Professional Documents

Culture Documents

Thesun 2009-10-15 Page14 HK Ready To Avert Property Bubble

Thesun 2009-10-15 Page14 HK Ready To Avert Property Bubble

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-10-15 Page14 HK Ready To Avert Property Bubble

Thesun 2009-10-15 Page14 HK Ready To Avert Property Bubble

Uploaded by

Impulsive collectorCopyright:

Available Formats

14 theSun | THURSDAY OCTOBER 15 2009

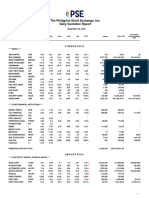

business KLCI

STI

1,246.84

2,708.48

13.33

40.08

Nikkei

TSEC

10,060.21

7,695.75

16.35

99.15

Hang Seng 21,886.48 419.12 KOSPI 1,649.09 20.16

SCI 2,970.53 34.34 S&P/ASX200 4,831.10 45.40

HK ready to avert property bubble

HONGKONG: Hongkong could increase quickening the pace of bringing readily Developers have been wooing million-

land supply in coming months to rein in available residential sites to the market,” aires from China with a slew of all-expenses

property prices, Chief Executive Donald Tsang said in his annual policy address to paid property-viewing tours. In September,

Tsang said, as a luxury flat sold for a world the Legislative Council. a one-bedroom 590sq ft apartment in a

record, heightening concerns about a pos- “The relatively small number of residen- downtown Kowloon district sold for just

sible property bubble. tial units completed and the record prices over US$3 million (RM10.5 million).

Developer Henderson Land Develop- attained in certain transactions this year “People are paying what I describe as EXCHANGE RATES October 14, 2009

ment said it had sold a deluxe duplex in have caused concern about the supply of trophy prices which don’t bear any reality

the Mid-Levels district on the lower slopes flats, difficulty in purchasing a home, and with what’s happening within the econo- Foreign currency Bank sell Bank buy Bank buy

of the city’s exclusive Peak for HK$71,280 the possibility of a property bubble,” Tsang my,” said Nicholas Brooke, chairman of real TT/OD TT OD

(RM31,850) per sq ft – setting a world record said. estate consultancy Professional Property 1 US DOLLAR 3.4210 3.3560 3.3460

per sq ft for an apartment and surpassing Two 372sq m penthouses in a develop- Services in Hongkong. 1 AUSTRALIAN DOLLAR 3.1220 3.0280 3.0120

London prices. ment on the Kowloon peninsula with views Brooke said a London flat by the Thames

Property prices in Hongkong have of the city’s harbour, will be among the would fetch £2,000 (RM11,200) per sq 1 BRUNEI DOLLAR 2.4570 2.3970 2.3890

surged 26% this year, despite the economic world’s most expensive apartments if they ft, while an apartment overlooking New 1 CANADIAN DOLLAR 3.3240 3.2430 3.2310

downturn, amid low new supply and strong fetch their price tag of nearly US$38 million York’s Central Park would go for US$4,000 1 EURO 5.0820 4.9780 4.9580

demand for luxury property from wealthy (RM133 million). (RM14,000) per sq ft. 1 NEW ZEALAND DOLLAR 2.5560 2.4440 2.4280

Chinese. Hongkong’s government, which Hongkong’s currency peg to a weak US Money from new stock market listings 1 PAPUA N GUINEA KINA 1.4110 1.1660 1.1500

controls land supply, has not sold residen- dollar makes property attractive to foreign and easy bank lending also allow Chinese 1 SINGAPORE DOLLAR 2.4565 2.3970 2.3890

tial for a year and a half. investors. The peg forces Hongkong to track to snap up luxury property, he said.

“The government will closely monitor US interest rates – which are expected to Broker Nomura estimates mainland 1 STERLING POUND 5.4470 5.3360 5.3160

market changes in the coming months. stay very low for some time – unlike South Chinese now account for 11% of Hongkong 1 SWISS FRANC 3.3550 3.2730 3.2580

When necessary, we will fine-tune land Korea, which has threatened to raise rates property sales and warns of a bubble. 100 ARAB EMIRATES DIRHAM 94.7800 89.7500 89.5500

supply arrangements ... with a view to soon to stave off a property bubble. – Reuters 100 BANGLADESH TAKA 5.2000 4.6840 4.4840

