Professional Documents

Culture Documents

Financial Management in Current Operations and Expansion of Capital in India

Financial Management in Current Operations and Expansion of Capital in India

Uploaded by

San Deep SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management in Current Operations and Expansion of Capital in India

Financial Management in Current Operations and Expansion of Capital in India

Uploaded by

San Deep SharmaCopyright:

Available Formats

PROJECT REPORT

ON

Financial management in current operations and expansion of capital in india

BY Name:Roll No.

Under the guidance of

Prof.

UNIVERSITY COLLEGE OF BUSINESS STUDIES

Punjabi University Patiala, Talwandi Sabo.

STUDENTS DECLARATION

I declare that the project titled Financial management in current operations and expansion of capital in india is an original project done by me and no part of the project is taken from any other project or materials published or otherwise or submitted earlier to any other college or university.

Students Signature NAME ROLL NO.

WORKING CAPITAL NEEDS OF A BUSINESS

INTRODUCTION Different industries have different optimum working capital profiles, reflecting their method of doing business and what they are selling. Business with a lot of cash sales and few credit sales should have minimal trade debtors. Supermarkets are good examples of such businesses. Business that exists to trade in completed products will only have finished goods in stock. Compared this with manufactures who will also have to maintain stock of raw material and work-in-progress. Some finished goods, notably foodstuffs, have to be sold within a limited period because of their perishable nature. Larger companies may be able to use their bargaining strength as customers to obtain more favourable, extended credit terms from suppliers. By contrast, smaller companies, particularly those that have recently started trading (and do not have a record of accomplishment of credit worthiness) may be required to pay their suppliers immediately. Some business will receive their monies at certain times of the year, although they my incur expenses thought the year at a consistent level. This is often known as seasonality of the cash flow. For example, travel agents have peak sales in the weeks immediately following Christmas.

Working Capital Cycle INTRODUCTION The working capital cycle can be define as: The period of time, which elapses between the point at which cash begins to be expended on the production of a product and the collection of cash from customer? Cash is used to buy raw material and other stores, so cash is converted into raw material and stores inventory. Then the raw material and stores are issued to the production department.

Wages are paid and other expenses are incurred in the process and work-in-process comes into existence. Work in-process becomes finished goods. Finished goods are sold to customer on credit. In the course of time these customer pay cash for the goods purchase by them. Cash is retrieved and the cycle is completed. Thus, working capital cycle consists of four stage.

The raw material and stores inventory stage The work-in-progress stage The finished goods inventory stage The receivable. The diagram below illustrates the working capital cycle for a manufacturing firm.

Work-In- progress

Raw material stock

Finished goods stock

Wages & overheads

sales

Trade creditors Selling expenses

Trade debtors

Cash

Taxation

Shareholders

Fixed assets Lease payment

loan Creditors

The upper portion of the diagram above shows in a simplified from the chain of a events in a manufacturing firm. Each of the boxes in the upper part of the diagram can be seen as a tank

through which funds flow. These tanks, which are concerned with day-to-day activities, have funds constantly following into and out of them. The chain starts with the firm buying raw material on credit. In due course, this stock to be used in production ,work will be carried out on the stock, and it will become part of the firms work in progress( WIP) Work will continue on the WIP until it eventually emerges as the finished product. As production progresses, labour costs and overheads will need to be met. Of course, at some stage trade creditors will need to be paid When the finished goods are sold on credit, debtors are increased They will eventually pay, so that cash will be injected into the firm Each of the areas stocks (raw material, work in progress and finished goods), trade debtors, cash (positive or negative) and trade creditors-can be viewed as tanks into and from which funds flow. Working capital is clearly not the only aspect of a business that affects the amount of cash: The business will have to make payments to government for taxation Fixed assets will be purchased and sold Lesser of fixed assets will be paid their rent. Shareholders (existing or new) may provide new funds in the form of cash. Some shares may be redeemed for cash. Dividends may be paid. Long term loan creditors (existing or new) may provide loan finance ,loan will need to be repaid from time to time , and Interest obligation will have to be met be the business. Unlike movement in the working capital items, most of this non- working capital cash transaction is not every day events. Some of them are annual events (e.g. tax payments, lease payment, dividends, interest and possibly, fixed assets purchase and sales). Others (e.g. new equity and loan finance and redemption of old equity and loan finance would typically be rarer events.

Working capital cycle involves conversions and rotation of various constituents/components of the working capital. Initially cash converted into raw materials. Subsequently ,with the usages of fixed assets resulting in value additions ,the raw material get converted into work in process and then into finished goods. When sold on credit, the finished goods assume the form of debtors who give the business cash on due date. Thus, cash assumes its original form against at the end of one such working capital cycle but in the course it passes through various other forms of current assets too. This is how various components of current assets keep on changing their forms due to value addition. As a result, they rotate and business operation continues. Thus, the working capital cycle involves rotation of various constituents of the working capital. While managing the working capital, two characteristics of current assets should be kept in mind viz. 1. Short life span 2. Swift transformation into other form of current assets. Each constituent of current assets has comparatively very short life span. Investment remains in a particular form of current assets for a short period. The life span of current assets depends upon the time required in the activities of procurement, production, sales and collection and degree of synchronisation among them. A very short life span of current assets results into swift transformation into other form of current assets for a running business. These characteristics have certain implicationi. Decision regarding management of the working capital has to be taken frequently and on a repeat basis. ii. The various components of the working capital are closely related and mismanagement of any one component adversely affects the other components too. iii. The difference between the present value and the book value of profit is not significant. The working capital has the following components, which are in several form of current assets: 1. Stock of cash

2. Stock of raw material

3. Stock of finished goods 4. Value of debtors 5. Miscellaneous current assets like short term investment loans & advances.

Factors Determining the working Capital Requirement

The is not set of universally applicable rules to ascertain working capital needs of a business organisation. The factors which influence the need level are discussed below.

Nature of Enterprise:The nature and the working capital requirement of an enterprise are interlinked. While a manufacturing industry has a long cycle of operation of the working capital, the same would be short in an enterprise involved in providing service. The amount required also varies as per the nature; an enterprise involved in production would required more working capital than a service sector enterprise.

Manufacturing / Production Policy:

Each enterprise in the manufacturing sectors has its own production policy, some follow the policy of uniform production even if the demand varies from time to time, and others may follow the principle of demand-based production in which production is based on the demand during that particular phase of time. Accordingly, the working capital requirement varies for both of them.

