Professional Documents

Culture Documents

Condensed Consolidated Statements of Income

Condensed Consolidated Statements of Income

Uploaded by

venkeeeeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Condensed Consolidated Statements of Income

Condensed Consolidated Statements of Income

Uploaded by

venkeeeeeCopyright:

Available Formats

Verizon Communications Inc.

Condensed Consolidated Statements of Income

(dollars in millions, except per share amounts)

Unaudited

3 Mos. Ended 12/31/12

3 Mos. Ended 12/31/11 % Change

12 Mos. Ended 12/31/12

12 Mos. Ended 12/31/11 % Change

Operating Revenues Operating Expenses Cost of services and sales Selling, general and administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income (Loss) Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income (Loss) Before (Provision) Benefit for Income Taxes (Provision) Benefit for income taxes Net Income (Loss)

30,045

28,436

5.7

115,846

110,875

4.5

13,069 16,008 4,137 33,214 (3,169) 87 (1,079) (575) (4,736) 2,810 (1,926) $ 2,303 $ (4,229) (1,926) $

12,090 13,278 4,180 29,548 (1,112) 97 (84) (703) (1,802) 1,590 (212) 1,811 (2,023) (212)

8.1 20.6 (1.0) 12.4 * (10.3) * (18.2) * 76.7 * 27.2 * *

46,275 39,951 16,460 102,686 13,160 324 (1,016) (2,571) 9,897 660 10,557 $ 9,682 875 10,557 $ $

45,875 35,624 16,496 97,995 12,880 444 (14) (2,827) 10,483 (285) 10,198 7,794 2,404 10,198

0.9 12.1 (0.2) 4.8 2.2 (27.0) * (9.1) (5.6) * 3.5 24.2 (63.6) 3.5

$ $ $

$ $ $

Net income attributable to noncontrolling interest Net income (loss) attributable to Verizon

Net Income (Loss)

Basic Earnings (Loss) per Common Share Net income (loss) attributable to Verizon Weighted average number of common shares (in millions) Diluted Earnings (Loss) per Common Share Net income (loss) attributable to Verizon Weighted average number of common shares-assuming dilution (in millions)

(1)

(1.48) $ 2,862

(.71) 2,835

.31 2,853

.85 2,833

(63.5)

(1.48) $

(.71)

.31

.85

(63.5)

2,862

2,835

2,862

2,839

Footnotes: (1) If there is a net loss, diluted EPS is the same as basic EPS. Diluted Earnings per Common Share includes the dilutive effect of shares issuable under our stock-based compensation plans. Certain reclassifications have been made, where appropriate, to reflect comparable operating results. * Not meaningful

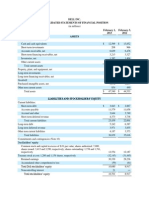

Verizon Communications Inc.

Condensed Consolidated Balance Sheets

(dollars in millions)

Unaudited

12/31/12

12/31/11

$ Change

Assets Current assets Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other Total current assets Plant, property and equipment Less accumulated depreciation Investments in unconsolidated businesses Wireless licenses Goodwill Other intangible assets, net Other assets Total Assets Liabilities and Equity Current liabilities Debt maturing within one year Accounts payable and accrued liabilities Other Total current liabilities Long-term debt Employee benefit obligations Deferred income taxes Other liabilities Equity Common stock Contributed capital Reinvested earnings (Accumulated deficit) Accumulated other comprehensive income Common stock in treasury, at cost Deferred compensation - employee stock ownership plans and other Noncontrolling interest Total equity Total Liabilities and Equity

3,093 470 12,576 1,075 4,021 21,235 209,575 120,933 88,642 3,401 77,744 24,139 5,933 4,128 225,222

13,362 592 11,776 940 4,269 30,939 215,626 127,192 88,434 3,448 73,250 23,357 5,878 5,155 230,461

(10,269) (122) 800 135 (248) (9,704) (6,051) (6,259) 208 (47) 4,494 782 55 (1,027) (5,239)

4,369 16,182 6,405 26,956 47,618 34,346 24,677 6,092

4,849 14,689 11,223 30,761 50,303 32,957 25,060 5,472

(480) 1,493 (4,818) (3,805) (2,685) 1,389 (383) 620

297 37,990 (3,734) 2,235 (4,071) 440 52,376 85,533 225,222

297 37,919 1,179 1,269 (5,002) 308 49,938 85,908 230,461

71 (4,913) 966 931 132 2,438 (375) (5,239)

Verizon - Selected Financial and Operating Statistics

Unaudited 12/31/12 12/31/11

Total debt (in millions) Net debt (in millions) Net debt / Adjusted EBITDA (1) Common shares outstanding end of period (in millions) Total employees Quarterly cash dividends declared per common share Footnotes: (1) Adjusted EBITDA excludes the effects of non-operational items.

