Professional Documents

Culture Documents

Sourcing Contingent Workforce - Rise of MSP Model - Service Provider Landscape

Sourcing Contingent Workforce - Rise of MSP Model - Service Provider Landscape

Uploaded by

everestgrp0 ratings0% found this document useful (0 votes)

80 views11 pagesIn this study, we focus on the dynamics of the 2013 MSP service provider landscape and its impact on the MSP market. We position service providers on the Everest Group PEAK Matrix, categorizing them as Leaders, Major Contenders, or Emerging Players. Key insights and differentiators that set the Leaders apart from the rest of the pack are discussed in detail. We analyze the MSP service provider landscape across market success, scale, scope, technology, delivery footprint, and other differentiating factors

Original Title

Sourcing Contingent Workforce - Rise of MSP model - Service provider landscape

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIn this study, we focus on the dynamics of the 2013 MSP service provider landscape and its impact on the MSP market. We position service providers on the Everest Group PEAK Matrix, categorizing them as Leaders, Major Contenders, or Emerging Players. Key insights and differentiators that set the Leaders apart from the rest of the pack are discussed in detail. We analyze the MSP service provider landscape across market success, scale, scope, technology, delivery footprint, and other differentiating factors

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

80 views11 pagesSourcing Contingent Workforce - Rise of MSP Model - Service Provider Landscape

Sourcing Contingent Workforce - Rise of MSP Model - Service Provider Landscape

Uploaded by

everestgrpIn this study, we focus on the dynamics of the 2013 MSP service provider landscape and its impact on the MSP market. We position service providers on the Everest Group PEAK Matrix, categorizing them as Leaders, Major Contenders, or Emerging Players. Key insights and differentiators that set the Leaders apart from the rest of the pack are discussed in detail. We analyze the MSP service provider landscape across market success, scale, scope, technology, delivery footprint, and other differentiating factors

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 11

Market Report: December 2013 Preview Deck

Topic: Managed Service Provider (MSP) Service

Provider Landscape with PEAK Matrix

TM

Assessment

2013

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

2

Our r esear c h of f er i ngs f or gl obal ser vi c es

Subscription information

l The full report is included in the

following subscription(s)

Recruitment Process

Outsourcing (RPO)

l In addition to published

research, a subscription may

include analyst inquiry, data

cuts, and other services

l If you want to learn whether

your organization has a

subscription agreement or

request information on pricing

and subscription options, please

contact us:

Corporate Headquarters

Office: +1-214-451-3000

info@everestgrp.com

European Headquarters

Office: +44-207-129-1318

unitedkingdom@everestgrp.com

1 Banking, financial services, and insurance

Custom research capabilities

l Benchmarking | Pricing, delivery model, skill portfolio

l Peer analysis | Scope, sourcing models, locations

l Locations | Cost, skills, sustainability, portfolio plus a tracking tool

l Tracking services | Service providers, locations, risk

l Other | Market intelligence, service provider capabilities, technologies, contract

assessment

Finance & accounting

Procurement

Human resources

Recruitment process

PricePoint

TM

Global sourcing

Locations Insider

TM

Contact center

Transaction Intelligence

Healthcare information technology

Information technology

Cloud Vista

TM

BFSI

1

business process

BFSI

1

information technology

Market Vista

TM

Global services tracking across functions, sourcing models, locations, and service

providers industry tracking reports also available

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

3

Bac k gr ound and met hodol ogy of t he r esear c h

Background of the research

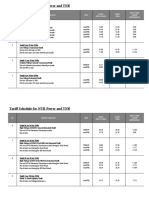

The global MSP is estimated to be US$60-65 billion based on managed spend and ~US$1.05 in terms of Net

Fee Income (NFI). Its landscape is characterized by the juxtaposition of traditional and emerging drivers which

are shaping the MSP market in a multitude of ways. To maintain a competitive edge in this evolving space,

service providers differentiate their offerings by specializing across various dimensions. However, only some

players have the capability to execute deals with both depth and breadth of scope.

