Professional Documents

Culture Documents

Certified Trade Finance Specialist

Certified Trade Finance Specialist

Uploaded by

Keith ParkerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certified Trade Finance Specialist

Certified Trade Finance Specialist

Uploaded by

Keith ParkerCopyright:

Available Formats

Organised By

New, Practical Exercises

In Trade Finance!

Certified

Trade Finance Specialist

The Route To Business Success

25 – 29 May 2008

JW Marriott Hotel, Dubai, UAE Attend this informative course led by world

renowned expert Martin Davies and learn

how to:

• Develop an in-depth understanding of the key areas in trade financing

including methods of payment, financing and how the specific

Who Should Attend? documentation of trade should be affected

• Manage complex areas of risk with trade failure contract design

This course is designed for both small and

• Protect yourself against late delivery and non-delivery

large merchants alike. However any manager • Engage and implement structures in liquidity and currency management

involved in trade finance who prices deals, • Ensure maximum upside is gained from the movement of cash across

establishes contracts, manages accounts currency zones

receivables or plans cash flow would benefit • Create a framework for establishing decision making processes

from this course. In addition, bankers who • Be responsive to changing positions in both the acquisition of raw materials

deal with merchants directly by selling them and the sale of finished goods

financial advice and strategies or are looking to • Trade, price trade and set standard profit and loss margins for overall

understand the various options used in trade performance monitoring

finance as well as controlling risk auditing • Measure market risk and resolve interest rate issues for short-term contracts

processes will benefit from this course

substantially.

“The Middle East is considered the largest market for trade financing in the

world, in light of the exceptional economical boom this part of the world is

going through, which has resulted in several diversified opportunities and

challenges that have created an increase in competitiveness in the search for Certification

funding sources.” Completion of this course entitles you

MENA Financial Network News to receive the ‘Certified Trade Finance

Specialist’ qualification. This core

qualification, offered by the American

Supported by: Academy of Financial Management, is

Official Regional Recruitment Partner Official IT Partner Official Media Monitoring Partner

recognised in more than 145 countries

and by 560 business schools

worldwide.

Tel: 971-4-3352437 Fax: 971-4-3352438 Email: register@iirme.com Web: www.iirme.com/trade

Certif ied Trade Finance Specialist 25 – 29 May 2008

Dear Trade Finance Professional, Course Timings

Regarded as one of the largest and most important trading hubs in the Registration will be at 08:00 on Day One. All five days will commence at

world, the Middle East is struggling to keep up with the endless 08:30 and conclude at 14:30 with lunch. There will be two networking

opportunities for trade arising every day. The constant demand for and refreshment breaks at appropriate times.

trade financing tells us that businesses seek to capitalise on trading

opportunities that require funding far in excess of their cash reserves.

Day One – Sunday, 25 May 2008

Of course, as a professional in trade finance, you already know all of

this. Most of your industry peers recognise these facts as well. That is Facilitating Trade

why competition has skyrocketed to new heights in recent years.

The first day leads through the key areas of trade finance considering the

Make your position clear in this market and pull yourself above the fray various methods of payment, financing and how the specific documentation

by gaining a professional, internationally recognised insight into Trade of trade should be effected.

Finance at the new, highly interactive Certified Trade Finance

Specialist (CTFS) course in association with the American Academy of Overview Of International Trade

Financial Management. A complete overview of the entire process for trade is delivered so that a

framework or straw man model can be established and evolved for the

remainder of the course.

Enable yourself to manage complex risks associated with trade

financing, develop effective contracts, protect against late and Methods Of Remittance

non-delivery, create effective trade finance frameworks and much Relationships between the principal parties are described and the process flow

more. This five-day course has been specially designed with you, the for trade is established outlining the traditional model for fund transfer.

trade finance professional, in mind with practical tools for gaining a

critical edge on your competitors. Payment Models

Discuss the building of primary remittance model cash terms, documentary

The insightful content of this course is essential to allow you and your credits, documentary collections, open accounts and consignments in further

company to cut through the competitive clutter in trade financing and detail, highlighting the risks between each party.

rise up as a market leader in this lucrative but complex industry.

