Professional Documents

Culture Documents

Alternative Investments Reviewer

Alternative Investments Reviewer

Uploaded by

J DOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alternative Investments Reviewer

Alternative Investments Reviewer

Uploaded by

J DCopyright:

Available Formats

Alternative Investments (Schweser notes) R.

66: Introduction to Alternative Investments Alternative investments Traditional: Publicly traded stocks, bonds, cash Alternative investments exhibit: Less liquidity More specialization by investment managers Less regulation Lack transparency Potentially problematic and limited historical return and volatility data Different legal issues and tax treatments Categories: Hedge funds, private equity, real estate, commodities, others (fine wines, stamps, art, antique furniture, patents) Potential benefits of holding alternative investments Low correlation with traditional investments over long periods, reducing overall portfolio risk Higher historical returns than traditional investments CAVEAT: May be affected by: o Survivorship bias: Non-surviving funds not included o Backfill bias: Only new, good funds included Strategies are typically active, alpha-seeking strategies Common structure for funds is limited partnership: limited partner (investor) and general partner (the fund) Hedge funds Aggressively managed portfolios across asset classes and regions, leveraged, take long and short positions, use derivatives Has goal of generating high returns and has few investment restrictions, if any Only limited to partners with adequate wealth, sufficient liquidity, and acceptable degree of investment sophistication Imposes restrictions on redemptions such as lockup period, notice period, and redemption fees Better returns than equities when market is down, lagging when market is up Fund of funds: Portfolio of hedge funds Allow small investors to access hedge funds Diversified among hedge funds Have expertise in due diligence May negotiate redemption terms Charge additional fees beyond fees by individual funds Strategies Event-driven: Based on corporate restructuring or acquisitions that create profit opportunities for equities and bonds o Merger arbitrage: Long target, short buyer o Distressed/restructuring: Long undervalued distressed securities that can be improved through restructuring o Activist shareholder: Buy sufficient shares to influence a company and increase value o Special situations: Invest in firms that are issuing/repurchasing securities, spinning off divisions, selling assets, distributing capital

Relative value: Long a security and short a related one with goal of profiting from perceived discrepancy o Convertible arbitrage fixed income o Asset-backed fixed income: MBS and ABS o General fixed income: Fixed income securities o Volatility: Discrepancies between volatility implied by options and expectations of future volatility o Multi-strategy: Different asset classes and markets Macro: Based on global economic trends, involves long/short in equities, bonds, currencies, commodities Equity: Long-short in traded equities and derivatives o Market neutral: Technical/fundamental analysis to long undervalued and short overvalued in approximately equal amounts to profit from relative price movements without exposure to market risk o Fundamental growth: High-growth companies using fundamental analysis o Fundamental value: Undervalued companies based on fundamental analysis o Quantitative directional: Based on technical analysis o Short bias: Predominantly short positions, possibly with smaller long positions, but negative overall o Sector specific: Technical and fundamental Fees and charges Typical: 2 and 20; FoF: 1 and 10 Until fund has recovered past loss and has returned to high watermark (previous net high), no incentive fee Watermark protects investors from double-charging returns Hurdle rate o Soft hurdle: Applied to entire returns o Hard hurdle: Applied only if greater than benchmark Management fee = Beginning value * rate Incentive fee = [Ending value beginning value - management fee (watermark * hurdle rate)] * rate o Only applied if all-time high For FoF, calculate percentage returns on hedge fund level, apply to initial FoF value to get ending, calculate as usual Valuation Based on market values of traded securities in portfolio, but must use model for non-traded ones Trading NAV, with adjustments for illiquidity o Side pockets: Separate illiquid assets from more liquid ones; once investment enters side pocket, only present investors will be entitled to share of it; future investors will not receive share of proceeds in event asset's returns get realized Due diligence: Require investigation, which may be hampered by lack of transparency Investment strategy and process Source of competitive advantages Historical returns Valuation and returns calculation models Longevity Amount of assets under management Management style Key person risk

Reputation Growth plans Systems for risk management Appropriateness of benchmarks

