Professional Documents

Culture Documents

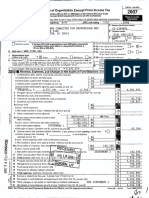

Tsunami Relief Inc. 2005 IRS Form

Tsunami Relief Inc. 2005 IRS Form

Uploaded by

DealBook0 ratings0% found this document useful (0 votes)

233 views17 pages2005 IRS form for Tsunami Relief Inc., the charity founded by Galleon Group head Raj Rajaratnam to rebuild homes in Sri Lank after the tsunami.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document2005 IRS form for Tsunami Relief Inc., the charity founded by Galleon Group head Raj Rajaratnam to rebuild homes in Sri Lank after the tsunami.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

233 views17 pagesTsunami Relief Inc. 2005 IRS Form

Tsunami Relief Inc. 2005 IRS Form

Uploaded by

DealBook2005 IRS form for Tsunami Relief Inc., the charity founded by Galleon Group head Raj Rajaratnam to rebuild homes in Sri Lank after the tsunami.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 17

Fam 990

Department of he Teas

[A For the 2005 calendar year, or tax year beginnin

© Name of erganaatien

ms| TSUNAMI RELIEF INC

benefit trust or private foundation)

Return of Organization Exempt From Income Tax

Under section $01(c), 827, of 4847(a)1) ofthe Interna Revenue Code (except black lung

> The organization may have to use a copy of this retum to satay state reporting requrements

2005, and ending

CSc

Employer seniteation number

1-3737294

City or town, state or county, and ZIP + 4

‘Section 501(¢X3) organizations and 8847(a)t) nonexempt chantable— [Wandlare

trusts must attach a completed Schedule A (Form 990 or 9902).

a

“Cie ofgonzsars goes recaps are ovmaly not more than $25,000 The

organaaten nad not fe a teu wih the RS, but the organaaton chases to Ne a ten be

ure oe a cempicte retum Seme states require a complete return Hi

cross recemis Ads ies 60, 8,95, and 10010 ne 12 PE 7,186,361.

na vom oop um ae [|

a) vues

ite) Are atte ce?

(Natacha et Sen tnt

ne woes test Dae [alm

‘ou Exergton Number Pe

Moe

to agen Sch (Fam 990, 90-2, oF 00.57)

[| ome [Number and atreet (or P © bax: mai not devered to auet adress) [Roomvsute | Tetphone number

| wee C/O THE GALLEON GROUP

fu 135 EAST S7TH STREET aerm en | (212)371-2939

we" | Jam [_Jacoun

ot appicabi lo secton 527 ean

(Te

ne expansion not egos

EATTD Revenue, Expenses, and Changes In Net Assets or Fund Balances (See the nsicions

1 Contos, os, arnt, and emlr sountrecened

a Drect pubic supper . [al 2.085.215.

B ndrect piesa. | fie

© Goverment corinne Grn) sss sess Me

4 tte neve) cams 74,085,115. tower fra 2,085,115.

2° rogram saree revenue ning govern esa cova (am Pa Vi ina 8) 2

3. Membership ds and sesesarts veeeteeseees 3

4 terest on sags and tomperay cath meses a ‘ ioL246.

5 Drdends and terete ecuten 5

8a Chester (ca

> ‘few

© Netrontal income of ess etic ne rom tne 6) ee

| 7 other investment income (desenbe riz

5 | aa cose amount trom clef ett ther 9 Broce oon

2 | an trenary aa

Less coat or other bass and aes pense eb

© Gator (oe) (tach sched) te

i@ 4. Net gan or (088) (combine ine Bc, columns (AVand (@) Toe lea!

2 8 Special evens and actus (afach schedule) Hf any amounts om gaming, cheek here [—]

z 2 Grows revenue (ct mciang 8

a ‘contributions reported on line 1a),

Fh |» ten eiccmemes cow man uten ree 2s

-Netancome or oss) rom special ever (etct ne om ine 2)

$S_—_—_ tla Gross sates of ventory, less retuns andaliowances 0

= D Lose cost of goods eld ca

a Grows proft or (ost) fom seg of mverory atch sche) (sutras ine 105 emf 108) oe

moh Rem Vii 103)

ee cre eS as, bia ses ns | Tass.3e

ah Ta (renee. 4/009.226

| 14 chomping 2008

§ || Bnisreng Crom ine 4, col 40,008,

a | 16

17 7045.206.

1 FEY Tore yar erate 17 tem he 72) 3.137.135.

49 Netavsets or nd balances at Beginng et yar eine 73 esinn(N) 9 Won

20° Otnerchanges in net ants or fund balance (aachexanaton)

24_ No assns or fd balances af end of yen (ombne ines 18,19, snd 2 173s

Fer Privacy Act and Paperwork Redon Ac Note, ee the separate stone om 990 2008

837509 Me21 05/12/2006 09:14:47 4 2

amano) * + 11-3937294 fron

Statement of “Al ogoraatans must compte coun (8) Game (Oar (O) ee requed for sectan BOUND) an (6)

Functional Expenses tpuncaiom nnd susen “Out totem aati toe 8 cp fa aes fos he move)

ar eed eid xt Omer | Orgs | orntenne

72. Grants and alocatons tach shea)

teams — $000,000, ness 22

ibe pagent eches trons grants, 4,000,000 4,000, 000. STMP 1

23. Specife essstence to nds tach

schedule) ee Li]

24 Beri gad to ofr monte itch

see) eee law

28 Compensaicn of cticers, reco, ste [25 Now

26 Omer salanes ndvages .. , [26

27 Pension plan contnbutons ||| 27 Now

28 Other employee benefits |... ,, [28

20 Payrl taxes 28

30 Professional funding fos ||| | 30

31 Accounting fees. ai

32 Legalfees ee 32

33 Supplies LIL 33

34 Telephone ane E7Y

35 Postage andshwond | 2.2... fas

38 Occupancy, 36

37 Equpment rental nd mantenance, | [37

38 Prmtng andpubloavons (38

39 Tale ey 38

40 Conterenedsconsnsandmecings | [40

4 Wests sees reees ee rm

42 Deprecacn,dpiten te ach caso [42

43. Otner expenses nt conre bee (er)

. 1.953 2.983

b ADVERTISING. 1130 1180.

a3, a3.

40,000, 70,000.

444 Faia tocol apes Aad Ws 92

Teena ort “conetna

he Gro) cry ee ie

oe ore jsa| 048,226] 4,009,226. 40,000.