Documentation Collection

The various documents are described showing examples. Conditions are

Martin Davies and I look forward to seeing you in May. outlined for release of such items. The relevant legal exposures within contracts

are outlined and methods for handling partial payments, avalising and

Yours sincerely, consignment of goods to banks is explained.

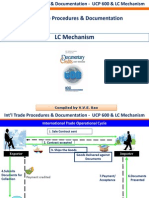

Letters Of Credit

Keith Parker Different types of letters of credit are fully explained taking into account

Conference Manager payment, acceptance, deferral and negotiation.

P.S. Register now to be involved with this Workshop

exciting, certified course with Different business models with examples are delivered. The attendees are

encouraged to identify the specific issues with each different structure.

Martin Davies!

Day Two – Monday, 26 May 2008

The American Academy

of Financial Management Semantics Of Trade Finance

The American Academy of Financial Management™, and its subsidiary The second day advances the course further by looking at some of the more

the European Institute of Financial Management, is the world’s fastest complex areas of trade failure contract design, the types of risks such contracts

growing professional association with approximately 40,000 members are designed to manage and methods for protection against late and

in over 145 countries hosting and organising certification training non-delivery.

worldwide and offering exclusive board certification designations to

candidates who meet the highest professional standards and Types Of Export Finance

assessment criteria. The AAFM was chosen in 2006 by Dubai Financial Factoring and invoice discounting with consideration of fees, commission and

Market (DFM) to conduct the 7-week professional training component variable facility costs are built up in a model showing the benefits of many

of the Kafa’at Programme for graduates entering the brokerage and approaches.

trading industry. AAFM also has alliances with the Kuwait Institute of

Banking Studies, Dubai Institute of Human Resource Development, Additional Instruments

Dubai Quality Group, Knowledge Village, and many more. With The course progresses to show forfeiting approaches and benefits. A

liaison offices in Dubai, Hong Kong, Kuwait, Singapore, San Francisco, comparison of a forfeit transaction against a letter of credit is delivered.

Monterey, New Orleans, Melbourne, Beijing, the Caribbean, India and

Europe, AAFM is fast becoming the world’s leading professional Transport Documents UCP 500

association for financial practitioners. The AAFM Executive Designation Multi-model transport documents are described and bills of lading are

Programmes also provide the assurance that the holder has met the explained. Policy certificates are also investigated as examples of cover.

suggested criteria for graduate credentials set out in the Ibanez US

Supreme Court Decision, and are recognised on both the NASD and Example Legal Cases

US Department of Labor websites. Examples of the rules for collection are described showing how protests can

be managed and trade breaks resolved. Theory is shown through examples.

Tel: 971-4-3352437 Fax: 971-4-3352438 Email: register@iirme.com Web: www.iirme.com/trade

Workshop Workshop

Walk through of legal cases and best practices for issue resolution. Workshop on setting up a best practice policy framework for managing trade

finance projects taking into account KPI and workflow sessions.

Contract Bonds And Guarantees

Tender/bid, bonds, performance bonds, retention guarantees, bail bonds, Islamic Finance

surety bonds and indemnities are described using examples for ease of A look at the products that allow Islamic finance structures to be used in the

learning. context of trade finance. This session is delivered with examples that show the

strength of Islamic finance.

Day Three – Tuesday, 27 May 2008

Day Five – Thursday, 29 May 2008

Liquidity Management, Currency And Structures

Capital Markets, Trading And Performance Monitoring

A special focus on liquidity management, currency and the types of structures

that should be engaged by a trade finance firm to ensure that maximum On day five, a specific emphasis is placed around capital market processes,

upside is gained from the movement of cash across currency zones. how to effectively trade, price such trades and set standard profit and loss

margins for overall performance monitoring. Techniques for measuring market

Treasury For Trade Finance risk and for resolving interest rate issues for short term lending contracts is

Trade finance has specific requirements that need to be met from a cash explained in detail.

management perspective. An approach for configuring the financial function

to trade finance to maximise working capital is outlined. Commodity Trading

Discuss how to trade commodity products either through an exchange

Resolving Liquidity Problems platform or over the counter. Why are such instruments important for

The treasury function is clearly defined, best practice approaches for liquidity businesses in trade finance?

management are shown and examples are given.