Private equity Invest in private companies or public companies to take private Strategies Leveraged buyout o Most common; purchase of company funded by debt o May be bank debt (leveraged debt), high-yield bonds, or mezzanine financing (debt or preferred shares subordinate to high-yield bonds, carrying warrants or conversion features) o Types Management buyout: Existing management is involved in the purchase Management buy-in: External management team will replace existing management o Seeks to increase value of firm through new management, management incentives, restructuring, cost reduction, and revenue enhancement o Firms with high cash flow are attractive LBO targets because their cash flow can be used to service and eventually pay down the debt Venture capital o Invest in early stages of development o Equity, but can be in convertible preferred or debt o While risk of startup is great, returns on successful companies can be very high o Managers involved in development of portfolio companies as board members or key management o Categories Formative: Made during firms earliest period Angel: Very early, so-called idea stage; funds used for business plans, assessing potential; source is usually individual investors, called angels Seed: Funds used for product development, marketing, market research; In form of ordinary/convertible preferred Early stage: Funds used for initial commercial production, sales Later stage: Company already has production and sales, operating as commercial entity; used to expand production and increase sales through marketing efforts Mezzanine: Used to prepare firm for IPO Developmental capital or minority equity: Used for business growth or restructuring, may be private or public; if public, private investment in public equities (PIPE) Distressed (vulture investing): Buying debt of mature companies experiencing financial difficulties; take an active role in turnaround by working with management on reorganization, determine direction company should take Structure and fees

Limited partnerships Committed capital: Capital provided to fund by investors; not invested immediately but drawn down as securities are added to portfolio (usually 3-5 years, but still depends on fund or general partner) Management fees: 1-3% of committed capital Incentive fees: 20% of profits, not earned until fund has returned investors initial capital Claw back provision: Requires manager to return any periodic incentive fees to investors that would result in investor receiving less than 80% (i.e., 100%20%) of profits generated by portfolio investments as a whole Exit strategies Trade sale: Sell to competitor or another strategic buyer IPO: Sell all or some shares to public Recapitalization: Company issued debt to fund dividend distribution to equity holders; only a step toward exit Secondary sale: Sell to another PE firm or investor Write-off/liquidation: Reassess and adjust to take losses from an unsuccessful outcome Benefits and risks Higher than average stock returns Less than perfect correlation with traditional investments Higher standard deviation than equity Revalued infrequently so standard deviation and correlation may be have downward bias Valuation approaches Market/comparables: Market or private transaction of peer companies may be used to estimate multiples of target DCF: Dividend discount and PV of FCFF or FCFE Asset-based: Liquidation/market values of assets less debt Due diligence Consider how interest rates and availability of capital may affect required refinancing of portfolio company debt Choice of general partner is important (e.g., operating and financial experience, valuation methods, incentive fee structure, drawdown procedures)

Real estate Private Debt Mortgages, constructionlending Equity Direct ownership (sole ownership, JV, real estate limited partnerships, other commingled funds) Shares in real estate corporations, REIT

Public

MBS (residential and commercial), CMO Characteristics Indivisibility Heterogeneity: No two properties are identical Fixed location Forms Residential: Direct investment in RE; can be purchased in cash, or on mortgage (leveraged); mortgages can be pool into traded MBS and, which is an indirect investment Commercial: Direct investment; generate income from rents (even homes purchased for rental income); long-time,

illiquid, and large investments; loans ban be pool into a commercial MBS; can be held by limited partnership, or real investment trust (REIT) REITs: Issue shares that trade publicly; identified by type of real estate they hold (e.g., mortgages, hotel, malls, office, commercial); income is used to pay dividends; 90% of income must be distributed to avoid taxes that would have to be paid by REIT before distribution to shareholders Timberland: Returns from sales of timber and price changes on timberland Farmland: Returns from land price changes, change in farm commodity prices, quality and quantity of crops Securitization of mortgages (MBS, CMO) Benefits and risks Performance is measured by 3 indices o Appraisal: Based on periodic estimate of property values; returns are smoother than based on actual sales and have lowest standard deviation o Repeat sales: Based on price changes for properties that have sold multiple times; sample is not random and may not be representative of properties available o REIT: Based on actual trading prices of REITs REIT index has high correlation with equity, because RE is affected by business cycles REIT index has low correlation with global bonds Index construction may be factor in low reported correlations, and diversification benefit may be less than expected Reasons for investing in real estate o Long-term returns driven by income generation and capital appreciation o Multiple-year leases with fixed rents may lessen cash flow impact from economic shocks o Diversification o Potential to provide inflation hedge if rents can be adjusted quickly for inflation Valuation Comparable sales: Based on sales of similar properties; hedonic pricing model Income approach: NOI / (discount rate growth) o Cap rate can also be derived using comparable sales Cost approach: Replacement cost REIT valuation o Funds from operations = NI + Dep gains from property sales + losses from property sales o Adjusted FFO = FFO capex o Asset-based: NAV liabilities Due diligence Global and national economic factors Interest rate levels Degree of leverage Abilities of managers to select and manage properties Changes in regulation Decisions about selecting, financing, managing RE projects Distressed properties has additional risk factors Real estate development has additional risk factors such as regulatory issues (zoning, permitting, environment, eco-

