Professional Documents

Culture Documents

BEN Buy Recommendation

BEN Buy Recommendation

Uploaded by

rjkostOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BEN Buy Recommendation

BEN Buy Recommendation

Uploaded by

rjkostCopyright:

Available Formats

FINANCIAL SECTOR UPDATE A Buy on BEN and Sell on BLK

Spring 2014

The Financials Team is reinitiating its Buy recommendation on BEN and Sell recommendation on BLK. We feel that many of BLKs catalysts have been realized, with upside viewpoints and street guidance as overly optimistic given BLKs current market position back -dropped against their past abnormal growth, which we believe will start to slow in 2HFY14. We place a Likely/High Price Target on BLK at $320.24/$338.15.

The Issue at Hand We originally initiated our defer position on rotating BLK out of the portfolio for BEN on the risk of continued concerns over EM volatility and the effect that rising interest rates would have on BENs AUM, relative to street and consensus guidance for 2QFY14 Ending AUM. To clarify, our decision was based off of potential short term downside AUM risk relative to high Analyst quarterly ending AUM guidance, estimated at over $890 billion. Given BENs AUM position and the current events of EM volatility, exacerbated by the civil conflict in Ukraine, that was taking place at the time of our pitch (January 17 th), we believed that it would be wise to defer, until the near term future became more transparent. This is as we wanted to avoid getting in front of potentially decreasing AUM or equity valuation, and missing earnings expectations or having them revised downward during our potential holding of BEN. Recommendation Thesis After closely monitoring the situation, we believe that now would pose the best time to rotate into BEN on the thesis of: BENs AUM has exceeded expectations and has experienced positive net inflows into Fixed-Income, pursuant with our Initiating Coverage thesis; uncertainty around the short term global macro-environment and EM volatility has subsided; and BLKs realized growth catalysts and lower HPR expected return relative to BEN.

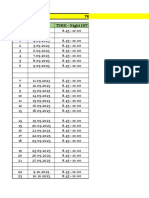

Analysis (refer also to the below chart: Assets Under Management) Since our pitch on January 17th, uncertainty regarding EM volatility ha s quelled, with BENs monthly AUM mark-to-market results exceeding expectations, increasing to $882.2 billion by 2.91% for February month end, from Januarys month end decrease of 2.49%, on Fixed -Income outflows. Such outflows were a result of the EM volatility and rising rates that were taking place at the time of our pitch, as well as since December 31st, when BEN first became undervalued relative to its peers. Given the strong inflows into Fixed-Income as well as equity accounts, combined with the improved macro-economic environment from our original pitch, we no longer view BEN as a risk of missing analyst estimates.

William C. Dunkleburg

Page 1

FINANCIAL SECTOR UPDATE

Spring 2014

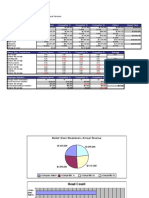

Rotation out of BLK We recommend a rotation out of BLK and into BEN for the following reasons: BLKs realized growth catalysts; and lower HPR expected return relative to BEN. (higher FI better) We believe that BLK has satisfied their growth catalysts, especially in respect to its ishares platform, and is now largely valued on capital market appreciation and economic growth. Therefore, we recommend a rotation into BEN, which has a much broader geographic diversification and larger Fixed-Income platform, which is its management specialty and claim to fame in the Asset Management Universe. This will allow BEN to capitalize greater than BLK on the increased inflows into their FI platforms in the rising domestic and global interest rate environment. In fact, since 2010, BEN has attracted FI inflows and appreciation at a much greater rate than BLK; where BENs 4-year FI growth CAGER was 12.31% versus BLKs of 2.86% (Please refer to below charts). Additionally, due to FI/Equity disparities that affect AUM appreciation, the 4-year CAGR was adjusted to reflect BENs performance to BLK (red) and BLKs performance to BEN (light blue). With the adjustment factor BEN is approximately 2x more efficient at growing their FI investments than BLK. On the equity side, after adjustments, BLK is still more efficient than BEN with equity appreciation, which is expected as equity is BLKs specialty. However the disparity is not quite as large, with BLK outperforming BEN by about .25x.