Teint Costs ck ® [_] yu are talowng SOP 98-2

ease be rare tnaertien tee) revanere =p Creel

ies! eter) the agaregate amount ofthese ont cote § (ithe amount aocate o Program aie’

{inthe amount locted to Monapement and general sd the amount alates to Funan §

Fem 990 (2005)

837507 M831 05/12/2006 0:

Frm 990 (2005) + + =3737294

‘Statement of Program Service Accomplishments (See the mnstructons )

Form 990 1s avalable for public inspection and, for some people, serves as the prmaly of &

Page 3

source of information about @

‘ericular organization Hoyt the pubic percenves_an organization wh such cases may be determined by the informaton presented

Ents rature. Therefore, please make sore the return fe complete and accurate and fuly deserbes, Par il, the organation’s

programs and accomplhments

What isthe organization's primary exempt purpose? PSEE_STATEMENT 2

All organizations must describe their exempt purpose achievements in a clear and concise manner State the rimber

fof chents served, pubhestions leeued, ete Decuse achievements thal ate not measurable (Section 501(6)3) and (4)

‘organcations and 4947(8)(1) nonexempt ehatitable trusts must also enter the amount of grants and alloetions to others)

@ 100_HO:

IN

NROVIA_ESTATE, SITUATED IN THE

Li

Program Service

Expenses

(equ ter 301) st

(gs, ond «847 aN9)

tt eta

‘(Grants and aliccatons $

© 200 CONDO HOUSING UNITS

Tis ann shies Taran eras, cea mare > []

WIUL_BE CONSTRUCTED. 1N_TSTANABATH

EAST. Q

ABTS, THE MINISTRY OF_ HOUSING AND

is nisin nates fran ara Reames > [7]

'. -TH! }GION_ HARDI XI

AOGRAY WILL. FINANCE THE, CONSTRUCTION. OF ‘HOMES

4. OF THREE AREAS: ____

PADU, VALLIDUNAM, THIYAKUNAGAR, KALLARU, VAHARI,_

Q

KALLA!

APPROX 1,400 PEOPLE WHO WERE LSET HOMELESS_BY THE TSUNAMI. -

(Grants and allocatons: an 9 ~OI

Other program services (attach schedule)

{Grants and alocabone.§. ) tf ys amount includes foreign grants, check here []

{1 Total of Program Service Expenses (should equal ine 44, column (B), Program servces), >

837505 M831 05/12/2006 09:14:47

4,009, 226

Form 880 (2005)

mm 990 (2005)_*

[ERIN _ Balance Shects (See he nstructons)

11-3737294 Poon 4

Note: Where requed. alached schedules and eros win fe desenpion @ @

Ct Seu ber endcbyeat eure on Began ot yer tnd Spar

| GE Gosh nenaarestbeamg a

| 48 Sawnge and temporary cashimvesinens | wong4s"| 3,137,135.

| Ara Aecounrecenable «era

Less allowance for doubitl accounts’ | | fare are

sa Pledges recenabe , co ee

Less aowance for doubitl accounts, || [aa ase

49 Grants recvable 49

20 Recevables om offces, decor, wisttes, and key employes

(otach sched) - 50

$a Other notes and cans recat (tach

sehedio) sta

|» Less atowance tr doit accounts”. [ste S10

3) 52 tnventones forsale use — 32

83. Prepaid expences and deeredchages 222222 27220UUETIIL 53

54 Investments secures (attach senedle) Cece Claw 54

8a vestments land, bugs, and

cqupment tess. ssa

b Lese accumulated deprecation (atch

schedule) ve [ss 80

58 Investments = other atach schecuig) | 5 36

57a Land, buldnge, and eqepment bass |= ===. sr

D Less accumulated deprecabon tach

schedule) a vee bee sre

58 Otner asses descnbe B ; a

50 Total assets (must equal ine 74) Add ines 45 through 58 ons

¢0 Accounts payable and accrued expenses 60

61 Grants payable c rm

82 Detered revenue 2

i|63 Leone rom oticors, directors, ste, nd kay employees (otach

E] schedule)... see eee ee eee eee 63

B|e4a Tar-exempt nd ibites (atch ech) | nn on

3 Mortgages and other notes payable (attach schedule) 7 a je4b,

Other habits (descrbe ra

66 _Total abilities. Add lines 60 through 65

‘Organizations that follow SFAS 117, check here b LX] and complete ines

667 through 69 and lines 73 and 74

ele7 Uncestactea . nowg 67 | __3,137,135.

Elen temporary resincted || ||| ee rm

Jos permanent restated |... .

| organizations that do not follow SFAS 117, check here ®{_] and

Boe Complete ines 70 through 74

110. Captal stock, rust petal, or curent nds 1

B21 Paxtinorcaptal surplus, or land, buldng, and equipment find || 7

B] 72 Retained earings, endowment, accumulated income, or other funds 72

2]7a Total net assete or und balances (add ines 67 tough 69 oF ines

3] 70 through 72;

column (A) must equal ine 19, column (8) must equaline 21)... ong 7s | __ 9,197,135

74 Total lables and net assets/und balances, Add ines 66 and 73 | ond 74 9,137,135.

Fo 990 (2005)

837505 M831 05/12/2006 0!

Form 990 (2005) _* 113737294 Page §

Regongiatjon of Revenue por Audited Financial Satoments With Revenue per Return (Seo

Insiruchone.

Total revenue, gains, and other support per audited fnancral statements a. a] 7,186,361.

‘Amounts included on line a but not on Part, ine 12

Net unrealized gains on investments a

Donated services and use offaciites.... 2... ' :

Recoveries of pnor year grants... - 22.22 e ees ee les

Other (spect)

ba

[Add ines b1 through ba

Subtract line b from line a

‘Amounts included on Part ine 12, but not on line

Investment expenses not included on Part |, ne 6 la

Other (spect).

e| 7,186,361,

Addines 1 andd2......s. 0s ssvtes eee

otal venue Pat ine 12) Addins an eee

‘Reconciliation of Expenses per Audited Financial Statements With Expenses per Retu

2 Total expenses and losses per audted fnancial statements... weet ee ees

bb Amounts nckuded on tne abut nat on Part, ne 17

4+ Donated services and use of facites.

2

7,186,361

Pise

4,049,226.

pal

Pror year adjustments reported on Patt ine 20

Losses reported on Part ine 20,

Other (spect) =

ba

‘Add ines b1 through ba

© Subtract ine b from ine a

4 Amounts incuded on Part, ine 17, But not on tne

2

4,049,226.

Investment expenses not included on Part |, ine 6 au

Other (specify). —.

‘dd ines dt and 62 fo

«fora expenses (Part ino 17)" Adines¢ nis slel “a oss 226.

Current Officers, Directors, Trustees, and Key Employees (Ust each person who was on offee,crector, ruses,

or key employee at any time dunng the year even they were not compensated ) (See the nsinictons )

o ememeen [Pomeemrrem=] RiSpSeaan

(Ay Name an across se tg ro ‘cat acre | Se oie sowanoes

22

‘SEE STATEMENT 3 NONE NONE, None.

