Professional Documents

Culture Documents

Forecasting and Budgeting

Forecasting and Budgeting

Uploaded by

Hemant KumarCopyright:

Available Formats

You might also like

- Chapter Introduction:: Advantages of BudgetDocument10 pagesChapter Introduction:: Advantages of BudgetreneeshrameshNo ratings yet

- Managerial Accounting IBPDocument58 pagesManagerial Accounting IBPSaadat Ali100% (1)

- Profit PlanningDocument5 pagesProfit PlanningChaudhry Umair YounisNo ratings yet

- CH - 2 Master Budget - Ahmed With Illustration and SolutionDocument15 pagesCH - 2 Master Budget - Ahmed With Illustration and SolutionYohannes MeridNo ratings yet

- Moduel 4Document11 pagesModuel 4sarojkumardasbsetNo ratings yet

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigNo ratings yet

- Profit PlanningDocument34 pagesProfit Planningmonkey beanNo ratings yet

- Chapter 5 SummaryDocument6 pagesChapter 5 SummaryDiana Mark AndrewNo ratings yet

- Assignment 02 - FIMO411Document4 pagesAssignment 02 - FIMO411Riznel Anthony CapaladNo ratings yet

- Master BudgetingDocument6 pagesMaster BudgetingKrNo ratings yet

- National BudgetDocument27 pagesNational BudgetMAGEZI DAVIDNo ratings yet

- Management Accounting Summary Chapter 15Document5 pagesManagement Accounting Summary Chapter 15Sanne PaulissenNo ratings yet

- Cost II-Ch - 3 Master BudgetDocument14 pagesCost II-Ch - 3 Master BudgetYitera SisayNo ratings yet

- Class 9 - Managerial AccountingDocument12 pagesClass 9 - Managerial AccountingcarlaNo ratings yet

- 14 Fgfgfgdsdcontrol TheoryDocument40 pages14 Fgfgfgdsdcontrol TheoryDeepak R GoradNo ratings yet

- BudgetrycontrolDocument25 pagesBudgetrycontrolSimmi AgrawalNo ratings yet

- Scribd DownloadDocument20 pagesScribd DownloadQuite VairaNo ratings yet

- BudgetsDocument35 pagesBudgetsMayank Pande100% (1)

- Chapter 6Document8 pagesChapter 6Rohit BadgujarNo ratings yet

- CH 9 Profit Planning and Activity-Based BudgetingDocument21 pagesCH 9 Profit Planning and Activity-Based BudgetingIsra' I. SweilehNo ratings yet

- CH - 3 Master Budget - With Illustration and SolutionDocument16 pagesCH - 3 Master Budget - With Illustration and SolutionMelat TNo ratings yet

- Unit - 4 Marginal Costing: DefinitionDocument5 pagesUnit - 4 Marginal Costing: DefinitionThigilpandi07 YTNo ratings yet

- Budget and BudgetryDocument6 pagesBudget and Budgetryram sagar100% (1)

- Profit Planning: Reporter: Maria Magdalena Dg. FranciscoDocument51 pagesProfit Planning: Reporter: Maria Magdalena Dg. FranciscoElmin ValdezNo ratings yet

- Chapter Budget ControlDocument5 pagesChapter Budget ControlnadishNo ratings yet

- 10) BudgetingDocument5 pages10) BudgetingAlbert Krohn SandahlNo ratings yet

- BHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3Document6 pagesBHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3neelsequeira.9No ratings yet

- Meaning of Budget: A Budget Is A Detail Plan of Operations For A Specific Period ofDocument3 pagesMeaning of Budget: A Budget Is A Detail Plan of Operations For A Specific Period ofMohan RanganNo ratings yet

- UNIT - 2 MA NotesDocument15 pagesUNIT - 2 MA NotesYashi SinghNo ratings yet

- Ethical Issues in Budget PreparationDocument26 pagesEthical Issues in Budget PreparationJoseph SimonNo ratings yet

- Ch.13 Managing Small Business FinanceDocument5 pagesCh.13 Managing Small Business FinanceBaesick MoviesNo ratings yet

- Chapter 4 PptsDocument111 pagesChapter 4 PptsKimberly Quin Cañas100% (1)

- Managerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaDocument3 pagesManagerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaCertified Public AccountantNo ratings yet

- Budget: A Condensed Business Plan For The Forthcoming Year (Or Less)Document7 pagesBudget: A Condensed Business Plan For The Forthcoming Year (Or Less)Mega Pop LockerNo ratings yet

- Budgeting Planning and ControlDocument31 pagesBudgeting Planning and Controlintan agustina100% (1)

- Unit 14Document25 pagesUnit 14divya kalyaniNo ratings yet

- Chapter 10Document13 pagesChapter 10Shane Melody G. GetonzoNo ratings yet

- Wa0001.Document29 pagesWa0001.kisipo6659No ratings yet

- BudgetDocument24 pagesBudgetAbhishek ChowdhuryNo ratings yet

- CHAPTER 3 5 Contents ONLYDocument18 pagesCHAPTER 3 5 Contents ONLYKimberly Quin CañasNo ratings yet

- Budget: On The Basis of Time: According To Time, Budgets May Be Classified AsDocument11 pagesBudget: On The Basis of Time: According To Time, Budgets May Be Classified Asuday prakashNo ratings yet

- Budgetary ControlDocument38 pagesBudgetary ControlraajnanjaiNo ratings yet

- Budget and BudgentryDocument4 pagesBudget and Budgentryd81784989No ratings yet

- Responsibility Accounting: Keval Patel ID - S32883Document14 pagesResponsibility Accounting: Keval Patel ID - S32883raj ramukNo ratings yet

- Budgetary ControlDocument31 pagesBudgetary Controlraghavmore5_11660812No ratings yet

- My Final ProjectDocument68 pagesMy Final ProjectSAINo ratings yet

- Lesson 3 Applying Management Control in Accounting and MarketingDocument17 pagesLesson 3 Applying Management Control in Accounting and MarketingCJ DuapaNo ratings yet

- Chapter 4 Budgeting For Planning and ControlDocument8 pagesChapter 4 Budgeting For Planning and ControlShem CasimiroNo ratings yet

- What Is A BudgetDocument4 pagesWhat Is A BudgetShweta DsouzaNo ratings yet

- Financial Management Chapter 10Document14 pagesFinancial Management Chapter 10Shane Melody G. GetonzoNo ratings yet

- Topic 3 Budgetary Process of An OrganisationDocument57 pagesTopic 3 Budgetary Process of An OrganisationMaryam MalieNo ratings yet

- CPA BEC - BudgetingDocument15 pagesCPA BEC - Budgetingpambia2000No ratings yet

- Budget in 1Document9 pagesBudget in 1Tanwi Jain100% (1)

- Maruti SuzukiDocument11 pagesMaruti Suzukikamblemounika05No ratings yet

- Cost and Management Accounting IIDocument9 pagesCost and Management Accounting IIarefayne wodajoNo ratings yet

- Developing Operating & Capital BudgetingDocument48 pagesDeveloping Operating & Capital Budgetingapi-3742302100% (2)

- 15.963 Management Accounting and Control: Mit OpencoursewareDocument21 pages15.963 Management Accounting and Control: Mit OpencoursewareFernando Miguel De StefanoNo ratings yet

- Performance Management Assignment 2 1Document6 pagesPerformance Management Assignment 2 1Ramsha ZahidNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- File1 - Laporan 5Document48 pagesFile1 - Laporan 5Bhaskoro AbdillahNo ratings yet

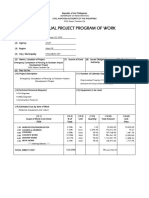

- Individual Project Program of Work: Civil Aviation Authority of The PhilippinesDocument2 pagesIndividual Project Program of Work: Civil Aviation Authority of The PhilippinesMo JackNo ratings yet

- Cariel Jean Donsing Bacc 8a Module 1 PDFDocument33 pagesCariel Jean Donsing Bacc 8a Module 1 PDFMary Anne MosedeilNo ratings yet

- Cost Lectures DR - Mohiy SamyDocument12 pagesCost Lectures DR - Mohiy SamyEiad WaleedNo ratings yet

