Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

30 viewsInside Webmoney Pt1 DGCmagazine Oct 09

Inside Webmoney Pt1 DGCmagazine Oct 09

Uploaded by

Carl MullanWebmoney Transfer is a Russian organization which was started in November of 1998. Webmoney's products are offered to a global audience but mainly cater to the local non bank population consumers in Russia, Latvia, Ukraine, Estonia and other surrounding areas.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Internet Banking of SbiDocument73 pagesInternet Banking of Sbijiya_ahuja57883% (12)

- Cryptocurrency Technology Foundations and Crimes InvestigationsDocument694 pagesCryptocurrency Technology Foundations and Crimes InvestigationsAnupam Tiwari100% (5)

- Online BankingDocument68 pagesOnline BankingArvind Sanu MisraNo ratings yet

- Online BankingDocument7 pagesOnline BankingSugan Pragasam100% (2)

- The First Fintech Bank Arrival - VSolodkiy - Sep-2017Document252 pagesThe First Fintech Bank Arrival - VSolodkiy - Sep-2017humdil100% (3)

- Central Bank Issued Digital CurrencyDocument7 pagesCentral Bank Issued Digital CurrencyCarl Mullan0% (1)

- FinCEN Form 105, Currency and Monetary Instrument Report (CMIR)Document2 pagesFinCEN Form 105, Currency and Monetary Instrument Report (CMIR)Carl Mullan100% (1)

- Douglas Jackson Interview 2012 E-GoldDocument8 pagesDouglas Jackson Interview 2012 E-GoldCarl MullanNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument3 pagesStatement of Account: Credit Limit Rs Available Credit Limit Rsarunkumar100% (1)

- Babe 1 Time Value QuestionsDocument9 pagesBabe 1 Time Value QuestionsCatherine LegaspiNo ratings yet

- Retail Payments in Russia: Closing The Infrastructure GapDocument30 pagesRetail Payments in Russia: Closing The Infrastructure GapJane ZavalishinaNo ratings yet

- Biblio Kelompok 6Document73 pagesBiblio Kelompok 6scarlett phantomNo ratings yet

- Fintech Regulation and RegtechDocument56 pagesFintech Regulation and Regtechsomnath_iii100% (1)

- 5 Bitcoin The Economic Case For A GlobalDocument35 pages5 Bitcoin The Economic Case For A GlobalgemaclawNo ratings yet

- The Book Resource 3Document20 pagesThe Book Resource 3Hardi FariqNo ratings yet

- Electronic Payment System Bank Financial Institution Financial Transactions Core Banking Branch BankingDocument28 pagesElectronic Payment System Bank Financial Institution Financial Transactions Core Banking Branch BankingShaikh AltafNo ratings yet

- Introduction To Project: State Bank of IndiaDocument79 pagesIntroduction To Project: State Bank of IndiaAru.SNo ratings yet

- Innovation in BankingDocument17 pagesInnovation in BankingSweety SinghNo ratings yet

- The Digital Currencies That MatterDocument3 pagesThe Digital Currencies That MatterCintia DiasNo ratings yet

- E-Banking and Legal IssuesDocument20 pagesE-Banking and Legal IssuesAnmani KanmaniNo ratings yet

- Presentation of e BankingDocument42 pagesPresentation of e BankingaakiyanzaNo ratings yet

- Why E-Money Still Fails: - Chances of E-Money Within A Competitive Payment Instrument MarketDocument23 pagesWhy E-Money Still Fails: - Chances of E-Money Within A Competitive Payment Instrument MarketИванаСтојановићNo ratings yet

- Online Marketplace Lending: The State ofDocument32 pagesOnline Marketplace Lending: The State ofPawanNo ratings yet

- Digital Bank of The FutureDocument4 pagesDigital Bank of The FutureBima Yoga Pratama100% (1)

- Axis AnkDocument63 pagesAxis Ankdhaypule deepaNo ratings yet

- Online Banking - WikipediaDocument39 pagesOnline Banking - WikipediaAjay RathodNo ratings yet

- Special Studies On Technology and Banking: Banking Over The InternetDocument6 pagesSpecial Studies On Technology and Banking: Banking Over The InternetFlaviub23No ratings yet

- Banks in 2010Document7 pagesBanks in 2010Srishty Puri GajbhiyeNo ratings yet

- Introduction of Online BankingDocument18 pagesIntroduction of Online BankingRavi Kashyap506No ratings yet

- Referat EnglezaDocument7 pagesReferat EnglezaBobescu AlinaNo ratings yet

- Central Bank Digital CurrenciesDocument46 pagesCentral Bank Digital CurrenciesluisNo ratings yet

