Professional Documents

Culture Documents

Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining Boom

Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining Boom

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining Boom

Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining Boom

Uploaded by

Impulsive collectorCopyright:

Available Formats

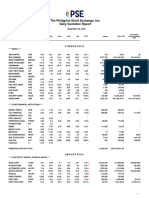

theSun | FRIDAY OCTOBER 23 2009 15

business KLCI

STI

1,260.02

2,681.97

0.04

10.58

Nikkei

TSEC

10,267.17

7,607.93

66.22

93.57

Hang Seng 22,210.52 107.59 KOSPI 1,630.33 23.53

KLCI Points

SCI 3,051.41 19.18 S&P/ASX200 4,812.80 25.80

market summary

INDICES

FBMEMAS

OCTOBER 22, 2009

CHANGE

8,478.71 +7.07

Australia set for

decades-long mining boom

FBM-KLCI 1,260.02 -0.04

INDUSTRIAL 2,675.32 +5.70

CONSUMER PROD 367.26 -0.55

INDUSTRIAL PROD 94.80 +0.86

CONSTRUCTION 235.92 +1.03

TRADING SERVICES 162.05 -0.13

FINANCE 10,737.04 +25.02 SYDNEY: Australia could be India, until the global financial on the previous year.

PROPERTIES 821.51 -1.36 set for a decades-long com- crisis. Iron ore comprised more EXCHANGE RATES

PLANTATIONS 6,179.05 -1.95 October 22, 2009

modities boom fuelled by But the world’s biggest than half of Australia’s A$32.48

MINING 316.12 -2.03 rocketing demand from China miner BHP Billiton in Septem- billion (RM100.69 billion) in

FBMSHA 8,530.82 +4.10 Foreign currency Bank sell Bank buy Bank buy

and India, a senior official said ber said it expected growth in exports to China, doubling to

FBMACE 4,358.99 +10.71 in the country’s latest upbeat China to fuel a new boom over A$18 (RM55.8 billion) over the TT/OD TT OD

TECHNOLOGY 17.15 -0.03 1 US DOLLAR 3.4080 3.3430 3.3330

economic assessment. coming decades, with global year.

TURNOVER VALUE Treasury secretary Ken steel demand to double in 15 Australia’s government 1 AUSTRALIAN DOLLAR 3.1820 3.0850 3.0690

761,112mil RM1.162bil Henry also said a return to full years. and central bank have cited 1 BRUNEI DOLLAR 2.4570 2.3960 2.3880

employment was a “conceiv- Both India and China would trade links with China as a

1 CANADIAN DOLLAR 3.2760 3.1950 3.1830

able possibility” in the coming drive a 40% surge in demand main reason for its success in

Prices close mixed years, with major export

partners showing unexpected

for energy, with the two nations

expected to account for over

weathering the global financial

storm as the fastest-growing

1 EURO

1 NEW ZEALAND DOLLAR

5.1210

2.6190

5.0160

2.5020

4.9960

2.4860

SHARE prices on Bursa Malaysia resilience despite the global half the world’s incremental economy in the developed 1 PAPUA N GUINEA KINA 1.4200 1.1800 1.1640

closed mixed yestrday with most downturn. electricity demand, BHP said. world. 1 SINGAPORE DOLLAR 2.4565 2.3960 2.3880

investors sidelining ahead of the “It now appears the impact The two countries this year Australia is the only major

of the global financial crisis signed liquefied natural gas Western nation to avoid a 1 STERLING POUND 5.6670 5.5500 5.5300

Budget 2010 announcement today,

on the Chinese economy and (LNG) supply contracts worth recession in the worldwide 1 SWISS FRANC 3.3980 3.3130 3.2980

dealers said.

The FBM KLCI ended the day at the Indian economy hasn’t tens of billions of dollars from slump and posted growth of 100 ARAB EMIRATES DIRHAM 94.6300 89.5100 89.3100

1,260.02, down 0.04 points. been nearly as large as many Australia’s massive Gorgon 0.6% in the three months to 100 BANGLADESH TAKA 5.1500 4.6620 4.4620

Jupiter Securities’ head of research, feared,” Henry told a Senate gas field. June – the best in the devel- 100 CHINESE RENMINBI N/A N/A N/A

hearing late Wednesday. Prime Minister Kevin oped world.

