Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (April 1, 2014)

Manila Standard Today - Business Daily Stocks Review (April 1, 2014)

Uploaded by

Manila Standard TodayOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (April 1, 2014)

Manila Standard Today - Business Daily Stocks Review (April 1, 2014)

Uploaded by

Manila Standard TodayCopyright:

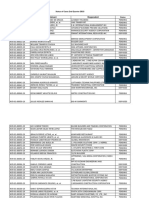

MST Business Daily Stocks Review

Tuesday, April 1, 2014

M

S

T

52 Weeks

High Low

STOCKS

3.74

2.12

105.5

56

99

66.2

114

82.5

2.62

0.82

78.2

50

2.42

1.32

21

15.36

37.85

22.8

24

7.5

0.73

0.175

139.5

69.35

2.09

1.64

38.85

21.6

117

65

145

103

515

299

74.5

40.75

206.4

105.7

1450

1015

160

110

AG Finance

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

COL Financial

Eastwest Bank

Filipino Fund Inc.

Macay Holdings

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

40.5

7.87

2.2

1.59

24.9

20

11

3.25

29.3

26

8.24

39.5

8.6

22

7.9

15.9

27.45

113.8

27.4

0.021

15.98

4.25

186.2

12.24

5.2

41.4

24.2

397

6.75

6.8

16.3

11.18

6.15

2.49

7.5

314.6

1.98

3.3

3

135.4

2.92

1.1

13

2.4

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alsons Cons.

Asiabest Group

C. Azuc De Tarlac

Calapan Venture

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Concepcion

Da Vinci Capital

Del Monte

DNL Industries Inc.

Emperador

Energy Devt. Corp. (EDC)

EEI

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Jollibee Foods Corp.

Lafarge Rep

LMG Chemicals

Manila Water Co. Inc.

Megawide

Mla. Elect. Co `A

Panasonic Mfg Phil. Corp.

Pepsi-Cola Products Phil.

Petron Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas and Co.

Roxas Holdings

San MiguelPure Foods `B

Seacem

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vivant Corp.

Vulcan Indl.

30

5

0.88

1.2

9.9

12

4

2.62

9.82

21.5

0.82

20

5.8

8.48

4.25

8.68

12.2

48.9

12.5

0.0110

12

1.81

108.4

8.55

1.93

20.35

10.1

246

3.2

4

11

4.33

4.12

1.1

2.28

200

0.9

1.59

1.37

87

2.25

0.550

8.2

1.25

0.69

0.46

61

40

28.4

18.86

7.3

5.58

6.3

2.800

1.63

0.9

1.69

0.91

688

485

18.1

0.147

63

44

3.96

2.51

3.68

1.15

6.99

3.9

0.26

0.151

899

685

9.3

5.7

50

34

7.68

3.95

1.02

0.58

28.4

12.96

0.81

0.500

6.33

4.06

7.65

4.8

0.0550

0.027

0.77

0.355

125

55.75

2.4

1.5

0.420

0.260

1213

605

2.54

1.04

1.4

1.03

0.300

0.150

0.630

0.270

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anscor `A

Asia Amalgamated A

ATN Holdings A

ATN Holdings B

Ayala Corp `A

Cosco Capital

DMCI Holdings

F&J Prince A

F&J Prince B

Filinvest Dev. Corp.

Forum Pacific

GT Capital

House of Inv.

JG Summit Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

LT Group

Mabuhay Holdings `A

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

Pacifica `A

Prime Orion

San Miguel Corp `A

Seafront `A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Top Frontier

Wellex Industries

Zeus Holdings

10.42

3.09

2.26

0.240

35.7

7.1

6.73

2.44

2.6

1.21

0.083

0.83

1.21

0.445

2.76

2.27

1.73

4.31

0.138

0.640

26.9

26.9

3.52

3.95

21.9

1.35

4.1

2.4

7.1

3.79

0.99

1

0.182

23

4.25

4.26

1.08

1.21

0.97

0.060

0.49

0.9

0.230

1.3

1.18

1.06

2.75

0.070

0.330

17.9

18.54

1.45

2.71

14.1

0.58

3.05

0.57

4.37

8990 HLDG

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

City & Land Dev.