- BanquedeFrance DigitalBanking Proof 2016Document8 pagesBanquedeFrance DigitalBanking Proof 2016azeNo ratings yet

- Reimagining Payments: The Business Case for Digital CurrenciesFrom EverandReimagining Payments: The Business Case for Digital CurrenciesNo ratings yet

- The Imperative of Online Payment System in Developing CountriesDocument7 pagesThe Imperative of Online Payment System in Developing CountriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Campusm599 SyedDocument9 pagesCampusm599 Syedshahadathossain6151No ratings yet

- MobiVi 2013Document20 pagesMobiVi 2013tramNo ratings yet

- SAP BlockchainDocument13 pagesSAP BlockchainYajula RamNo ratings yet

- The Evolution of Eft Networks From Atms To New On-Line Debit Payment ProductsDocument12 pagesThe Evolution of Eft Networks From Atms To New On-Line Debit Payment ProductsFlaviub23No ratings yet

- Banking On The Future Summary EnglishDocument10 pagesBanking On The Future Summary EnglishAhmed Abd El GawadNo ratings yet

- Cybercash - The Coming Era of Electronic Money (Preview)Document22 pagesCybercash - The Coming Era of Electronic Money (Preview)Bayu HerkuncahyoNo ratings yet

- Resilience and Continuity in An Interconnected and Changing World Speech by Lyndon NelsonDocument8 pagesResilience and Continuity in An Interconnected and Changing World Speech by Lyndon NelsonHao WangNo ratings yet

- Online BankingDocument10 pagesOnline Bankingamir_saheedNo ratings yet

- MD Parvez ShairfDocument12 pagesMD Parvez ShairfMd parvezsharifNo ratings yet

- The Web Is Dead. Long Live The Internet - MagazineDocument35 pagesThe Web Is Dead. Long Live The Internet - MagazinePatrícia AzevedoNo ratings yet

- American ExpressDocument12 pagesAmerican ExpressBTC FAREWELL PARTY'S NTVTNo ratings yet

- Ilovepdf MergedDocument91 pagesIlovepdf Mergedirfan khanNo ratings yet

- Presentation PaygineDocument17 pagesPresentation PaygineLaWise AresOf Tarik100% (1)

- MPESAcaseMASTER7Aug2012 2Document21 pagesMPESAcaseMASTER7Aug2012 2Olivier TuyisabeNo ratings yet

- Welcome: To The World ofDocument28 pagesWelcome: To The World ofPratik GuptaNo ratings yet

- Digital Money Will Replace Paper MoneyDocument23 pagesDigital Money Will Replace Paper MoneyKrittyka ChatterjeeNo ratings yet

- Online Banking - 1475002569159Document16 pagesOnline Banking - 1475002569159Zoya KhanNo ratings yet

- E-Money and How It Can Influence The World Finance MarketDocument15 pagesE-Money and How It Can Influence The World Finance MarketSamrat SinghNo ratings yet

- Online Banking:: Definition of Electronic BankingDocument3 pagesOnline Banking:: Definition of Electronic BankingTuqa Al HussainiNo ratings yet

- ATM Cash ManagementDocument5 pagesATM Cash Managementtulips26No ratings yet

- Mobile Banking SekDocument141 pagesMobile Banking SekLoveday OsiagorNo ratings yet

- Risk Fraud and Operational Efficiency of Swift Payment NetworkDocument28 pagesRisk Fraud and Operational Efficiency of Swift Payment Networkludovic kueteNo ratings yet

- Above & Beyond Tech - FinTech OutlookDocument5 pagesAbove & Beyond Tech - FinTech OutlookJaime García-NietoNo ratings yet

- 0019js Fin Dar Mai SlabDocument31 pages0019js Fin Dar Mai SlabFlaviub23No ratings yet

- Fintech - BBA MaterialDocument41 pagesFintech - BBA MaterialkarthikNo ratings yet

- Article Vandezande2017Document13 pagesArticle Vandezande2017HenryNo ratings yet

- Fintech and Blockchain PPT-1-1Document47 pagesFintech and Blockchain PPT-1-1Namyenya MaryNo ratings yet

- Beginner's Guide To Buying, Selling, And Investing In BitcoinsFrom EverandBeginner's Guide To Buying, Selling, And Investing In BitcoinsNo ratings yet

- 2020.09.28 Government Response E-Gold CaseDocument26 pages2020.09.28 Government Response E-Gold CaseCarl MullanNo ratings yet

- Digital Gold Magazine Jan 2016Document49 pagesDigital Gold Magazine Jan 2016Carl MullanNo ratings yet

- PETITION FOR WRIT OF ERROR CORAM NOBIS. Criminal Action No. 07-109Document62 pagesPETITION FOR WRIT OF ERROR CORAM NOBIS. Criminal Action No. 07-109Carl Mullan100% (1)