Commodity Benchmarks

Strategies For Short Term Debt With trading systems enabled, there are many ways to measure and hedge

There are many different methods for managing liquidity gaps, one of which against price volatility. The techniques for achieving these goals are explained.

is using debt instruments. A set of common instruments are chosen and the

structures are shown. The instruments are then compared in a case study to Resolve Interest Rate Issues

show which is the most cost effective. Many businesses have problems with short and medium term debt due to

fluctuations in interest rates. Methods for hedging and swapping interest rate

Risk Management – Forex I risk are explained with instrument examples.

Even with effective trade, risk in currency conversion is ever present. Key

methods for pricing such exposures into contracts and the methods of Calculating Market Risk

creating forward exchange contracts are outlined using a diagrammatic model. How can risk be calculated and valued from a financial perspective for each

individual class and instrument set?

Risk Management – Forex II

How to use options and swaps to reduce currency exposure is clearly delivered What is the price of risk throughout your business and how are such numbers

with several sets of examples. aggregated to assign an overall cost to delivery of trade finance?

Consortiums

Day Four – Wednesday, 28 May 2008 Establishing consortiums, detailing different types of working arrangements

and debt sharing/payment models are discussed using diagrammatic formats

for ease of comprehension.

Internal Trade Finance Focus

Workshop

A specific focus on how to run a trade finance business internally by creating a Workshop for a full running consortium with a multi-payment model is built

framework for establishing policy decision making processes, exploring how to up in stages showing the legal layer, the risk layer, the delivery layer and the

benchmark such policy networks and becoming responsive to changing financial baseline.

positions in both the acquisition of raw materials and the sale of finished

goods.

Controlling Trade Finance Risk

Outside traditional delivery failure, an exploration into the types of instruments

(such as insurance) for controlling trade break is presented. Insight into Meet Your Expert Course Leader

capturing fraud and formalising a control set to monitor risks at different level

sets is discussed.

Martin Davies is a leading principal consultant and

How To Audit Trade Finance a specialist financial risk manager for Causal Capital.

Many banks struggle to audit this process and auditors are often confused He has extensive experience across the financial,

by the paper trail against underlying transaction. A way to improve auditing

effectiveness for trade finance controls is shown. utility and energy sectors with over ten years

background constructing best practice frameworks

The Role Of Staff Workflow for allowing businesses to manage their risk more

The full workflow between each staff member and their roles and authorities

during the trade is explained. The escalation levels for trade breaks, fraud effectively. He is an accredited financial specialist

checking and auditing are also outlined in an eco-system type model. and a journalist for PRMIA, the global risk organisation. In addition he

has worked both inside and outside the banking environment and can

Key Performance Indicator Set

explain trade finance from both sides of the game.

What is a key performance indicator set for trade finance, how can specific

trade finance projects be taxonomically ordered so that benchmarking can

occur and policy be designed against unsatisfactory indicator values?

Tel: 971-4-3352437 Fax: 971-4-3352438 Email: register@iirme.com Web: www.iirme.com/trade

Certif ied

IIR Middle East certified by

Trade Finance Specialist

25 – 29 May 2008 • JW Marriott Hotel, Dubai, UAE ISO 9001:2000

FIVE EASY WAYS TO REGISTER

971-4-3352437 971-4-3352438 register@iirme.com

IIR Holdings Ltd. GCS/IIR Holdings Ltd.

PO Box 21743, Dubai, UAE P O Box 13977, Muharraq, Kingdom of Bahrain

www.iirme.com/trade

For further information and Group Discounts

contact 971-4-3352483 or email: info@iirme.com

WEB BC2691

Yes, I want to register for:

Event Dates Price before Price between Price after

16 March 2008 16 March and 13 April 2008 13 April 2008

Certified Trade Finance 25 – 29 May 2008 US$ 4,250 US$ 4,550 US$ 4,750

Specialist (Save US$ 500) (Save US$ 200)

If you have eight or more delegates who need this training, contact IIR In-House on 971-4-3352439 or inhouse@iirme.com

Course fees include documentation, luncheon and refreshments. Delegates who attend all sessions will receive a Certificate of Attendance.