- Review ch.1 2Document21 pagesReview ch.1 2Nguyễn Thị Hồng YếnNo ratings yet

- Assessing Future and Current Performance of Organisations Using Ratio AnalysisDocument11 pagesAssessing Future and Current Performance of Organisations Using Ratio AnalysisGeorge Rabar100% (1)

- TopicDocument1 pageTopicYajanyNo ratings yet

- Branches of Accounting: Prepared By: Prof. Jonah C. PardilloDocument17 pagesBranches of Accounting: Prepared By: Prof. Jonah C. PardilloShaneil MatulaNo ratings yet

- ch11 Kieso IFRS4 SMDocument82 pagesch11 Kieso IFRS4 SM黃炳智No ratings yet

- Room Clean : Room The Thesa FDocument6 pagesRoom Clean : Room The Thesa FDRLNNo ratings yet

- Applied Overhead: Costing SheetDocument8 pagesApplied Overhead: Costing SheetGK SKNo ratings yet

- 2016 Winter Model Answer PaperDocument20 pages2016 Winter Model Answer PaperMayur AhireNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingCarl AngeloNo ratings yet

- Transfer PricingDocument20 pagesTransfer Pricingabhi2244inNo ratings yet

- Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument7 pagesAbsorption, Variable, and Throughput Costing: Multiple Choice QuestionsRhea RamirezNo ratings yet

- Chapter 19 - Biological AssetsDocument40 pagesChapter 19 - Biological AssetsDidik DidiksterNo ratings yet

- Topic 4 Total Project CostDocument39 pagesTopic 4 Total Project CostCjoy De RoxasNo ratings yet

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- MSQ 03 Standard Costs and Variance Analysis BrylDocument13 pagesMSQ 03 Standard Costs and Variance Analysis BrylDavid DavidNo ratings yet

- Topic 6 & 7 - Accounting For RevenuesDocument101 pagesTopic 6 & 7 - Accounting For RevenuesLê Thiên Giang 2KT-19No ratings yet

- 1st Workshop - KickOff - Indonesia - v1.0Document37 pages1st Workshop - KickOff - Indonesia - v1.0Aries SofyanNo ratings yet

- Lehigh SteelDocument12 pagesLehigh SteelAto SumartoNo ratings yet

- Pas 16Document30 pagesPas 16Hannah Mae D. LozanoNo ratings yet

- FM Chapter 2 - Study TextDocument14 pagesFM Chapter 2 - Study Textirmaya.safitraNo ratings yet

- Chap 002Document69 pagesChap 002NitinNo ratings yet

- Why Is It Important To Identify and Prioritize Risk?Document2 pagesWhy Is It Important To Identify and Prioritize Risk?John Dexter CallaoNo ratings yet

- CH 2 PPEDocument71 pagesCH 2 PPEhassen mustefaNo ratings yet

- Rel Costs Summer Cb-1 PDFDocument2 pagesRel Costs Summer Cb-1 PDFJohn Carlo CruzNo ratings yet

- Food Cost Portion & ControlDocument24 pagesFood Cost Portion & Controloutmane4100% (6)

- MAS 2 - Standard CostingDocument13 pagesMAS 2 - Standard CostingLovely Mae Lariosa100% (1)

Forecasting and Budgeting

Forecasting and Budgeting

Uploaded by

Hemant KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forecasting and Budgeting

Forecasting and Budgeting

Uploaded by

Hemant KumarCopyright:

Available Formats

FORECASTING AND BUDGETING

Budget is said to be projection for the future. This projection may also be called a forecast.

It is a financial as well as quantitative statement of what an organization is expecting about its business in terms of1. Quantity of the product that the establishment will be producing 2. What is going to be the revenue generation For a specific time period.

It can also be called a benchmark in terms of quantity and revenue generation. A budget is a comprehensive and co-ordinated plan expressed in financial terms, for a specific future period of time. It is a tool devised by the management to keep a proper balance between the income and expenditure. Budget is a mirror that shows the future income and expenditure of the organization. Most budgets are prepared in terms of money. A budget has been compared to a road map which indicates an accurate route and serves as a guide.