- Hunter Biden Prescott Police Report 2016Document23 pagesHunter Biden Prescott Police Report 2016Carl MullanNo ratings yet

- DigixGlobal Proof of AssetDocument5 pagesDigixGlobal Proof of AssetCarl MullanNo ratings yet

- Digital Gold Currency Magazine November 2011Document59 pagesDigital Gold Currency Magazine November 2011Carl MullanNo ratings yet

- E-Bullion Remission FundDocument3 pagesE-Bullion Remission FundCarl MullanNo ratings yet

- Digital Laundry An Analysis of Online Currencies, and Their Use in CybercrimeDocument17 pagesDigital Laundry An Analysis of Online Currencies, and Their Use in CybercrimeCarl MullanNo ratings yet

- Missouri House Bill No. 1637Document3 pagesMissouri House Bill No. 1637Carl MullanNo ratings yet

- Kens Artisan Bakery BrochureDocument2 pagesKens Artisan Bakery BrochureCarl MullanNo ratings yet

- Voucher Safe Open Source Voucher Payment ProjectDocument3 pagesVoucher Safe Open Source Voucher Payment ProjectCarl MullanNo ratings yet

- FAQ Electronically Filing Your Registration of Money Services Business (RMSB) FormDocument3 pagesFAQ Electronically Filing Your Registration of Money Services Business (RMSB) FormCarl MullanNo ratings yet

- Jon Matonis Interview: DGC Magazine Person of The YearDocument6 pagesJon Matonis Interview: DGC Magazine Person of The YearCarl MullanNo ratings yet

- Client Briefing Fatca Usa Imposes New Global Withholding and Information Obligations For Non American Financial Institutions 6011359Document2 pagesClient Briefing Fatca Usa Imposes New Global Withholding and Information Obligations For Non American Financial Institutions 6011359Carl MullanNo ratings yet

- Silver Viral Project Official GuidebookDocument14 pagesSilver Viral Project Official GuidebookCarl MullanNo ratings yet

- Sound Money Promotion Act 2011Document2 pagesSound Money Promotion Act 2011Carl MullanNo ratings yet

- Digital Gold Currency Magazine July 2011Document45 pagesDigital Gold Currency Magazine July 2011Carl MullanNo ratings yet

- Digital Gold Currency Magazine June 2011Document50 pagesDigital Gold Currency Magazine June 2011Carl MullanNo ratings yet

- Banking and Financial InstitutionsDocument40 pagesBanking and Financial Institutionssourav100% (1)

- Saxo Standard Settlement InstructionsDocument3 pagesSaxo Standard Settlement InstructionsaurakayaNo ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheAli AshrafNo ratings yet

- Debit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseDocument9 pagesDebit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseShovan ChowdhuryNo ratings yet

- Liquidity ManagementDocument13 pagesLiquidity ManagementUpomaAhmedNo ratings yet

- Money Pad-The Future WalletDocument33 pagesMoney Pad-The Future WalletPatel Jinkal100% (13)

- Plan - TRON M3Document20 pagesPlan - TRON M3Amit100% (2)

- Agricultural Loan PDFDocument68 pagesAgricultural Loan PDFRakesh100% (1)

- Property Valuation and Appraisal PracticeDocument3 pagesProperty Valuation and Appraisal Practiceanon_775303186No ratings yet

- Com Trac Registration FormDocument1 pageCom Trac Registration Formputery_honuckNo ratings yet

- Knet03 Jan 19Document2 pagesKnet03 Jan 19anand singhNo ratings yet

- Chapter 9 Specialized Bank ServicesDocument27 pagesChapter 9 Specialized Bank ServicesTừ Lê Lan HươngNo ratings yet

- FIN350 - Solutions Slides 9Document4 pagesFIN350 - Solutions Slides 9David NguyenNo ratings yet

- Master Directions On Priority Sector LendingDocument42 pagesMaster Directions On Priority Sector Lendingindrajit royNo ratings yet

- Rural Marketing Assignment PDFDocument6 pagesRural Marketing Assignment PDFSriram RajasekaranNo ratings yet

- KKDocument19 pagesKKAramina Cabigting BocNo ratings yet

- Manappuram Finance Limited: SR - NoDocument2 pagesManappuram Finance Limited: SR - NoPrayag UpadhyayNo ratings yet

- Project Report KCC BankDocument57 pagesProject Report KCC BankShubhamSood90% (10)

- Appendix 1 - Revised Vendor Form - Including Travel ProfileDocument2 pagesAppendix 1 - Revised Vendor Form - Including Travel ProfileHiwot TsegayeNo ratings yet

