GoldmanNo ratings yet

- ASCE PipelinesbrochureDocument2 pagesASCE Pipelinesbrochurespringtide2722No ratings yet

- 144 Daftar P2P Ilegal AprilDocument12 pages144 Daftar P2P Ilegal AprilSumiatiNo ratings yet

- The 3-Level Acupuncture Balance - Part 3 - More On The Eight Extraordinary Channel Balance - Dr. Jake Fratkin - Boulder, CODocument17 pagesThe 3-Level Acupuncture Balance - Part 3 - More On The Eight Extraordinary Channel Balance - Dr. Jake Fratkin - Boulder, COzhikNo ratings yet

- Docker Management Design Patterns: Swarm Mode On Amazon Web ServicesDocument1 pageDocker Management Design Patterns: Swarm Mode On Amazon Web ServicesAli AhmadNo ratings yet

- Salt Market StructureDocument8 pagesSalt Market StructureASBMailNo ratings yet

- BUSETH - Ethical Issues in EntrepreneurshipDocument4 pagesBUSETH - Ethical Issues in EntrepreneurshipAngelicaHermoParasNo ratings yet