IMPORTANCE OF BUDGETING It sets the parameter of earmarked expenditures. It reflects the efficiency of the organization as it helps to operate within the budget. It helps in fixing the priorities of the establishment. It acts as a control tool and helps in gauging diversions. It becomes easy for the operators to understand how to achieve the targeted figures. The resources can be put to best utilization, with the view to maximize profits. A control through budget indicates where the management policy has gone wrong and why. Productivity can be increased to meet the budgeted revenues. Budget provides cost consciousness. Budgeting process forces the management to become effective and efficient.

PREPARING OF BUDGET The first thing to be done is to recognize the prime function of the property/ business. Know the needed profits The budget is prepared under two heads1) Capital expenditure- covers equipment, furniture, artwork etc 2) The revenue expenditure- is the total of operational costs. Budgets are generally prepared at the end of the fiscal year, generally in the month of March. It is presented to the board of governors. Once approved by the BOG, it is implemented from April 1

BUDGET PERIOD For a big establishment, an annual budget is appropriate while for smaller catering units, usually two budgets, on-season and off-season, should be planned. Even monthly or weekly budgets can be planned for the smaller units.

BUDGETRY CONTROL The budget establishes definite objectives with regard to operating performance. It sets the limits to stay within the limits. The management must establish adequate controls to prevent any 1. Wastage 2. Loss 3. Pilferage

KIND OF BUDGETS 1.Capital budget- deals with the assets and capital funds of the business. Budget for plant, equipment, cash and stock, is therefore capital budget. 2.Operating budget is concerned with income and expenditure of the business and the operating costs. Budget for sales, purchases, labour costs and overheads is therefore, operating budget. 3.Sales Budget- this essentially consists of one estimate- volume of business. It Helps to estimate separately the volume of sales of each F & B outlet. It is the future projection regarding the number of portions to be produced and the possible revenue that is expected to be generated. This estimate can be based on the following Analysis of the past trend of the business Reports by the sales department Market research and market survey Overall economic conditions in the market.

4.Advertising cost budget- the budget of advertising is related to sales. Usually it has been seen that the product which is selling well, does not require an advertisement. Usually the advertising budget is fixed in the form of a fixed amount for a specific period of time. 5. Production Budget- it is basically a forecast of the quantity ( number of portions ) that should be prepared. The material cost that is the food cost estimation, is done in the budget that shall tell the forecast quantities of various raw material and their costs. The following points should be considered while preparing this budget It should be relative to sales forecast Production capacity Stock of raw material Policy of the management

6.Purchase budget- the material has been classifies under two heads- direct and indirect. The budget that tells about the quantity and volume of raw material required to be purchased during a specific period. The opening and the closing stock of the raw materials should be kept in mind while forecasting. 7. Human Resource Budget- this budget tells about the requirement of the human resources in order to meet the projected production, during the budgeted period.

8.Finance Resource Budget- this budget is an estimate of cash required for business for the specified period. The function of this budget is that the management should never be short of funds to operate the business. This budget tells that if money is short, what steps to be taken to overcome this problem 9.Overhead Cost Budget- this budget shows various types of overheads that will be incurred during the budgeted production period. Overheads should be classified under the following heads-fixed, variable, semi-variable

VARIANCE ANALYSIS The term variance means difference. In regard to the food service operations, variance means the difference between the projected/ budgeted or forecasted figure and the actual figure achieved. The main objective of the business is to earn profit and profit depends on two factors- cost and sales. The management should fix targets in terms of both costs and sales and then make plans to achieve these targets. The objective should be to maximize the sales and minimize the costs. This will result in maximization of profits and accumulation of funds.

Different types of cost variance1. Direct Material Cost Variance- is the difference between what should have been the cost and what has been the cost. This variance may be due to High consumption of raw material due to inefficiency of the staff, lack of skill and faulty workmanship. Wastage due to incorrect processing of the material. Break down of plant and machinery Inter- transfer of material from job to another. Lack of supervision and inspection Excessive spoilage

2. Direct Labour Cost Variance- the variance in the cost of labour is due to two main factorsdifference in actual rates of the labour and the standard rates. Difference in actual time taken to perform the job and the standard time prescribed to perform the job. Other reasons responsible for the variance are Appointing of labour that is more skilled than the required level, demanding higher payment. The labour being paid higher rates as there is shortage of labour in the market. Lower than the standard rate paid as unskilled labour is employed to do the job. Overtime paid to the labour required to put in extra time, resulting in higher wages. Changes in the standard wage rates.