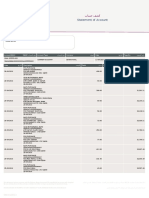

- Statement of AccountDocument5 pagesStatement of AccountabdoNo ratings yet

- Types of DebtDocument5 pagesTypes of Debtayesha1985100% (2)

- SITXFIN201 Assessment 2Document10 pagesSITXFIN201 Assessment 2DaveNo ratings yet

- Islamic BankingDocument11 pagesIslamic BankingAmara Ajmal100% (5)

- AprilDocument4 pagesAprilTerry WinegarNo ratings yet

- 01B Moving Money Through TimeDocument3 pages01B Moving Money Through TimeNatalie RamosNo ratings yet

- Realme and Narzo - May 2023 - Scheme Letter RevisedDocument7 pagesRealme and Narzo - May 2023 - Scheme Letter RevisedAravind ByjuNo ratings yet

- Presented By: Sandeep Gupta: Nimt B School (Ghaziabad)Document7 pagesPresented By: Sandeep Gupta: Nimt B School (Ghaziabad)sandeep gNo ratings yet

- Business Deposit Accounts Fee ScheduleDocument15 pagesBusiness Deposit Accounts Fee ScheduleJohnNo ratings yet

Inside Webmoney Pt1 DGCmagazine Oct 09

Inside Webmoney Pt1 DGCmagazine Oct 09

Uploaded by

Carl Mullan0 ratings0% found this document useful (0 votes)

30 views5 pagesWebmoney Transfer is a Russian organization which was started in November of 1998. Webmoney's products are offered to a global audience but mainly cater to the local non bank population consumers in Russia, Latvia, Ukraine, Estonia and other surrounding areas.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWebmoney Transfer is a Russian organization which was started in November of 1998. Webmoney's products are offered to a global audience but mainly cater to the local non bank population consumers in Russia, Latvia, Ukraine, Estonia and other surrounding areas.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

30 views5 pagesInside Webmoney Pt1 DGCmagazine Oct 09

Inside Webmoney Pt1 DGCmagazine Oct 09

Uploaded by

Carl MullanWebmoney Transfer is a Russian organization which was started in November of 1998. Webmoney's products are offered to a global audience but mainly cater to the local non bank population consumers in Russia, Latvia, Ukraine, Estonia and other surrounding areas.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

DGC Magazine

“Paper is poverty....it is only the ghost of money, and not money itself.” - Thomas Jefferson 1788

Webmoney Transfer

Russia’s Brilliant

Online Payment System

Part Deux - October 2009

8One of several

§ DGC MagazineWebmoney Transfer

October 2009 offices

Webmoney in Moscow

Special Issue

DGC Magazine Visits

Webmoney Transfer in

Moscow, Russia

“If the Internet payments business was a game of chess, Webmoney Transfer would always be

6 moves ahead”

In early September of this year, Webmoney Transfer

was kind enough to host me for a three day visit to

their Moscow operation. During this visit I met with

management, toured their offices, worked with their

software and even had a sneak peak at some at some

of their partner’s high tech hardware. I was very

impressed with their business.

Around the world there are some brilliant people

creating online payment products for tomorrow’s

consumer. These Internet visionaries analyze the

everyday financial issues we all face then create

convenient solutions which make our world run

smoother. Webmoney Transfer in Moscow, Russia

engages a small army of these bright young minds.

Webmoney Transfer is a family of products created

reside in that part of the world.

by knowledgeable professionals with backgrounds in

the daily business practices of Russian consumers.

If you have never been to Russia it is impossible

The operation and the regulatory framework for

to comprehend the many non bank local payment

this dynasty started in Russia and are based on

solutions offered by Webmoney. The company’s

the changing Russian economic model. When the

software provides a wide variety of solutions that

company first began operations in 1998, the Internet

seem permanently integrated into everyday Russian

was brand new, cell phones were very expensive

life.

& the “Internet payments” industry was still in

diapers. The April ‘98 Time Magazine cover story

Over the past 5-10 years, detailed information about

was asking, “The Future of Money...are banks really

the Webmoney business, for any English speaking

necessary?”

person, has been somewhat limited. It was very

enlightening to visit Moscow and see the system from

Although during the past decade Webmoney has been

a local point of view. As a non Russian person, if

rapidly expanding around the world, a large segment

you tour their English language web site http://www.

of their products and services still cater to local

wmtransfer.com the information you learn online is

Russian consumers and a majority of their customers

only a small slice of the total company’s operation.

DGC Magazine October 2009 Webmoney Special Issue § 9

Miami? Panama? Neither...welcome to the changing skyline of downtown Moscow.