Fam 990 (7005)

837503 M831 05/12/2006 09:14:47 8

um 5902005) : =3737294

ro

Current Officers, Directors, Trustees, and Key Employees (confinued)

Yes] No

75a Enter the total numberof officers, directors, and tustes permtted to vote on organization busi

meetings «+--+ >

Are any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated

employees listed in Schedule A, Part I, or highest compensated professional and other independent

Contractors listed in Schedule A, Part iA or IHB, related to each other through family or business

felationships? If "Yes," attach a statement that identifies the individuals and explams the relatonship(s) . .. »

© Do any officers, directors, trustees, or key employees listed in From 980, Part V-A, or highest compensated

employees listed in Schedule A, Part I, or highest compensated professional and other independent

Contractors listed in Schedule A, Part ILA cr -8, recewe compensation fram any other organizations, whether

tax exempt or taxable, that are related to this organization through common supervision er common control?

Note. Related organizations include section 809(a)(3) supporting organatons 7sc|__| x

I{"Yes,” attach a statement that identifies the individuals, explains the relationship between ths organzzaton and

the other organization(s), and describes the compensation arrangements, incding amounts paid to each

individual by each related organization.

4 Does the organzaton have awntten conflict of nterest poly? v2. 158

Former Officers, Directors, Trustees, and Key Employees That Received Compensation or Other Benefta

(Pony former sien srester‘custe. or kay employes rested compencavon or einer beret (dessroed below) arn

the year, ist that person below and enter the amount of compensation or other benefits n the appropriate

Instructions )

‘column See the

(ay Name are acess (1 Loan na Adres | (6) Compencaton | tsa

account bn oer

Other Information (See the instructions)

[Yes [ No

76 bud the organzaton engage in any actty not prewously reported tothe AS? I es” attach a detaled

description of each actity

TT Were any changes made inthe organzing or governing documents but not reported tothe IRS? .

"Yes," attach a conformed copy of the changes

78a Did the organization have unrelated business gross income of $1,000 or more during the year covered by

this return’... =

b "Yes," has i fied a tax return on Form 390-7 forts year?

Tab),

79 Was there & haudabon, dissolution, temnation, or substantial contraction dung the year?

a statement -

80a Is the organization related (other than by association with a statewide or nationwide organzation) through

common /membershp, governing bodes, tustees, oie, etc, to any other exempt or nonexempt

bb IfYes.” enter the name of the organization pe

erganizaton?

“Ol:

and check whether tis mt or L_] nonexempt

81a Enter direct and indirect poltical expenditures (See line 81 instructons ). a

bb Did the organization file Form 1120-POL forthe year? eee

sib

837503 M831 05/12/2006 0!

9

oc 990 (2008) 113737294

‘Other Information (continued) Yes|

‘82 Did the organzation recewe donated seruces or the use of maleale,equpment, or facilien at no charge

cor at subetantally less than fr renta value?”

bb F-Yes," you may maleate the valve ofthese tems hare Do net neue ths mount

‘as revenue in Part or as an expense m Patil (See nstuctons i Patil),

1824 Did the organization comply wih the public inspection cequrements for retums and exemption appicatons?

a

Dig the organization comply with the disclosure cequuements relating to quid pro quo contnbutons?

{24a Die the organization solict any contnbutione or gifts that were nt tax deductible?

ites, dd the organization include with every soletation an express statement that such conions

orgie were not tax deductble? 4b

85 504(c(4, (5, 0 (6)exganzatons. s Were substantially all dues nondeducibleby members? |

' Did the organization make ony n-house lobbying expenditures of $2,000 0rfess? 2b

"Yes was answered to thor 85a or 8Sb, do not complete 85¢ through 85h below unless the organization

recowed a wawer for proxy tax owed forthe por year

1 Duet, assessments, and mar amounts fom members. abe N/A.

«4 Section 162(e) fobbying and politeal expenditures, asd NLA.

« Aggregate nondeductible amount of section 6033(e)(3)A) dues notices - ase N/A.

{Taxable amount of lobbying and political expenditures (ine 854 less 85e) ast N/A

19 Does the organization elect to pay the section 6033(0) taxon the arsounteoniine@5? ss. 850

Pit section 6033(e)(1)(A) dues notices were sent, does the organization agree to adé the amount on ine 6 fos reasonable

estimate of duet allocable to nondeductible lobbying and politcal expenditures forthe folowing YER. vee ev eee ev es [85H

{86 501(c(7) orgs Enter a nation fees and capital contnbutions included on ne 12 , 6a Za

bb Gross receipts, mcluded on line 12, for puble use of cub facies... 6508 ab N/A.

87 504(c)(12) orgs Enter a Gross come from members or shareholders | Ls 87a N/A,

'b Gross income from other sources (Do net net amounts due or pat cer

sources against amounts due or received from them)... «Lee: N/a.

[A any time during the year, did the organization own 2 60% or greater nferest ma taable corporation or

partnership, or an entiy disregarded as separate from the organzation under Regulations sections

301 7701-2 and 301 7701-27 If"Yes,"complate Part IX,

£88 50%(¢)(3) erganzatons Enter Amount of tax imposed on the organization ung the year under

sechon 4911 N/A section 4912 N/A. Section 4855 N/A.

'»501(¢(3) and 501(e(4) orgs Did the organization engage in any section 4858 excess benef transaction

during the year or dd 1 become awate of an excess benefit transaction fom a por year? It "Yes," attach

2 statement explaining each transaction . . . .

‘© Enter Amount of tax umposed on the organization managers or dequaified persons dung the year under

sections 4912, 4955, and 4958 a

Enter Amount of tax online 69e, above, reembursed by the organzation

80a List the states wth which a copy of ths retumis led NY,

‘b Number of employees employed in the pay pered that includes March 12,2005 (See msirucions ) 208

91 The books wemceat be THE GALLEON GROUP. ‘Texproneno 212-371-2939

Loctedat y 135 EAST 57TH apee y yoo22

Yes]

‘At any ime during the ealendar year, did the organization have an interestin or 2 signature or other aunty over

‘a financial account in a foreign country (euch asa bank account, secures account, or ther financial account)? «= « 210

U17Yes," enter the name ofthe foreign country pe —————--—— 7 - .