$ $

51,987 48,894 1.3x 2,859 183,400 0.515

$ $

55,152 41,790 1.2x 2,834 193,900 0.500

The unaudited condensed consolidated balance sheets are based on preliminary information.

Verizon Communications Inc.

Condensed Consolidated Statements of Cash Flows

(dollars in millions)

Unaudited

12 Mos. Ended 12/31/12

12 Mos. Ended 12/31/11

$ Change

Cash Flows From Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense Employee retirement benefits Deferred income taxes Provision for uncollectible accounts Equity in earnings of unconsolidated businesses, net of dividends received Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses Other, net Net cash provided by operating activities Cash Flows From Investing Activities Capital expenditures (including capitalized software) Acquisitions of investments and businesses, net of cash acquired Acquisitions of Wireless licenses, net Net change in short-term investments Other, net Net cash used in investing activities Cash Flows From Financing Activities Proceeds from long-term borrowings Repayments of long-term borrowings and capital lease obligations Increase (decrease) in short-term obligations, excluding current maturities Dividends paid Proceeds from sale of common stock Special distribution to noncontrolling interest Other, net Net cash used in financing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period

10,557

10,198

359

16,460 8,198 (952) 972 77 (403) (3,423) 31,486

16,496 7,426 (223) 1,026 36 (2,279) (2,900) 29,780

(36) 772 (729) (54) 41 1,876 (523) 1,706

(16,175) (913) (3,935) 27 494 (20,502)

(16,244) (1,797) (221) 35 977 (17,250)

69 884 (3,714) (8) (483) (3,252)

4,489 (6,403) (1,437) (5,230) 315 (8,325) (4,662) (21,253) (10,269) 13,362 3,093

11,060 (11,805) 1,928 (5,555) 241 (1,705) (5,836) 6,694 6,668 13,362

(6,571) 5,402 (3,365) 325 74 (8,325) (2,957) (15,417) (16,963) 6,694 (10,269)

Verizon Communications Inc.

Verizon Wireless Selected Financial Results

(dollars in millions)

Unaudited

3 Mos. Ended 3 Mos. Ended 12/31/12 12/31/11 % Change

12 Mos. Ended 12 Mos. Ended 12/31/12 12/31/11 % Change

Operating Revenues Retail service Other service Service Equipment Other Total Operating Revenues Operating Expenses Cost of services and sales Selling, general and administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Operating Income Margin Segment EBITDA Segment EBITDA Service Margin

15,786 607 16,393 2,559 1,042 19,994

14,562 544 15,106 2,215 933 18,254

8.4 11.6 8.5 15.5 11.7 9.5

61,440 2,293 63,733 8,023 4,112 75,868

56,660 2,497 59,157 7,457 3,540 70,154

8.4 (8.2) 7.7 7.6 16.2 8.1

7,332 5,877 1,994 15,203 $ 4,791 24.0% 6,785 41.4% $

6,707 5,167 2,045 13,919 4,335 23.7% 6,380 42.2%

9.3 13.7 (2.5) 9.2 10.5 $

24,490 21,650 7,960 54,100 21,768 28.7% 29,728 46.6% $

24,086 19,579 7,962 51,627 18,527 26.4% 26,489 44.8%

1.7 10.6 4.8 17.5

6.3

12.2

Footnotes: The segment financial results and metrics above are adjusted to exclude the effects of non-operational items, as the Company's chief operating decision maker excludes these items in assessing business unit performance. Intersegment transactions have not been eliminated. Certain reclassifications have been made, where appropriate, to reflect comparable operating results.

Verizon Communications Inc.