In this research, we analyze the global MSP market across the following dimensions:

l Market overview and service provider landscape

l 2013 MSP PEAK Matrix

l Key insights into PEAK Matrix dimensions

l Key areas of differentiation and specialization

The scope and methodology of this report includes:

l Proprietary data collected from ~15 MSP providers

l MSP deals with a minimum of four core processes included and minimum contract term of two years

l Scope of hires includes temporary/contingent hires, SoW consultants, and independent contractors

l Everest Group defines MSP as the transfer of ownership of all or part of the management of an

organizations contingent/temporary staffing activities on an ongoing basis

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

4

Tabl e of c ont ent s (page 1 of 2)

Background and methodology 5

Executive summary 8

l Summary of key messages 9

l Implications for key stakeholders 12

Section I: Market overview and service provider landscape 13

l Summary 14

l Market size 15

l Market dynamics 16

l Service provider landscape 18

Section II: 2013 MSP PEAK Matrix 19

l Summary 20

l 2013 MSP PEAK Matrix scoring methodology 21

l 2013 MSP PEAK Matrix 23

l Service provider assessment 24

Section III: Key insights into PEAK Matrix dimensions 27

l Summary 28

l Market success 29

l Delivery capability scale 30

l Delivery capability scope 31

Topic Page no.

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

5

Tabl e of c ont ent s (page 2 of 2)

Section III: Key insights into PEAK Matrix dimensions (continued)

l Delivery capability technology 32

l Delivery capability delivery footprint 33

Section IV: Key areas of differentiation and specialization 34

l Summary 35

l Areas of differentiation and specialization 36

J ob category and family 37

Industry 39

Deal size 40

Multi-country MSP 41

Geographic reach 42

Global sourcing 44

Technology 45

Appendix 46

l Glossary of terms 48

l MSP research calendar 50

l References 51

Topic Page no.

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

6

This report examines the global 2013 MSP service provider landscape and its impact on the MSP market. It

focuses on service provider position and growth in the MSP market, changing market dynamics and emerging

service provider trends, assessment of service provider delivery capabilities, and key MSP service provider

differentiators. It also identifies the key implications of the research findings for buyers and service providers.

MSP market and

growth

2013 MSP PEAK

Matrix

Over vi ew and abbr evi at ed summar y of k ey messages

(page 1 of 2)

l Everest Group PEAK Matrix categorizes MSP service providers into Leaders,

Major Contenders, and Emerging Players based on their market success and

overall MSP delivery capability

l We assessed service providers delivery capabilities along the following four

dimensions:

Scale

Scope

Technology capability

Delivery footprint

Some of the findings in this report, among others, are:

l The managed spend in the MSP market grew by 13 to 16% in 2012 to reach

US$60 to 65 billion

l The current market size, in terms of Net Fee Income (NFI), is ~US$1.05 billion

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

7

Key insights into

PEAK Matrix

dimensions

Key areas of

differentiation and

specialization

l Key insights on comparing the top quartile performers and other performers on

delivery capability dimensions

Market success: The top quartile performers are massively ahead of their

peers in terms of market success, which leads to a domino effect contributing

to greater success

Delivery capability scope: Top quartile performers are masters of multiple

trades, across industries, job families, deal sizes, and geographies

l MSP providers differentiate through varying capabilities along multiple

dimensions job category and family, industry, deal size, multi-country MSP,

geographic reach, and global sourcing

Industry MSP providers generally have experience across multiple industries

with focused play around a couple of industries

Technology Pure-play and niche MSP providers have a stronger focus on

proprietary VMS technology

Over vi ew and abbr evi at ed summar y of k ey messages

(page 2 of 2)

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

8

Others Top quartile

performers

Others Top quartile

performers

Thi s st udy of f er s f our di st i nc t c hapt er s pr ovi di ng a deep di ve

i nt o k ey aspec t s of t he MSP mar k et ; bel ow ar e f our c har t s t o

i l l ust r at e t he dept h of t he r epor t

Source: Everest Group (year)