The inability of the Russian government to

For permitting such unrestricted access to their implement a coherent set of economic reforms

company and employees I would like to send a led to a severe erosion in investor confidence

special thanks to Peter Darakhvelidze and Jane and a chain-reaction that can be likened to a

(double thanks to Jane for translating:-) run on the Central Bank. Investors fled the

market by selling rubles and Russian assets

Computing Forces (such as securities), which also put downward

Mid 1998, there was a group of Russian software pressure on the ruble. On August 13, 1998, the

engineers creating a new online banking package. Russian stock, bond, and currency markets

This software would have been marketed to Russian collapsed as a result of investor fears that the

banks, however, in August of 1998, Russian banking government would devalue the ruble, default

business experienced a major financial meltdown on domestic debt, or both. On August 17,

(also called “Ruble crisis” or “Default”). This event 1998, the Russian government and the Central

was essentially a total collapse of their banking Bank of Russia issued a “Joint Statement”

industry. announcing, in substance, that: (i) the ruble/

dollar trading band would be widened from

Wikipedia describes the Russian bank situation like 5.3-7.1 RUR/USD to 6.0-9.5 RUR/USD; (ii)

this: Russia’s ruble-denominated debt would be

restructured in a manner to be announced at a

10 § DGC Magazine October 2009 Webmoney Special Issue

later date; and, to prevent mass Russian bank The Road to Success

default, (iii) a temporary 90-day moratorium In order to be successful, the Webmoney software

would be imposed on the payment of some had to deliver payout and funding methods which

bank obligations, including certain debts and were accessible for all potential local users. (rural,

forward currency contracts. Russian inflation city, wealthy, poor, etc) In the new Russian cash

in 1998 reached 84 percent and welfare costs based society, if consumers could not have quickly

grew considerably. Many banks, including added funds to an account or accessed their electronic

Inkombank, Oneximbank and Tokobank, were money, that new business would not have survived.

closed down as a result of the crisis....millions of

people lost their bank savings. In contrast to some of the early digital gold companies,

Webmoney Transfer’s solutions did not target all

The Russian crisis also had a negative effect on of humanity. The Webmoney software specifically

the surrounding countries including but not limited catered to the local non bank Russian population.

to Estonia, Latvia, Lithuania, Georgia, Belarus, Unlike potential global customers located across

Kazakhstan, Moldova, Ukraine & Uzbekistan. multiple jurisdictions, the local Russian consumers

After August, the engineers’ original online banking offered a very identifiable and distinct target market.

software was no longer needed by the banks. As with any true electronic cash product, the

Additionally, local consumers across Russia and the new Webmoney accounts had to meet some basic

region quickly stopped using the local banks. Russian requirements in order to succeed. Webmoney had to

banks were not considered safe and as millions of be:

Russian consumers had just lost their savings a new

cash driven society was created almost overnight. Non • Instant & free to open

bank payment options were now in big demand. • Inexpensive to operate each month (cheaper

than banks)

WebMoney Transfer Is Born • Simple to understand and use (even for the

The banking crisis had created a large receptive smallest of local rural users)

market for online payment services. In late 1998 the

Webmoney Transfer software was created from this Finally, the system had to be closely integrated into

original online banking package. The new system the local marketplace. In other words, the payments

permitted consumer payments without the need for which could be made using Webmoney had to be

a bank account. useful for local consumers. It’s easy to imagine the

1998 Webmoney team saying, “Everyone uses cash

At that time there were very large differences between to pay their electric bill and cell phone each month,

regulated online banking and non bank Internet let’s make it easy for them to pay online.”

electronic money.

This new system of Webmoney online transfers has

• Much lower fees quickly developed into a simple but sophisticated

• Less regulation from the state account which attracts both small & large balances

• Smaller more receptive operators able to and functioned effortlessly for all local customers.

quickly adapt their business practices

• Easy entry for new businesses

• Real advantages for local private businesses

using these new consumer products and

technology.

Since their first day of operation Webmoney has

been the front runner in the industry and today still

occupies this top position.

DGC Magazine October 2009 Webmoney Special Issue § 11

You might also like

- Internet Banking of SbiDocument73 pagesInternet Banking of Sbijiya_ahuja57883% (12)

- Cryptocurrency Technology Foundations and Crimes InvestigationsDocument694 pagesCryptocurrency Technology Foundations and Crimes InvestigationsAnupam Tiwari100% (5)

- Online BankingDocument68 pagesOnline BankingArvind Sanu MisraNo ratings yet

- Online BankingDocument7 pagesOnline BankingSugan Pragasam100% (2)

- The First Fintech Bank Arrival - VSolodkiy - Sep-2017Document252 pagesThe First Fintech Bank Arrival - VSolodkiy - Sep-2017humdil100% (3)