‘See the instructions for exceptions and fing requrements for Form TD F 80:72.1, Report of Foreign Bank

‘and Finaneral Aceounte

‘© At anytime dung the calendar year, dt the organization maintain an office outs ofthe United States? ste

U1-Yes," enter the name ofthe foreign country me —

192 Section 4947(a)(1) nonexempt chantable trusts ing Form 950 "leu ef Form 1041 Check here

and enter the amount of tax-exempt iferestrecowed or accrued dunng thetaxyear ss vv es

Ferm 980 (2005)

83750 M831 05/12/2006 09:14:47 10

cam 90 2008) 1123737294 ag 8

GEER Analysis of ncome Producing Activities (Sea the isructons)

Note: Enter gross amounts unless etherwse Unrelated business come [_Excuded by easton 512,513 ort @

Lead a, e © (0) Eee

meee cae anteunt excite coe amount fs

92. Program servce revenue income

»

1 Meacaremedcan payers :

19 Fees and contracts ran govemmart agencies

94 Membership dues and assessments

95 erst onsoengy an anpoy nh eset 14 101,246,

96 Owidends and interest from secures

97. Net rental income or (os) trom real estate

1 debt-inanced propery -

bb not debt-financed property

98 nercetatncont=rfox)tom pers ery

99 Other ivestmentincome

100 Gana (he tom stect anes ce hana

401 Net income or (loss) rom special events .

4102 Gross proto oss) tom ss verry

403. Otherreverue

104 Subtotal (add cotame (0, and ©) 701.246.

405. Total (ad@ ine 104, corms (8), (0), an (E) = :

Note: Line 108 pls i ar ld eal emt one 2, Pa

Relationship of Activities to the Accomplishment of Exempt Purposes (See tho instrucfons)

Line No, | Explain how each aetvty for which income is reported n column (E) of Part Vil contributed wnpatany tothe accomplishment

‘¥___ | ofthe organization's exempt purposes (other than by promding funds for such purposes)

» 101,246.

[RENT information Regarding Taxable Subsidiaries and Disregarded Entlies (See the insirucfions

Name, ndsees, mE ocr,

Suing bance

‘l

Pi

“

[EERE __Information Regarding Transfers Associated with Personal Benefit Contracts (See the instructions)

{2) 0: te oranaaton, rg te yes, rece ay Rn, rely oF MOC, 9p PEMA Gna eS Dene AOE Yes [x]Wo

(0) Did the orgenzabon, during the year, pay premums, drecty or mdrecty, on s personal benefit ceniact?” [T]ves [x] no

Note: "Yes" o (hile Form 8870 and Form 4720 (see mstricons)

Di peat apron, ice al hae canes an a ET

matey Soars Bassons popu be Wav cbochwlaad onal lamar cach peste hs ay oe

Please

I hoo.

Sign Sigotare of I, = !

Here Raa RATARAT WANA

ypeer ponte ape

Paso Bay a Fear ar PF

Paid Syaue D Shiiloe |e, eC |rotaziae

Preparer’s |rimsnnewyak . MARCUM & KEIEGMAN LLP EN 111986323

Use Only | earanpes 10 MELVILLE PARK RD one

reer 2) eg naz ro > 631 414-4000

sea Fam 990 ab08)

83750g M831 05/12/2006 09:14:47 11

SCHEDULEA’ |' Organization Exempt Under Section 504(c)(3) Coma io 8460047

Except Private Foundation (2) S044, $01¢4), SH),

or ae ee eae "or a947(aht) Nonenemp Chontable Trust

eee ee Supplemantary information - (See separate instructions, 2005

RiSaaiiwaseSenee’” |p MUST be completed by the above arganizations and attached to their Form 990 of 90.52

Name of the ergancation Eloy SeTTIERDON RTD

TSUNAMI RELIEF INC 11-3737294

‘Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees

(See page 1 of the instructions. List each one. If there are none, enter "None.”)

(ayname and wastes. ach employes pad mare (0) Te and average Pou (ay coneroang eer,

en 450.00 Dries sesase rau |e) compensaton| employee brett pens 8 | account re har

$50,000 Pes deletes compereston |” slowanees

NONE.

“otal numbor of ether employees pard over $50,000. >| NONE

‘Compensation of the Five Highest Paid Independent Contractors for Professional Services

(See page 2 of the instructions List each one (whether individuals or firms). Ifthere are none, enter "None.")

[Ei Nome ond sees of each ndependent core pan mere than $30 000 1) Type of seve {€)Gonpensston

NONE

Tolal number of others recewing over $80,000 for

professional sernces 2... | none

‘Compensation of the Five Highest Paid Independent Contractors for Other Services,

(List each contractor who performed services other than professional services, whether individuals or

firms. If there are none, enter "None." See page 2 of the instructions.)

Tey ame and aera ofeach ndoperint contr pad re an 80000 erype eae ‘eiconperaaton

HONE,

Total name’ of einer conrad rerang oer " z 7

$50,000 fr ener sences >| None

For Paperwork Reduction Act Notice, see the nsuctons for Form 850 and Form 90-62. ‘Schedule A (Form 990 or 90-62) 2005

12

837505 MB31 05/12/2006 09:14:47

‘Sena & (Foun 990 900.22) 2008 113737294 Page 2

‘Statements About Activities (See page 2 of the instructions.) [ves] No

During the year, has the organization attempted to influence national, state, or local legislaton, wcluding any

attempt to influence publ opinion on a legislative matter or referendum? lf “Yee” enter the total expenses paid

for incurred in connection wih the lobbying acties De § (ust equal amounts en ine 38,

Part VLA, of ine sof Part VIB)

‘rgarizatons that made an election under section 501(h) by fing Form 5768 ‘must complete Part Vi-A. Oiner

‘organizatons checking “Yes” must complete Part VIB AND attach a statement giving @ detaled description of

the lobbying actwtes

During the year, has the organization, either drectly or mdrecty, engaged in any of the followng acts with any

‘substantial contabutere, trustees, directors, ofleers, creators, Key employees, or members of thew fambes, of

with any taxable organuzatin with which any such person is afflated as an officer, director, trustee, monty

‘owner, oF principal benefleary? (if the answer to any queston 1s "Yes," atlach 9 dotaled statement explanng tho

transactions }

1 Sale, exchange, or teasing of property? . a Fe

Lending of money or other extension of cred? 2 x

© Furnishing of goods, serwces, or facies? ze x

<4. Payment of compensation (ar payment or reimbursement of expenses more than $1,000)? . . .. . « tees - [ae x

‘© Transtor of any part of ts ncome or assets? - ze x

2 Do you make grants for scholarships, fellowshps, student lane, ee (I "Yes> attach an explanation of how

{you determine tha recipients quaiy to receive payments) aa x

1b Doyou have a section 403(b) annuty plan for your employees?” 3b x

During the yea, dd the organization recewe a contribution of quand veal propery wereat unde eecbon 170()? Be x

443 Did you mannan any separate account for parerpating doners where donors have the ght to prowde aduce on

the use oF disinbuton of funds... : af |x

b_Do you provde credit counseling, debt management, cred fepat, or debi nagatation services? ab x

Reason for Non-Private Foundation Status (See pages 3 through 6 of the instructions.)