nomic, financing decisions over development period), inability to get long-term financing Commodities Exposures to commodities Direct Derivatives ETFs: Invest in commodities or commodity futures and can track prices and indices Equities directly linked to commodities (e.g., oil producer, gold mining); drawback: equity and commodity prices may not be perfectly correlated Managed futures funds: Actively managed; can be structured as limited partnerships or mutual funds Individual managed accounts: Alternative to pooled funds for high net worth individuals, tailored to needs of investor Specialized funds in specific commodity sectors: Focus on certain commodities (e.g., oil and gas, grain, precious metals, industrial metals) Benefits and risks Lower returns and higher volatility than stock or bonds Low correlation with equities and bonds Hedges inflation risk Returns only come from price changes Commodity prices and investments Spot: Function of supply and demand o Demand: Affected by value of commodity to endusers, global economic conditions and cycles o Supply: Affected by production, storage costs, existing inventories o Both are affected by purchases and sales of nonhedging investors (speculators) Most commodities have inelastic supply in short-run, making prices volatile when demand changes over cycles Commodities producers analyze future needs, economic events, government policies, forecast of future supply Investors analyze inventory levels, forecasts of production, changes in government policies, expectations of economic growth to forecast prices Futures pricing: Futures = Spot (1 + RFR) + storage costs convenience yield Convenience yield: Value of having physical commodity for use over the period of the futures contract Other alternative investments Tangible collectibles: Rare wines, art, rare coins and stamps, valuable jewelry and watches, sports memorabilia, automobile Intangibles: Patents Storage costs may be significant Specialized knowledge is required Illiquid, gains result only from price increases, but owners get enjoyment from use Risk management Important risk considerations Standard deviation of returns may be misleading

Return distributions are not approximately normal, tend to be leptokurtic and negatively skewed o Returns are smoothed for assets that use appraisal, models, or market-based values (if transactions are infrequent) to estimate values; volatility and correlations with traditional investments may be understated o Consider downside risk suck as value at risk (size of potential decline over a period), Sortino ratio (risk measured as downside rather than standard) o REIT and ETF: standard risk definitions are applicable Use of derivatives introduces operational, financial, counterparty and liquidity risk Performance for some alternative investments is primarily determined by managements expertise and execution, so risk also includes risk of management underperformance Hedge funds and PE are much less transparent than traditional investments, since information may be considered as proprietary information Illiquid; returns should reflect premium to compensate investors for liquidity risk or inability to redeem securities at all during lockup periods When calculating optimal allocations, indices of historical returns are not good indicators of future risk and return Correlations vary across periods and are events-driven Due diligence Organization: Experience, quality, compensation of management; analysis of prior and current fund results; alignment of investor and manager interests; reputation and quality of third-party service providers used Portfolio management: Investment process, target markets, asset types and strategies, investment sources, partners roles, underwriting, environmental and engineering review, integration of asset management, acquisitions and dispositions, process for dispositions Operations and controls: Reporting and accounting methods, AFS, internal controls, frequency of valuations approaches, insurance, contingency plans Risk management: Fund policies and limits, portfolio risk and key factors, constraints on leverage and currency and hedging of related risks Legal review: Legal structure, registration, litigation Fund terms: Fees, both management and incentive, and expenses; contractual terms; investment period; fund term and extensions; carried interest; distributions; conflicts; rights of LP; termination procedures by key personnel o

Sources of return and risk and other benefits Collateral yield: To take a position in futures, hedger must post collateral, which can be T-bills; equal to yield on T-bills Price return: Change in spot price for the commodity over the life of the derivatives contract Roll yield: Gains or loss realized on futures position if the spot price remained unchanged Rolling over: Process of closing out expiring derivative positions and reestablishing a new one with a settlement date further in the future Provide diversification and serve as hedge against inflation Commodity index strategy In equities, index strategy is considered passive In commodities, index strategy is considered active due to the necessity of closing out and reestablishing long derivative positions to maintain long exposure to changes in commodity prices Aspects requiring active management Choosing maturity of long derivative positions When to roll over the positions Weights of various commodities and commodity blocks in index do not necessarily change with value of derivatives position, but with commodity production or consumption Managing collateral

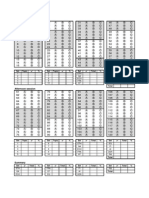

R. 67: Investing in Commodities Contango and backwardation Difference Contango Futures vs. spot F>S Market dominated by Long hedgers End-users Convenience yield Low Roll yield Negative

Backwardation F<S Short hedgers Producers High Positive

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Fifth Third Bank StatementDocument2 pagesFifth Third Bank StatementNadiia Avetisian100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mckinsey Standard Elements: Message Title StickerDocument19 pagesMckinsey Standard Elements: Message Title StickerJ D100% (7)

- FSKXICEDANCE - FNL 000100 - JudgesDetailsperSkater PDFDocument10 pagesFSKXICEDANCE - FNL 000100 - JudgesDetailsperSkater PDFJ DNo ratings yet

