Professional Documents

Culture Documents

Categories of Ratios

Categories of Ratios

Uploaded by

NicquainCTOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Categories of Ratios

Categories of Ratios

Uploaded by

NicquainCTCopyright:

Available Formats

Categories of Ratios

I) Profitability Ratios a) Net Profit to Sales = Net Profit % = Net Profit x 100% Sales This reflects a measure of management s success in earning !rofits from tra"ing o!erations# $ lo% margin coul" be cause" by lo% selling !rices& high costs or both# b) R'C( = Profit before Interest ) Tax x 100% Ca!ital (m!loye"

This ratio in"icates the le*el of !rofitability earne" base" on the resources in*este"# It is essentially a measure of the efficiency %ith %hich a business uses the fun"s at its "is!osal# 'ne has to be consistent in "efining R'C(& other%ise com!arability issues arise# N+# Ca!ital (m!loye", 'r"# Share Ca!ital - Reser*es - .ong/term .iabilities c) 0ross Profit % = 0ross Profit x 100% Sales The 0P% is in"icating ho% %ell management has been able to control the costs associate" %ith !rocuring the goo"s1ser*ices integral to generating re*enues# 2argins coul" be affecte" by !rice "iscounts 3gi*en ) recei*e")& bul4 buying etc# d) $sset Turno*er This ratio measures the efficiency %ith %hich the business is utili5ing its assets in the generation of sales# $sset Turno*er = Sales Ca!ital (m!loye" This ratio& %hen combine" %ith the Net Profit % ratio& gi*es the R'C( as follo%s, Sales 6 Net Profit = R'C( Ca!ital (m!loye" Sales Situations that nee" to be a"7uste" for inclu"e calculating net sales an" "efining ca!ital em!loye"# In a""ition& inflation %ill im!ro*e this ratio o*er time& as sales normally incor!orate these !rice a"7ustments# Com!arability is normally limite" as a conse8uence to 9/ : years#

The general inter!retation is that the higher the asset turno*er ratio& the har"er or more efficiently are the assets being use" an" as a result& the greater the !rofit# 3Remember the argument& small !rofit an" large *olumes)# If the ratio is lo% or "ecreasing& the im!lication is that there is an un"erutili5ation of the entity s assets# ;urther analysis can be "one using the fixe" asset turno*er an" the %or4ing ca!ital ratios# e) Return on (8uity 3R'() R'(=Profit before Interest ) Tax1Sharehol"ers (8uity This measure reflects the earning !o%er of the entity s boo4 in*estment an" thus affor"s com!arability# <igh returns are a !ossible in"ication of ho% %ell the entity is able to manage its ex!enses an" un"erta4e !rofitable !ro7ects# It coul" also in"icate a higher le*el of "ebt finance an" conse8uently& higher ris4# II)# .i8ui"ity ) $cti*ity 1=or4ing Ca!ital Ratios

$) .i8ui"ity Ratios, a) Current Ratio = Current $ssets Current .iabilities This ratio !ro*i"es an in"ication of the entity s ability to settle its current liabilities as they fall "ue# Too high a ratio may in"icate i"le ca!acity in the form of excess cash or stoc4 %hich may re"uce future rates of return# b) >uic4 Ratio 1 $ci" Test Ratio = Current $ssets ? Closing Stoc4 Current .iabilities This ratio focuses on i"entifying assets %hich can be 8uic4ly con*erte" into cash to meet its obligations to cre"itors# c) $cti*ity 1 =or4ing Ca!ital Ratios i) Stoc4 Turno*er = @@@@@ Sales @@@ $*erage Stoc4 $ high or rising ratio in"icates any or all of the follo%ing, lo% in*estment in stoc4 a healthy cash flo% !osition or if too high& !ossibility of stoc4 shortages#

The ratio %ill be affecte" by, - !urchasing factors such as "eli*ery times ) reor"er 8uantities - !ro"uction cycle time - the le*el of finishe" goo"s nee"e" to be hel"