Personal Details:

Title First Name Surname Job Title Department Email

1 Delegate

st

2nd Delegate

3rd Delegate

4th Delegate

To assist us with future correspondence, please supply the following details:

Head of Department

Training Manager

Booking Contact

Company: .......................................................................................................................................................................................................................................................................................

Address (if different from label above): ............................................................................................................................................................................................................................................

.............................................................................................................................. Postcode: .................................................. Country: .......................................................................................

Tel: ......................................................... Fax: .....................................................

No. of employees on your site: Yes! I would like to receive information about future events & services via email.

0-49 50-249 250-499 500-999 1000+ My email address is: .....................................................................................................................

Nature of your company’s business: .................................................................................................................................................................................................................................................

Payments Cancellation

A confirmation letter and invoice will be sent upon receipt of your registration. Please note If you are unable to attend, a substitute Event Venue

that full payment must be received prior to the event. Only those delegates whose fees have delegate will be welcome in your place. If this

JW Marriott Hotel, Dubai, UAE

been paid in full will be admitted to the event. You can pay by company cheques or bankers is not suitable, a US$ 200 service charge will

be payable. Registrations cancelled less than Tel: 971-4-2624444

draft in Dirhams or US$. Please note that all US$ cheques and drafts should be drawn on a

New York bank and an extra amount of US$ 6 per payment should be added to cover bank seven days before the event must be paid in

clearing charges. In case you prefer payment in Dirhams, please use our exchange rate - full. Accommodation Details

We highly recommend you secure your room

US$ 1 = AED 3.6724. All payments should be made in favour of IIR Holdings Ltd. Avoid Visa Delays – Book Now reservation at the earliest to avoid last minute

Delegates requiring visas should contact the

Card Payment hotel they wish to stay at directly, as soon as

inconvenience. You can contact the IIR

Please charge my credit card: Visa Mastercard American Express Hospitality Desk for assistance on:

possible. Visas for non-GCC nationals may take

several weeks to process. Tel: 971-4-4072693

Name on Card: ..................................................................................................................... Fax: 971-4-4072517

Due to unforeseen circumstances, the programme

Card Number: ....................................................................... Exp. Date: ............................... may change and IIR reserves the right to alter the Email: hospitality@iirme.com

venue and/or speakers.

Signature: .............................................................................................................................

CJ PG F150 Finance © Copyright I.I.R. HOLDINGS B.V.

You might also like

- Labour Act, 2023 - Passed June 12th 2023Document101 pagesLabour Act, 2023 - Passed June 12th 2023Isatou MannehNo ratings yet

- Economics Project: Effects On PPC Due To Various Government PoliciesDocument11 pagesEconomics Project: Effects On PPC Due To Various Government PoliciesHarsha Billore88% (121)

- How To Win Friends and Influence PeopleDocument2 pagesHow To Win Friends and Influence PeopleKeith Parker100% (3)

- Euromoney Books - Shipping Finance, 3rd Edition - Leasing & Asset Finance - BooksDocument5 pagesEuromoney Books - Shipping Finance, 3rd Edition - Leasing & Asset Finance - Booksahong100No ratings yet

- Argus: Tanker FreightDocument25 pagesArgus: Tanker FreightIvan OsipovNo ratings yet

- Session 3 - Valuation Model - AirportsDocument105 pagesSession 3 - Valuation Model - AirportsPrathamesh GoreNo ratings yet

- Galena Asset Management BrochureDocument7 pagesGalena Asset Management Brochureabiesaga90No ratings yet

- Brief History of TimeDocument10 pagesBrief History of TimeKeith ParkerNo ratings yet

- 18 Gasstation ValuationDocument53 pages18 Gasstation ValuationipjdsgsergjNo ratings yet

- IFM Presentation On IFCDocument18 pagesIFM Presentation On IFCSyefSazzadNo ratings yet

