Professional Documents

Culture Documents

General Journal: Goodwill 70

General Journal: Goodwill 70

Uploaded by

zahid_mahmood3811Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Journal: Goodwill 70

General Journal: Goodwill 70

Uploaded by

zahid_mahmood3811Copyright:

Available Formats

June 2008 paper 3 1 C Operating profit 70 600 add depreciation 20 100 loss on sale 1900 less increase in working

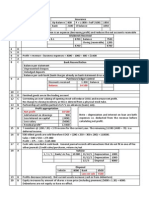

capital (14 300) Operating cash flow 78 300 Operating profit before depreciation 1 220 increase in stock (13) decrease in debtors 8 decrease in creditors (12) Operating cash flow 1 203 The retained earnings must be debited for the entire premium as the shares were originally issued at par. A capital redemption reserve must be created to replace the redeemed capital by debiting the retained earnings. 1 share for $4 of loan equates to 5000 shares so a premium of $3 per share. Ordinary shares increase by (5 x $1) $5000. Share premium increases by (5 x $3) $15000 Preference shares will be reduced by 60% - $40 000. Ordinary shares will be reduced to 5% of existing total - $20 000 Total = $60 000 The Capital redemption reserve is required to replace the capital redeemed only. General Journal Assets 200 Goodwill 70 Ordinary share capital 200 Share premium 50 Bank 20 Premium = $137 50 60 = $27 000 per share = $27 / 60 = 0.45c General Journal Assets 150 Goodwill 30 Liabilities 40 Ordinary shares 32 Share premium 48 On 31/12/08 half of the debentures ($35000) and all of the loan will be current liabilities as they are due for repayment in the next period. The other half will still be non-current. On 31/12/07 the loan stock is still a non-current liability incurring 8% ($80 000) interest per year, Earnings = profit after interest (and tax) = $30m - $6m = $24m EPS = $24m / 20m shares = $1.20 per share Price : earnings = $15 : 1.20 = 12.5 Debtors turnover = debtors / credit sales x 365 so debtors = 40 / 365 x $146000 = $16000 If assets were $100, liabilities $20 and profit $50 then asset use is 50% and gearing 20%. By taking a loan of $20 to increase assets. Asset use is now 50/120 = 41.47%. Gearing = 40/120 = 33.33% A no change to liabilities or net assets B and C increases liabilities so increases gearing D rights issue increases cash, no increased liabilities so improves gearing Earnings per share is a measure of the profit earned for each ordinary share therefore the preference dividend ($15) is deducted from the NPAT ($215). Window dressing is the term that describes the directors attempts to make the final accounts look better than they are. A, B and C may be done to dress up the final accounts.

4 5

B B

6 7

C C

8 9

A A

10

11 12

B C

13 14

C B

15

16 17

C D

18 19 20

A D A

21

22

23

24 25 26

D D A

27 28 29

B B B

30

An overdraft is a short-term source of finance Sensitivity analysis determines the impact of price/cost changes will have on future profitability. Breakeven = Fixed cost / contribution Budgeted Breakeven = $30 / $3 = 10 000 units. Actual breakeven = $30 / 4 = 7500 units 25% lower (better) breakeven Overhead absorption rate = budgeted overheads / budgeted hours = $104 / 8 = $13 per dlh. If 7500 hours worked then (7500 x $13) = $97 500 has been absorbed. Under recovered (absorbed) overheads = Actual overheads absorbed overheads So actual overheads = $97500 (absorbed) + $15000 (under-absorbed) = $112 500 Only the variable component of the costs will change. 4000 2000 units = 2000 extra units cost extra ($248 - $154) = $94 000. Per unit this is $94 / 2 = $47 Total cost (2000 units) = Variable costs + Fixed costs so fixed costs = $154 (2000 x 47) = $60 000 Total cost (3000 units) = (3000 x $47) + $60 000 = $201 000 20 000 units 16 000 units $ $ Direct material 80 000 16/20 x 80 000 64 000 Direct labour 120 000 16/20 x 120 000 96 000 Variable overheads (100% prime cost 200 000 64 + 96 or 16/20 x 200 160 000 Fixed costs 280 000 unchanged 280 000 680 000 $600 000 40 000 extra units (120 80) cost an extra $160 000 ($660 - $500). This is the variable cost. Per unit this is $160 / 40 = $4 per unit. Budgeted production = 240 000 hours / 3 hrs per unit = 80 000 units Budgeted costs $720 000 / 80 000 units = $9 per unit. Standard cost Actual cost Materials (24 x $12) $288 Materials (26 x $16) $416 Labour (8 x $25) $200 Labour (6 x $22) $132 $488 / unit $548 / unit Variance = standard actual = $488 - $548 = ($60). Negative so adverse AQ x SP 4350 x $9 $39 150 AQ x AP ($39150 435) = $38 715 $435 F Net present value is based on cash flow only depreciation is a non-cash item. ARR = average profit / average investment Net profit (5 years) = $100 - $20 (depreciation) + $10 (reduced costs) = $90 000 Average profit = $90/5 = $18 000. Average investment = $200 / 2 = $100 000 ARR = $18 / $100 = 18% $40000 x (.909 + .826 + .751) = $99 440 - $80 000 (initial investment) = $19 440