$lternate to Stoc4 Turno*er ii) Stoc4 Turno*er Perio" 3STP) = $*erage Stoc4 x :AB "ays Sales 3or Cost of Sales) P#$# The information "etaile" in 3i) abo*e is !articularly rele*ant# In a""ition& a rising !erio" coul" also in"icate a !ossible slac4ening o*er stoc4 le*elsC an" the !ossibility of stoc4 obsolescence c) Debtors Turno*er Perio" 3DTP) DTP = $*erage Debtors x :AB "ays Sales $ rising tren" is in"icati*e of, "ebtors ta4ing longer to !ay the !ossibility of future losses *ia the ba" "ebt routeC an" !ossibly ba" cre"it control ") Cre"itors Turno*er Perio" 3CTP) CTP = $*erage Cre"itors x :AB "ays Purchases $n increasing !ayment !erio" is !otentially in"icating the entity s inability to !ay# This has im!lications for further su!!lies an" o*erall cre"it %orthiness# N+# ;or =or4ing Ca!ital !ur!ose& the Net Tra"ing or '!erating time is Stoc4 turno*er !erio" - Debtors E E / Cre"itors E E Net o!# cycle e) Stoc4s to Net Current $ssets If this ratio is too high& the cause coul" be any of the follo%ing, !oor stoc4 controlC an"1or 3 = 6 "ays = $ "ays = 3+ "ays) C "ays

stoc4 obsolescenceC an"1or tight control of cash an" "ebtors

=or4ing Ca!ital management is critical to the sur*i*ability of a business# '*er/ca!itali5ation is an in"ication that the com!any has too much resources for its current le*el of o!erations# '*ertra"ing& on the other han"& is %here an entity carries on a le*el of o!eration in excess of that for %hich it is ca!able of financing# Some conse8uences inclu"e a)# using short term borro%ings to finance long term in*estments b)# facing li8ui"ity !roblems 'ther sym!toms inclu"e a# !oor current ) 8uic4 ratio "ue to excessi*e cre"itors or o*er"rafts or high stoc4 le*els b# a high o*er"raft le*el usually at its full limit c# ac8uisition of ne% assets using <P financing "# lo%er !rofit margins cause" by "iscount offere" to collect e# a high stoc4 to net current asset ratio# III) 0earing Ratio Fsually one of the follo%ing ratios coul" be use"# 0earing = ;ixe" Interest Ca!ital (8uity Ca!ital - Reser*es N+# ;ixe" interest Ca!ital = Preference share ca!ital - loans 3long term "ebt) = ;ixe" Interest Ca!ital Total Ca!ital 'ther *ariants inclu"e, = 2ar4et *alue of "ebt 2ar4et *alue of e8uity It in"icates to the entity s in*estors& its ability to ex!an" its "ebt ca!acity# The "isa"*antage is that it "oes not in"icate the *alues of the entity s assets %hich coul" be use" to secure further financial a"*ances# The asset *alues reflect har"& !hysical collateral# 0earing or 0earing

Interest co*er

= Profits before Int# ) Tax# Interest

In"icates the extent to %hich !rofits can "ecline before the business is unable to meet current interest out of current !rofits# Consi"er a multi!le co*erage of : times as a referral !oint# ;inancial 0earing 3from income statement) = Debt interest # '!erating Profit before Int ) Tax# Profit before interest ) Tax less interest charges ? Preference "i*i"en"s 'r % change in (PS % increase in earnings before int# ) Tax ;inancial 0earing 3from balance sheet) = Prior Charge Ca!ital (8uity Ca!ital ) Reser*es 'R Prior Charge Ca!ital Total Ca!ital (m!loye"

The higher the gearing& the higher the *olatility of earnings an" *ice/*ersa# (8uity hol"ers ex!erience greater ris4s& the higher the gearing le*els an" *ice/*ersa# '!erational 0earing=Contribution Profit before Interest )Tax This reflects a measure of business ris4# ;or exam!le& high contribution le*els an" a lo% P+IT in"icate high fixe" costs %hich are barely co*ere" by the contribution# This gi*es a high le*el of business ris4# If of similar 8uantum %ith lo% fixe" costs& then those costs %ill be easily co*ere" resulting in lo% business ris4# IG)# In*estment Ratios a) Di*i"en" Hiel" = 0ross "i*i"en" !er share x 100 2ar4et *alue !er share