Operation:

The requirement of working capital fluctuates for seasonal business. The working capital needs of such businesses may increase considerably during the busy season and decrease during the slack season. Ice creams and cold drinks have great demand during summers; while winter the sales are negligible.

Market Condition:If there is high competition in the chosen product category, then one shall need to offer sops like credit, immediate delivery of goods etc, for which the working capital

requirement will be high. Otherwise, if there is no competition or less competition in the market then the working capital requirement will be low. Availability of Raw material:If raw material is readily then one need not maintain a large stock of the same, thereby reducing the working capital investment in raw material stock. On the other hand, if raw material is not readily available then a large inventory/ stock needs to be maintained, thereby calling for substantial investment in the same. Growth and Expansion:Growth and expansion in the volume of business result in enhancement of the working capital requirement. As business grows and expands, it needs a larger amount of working capital. Normally the need for increased working capital funds precedes growth in business activities. Manufacturing Cycle :The manufacturing cycle starts with the purchase of raw material and is completed with the production of finished goods. If the manufacturing cycle involves a longer period, the need for working capital would be more. At times, business needs to estimate the requirement of working capital in advance for proper control and management. The factor discussed above influence the quantum of working capital in the business. The assessment of working capital requirement is made keeping these factors in view. Each constituent of working capital retains its form for a certain period and that holding period is determined by the factors discussed above. So for correct assessment of the working capital cycle requirement, the duration at various stages of the working capital estimated. Thereafter, proper value is assigned to the respective current assets, depending on its level of completion. Each constituent of the working capital is valued on the basis of valuation enumerated above for the holding period estimated. The total of all such valuation becomes the total estimated working capital requirement. The assessment of the working capital should be accurate even in the case of small and micro enterprise where business operation is not very large. We know that working capital has a very close relationship with day-to-day

operation of a business. Negligence in proper assessment of the working capital, therefore, cans affect the day-to day operation severely. It may lead to cash crisis and ultimately to liquidation. An inaccurate assessment of the working capital may cause either under-assessment or over assessment of the working capital and both of them are dangerous.

TYPES OF WORKING CAPITAL:1. NET WORKING CAPITAL: The net working capital is the different between current assets and current liabilities. The concept of net working capital enables a firm to determine how much amount is left for operational requirements. 2. GROSS WORKING CAPITAL: Gross working capital is the amount of funds invested in the various components of current assets. 3. PERMANENT WORKING CAPITAL: Permanent working capital is the minimum amount of current assets which is needed to conduct a business even during the dullest season of the year. The amount varies from year to year depending up on the growth of the company and stage of business cycle in which it operates. It is the amount of funds required to produce goods and services which are necessary to satisfy demand at a particular point. 4. TEMPORARY OR VARIABLE WORKING CAPITAL: It is represents the additional assets which are required at different times during the operating year additional inventory, extra cash etc., seasonal working capital is the additional amount of current assets particularly cash, receivables and inventory which is required during the more active business seasons of the year. 5. BALANCE SHEET WORKING CAPITAL: The balance sheet working capital is one which calculated from the items appearing in the balance sheet. Gross working capital which is represented by the excess of current

assets, and net working capital which is represented by the excess of current assets over current liabilities are examples of balance sheet working capital.

6. CASH WORKING CAPITAL: Cash working capital is one which is calculated from the appearing in the profit and loss account. It shows the real flow of money or value at a particular time and is considered to be the most realistic approach in working capital management. It is the basis of the operating cycle concept which has assumed a great importance in financial management in recent years. The reason is the working capital indicates the adequacy of the cash flow. Which is an essential pre-requisite of a business. 7. NEGATIVE WORKING CAPITAL: Numbers working capital emerges when current liabilities exceed current assets. Such a situation is not absolutely theoretical, and occurs when a firm is nearing a crisis of some magnitude. DETERMINANTS OF WORKING CAPITAL:Numbers of rules are formulated to determine the working capital requirement of the firm. a large number of factors influence the working capital needs of the firm. All these factors have different importance, also the importance of the factor change for a firm over time. Therefore analysis of the relevant factor should be made in order to determine the total investment in working capital requirements of the firm.

1. Nature and size of business 2. Seasonality of operation

3. Production policy 4. Marketing conditions

5. Business cycle fluctuation 6. Credit policy 7. Conditions of supply 8. Working capital policy 9. Current assets in relation to sales WORKING CAPITAL MANAGEMANT THEORY MEANING AND DEFINATION: A part from investment in fixed assets , every enterprise has to arrange for adequate funds for meeting day (operations) expenses to kept it a concern. So originally speaking working capital refers to the flow funds , necessary for working of enterprise however these is no agreement among the financial experts regarding the meaning of working capital. They define working capital in the following ways. ACCORDING TO MEAD MALLOT: Working capital means current assets. ACCORDING TO WESTON AND BRIGHAM:

working capital refers to a firm investment in short term assets, cash, short term securities, accounts receivable and inventories. CONCEPT OF WORKING CAPITAL:There are 2 concepts of working capital : gross and net. The term gross working capital also referred to as a working capital, means the total current assets. The term net working capital can be defined in 2 ways. 1. The most common definition of net working capital is the different between current assets and current liabilities 2. Alternate definition of net working capital is that portion of current assets which is financed with long term funds. The task of the financial manager in managing working capital efficiency is to ensure sufficient liquidity in the operation of the enterprise. The liquidity of a business firm is measured by its ability to satisfy short term obligations as they become due. The three basics measure of a firms overall liquidity are 1. The acid test ratio 2. The net working capital 3. The current ratio In brief , they are useful in inter firm comparison of liquidity . net working capital as a measure of liquidity, is not very useful for comparing the performance of different firms, but it is quite useful for internal control. The net working capital helps in comparing the same firm over time.