Cityland Dev. `A

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

1.92

47

0.93

15.88

16.88

0.2090

5.4

84.8

12.3

6.56

1833

9.99

2.02

107.3

0.026

2.6000

9.5

1.7

4.32

1.06

17.36

6.99

17.5

7.35

2.97

18

150

15.88

3290

0.360

47.5

60.5

1.07

11.46

0.48

1.5

28.9

0.61

10

8.28

0.1090

2.97

44.8

10

3.72

1113

7.18

1.2

75.2

0.012

1.800

5.81

1.24

1.9

0.62

7.5

0.010

13.78

4.2

1.85

8.8

89

7.40

2572

0.250

32.3

48

0.59

9.6

0.310

2GO Group

ABS-CBN

APC Group, Inc.

Asian Terminals Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Centro Esc. Univ.

DFNN Inc.

Globe Telecom

GMA Network Inc.

Harbor Star

I.C.T.S.I.

IP E-Game Ventures Inc.

ISM Communications

Leisure & Resorts

Lorenzo Shipping

Macroasia Corp.

Manila Bulletin

Melco Crown

Nextstage Inc.

Pacific Online Sys. Corp.

PAL Holdings Inc.

Paxys Inc.

Phil. Racing Club

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

Robinsons RTL

STI Holdings

Travellers

Waterfront Phils.

0.0055

4.78

23.35

0.315

19

19.38

1.26

1.13

16.5

0.6

1.23

0.066

0.073

4.22

28.55

4.49

3.93

0.026

7.24

19.76

34.4

0.047

321

0.0028

1.72

11.7

0.225

6.2

6

0.5

0.79

4.93

0.385

0.3000

0.012

0.014

1.400

14.22

1.47

1.16

0.016

4.02

7.8

7.56

0.033

220

Abra Mining

Apex `A

Atlas Cons. `A

Basic Energy Corp.

Benguet Corp `A

Benguet Corp `B

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Manila Mining `A

Manila Mining `B

Marcventures Hldgs., Inc.

Nickelasia

Nihao Mineral Resources

Oriental Peninsula Res.

Oriental Pet. `A

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

49.9

535

117

10.26

9.5

115

80.5

1080

28

504

104.9

7.1

5.81

107

74.5

1005

ABS-CBN Holdings Corp.

Ayala Corp. Pref B

First Gen G

GMA Holdings Inc.