Verizon Wireless Selected Operating Statistics

Unaudited 12/31/12 12/31/11 % Change

Connections ('000) Retail postpaid Retail prepaid Retail

92,530 5,700 98,230

87,382 4,785 92,167

5.9 19.1 6.6

Unaudited

3 Mos. Ended 3 Mos. Ended 12/31/12 12/31/11 % Change

(1)

12 Mos. Ended 12 Mos. Ended 12/31/12 12/31/11 % Change

Net Add Detail ('000) Retail postpaid Retail prepaid Retail

2,100 142 2,242

1,207 252 1,459

74.0 (43.7) 53.7

5,024 893 5,917

4,252 372 4,624

18.2 * 28.0

Account Statistics (2) Retail Postpaid Accounts ('000) Retail postpaid ARPA (2) Retail postpaid connections per account Churn Detail Retail postpaid Retail Retail Postpaid Connection Statistics Total Smartphone postpaid % of phones sold Total Smartphone postpaid phone base (2) Total Internet postpaid base (2) Other Operating Statistics Capital expenditures (in millions)

146.80

137.69

6.6

35,057 144.04 2.64

34,561 134.51 2.53

1.4 7.1 4.3

0.95% 1.24%

0.94% 1.23%

0.91% 1.19%

0.95% 1.26%

86.5%

70.3%

78.4% 58.1% 9.3%

62.6% 43.5% 8.1%

2,791

1,787

56.2

8,857

8,973

(1.3)

Footnotes: (1) Connection net additions exclude acquisitions and adjustments. (2) Statistics presented as of end of period. The segment financial results and metrics above are adjusted to exclude the effects of non-operational items, as the Company's chief operating decision maker excludes these items in assessing business unit performance. Intersegment transactions have not been eliminated. Certain reclassifications have been made, where appropriate, to reflect comparable operating results. * Not meaningful

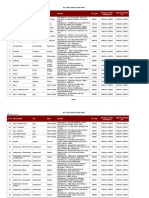

Verizon Communications Inc.

Wireline Selected Financial Results

(dollars in millions)

Unaudited

3 Mos. Ended 3 Mos. Ended 12/31/12 12/31/11 % Change

12 Mos. Ended 12 Mos. Ended 12/31/12 12/31/11 % Change

Operating Revenues Consumer retail Small business Mass Markets Strategic services Core Global Enterprise Global Wholesale Other Total Operating Revenues Operating Expenses Cost of services and sales Selling, general and administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income (Loss) Operating Income Margin Segment EBITDA Segment EBITDA Margin

3,569 660 4,229 2,090 1,756 3,846 1,770 145 9,990

3,429 684 4,113 1,984 1,945 3,929 1,938 159 10,139

4.1 (3.5) 2.8 5.3 (9.7) (2.1) (8.7) (8.8) (1.5)

14,043 2,659 16,702 8,052 7,247 15,299 7,240 539 39,780

13,606 2,731 16,337 7,575 8,047 15,622 7,973 750 40,682

3.2 (2.6) 2.2 6.3 (9.9) (2.1) (9.2) (28.1) (2.2)

5,878 2,313 2,125 10,316 $ (326) (3.3)% 1,799 18.0% $

5,511 2,213 2,115 9,839 300 3.0% 2,415 23.8%

6.7 4.5 0.5 4.8 * $

22,413 8,883 8,424 39,720 60 0.2% 8,484 21.3% $

22,158 9,107 8,458 39,723 959 2.4% 9,417 23.1%

1.2 (2.5) (0.4) (93.7)

(25.5)

(9.9)

Footnotes: The segment financial results and metrics above are adjusted to exclude the effects of non-operational items, as the Company's chief operating decision maker excludes these items in assessing business unit performance. Intersegment transactions have not been eliminated. Certain reclassifications have been made, where appropriate, to reflect comparable operating results. * Not meaningful

Verizon Communications Inc.