‘The oxganvzaton isnot a private foundation because ts (Please check only ONE applicable box)

‘Achurch, convention of churches, or association af churches Secton 170(\ KA)

‘A schoo! Section 170(0)(1)()() (Also complete Part V)

‘Ahosptal or a cooperative hosptal service organzation Section 170(6\1)Aa)

[A Federal, state, or local government or governmental unt. Secon 170(8)(1HANY)

‘A medial research organization operated in conjunction witha hosptal Secten 170(6)1)(AY) Enter the hospitas name, ty,

and state

10 [[] Ancrgameation operated forthe benelit of @ college er university owned or operated by a governmental unt. Section 170%8)(3,AK®)

{Also complete the Support Schedule n Part VA)

112 Lad] An organization that normally recewes 2 substantial part of ts support from a governmental unt or from the general puble Secon

118

470(0))(A)(w) (Also complete the Support Schedule n Pat V-A)

‘A.communty trust Section 170(b)(1}{AXw) (Ato complete the Support Schedule m Part IV-A)

[An organization that normaly recewes (1) more than 33 1/9% of il suppart from contnbutons, membership fee, and gross

receipts from actives related tots chartable, ete, unetons - subject to certan exceptions and (2) no more than 33 13% of

‘ts support from gross investment income and untelated business taxable income (less section 511 tay rom businesses aequred

by the organzation ater June 30, 1975 See section 500(2)(2) (Also complete the Support Schedulein Part IV-A)

13 [[) Anerganization that 1s not contrlied by any disqualified persons (other than foundation managers) and supports organcations

deveriodm (1) ines 5 through 12 above, oF 2 section SO1(eKA) (5), "(they mee hfs of eecton 5091) Check

the bor that desenbes the type of sunporing organaston | [Type1 {_Itwe2 [twee

Provide the folowing #etmation about the supported erganaations (See page 6 af the meructons)

(@ Line ramber

(a) Name(e) of supported erganaation(s) from above

14 [An rganastonerganced and operated to tet for pub salty Sarton SO) (Seo pape ofthe msrctens)

‘Sehedule A (Form 990 9 650.62) 2005

837505 M831 05/12/2006 09:14:47 13

sensaue & (Form 980 9902) 2008 31-3737294 Page 3

‘Support Schedule (Complete only f you checked a box on ine 10, 11, 07 12) Usecash method of accounting,

Note: You may use the worksheet in the instructions for converting from the accrual othe cash method of accounting

Galendar year (or fiscal year beginning in) > | (2)2004 (2003 2) 2002 (2008 @ Taal

45 Gifts, grant, and contnbuttone recaved (Os

not clude unusual grants See ine 28) . =.

TE Membership fees receved

17 Gres receipe trom admissions, merchandise

sold oF serwees performed, or furnishing of

facilites in any activty that 1s related to the

organization's chantable, ele purpoce

J8 Gross mcome trom interest, dividends,

amounts recewed from payments on secures

foans (section 512(aX5)), rents, royates, and

unrated business taxable income (ess

section $11 taxes) from businesses acquired

by the erganzation after June 30,1975...

FB Net income from unrelated business

activities not included in ine 18 - - «- «

20 Tax revenues levied for the organization's

benefit and either paid to or expended on

tts behalf

24 The vale of serwces or Facies farmshed to

the organastion by a governmental unt

without charge Do not include the value of

-sernces of facies generally furnished tothe

pubic without charge...

BF Other income Attach a schedule Do not

tnelude gain of (loss) fom sale of capa assets

23 Total of nes 1S thvowgh22 2s.

24_Line 23 minus ine 17. meee

25 Enter 1%ollne23.

26 Organizations described oniines 10 or 1%: a Enler 2% of amount matumn (@), me 24,

LbPrepare a bist for your records to show the name of and amount contnbuted by each’ person (other than a

governmental unt or publicly supported organization) whose total gifts for 2001 through 2004 exceeded the

amount shown in line 26a Do not file this lst with your return. Enfer the total of all these excess amounts | 26»

«© Total support for section 5091) test Erterine24, column) a ae _ >Los.

ddd Amounts from column ()forines 18 is

2 266 >l a6

‘Public euppot (ne 26 minus ine 264tota) veseseeseners flip fase

{ Public upport percentage (Ine 26e (numerator) divided by ine 266 (denormmator) 22 aet NONE %_

ns_deacribed on line 12: a For amounts included in ines 15, 16, and 17 that were recenea from @ “disqualified

‘7 Orgaruzat

person” prepare alist for your records to show the amo ol, and total amounts recelved in each yoar from, each “Zlsqualiied. person

Bornot fe this list wth your return, Ente the sum of such amounts for each Year

NOT APPLICABLE,

(2008) (2003) _ _ (2002) _ 2001)

For any amount included in ine 17 that was recewed from each person (other than “dlequaliied persone"), prepare a list for your records 10

Show the name of and amount recened for each year, that wae more than the larger of (1) the amount on tine 25 for tho year ot (2) $5,000

(Include in the fst organizations desenbed in lines’ 5 through 11, a8 well a8 ndivduais ) Do rot fle this list with your return. After computing

the diferenee between the amount received and the Yarger amount desenbed in (1) oF (2), enter the sum of these sitferences (the excess

amounts) foreach year

(2004) (2003) = (2002) (2001), .

.& Add Amounts trom column (e)fortnes 15 16

7 20 a eee ee lize

Ads Line 278 total. ‘and ine 276 total. . ee eral

fe Public support (ine 27¢ total minus ne 274Q0a)- = = ss eves eevee reese streeeceeeeees DLaTe

{Total support for section 509(a)(2) test Enter amount trom ine 23, column fe) «= + ss = « DLaTE

19 Publie support percentage (line 27¢ (numerator) divided by line 27 (denominator)... - ss + vee > Lz %

hh Investment income percentage (line 18, column (e) (numerator) divided by line 27{(denominatoy) ss BL 2Th *

Fe Unusual Grants: For an organizaten described in line 10, 11, or 12 that recewed any unusual grante Gunng 2001 thravgh 7004,

prepare a tat for’ your records to show, for each year, the name of the contnbulor, the date and amount of the stant, snd a. Boel

‘description ofthe nature ofthe grant Oo not file this lst wilh your return. Do not include these grants mine 15

my ‘Schule A (Form 00 3 OED OS

837507 M831 05/12/2006 09:14:47 14

“SenecleA(Ferm 990 90:62) 2005, 11-3737294 Page 4

Private School Questionnaire (See page T of the instructions) NOT APPLICABLE

(To be completed ONLY by schools that checked the box on line 6 in Part V)