Its rele*ance is that it allo%s in*estors to ma4e "irect com!arisons %ith interest from loan stoc4 an" go*ernment securities# b) (arnings !er Share 3(PS) (PS = Profit a*ailable to (8uity Sharehol"ers (8uity Shares in Issue ) Ran4ing for Di*i"en"s The (PS %ill be im!acte" by share re!urchase schemes& bonus an" rights issues an" these factors must be consi"ere" before un"erta4ing com!arisons#

c) Price 1 (arnings Ratio 3P1() P1( = 2ar4et Price (PS P1( measure lin4s the mar4et !rice of a share an" the entity s earning ca!acity $ higher P1( in"icates to in*estors either that, the entity ex!ects its earnings to increase faster than others3future ex!ectations) consi"er that the in*estment is less ris4y or is in a more secure in"ustry ") Di*i"en" Co*er 3DC) This is the number of times the actual "i*i"en" coul" be !ai" out of current !rofits# DC = 2aximum (arnings Payable $ctual Di*i"en" This in"icates that, the !ro!ortion of earnings retaine" by an entity the le*el of ris4& in the face of a "ecline in future earnings& in maintaining the same "i*i"en" !ayments e) (arnings Hiel" (PS x 100 2ar4et Galue !er Share This measure is allie" to the (PS ratio abo*e an" in"icates the le*el of return achie*e" in the stoc4 mar4et#

You might also like

- Midterm Examination 2Document4 pagesMidterm Examination 2Nhật Anh OfficialNo ratings yet

- The Five Rules For Successful Stock InvestingDocument4 pagesThe Five Rules For Successful Stock Investingkt0% (2)

- Problem Set ADocument14 pagesProblem Set ADyenNo ratings yet

- Module 3 Answers To End of Module QuestionsDocument40 pagesModule 3 Answers To End of Module QuestionsYanLi100% (3)

- Modern Financial Management Solutions ManualDocument559 pagesModern Financial Management Solutions Manualrutemarlene40No ratings yet

- P3 Business Analysis Class Notes LSBF D10Document153 pagesP3 Business Analysis Class Notes LSBF D10Muhammad Idrees100% (1)

- Results For Item 2Document26 pagesResults For Item 2Kath LeynesNo ratings yet

- University of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisDocument6 pagesUniversity of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisBarby AngelNo ratings yet

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayaya100% (1)

- Cheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosDocument5 pagesCheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosQaiser KhanNo ratings yet

- PDF EvaDocument36 pagesPDF EvaShrey GoelNo ratings yet

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesDocument17 pagesChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourNo ratings yet

- Chapter 15 Alternative Corporate Restructuring StrategiesDocument7 pagesChapter 15 Alternative Corporate Restructuring StrategiesNishtha SethNo ratings yet

- Chapter 08Document18 pagesChapter 08Tam NguyenNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorDocument5 pagesConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969No ratings yet

- Chapter 23 Ratio Analysis: 1. ObjectivesDocument26 pagesChapter 23 Ratio Analysis: 1. Objectivessamuel_dwumfourNo ratings yet

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7No ratings yet

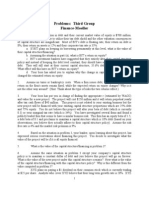

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- Honda Case StudyDocument11 pagesHonda Case StudySarjodh SinghNo ratings yet

- Ratio Analysis FormulaDocument7 pagesRatio Analysis FormulaHozefadahodNo ratings yet

- FIN621 Solved MCQs Finalterm Mega FileDocument23 pagesFIN621 Solved MCQs Finalterm Mega Filehaider_shah882267No ratings yet

- Return On Assets (ROA) - Meaning, Formula, Assumptions and InterpretationDocument4 pagesReturn On Assets (ROA) - Meaning, Formula, Assumptions and Interpretationakashds16No ratings yet

- Chapter 4Document4 pagesChapter 4A Muneeb QNo ratings yet

- Fin 635 Project FinalDocument54 pagesFin 635 Project FinalCarbon_AdilNo ratings yet

- Advanced Financial Accounting CH 6 NotesDocument18 pagesAdvanced Financial Accounting CH 6 NotesLiz HopeNo ratings yet

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Document12 pagesChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourNo ratings yet

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDocument5 pages2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraNo ratings yet

- Ratio ExplainDocument4 pagesRatio ExplainAnendya ChakmaNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnDocument55 pagesMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienNo ratings yet