Pong Teng Siew, said investors were 100 HONGKONG DOLLAR 44.7400 42.3700 42.1700

“It seems that’s likely to Rudd said the Gorgon project, This month it became the

adopting a wait-and-see attitude support relatively high com- 100 INDIAN RUPEE 7.6200 7.0000 6.8000

Australia’s largest-ever re- first advanced economy to raise

ahead of the Budget. modity prices, that is prices for sources development and the interest rates since the credit 100 INDONESIAN RUPIAH 0.0375 0.0330 0.0280

The downtrend was also attributed Australian export commodi- world’s largest LNG plant, was meltdown and promised more

to the Wall Street’s overnight losses 100 JAPANESE YEN 3.7580 3.6660 3.6560

ties, for a considerable period expected to generate A$300 bil- rises to come, boldly declaring

which set the negative tone for Asian of time, quite possibly for some lion (RM930 billion) in export the risk of recession over. 100 PAKISTAN RUPEE 4.2000 3.9300 3.7300

markets with the entire indices in the decades.” earnings. China yesterday posted 100 PHILIPPINE PESO 7.4800 7.0100 6.8100

region closing in the red, he said. Australia enjoyed a decade China was Australia’s 8.9% growth for the third 100 QATAR RIYAL 95.0400 90.4000 90.2000

He said profit taking meanwhile of stellar economic growth, number two trading partner quarter, its fastest pace in a 100 SAUDI RIYAL 92.2600 87.7600 87.5600

capped upside potential despite active underpinned by intense in 2008, recording two-way year and keeping it on course 100 SRI LANKA RUPEE 3.0600 2.8200 2.6200

buying interest in the late afternoon. demand for resources from trade worth A$73.93 billion to meet government targets of

– Bernama fast-industrialising China and (RM229.18 billion), up 13.3% 8% growth for 2009. – AFP 100 THAI BAHT 10.9400 9.2700 8.8700

Source: Malayan Banking Berhad/ Bernama

You might also like

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Chapter 2 Multiple Choice Comp AdvantageDocument6 pagesChapter 2 Multiple Choice Comp AdvantageKifah Charaf100% (3)

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocument1 pageThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-08-25 Page17 Market SummaryDocument1 pageThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNo ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDocument1 pageThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- TheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistDocument1 pageTheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistImpulsive collectorNo ratings yet

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- Thesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangDocument1 pageThesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDocument1 pageThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNo ratings yet

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocument1 pageThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNo ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- Thesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingDocument1 pageThesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingImpulsive collectorNo ratings yet

- Thesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingDocument1 pageThesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingImpulsive collectorNo ratings yet

- Thesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeDocument1 pageThesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeImpulsive collectorNo ratings yet

- Thesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedDocument1 pageThesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedImpulsive collectorNo ratings yet

- TheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaDocument1 pageTheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaImpulsive collectorNo ratings yet

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDocument1 pageTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNo ratings yet

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Document1 pageTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- Thesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesDocument1 pageThesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- Thesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearDocument1 pageThesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearImpulsive collectorNo ratings yet

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankDocument1 pageTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorNo ratings yet

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocument1 pageTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Thesun 2009-07-17 Page13 Chinas Economy Grows 7Document1 pageThesun 2009-07-17 Page13 Chinas Economy Grows 7Impulsive collectorNo ratings yet

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Document1 pageThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabDocument1 pageThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorNo ratings yet

- Thesun 2009-07-28 Page17 World Stocks at 9-Mth PeakDocument1 pageThesun 2009-07-28 Page17 World Stocks at 9-Mth PeakImpulsive collector100% (2)

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthDocument1 pageThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorNo ratings yet

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocument1 pageThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNo ratings yet

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocument1 pageThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNo ratings yet

- Thesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpDocument1 pageThesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpImpulsive collectorNo ratings yet

- Thesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughDocument1 pageThesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughImpulsive collectorNo ratings yet

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocument1 pageTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNo ratings yet

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDocument1 pageThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022craftersxNo ratings yet

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocument1 pageThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNo ratings yet

- Market Update 8th June 2018Document1 pageMarket Update 8th June 2018Anonymous iFZbkNwNo ratings yet

- Thesun 2009-05-27 Page15 Asian Shares Hit by North Korea TensionDocument1 pageThesun 2009-05-27 Page15 Asian Shares Hit by North Korea TensionImpulsive collectorNo ratings yet

- Morning Brief: JCI Index JCI MovementDocument8 pagesMorning Brief: JCI Index JCI MovementPutu Chantika Putri DhammayantiNo ratings yet

- September 29, 2023-EODDocument14 pagesSeptember 29, 2023-EODMJA MAMANo ratings yet

- Thesun 2009-04-14 Page17 South Korea Wary of Chinas Rise To Economic PowerDocument1 pageThesun 2009-04-14 Page17 South Korea Wary of Chinas Rise To Economic PowerImpulsive collectorNo ratings yet

- Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessDocument1 pageThesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessImpulsive collectorNo ratings yet

- Thesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyDocument1 pageThesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyImpulsive collectorNo ratings yet

- TheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKDocument1 pageTheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKImpulsive collectorNo ratings yet