- Morning Session: Set Topic % Set Topic % Set Total % Set Total %Document1 pageMorning Session: Set Topic % Set Topic % Set Total % Set Total %J DNo ratings yet

- 50 Successful Harvard Application EssaysDocument58 pages50 Successful Harvard Application EssaysJ D100% (5)

- Publication FileDocument17 pagesPublication FileAng SHNo ratings yet

- ACCCOB2-Chapter 3 - RECEIVABLESDocument43 pagesACCCOB2-Chapter 3 - RECEIVABLESVan TisbeNo ratings yet

- Accounting Ratio Formula Excel TemplateDocument4 pagesAccounting Ratio Formula Excel TemplatenazninNo ratings yet

- SharesDocument2 pagesSharesChaitra KNo ratings yet

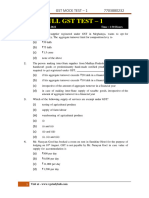

- Full Syllabus GST Test - 1 Without AnswersDocument19 pagesFull Syllabus GST Test - 1 Without Answersrajbhanushali3981No ratings yet

- 5049180316Document127 pages5049180316Siddharth ShekharNo ratings yet

- The Relationship Between AccessDocument19 pagesThe Relationship Between AccessGo ChannelNo ratings yet

- Income Tax - Ii: Semester - VIDocument154 pagesIncome Tax - Ii: Semester - VIiya100% (1)

- Process of IPO and Due DiligenceDocument15 pagesProcess of IPO and Due Diligenceabhishek shuklaNo ratings yet

- Acct 559Document11 pagesAcct 559nidal charaf eddine100% (1)

- Judicial Affidavit DraftDocument3 pagesJudicial Affidavit DraftSonny Xavier AbellaNo ratings yet

- Belief in Divine GuidanceDocument13 pagesBelief in Divine GuidanceAsjad Jamshed100% (2)

- MIRM Revised Syllabus (27.09.2022)Document30 pagesMIRM Revised Syllabus (27.09.2022)bxhhdNo ratings yet

- Sdoc 02 10 SiDocument5 pagesSdoc 02 10 Siمحي الدين محمدNo ratings yet

- Analisis Penggunaan Hedging Forward Contract Sebagai Upaya Perlindungan Atas Eksposur Transaksi (Pada PT Multibintang Indonesia Tahun 2015)Document9 pagesAnalisis Penggunaan Hedging Forward Contract Sebagai Upaya Perlindungan Atas Eksposur Transaksi (Pada PT Multibintang Indonesia Tahun 2015)dini sodexoNo ratings yet

- HOBA Practice Problems - Inter-Branch TransactionsDocument1 pageHOBA Practice Problems - Inter-Branch TransactionsJefferson ArayNo ratings yet

- 03 Handouts Mrunal Economy Batch Code CSP20Document43 pages03 Handouts Mrunal Economy Batch Code CSP20dbiswajitNo ratings yet

- Donna Dewberry Designs Distributorship Acct 10227 Dovehill LN CLERMONT FL 34711-6284Document3 pagesDonna Dewberry Designs Distributorship Acct 10227 Dovehill LN CLERMONT FL 34711-6284novelNo ratings yet

- Macronia Country CaseDocument3 pagesMacronia Country CaseDahagam SaumithNo ratings yet

- Vice President Finance Operations in Southeast MI Resume Stephen ManascoDocument2 pagesVice President Finance Operations in Southeast MI Resume Stephen ManascoStephenManascoNo ratings yet

- Financial Ratios Wal MartDocument4 pagesFinancial Ratios Wal MartValerie SantiagoNo ratings yet

- (A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Document4 pages(A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1DuvgiNo ratings yet

- GREECE DEBT CRISIS Final Presentation 1Document9 pagesGREECE DEBT CRISIS Final Presentation 1Abhinandan Kumar100% (1)

- Project Report On Indian Banking SystemDocument54 pagesProject Report On Indian Banking SystemParth prajapatiNo ratings yet

- The - Ict - Mentorship - Core - Thread - by - Trader - Theory - Jan 5, 23 - From - RattibhaDocument30 pagesThe - Ict - Mentorship - Core - Thread - by - Trader - Theory - Jan 5, 23 - From - RattibhaarchangelpromiseNo ratings yet

- Lesson Note On Economics SS1 Third TermDocument72 pagesLesson Note On Economics SS1 Third Termchrizyboyzi100% (1)

- Take Home Test Credit Transactions May 2020Document7 pagesTake Home Test Credit Transactions May 2020Patatas SayoteNo ratings yet

- ECO120 - ScriptDocument3 pagesECO120 - ScriptNrainatasha 25No ratings yet

- Gross Estate ReviewerDocument9 pagesGross Estate ReviewerMark Noel SanteNo ratings yet