- CH 9: General Principles of Bank ManagementDocument45 pagesCH 9: General Principles of Bank ManagementkunjapNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisLiya JahanNo ratings yet

- 10 Chapter Two Investment AlternativesDocument15 pages10 Chapter Two Investment AlternativesMuhammad HarisNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- SFM Theory RevisionDocument23 pagesSFM Theory Revisionrkrocks24100% (2)

- Mcs Merged Doc 2009.Document137 pagesMcs Merged Doc 2009.Nimish DeshmukhNo ratings yet

- Corporate Financial Reporting: Session-2 IIMC-PGP-2013: Prof. Arpita GhoshDocument23 pagesCorporate Financial Reporting: Session-2 IIMC-PGP-2013: Prof. Arpita GhoshmilepnNo ratings yet

- Balakrishnan MGRL Solutions Ch05Document67 pagesBalakrishnan MGRL Solutions Ch05deeNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- Solution Manual For Beams Chapter 8Document36 pagesSolution Manual For Beams Chapter 8Zulfi Rahman Hakim67% (6)

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesNo ratings yet

- Data Analysis and Interpretation: 1.stability RatiosDocument31 pagesData Analysis and Interpretation: 1.stability RatiosAnonymous nTxB1EPvNo ratings yet

- Porter SM Ch. 06 - 2ppDocument17 pagesPorter SM Ch. 06 - 2ppmfawzi010No ratings yet

- ch03 AsdfasdfasdfDocument33 pagesch03 Asdfasdfasdfbobdole00No ratings yet

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghNo ratings yet

- Chap 016Document77 pagesChap 016limed1100% (1)

- Profitability Sustainability RatiosDocument3 pagesProfitability Sustainability RatiosRhodelbert Rizare Del SocorroNo ratings yet

- Chap 3Document5 pagesChap 3Tahir Naeem JattNo ratings yet

- Instructions: All Questions Carry Equal MarksDocument2 pagesInstructions: All Questions Carry Equal Marksnisarg_No ratings yet

- Bombay Stock ExchangeDocument25 pagesBombay Stock Exchangemadhav5544No ratings yet

- Salient Features of GNDocument10 pagesSalient Features of GNChethan VenkateshNo ratings yet

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiNo ratings yet

- Cogent Analytics M&A ManualDocument19 pagesCogent Analytics M&A Manualvan070100% (1)

- FM11 CH 16 Mini-Case Cap Structure DecDocument11 pagesFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNo ratings yet

- Balance Sheet and Income StatementDocument11 pagesBalance Sheet and Income StatementAmelia Butan50% (2)

- Assignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsDocument3 pagesAssignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsashishthecoolNo ratings yet

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Technical Note: DisclaimerDocument13 pagesTechnical Note: DisclaimerNicquainCTNo ratings yet

- Agriculture: International Accounting Standard 41Document16 pagesAgriculture: International Accounting Standard 41NicquainCTNo ratings yet

- Payroll and Contribution Rates Employers PDFDocument2 pagesPayroll and Contribution Rates Employers PDFNicquainCTNo ratings yet

- Payroll TaxesDocument40 pagesPayroll TaxesNicquainCT0% (1)

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTNo ratings yet

- Pass Professional PapersDocument10 pagesPass Professional PapersNicquainCTNo ratings yet

- Market Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016Document13 pagesMarket Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016NicquainCTNo ratings yet

- Sweet River Abattoir 2015 Annual ReportDocument60 pagesSweet River Abattoir 2015 Annual ReportNicquainCT100% (1)

- International Standard On Auditing 220 Quality Control For An Audit of Financial StatementsDocument19 pagesInternational Standard On Auditing 220 Quality Control For An Audit of Financial StatementsNicquainCTNo ratings yet

- Professional Accounting College of The Caribbean (Pacc) : Ratio Analysis / Performance AppraisalDocument4 pagesProfessional Accounting College of The Caribbean (Pacc) : Ratio Analysis / Performance AppraisalNicquainCTNo ratings yet

- Acca 2.4 2002 - 2007Document237 pagesAcca 2.4 2002 - 2007NicquainCTNo ratings yet