NEED FOR WORKING CAPITAL:In order earn sufficient profits, a firm has to depend on its sales activities apart from others. We know that sales are not analysis converted into cash immediately. i.e, there is a time lack between the sale of a product and the realization of cash so, an adequate amount of working capital is required by a firm in the form of different current assets for its activities to continue un interrupted and to tackle the problem that may arise because of the time lay. Practically this happens simply owing to the operating cycle(or) cash cycle, involves the following steps. (a) Conversion of cash into inventory. (b) Conversion of inventory into receivables. (c) Conversion of receivables into cash. NATURE OF WORKING CAPITAL:The term working capital refers to current assets which may be defined as (1) Those which are convertible in to cash or equivalents with in a period of one year and (2) Those which are required to meet day operations. This fixed assets as well as current assets, both required investment of funds. So, the management of working capital and of fixed assets, appearently seen to involve same type of consideration but it is not so. The management of capital involves different concepts and methodology than the techniques used in fixed assets management. The reason for this different is obvious. The very basics of fixed assets decision process (i.e the capital budgeting ) and the working capital decision process are different. The fixed assets involve long period perspective and therefore, the concept of time value of money is applied where as in working

capital the time horizon is limited, in general, to one year only and the time value of money concept is not considered. The fixed assets the long term profitability of the while the current assets affect the short term liquidity position. Managing current assets may require more attention than managing fixed assets. The financial manager must. Therefore continuously monitor the assets to ensure that the desire levels are being maintained. Since the amount of money invested in current assets can change rapidly. So does the financing required. Mis management of current assets can be costly. Too large an investment in current means tying up funds that can be productively used else where (or it means added interest cost if the firm has borrowed funds to finance the investment in current assets). Excess investment may also expose the firm to undue risk eg. In case, the inventory cannot be sold or the receivable cannot be collected. On the other hand, too little investment also can be expensive for ex:insufficient inventory may mean that sales are lost as the goods which a customer wants are not available. The results is that financial managers spend a large chunk of their time managing the current assets because level of these assets changes quickly and a lack of attention paid to them may result in appreciably lower profits for firm. So, in the working capital management, a financial manager is faced with a decisions involving some consideration as follows: 1. what should be the total investment in working capital of the firm?

2. What should be the level of individual current assets?

3. What should be the relative proportion of different sources to financial the working capital requirements? RECEIVABLES CONVERSION PERIOD: (RCP) It is the time required to convert the credit sales in to cash realization. It refers to the period between the occurrence of credit sales and collection of debtors. The total of ICP and RCP is also known as total operating cycle period (TOCP). The firm might be getting some credit facilities from the supplier of raw material wag earners etc. this period for which the payment it these parties are deferred or delayed is known as deferral period. The net operating cycle of a firm is arrived at by deducting the deferral period from total operating cycle period. Thus NOC = TOCP-D OPERATING CYCLE The duration of time required for completing the following sequencies of events in case of manufacturing firm s called the operating cycle. 1. Conversion of cash into raw material. 2. Convertion of raw material into work in progress. 3. Conversion of work in progress into finished goods. 4. Conversion of finished goods into debtors & bills receivable through sale. 5. Conversion of debtors & bills receivable into cash. = ICP+RCP- DP.

CASH

ACCOUNTS RECIEVABLE

RAW MATERIAL

FINISHED GOODS

WORK IN PROGRESS

The duration of the operating cycle for the purpose of estimating working capital requirement is equivalent to the sum of duration of each of these tables less the credit period allowed by the suppliers of the firm. NATURE OF BUSINESS:The working capital requirement of a firm is closing related to the nature of its business. A service firm likes an electricity. A service firm like an electricity undertaking of a transport corporation, which has short operating cycle and sells on cash basis, has modest working capital requirement. On the other hand manufacturing concern like machine tools units which has long operating cycle and which sells largely on credit had varied substantial working capital management. SEASONALITY OF OPERATION:Firms which have market seasonally in their operation usually have highly function working capital requirement. For a sugar industry the raw material i.e., sugar cane is available in particular season only. So sugar industry mainly depends upon seasonality of operations. PRODUCTION POLICY:-

A firm marked by pronounced seasonal fluctuations in its sales many pursue a production policy which many reduce the shape variation is working capital requirement. MARKETING CONDITIONS:In view of competitive conditions prevailing in the firm may have to offer liberal credit terms, to customs resulting in higher debtors, even large inventories many be maintain to serve an order as and when received. BUSINESS CYCLE FLUCTUATIONS:Different phases of business cycle i.e boom, recession, recovery etc, also effect working capital requirement. In case of born conditions inflationary pressure appear and business activities expand. As a result the overall need for cash , inventories etc., increase resulting more and more funds blocked in these current assets. In case of recession period.How ever, there is usually dullness in business activities and there will be opposite effect on the level of working capital. CREDIT POLICY:The credit policy means the totality of terms and conditions on which goods are sold and purchased. At firm has interact with 2 types of credit policies at a time one, the credit policy of the supplier of raw material, goods etc, and two the credit policy relating to credit which it octends to its customer. In both the cases, however ,the firm while deciding its credit policy has to take care of credit policy of the market for example affirm might be purchasing goods and services on credit but selling foods only for cash the working capital requirement of this firm will be lower than that of a firm which is purchasing cash, but has to sell on credit basis. CONDITIONS OF SUPPLY:-

If the supply is prompt and adequate the firm can manage with small inventory, if the supply is unpredicted and service then the firm has to ensure continuity of production. WORKING CAPITAL POLICY:Two important issue in formulation the working capital policy are: 1. What should be the ratio of current assets to sales. 2. What should be the ratio of short term financing to long-term financing. CURRENT ASSETS IN RELATION TO SALES: It usually does the investment in current assets cannot be specified unequally. In sales of uncertainty the outlook on current assets would consist of base component meant to meet normal requirement and safety component mean to copy with unusual demands and requirements. The safety assets policy of the firm . 1. If the firm pursues a very conservation current assets policy is should carry a high level of current assets in relation to sales. 2. If the adopts a moderate current assets policy it would carry a moderate level of current assets in relation to assets. 3. If the term follows highly aggressive current assets policy. It would carry a low level of current assets in relation of sales. A conservative current assets policy trends to reduce risk. The surplus current assets under the policy enable firm to copy rather easily with variations in sales. 54&55 An aggressive current assets policy seeking to minimize the investment in current assets exposes the firm to greater risk. RATIO OF SHORT TERM FINANCING TO LONG TERM FINANCING:-

What would be the relative proportions of short-term bank financing on one hand and long-term sources of finance and the other hand. The board policy alternatives in the respect are: 1. A conservative current assets financing policy. 2. An aggressive current assets financing policy. A conservative current assets financing policy refills less on short-term bank financing and more long on term sources like debentures. An aggressive current financing policy relies heavily on short-term bank finance and seek to reduce dependants on long term financing. CHOOSING THE WORKING CAPITAL POLICY:The overall working capital policy adopted by the firm may broadly:1. Conservative 2. Moderate 3. Aggressive CONSERVATIVE: A conservative overall working capital policy means that the firm chooses conservative current assets policy along with conservative current assets financing policy. MODERATE: A moderate overall working capital policy reflects a combination of a conservative current assets policy and aggressive current assets financing policy or a combination of an aggressive current assets policy and conservative current assets financing policy.