- Central Bank Issued Digital CurrencyDocument7 pagesCentral Bank Issued Digital CurrencyCarl Mullan0% (1)

- FinCEN Form 105, Currency and Monetary Instrument Report (CMIR)Document2 pagesFinCEN Form 105, Currency and Monetary Instrument Report (CMIR)Carl Mullan100% (1)

- Douglas Jackson Interview 2012 E-GoldDocument8 pagesDouglas Jackson Interview 2012 E-GoldCarl MullanNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument3 pagesStatement of Account: Credit Limit Rs Available Credit Limit Rsarunkumar100% (1)

- Babe 1 Time Value QuestionsDocument9 pagesBabe 1 Time Value QuestionsCatherine LegaspiNo ratings yet

- Retail Payments in Russia: Closing The Infrastructure GapDocument30 pagesRetail Payments in Russia: Closing The Infrastructure GapJane ZavalishinaNo ratings yet

- Biblio Kelompok 6Document73 pagesBiblio Kelompok 6scarlett phantomNo ratings yet

- Fintech Regulation and RegtechDocument56 pagesFintech Regulation and Regtechsomnath_iii100% (1)

- 5 Bitcoin The Economic Case For A GlobalDocument35 pages5 Bitcoin The Economic Case For A GlobalgemaclawNo ratings yet

- The Book Resource 3Document20 pagesThe Book Resource 3Hardi FariqNo ratings yet

- Electronic Payment System Bank Financial Institution Financial Transactions Core Banking Branch BankingDocument28 pagesElectronic Payment System Bank Financial Institution Financial Transactions Core Banking Branch BankingShaikh AltafNo ratings yet

- Introduction To Project: State Bank of IndiaDocument79 pagesIntroduction To Project: State Bank of IndiaAru.SNo ratings yet

- Innovation in BankingDocument17 pagesInnovation in BankingSweety SinghNo ratings yet

- The Digital Currencies That MatterDocument3 pagesThe Digital Currencies That MatterCintia DiasNo ratings yet

- E-Banking and Legal IssuesDocument20 pagesE-Banking and Legal IssuesAnmani KanmaniNo ratings yet

- Presentation of e BankingDocument42 pagesPresentation of e BankingaakiyanzaNo ratings yet

- Why E-Money Still Fails: - Chances of E-Money Within A Competitive Payment Instrument MarketDocument23 pagesWhy E-Money Still Fails: - Chances of E-Money Within A Competitive Payment Instrument MarketИванаСтојановићNo ratings yet

- Online Marketplace Lending: The State ofDocument32 pagesOnline Marketplace Lending: The State ofPawanNo ratings yet

- Digital Bank of The FutureDocument4 pagesDigital Bank of The FutureBima Yoga Pratama100% (1)

- Axis AnkDocument63 pagesAxis Ankdhaypule deepaNo ratings yet

- Online Banking - WikipediaDocument39 pagesOnline Banking - WikipediaAjay RathodNo ratings yet

- Special Studies On Technology and Banking: Banking Over The InternetDocument6 pagesSpecial Studies On Technology and Banking: Banking Over The InternetFlaviub23No ratings yet

- Banks in 2010Document7 pagesBanks in 2010Srishty Puri GajbhiyeNo ratings yet

- Introduction of Online BankingDocument18 pagesIntroduction of Online BankingRavi Kashyap506No ratings yet

- Referat EnglezaDocument7 pagesReferat EnglezaBobescu AlinaNo ratings yet

- Central Bank Digital CurrenciesDocument46 pagesCentral Bank Digital CurrenciesluisNo ratings yet

- BanquedeFrance DigitalBanking Proof 2016Document8 pagesBanquedeFrance DigitalBanking Proof 2016azeNo ratings yet

- Reimagining Payments: The Business Case for Digital CurrenciesFrom EverandReimagining Payments: The Business Case for Digital CurrenciesNo ratings yet

- The Imperative of Online Payment System in Developing CountriesDocument7 pagesThe Imperative of Online Payment System in Developing CountriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Campusm599 SyedDocument9 pagesCampusm599 Syedshahadathossain6151No ratings yet

- MobiVi 2013Document20 pagesMobiVi 2013tramNo ratings yet

- SAP BlockchainDocument13 pagesSAP BlockchainYajula RamNo ratings yet

- The Evolution of Eft Networks From Atms To New On-Line Debit Payment ProductsDocument12 pagesThe Evolution of Eft Networks From Atms To New On-Line Debit Payment ProductsFlaviub23No ratings yet

- Banking On The Future Summary EnglishDocument10 pagesBanking On The Future Summary EnglishAhmed Abd El GawadNo ratings yet