- Share Based PaymentDocument3 pagesShare Based PaymentNicquainCTNo ratings yet

- ACCA Corporate Governance Technical Articles PDFDocument17 pagesACCA Corporate Governance Technical Articles PDFNicquainCTNo ratings yet

- Acca p1 Slides 2011Document153 pagesAcca p1 Slides 2011Ee Ting TangNo ratings yet

- F9 Technical ArticlesDocument122 pagesF9 Technical ArticlesNicquainCTNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- LeveragedLoan PrimerDocument38 pagesLeveragedLoan PrimerMichael AlguNo ratings yet

- Presentation For AO IIDocument103 pagesPresentation For AO IIClerica Realingo100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 02Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 02Alli TobbaNo ratings yet

- 106 - Prajwal Khandare - ABM Case 2 (Pepe Denim)Document6 pages106 - Prajwal Khandare - ABM Case 2 (Pepe Denim)Prajwal KhandareNo ratings yet

- Fabm1 q3 Mod8 Postingtransactionsintheledger FinalDocument32 pagesFabm1 q3 Mod8 Postingtransactionsintheledger FinalAdonis Zoleta Aranillo33% (3)

- CHKD FABM1 - Q3 - LA 22. Comprehensive Example Using T-AccountsDocument1 pageCHKD FABM1 - Q3 - LA 22. Comprehensive Example Using T-AccountsGladys Angela ValdemoroNo ratings yet

- Law QuestionsDocument14 pagesLaw QuestionsAlthea CagakitNo ratings yet

- Ultratech Cement Limited Swot Analysis BDocument6 pagesUltratech Cement Limited Swot Analysis BMohd HussainNo ratings yet

- 0 - Summer Internship Project ReportDocument26 pages0 - Summer Internship Project ReportSandeep SharmaNo ratings yet

- M&A NotesDocument22 pagesM&A NotesБота ОмароваNo ratings yet

- Zərərsizlik NöqtəsiDocument1 pageZərərsizlik Nöqtəsizaur.a.ibishovNo ratings yet

- Joint Arrangements Answer Key Chapter 10 Problems 4 To 7Document3 pagesJoint Arrangements Answer Key Chapter 10 Problems 4 To 7Jeane Mae BooNo ratings yet

- DF1 601 Individual AssignmentDocument5 pagesDF1 601 Individual AssignmentIan KipropNo ratings yet

- Andhra Bank Annual Report 2014 15Document372 pagesAndhra Bank Annual Report 2014 15JyotiNo ratings yet

- Khatabook Customer Transactions 08.04.2024 07.24.41.PMDocument11 pagesKhatabook Customer Transactions 08.04.2024 07.24.41.PMfaizancscmailNo ratings yet

- 3 Types of Discount in AccountingDocument6 pages3 Types of Discount in AccountingERMYLIN ENCINARES100% (1)

- Your Division Is Considering Two Projects Its Wacc Is 10Document1 pageYour Division Is Considering Two Projects Its Wacc Is 10Amit PandeyNo ratings yet

- Project Report For Spare PartsDocument5 pagesProject Report For Spare Partsrajesh patelNo ratings yet

- Saving RecordDocument2 pagesSaving RecordAlexander WuNo ratings yet

- PC AccountingDocument15 pagesPC AccountingDianne SantiagoNo ratings yet

- 66 Tan Tiong Bio V Cir, GR No. L-15778, April 23, 1962, 4 Scra 986Document9 pages66 Tan Tiong Bio V Cir, GR No. L-15778, April 23, 1962, 4 Scra 986Edgar Calzita AlotaNo ratings yet

- Analisis Kelayakan Pada Agroindustri Kopi Bubuk Di Desa Nogosari Kecamatan Rambipuji Kabupaten JemberDocument19 pagesAnalisis Kelayakan Pada Agroindustri Kopi Bubuk Di Desa Nogosari Kecamatan Rambipuji Kabupaten JemberFemme MaginaNo ratings yet

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3bia070386100% (1)

- Cup 2 (Far)Document8 pagesCup 2 (Far)Chan DagaleNo ratings yet

- Intermediate AccountingDocument4 pagesIntermediate AccountingMary Ellen LuceñaNo ratings yet

- Endalew LijalemDocument38 pagesEndalew Lijalemesayasserbesa60No ratings yet