William C. Dunkleburg

Page 2

FINANCIAL SECTOR UPDATE

Spring 2014

Recommendation Given out macro-economic outlook, we expect BEN to outperform BLK for the several reasons: continued rising domestic and global interest rates, and slowing equity markets and equity market appreciation. These two facets will allow BEN to outperform BLK as BEN, who is a specialty FI manager, and greater weighted in FI, will capitalize on increased inflows on rising rates and a smaller capital loss on face value than BLK. Additionally, equity markets are not expected to abnormally outperform as they have in 2012, lowering performance for BLK greater than for BEN, who is weighted less in equities. Therefore, relative to BLK, BEN will perform greater overall, due to better performance on FI AUM growth, which is expected to increase in 2H2014 relative to equities, and would also outperform on equities in a market downturn or correction, due to their higher FI weighting and lower equity weighting. Given our current economic outlook of rising rates and smaller equity market growth, we expect BEN to outperform BLK.

William C. Dunkleburg

Page 3

You might also like

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- Yell FinalDocument10 pagesYell Finalbumz1234100% (2)

- Sabya BhaiDocument6 pagesSabya BhaiamanNo ratings yet

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Viking Onshore - 4Q 2008 LetterDocument16 pagesViking Onshore - 4Q 2008 LetterDealBook100% (15)

- Soapbox Whirlpool VFINALDocument15 pagesSoapbox Whirlpool VFINALAnonymous Ecd8rCNo ratings yet

- Hunnid Ståx: GMD (Given Market Direction Strategy)Document3 pagesHunnid Ståx: GMD (Given Market Direction Strategy)ElijahNo ratings yet

- Hutchison Whampoa Case ReportDocument6 pagesHutchison Whampoa Case ReporttsjakabNo ratings yet

- Indian Bank Investment Note - QIPDocument5 pagesIndian Bank Investment Note - QIPAyushi somaniNo ratings yet

- Agricultural Bank of ChinaDocument7 pagesAgricultural Bank of ChinaJack YuanNo ratings yet

- Annual Report Avenue CapitalDocument44 pagesAnnual Report Avenue CapitalJoel CintrónNo ratings yet

- KBC Group: Q4 Results 20% Ahead of Consensus & Bullish Irish LLP GuidanceDocument6 pagesKBC Group: Q4 Results 20% Ahead of Consensus & Bullish Irish LLP Guidanceagrimensork2000No ratings yet

- Arlington Value's 2013 LetterDocument7 pagesArlington Value's 2013 LetterValueWalk100% (7)

- SHAW Equity Research ReportDocument13 pagesSHAW Equity Research ReportAnonymous 7CxwuBUJz3No ratings yet

- Investor Letter by Indvest GroupDocument11 pagesInvestor Letter by Indvest GroupSiddharthNo ratings yet

- AdditionallyDocument3 pagesAdditionallyJOHN KAISERNo ratings yet

- Pershing Square Management's Letter To InvestorsDocument7 pagesPershing Square Management's Letter To InvestorsDealBook100% (1)

- PVH Financial Analysis - Q1Document7 pagesPVH Financial Analysis - Q1Dulakshi RanadeeraNo ratings yet

- Evaluation of Financial PositionDocument1 pageEvaluation of Financial PositionJoy ConstantinoNo ratings yet

- Sector Strategies: U.S. TreasuriesDocument5 pagesSector Strategies: U.S. TreasuriesAbe MartinNo ratings yet

- Executive Summary: We Are Sri Lanka Rupee Bulls'Document8 pagesExecutive Summary: We Are Sri Lanka Rupee Bulls'Amal SanderatneNo ratings yet

- Fixed Income Market - Encouraging Signs AheadDocument2 pagesFixed Income Market - Encouraging Signs AheadTarique kamaalNo ratings yet

- Case Assignment - JC PenneyDocument6 pagesCase Assignment - JC PenneyHenri De sloovereNo ratings yet