100 CHINESE RENMINBI N/A N/A N/A

100 DANISH KRONE 70.4500 64.7200 64.5200

100 HONGKONG DOLLAR 44.9200 42.5300 42.3300

100 INDIAN RUPEE 7.6500 7.0300 6.8300

100 INDONESIAN RUPIAH 0.0376 0.0330 0.0280

Two win 100 JAPANESE YEN 3.8210 3.7270 3.7170

Nissan 100 NEW TAIWAN DOLLAR N/A N/A N/A

Sylphy 100 NORWEGIAN KRONE 62.9000 57.7800 57.5800

each from 100 PAKISTAN RUPEE 4.2200 3.9300 3.7300

100 PHILIPPINE PESO 7.5300 7.0500 6.8500

1 Utama 100 QATAR RIYAL 95.3900 90.7300 90.5300

pg 16 100 SAUDI RIYAL 92.6200 88.1000 87.9000

100 SOUTH AFRICAN RAND 48.5400 44.4100 44.2100

100 SRI LANKA RUPEE 3.0800 2.8300 2.6300

100 SWEDISH KRONA 50.9500 46.3400 46.1400

100 THAI BAHT 11.0300 9.3500 8.9500

Source: Malayan Banking Bhd/Bernama

market summary OCTOBER 14, 2009

CI hits year’s INDICES CHANGE

FBMEMAS 8,393.58 +97.57

high FBM-KLCI 1,246.84 +13.33

THE FTSE Bursa Malaysia Kuala INDUSTRIAL 2,667.12 +13.85

CONSUMER PROD 368.95 +2.31

Lumpur Composite Index (FBM INDUSTRIAL PROD 93.62 +1.17

KLCI) jumped to the year’s new CONSTRUCTION 238.56 +1.96

high as investors snapped up TRADING SERVICES 161.06 +1.41

banking-related stocks yes- FINANCE 10,528.24 +171.58

terday. The benchmark index PROPERTIES 813.84 +7.96

closed 13.33 points higher at PLANTATIONS: 6,031.33 +43.75

1,246.84 after hitting an intra- MINING: 316.12 +8.10

day high of 1,248.14. FBMSHA 8,474.84 + 79.14

FBMACE 4,269.02 + 48.30

Dealers said the Malay- TECHNOLOGY 17.25 + 0.29

sian Institute of Economic

Research’s forecast that the TURNOVER VALUE

country’s economy would 1.260bil RM1.655bil

shrink at a slower pace of 3.3%

this year, an improvement from 8,393.58, the FBM Top 100 in-

4.2% projected earlier, provided creased 91.98 points to 8,171.25,

some support. the FBM 70 jumped 111.23

Rising buying interest in penny points to 8,257.70 and the FBM

and small cap stocks with the ACE Index advanced 48.30

return of risk appetite was also points to 4,269.02. The Finance

evident, they said. Index surged 171.58 points to

“Follow-through buying by 10,528.24, the Plantation Index

foreign funds in key banking- gained 43.75 points to 6,031.33

related stocks such as Maybank and the Industrial Index added

and CIMB Group helped the FBM 13.85 points to 2,667.12.

KLCI extend its gain,” a dealer Gainers outnumbered losers

said. by 574 to 174 while 208 counters

At the close, the FBM Emas unchanged and 338 others un-

Index gained 97.57 points to traded. – Bernama

More than 50,000 Nissan vehicles

recalled in China

BEIJING: A Chinese joint venture yesterday. A problem with the ve-

involving Japan’s Nissan Motors will hicles’ steering nut may lead to the

recall nearly 52,000 cars in China loss of direction control in extreme

due to safety defects in the steering cases, the statement said.

system, the country’s product-qual- Dongfeng Motor will install

ity watchdog said. fasteners on the recalled cars, it

The recall by Dongfeng Motor Co added. Average monthly sales of

Ltd covers 18,146 X-Trail sport utility the two cars in China this year

vehicles and 33,667 Qashqai units, stood at around 5,000 units in total,

said a statement posted on Tuesday according to Beijing Times.

on the website of the General Ad- Dongfeng Motor Co Ltd was

ministration of Quality Supervision, established in 2003 between state-

Inspection and Quarantine. owned Dongfeng Motor Corporation

It said the recall was to begin and Nissan Motors. – AFP

You might also like

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Financial Asset Debt Securities Practice QuizDocument3 pagesFinancial Asset Debt Securities Practice QuizMarjorie PalmaNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- New Century Loan Pools - List of Securities TrustsDocument11 pagesNew Century Loan Pools - List of Securities Trusts83jjmack100% (1)

- Hemant Kandpal Internship ReportDocument30 pagesHemant Kandpal Internship Reporthemant kandpalNo ratings yet

- Thesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesDocument1 pageThesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesImpulsive collectorNo ratings yet

- Thesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangDocument1 pageThesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- Thesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingDocument1 pageThesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingImpulsive collectorNo ratings yet

- Fxrate 28 03 2022Document2 pagesFxrate 28 03 2022G. M. Sadrul IslamNo ratings yet

- Thesun 2009-07-28 Page17 World Stocks at 9-Mth PeakDocument1 pageThesun 2009-07-28 Page17 World Stocks at 9-Mth PeakImpulsive collector100% (2)

- Dollar: QG (F (QL (SRDocument2 pagesDollar: QG (F (QL (SRShibleNo ratings yet

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocument1 pageThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNo ratings yet

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomDocument1 pageThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorNo ratings yet

- Fxrate 12 06 2023Document2 pagesFxrate 12 06 2023ShohanNo ratings yet

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankDocument1 pageTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorNo ratings yet

- Thesun 2009-07-17 Page13 Chinas Economy Grows 7Document1 pageThesun 2009-07-17 Page13 Chinas Economy Grows 7Impulsive collectorNo ratings yet

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocument1 pageThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNo ratings yet

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDocument1 pageTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNo ratings yet

- Fxrate 21 03 2024Document2 pagesFxrate 21 03 2024Borhan PiasNo ratings yet

- Fxrate 06 06 2023Document2 pagesFxrate 06 06 2023ShohanNo ratings yet

- Fxrate 01 06 2023Document2 pagesFxrate 01 06 2023ShohanNo ratings yet

- Magway 2Document1 pageMagway 2yanlinaung176409No ratings yet

- Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessDocument1 pageThesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessImpulsive collectorNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- Fxrate 23 05 2023Document2 pagesFxrate 23 05 2023ShohanNo ratings yet

- Fxrate 11 05 2023Document2 pagesFxrate 11 05 2023ShohanNo ratings yet

- TheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistDocument1 pageTheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- By Aad Real Estate-Mavera Luxury Palace PresentationDocument7 pagesBy Aad Real Estate-Mavera Luxury Palace PresentationDennis KigenNo ratings yet

- Fxrate 28 05 2023Document2 pagesFxrate 28 05 2023ShohanNo ratings yet

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocument1 pageTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNo ratings yet

- Thesun 2009-08-26 Page15 Market SummaryDocument1 pageThesun 2009-08-26 Page15 Market SummaryImpulsive collectorNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocument1 pageThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- BQ Cover Manhole - R1 (After Discount)Document2 pagesBQ Cover Manhole - R1 (After Discount)Adhe Ahmad YazidNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- Thesun 2009-08-25 Page17 Market SummaryDocument1 pageThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNo ratings yet

- TheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaDocument1 pageTheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaImpulsive collectorNo ratings yet

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDocument1 pageThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNo ratings yet

- Thesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerDocument1 pageThesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerImpulsive collector100% (2)

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocument1 pageThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNo ratings yet

- Copy1-DEVIS 40FT 2024 (1) 70Document3 pagesCopy1-DEVIS 40FT 2024 (1) 70AntoineNo ratings yet

- Rencana Anggaran Biaya Kegiatan Penambangan Nikel Fob Tongkang Grid 1.8 Vol. 200 RB MTDocument5 pagesRencana Anggaran Biaya Kegiatan Penambangan Nikel Fob Tongkang Grid 1.8 Vol. 200 RB MTnur lianaNo ratings yet

- Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker BulgeDocument1 pageThesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker BulgeImpulsive collectorNo ratings yet

- TheSun 2009-08-10 Page15 World Pins Recovery Hopes On Rising House PricesDocument1 pageTheSun 2009-08-10 Page15 World Pins Recovery Hopes On Rising House PricesImpulsive collectorNo ratings yet

- Lintels & Tie BeamsDocument11 pagesLintels & Tie BeamsWilbert ReuyanNo ratings yet

- Thesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesDocument1 pageThesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesImpulsive collectorNo ratings yet

- 21KG0048R Bid EvaluationDocument1 page21KG0048R Bid EvaluationElbert EinsteinNo ratings yet

- CASH FLOW GRAHA Jatinangor Format BaruDocument96 pagesCASH FLOW GRAHA Jatinangor Format BaruHadi subadjaNo ratings yet

- Fxrate 18 12 2023Document2 pagesFxrate 18 12 2023m.rahmanNo ratings yet

- Thesun 2009-05-27 Page15 Asian Shares Hit by North Korea TensionDocument1 pageThesun 2009-05-27 Page15 Asian Shares Hit by North Korea TensionImpulsive collectorNo ratings yet