Leisure and Resort

PCOR-Preferred

SMC Preferred A

SMPFC Preferred

1.6

3.22

0.0010

1.39

LR Warrant

Megaworld Corp. Warrants

19.98

7.54

IRipple E-Business Intl

101.5

94

First Metro ETF

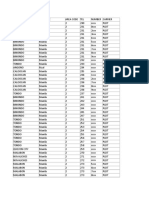

Previous

Close

High

Low

FINANCIAL

3.35

3.35

3.35

70.9

71.1

70.5

85.00

86.00

84.50

85.90

88.50

86.00

2.21

2.30

2.20

58.45

59.00

58.50

2.00

2.00

2.00

18.46

18.5

18.46

28.6

28.85

28.1

8.19

8.01

8.01

26.50

26.50

26.10

0.221

0.265

0.220

77.30

80.05

76.95

1.47

1.48

1.48

23.00

23.15

23.00

82.00

82.70

81.50

139.00

138.90

133.50

294.8

295

294.2

47

47.75

47

106

107

105.5

1400.00

1400.00

1395.00

121.60

125.60

121.50

INDUSTRIAL

37.2

38.65

37.5

3.9

3.99

3.88

1.29

1.28

1.27

1.38

1.40

1.38

10.92

10.92

10.8

32.00

32.20

30.00

6.49

6.49

6.49

3.56

3.58

3.56

14.16

14.16

14.16

27.8

28

27.7

1

1.06

1

24

23.7

22.4

8.310

8.650

8.33

11.68

11.68

11.50

5.66

5.70

5.62

11.48

11.68

11.50

18.76

18.76

18.64

72.5

72.35

71.5

20.50

20.00

20.00

0.0099

0.0100

0.0099

13.18

13.18

13.10

3.09

3.29

3.09

171.00

172.00

170.00

9.17

9.3

9.2

3.43

3.42

3.33

23.9

24.5

23.8

11.920

12.700

11.760

284.00

288.80

280.00

5.10

5.10

5.10

4.9

5.05

4.9

11.74

11.86

11.74

5.00

5.00

4.97

5.83

6.20

5.80

3.38

3.1

2.9

5.61

5.62

5.57

266

267.6

259

1.09

1.14

1.07

1.67

1.65

1.61

1.97

2.02

1.93

142

142.00

140.70

4.2

4.32

4.22

0.71

0.7

0.69

11.64

11.50

11.50

1.46

1.46

1.45

HOLDING FIRMS

0.500

0.490

0.490

56.00

56.90

55.95

28.50

29.35

28.80

6.75

6.75

6.70

1.78

1.82

1.75

1.88

1.84

1.65

1.97

1.96

1.8

578

590

575

9.5

9.7

9.49

70.00

71.60

70.00

3.1

3.05

3.05

3

3

3

5.00

5.00

4.87

0.180

0.179

0.171

785.5

799

785

6.37

6.49

6.49

49.50

49.60

49.35

4.65

4.67

4.6

0.79

0.81

0.78

17.44

17.4

16.88

0.65

0.67

0.65

4.73

4.78

4.70

5

5.15

4.9

0.0380

0.0380

0.0380

0.520

0.460

0.435

76.00

76.30

75.50

1.77

1.77

1.76

0.330

0.335

0.320

705.00

718.50

705.00

1.26

1.26

1.22

1.02

1.02

1.02

88.95

90.00

88.20

0.1870

0.1860

0.1790

0.335

0.320

0.315

PROPERTY

6.580

6.580

6.270

1.34

1.39

1.34

1.730

1.750

1.720

0.195

0.198

0.195

29.90

30.40

29.75

5.59

5.63

5.55

5

5.19

5

1.42

1.44

1.39

1.80

1.80

1.72

1.02

1.07

1.70

0.088

0.089

0.089

0.61

0.66

0.61

0.910

0.910

0.900

0.255

0.270

0.234

1.84

1.96

1.81

1.44

1.48

1.44

1.28

1.29

1.27

4.19

4.35

4.19

0.0920

0.0900

0.0880

0.3700

0.3750

0.3500

0.6300

0.6800

0.6200

21.90

22.20

21.20

1.7

1.7

1.69

3.22

3.20

3.18

14.60

14.98

14.56

0.64

0.64

0.63

3.51

3.52

3.4

1.000

1.040

0.990

5.270

5.310

5.270

SERVICES

2.51

2.54

2.51

31.75

32.6

31.7

0.620

0.620

0.610

11.16

11.12

11.12

10.04

10.12

9.89

0.1360

0.1380

0.1340

3.19

3.26

3.19

47.95

47.9

46.45

10.5

10.5

10.5

7.03

7.12

7.03

1664

1655

1621

7.40

7.68

7.45

1.81

1.80

1.76

108

113.2

108.1

0.013

0.014

0.013

1.6500

1.6500

1.6000

7.75

7.84

7.79

1.28

1.3

1.3

2.00

2.01

1.95

0.53

0.54

0.50

13

13

12.86

2.63

2.76

2.63

15

15.1

15

5.40

5.49

5.45

2.55

2.65

2.55

9.99

8.81

8.8

98.00

98.50

96.00

5.10

5.10

5.00

2730.00

2734.00

2716.00

0.360

0.370

0.345

44.00