AGGRESSIVE: An aggressive overall working capital consists of an aggressive current assets policy and aggressive current assets financing policy. FINANCING OF WORKING CAPITAL:Normally, financing arrangements are planned for a combination of needs including capital expenditure and working capital investment the assessment of sources of funds from a package and rarely will be possible to concept upto a particular shows to a specific application or use at the same time financing manager does make an assessment of the investment needs as well as current assets and decider an a proper mix of long and short term funds. Taking note of the internal generation of funds for 56 &57 the period in question be decisions on the extent to which the firm would resort to issue of share or long short-term borrowing to mobile the required sources. Typically the current assets of a firm are supported by the combination of long term and short term sources of financing long term sources of finance are equity, preference term loans and debentures which primarily are fixed assets and secondarily provide working capital margin. Where the commitments are certain but cash flows are not clearly predictable, it would wise to cut down drastically the number and extent of short term debts to manageable levels and prefer longer maturity schedules for debts. Short term debts can take care of the seasonal needs of the organization even here to take care of vagaries in cash flow, a past of the funds required may be obtained from sources with longer maturity schedules of the debts. Thus usually permanent and long-term finance is used to finance the permanent requirements or

fixed assets and the net permanent current assets and a apart of the reasonable short term needs. The important sources of finance which more or less exclusively support current assets are: 1. Trade credit 2. Working capital advances by commercial bank. 3. Public corporate deposits 4. Inter corporate deposits 5. Short term loans from financial institutions . 6. Rights debentures for working capital. 7. Emerging sources commercial paper and factoring. Of all the above the most significant sources of working capital finance are trade credit and bank borrowings, after trade credit bank borrowing are the next important sources of financing working capital requirements of firms in India. Tandon committee has suggested guidelines for the ratio allocation and optimum use of the bank credit for the working capital requirement. TANDON COMMITTEE RECOMMENTIONS:1. The borrowers should indicate the likely demand for credit. For this purpose, he should draw operating plans for the ensuring year and supply them bankers. This procedure will facilitate credit planning at the bankers credit needs in a realistic manner and the periodic follow up during the ensuring year 2. The bankers should finance only the genuine production needs of the borrower. The borrower should maintain the reasonable levels of the investor and receivable. He should hold just enough to carry on his targets

production. Efficient management of resources

should, therefore, be

ensured to eliminate slow moving and flabby inventories. CHORE COMMITTEE RECOMMENDATIONS:1. Borrowers should submit quarterly projection of cash credit banks. 2. The banks while assessing the credit requirements from borrowers should fix separate limits where as feasible. 3. As far as possible the borrowers should be discouraged for approaching the bank frequently limitation in excess of sanction limits. 4. Suitable provision should be made for charging of pena rate of interest in even of any defaults in the timely repayment of working capital loan. CHANGES IN WORKING CAPITAL:The working capital of a concern is subject to changes due to several reasons. As we know that the gross working capital is equal to current assets. But net working capital we mean the excess of current assets over current liabilities. The net working capital is therefore, affected by the following transactions. 1. Which increase the current but not the current liabilities. 2. Which decrease the current assets and current liabilities both increase in the same direction by a transaction it does not bring any change in the net working capital of the concern. Only the total of current assets and current liabilities increase and decrease. REASONS FOR CHANGES IN WORKING CAPITAL:1. Changes in the level of sales and\ or operating expenses. 2. Policy changes. 3. Changes in the technology.

STATEMENT OF CHANGES IN WORKING CAPITAL:Until now any increase decrease in any individual item of current assets and current liabilities was shown in the funds flow statement. But now a statement is prepared to deficit the changes in working capital. The net increase or decrease is then carried forward to the funds flow statement. The statement of working capital is prepared with the help of current assets and current liabilities of the two periods the figures of 2 periods are compared. If there is an increase in the amount of any current liabilities in the current year in comparison to that in that in the previous year, it will result to an increase in the working capital. Similarly, a decrease in the amount of any current assets or an increase in amount of current liabilities in the current year in comparison to that in the previous year and total decrease in the end is compared and the different of total increase and total decrease shows net increase or decrease in the working capital. Net increase in working capital is an application of funds and net decrease in working capital in the source of funds. A form of statement is shown below.

RATIO ANALYSIS Several ratios calculated from the accounting date, can be grouped into various classes according to financial activity or function to be evaluated. As stated earlier, the parties interested in financial analysis are short and short and long-term creditors, owners and management. Short-term creditors main interest is in liquidity position or the short-term solvency of the firm. Long-term creditors, on the other hand, and more interested in the long-term solvency and profitability of the firm. Similarly, owners concentrate on the firms profitability and financial conditions. Management is interested on in evaluating every aspect of the firms performance. They have to protect the interests of all parties and see that the firm grows profitably. In view of the requirements of the various users of ratio, we may classify them into the following four important categories.