- Cybercash - The Coming Era of Electronic Money (Preview)Document22 pagesCybercash - The Coming Era of Electronic Money (Preview)Bayu HerkuncahyoNo ratings yet

- Resilience and Continuity in An Interconnected and Changing World Speech by Lyndon NelsonDocument8 pagesResilience and Continuity in An Interconnected and Changing World Speech by Lyndon NelsonHao WangNo ratings yet

- Online BankingDocument10 pagesOnline Bankingamir_saheedNo ratings yet

- MD Parvez ShairfDocument12 pagesMD Parvez ShairfMd parvezsharifNo ratings yet

- The Web Is Dead. Long Live The Internet - MagazineDocument35 pagesThe Web Is Dead. Long Live The Internet - MagazinePatrícia AzevedoNo ratings yet

- American ExpressDocument12 pagesAmerican ExpressBTC FAREWELL PARTY'S NTVTNo ratings yet

- Ilovepdf MergedDocument91 pagesIlovepdf Mergedirfan khanNo ratings yet

- Presentation PaygineDocument17 pagesPresentation PaygineLaWise AresOf Tarik100% (1)

- MPESAcaseMASTER7Aug2012 2Document21 pagesMPESAcaseMASTER7Aug2012 2Olivier TuyisabeNo ratings yet

- Welcome: To The World ofDocument28 pagesWelcome: To The World ofPratik GuptaNo ratings yet

- Digital Money Will Replace Paper MoneyDocument23 pagesDigital Money Will Replace Paper MoneyKrittyka ChatterjeeNo ratings yet

- Online Banking - 1475002569159Document16 pagesOnline Banking - 1475002569159Zoya KhanNo ratings yet

- E-Money and How It Can Influence The World Finance MarketDocument15 pagesE-Money and How It Can Influence The World Finance MarketSamrat SinghNo ratings yet

- Online Banking:: Definition of Electronic BankingDocument3 pagesOnline Banking:: Definition of Electronic BankingTuqa Al HussainiNo ratings yet

- ATM Cash ManagementDocument5 pagesATM Cash Managementtulips26No ratings yet

- Mobile Banking SekDocument141 pagesMobile Banking SekLoveday OsiagorNo ratings yet

- Risk Fraud and Operational Efficiency of Swift Payment NetworkDocument28 pagesRisk Fraud and Operational Efficiency of Swift Payment Networkludovic kueteNo ratings yet

- Above & Beyond Tech - FinTech OutlookDocument5 pagesAbove & Beyond Tech - FinTech OutlookJaime García-NietoNo ratings yet

- 0019js Fin Dar Mai SlabDocument31 pages0019js Fin Dar Mai SlabFlaviub23No ratings yet

- Fintech - BBA MaterialDocument41 pagesFintech - BBA MaterialkarthikNo ratings yet

- Article Vandezande2017Document13 pagesArticle Vandezande2017HenryNo ratings yet

- Fintech and Blockchain PPT-1-1Document47 pagesFintech and Blockchain PPT-1-1Namyenya MaryNo ratings yet

- Beginner's Guide To Buying, Selling, And Investing In BitcoinsFrom EverandBeginner's Guide To Buying, Selling, And Investing In BitcoinsNo ratings yet

- 2020.09.28 Government Response E-Gold CaseDocument26 pages2020.09.28 Government Response E-Gold CaseCarl MullanNo ratings yet

- Digital Gold Magazine Jan 2016Document49 pagesDigital Gold Magazine Jan 2016Carl MullanNo ratings yet

- PETITION FOR WRIT OF ERROR CORAM NOBIS. Criminal Action No. 07-109Document62 pagesPETITION FOR WRIT OF ERROR CORAM NOBIS. Criminal Action No. 07-109Carl Mullan100% (1)

- Hunter Biden Prescott Police Report 2016Document23 pagesHunter Biden Prescott Police Report 2016Carl MullanNo ratings yet

- DigixGlobal Proof of AssetDocument5 pagesDigixGlobal Proof of AssetCarl MullanNo ratings yet

- Digital Gold Currency Magazine November 2011Document59 pagesDigital Gold Currency Magazine November 2011Carl MullanNo ratings yet

- E-Bullion Remission FundDocument3 pagesE-Bullion Remission FundCarl MullanNo ratings yet

- Digital Laundry An Analysis of Online Currencies, and Their Use in CybercrimeDocument17 pagesDigital Laundry An Analysis of Online Currencies, and Their Use in CybercrimeCarl MullanNo ratings yet

- Missouri House Bill No. 1637Document3 pagesMissouri House Bill No. 1637Carl MullanNo ratings yet

- Kens Artisan Bakery BrochureDocument2 pagesKens Artisan Bakery BrochureCarl MullanNo ratings yet