- Voyage Cash Flow AnalysisDocument4 pagesVoyage Cash Flow AnalysisNivaldo Pedro100% (1)

- MAS ClearSight Corporate ProfileDocument36 pagesMAS ClearSight Corporate Profilemaycol romeoNo ratings yet

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- IQPC Airport Security BrochureDocument4 pagesIQPC Airport Security BrochureKeith ParkerNo ratings yet

- University Notes - Senior Year, 2nd SemesterDocument568 pagesUniversity Notes - Senior Year, 2nd SemesterKeith ParkerNo ratings yet

- Vitolgroupbrochure2011 13003224000686 Phpapp02Document34 pagesVitolgroupbrochure2011 13003224000686 Phpapp02sthegNo ratings yet

- Market+Roadmap+ +ugandaDocument99 pagesMarket+Roadmap+ +ugandaMuse AFNo ratings yet

- Trade FinanceDocument8 pagesTrade FinanceMetta TerraNo ratings yet

- Itd 04 Ucp 600 LC MechanismDocument28 pagesItd 04 Ucp 600 LC MechanismVvs RaoNo ratings yet

- UaeDocument8 pagesUaeAnand ArgNo ratings yet

- The Difference Between Risk of Default and Risk of LossDocument4 pagesThe Difference Between Risk of Default and Risk of LossNikos NoulezasNo ratings yet

- Trade & Commodity Finance Experience BrochureDocument28 pagesTrade & Commodity Finance Experience BrochureRongye Daniel Lai0% (1)

- Commodity MarketDocument31 pagesCommodity MarketrzajamNo ratings yet

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1No ratings yet

- IIFM Sukuk Report (3rd Edition) A Comprehensive Study of The Global Sukuk MarketDocument86 pagesIIFM Sukuk Report (3rd Edition) A Comprehensive Study of The Global Sukuk MarketririnkhairaniNo ratings yet

- Aurionpro AR 2013Document104 pagesAurionpro AR 2013susegaadNo ratings yet

- CommodityTradingHubs. SingaporeDocument20 pagesCommodityTradingHubs. SingaporeSaumya Raizada100% (1)

- Redstone Commodity Update Q1 2020Document13 pagesRedstone Commodity Update Q1 2020Frianata ZrNo ratings yet

- Advancing Trade Trafigura Corporate Brochure 2017 enDocument40 pagesAdvancing Trade Trafigura Corporate Brochure 2017 enfalsflorinNo ratings yet

- Crude Oil Methodology PDFDocument58 pagesCrude Oil Methodology PDFMaha AliNo ratings yet

- FINALbank of BarodaDocument27 pagesFINALbank of BarodaAbdussamad ChandiwalaNo ratings yet

- Checklist MindmapDocument25 pagesChecklist Mindmapsadgh gyuhj0% (1)

- ACT - Treasurer's Guide To Trade Finance - 2nd - EditionDocument316 pagesACT - Treasurer's Guide To Trade Finance - 2nd - Editionmyokyawthu671989No ratings yet

- Asia Refined Oil Products Methodology PDFDocument45 pagesAsia Refined Oil Products Methodology PDFAli Hyder SyedNo ratings yet

- Loan SalesDocument17 pagesLoan SalesWILLY SETIAWANNo ratings yet

- Trafigura Job DescDocument4 pagesTrafigura Job DescMarius George CiubotariuNo ratings yet

- Project & Trade FinanceDocument8 pagesProject & Trade FinanceasfasfqweNo ratings yet

- Status and Issues in SMEs Financing Through Digital Innovation in MyanmarDocument25 pagesStatus and Issues in SMEs Financing Through Digital Innovation in MyanmarADBI EventsNo ratings yet

- CommoditiesDocument122 pagesCommoditiesAnil TiwariNo ratings yet

- DB Corp Pinc 071210Document51 pagesDB Corp Pinc 071210Jayantwin KatiaNo ratings yet

- Oliver Wyman Transaction Banking Trade FinanceDocument29 pagesOliver Wyman Transaction Banking Trade FinanceRc CaloNo ratings yet