TYPES OF RATIO: Liquidity ratios Leverage ratios Activity ratios Profitability ratios

1) Liquidity ratio:The liquidity refers to the maintenance of cash, bank balance and those assets, which are easily convertible into cash in order to meet the liabilities as and when arising. So, the ratios study the firms short-term solvency and its ability to pay off the liabilities.

a. Current ratio:Current ratio is the ratio of current and current liabilities. Current assets are assets which can be converted into cash within one year and include cash in hand and at bank, bills receivable, net sundry debtors, stock of raw materials, finished goods and work in progress, prepaid expenses, outstanding and occurred incomes, and short term or temporary investments. Current liabilities are liabilities, which are to be repaid with in a period of 1 year and include bills payable, sundry creditors, bank over drafts, and outstanding expenses, Income received in advanced, proposed dividend, provision for taxation, unclaimed dividends and short term loans and advances repayable within 1 year Current assets Current Ratio = ------------------------------------------Current liabilities A current ratio 2:1 is considered as ideal: if a business has an undertaking with its bankers to meet its working capital requirements short notices, a current ratio of is adequate. b. Quick Ratio:Quick assets Quick ratio = -------------------------------------------------Quick liabilities A quick ratio of 1 is considered as ideal. A quick ratio of less than 1 is indicated of inadequate liquidity of the business. A very high ratio is also not available as funds can be profitability employed.

c. Absolute liquid ratio:It is ratio of absolute liquid ratio assets to quick liabilities. However, for calculation purposes, it is taken as ratio of liquid assets of current liabilities. Trade investment or marketable securities are equivalent of cash therefore, they may be included in the computation of absolute liquid ratio. Absolute liquid ratio Absolute quick ratio = ------------------------------------------------Current liabilities

2) Leverage ratios:leverage ratio indicate the relative interest of owners and creditors in a business. It shows the proportions of debt and equity in financing the firms assets the long term solvency of a firm can be examined by using leverage ratio. The long-term creditors like debenture holders, financial institutions etc,.are more concerned with firms long term financial strength. There are two aspects of the long-term solvency of a firm 1) Ability to repay the principal when due, and 2) Regular payment of the interest they leverage ratio are calculated to measure the financial rest and firms abilities of using debt. a. TOTAL DEBT RATIO:Total debt will include short and long-term borrowing from financial institution debentures bonds. Capital employed will include total debt and net worth.

The firm may be interested in knowing the proportion of the interest bearing debt in the capital structure by calculating total debt ratio. A highly debt burdened firm difficulty in raising funds from creditors and owners in future. Creditors treat the owners equities as a margin of safety. Total Debt Total Ratio = ---------------------------------------------Capital Employed b. DEBT -EQUITY RATIO:It reflects the relative claims of creditors and shareholders against the assets of the business. Debt, usually, refers to long-term liabilities. Equity include preference share capital and reserves. The relationship describing the lenders contribution for each refers of the owners contribution is called debt equity ratio. A high ratio shows a large share of financing by the creditors relative to the owners and therefore, large claim against the assets of the firm. A low ratio implies a smaller claim of creditors. The equity indicates the margin of satisfy to the creditors so, there is no doubt the Beth high and low debt equity ratios are not desirable. What is needed is a ratio, which strikes a proper balance between debt and equity.

Total Debt Debt-Equity = ------------------------------------Net worth

Some financial experts opine that debt should indicate current liabilities also. However, this is not a popular practice. In case of preference share capital, it is treated as a part of shareholders funds, but if the preference shares are redeemable, they are taken as a part of long-term debt shareholder funds are also known as proprietor funds and it indicates items equity share capital, reserve, and surplus. A debt equity ratio of 3:1 is considered ideal. c. PROPRIETORY RATIO:It expresses the relation between net worth and total assets. Net worth Property ratio= ---------------------------------------Total assets Net worth= equity share capital + preference share capital + reserves fictitious assets. Total assets= fixed assets + current assets (excluding fictitious assets) Reserve earmarked specifically for a particular purpose should not be included in calculation of net worth. A high proprietors ratio is indicative of strong financial position of the business. The higher the ratio, the better it is. d. FIXED ASSETS RATIO:Fixed assets Fixed Assets = -----------------------------------------Capital employed

Capital employed equity share capital + preference share capital + reserves + long term liabilities fictitious assets. This ratio indicates the mode of financing the fixed assets. A financially well- managed company will have its fixed assets financed by long term funds. Therefore, the fixed assets ratio should never be more than A ratio of 0.67 is considered idea e. INTEREST COVERAGE RATIO: This interest coverage ratio is computed by dividing earnings before interests and taxed by interest charges. Debt Interest coverage ratio = ----------------------------Interest This interest coverage ratio shows the number of times the interest charges are covered by funds that are or demurely available for their payment. A high ratio is desirable but too high ratio indicates that the firm is very conservative in using debt and that is not using credit to the debt advantage of shareholder. A lower ratio indicates excessive use of debt or inefficiency operations. The firm should make efforts to improve the operating efficiency or to retire debt to have a comfortable coverage ratio.

3) ACTIVITY RATIOS:Activity assets turnover ratio, measures the efficiency of a firm in managing and utilizing its assets. The higher the turnover ratio, the more efficiency the management and utilization of the assets while low turnover ratio is indicate of

under- utilization of available resources and presence idle capacity. The total assets turnover ratio is computed by dividing sales by total assets. Sales Total assets turnover ratio = ------------------------------------Total assets a. WORKING CAPITAL TURNOVER RATIOS:Cost of goods sold Working capital turnover ratio = ------------------------------------Working capital Where if cost of goods sold is known. Net sales can be taken in the numerator. Working capital = current assets current liabilities. A high working capital turnover ratio indicates efficiency utilization of the firms funds. However, it should not result in over trading. b. DEBTORS TURNOVER RATIO :Debtors turnover ratio expresses the relationship between debtors and sales. It is calculated. Net credit sales Debtors turnover ratio = ------------------------------------Average debtors Net credit sales inspire credit sales after adjusting for sales returns. In case information no credit sale is not available. sales can be taken in the numerator.

Debtors include bills receivable. Debtors should be taken at gross value, without adjusting provisions for bad debts. In case, average debtors be found; closing balance of debtors should be taken in the denominator. A high debtorsturn over ratio or a low debt collection period is indicative of a sound credit management policy. A debtors turnover collection period of 30-36 days is considered ideal. c. DEBT COLLECTION PERIOD:The debt collection period measures the quality of debtors since it indicates the speed of the collection. The shortest the average collection period implies the prompt payment by debtors. No. of days year Debt collection period = ----------------------------------------Debt collection period An excessively long collection period implies a very liberal and inefficient credit and collection performance. This certain delays the collection delays the collection of each and impairs the firms liquidity. The average no. of days for which debtors remain outstanding is called debt collection period or average collection period. d. CREDITORS TURNOVER RATIO:Creditors turnover ratio expresses the relationship between creditors and purchases. Net credit purchase Creditors turnover ratio = --------------------------------------------Average creditors