7B Does the organization have a racially nondiscriminatory pokey toward students by statement in i chr, bylaws, [Yes] No

other governing nstrument, or ma resoliton of ts governing body? FD

30 Does the organization include a statement of its racially nondiscnminatory policy toward students in alls

brochures, catalogues, and other wntten communications with the public dealing with student admissions,

programs, and scholarships? 30

31 Has the organization publicized is racially nondiscrimunatory pobcy trough newspaper oF broadcast media dinng

the pend of solicitation for students, or during the registration period iit has no solicitation program, im away

that makes the policy known to all pats of the general communty it serves? pla

It"Yes," please describe, f "No," please explan (If youneed more space, attach a Separate statement )

32. Does the organgation maintain the following

18 Records indicating the racial composition of the student body, faculty, and admnistratve stat? 32al

bb Records documenting that scholarships and other financial assistance are awarded on a racialy nondiscamnatory

bass? 320]

© Copies of all catalogues, brochures, annicuncements, and other written communications to the public deaing

wath student admissions, programs, and scholarships? eee 32¢|

4 Copies of all matenal used by the organization or on its behalf to soket contributions? 32d

It you answered "No" to any of the above, please explan (ifyounsed more space, attach a separate statement )

33._Does the organization discriminate by race in any way with respect to

2 Students nights or pruleges? 33a

b Admissions policies? 330]

. 33¢|

@ Scholarships or other financial assistance? aad

¢ Educational potcies? | 33e|

1 Use of facies? 3st

Athletic programs? 334

hh Other extracurricular actwites? 33h]

I you answered "Yes" to any of the above, please explan (It you need more space, attach a separate statement)

34a Does the organization recewve eny financial aid ar assistance from a governmental agency?” 3aal

bb Has the organization's right to such aid ever been revoked or suspended? sap]

to either 34a orb, please explain using an attached statement |" ”

It you answered "Yes

35 Does the organization certify that it has complied wnth the applicable requirements of sections 4 01 through 4 05

of Rev Proc 75-50, 1975-2 C B 587, covering racial nondiscrmmation? f'No,” attach an explanaton 35,

‘Schedule & (Form 880 or 86042) 2005

837507 M831 05/12/2006 09:14:47 15

‘Schedule A (Fotm 900 or 90-£2) 2005, 31-3737294

Lobbying Expenditures by Electing Public Charities (See page 9 of the instructions)

(To be completed ONLY by an eligible organization that fled Form 5768) No APPLICABLE

Page §

Check pa] [it the organization belongs to an affitated group Check Bb | |i you checked “a” and "imited control” provisions apply

Limits on Lobbying Expenditures ‘tiated group | Tobe completed

tot for Att electing

(The term “expenditures” means amounts paid or neurred ) rganizatons

436. Total lobbying expenditures to nfluence public opmion (grassroots lobbying), . [38

37, Total lobbying expenditures to fluence a legslatwe body (direct lobbyng) | | [37

38 Total lobbying expenditures (add lines 36 and 37) 38

39 Other exempt purpose expendiwes.......0 39

40 Total exempt purpose expenditures (add lines 38 and 38) 40

41. Lobbying nontaxable amount Enter the amount from the folowing table -

It the amount on tine 40 is - ‘The lobbying nontaxable amount is =

Not over 8500000... , 20M ot tReamountonIne ee es

ver $500,000 but ot over 83,00.009 | | $100,000 pis 18% a ne excect over $560,000

(ver $1,000,000 bt ret over 81,500,000 | | $175,000 plus 10% athe excess over 3000000 | 44

‘ver $150,000 but ret over $17,000,000 $225,000 pus 5H ofthe excess ove $1,500,000,

ver$17,000.000 89.0000 ee

42 Grassroots nontaxable amount (ériet 25% of ine 44) 42

43. Subtract line 42 from line 36 Enter -0- tine 421s more than ine 36 || |” | | [aa

44 Subtract line 41 from line 38 Enter -0- fine 41 1s more than ine 38 | 44

Caution: If there 1s an amount on either ine 43 or ine 4, you must fle Form $720,

4-Year Averaging Period Under Section 501(h)

{Some organzations that made a section 501(h) election do not have to complete all ofthe five columns below

See the instructions for mes 45 through 50 on page 11 of the instructons )

Lobbying Expenditures During 4-Year Averaging Period

‘Calendar year (or fiscal @ © © @) ©

Jear beginning in) 2005 2004 2003, 2002 Total

‘Lobbying nontaxable

45. amount -

‘Lobbying ceiing amount

45 _(150% of tne 45(0) - »

47_to.l eobeng openers

(Grassroots nontaxable

48_amount ++ + +

CGrassroatsceang amount

49150 ot tease)

Grassroots lobbying

50 oxpendiures

i Lobbying Activity by Nonelecting Public Charities NO? APPLICABLE

(For reporting only by organizations that did not complete Part VI-A) (See page 11 of the instructions.)

DDunng the year, dd the organization attempt to influence nabonal, state or oallegalatin, including any

attempt to influence pubic opinion on a

@ Volunteers...

Yes|No| Amount

Media advertisements

Matings to members, legislators, of the public,

Publications, or published or broadcast statements

Grants to other organizations for lobbying purposes.

Direct contact with legislators, ther staffs, government offcials, or alegisiabve body | |

Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means | | |

Total lobbying expenditures (Add lines ¢ through h ),

"Yes" to any of the above, also attach a statement ging a detailed description of the iobbying actwbes

'SehedaTe A (Fotn 90 of BBO) 05

83750I M831 05/12/2006 09:14:47 16

Schedule A (Fotm 990 o 990-£7) 2005 11-3737294 Page 8

EEEXW Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations (See page 12 of the instructions.)

57 Did the reporting organization directly or directly engage m any of the following with any other organzation descnbed n secton

501(c) of the Code (other than section 501(c\(3) organizations) or in section 527, relating te politcal organations?

a Transfers fram the reporting organzaton to nenchantable mem ergencation of [ves[ wo

@) Cah fiaml | x

{iy Other assets aii) |x

bb Other transactons|

{) Soles or exchanges of assets wih a nonchantable exempt organza o | |x

(i) Purchases of assets from @ nonchartable exempt erganzaton Seancecc: = Do Ta

(i) Rental of facites, equpment, or oher assets, equ | x

{iw} Rembursement arrangements. wi) | Px

(0) Loans or loan quarantoes . | poecscees {Lo TP

(vi) Performance of seruces or membership or fundrasingsoketatons ew | Px

© Sharing of facies, equpment, mating tists, otter assets, or pad employees ||” . x

4 tthe answer to any of the above #5 "Yes," complete the following schedule Column (8) shoul always chow the far marke value ofthe

goods, other assets, or services given bythe reporting organcalcn Ifthe organization recetved less than far market value m any

transaction or shanng

@ ©) © @

Lune no Amount involved Name of nenenarable expt ogenasion | Cesenpton of verte, vanctons, ond shang arangements

rangement, chow in column (the value ofthe good, other asses, or services recewed

ZA

52 Is the ergenzston drecty or ndrectyaftated wih, or elated to, one oF more t-exempt organcstons

desenbedm secton 5012) of the Code (other than secton $01(6\3)) orm section 277 >Clves

b if Yes," complete the following schedule

@ C ©,

Name of organization ‘Type of organzation Description of relatonshp

M/A

= ‘Sehedule A (Form 990 oF 990-62) 2008

83750g M831 05/12/2006 0!