- Voucher Safe Open Source Voucher Payment ProjectDocument3 pagesVoucher Safe Open Source Voucher Payment ProjectCarl MullanNo ratings yet

- FAQ Electronically Filing Your Registration of Money Services Business (RMSB) FormDocument3 pagesFAQ Electronically Filing Your Registration of Money Services Business (RMSB) FormCarl MullanNo ratings yet

- Jon Matonis Interview: DGC Magazine Person of The YearDocument6 pagesJon Matonis Interview: DGC Magazine Person of The YearCarl MullanNo ratings yet

- Client Briefing Fatca Usa Imposes New Global Withholding and Information Obligations For Non American Financial Institutions 6011359Document2 pagesClient Briefing Fatca Usa Imposes New Global Withholding and Information Obligations For Non American Financial Institutions 6011359Carl MullanNo ratings yet

- Silver Viral Project Official GuidebookDocument14 pagesSilver Viral Project Official GuidebookCarl MullanNo ratings yet

- Sound Money Promotion Act 2011Document2 pagesSound Money Promotion Act 2011Carl MullanNo ratings yet

- Digital Gold Currency Magazine July 2011Document45 pagesDigital Gold Currency Magazine July 2011Carl MullanNo ratings yet

- Digital Gold Currency Magazine June 2011Document50 pagesDigital Gold Currency Magazine June 2011Carl MullanNo ratings yet

- Banking and Financial InstitutionsDocument40 pagesBanking and Financial Institutionssourav100% (1)

- Saxo Standard Settlement InstructionsDocument3 pagesSaxo Standard Settlement InstructionsaurakayaNo ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheAli AshrafNo ratings yet

- Debit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseDocument9 pagesDebit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseShovan ChowdhuryNo ratings yet

- Liquidity ManagementDocument13 pagesLiquidity ManagementUpomaAhmedNo ratings yet

- Money Pad-The Future WalletDocument33 pagesMoney Pad-The Future WalletPatel Jinkal100% (13)

- Plan - TRON M3Document20 pagesPlan - TRON M3Amit100% (2)

- Agricultural Loan PDFDocument68 pagesAgricultural Loan PDFRakesh100% (1)

- Property Valuation and Appraisal PracticeDocument3 pagesProperty Valuation and Appraisal Practiceanon_775303186No ratings yet

- Com Trac Registration FormDocument1 pageCom Trac Registration Formputery_honuckNo ratings yet

- Knet03 Jan 19Document2 pagesKnet03 Jan 19anand singhNo ratings yet

- Chapter 9 Specialized Bank ServicesDocument27 pagesChapter 9 Specialized Bank ServicesTừ Lê Lan HươngNo ratings yet

- FIN350 - Solutions Slides 9Document4 pagesFIN350 - Solutions Slides 9David NguyenNo ratings yet

- Master Directions On Priority Sector LendingDocument42 pagesMaster Directions On Priority Sector Lendingindrajit royNo ratings yet

- Rural Marketing Assignment PDFDocument6 pagesRural Marketing Assignment PDFSriram RajasekaranNo ratings yet

- KKDocument19 pagesKKAramina Cabigting BocNo ratings yet

- Manappuram Finance Limited: SR - NoDocument2 pagesManappuram Finance Limited: SR - NoPrayag UpadhyayNo ratings yet

- Project Report KCC BankDocument57 pagesProject Report KCC BankShubhamSood90% (10)

- Appendix 1 - Revised Vendor Form - Including Travel ProfileDocument2 pagesAppendix 1 - Revised Vendor Form - Including Travel ProfileHiwot TsegayeNo ratings yet

- Statement of AccountDocument5 pagesStatement of AccountabdoNo ratings yet

- Types of DebtDocument5 pagesTypes of Debtayesha1985100% (2)

- SITXFIN201 Assessment 2Document10 pagesSITXFIN201 Assessment 2DaveNo ratings yet

- Islamic BankingDocument11 pagesIslamic BankingAmara Ajmal100% (5)

- AprilDocument4 pagesAprilTerry WinegarNo ratings yet

- 01B Moving Money Through TimeDocument3 pages01B Moving Money Through TimeNatalie RamosNo ratings yet

- Realme and Narzo - May 2023 - Scheme Letter RevisedDocument7 pagesRealme and Narzo - May 2023 - Scheme Letter RevisedAravind ByjuNo ratings yet

- Presented By: Sandeep Gupta: Nimt B School (Ghaziabad)Document7 pagesPresented By: Sandeep Gupta: Nimt B School (Ghaziabad)sandeep gNo ratings yet

- Business Deposit Accounts Fee ScheduleDocument15 pagesBusiness Deposit Accounts Fee ScheduleJohnNo ratings yet