44.20

43.90

68.00

68.05

67.05

0.69

0.71

0.69

9

9.05

8.93

0.330

0.315

0.315

MINING & OIL

0.0049

0.0049

0.0048

3.55

3.38

3.35

13.98

14.40

13.98

0.242

0.242

0.240

7.41

7.79

7.25

7.19

7.15

7.15

0.59

0.59

0.59

0.79

0.8

0.79

6.20

6.28

6.09

0.405

0.415

0.405

0.380

0.380

0.375

0.0160

0.0160

0.0160

0.0170

0.0170

0.0170

4.12

4.26

4.14

19.78

20.8

19.78

2.6

2.73

2.65

1.530

1.550

1.510

0.0170

0.0180

0.0170

5.60

5.60

5.43

8.62

8.740

8.480

7.99

8.1

8

0.037

0.037

0.036

410.00

415.00

408.60

PREFERRED

32

32.75

32

538

538

538

110

110

109.4

7.78

7.78

7.76

1.02

1.02

1.01

105.6

105.7

105.6

75

75.15

75

1035

1034

1030

WARRANTS & BONDS

1.220

1.400

1.210

2.9

3.11

3.02

SME

17.78

18.4

18

EXCHANGE TRADED FUNDS

103.5

105

102.8

Close Change Volume

Net Foreign

Trade/Buying

3.35

70.9

86.00

88.50

2.20

58.60

2.00

18.46

28.7

8.01

26.50

0.260

79.70

1.48

23.05

82.40

138.90

295

47

106.7

1400.00

125.50

0.00

0.00

1.18

3.03

-0.45

0.26

0.00

0.00

0.35

-2.20

0.00

17.65

3.10

0.68

0.22

0.49

-0.07

0.07

0.00

0.66

0.00

3.21

5,000

30,030

3,381,010

1,331,960

1,331,000

57,480

23,000

7,600

171,100

800

2,100

510,000

7,972,540

25,000

55,500

239,990

1,450

9,650

808,000.00

2,642,500

115

4,690

38.35

3.99

1.27

1.38

10.8

31.90

6.49

3.57

14.16

28

1

23.7

8.450

11.60

5.68

11.60

18.7

72

20.00

0.0099

13.10

3.18

172.00

9.24

3.36

23.85

11.760

287.80

5.10

4.99

11.82

4.97

6.19

3.1

5.62

261

1.10

1.65

2.00

142

4.28

0.7

11.50

1.46

3.09

2.31

-1.55

0.00

-1.10

-0.31

0.00

0.28

0.00

0.72

0.00

-1.25

1.68

-0.68

0.35

1.05

-0.32

-0.69

-2.44

0.00

-0.61

2.91

0.58

0.76

-2.04

-0.21

-1.34

1.34

0.00

1.84

0.68

-0.60

6.17

-8.28

0.18

-1.88

0.92

-1.20

1.52

0.00

1.90

-1.41

-1.20

0.00

7,417,100

9,000

393,000

919,000

13,100

4,100

9,500

422,000

3,700

115,700

1,392,000

2,700

121,655,600

159,200

14,527,100

159,200

4,253,000

100,230

22,900

47,000,000

24,300

116,000

457,900

238,500

689,000

3,265,800

1,007,800

219,170

100

6,633,000

16,972,200

1,164,000

5,788,400

27,000

35,800

107,520

216,000

111,000

13,234,000

2,019,340

7,973,000

775,000

2,000

234,000

0.490

56.90

29.20

6.70

1.82

1.79

1.8

590

9.5

71.00

3.05

3

5.00

0.179

798

6.49

49.50

4.62

0.8

16.9

0.67

4.76

5.07

0.0380

0.460

76.00

1.76

0.335

717.50

1.22

1.02

89.00

0.1850

0.320

-2.00

1.61

2.46

-0.74

2.25

-4.79

-8.63

2.08

0.00

1.43

-1.61

0.00

0.00

-0.56

1.59

1.88

0.00

-0.65

1.27

-3.10

3.08

0.63

1.40

0.00

-11.54

0.00

-0.56

1.52

1.77

-3.17

0.00

0.06

-1.07

-4.48

512,000.00

1,381,140.00

10,978,300

68,000

11,000

230,000

207,000

664,780

8,426,800

4,340,380

285,000

10,000

8,000

30,000

249,550

1,600

3,369,500

5,123,000

364,000

9,698,500

326,000

43,081,000

72,000

2,100,000

228,000

581,080

30,000

750,000

540,810

204,000

24,000

80,240

760,000

650,000

6.280

1.35

1.720

0.198

30.40

5.62

5.05

1.4

1.76

1.07

0.089

0.63

0.910

0.265

1.93

1.47

1.27

4.32

0.0890

0.3600

0.6200

22.20

1.7

3.18

14.90

0.64

3.5

1.020

5.300

-4.56

0.75

-0.58

1.54

1.67

0.54

1.00

-1.41

-2.22

4.90

1.14

3.28

0.00

3.92

4.89

2.08

-0.78

3.10

-3.26

-2.70

-1.59

1.37