17

*000'00'2

xno

1 ues oz

‘ava svorunereanoo ‘Wao

siawnea

swore

‘mon

ana

ow

YoUNETALNCD TVELRVASHAS OL ATHSNOLEVTES

LeVT60 9002/21/50 Tea cosece

WoLuvONOs ALITaTSNOdsaN TVTOOS STTRH MOE

oer 18s

NoLUYSIWOHD KOLINLITIEVHSE IML

TSUNAMI RELIEF INC 11-3737294

FORM 990,

PART III - ORGANIZATION'S PRIMARY EXEMPT PURPOSE

THE OBJECTIVE OF TSUNAMI RELIEF INC. IS TO REBUILD HOUSING IN SRI

LANKA, PROVIDING THE NECESSARY SHELTER TO THE VICTIMS LEFT HOMELESS

WHEN THE TSUNMAI HIT ON DECEMBER 26TH.

STATEMENT

837503 M831 05/12/2006 09:14:47

2

21

€ INSWIIWLS

zz LbibT:60 900Z/zT/SO Tean rosLEes

NON

NON

SNON

+ SHONWMOTTY

UGHLO ONY

Loow ASNaaXa

SNON

NON

SNVId LIGaNaa

SEAOTAWS OL

SNOTLAGIYLNOD

NON STWLOL anwio

agagan sw

NON YOLOTYIT

agagan sw

NON UTUASWTUL

agagan sw

SNON HOLOTUIG /NWWYIVEO

NOILWSNGAWOD — NOILISOA OL ATLOATA

SAIL ONY SILIL

ZZOOT AN ‘HOA MaN

Id HL9T LAGULS HLLS SWS SET

aNO¥D NOSTTYD SHL 0/9

ZSGNWNYGS WOL

ZZ00T AN ‘HOA MON

Td HOT ISMWLS HLL LSW SET

aN0U9 NOBTTYD BHI 0/9

‘WWAMIWDOR WWONTTWDOL

ZZOOT AN ‘¥¥OX MGN

Id HL9T ISSULS HLLS LSWa SET

aN0ud NOSTIYD 3HL 0/9

WUNLWEWEWE Cee

ssauaqy GNY SHYN

SAILSMYL GNY /SHOLOTUIG ‘S¥aOTIIO INTWIND - W-A LuWd ‘066 WOT

vOZLELE-TT

ONI ASITSY IMWNASL

You might also like

- OpenAI Form 990 (2022)Document44 pagesOpenAI Form 990 (2022)CNBC.com100% (1)

- Urban Alchemy 2020 990Document28 pagesUrban Alchemy 2020 990auweia1No ratings yet

- Hedge Funds' Suit Against Bank of New York MellonDocument27 pagesHedge Funds' Suit Against Bank of New York MellonDealBookNo ratings yet

- Carpenters Charity Fund 2007Document25 pagesCarpenters Charity Fund 2007Latisha WalkerNo ratings yet

- 2008 Form 990 Carpenter Charity FundDocument30 pages2008 Form 990 Carpenter Charity FundLatisha WalkerNo ratings yet

- Lillian Kaplan 2006-300127083-0373d0e6-F-1Document25 pagesLillian Kaplan 2006-300127083-0373d0e6-F-1yadmosheNo ratings yet

- US Internal Revenue Service: f990 - 1995Document6 pagesUS Internal Revenue Service: f990 - 1995IRSNo ratings yet

- 2015 - 990EZ - Teachers Without BordersDocument18 pages2015 - 990EZ - Teachers Without BordersFred MednickNo ratings yet

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterNo ratings yet

- Riaa 2009 Form 9090Document32 pagesRiaa 2009 Form 9090Bruce HoughtonNo ratings yet

- FTG Irs Form 990 2005Document17 pagesFTG Irs Form 990 2005L. A. PatersonNo ratings yet

- 2014 - 990form - Teachers Without BordersDocument28 pages2014 - 990form - Teachers Without BordersFred MednickNo ratings yet

- US Internal Revenue Service: f990 - 1999Document6 pagesUS Internal Revenue Service: f990 - 1999IRSNo ratings yet

- American College of Lifestyle Medicine, IRS 990s 2008 + 2011-PresentDocument41 pagesAmerican College of Lifestyle Medicine, IRS 990s 2008 + 2011-PresentPeter M. HeimlichNo ratings yet

- Exempt From TaxDocument32 pagesExempt From TaxErik KaufmanNo ratings yet

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument12 pagesReturn of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1No ratings yet

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument12 pagesReturn of Organization Exempt From Income Tax: Open To Public InspectionsakkioNo ratings yet

- 2007 Westlake Foundation 990 (Paul Konigsberg's Foundation)Document18 pages2007 Westlake Foundation 990 (Paul Konigsberg's Foundation)jpeppard100% (2)

- FWD - Us Education Fund-Form 990, 2019 (Public Disclosure)Document57 pagesFWD - Us Education Fund-Form 990, 2019 (Public Disclosure)Breitbart NewsNo ratings yet

- Net Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreDocument3 pagesNet Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreHazem El SayedNo ratings yet

- Pfhof Enshrinees Assistance Foundation 2005Document11 pagesPfhof Enshrinees Assistance Foundation 2005DolfanJillNo ratings yet

- David H Koch Charitable Foundation 480926946 2009 0689FA5BDocument23 pagesDavid H Koch Charitable Foundation 480926946 2009 0689FA5Bcmf8926No ratings yet

- Steve Bannon's Nonprofit Tax Return From 2018Document31 pagesSteve Bannon's Nonprofit Tax Return From 2018CNBC.com100% (1)

- 2009 561750279 05ba1360 9Document31 pages2009 561750279 05ba1360 9Fecund StenchNo ratings yet

- JEHT Foundation - 2001 Tax ReturnDocument17 pagesJEHT Foundation - 2001 Tax ReturnMain JusticeNo ratings yet

- Return of Private FoundationDocument36 pagesReturn of Private FoundationKaycey JoNo ratings yet