- The Strategy of Sinochem Group Oil and Gas ResourceDocument20 pagesThe Strategy of Sinochem Group Oil and Gas ResourceQingming MaNo ratings yet

- Case Study-Entring International MarketDocument6 pagesCase Study-Entring International MarketfeelfreetodropinNo ratings yet

- ICC Global Trade and Finance Survey 2014Document144 pagesICC Global Trade and Finance Survey 2014Radu Victor Tapu100% (1)

- A Project On Commodity TradingDocument80 pagesA Project On Commodity Tradingswami808100% (9)

- Commodity and Dry Bulk OutlookDocument21 pagesCommodity and Dry Bulk Outlooktuyetnt20016337No ratings yet

- Dry Bulk Research 9sep16Document13 pagesDry Bulk Research 9sep16Takis RappasNo ratings yet

- Border Export Zones Gateway To Uganda's Regional MarketsDocument1 pageBorder Export Zones Gateway To Uganda's Regional MarketsThe Observer Media LtdNo ratings yet

- Issues in Commodity FinanceDocument23 pagesIssues in Commodity FinancevinaymathewNo ratings yet

- Example ConfirmationDocument19 pagesExample ConfirmationAnonymous mowhIc5LyNo ratings yet

- US EIA March 2022 Libya Country Analysis Executive SummaryDocument11 pagesUS EIA March 2022 Libya Country Analysis Executive SummarySalah ElbakkoushNo ratings yet

- IBFE Note 1Document9 pagesIBFE Note 1Dinesh SinghNo ratings yet

- Fortis Bank Maritime FinanceDocument43 pagesFortis Bank Maritime FinancebluepperNo ratings yet

- Rajiv ShahDocument32 pagesRajiv ShahRajiv ShahNo ratings yet

- M& A Version 1.1Document34 pagesM& A Version 1.1goelabhishek90No ratings yet

- Energy TradeDocument48 pagesEnergy TradeNaina Singh AdarshNo ratings yet

- Manappuram General Finance & Leasing Ltd. (Gold Loan)Document14 pagesManappuram General Finance & Leasing Ltd. (Gold Loan)Rushabh ShahNo ratings yet

- Trade Finance Import SabDocument67 pagesTrade Finance Import SabMohammed BilalNo ratings yet

- Cargill // Steel SwapsDocument14 pagesCargill // Steel Swapsinfo8493No ratings yet

- India Consumer - Enjoying A Slice of Luxury.248.175.146Document60 pagesIndia Consumer - Enjoying A Slice of Luxury.248.175.146Harinig05No ratings yet

- Infrastructure FinanceDocument7 pagesInfrastructure FinanceKaran VasheeNo ratings yet

- Transhipment Criterion Based On UCP 600Document2 pagesTranshipment Criterion Based On UCP 600Prac AnalyzeNo ratings yet

- GCC Banking Sector Detailed ReportDocument534 pagesGCC Banking Sector Detailed ReportSurendra JainNo ratings yet

- Traits - 23andmeDocument1 pageTraits - 23andmeKeith ParkerNo ratings yet

- Genome Keith Parker Full 20110831072202Document8,792 pagesGenome Keith Parker Full 20110831072202Keith ParkerNo ratings yet

- A Briefer History of Time PicturesDocument40 pagesA Briefer History of Time PicturesSagar DuwalNo ratings yet

- Gazetter of The Persian Gulf, Oman and Central Arabia Abu Dhabi GeographyDocument16 pagesGazetter of The Persian Gulf, Oman and Central Arabia Abu Dhabi GeographyKeith ParkerNo ratings yet

- Keith Alan Parker - Family TreeDocument1 pageKeith Alan Parker - Family TreeKeith ParkerNo ratings yet

- Eye On Earth BrochureDocument5 pagesEye On Earth BrochureKeith ParkerNo ratings yet

- MoneyWeek Article With QuoteDocument3 pagesMoneyWeek Article With QuoteKeith ParkerNo ratings yet

- University Notes - Junior Year, 1st SemesterDocument424 pagesUniversity Notes - Junior Year, 1st SemesterKeith Parker100% (2)