Wireline Selected Operating Statistics

Unaudited 12/31/12 12/31/11 % Change

Connections ('000) FiOS Video Subscribers FiOS Internet Subscribers FiOS Digital Voice residence connections FiOS Digital connections HSI Total Broadband connections Primary residence switched access connections Primary residence connections Total retail residence voice connections Total voice connections

4,726 5,424 3,227 13,377 3,371 8,795 7,982 11,209 11,849 22,503

4,173 4,817 1,884 10,874 3,853 8,670 9,906 11,790 12,626 24,137

13.3 12.6 71.3 23.0 (12.5) 1.4 (19.4) (4.9) (6.2) (6.8)

Unaudited

3 Mos. Ended 12/31/12

3 Mos. Ended 12/31/11 % Change

12 Mos. Ended 12/31/12

12 Mos. Ended 12/31/11 % Change

Net Add Detail ('000) FiOS Video Subscribers FiOS Internet Subscribers FiOS Digital Voice residence connections FiOS Digital connections HSI Total Broadband connections Primary residence switched access connections Primary residence connections Total retail residence voice connections Total voice connections Revenue and ARPU Statistics Consumer ARPU FiOS revenues (in millions) Strategic services as a % of total Enterprise revenues Other Operating Statistics Capital expenditures (in millions) Wireline employees ('000) FiOS Video Open for Sale ('000) FiOS Video penetration FiOS Internet Open for Sale ('000) FiOS Internet penetration

134 144 289 567 (117) 27 (402) (113) (156) (344)

194 201 424 819 (103) 98 (550) (126) (183) (382)

(30.9) (28.4) (31.8) (30.8) 13.6 (72.4) (26.9) (10.3) (14.8) (9.9)

553 607 1,343 2,503 (482) 125 (1,924) (581) (777) (1,634)

701 735 1,067 2,503 (457) 278 (1,851) (784) (990) (1,864)

(21.1) (17.4) 25.9 5.5 (55.0) 3.9 (25.9) (21.5) (12.3)

$ $

105.63 2,565 54.3%

$ $

96.43 2,216 50.5%

9.5 15.7

$ $

101.77 $ 9,722 $ 52.6%

93.07 8,293 48.5%

9.3 17.2

1,725

1,632

5.7

6,342 86.4 14,200 33.3% 14,528 37.3%

6,399 91.8 13,250 31.5% 13,585 35.5%

(0.9)

Footnotes: The segment financial results and metrics above are adjusted to exclude the effects of non-operational items, as the Company's chief operating decision maker excludes these items in assessing business unit performance. Intersegment transactions have not been eliminated. Certain reclassifications have been made, where appropriate, to reflect comparable operating results.

You might also like

- Ambuja Day 3 AssignmentDocument4 pagesAmbuja Day 3 AssignmentRoopeshkumar Yadav60% (5)

- Aifs Case - Fin 411Document2 pagesAifs Case - Fin 411Tanmay MehtaNo ratings yet

- Company Profile SKHA CONSULTING (PT SKHA INDONESIA)Document5 pagesCompany Profile SKHA CONSULTING (PT SKHA INDONESIA)Novia AristaNo ratings yet

- Health Development Corporation Spread Sheet (Sol)Document8 pagesHealth Development Corporation Spread Sheet (Sol)Surya Kant100% (2)

- Ch07 SSolDocument7 pagesCh07 SSolvenkeeeee100% (1)

- To AuditorsDocument6 pagesTo AuditorsJson LooiNo ratings yet

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocument9 pagesNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNo ratings yet

- Macys 2011 10kDocument39 pagesMacys 2011 10kapb5223No ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- Marchex 10Q 20121108Document60 pagesMarchex 10Q 20121108shamapant7955No ratings yet

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniNo ratings yet

- Apple Inc.: September 30, 141,048 Cost of Sales Gross Margin September 24, 131,376 September 93,626Document8 pagesApple Inc.: September 30, 141,048 Cost of Sales Gross Margin September 24, 131,376 September 93,626Juan LaverdeNo ratings yet

- Att Ar 2012 ManagementDocument35 pagesAtt Ar 2012 ManagementDevandro MahendraNo ratings yet

- Dell IncDocument6 pagesDell IncMohit ChaturvediNo ratings yet

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Document3 pagesActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1No ratings yet

- Case SolutionsDocument106 pagesCase SolutionsRichard Henry100% (5)

- Apple 2014 Q2Document54 pagesApple 2014 Q2ikiqNo ratings yet

- Cognizant 10qDocument53 pagesCognizant 10qhaha_1234No ratings yet

- Cost Accounting EVADocument6 pagesCost Accounting EVANikhil KasatNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57No ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- Document Research: MorningstarDocument52 pagesDocument Research: Morningstaraaa_13No ratings yet