2013 MSP PEAK Matrix Key insight into PEAK Matrix dimension scale

MSP provider capability large sized contracts

MSP provider capability proprietary VMS

High

Low

Low

High 25

t h

percentile

2

5

t

h

p

e

r

c

e

n

t

i

l

e

75

t h

percentile

7

5

t

h

p

e

r

c

e

n

t

i

l

e

M

a

r

k

e

t

s

u

c

c

e

s

s

Delivery capability

Leaders

Emerging Players

Major Contenders

Hudson RPO

Xchanging

AMN Healthcare

Capita Resourcing

Yoh

Superior Group

nextSource

Hays

ZeroChaos

Randstad

Sourceright

KellyOCG

Allegis Group Services

ManpowerGroup

Solutions TAPFIN

Average managed spend per provider

FTE

(denotes economies of scale)

US$ million

Average number of FTEs per provider

Number of FTEs

Large-sized deals Mega-sized deals

Market share by deal size

Number of deals

100% =

Service provider 1

Service provider 2

Service provider 3

Service provider 4

Service provider 5

Service provider 6

Service provider 7

Others

Service provider 1

Service provider 2

Service provider 3

Service provider 4

Service provider 5

Service provider 6

Service provider 7

Service provider 8

Service provider 9

Service provider 10

Service provider 11

Service provider 12

Service provider 13

Staffing-legacy

MSP providers

Pure-play

MSP providers

Other new

providers

Service providers

Proprietary

VMS?

Number of deployments of

proprietary VMS

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

9

MSP pr ogr am r esear c h c al endar

Topic Release date

Published Current

December-2013 MSP Service Provider Landscape with PEAK Matrix

TM

Assessment 2013

October-2013 Managed Service Provider (MSP) Mastering the Winds of Change

Q1-2014 Managed Service Provider (MSP) Service Provider Compendium 2013

Q1-2014 Multi-country MSP: Market adoption, best practices and challenges

Q1-2014 The Rise of Procurement and HR Collaboration Effectively Managing HR-spend

Q3-2014 Managed Service Provider (MSP) Service Provider Landscape with PEAK Matrix 2014

Q3-2014 Managed Service Provider (MSP) Service Provider Compendium 2014

Q2-2014 Managed Service Provider (MSP) State of the Market 2014

Copyright 2013, Everest Global, Inc.

EGR-2013-3-PD-1034

10

Addi t i onal r esear c h r ec ommendat i ons

The following documents are recommended for additional insight into the topic covered in this research. The recommended

documents either provide additional details on the topic or complementary content that may be of interest

1. Managed Service Provider (MSP) Mastering the Winds of Change (EGR-2013-3-R-0958); 2013. Over the last few years, the

Managed Service Provider (MSP) market has experienced steady growth as well as concurrent elementary changes that are altering the

dynamics of the market. Not only are buyer expectation and drivers changing, but also the buyer profile. The service provider landscape

is also morphing, as is the operating model of the providers. This flux in MSP makes it imperative for buyers to understand what they can

derive from the offering in the market and for service providers to update/upgrade their service portfolio

1. RPO Annual Report 2013 Dichotomy of Market Exuberance and Subdued Economy (EGR-2013-3-R-0850); 2013. Recruitment

Process Outsourcing (RPO) continued its momentum in 2012 with record new deal signings. However, due to a decrease in hiring

volumes, the RPO market grew at a moderate rate of 12% to touch US$1.5 billion. This research provides comprehensive coverage of

the market across dimensions such as market overview, key business drivers, buyer adoption trends, transaction trends, and service

provider landscape. It also provides predictions for the 2013 RPO market

2. Rise of Blended RPO Addressing the Total Talent Acquisition Need (EGR-2011-3-R-0597); 2011. The "Rise of Blended RPO"

report provides insights into the value proposition of a total talent acquisition approach leveraging a blended RPO solution. It highlights

the drivers behind such an approach; provides an analysis of the benefits in terms of financial, business, and strategic impact; and

describes challenges and key considerations for adoption

Phone: +1-214-451-3110

Email: info@everestgrp.com

Everest Group

Two Galleria Tower

13455 Noel Road, Suite 2100

Dallas, TX 75240

For more information on this and other researches published by Everest Group, please contact us:

Raj esh Ranj an, Vice President:

Abhishek Menon, Practice Director:

Arkadev Basak, Senior Analyst:

Dhananj ai Gaur, Analyst:

rajesh.ranjan@everestgrp.com

abhishek.menon@everestgrp.com

arkadev.basak@everestgrp.com

dhananjai.gaur@everestgrp.com

Blogs

www.sherpasinblueshirts.com

www.gainingaltitudeinthecloud.com

@EverestGroup

@Everest_Cloud

Stay connected

Websites

www.everestgrp.com

research.everestgrp.com

Dallas (Headquarters)

info@everestgrp.com

+1-214-451-3000

New York

info@everestgrp.com

+1-646-805-4000

Toronto

canada@everestgrp.com

+1-647-557-3475

London

unitedkingdom@everestgrp.com

+44-207-129-1318

Delhi

india@everestgrp.com

+91-124-284-1000

At a glance

l With a fact-based approach driving outcomes, Everest Group counsels

organizations with complex challenges related to the use and delivery of the

next generation of global services

l Through its practical consulting, original research, and industry resource

services, Everest Group helps clients maximize value from delivery strategies,

talent and sourcing models, technologies, and management approaches

l Established in 1991, Everest Group serves users of global services, providers

of services, country organizations, and private equity firms in six continents

across all industry categories

You might also like

- Inside Gartner ResearchDocument32 pagesInside Gartner ResearchNandan AurangabadkarNo ratings yet

- Steve W. Martin: BooksDocument8 pagesSteve W. Martin: BooksParvez2zNo ratings yet

- Benefits Administration Outsourcing (BAO) - Service Provider Landscape and Capability AssessmentDocument10 pagesBenefits Administration Outsourcing (BAO) - Service Provider Landscape and Capability AssessmenteverestgrpNo ratings yet

- IDN & GPO in USADocument2 pagesIDN & GPO in USAreddykmpNo ratings yet

- How To Think Like A Strategy Consultant A Primer For General Managers1Document3 pagesHow To Think Like A Strategy Consultant A Primer For General Managers1jexxicuhNo ratings yet

- Ebook 1 SiriusDecisions Demand Waterfall Marketing AutomationDocument17 pagesEbook 1 SiriusDecisions Demand Waterfall Marketing AutomationMubashsher SalimNo ratings yet

- Ajit NewspaperDocument27 pagesAjit NewspaperNadeem YousufNo ratings yet

- Growth of Horizontal BPO in LATAMDocument10 pagesGrowth of Horizontal BPO in LATAMeverestgrpNo ratings yet

- Top 10 Problems-With OutsourcingDocument13 pagesTop 10 Problems-With Outsourcinginformatic1988No ratings yet

- Content 995Document76 pagesContent 995Vinoth RoyNo ratings yet

- BPO - Business Process OutsourcingDocument18 pagesBPO - Business Process Outsourcinggunjan tiwariNo ratings yet

- BCG Next Generation Medical Management - v3Document14 pagesBCG Next Generation Medical Management - v3Sumit Kumar AwkashNo ratings yet

- Indirect Source To Pay OverviewDocument4 pagesIndirect Source To Pay OverviewLionelkeneth12No ratings yet

- Sixth and Final Application Alvarez & Marsal, LLCDocument535 pagesSixth and Final Application Alvarez & Marsal, LLCChapter 11 DocketsNo ratings yet