0.00

-1.24

2.05

0.00

-0.28

2.00

0.57

152,100

299,000

278,000

1,630,000

18,819,000

1,983,300

271,300

20,975,000

20,000

20,000

10,000

5,379,000

4,307,000

2,580,000

10,384,000

29,171,000

278,000

74,338,000

530,000

4,100,000

16,485,000

3,814,000

985,000

7,000

31,062,100

185,000

31,000

688,000

3,656,000

2.54

32.4

0.620

11.12

9.95

0.1370

3.19

46.45

10.5

7.03

1648

7.50

1.76

112.5

0.013

1.6500

7.82

1.3

1.99

0.50

12.86

2.76

15.02

5.45

2.65

8.8

98.50

5.04

2730.00

0.350

44.00

67.90

0.71

9.01

0.315

1.20

2.05

0.00

-0.36

-0.90

0.74

0.00

-3.13

0.00

0.00

-0.96

1.35

-2.76

4.17

0.00

0.00

0.90

1.56

-0.50

-5.66

-1.08

4.94

0.13

0.93

3.92

-11.91

0.51

-1.18

0.00

-2.78

0.00

-0.15

2.90

0.11

-4.55

12,000

109,700

1,274,000

300

5,388,200

156,130,000

39,000

18,800

500

20,700

43,045

171,000

1,645,000

3,493,500

13,100,000

17,000

182,100

2,000

412,000

859,000

712,500

35,000

28,700

11,200

1,113,000

3,500

370

725,200

145,335

7,350,000

2,531,700

1,087,250

7,086,000

520,100

10,000

0.0049

3.35

14.06

0.240

7.25

7.15

0.59

0.8

6.09

0.415

0.375

0.0160

0.0170

4.22

20.5

2.7

1.550

0.0170

5.60

8.54

8

0.036

409.00

0.00

-5.63

0.57

-0.83

-2.16

-0.56

0.00

1.27

-1.77

2.47

-1.32

0.00

0.00

2.43

3.64

3.85

1.31

0.00

0.00

-0.93

0.13

-2.70

-0.24

112,000,000

146,000

114,200

1,190,000

19,300

7,700

8,000

233,000

7,300

320,000

1,650,000

29,800,000

600,000

12,239,000

7,117,900

3,521,000

343,000

4,100,000

500

3,007,700

16,500

40,100,000

1,825,230

32.5

538

109.4

7.78

1.01

105.7

75

1030

1.56

0.00

-0.55

0.00

-0.98

0.09

0.00

-0.48

361,300

300

56,300

37,700

2,220,000

13,930

975,950

16,950

2,721,780.00

1.320

3.11

8.20

7.24

11,088,000

178,000

12,700.00

18.4

3.49

2,600

105

1.45

64,540

1,665,443.00

28,633,794.00

66,690,468.00

22,100.00

200.00

1,846.00

2,056,355.00

-40,638,471.00

303,600.00

12,351,816.00

-27,264,420.00

-189,990,045.00

7,010.00

97,679,880.00

38,400.00

2,266,140.00

18,501,364.00

-34,740.00

-10,986,504.00

-34,740.00

9,769,754.00

1,971,178.00

39,772.00

31,725,791.00

-246,591.00

100,800.00

-994,905.00

27,952.00

-4,023,432.00

-4,121,910.00

-153,306,400.00

149,100.00

25,524,904.00

-2,832,710.00

-1,650.00

1,021,260.00

-70,094,458.00

-1,124,990.00

26,020,755.00

53,370,670.00

103,564,815.00

-49,871,410.00

9,484,938.50

-18,244,045.00

31,682,470.00

-557,700.00

-69,674,980.00

62,793,770.00

-891,660.00

-43,897,715.00

-18,360.00

-891,414.50

-32,400.00

86,000.00

127,164,240.00

5,590.00

-964,500.00

-21,212,570.00

-246,650.00

2,174,900.00

16,536,900.00

16,599,550.00

128,600.00

60,741,950.00

-20,514,815.00

-1,238,930.00

22,300.00

-44,114,122.00

-14,080.00

-101,000.00

339,060.00

-1,495,568.00

-834,260.00

6,400.00

-703,775.00

-14,303,320.00

671,300.00

36,365,073.00

-458,220.00

281,274.00

2,770.00

35,820.00

-2,795,962.00

269,660,990.00

-12,657,300.00

152,275.00

4,520,900.00

331,442.00

-55,055.00

144,000.00

-3,302,540.00

40,617,224.00

-147,500.00

13,630.00

-15,314,248.00

-547,000.00

-67,762,713.50

You might also like

- 2019 Q2 Status of CasesDocument469 pages2019 Q2 Status of CasesJenny Vi Estonelo67% (3)

- PLDT Area CodesDocument53 pagesPLDT Area Codesjosh0% (1)