Net credit purchase imply credit purchase after adjusting for purchases returns. In case information on credit purchase is not available purchase may be taken in the numerator. Creditors include bills payable. In case avenue creditors cant be found, closing balance of creditors should be taken in the denominator. The creditors turnover ratio is 12 or more. However, very less creditors turnover ratio, or a high debt payment period, may indicate the firms inability in meeting its obligation in time. e. PAYMENT PERIOD RATIO:Creditors turnover rate can also be expressed in terms of number of days by the business to pay off its debts. It is termed as debt payment period which is calculated as:Number of days in a year Payment period ratio = -------------------------------------------Creditors turnover ratio

f. FIXED ASSETS TURNOVER RATIO:It is defined as Net sales Fixed assets turnover ratio = --------------------------------Fixed assets

Fixed assets imply net fixed assets i.e. after depreciation. A high fixed assets turnover ratio indicates better utilization of the firms fixed assets. A ratio around 5 is considered ideal. g. INVENTORY TURNOVER RATIO:Stock turnover ratio indicates the number of times the stock has turned over into sale sin the year. It is calculated. Cost of goods sold Inventory turnover ratio = ------------------------------------------Average inventory Cost of goods sold = sales gross profit Average stock = (opening stock and closing stock 1\2) In case, information regarding cost goods sold is not known. Sales may be taken in the numerator. Similarly, if average stock cant be calculated, closing stock should be taken in the denominator. A stock turnover ratio of 8 is considered ideal. A high stock tur nover ratio indicates that the stocks are fast moving and get converted into sales quickly. However, it may also be on account of holding low amount of stocks and replenishing stocks in larger number of installments.

4) PROFITABILITY RATIO:It measure the overall performance and effective of the firm. Poor operational performance may indicate poor sales and hence poor profits. A lower

profitability may arise due to the lack of control over the expenses. Bankers, financial institutions and other creditors look at the profitabilitys. ratio as an indicator whether or not the firm earns substantially more than it pays interest for the use of borrowed funds and weather the ultimate repayment of their debt appear reasonably certain owner are interest to know the profitability as it indicates the return which they can get on this instruments. Profitability ratios measure the profitability of a concern generally. They are calculated either in relation to sales or in relation to investment. a. NET PROFIT RATIO It indicates the result of the overall operation of the firm. The higher the ratio, per profitable is the business. The net profit ratio is reassured by dividing net profit ratio indicates management efficiency in manufacturing administration and selling the products. This ratio is the overall firms ability to turn each rupee of sale into net profit. If the profit margin is inadequate, the firm fails to achieve satisfactory return on share holders funds. Profit after tax Net profit ratio = ---------------------------------Net sales A firm with high net profit margin can make better use of favorable conditions. Such as rising selling prices, falling cost of products or increasing demand for the product. Such a firm will be able to accelerate its profits at a faster rate than a firm with a low net profit margin. This ratio also indicates the firm capacity to withstand adverse economic conditions. b. RETURN ON NET WORTH RATIO :-

It indicates the return, which the shareholders are earning on their resources invested in the business. Profit after tax Return on net worth ratio = -----------------------------------------Net worth Net worth = share holders funds = equity share capital + preference share capital + Reserves factious assets. The higher the ratio, the better it is for the share holders. However, inter firm comparisons should be made to ascertain if the returns from the company are adequate. A trend analysis of the ratio over the past few years much is done to find out the growth or deterioration in the profitability of the business. c. RETURN ON ASSETS RATIO :Profit after tax Return on assets ratio = -----------------------------------------Total assets Total assets do not include fictitious assets. The higher the ratio, the better it is. d. EARNINGS PER SHARE RATIO:Earnings per share are the net profit after tax and preferences dividend, which is earned on the capital representative of one equity share. It calculated as :Profit after tax available to equity holders Earnings per share ratio = -----------------------------------------------------------Number of ordinary share

ADVANTAGE OF RATIOS: Useful of evaluation performance in terms of profitability and financial stability. Useful for intra & inter firm comparison. Useful forecasting and budgeting. It is just in tabular form over a period of years indicated the trend of business. Smile to understand rather than the reading but the figures of financial statement. Key tool in the hand of modern financial management. Enable outside parties to assess the strength and weakness of the firm. Ratio analysis is very useful for ranking management decisions and also highlights the performance in the area of profitability financial stability and operational efficiency.

LIMITATIONS OF FINANCIAL RATIOS

The ratio analysis is widely used of technique to evaluate the financial position and performance of business. But there are certain problems in using ratios. The analyst should be aware of these problems the following are some of the limitations of ratio analysis. It is difficult to decide on the proper basis of comparison. The comparison is rendered difficult because of differences in situations of two companies or of one company over years. The price level changes make the interpretation of ratios invalid.the differences in the definitions of items in the balance sheet and the profit & loss statement make the interpretation of ratios difficult. The ratios calculatedat a point of time or less informative and defective as they suffer from short term changes. Difference in accounting policies and accounting period make the accounting data of firms non comparable as also the accounting ratios. It is very difficult to generalize weather a particular ratio is good or bad. For ex: a low current ratio may be said bad from the point of view of low liquidity. But a high current ratio may not be good. As this may results from in efficient working capital management.

CONCLUSION

Working capital management analysis is an in depth analysis, overages the entire financial management the with refers to integrated. Hence, it is on integrated approach and constant measure may be adopted for better managerial performance. Working capital analysis itd criteria is distinctive work while and commendable technique in postulating the financial behavior of business enterprise. Thus, working capital management which integrated, internal, intermediate, and organization based financial and analytical measurement the study always a strategic measurement with reference in performance, growth expansion and modernization of the business

BIBLIOGRAPHY

Books: I.M. Pandey: Financial Management, 4th edition Tata McGraw-Hill PublishingCompany Limited, New Delhi (2004). V.K. BI.T.I.l: Working Capital Management, 5th edition Anmol Publication NewDelhi (2003). Prasanna Chandra: Financial Management Theory and Practice, 6th edition TataMcGraw-Hill Publishing Company Limited, New Delhi (2004). Khan and Jain: Financial management, 4th edition Tata McGraw-Hill PublishingCompany Limited, New Delhi (2004). Annual Report of I.T.I. Raibareli.