- Market Update 26th February 2018Document1 pageMarket Update 26th February 2018Anonymous iFZbkNwNo ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- Thesun 2009-08-13 Page17 Rio Employees Formally ArrestedDocument1 pageThesun 2009-08-13 Page17 Rio Employees Formally ArrestedImpulsive collectorNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- Market Update 15th February 2018Document1 pageMarket Update 15th February 2018Anonymous iFZbkNwNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Daniels - IBT - 16e - Final - PPT - 07 Economic Integration and CooperationDocument42 pagesDaniels - IBT - 16e - Final - PPT - 07 Economic Integration and Cooperationrola mohammadNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01Document6 pagesECO121 - Test 01 - Individual Assignment 01Ngọc YếnNo ratings yet

- Exchane Rate RegimesDocument17 pagesExchane Rate RegimesAvinash SupkarNo ratings yet

- Addis Ababa University School of Commerce Department of EconomicsDocument9 pagesAddis Ababa University School of Commerce Department of EconomicsGidisa Lachisa100% (1)

- CH 10. Money Its Functions and PropertiesDocument12 pagesCH 10. Money Its Functions and PropertiesMr RamNo ratings yet

- 04.05.06 WP146 Afonso e AguiarDocument43 pages04.05.06 WP146 Afonso e AguiarTiago NobreNo ratings yet

- Chapter 3 - Global Trading EnvironmentDocument46 pagesChapter 3 - Global Trading Environmentkirthi nairNo ratings yet

- Jurnal Skripsi (Surmayani)Document22 pagesJurnal Skripsi (Surmayani)el fareiziNo ratings yet

- International Economics I Lecture NotesDocument20 pagesInternational Economics I Lecture NotesChidire MrNo ratings yet

- Solution Manual For International Economics 17th EditionDocument4 pagesSolution Manual For International Economics 17th EditionysaintogttNo ratings yet

- 8 International Monetary System PDFDocument22 pages8 International Monetary System PDFdevesh_mendiratta_61No ratings yet

- The Foreign Exchange Market: All Rights ReservedDocument54 pagesThe Foreign Exchange Market: All Rights ReservedIrakli SaliaNo ratings yet

- Project List RegularDocument6 pagesProject List RegularTanveer PathanNo ratings yet

- European Currency UnitDocument13 pagesEuropean Currency UnitSoorya HaridasanNo ratings yet

- 16 FemaDocument25 pages16 Fema2022pbm5034No ratings yet

- Forex Never Lose Trade: DisclaimerDocument7 pagesForex Never Lose Trade: DisclaimerSinclair ForexNo ratings yet

- Tiểu luận đã chỉnhDocument28 pagesTiểu luận đã chỉnhĐức HoàngNo ratings yet

- Features of Free Trade: Free Trade Is A Policy by Which A Government Does Not Discriminate Against Imports or InterfereDocument6 pagesFeatures of Free Trade: Free Trade Is A Policy by Which A Government Does Not Discriminate Against Imports or Interfereatul_rockstarNo ratings yet

- 2019 ECO State Rank Essay Plan BOP Lucas LinDocument2 pages2019 ECO State Rank Essay Plan BOP Lucas LinAbishek KarnanNo ratings yet

- How Is The Exchange Rate Defined?: T E R K D CDocument16 pagesHow Is The Exchange Rate Defined?: T E R K D CNherwin OstiaNo ratings yet

- Smart Money Technqiue PDF by DayTradingRauf UPDATEDDocument6 pagesSmart Money Technqiue PDF by DayTradingRauf UPDATEDMiguel16985No ratings yet

- Exer 5 - Chap 8Document2 pagesExer 5 - Chap 8duongyenngoc1804No ratings yet

- Chapter 3Document36 pagesChapter 3Muhammad Saddam SofyandiNo ratings yet

- Updated Coursework 2 QuestionsDocument2 pagesUpdated Coursework 2 QuestionsSanuja SundereshanNo ratings yet

- BERF Ethiopia Foreign Exchange For BusinessesDocument83 pagesBERF Ethiopia Foreign Exchange For Businessesmsurafel385No ratings yet

- The Analysis of Tariffs: Prepared by Anchela Yap Uy-Biag, MD, MBADocument17 pagesThe Analysis of Tariffs: Prepared by Anchela Yap Uy-Biag, MD, MBAAnchela Biag0% (1)

- DSE Past Paper S6 CH 24 Trade BarriersDocument3 pagesDSE Past Paper S6 CH 24 Trade BarriersSunny HuangNo ratings yet

- Regional Economic IntegrationDocument8 pagesRegional Economic IntegrationMary Mia CenizaNo ratings yet

- IncotermsDocument12 pagesIncotermschandra sekhar reddyNo ratings yet