- Tank FABRICATIONDocument1 pageTank FABRICATIONsampeters.infoNo ratings yet

- Grand Total 38 9Document3 pagesGrand Total 38 9Annur sweetNo ratings yet

- September 29, 2023-EODDocument14 pagesSeptember 29, 2023-EODMJA MAMANo ratings yet

- RAB Pekerjaan Cover ManholeDocument2 pagesRAB Pekerjaan Cover ManholeAdhe Ahmad YazidNo ratings yet

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Document1 pageTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- Agreement (Dosc (Rev.) )Document3 pagesAgreement (Dosc (Rev.) )Lerramie Dela PeñaNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Project On Sharekhan Investors Behavior For Investing in Equity Market in Various SectorDocument120 pagesProject On Sharekhan Investors Behavior For Investing in Equity Market in Various Sectorashish88% (26)

- Audit Exam 3 Part 3 Flashcards - QuizletDocument15 pagesAudit Exam 3 Part 3 Flashcards - QuizletLilliane EstrellaNo ratings yet

- Derivatives - HEC LausanneDocument2 pagesDerivatives - HEC LausanneRavi SharmaNo ratings yet

- Options Futures and DerivativesDocument33 pagesOptions Futures and DerivativesSudhir Kumar YadavNo ratings yet

- What Is Insider TradingDocument7 pagesWhat Is Insider TradingAsif HussainNo ratings yet

- Ethical Consulting Presentation - 8860456000Document20 pagesEthical Consulting Presentation - 8860456000Pankaj KumarNo ratings yet

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- Forex Robots and How They WorkDocument6 pagesForex Robots and How They WorkEugene SolomonNo ratings yet

- Develop Understanding of The Ethiopian Financial System and MarketDocument15 pagesDevelop Understanding of The Ethiopian Financial System and MarketMamush Sagoya100% (3)

- Do Tracking Stocks Reduce Informational Asymmetries by Elder Et Al. (JFR 2005)Document17 pagesDo Tracking Stocks Reduce Informational Asymmetries by Elder Et Al. (JFR 2005)Eleanor RigbyNo ratings yet

- Digital Marketing Fundamentals 7boatsDocument26 pagesDigital Marketing Fundamentals 7boatsRohit DubeyNo ratings yet

- KELOMPOK 5 (CHAPTER 17) RevDocument40 pagesKELOMPOK 5 (CHAPTER 17) Revnandya rizkyNo ratings yet

- Project Report Rajdeep 2k16mba44Document57 pagesProject Report Rajdeep 2k16mba44Gaurav KushwahNo ratings yet

- Analisis Tingkat Kesehatan Bank Dengan M 3815af8dDocument9 pagesAnalisis Tingkat Kesehatan Bank Dengan M 3815af8dWardaNo ratings yet

- ENDECA TechnologiesDocument3 pagesENDECA TechnologiesParitoshNo ratings yet

- Edwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewDocument36 pagesEdwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewHITESH MAKHIJANo ratings yet

- Ammen Case-Study3Document2 pagesAmmen Case-Study3JackNo ratings yet

- Sample Final Exam Questions W19 March 31 With Answers - Leverage DividendsDocument3 pagesSample Final Exam Questions W19 March 31 With Answers - Leverage Dividendsbusiness docNo ratings yet

- Sherkhan ProjectDocument96 pagesSherkhan ProjectAbhishek AgarwalNo ratings yet

- Statistic Id1342958 Leading Startups Indonesia 2022 by Funding AmountDocument5 pagesStatistic Id1342958 Leading Startups Indonesia 2022 by Funding AmountUlfah Fitriana AkbarNo ratings yet

- The Following Are Selected Transactions That May Affect Shareholders Equity PDFDocument1 pageThe Following Are Selected Transactions That May Affect Shareholders Equity PDFFreelance WorkerNo ratings yet

- Script Pano TorcidoDocument7 pagesScript Pano TorcidoGAME CRAFT vitorNo ratings yet

- STATEMENT OF PURPOSE - Komal GujwarDocument3 pagesSTATEMENT OF PURPOSE - Komal GujwarAjai KumarNo ratings yet

- Bài tập chap 17 18Document3 pagesBài tập chap 17 18huanbilly2003No ratings yet

- Practice Set - Foreign Exchange - AfarDocument3 pagesPractice Set - Foreign Exchange - AfarFannie GailNo ratings yet

- Lecture - Big Mac IndexDocument11 pagesLecture - Big Mac IndexKatherine SauerNo ratings yet

- Managing Bank CapitalDocument24 pagesManaging Bank CapitalHenry So E DiarkoNo ratings yet