Financial websites : www.I.T.I.-india.com www.hindubusiness.com www.mag-india.com www.google.com

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- SampleDocument15 pagesSamplesarthak50% (2)

- Management Tri Nova CaseDocument4 pagesManagement Tri Nova CaseAie Kah Dupal100% (2)

- 10 Market's Economic in MalaysiaDocument39 pages10 Market's Economic in MalaysiaZhenRuiShe100% (2)

- Working Capital Analysis of MafatlalTextileDocument91 pagesWorking Capital Analysis of MafatlalTextileChandrashekhar Joshi100% (1)

- 935 Robert Bosch Interview Questions in C A Micro Controllers PDFDocument2 pages935 Robert Bosch Interview Questions in C A Micro Controllers PDFdhapra0% (1)

- BCom I-Unit III - Notes On Working Capital ManagementDocument9 pagesBCom I-Unit III - Notes On Working Capital ManagementRohit Patel100% (3)

- Corporate FinanceDocument31 pagesCorporate FinanceAbhi RainaNo ratings yet

- Introduction of TopicDocument46 pagesIntroduction of TopicsunilbghadgeNo ratings yet

- WC MGMT Draft 1Document9 pagesWC MGMT Draft 1api-311798551No ratings yet

- Working Capital Management ThingsDocument9 pagesWorking Capital Management ThingsNeel ManushNo ratings yet

- Management of Working CapitalDocument9 pagesManagement of Working CapitalKushal KaushikNo ratings yet

- A Study of Working Capital Management and Its Impact On Profitabilty and Networth of CNX FMCG Index CompaniesDocument12 pagesA Study of Working Capital Management and Its Impact On Profitabilty and Networth of CNX FMCG Index CompaniesNasirNo ratings yet

- Working Capital ManagementDocument52 pagesWorking Capital Managementforevers2218No ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word Documentrajput12345No ratings yet

- Working Capital Management in Vardhman-Final ProjectDocument84 pagesWorking Capital Management in Vardhman-Final ProjectRaj Kumar100% (3)

- Financial MGMT Notes - Unit VDocument10 pagesFinancial MGMT Notes - Unit Vhimanshujoshi7789No ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital Managementsidhantha100% (12)

- Working Capital Unit 5Document10 pagesWorking Capital Unit 5Divyasree DsNo ratings yet

- Working Capital ManagementDocument35 pagesWorking Capital ManagementNilesh KasatNo ratings yet

- Institute of Accountancy ArushaDocument4 pagesInstitute of Accountancy ArushaAurelia RijiNo ratings yet

- 3CETTDocument11 pages3CETTNarendra KilariNo ratings yet

- Working CapitalDocument7 pagesWorking CapitalDnyaneshwar JadhavNo ratings yet

- Sources of Working Capital Finance EssayDocument11 pagesSources of Working Capital Finance EssayMehak JainNo ratings yet

- Working Capital ManagementDocument26 pagesWorking Capital ManagementMrinal KalitaNo ratings yet

- What Is Working Capital? (Refer To This Web Site For Getting Clarity Before Learning The Chapter)Document7 pagesWhat Is Working Capital? (Refer To This Web Site For Getting Clarity Before Learning The Chapter)Pushpendra Singh ShekhawatNo ratings yet

- Financial Management Lecture NoteDocument50 pagesFinancial Management Lecture NoteTuryamureeba JuliusNo ratings yet

- Unit - 6: Working CapitalDocument14 pagesUnit - 6: Working CapitaldeepshrmNo ratings yet

- Chapter IDocument57 pagesChapter IGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- Working CapitalDocument15 pagesWorking CapitalAdeem AshrafiNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementSuresh Dhanapal100% (1)

- Body PartDocument66 pagesBody PartSourabh SabatNo ratings yet

- Working Capital Management Debendra ShawDocument6 pagesWorking Capital Management Debendra ShawRohit BajpaiNo ratings yet

- Financial Management Lecture NoteDocument51 pagesFinancial Management Lecture NoteJade MalaqueNo ratings yet

- Financial Management Lecture NoteDocument48 pagesFinancial Management Lecture NotesumuNo ratings yet

- Acf Unit 1Document27 pagesAcf Unit 1Sachin D SalankeyNo ratings yet

- Introduction On FinanceDocument38 pagesIntroduction On FinanceworldontopNo ratings yet

- Working Capital ManagementDocument9 pagesWorking Capital ManagementSaket MehtaNo ratings yet

- Working Capital Management in Icici PrudentialDocument83 pagesWorking Capital Management in Icici PrudentialVipul TandonNo ratings yet

- Akash Yadav 2Document55 pagesAkash Yadav 2Akash SinghNo ratings yet

- Working Capital Management at Maruti-SuzukiDocument111 pagesWorking Capital Management at Maruti-SuzukiRajesh BathulaNo ratings yet

- Swaraj WcapitalDocument63 pagesSwaraj Wcapitalram801No ratings yet

- Swaraj WcapitalDocument63 pagesSwaraj WcapitalNoushad AhmedNo ratings yet

- Working CapitalDocument5 pagesWorking CapitalRajan GavaliNo ratings yet

- Working Capital ManagementDocument56 pagesWorking Capital ManagementmanuNo ratings yet

- Phi Long WCWDocument48 pagesPhi Long WCWGia MinhNo ratings yet

- Components of Working Capital CashDocument3 pagesComponents of Working Capital Cashkavitachordiya86No ratings yet

- AFSALDocument3 pagesAFSALafsalpkgroupNo ratings yet

- Working Capital ManagementDocument9 pagesWorking Capital ManagementYogesh SainiNo ratings yet

- Final Project On WCMDocument51 pagesFinal Project On WCMAnup KulkarniNo ratings yet

- Literature ReviewDocument17 pagesLiterature Reviewجاين شاكوNo ratings yet

- Management of Working Capital: Ajeet Kumar ThakurDocument125 pagesManagement of Working Capital: Ajeet Kumar ThakurDilip Kumar YadavNo ratings yet

- Unit 5Document23 pagesUnit 5prasadarao yenugulaNo ratings yet

- FM Unit 5Document23 pagesFM Unit 5prasadarao yenugulaNo ratings yet

- Working Jocil 06Document83 pagesWorking Jocil 06Phani Deepika Koritala0% (1)

- Working Capital ManagementDocument6 pagesWorking Capital Managementarchana_anuragiNo ratings yet

- Chapter 1 OnwardsDocument60 pagesChapter 1 OnwardsChirag MittalNo ratings yet

- Working Capital Samsoe MadocDocument14 pagesWorking Capital Samsoe Madocanuragsamanta1208No ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument17 pagesWORKING CAPITAL - Meaning of Working CapitalPriyanka AjayNo ratings yet