You might also like

- Indonesia Flexible Packaging Market Growth, Trends, COVID 19 ImpactDocument135 pagesIndonesia Flexible Packaging Market Growth, Trends, COVID 19 ImpactIndah YuneNo ratings yet

- Aqa Accn4 W Ms Jun13Document12 pagesAqa Accn4 W Ms Jun13zahid_mahmood3811No ratings yet

- Case Study of The Change Management of British Airways After The Economic Crisis of 2008Document5 pagesCase Study of The Change Management of British Airways After The Economic Crisis of 2008Mirela-Elena Popa0% (1)

- VSDC LAC Test Keys v4 - 8Document2 pagesVSDC LAC Test Keys v4 - 8Nirvana Munar Meneses100% (2)

- MBA 620 Week 3 HW SolutionsDocument5 pagesMBA 620 Week 3 HW SolutionsphoebeNo ratings yet

- Revise Mid TermDocument43 pagesRevise Mid TermThe FacesNo ratings yet

- BKM9e-Answers-Chap003-Margin and Short Extra QuestionsDocument3 pagesBKM9e-Answers-Chap003-Margin and Short Extra QuestionsLê Chấn PhongNo ratings yet

- Aqa Accn4 W Ms Jun12Document15 pagesAqa Accn4 W Ms Jun12zahid_mahmood3811No ratings yet

- Aqa Accn1 W Ms Jan13Document10 pagesAqa Accn1 W Ms Jan13zahid_mahmood3811No ratings yet

- POSCO ActDocument14 pagesPOSCO Actnirshan raj100% (1)

- Slaying The DragonDocument5 pagesSlaying The DragonMarkus ChNo ratings yet

- Resulting Trust Essay PlanDocument3 pagesResulting Trust Essay PlanSebastian Toh Ming WeiNo ratings yet

- Income Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent ReceivedDocument2 pagesIncome Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent Receivedzahid_mahmood3811No ratings yet

- Capital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation AccountDocument2 pagesCapital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation Accountzahid_mahmood3811No ratings yet

- 2008 June Paper 1Document2 pages2008 June Paper 1zahid_mahmood3811No ratings yet

- 2012 Nov Paper 32Document2 pages2012 Nov Paper 32zahid_mahmood3811No ratings yet

- ACG 2071, Test 2-Sample QuestionsDocument11 pagesACG 2071, Test 2-Sample QuestionsCresenciano MalabuyocNo ratings yet

- Depreciation Schedule: Income Statement 95Document2 pagesDepreciation Schedule: Income Statement 95zahid_mahmood3811No ratings yet

- Final Requirement ProblemsDocument5 pagesFinal Requirement ProblemsYoite MiharuNo ratings yet

- Insurance: Balance 14 100Document2 pagesInsurance: Balance 14 100zahid_mahmood3811No ratings yet

- Tugas Manajemen Keuangan II (P13-9, P13-12, P13-17)Document7 pagesTugas Manajemen Keuangan II (P13-9, P13-12, P13-17)L RakkimanNo ratings yet

- Chapter 11 Exercises and Problems Exercise 11-2: 1. Straight-LineDocument23 pagesChapter 11 Exercises and Problems Exercise 11-2: 1. Straight-LineHazel Rose CabezasNo ratings yet

- Tugas Manajemen Keuangan IIDocument8 pagesTugas Manajemen Keuangan IIL RakkimanNo ratings yet

- MA Chap 5Document19 pagesMA Chap 5Lan Tran HoangNo ratings yet

- Chapter 1Document13 pagesChapter 1clara2300181No ratings yet

- Final ExamDocument9 pagesFinal ExamWaizin KyawNo ratings yet

- CheatSheet 3FF3Document1 pageCheatSheet 3FF3Muntaha Rahman MayazNo ratings yet

- Dividend Policy Question and AnswerDocument7 pagesDividend Policy Question and AnswerBella CynthiaNo ratings yet

- Contribution Margin Practice SolutionsDocument4 pagesContribution Margin Practice Solutionskljasdf lkjasdf;lljNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Unit7 D (A2)Document10 pagesUnit7 D (A2)punte77No ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- Midterm Review Winter 2019Document11 pagesMidterm Review Winter 2019Gurveen Kaur100% (1)