3. Direct overhead Cost Variance- overheads are related to different operations in the food service operations. Overheads are of two types- variable overheads and fixed overheads. Reasons for variances are Advance payments made for any of the overheads. Due to outstanding expenses but payments not done. Due to abnormal expenses incurred such as repairs to machinery, spoilage.

4. Sales Variance- this is the difference between what should have been the sales and the actual sale. In case the actual sales is more than the budgeted sales, the variance is termed as favourable. Sale is an important activity and the profit depends upon it.

CHARACTERISTICS OF BUDGET Forecast- budgets are not actual but only future projections based on the past happenings. Flexibility- a budget should have flexibility and should be capable of changing with the changing situations. Clear and realistic- the goals set in the budget must be achievable. Creation of responsibility centres- people should be made responsible for following the budgeted guide. Effective communication- this is key to success to forecasting.

You might also like

- Chapter Introduction:: Advantages of BudgetDocument10 pagesChapter Introduction:: Advantages of BudgetreneeshrameshNo ratings yet

- Managerial Accounting IBPDocument58 pagesManagerial Accounting IBPSaadat Ali100% (1)

- Profit PlanningDocument5 pagesProfit PlanningChaudhry Umair YounisNo ratings yet

- CH - 2 Master Budget - Ahmed With Illustration and SolutionDocument15 pagesCH - 2 Master Budget - Ahmed With Illustration and SolutionYohannes MeridNo ratings yet

- Moduel 4Document11 pagesModuel 4sarojkumardasbsetNo ratings yet

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigNo ratings yet

- Profit PlanningDocument34 pagesProfit Planningmonkey beanNo ratings yet

- Chapter 5 SummaryDocument6 pagesChapter 5 SummaryDiana Mark AndrewNo ratings yet

- Assignment 02 - FIMO411Document4 pagesAssignment 02 - FIMO411Riznel Anthony CapaladNo ratings yet

- Master BudgetingDocument6 pagesMaster BudgetingKrNo ratings yet

- National BudgetDocument27 pagesNational BudgetMAGEZI DAVIDNo ratings yet

- Management Accounting Summary Chapter 15Document5 pagesManagement Accounting Summary Chapter 15Sanne PaulissenNo ratings yet

- Cost II-Ch - 3 Master BudgetDocument14 pagesCost II-Ch - 3 Master BudgetYitera SisayNo ratings yet

- Class 9 - Managerial AccountingDocument12 pagesClass 9 - Managerial AccountingcarlaNo ratings yet

- 14 Fgfgfgdsdcontrol TheoryDocument40 pages14 Fgfgfgdsdcontrol TheoryDeepak R GoradNo ratings yet

- BudgetrycontrolDocument25 pagesBudgetrycontrolSimmi AgrawalNo ratings yet

- Scribd DownloadDocument20 pagesScribd DownloadQuite VairaNo ratings yet

- BudgetsDocument35 pagesBudgetsMayank Pande100% (1)

- Chapter 6Document8 pagesChapter 6Rohit BadgujarNo ratings yet

- CH 9 Profit Planning and Activity-Based BudgetingDocument21 pagesCH 9 Profit Planning and Activity-Based BudgetingIsra' I. SweilehNo ratings yet

- CH - 3 Master Budget - With Illustration and SolutionDocument16 pagesCH - 3 Master Budget - With Illustration and SolutionMelat TNo ratings yet

- Unit - 4 Marginal Costing: DefinitionDocument5 pagesUnit - 4 Marginal Costing: DefinitionThigilpandi07 YTNo ratings yet

- Budget and BudgetryDocument6 pagesBudget and Budgetryram sagar100% (1)

- Profit Planning: Reporter: Maria Magdalena Dg. FranciscoDocument51 pagesProfit Planning: Reporter: Maria Magdalena Dg. FranciscoElmin ValdezNo ratings yet