- CHP 2018 990Document45 pagesCHP 2018 990auweia1No ratings yet

- Received: Return of Organization Exempt From Income TaxDocument16 pagesReceived: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- NCHC Public Form 990 Fye09Document27 pagesNCHC Public Form 990 Fye09nchc-scribdNo ratings yet

- FTG Irs Form 990 2006Document19 pagesFTG Irs Form 990 2006L. A. PatersonNo ratings yet

- The Barbara Streisand Foundation 2006 990Document31 pagesThe Barbara Streisand Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- US Internal Revenue Service: F990ez - 1999Document2 pagesUS Internal Revenue Service: F990ez - 1999IRSNo ratings yet

- Barbara and Barrie Seid Foundation 363342443 2011 08e875b6searchableDocument22 pagesBarbara and Barrie Seid Foundation 363342443 2011 08e875b6searchablecmf8926No ratings yet

- Tax ReturnDocument16 pagesTax ReturnJameriaNo ratings yet

- Return of Organization Exempt From Income Tax: Employer Identification NumberDocument31 pagesReturn of Organization Exempt From Income Tax: Employer Identification NumberThe Futuro Media GroupNo ratings yet

- Claude R Lambe Charitable Foundation 480935563 2011 08d6a523Document24 pagesClaude R Lambe Charitable Foundation 480935563 2011 08d6a523cmf8926No ratings yet

- IRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Document392 pagesIRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Peter M. Heimlich100% (1)

- 2006 Lax Charity Foundation 990 - Moshe Lax, DirectorDocument24 pages2006 Lax Charity Foundation 990 - Moshe Lax, Directorjpeppard100% (1)

- Return of Organization Exempt From Income Tax: Statement 2Document27 pagesReturn of Organization Exempt From Income Tax: Statement 2DiegoNo ratings yet

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926No ratings yet

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument12 pagesReturn of Organization Exempt From Income Tax: Open To Public InspectionYarod ELNo ratings yet

- Publick Theater Financial Statements 2020-2021Document51 pagesPublick Theater Financial Statements 2020-2021Soko123No ratings yet

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimeNo ratings yet

- Bloomberg Family Foundation 2008 Tax ReturnDocument105 pagesBloomberg Family Foundation 2008 Tax ReturnCeleste KatzNo ratings yet

- Hopewell Fund's 2018 Tax FormsDocument72 pagesHopewell Fund's 2018 Tax FormsJoe Schoffstall100% (1)

- Full Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFDocument54 pagesFull Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFstephen.crawford258100% (18)

- David H Koch Charitable Foundation 480926946 2007 03FB98C2Document12 pagesDavid H Koch Charitable Foundation 480926946 2007 03FB98C2cmf8926No ratings yet

- Claude R. Lambe Charitable Foundation 2002Document17 pagesClaude R. Lambe Charitable Foundation 2002cmf8926No ratings yet

- 2008b 990 PFDocument360 pages2008b 990 PFChristian FaltermeierNo ratings yet

- Picower Foundation - 2001 Tax ReturnDocument48 pagesPicower Foundation - 2001 Tax ReturnMain JusticeNo ratings yet

- US Internal Revenue Service: f1120pc - 1993Document8 pagesUS Internal Revenue Service: f1120pc - 1993IRSNo ratings yet

- Olive Branch Foundation 2007 990Document25 pagesOlive Branch Foundation 2007 990TheSceneOfTheCrimeNo ratings yet

- FY 21 Form 990Document47 pagesFY 21 Form 990prescongoa.ikigaiNo ratings yet

- 6) CaliforniaALL 2008 Tax ReturnDocument21 pages6) CaliforniaALL 2008 Tax ReturnCaliforniaALLExposedNo ratings yet

- 1Document1 page1hansNo ratings yet

- Foreign Tax Credit: (Individual, Estate, or Trust)Document2 pagesForeign Tax Credit: (Individual, Estate, or Trust)Tanasha FlandersNo ratings yet

- Complaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsDocument254 pagesComplaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsCREWNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 16-08697 Notice of InterventionDocument9 pages16-08697 Notice of InterventionDealBookNo ratings yet

- Corinthian Colleges Chapter 11 PetitionDocument19 pagesCorinthian Colleges Chapter 11 PetitionDealBookNo ratings yet

- Cerberus StatementDocument2 pagesCerberus StatementDealBookNo ratings yet

- General Motors Ignition Switch Litigation Crime Fraud Memorandum July 9 2015Document48 pagesGeneral Motors Ignition Switch Litigation Crime Fraud Memorandum July 9 2015DealBookNo ratings yet

- EBITDA Used and Abused Nov-20141Document10 pagesEBITDA Used and Abused Nov-20141DealBookNo ratings yet

- Radioshack's Chapter 11 PetitionDocument22 pagesRadioshack's Chapter 11 PetitionDealBookNo ratings yet

- The IRR of NoDocument9 pagesThe IRR of NoDealBookNo ratings yet

- SEC V Syron Resolution April 14 2015Document13 pagesSEC V Syron Resolution April 14 2015DealBookNo ratings yet

- Inversiones Alsacia Disclosure StatementDocument648 pagesInversiones Alsacia Disclosure StatementDealBookNo ratings yet

- Robert Madsen Whistle-Blower CaseDocument220 pagesRobert Madsen Whistle-Blower CaseDealBook100% (1)

- Globalstar GSAT ReportDocument67 pagesGlobalstar GSAT ReportDealBook100% (2)

- New York v. Davis, Et AlDocument60 pagesNew York v. Davis, Et AlDealBookNo ratings yet

- FILED Motion To Intervenechallenge SettlementDocument12 pagesFILED Motion To Intervenechallenge SettlementArik HesseldahlNo ratings yet

- Anne Griffin Request For Temporary Restraining Order in Divorce CaseDocument15 pagesAnne Griffin Request For Temporary Restraining Order in Divorce CaseDealBookNo ratings yet

- Ken Griffin's Further Response To Divorce ProceedingsDocument20 pagesKen Griffin's Further Response To Divorce ProceedingsDealBookNo ratings yet

- United States Court of Appeals: Circuit JudgesDocument1 pageUnited States Court of Appeals: Circuit JudgesDealBookNo ratings yet

- Ken Griffin's Response To Divorce Proceeding Counter-PetitionDocument18 pagesKen Griffin's Response To Divorce Proceeding Counter-PetitionDealBookNo ratings yet

- Mediator's Memorandum LightSquared CaseDocument22 pagesMediator's Memorandum LightSquared CaseDealBookNo ratings yet

- Motion To TransferDocument40 pagesMotion To TransferDealBook100% (1)

- Greene-v-MtGox Class Action LawsuitDocument32 pagesGreene-v-MtGox Class Action LawsuitAndrew CoutsNo ratings yet

- Search WarrantDocument16 pagesSearch WarrantDealBookNo ratings yet