- HP - Strong Buy: HP Lowers The BarDocument5 pagesHP - Strong Buy: HP Lowers The BarChetan AgarwalNo ratings yet

- Banner Corp. (BANR) : Northwest CoverageDocument9 pagesBanner Corp. (BANR) : Northwest CoveragecogitatorNo ratings yet

- JP Morgan 8.02.13 PDFDocument9 pagesJP Morgan 8.02.13 PDFChad Thayer VNo ratings yet

- Banks & NBFCS: 2Qfy17E Results PreviewDocument12 pagesBanks & NBFCS: 2Qfy17E Results Previewarun_algoNo ratings yet

- Market Outlook 19th December 2011Document5 pagesMarket Outlook 19th December 2011Angel BrokingNo ratings yet

- Fitch - KOR - Affirmed at AA-, Outlook Stable - 28sep2022Document9 pagesFitch - KOR - Affirmed at AA-, Outlook Stable - 28sep2022jatulanellamaeNo ratings yet

- KICTalking Points 080608Document6 pagesKICTalking Points 080608russ8609No ratings yet

- Barclays Q322 Analyst Call TranscriptDocument14 pagesBarclays Q322 Analyst Call TranscripttaohausNo ratings yet

- FitchDocument9 pagesFitchTiso Blackstar Group100% (1)

- Corsair Capital Q4 2011Document3 pagesCorsair Capital Q4 2011angadsawhneyNo ratings yet

- DeluxeDocument4 pagesDeluxeshielamaeNo ratings yet

- Q3 CLCDocument1 pageQ3 CLCpeterNo ratings yet

- Forecasting - Module 4 AllDocument22 pagesForecasting - Module 4 AllSandeepPusarapu50% (2)

- READING 8 Free Cashflow (Equity Valuation)Document25 pagesREADING 8 Free Cashflow (Equity Valuation)DandyNo ratings yet

- Workshop 3Document7 pagesWorkshop 3rameenNo ratings yet

- RBS Round Up: 07 December 2010Document8 pagesRBS Round Up: 07 December 2010egolistocksNo ratings yet

- RBS Round Up: 08 December 2010Document8 pagesRBS Round Up: 08 December 2010egolistocksNo ratings yet

- FIN410.5 Team 2 Fall 2022 1Document6 pagesFIN410.5 Team 2 Fall 2022 1Mohammad Fahim HossainNo ratings yet

- KeefeDocument5 pagesKeefeRochester Democrat and ChronicleNo ratings yet

- Financial Performance of Larsen and Toubro With Respect To TurnoverDocument6 pagesFinancial Performance of Larsen and Toubro With Respect To TurnoverK Arun NarayanaNo ratings yet

- ANALYST NOTES - December 4, 2015: RailroadsDocument4 pagesANALYST NOTES - December 4, 2015: Railroadsapi-302183100No ratings yet

- FCCB Project by - Ankit BhansaliDocument39 pagesFCCB Project by - Ankit BhansaliAnkit BhansaliNo ratings yet

- Initiating Coverage HDFC Bank - 170212Document14 pagesInitiating Coverage HDFC Bank - 170212Sumit JatiaNo ratings yet

- Microequities High Income Value Microcap Fund April 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNo ratings yet

- Prescient Point - CBI - 2014.06.17Document38 pagesPrescient Point - CBI - 2014.06.17Wall Street WanderlustNo ratings yet

- J.P. 摩根-美股-保险行业-2021年寿险业展望:L-T基本面不佳,但业绩改善和估值低迷是利好-2021.1.5-102页Document104 pagesJ.P. 摩根-美股-保险行业-2021年寿险业展望:L-T基本面不佳,但业绩改善和估值低迷是利好-2021.1.5-102页HungNo ratings yet

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDocument61 pagesC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNo ratings yet

- Pimco Corp. Opp Fund (Pty)Document46 pagesPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongNo ratings yet

- Spring 2014 HCA Letter FinalDocument4 pagesSpring 2014 HCA Letter FinalDivGrowthNo ratings yet