- Gas WeldingDocument30 pagesGas WeldingNagendrababu BabuNo ratings yet

- Beauty SinghDocument1 pageBeauty SinghSan Deep SharmaNo ratings yet

- Reevaluation Form ReportDocument1 pageReevaluation Form ReportSan Deep SharmaNo ratings yet

- Cca India 2014Document1 pageCca India 2014San Deep SharmaNo ratings yet

- 1 PH.D Associate Professor Dr. Vandna ChhabraDocument2 pages1 PH.D Associate Professor Dr. Vandna ChhabraSan Deep SharmaNo ratings yet

- Space Radiations and Its Effect On Ultra High Temperature Resistant Polymeric Nano CompositeDocument4 pagesSpace Radiations and Its Effect On Ultra High Temperature Resistant Polymeric Nano CompositeSan Deep SharmaNo ratings yet

- CBSE Class XII - Computer Science Syllabus: Unit 1: Object Oriented Programming in C++Document4 pagesCBSE Class XII - Computer Science Syllabus: Unit 1: Object Oriented Programming in C++San Deep SharmaNo ratings yet

- Theoretical Studies of Electronic Properties of Graphene Using Atk SimulationDocument5 pagesTheoretical Studies of Electronic Properties of Graphene Using Atk SimulationSan Deep SharmaNo ratings yet

- Converse: Cash On Account P.O # Qty. Description AmountDocument1 pageConverse: Cash On Account P.O # Qty. Description AmountSan Deep SharmaNo ratings yet

- An Overview of The Effect of Hot Corrosion in Waste-To-Energy (Wte) Plant EnvironmentDocument4 pagesAn Overview of The Effect of Hot Corrosion in Waste-To-Energy (Wte) Plant EnvironmentSan Deep SharmaNo ratings yet

- Study of Design of Gating System For A Die-Casting Die: A Review Chandan Deep Singh, Rajdeep SinghDocument11 pagesStudy of Design of Gating System For A Die-Casting Die: A Review Chandan Deep Singh, Rajdeep SinghSan Deep SharmaNo ratings yet

- Structural and Optical Investigation of Aluminium-Lithium-Borate GlassesDocument4 pagesStructural and Optical Investigation of Aluminium-Lithium-Borate GlassesSan Deep SharmaNo ratings yet

- Statement of PurposeDocument1 pageStatement of PurposeEngr Mubashir MukhtarNo ratings yet

- Power Line Carrier Communication (PLCC) : ContentDocument10 pagesPower Line Carrier Communication (PLCC) : ContentManuel Henríquez SantanaNo ratings yet

- Part 1 - Clinical Manual - January 2018 - Version 8.0Document260 pagesPart 1 - Clinical Manual - January 2018 - Version 8.0AbhishekNo ratings yet

- Letter of Indemnity For Maturity - Survival ClaimDocument2 pagesLetter of Indemnity For Maturity - Survival Claimsajeer n FORWARDNo ratings yet

- Business Plan Hindi Pa FinalDocument10 pagesBusiness Plan Hindi Pa FinalMaria Theresa Cortez MendozaNo ratings yet

- Pennsylvania Wing - Aug 2006Document28 pagesPennsylvania Wing - Aug 2006CAP History LibraryNo ratings yet

- Presentation 4th Global Tea Forum Dubai (World Tea News)Document10 pagesPresentation 4th Global Tea Forum Dubai (World Tea News)Dan BoltonNo ratings yet

- The High Cost of College Textbooks: Mem PresentationDocument12 pagesThe High Cost of College Textbooks: Mem Presentationchinmayaa reddyNo ratings yet

- Architect ListDocument24 pagesArchitect Listzaffarabbasin786No ratings yet

- Teoria de Las 4 Columnas Pilon TibialDocument11 pagesTeoria de Las 4 Columnas Pilon TibialOscar Cayetano Herrera RodríguezNo ratings yet

- Balance Sheet of JYOTHI Brass Metal Works (2010-20014) : - in Rs. Cr.Document4 pagesBalance Sheet of JYOTHI Brass Metal Works (2010-20014) : - in Rs. Cr.nawazNo ratings yet

- Barco Vs CADocument5 pagesBarco Vs CAdjango69No ratings yet

- Transmission Hydraulic SystemDocument4 pagesTransmission Hydraulic SystemA Ramos Gaby100% (5)

- Topic 19 - Manufactures - and - IndustriesDocument1 pageTopic 19 - Manufactures - and - IndustriesMATIAS XAVIER LUNA PARRANo ratings yet

- Appendix 13a - BACHELOR Internship Final Report Assessment Sheet (202012)Document4 pagesAppendix 13a - BACHELOR Internship Final Report Assessment Sheet (202012)Pang Kok OnnNo ratings yet

- Castilex Industrial Corporation V VasquezDocument3 pagesCastilex Industrial Corporation V VasquezJaz SumalinogNo ratings yet

- How I Made My First: Hundred Thousand DollarsDocument9 pagesHow I Made My First: Hundred Thousand DollarsysabananananaNo ratings yet

- Aire Acondicionado Iveco DailyDocument1 pageAire Acondicionado Iveco DailyjasogtiNo ratings yet

- Computer Science IADocument51 pagesComputer Science IAMarshall CampbellNo ratings yet

- Potent Drugs HandlingDocument4 pagesPotent Drugs HandlingOMKAR BHAVLENo ratings yet

- Challenges and Opportunities of Artificial IntelligenceDocument9 pagesChallenges and Opportunities of Artificial IntelligencePraveen KumarNo ratings yet

- DIDIDocument3 pagesDIDIRamon GarciaNo ratings yet

- Industrial Training ReportDocument13 pagesIndustrial Training ReportBharathwaj SK0% (2)

- 1 Communicative English SkillsDocument24 pages1 Communicative English Skillskiya0191% (35)

- Personal Kanban - Mapping Work, Navigating LifeDocument149 pagesPersonal Kanban - Mapping Work, Navigating LifeDario Dorko100% (2)

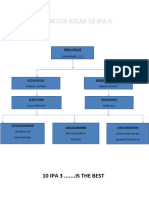

- Struktur Kelas 10 Ipa 3Document17 pagesStruktur Kelas 10 Ipa 3Okvie AjaNo ratings yet