- Engineering Economy Review III 2010Document4 pagesEngineering Economy Review III 2010Ma Ella Mae LogronioNo ratings yet

- Test 3 Corprate FinanceDocument10 pagesTest 3 Corprate FinancekeelyNo ratings yet

- LeverageDocument6 pagesLeverageOoi Yeung YeeNo ratings yet

- Mock Test SolutionsDocument11 pagesMock Test SolutionsMyraNo ratings yet

- Answers To QuestionsDocument15 pagesAnswers To QuestionsElie YabroudiNo ratings yet

- Cost - Chapter Two - FinalDocument50 pagesCost - Chapter Two - FinaltewodrosbayisaNo ratings yet

- Lecture 10 Relevant Costing PDFDocument49 pagesLecture 10 Relevant Costing PDFShweta Sridhar57% (7)

- Solutions CH 04 Managerial Accounting 11th Edition GarrisonDocument24 pagesSolutions CH 04 Managerial Accounting 11th Edition GarrisonArina Kartika RizqiNo ratings yet

- Corporate FinanceDocument11 pagesCorporate FinanceShamsul HaqimNo ratings yet

- SCM Lec 2Document67 pagesSCM Lec 2Star KerenzaNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- ECON PS 1 With Soln by Julius GrazaDocument3 pagesECON PS 1 With Soln by Julius GrazaEzlan HarithNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Tutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Document3 pagesTutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Hu-Ann KeymistNo ratings yet

- Answer - Case 1Document10 pagesAnswer - Case 1EVI MARIA SIBUEANo ratings yet

- $70) ÷ $150 53.33%) - This May Suggest That D. LawranceDocument1 page$70) ÷ $150 53.33%) - This May Suggest That D. LawrancejppjelNo ratings yet

- Soha Balance SheeDocument7 pagesSoha Balance SheeMohamed ZaitoonNo ratings yet

- Your Company Sponsors A 401Document8 pagesYour Company Sponsors A 401JOHNNo ratings yet

- Quiz 5Document4 pagesQuiz 5朱潇妤No ratings yet

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDocument18 pagesPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Financial Statement Analysis: Practice Exercises PE 15Document29 pagesFinancial Statement Analysis: Practice Exercises PE 15Samuel EtanaNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Additional Materials For Final ExamDocument12 pagesAdditional Materials For Final ExamjohannachannnnnnNo ratings yet

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Document6 pagesHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryNo ratings yet

- Chapter 20Document6 pagesChapter 20Dasun LakshithNo ratings yet

- Sol ch13Document6 pagesSol ch13Kailash KumarNo ratings yet

- Essentials of Investments (BKM 7 Ed.) Answers To Suggested Problems - Lecture 1Document4 pagesEssentials of Investments (BKM 7 Ed.) Answers To Suggested Problems - Lecture 1masterchocoNo ratings yet

- Margin 60% 50,000 Interest Cost (20,000)Document7 pagesMargin 60% 50,000 Interest Cost (20,000)hijab zaidiNo ratings yet

- Answers Chapter 4 - ACCT5204Document16 pagesAnswers Chapter 4 - ACCT5204abdulraheem.eesNo ratings yet

- CA CHP 3 MC Questions ShareDocument11 pagesCA CHP 3 MC Questions SharedangminhphuonggNo ratings yet

- Afm Week 2 Assignments Summer 2016Document4 pagesAfm Week 2 Assignments Summer 2016lexfred55No ratings yet

- ACF 103 Tutorial 6 Solns Updated 2015Document18 pagesACF 103 Tutorial 6 Solns Updated 2015Carolina SuNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (13)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 7110 s04 Ms 1Document1 page7110 s04 Ms 1zahid_mahmood3811No ratings yet

- Aqa Accn1 QP Jun13 2Document20 pagesAqa Accn1 QP Jun13 2zahid_mahmood3811No ratings yet

- 7110 s03 QP 1Document12 pages7110 s03 QP 1zahid_mahmood3811No ratings yet

- Question Paper Unit f012 01 Accounting ApplicationsDocument28 pagesQuestion Paper Unit f012 01 Accounting Applicationszahid_mahmood3811No ratings yet

- 7110 s03 Ms 1Document1 page7110 s03 Ms 1zahid_mahmood3811No ratings yet

- Aqa Accn1 QP Jun12Document16 pagesAqa Accn1 QP Jun12zahid_mahmood3811No ratings yet

- Lasania Real TasteDocument6 pagesLasania Real Tastezahid_mahmood3811No ratings yet