- Health Plan Price TransparencyDocument16 pagesHealth Plan Price TransparencyMartha Bebinger100% (1)

- Sales Excellence in The Pharma IndustryDocument4 pagesSales Excellence in The Pharma IndustryKushal AgrawalNo ratings yet

- WNS PresentationDocument24 pagesWNS PresentationRohit Prasad100% (1)

- Chapter 11 Supply Chain Management 8th Ed 2011Document16 pagesChapter 11 Supply Chain Management 8th Ed 2011johnSianturiNo ratings yet

- Outsourcing 2Document14 pagesOutsourcing 2Garang GeorgeNo ratings yet

- 2019 HR Tech Survey ReportDocument33 pages2019 HR Tech Survey ReportSiddharth KarNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- Hysea SentTalent MGT Prog-By Allen Mathew (1) OracleDocument27 pagesHysea SentTalent MGT Prog-By Allen Mathew (1) Oracleyantra3031No ratings yet

- KPMG 2010 Project Management Survey ReportDocument20 pagesKPMG 2010 Project Management Survey ReportPhoulLitNo ratings yet

- "Recruitment and Selection Process at Mindlance" 12Document8 pages"Recruitment and Selection Process at Mindlance" 12Lalit SinghNo ratings yet

- UndergraduateGraduate Bro 210x210mm CM APAC PRINT 0216 Rev05 EmailDocument12 pagesUndergraduateGraduate Bro 210x210mm CM APAC PRINT 0216 Rev05 EmailvandelfinNo ratings yet

- Mergers Acquistions PDFDocument24 pagesMergers Acquistions PDFGovardhan RaviNo ratings yet

- Accenture When Bots Do The Buying POVDocument11 pagesAccenture When Bots Do The Buying POVSaritha SinghNo ratings yet

- PWC Pharma Deals Insights q1 2014Document20 pagesPWC Pharma Deals Insights q1 2014leohytuNo ratings yet

- Overview of The Global Human Resources Outsourcing IndustryDocument26 pagesOverview of The Global Human Resources Outsourcing IndustryTracey MorinNo ratings yet

- Management Consulting - To The Brainy, The Spoils - The EconomistDocument3 pagesManagement Consulting - To The Brainy, The Spoils - The EconomistAbhj SaNo ratings yet

- Negotiations Planning Best ValueDocument31 pagesNegotiations Planning Best ValueMohammed Arshad AliNo ratings yet

- Tab 4: Subject Matter Categories / AreasDocument34 pagesTab 4: Subject Matter Categories / AreasEkta ParabNo ratings yet

- Accenture - Artificial Intelligence - Healthcare's New Nervous SystemDocument8 pagesAccenture - Artificial Intelligence - Healthcare's New Nervous SystemRobert KoverNo ratings yet

- Inv Management MindmapDocument1 pageInv Management Mindmaplittle_acreNo ratings yet

- Procurement Outsourcing: - Managing Indirect SpendDocument19 pagesProcurement Outsourcing: - Managing Indirect SpendmalikajNo ratings yet

- About ZinnovDocument12 pagesAbout Zinnoviisc cpdmNo ratings yet

- What Is Management ConsultingDocument5 pagesWhat Is Management ConsultingParam ShahNo ratings yet

- ConclusionDocument29 pagesConclusionVarunMalhotra100% (1)

- Consultative Selling Process OverviewDocument11 pagesConsultative Selling Process Overviewocto widodo100% (1)

- Global Startups FactsheetDocument4 pagesGlobal Startups FactsheetAnshuman PanwarNo ratings yet

- Sourcing Strategy and Outsourcing and SRMDocument66 pagesSourcing Strategy and Outsourcing and SRMApratim AryaNo ratings yet

- Ebs r12 r12 1 Stories 1956830 PDFDocument586 pagesEbs r12 r12 1 Stories 1956830 PDFShivanagowda SannagowdarNo ratings yet