- List of Accredited Tourism Enterprises - NCRDocument3 pagesList of Accredited Tourism Enterprises - NCRRonald50% (2)

- Manila Standard Today - Business Daily Stocks Review (April 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 7, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 7, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 24, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 24, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 21, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (September 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 4, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 4, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 28, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 28, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 6, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 6, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 30, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (September 30, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (March 24, 2014)Document1 pageManila Standard Today - Business Daily Stock Review (March 24, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 24, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 24, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (June 23, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 16, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 16, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 13, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 13, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 30, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 30, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 2, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 2, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNo ratings yet

- Silicon Triangle: The United States, Taiwan, China, and Global Semiconductor SecurityFrom EverandSilicon Triangle: The United States, Taiwan, China, and Global Semiconductor SecurityNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayNo ratings yet

- PPPC 06302017 Report Suppliers-ListDocument12 pagesPPPC 06302017 Report Suppliers-ListCess SexyNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- RailwaysDocument67 pagesRailwaysJoshua MontesNo ratings yet

- Guest House, Court Rental & Donation Collection From 2016 To 2020 - With BDU RemarksDocument62 pagesGuest House, Court Rental & Donation Collection From 2016 To 2020 - With BDU RemarksJenalyn BihagNo ratings yet

- Region NCR Directory 01052024Document4 pagesRegion NCR Directory 01052024Alfredo Osana QuejadasNo ratings yet

- 2 Alorica Shuttle Service March 29-April 4 AM SHIFTDocument2 pages2 Alorica Shuttle Service March 29-April 4 AM SHIFTRafael John Guiraldo OaniNo ratings yet

- Sales InvoiceDocument1,306 pagesSales InvoiceMenard AguinaldoNo ratings yet

- Transpo ReflectionDocument3 pagesTranspo ReflectionMae PaviaNo ratings yet

- Obligations Contracts CASE AssignmentsDocument7 pagesObligations Contracts CASE AssignmentsMyfanwy DecenaNo ratings yet

- List of Blue Chip Companies in The Philippine Stock ExchangeDocument1 pageList of Blue Chip Companies in The Philippine Stock ExchangeSj EclipseNo ratings yet

- Case Assignment - FINALDocument12 pagesCase Assignment - FINALGlutton ArchNo ratings yet

- IndexDocument18 pagesIndexChristine FloreteNo ratings yet

- CASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangDocument2 pagesCASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangErica Dela CruzNo ratings yet

- Dj-Expenses Mar 2023Document18 pagesDj-Expenses Mar 2023Yt premiumNo ratings yet

- Nil Syllabus 2022Document3 pagesNil Syllabus 2022Angelica MaquiNo ratings yet

- 2020 KEMPAL Sales Report1Document146 pages2020 KEMPAL Sales Report1Pajarillo Kathy AnnNo ratings yet

- BPI Securities Corporation - Symbol GuideDocument7 pagesBPI Securities Corporation - Symbol Guidescrib07No ratings yet

- List of Accredited Collection Agency As of October 2021Document3 pagesList of Accredited Collection Agency As of October 2021DODJIE DIMACULANGANNo ratings yet

- BCR-0-744-2022 - SM Store Installment Offer For Year 2023Document3 pagesBCR-0-744-2022 - SM Store Installment Offer For Year 2023Vivienne MarchelineNo ratings yet

- Qualified Contestable Customers - January 2022 DataDocument59 pagesQualified Contestable Customers - January 2022 DataDr. MustafaAliNo ratings yet

- Transpo FormDocument2 pagesTranspo FormRyan VillanuevaNo ratings yet

- Employer-Employee RelationshipDocument3 pagesEmployer-Employee RelationshipvinaNo ratings yet

- BanksDocument16 pagesBanksjofer63No ratings yet

- ClientsDocument2 pagesClientsRicardo Delacruz100% (1)

- SRC Supplement 1-Registered Debt CompaniesDocument2 pagesSRC Supplement 1-Registered Debt CompaniesMae Richelle Dizon DacaraNo ratings yet

- Blue Chip Companies For The Year 2014Document2 pagesBlue Chip Companies For The Year 2014Nadine SantiagoNo ratings yet

- VAT Spartha 2017 Purchases - LitaDocument24 pagesVAT Spartha 2017 Purchases - LitaAshley MaeNo ratings yet