- Aqa 2121 Accn3 W MS Jan 12Document14 pagesAqa 2121 Accn3 W MS Jan 12zahid_mahmood3811No ratings yet

- Capital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation AccountDocument2 pagesCapital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation Accountzahid_mahmood3811No ratings yet

- Income Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent ReceivedDocument2 pagesIncome Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent Receivedzahid_mahmood3811No ratings yet

- Insurance: Balance 14 100Document2 pagesInsurance: Balance 14 100zahid_mahmood3811No ratings yet

- 2013 June Paper 11Document2 pages2013 June Paper 11zahid_mahmood3811No ratings yet

- 2012 Nov Paper 32Document2 pages2012 Nov Paper 32zahid_mahmood3811No ratings yet

- Profit (50:50 Split) 16: RealisationDocument3 pagesProfit (50:50 Split) 16: Realisationzahid_mahmood3811No ratings yet

- Depreciation Schedule: Income Statement 95Document2 pagesDepreciation Schedule: Income Statement 95zahid_mahmood3811No ratings yet

- 2008 June Paper 1Document2 pages2008 June Paper 1zahid_mahmood3811No ratings yet

- GoodmorningDocument17 pagesGoodmorningzahid_mahmood3811No ratings yet

- Diet PlanDocument1 pageDiet Planzahid_mahmood3811No ratings yet

- (Normal Probability) (Discrete Probability) : Xy Xy X yDocument1 page(Normal Probability) (Discrete Probability) : Xy Xy X yzahid_mahmood3811No ratings yet

- CEDR Solve Mediation Statistics 2004Document2 pagesCEDR Solve Mediation Statistics 2004Nur Hidayah Ab AzizNo ratings yet

- Weekly Report w34Document19 pagesWeekly Report w34Asep MAkmurNo ratings yet

- LGTB Parent FamiliesDocument372 pagesLGTB Parent FamiliesMaJose Cazco HidalgoNo ratings yet

- 2016 2as Exam JadaDocument3 pages2016 2as Exam JadaZima OkNo ratings yet

- Two Versions PDFDocument70 pagesTwo Versions PDFkamilghoshalNo ratings yet

- The Danube 3D: Europeity and EuropeismDocument14 pagesThe Danube 3D: Europeity and EuropeismcursantcataNo ratings yet

- 2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyDocument10 pages2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyNick PopeNo ratings yet

- Startup Ecosystem in IndiaDocument17 pagesStartup Ecosystem in IndiaDimanshu BakshiNo ratings yet

- PP 18 The Missa LectaDocument13 pagesPP 18 The Missa LectaRicardo TerrabuzziNo ratings yet

- FINA3010 Assignment1Document5 pagesFINA3010 Assignment1Hei RayNo ratings yet

- Philippine Criminology Profession Act of 2018 (RADocument46 pagesPhilippine Criminology Profession Act of 2018 (RARhem Rick CorpuzNo ratings yet

- Week 1 Origins of Hospitality and HousekeepingDocument12 pagesWeek 1 Origins of Hospitality and HousekeepingEmmanuel CherianNo ratings yet

- Garcia v. Drilon, G.R. No. 179267, 25 June 2013Document1 pageGarcia v. Drilon, G.R. No. 179267, 25 June 2013Albert RoseteNo ratings yet

- Tenses For Talking About The NewsDocument5 pagesTenses For Talking About The NewsThunder BurgerNo ratings yet

- MINORS TRAVELLING ABROAD Application Form Affidavit of Support and Consent Affidavit of UndertakingDocument3 pagesMINORS TRAVELLING ABROAD Application Form Affidavit of Support and Consent Affidavit of UndertakingBhong caneteNo ratings yet

- Vinayyak - CV - Sap - ExpDocument3 pagesVinayyak - CV - Sap - ExpmanikandanNo ratings yet

- University of Caloocan City - : An Analysis Paper OnDocument7 pagesUniversity of Caloocan City - : An Analysis Paper OnKylieNo ratings yet

- Ssy R R 2017 Form IDocument3 pagesSsy R R 2017 Form ISoumen Gorai50% (2)

- Rajasthan High Court OrderDocument7 pagesRajasthan High Court OrderNDTVNo ratings yet

- STUDENT 2021-2022 Academic Calendar (FINAL)Document1 pageSTUDENT 2021-2022 Academic Calendar (FINAL)Babar ImtiazNo ratings yet

- Pre-Test - Pediatric NursingDocument6 pagesPre-Test - Pediatric NursingogiskuadzNo ratings yet

- Netflix and Its InnovationDocument14 pagesNetflix and Its InnovationAkash yadavNo ratings yet

- Kurt LewinDocument6 pagesKurt Lewinfotiadis100% (2)