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- 2012 DMO Unified System of AccountsDocument30 pages2012 DMO Unified System of AccountshungrynicetiesNo ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Online Presentation 11-1-11Document18 pagesOnline Presentation 11-1-11Hari HaranNo ratings yet

- Laporan Keuangan - Mki IchaDocument6 pagesLaporan Keuangan - Mki IchaSempaks KoyakNo ratings yet

- Financial Statement Fy 14 Q 3Document46 pagesFinancial Statement Fy 14 Q 3crtc2688No ratings yet

- Office MaxDocument21 pagesOffice MaxBlerta GjergjiNo ratings yet

- 61 JPM Financial StatementsDocument4 pages61 JPM Financial StatementsOladipupo Mayowa PaulNo ratings yet

- Life Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDocument33 pagesLife Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-Qpeterlee100No ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Addendum Q1 2016Document7 pagesAddendum Q1 2016redchillpillNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyNo ratings yet

- Alphabet 2014 Financial ReportDocument6 pagesAlphabet 2014 Financial ReportsharatjuturNo ratings yet

- Statement of Cash Flow - Ias 7Document5 pagesStatement of Cash Flow - Ias 7Benjamin JohnNo ratings yet

- In Millions Assets Operations (USD $)Document41 pagesIn Millions Assets Operations (USD $)mohd_shaarNo ratings yet

- Week Six ProjectDocument21 pagesWeek Six ProjectRandall PottsNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Net Sales: January 28, 2012 January 29, 2011Document9 pagesNet Sales: January 28, 2012 January 29, 2011장대헌No ratings yet

- 1q18 Press ReleaseDocument8 pages1q18 Press ReleaseBob SmithNo ratings yet

- Fina 004Document4 pagesFina 004Mike RajasNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Consol FY11 Annual Fin StatementDocument13 pagesConsol FY11 Annual Fin StatementLalith RajuNo ratings yet

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- MMDZ Audited Results For FY Ended 31 Dec 13Document1 pageMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Question 31Document2 pagesQuestion 31Noopur Gandhi0% (2)

- GP MIS ReportDocument16 pagesGP MIS ReportFarah MarjanNo ratings yet

- Pepsi Co - Calculations - FinalDocument46 pagesPepsi Co - Calculations - FinalMelissa HarringtonNo ratings yet

- Foreign Banks P&LDocument8 pagesForeign Banks P&LKarthik K JanardhananNo ratings yet

- Att-Ar-2012-Financials Cut PDFDocument5 pagesAtt-Ar-2012-Financials Cut PDFDevandro MahendraNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- United States Securities and Exchange Commission FORM 10-QDocument71 pagesUnited States Securities and Exchange Commission FORM 10-QWai LonnNo ratings yet

- Apple Inc: FORM 10-QDocument76 pagesApple Inc: FORM 10-Qwill2222No ratings yet

- Ar 2005 Financial Statements p55 eDocument3 pagesAr 2005 Financial Statements p55 esalehin1969No ratings yet

- CBB 3Q13 Earnings SlidesDocument29 pagesCBB 3Q13 Earnings SlidesTaylor FinchNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Placement Report Class 2014Document17 pagesPlacement Report Class 2014Mudassir KhanNo ratings yet

- VTSP Foundation (2015) - VCenter OverviewDocument6 pagesVTSP Foundation (2015) - VCenter OverviewvenkeeeeeNo ratings yet

- AkzoNobel Report 2014 en Tcm9-90769Document258 pagesAkzoNobel Report 2014 en Tcm9-90769venkeeeeeNo ratings yet

- Fund 4e Chap07 PbmsDocument14 pagesFund 4e Chap07 PbmsChu Minh LanNo ratings yet

- 2013 Annual Report FinalDocument64 pages2013 Annual Report FinalvenkeeeeeNo ratings yet

- Z-Score Review: - To Translate A Raw Score Into A Z ScoreDocument5 pagesZ-Score Review: - To Translate A Raw Score Into A Z ScorevenkeeeeeNo ratings yet

- Wksheet 05Document18 pagesWksheet 05venkeeeeeNo ratings yet

- UhuahulhDocument1 pageUhuahulhvenkeeeeeNo ratings yet

- Accounting CH 26Document34 pagesAccounting CH 26venkeeeee100% (1)