- Chapter Budget ControlDocument5 pagesChapter Budget ControlnadishNo ratings yet

- 10) BudgetingDocument5 pages10) BudgetingAlbert Krohn SandahlNo ratings yet

- BHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3Document6 pagesBHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3neelsequeira.9No ratings yet

- Meaning of Budget: A Budget Is A Detail Plan of Operations For A Specific Period ofDocument3 pagesMeaning of Budget: A Budget Is A Detail Plan of Operations For A Specific Period ofMohan RanganNo ratings yet

- UNIT - 2 MA NotesDocument15 pagesUNIT - 2 MA NotesYashi SinghNo ratings yet

- Ethical Issues in Budget PreparationDocument26 pagesEthical Issues in Budget PreparationJoseph SimonNo ratings yet

- Ch.13 Managing Small Business FinanceDocument5 pagesCh.13 Managing Small Business FinanceBaesick MoviesNo ratings yet

- Chapter 4 PptsDocument111 pagesChapter 4 PptsKimberly Quin Cañas100% (1)

- Managerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaDocument3 pagesManagerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaCertified Public AccountantNo ratings yet

- Budget: A Condensed Business Plan For The Forthcoming Year (Or Less)Document7 pagesBudget: A Condensed Business Plan For The Forthcoming Year (Or Less)Mega Pop LockerNo ratings yet

- Budgeting Planning and ControlDocument31 pagesBudgeting Planning and Controlintan agustina100% (1)

- Unit 14Document25 pagesUnit 14divya kalyaniNo ratings yet

- Chapter 10Document13 pagesChapter 10Shane Melody G. GetonzoNo ratings yet

- Wa0001.Document29 pagesWa0001.kisipo6659No ratings yet

- BudgetDocument24 pagesBudgetAbhishek ChowdhuryNo ratings yet

- CHAPTER 3 5 Contents ONLYDocument18 pagesCHAPTER 3 5 Contents ONLYKimberly Quin CañasNo ratings yet

- Budget: On The Basis of Time: According To Time, Budgets May Be Classified AsDocument11 pagesBudget: On The Basis of Time: According To Time, Budgets May Be Classified Asuday prakashNo ratings yet

- Budgetary ControlDocument38 pagesBudgetary ControlraajnanjaiNo ratings yet

- Budget and BudgentryDocument4 pagesBudget and Budgentryd81784989No ratings yet

- Responsibility Accounting: Keval Patel ID - S32883Document14 pagesResponsibility Accounting: Keval Patel ID - S32883raj ramukNo ratings yet

- Budgetary ControlDocument31 pagesBudgetary Controlraghavmore5_11660812No ratings yet

- My Final ProjectDocument68 pagesMy Final ProjectSAINo ratings yet

- Lesson 3 Applying Management Control in Accounting and MarketingDocument17 pagesLesson 3 Applying Management Control in Accounting and MarketingCJ DuapaNo ratings yet

- Chapter 4 Budgeting For Planning and ControlDocument8 pagesChapter 4 Budgeting For Planning and ControlShem CasimiroNo ratings yet

- What Is A BudgetDocument4 pagesWhat Is A BudgetShweta DsouzaNo ratings yet

- Financial Management Chapter 10Document14 pagesFinancial Management Chapter 10Shane Melody G. GetonzoNo ratings yet

- Topic 3 Budgetary Process of An OrganisationDocument57 pagesTopic 3 Budgetary Process of An OrganisationMaryam MalieNo ratings yet

- CPA BEC - BudgetingDocument15 pagesCPA BEC - Budgetingpambia2000No ratings yet

- Budget in 1Document9 pagesBudget in 1Tanwi Jain100% (1)

- Maruti SuzukiDocument11 pagesMaruti Suzukikamblemounika05No ratings yet

- Cost and Management Accounting IIDocument9 pagesCost and Management Accounting IIarefayne wodajoNo ratings yet

- Developing Operating & Capital BudgetingDocument48 pagesDeveloping Operating & Capital Budgetingapi-3742302100% (2)