- Shared Services & Bpo in The Philippines 15 Nov 2011Document29 pagesShared Services & Bpo in The Philippines 15 Nov 2011Trish BustamanteNo ratings yet

- BCG The One Ratio Every Subscription Business Feb 2017-NL - tcm9-159788Document5 pagesBCG The One Ratio Every Subscription Business Feb 2017-NL - tcm9-159788Monica Ahuja100% (1)

- Data Digitization and DisruptionDocument18 pagesData Digitization and DisruptionSimpleLuNo ratings yet

- PwC's Health Research Institute ReportDocument21 pagesPwC's Health Research Institute ReportHLMeditNo ratings yet

- SWC 428 Govt Efficiency Consulting Signed Contract 66331Document33 pagesSWC 428 Govt Efficiency Consulting Signed Contract 66331The Center SquareNo ratings yet

- Iqvia Longitudinal Prescription DataDocument2 pagesIqvia Longitudinal Prescription DataShyamsree Nandi100% (1)

- 2015 Sia Competitive Landscape Industry Report BeelineDocument81 pages2015 Sia Competitive Landscape Industry Report BeelineMaxi MaNo ratings yet

- A Bird's Eye View of Indian BPODocument77 pagesA Bird's Eye View of Indian BPOwanttopublish100% (1)

- Private Equity Opportunities in Healthcare Tech VFDocument9 pagesPrivate Equity Opportunities in Healthcare Tech VFGm BaigNo ratings yet

- Annual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management ConsultingDocument10 pagesAnnual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management Consultingchocobanana123No ratings yet

- Indian Call Centers DisadvantagesDocument1 pageIndian Call Centers DisadvantagesClara PalmaNo ratings yet

- Index of Thought Leaders 2012Document4 pagesIndex of Thought Leaders 2012lomax2No ratings yet

- Building and Delivering The PresentationDocument42 pagesBuilding and Delivering The PresentationParatchana JanNo ratings yet

- McKinsey Case AnalysisDocument2 pagesMcKinsey Case AnalysisAbhishek Goyal100% (1)

- Boutique Managed Service Providers - Chatdesk August 2019 GuideDocument205 pagesBoutique Managed Service Providers - Chatdesk August 2019 GuideHal ChatdeskNo ratings yet

- The Delta Model: Reinventing Your Business StrategyFrom EverandThe Delta Model: Reinventing Your Business StrategyRating: 3 out of 5 stars3/5 (1)

- Indirect Sourcing and Procurement BPO A Complete Guide - 2019 EditionFrom EverandIndirect Sourcing and Procurement BPO A Complete Guide - 2019 EditionNo ratings yet

- Market Vista: Q4 2013Document21 pagesMarket Vista: Q4 2013everestgrpNo ratings yet

- Growth of Horizontal BPO in LATAMDocument10 pagesGrowth of Horizontal BPO in LATAMeverestgrpNo ratings yet

- Insurance BPO - Service Provider Landscape With PEAK Matrix Assessment 2013Document10 pagesInsurance BPO - Service Provider Landscape With PEAK Matrix Assessment 2013everestgrpNo ratings yet

- Finance & Accounting in Latin AmericaDocument10 pagesFinance & Accounting in Latin AmericaeverestgrpNo ratings yet

- PO Service Provider Profile CompendiumDocument13 pagesPO Service Provider Profile CompendiumeverestgrpNo ratings yet

- Managed Service Provider (MSP) - Mastering The Winds of ChangeDocument11 pagesManaged Service Provider (MSP) - Mastering The Winds of ChangeeverestgrpNo ratings yet

- Tata Acquired Luxury Auto Brands Jaguar and Land Rover - From Ford MotorsDocument15 pagesTata Acquired Luxury Auto Brands Jaguar and Land Rover - From Ford MotorsJoel SaldanhaNo ratings yet

- BAC 200 Accounting For AssetsDocument90 pagesBAC 200 Accounting For AssetsFaith Ondieki100% (3)