- 2010 Kellogg Employment Report FinalDocument67 pages2010 Kellogg Employment Report FinalSrinivasan RavindranNo ratings yet

- Revenue and Monetary Assets: Changes From Tenth EditionDocument41 pagesRevenue and Monetary Assets: Changes From Tenth EditionvenkeeeeeNo ratings yet

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocument9 pagesNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNo ratings yet

- Grennell FarmDocument11 pagesGrennell FarmvenkeeeeeNo ratings yet

- Kotak MahindraDocument65 pagesKotak MahindraNidhi Vijayvergiya100% (1)

- Management Accounting Assignment - 1: Q-3 Prepare The Following Statements From The Balance Sheet of Y Ltd. As On 31Document3 pagesManagement Accounting Assignment - 1: Q-3 Prepare The Following Statements From The Balance Sheet of Y Ltd. As On 31Parminder BajajNo ratings yet

- Technical Analysis: Presented by Anita Singhal 1Document41 pagesTechnical Analysis: Presented by Anita Singhal 1anita singhalNo ratings yet

- Cash Flow Statement - Indirect MethodDocument5 pagesCash Flow Statement - Indirect MethodBimal KrishnaNo ratings yet

- Basic Accounting & Tally: Imensions InfotechDocument20 pagesBasic Accounting & Tally: Imensions Infotechkarishma10No ratings yet

- Islamic Financial InstrumentsDocument16 pagesIslamic Financial InstrumentsMuhammad ArslanNo ratings yet

- Application For Seed FundDocument6 pagesApplication For Seed FundGravitate JobsNo ratings yet

- Kovtun DianaDocument88 pagesKovtun DianaЂорђе ДимитрићNo ratings yet

- June 17Document32 pagesJune 17Strathmore TimesNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Buying - And.selling.a.home - Ebook EEnDocument369 pagesBuying - And.selling.a.home - Ebook EEndwdgNo ratings yet

- A Study On Financial Derivatives (Futures & Options)Document93 pagesA Study On Financial Derivatives (Futures & Options)Vinod Ambolkar100% (2)

- PSNT of MFSDocument8 pagesPSNT of MFSPayal ParmarNo ratings yet

- CapitalMarketandSecuritesLaw 8368253282294136246.PDF 1Document5 pagesCapitalMarketandSecuritesLaw 8368253282294136246.PDF 1Jitendra RavalNo ratings yet

- AramcoGoldCoins FOFOA032210Document15 pagesAramcoGoldCoins FOFOA032210Christien PetrieNo ratings yet

- Icicitiming 3Document147 pagesIcicitiming 3Renjith KrishnanNo ratings yet

- Span Margin SystemDocument69 pagesSpan Margin SystemAbhinav KumarNo ratings yet

- HMSP - Icmd 2009 (B02)Document4 pagesHMSP - Icmd 2009 (B02)IshidaUryuuNo ratings yet

- Interview Questions and Answers For Freshers in Chemical EngineeringDocument4 pagesInterview Questions and Answers For Freshers in Chemical EngineeringAkash BodekarNo ratings yet

- Aud Flash CardsDocument3,014 pagesAud Flash Cardsmohit2uc100% (1)

- SAP FICO Running MaterialDocument250 pagesSAP FICO Running Materialtalupurum100% (1)

- L1 Investment SettingDocument30 pagesL1 Investment SettingTh'bo Muzorewa ChizyukaNo ratings yet

- Washpool Hard Coking Coal Project Feasibility Study CompletedDocument6 pagesWashpool Hard Coking Coal Project Feasibility Study CompletedTessfaye Wolde GebretsadikNo ratings yet

- Edu 2012Document30 pagesEdu 2012Adriancisneros PelNo ratings yet

- Sample ChapterDocument25 pagesSample ChapterYimei DengNo ratings yet

- Competition and Class: A Reply To Foster and McnallyDocument11 pagesCompetition and Class: A Reply To Foster and McnallyMario CplazaNo ratings yet

- ADFIANP - Semi-Final Examination - 2016NDocument3 pagesADFIANP - Semi-Final Examination - 2016NKenneth Bryan Tegerero TegioNo ratings yet