- 15.963 Management Accounting and Control: Mit OpencoursewareDocument21 pages15.963 Management Accounting and Control: Mit OpencoursewareFernando Miguel De StefanoNo ratings yet

- Performance Management Assignment 2 1Document6 pagesPerformance Management Assignment 2 1Ramsha ZahidNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- File1 - Laporan 5Document48 pagesFile1 - Laporan 5Bhaskoro AbdillahNo ratings yet

- Individual Project Program of Work: Civil Aviation Authority of The PhilippinesDocument2 pagesIndividual Project Program of Work: Civil Aviation Authority of The PhilippinesMo JackNo ratings yet

- Cariel Jean Donsing Bacc 8a Module 1 PDFDocument33 pagesCariel Jean Donsing Bacc 8a Module 1 PDFMary Anne MosedeilNo ratings yet

- Cost Lectures DR - Mohiy SamyDocument12 pagesCost Lectures DR - Mohiy SamyEiad WaleedNo ratings yet

- Review ch.1 2Document21 pagesReview ch.1 2Nguyễn Thị Hồng YếnNo ratings yet

- Assessing Future and Current Performance of Organisations Using Ratio AnalysisDocument11 pagesAssessing Future and Current Performance of Organisations Using Ratio AnalysisGeorge Rabar100% (1)

- TopicDocument1 pageTopicYajanyNo ratings yet

- Branches of Accounting: Prepared By: Prof. Jonah C. PardilloDocument17 pagesBranches of Accounting: Prepared By: Prof. Jonah C. PardilloShaneil MatulaNo ratings yet

- ch11 Kieso IFRS4 SMDocument82 pagesch11 Kieso IFRS4 SM黃炳智No ratings yet

- Room Clean : Room The Thesa FDocument6 pagesRoom Clean : Room The Thesa FDRLNNo ratings yet

- Applied Overhead: Costing SheetDocument8 pagesApplied Overhead: Costing SheetGK SKNo ratings yet

- 2016 Winter Model Answer PaperDocument20 pages2016 Winter Model Answer PaperMayur AhireNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingCarl AngeloNo ratings yet

- Transfer PricingDocument20 pagesTransfer Pricingabhi2244inNo ratings yet

- Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument7 pagesAbsorption, Variable, and Throughput Costing: Multiple Choice QuestionsRhea RamirezNo ratings yet

- Chapter 19 - Biological AssetsDocument40 pagesChapter 19 - Biological AssetsDidik DidiksterNo ratings yet

- Topic 4 Total Project CostDocument39 pagesTopic 4 Total Project CostCjoy De RoxasNo ratings yet

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- MSQ 03 Standard Costs and Variance Analysis BrylDocument13 pagesMSQ 03 Standard Costs and Variance Analysis BrylDavid DavidNo ratings yet

- Topic 6 & 7 - Accounting For RevenuesDocument101 pagesTopic 6 & 7 - Accounting For RevenuesLê Thiên Giang 2KT-19No ratings yet

- 1st Workshop - KickOff - Indonesia - v1.0Document37 pages1st Workshop - KickOff - Indonesia - v1.0Aries SofyanNo ratings yet

- Lehigh SteelDocument12 pagesLehigh SteelAto SumartoNo ratings yet

- Pas 16Document30 pagesPas 16Hannah Mae D. LozanoNo ratings yet

- FM Chapter 2 - Study TextDocument14 pagesFM Chapter 2 - Study Textirmaya.safitraNo ratings yet

- Chap 002Document69 pagesChap 002NitinNo ratings yet

- Why Is It Important To Identify and Prioritize Risk?Document2 pagesWhy Is It Important To Identify and Prioritize Risk?John Dexter CallaoNo ratings yet

- CH 2 PPEDocument71 pagesCH 2 PPEhassen mustefaNo ratings yet

- Rel Costs Summer Cb-1 PDFDocument2 pagesRel Costs Summer Cb-1 PDFJohn Carlo CruzNo ratings yet

- Food Cost Portion & ControlDocument24 pagesFood Cost Portion & Controloutmane4100% (6)

- MAS 2 - Standard CostingDocument13 pagesMAS 2 - Standard CostingLovely Mae Lariosa100% (1)