- In The Days of Your YouthDocument3 pagesIn The Days of Your YouthGideonNo ratings yet

- ZeitgeistDocument1 pageZeitgeistNabiha NadeemNo ratings yet

- China and Africa - BibliographyDocument357 pagesChina and Africa - BibliographyDavid ShinnNo ratings yet

- Illiashenko and Strielkowski 2018 Innovative Management LibroDocument296 pagesIlliashenko and Strielkowski 2018 Innovative Management LibroYaydikNo ratings yet

- Komunikasi SBAR Perawat Dan Dokter Dalam Kolaborasi Interprofesional Di Rumah Sakit X 2023Document13 pagesKomunikasi SBAR Perawat Dan Dokter Dalam Kolaborasi Interprofesional Di Rumah Sakit X 2023Laras Adythia PratiwiNo ratings yet

- Atlantic Coastwatch: An Era Ending?Document8 pagesAtlantic Coastwatch: An Era Ending?Friends of the Atlantic Coast Watch NewsletNo ratings yet

- The Ultimate Beginner S Guide To Feng ShuiDocument8 pagesThe Ultimate Beginner S Guide To Feng Shuibilldockto_141471063No ratings yet

- St. Martin vs. LWVDocument2 pagesSt. Martin vs. LWVBaby T. Agcopra100% (5)

- Manual For Conflict AnalysisDocument38 pagesManual For Conflict AnalysisNadine KadriNo ratings yet

- Kakori ConspiracyDocument8 pagesKakori ConspiracyAvaneeshNo ratings yet

- Modul Berbicara 1Document49 pagesModul Berbicara 1Alif Satuhu100% (1)

- Unit 3 Bible Exam and MidtermDocument3 pagesUnit 3 Bible Exam and MidtermMicah BrewsterNo ratings yet

- Value Education Syllabi 2022-2023Document2 pagesValue Education Syllabi 2022-2023bharad wajNo ratings yet

- TNB and NUR Tariff DifferencesDocument2 pagesTNB and NUR Tariff DifferencesAzree Mohd NoorNo ratings yet

- Hooker Electrochemical Quit Claim Deed To Board of EducationDocument4 pagesHooker Electrochemical Quit Claim Deed To Board of Educationapi-445004460No ratings yet

- APUSH Civil Rights Movement NotesDocument6 pagesAPUSH Civil Rights Movement NotesphthysyllysmNo ratings yet

- Tips For Teaching PronunciationDocument271 pagesTips For Teaching Pronunciationasanchez_808148100% (16)

- Banaszynski v. United States Government - Document No. 4Document2 pagesBanaszynski v. United States Government - Document No. 4Justia.comNo ratings yet

- UntitledDocument18 pagesUntitledjeralyn juditNo ratings yet

- 2007 AmuDocument85 pages2007 AmuAnindyaMustikaNo ratings yet

- Iris Yessenia Reyes-Zavala, A206 775 262 (BIA March 22, 2016)Document7 pagesIris Yessenia Reyes-Zavala, A206 775 262 (BIA March 22, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- The Jet Volume 7 Number 4Document24 pagesThe Jet Volume 7 Number 4THE JETNo ratings yet

- Holy Spirit in Christianity - WikipediaDocument21 pagesHoly Spirit in Christianity - WikipediaSunny BautistaNo ratings yet

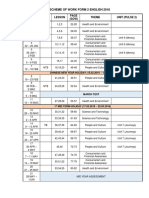

- Scheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Document2 pagesScheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Subramaniam Periannan100% (2)

- Serres InterviewDocument9 pagesSerres InterviewhumblegeekNo ratings yet

- Teaching Guide: Ismat RiazDocument56 pagesTeaching Guide: Ismat RiazAbid GandapurNo ratings yet

- FortiGate Security 6.4 Course Description-OnlineDocument2 pagesFortiGate Security 6.4 Course Description-OnlineThaw Zin OoNo ratings yet