- UBL AnalysisDocument19 pagesUBL Analysismuhammad akramNo ratings yet

- Lloyds Banking Group PLC - Q1 2019 Interim Management Statement - TranscriptDocument14 pagesLloyds Banking Group PLC - Q1 2019 Interim Management Statement - TranscriptsaxobobNo ratings yet

- Business Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationFrom EverandBusiness Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPFrom EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPRating: 4.5 out of 5 stars4.5/5 (3)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Financial Institution and MarketDocument52 pagesFinancial Institution and Marketsabit hussenNo ratings yet

- Second Purchase Agreement GRAMDocument29 pagesSecond Purchase Agreement GRAMFrank TopbottomNo ratings yet

- Saudi Arabia Stock MarketDocument16 pagesSaudi Arabia Stock MarketMarvin ItolondoNo ratings yet

- Financial Markets and Institutions 26mLkeG0NODocument2 pagesFinancial Markets and Institutions 26mLkeG0NOKhushi SangoiNo ratings yet

- Changing Scenario of Indian Banking SectorDocument14 pagesChanging Scenario of Indian Banking Sectorrupeshdahake8586100% (2)

- Value at Risk and Its Method of CalculationsDocument4 pagesValue at Risk and Its Method of CalculationskoghillahNo ratings yet

- International FinanceDocument252 pagesInternational FinanceARUNSANKAR NNo ratings yet

- Mindmap Chapter 1 Fin645 - Natasha Azzarienna (2020966579) Ba2425dDocument3 pagesMindmap Chapter 1 Fin645 - Natasha Azzarienna (2020966579) Ba2425dNatasha AzzariennaNo ratings yet

- Week 3 NTDocument9 pagesWeek 3 NTCikgu kannaNo ratings yet

- Lesson 1 Business EthicsDocument10 pagesLesson 1 Business EthicsSherren Marie Nala100% (1)

- IFM-Chap 8 - Options - 3.11.2019Document44 pagesIFM-Chap 8 - Options - 3.11.2019Son VuNo ratings yet

- Updated List Test Banks and Solutions Manual (Student Saver Team 2019-2020) Part 3Document62 pagesUpdated List Test Banks and Solutions Manual (Student Saver Team 2019-2020) Part 3Studentt SaverrNo ratings yet

- Leading Experts in Islamic FinanceDocument238 pagesLeading Experts in Islamic FinanceZX Lee100% (1)

- Waste Management in IndiaDocument26 pagesWaste Management in IndiaAndre SuitoNo ratings yet

- Financial Market Final QuestionsDocument6 pagesFinancial Market Final Questionsnewaybeyene5No ratings yet

- IchimokuDocument3 pagesIchimokuneeltambeNo ratings yet

- FULL Training Schedule September 2023Document2 pagesFULL Training Schedule September 2023Rajesh pillaNo ratings yet

- Masala BondsDocument3 pagesMasala Bondsayantripathi29No ratings yet

- Role of RBIDocument24 pagesRole of RBImontu9No ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Abhi RTMDocument7 pagesAbhi RTMMuhammad saiful Faza100% (2)

- 12 Global Indices INDEXDocument31 pages12 Global Indices INDEXjudas1432No ratings yet

- Financial Analysis of BHEL: Section B Group 18Document18 pagesFinancial Analysis of BHEL: Section B Group 18Deenbandhu MishraNo ratings yet

- Chapter 1 Globalization and Multinational FirmDocument30 pagesChapter 1 Globalization and Multinational FirmIrnes ImamovicNo ratings yet

- Competitive Market Benchmark Analysis For Financial ServicesDocument2 pagesCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857No ratings yet

- Ind As, IfRS and Applicability-2Document2 pagesInd As, IfRS and Applicability-2sandeepNo ratings yet

- Pricing IRSDocument13 pagesPricing IRSswapnil6121986No ratings yet

- (Agogue) - E Auction (Phy Possession) - SALE NOTICE PUBLICATION DRAFTDocument3 pages(Agogue) - E Auction (Phy Possession) - SALE NOTICE PUBLICATION DRAFTSaurabh KapurNo ratings yet