- 16th Annual Internal Audit CongressDocument8 pages16th Annual Internal Audit CongressKeith ParkerNo ratings yet

- Product Launching and Brand Positioning StrategiesDocument6 pagesProduct Launching and Brand Positioning StrategiesKeith Parker100% (5)

- Innovative Audit ReportingDocument6 pagesInnovative Audit ReportingKeith ParkerNo ratings yet

- Advanced ExcelDocument6 pagesAdvanced ExcelKeith Parker100% (4)

- Project Management For Special EventsDocument6 pagesProject Management For Special EventsKeith ParkerNo ratings yet

- LicDocument56 pagesLicvarshaNo ratings yet

- Challenges For Human Resource Management and Global Business StrategyDocument6 pagesChallenges For Human Resource Management and Global Business StrategyRoselle AbuelNo ratings yet

- Learnforexforex Market StructureDocument9 pagesLearnforexforex Market Structurelewgraves33No ratings yet

- TATA STEEL's Acquisition of CORUSDocument9 pagesTATA STEEL's Acquisition of CORUSPallabi DowarahNo ratings yet

- Planning Final ReportDocument30 pagesPlanning Final ReportAndyMaviaNo ratings yet

- DATEM Portfolio 1Document21 pagesDATEM Portfolio 1allyssa monica duNo ratings yet

- An Introduction To Portfolio OptimizationDocument55 pagesAn Introduction To Portfolio OptimizationMarlee123100% (1)

- Defining Marketing For The 21st CenturyDocument46 pagesDefining Marketing For The 21st CenturytawandaNo ratings yet

- Principles of Institutional EconomicsDocument73 pagesPrinciples of Institutional EconomicsAriq Hasna SalsabilaNo ratings yet

- Management-A Study On Inventory-Nandini RavichandranDocument14 pagesManagement-A Study On Inventory-Nandini RavichandranBESTJournalsNo ratings yet

- Business Plan Otaku Haven Restaurant A.S., Fortuna Street Bakilid Mandaue CityDocument6 pagesBusiness Plan Otaku Haven Restaurant A.S., Fortuna Street Bakilid Mandaue CityRhea DelarmenteNo ratings yet

- in Most Cases, A Company Sets The Price Instead of It Being Set by The Competitive MarketDocument1 pagein Most Cases, A Company Sets The Price Instead of It Being Set by The Competitive MarketCamille SalasNo ratings yet

- Good Governance in CooperativesDocument7 pagesGood Governance in CooperativesMichael Nyaongo100% (3)

- Revision MarketingDocument8 pagesRevision MarketingAnna FossiNo ratings yet

- Ichwamba Mixed Farm Project Concept PaperDocument3 pagesIchwamba Mixed Farm Project Concept Paperabrham astatikeNo ratings yet

- Public Borrowing and Debt Management by Mario RanceDocument47 pagesPublic Borrowing and Debt Management by Mario RanceWo Rance100% (2)

- JFK EO 11110 and The FedDocument7 pagesJFK EO 11110 and The FedGuy Razer100% (3)

- Mutual Fund ScriptDocument12 pagesMutual Fund ScriptSudheesh Murali NambiarNo ratings yet

- Chapter 6 Theory and Estimation of Production Function MCQs1Document8 pagesChapter 6 Theory and Estimation of Production Function MCQs1Muhammad Ahmed100% (1)

- Indian Institute of Management Kozhikode Executive Post Graduate Programme in ManagementDocument3 pagesIndian Institute of Management Kozhikode Executive Post Graduate Programme in Managementreva_radhakrish1834No ratings yet

- HRM-360 Final ReportDocument16 pagesHRM-360 Final Reportamir hamza sajidNo ratings yet

- Some MCQDocument3 pagesSome MCQJPIA-UE Caloocan '19-20 AcademicsNo ratings yet

- Article ReviewDocument2 pagesArticle ReviewRameNo ratings yet

- AS-2-Valuation of Inventories PDFDocument6 pagesAS-2-Valuation of Inventories PDFRanjith Kumar CANo ratings yet

- Private: Anarchy and InventionDocument4 pagesPrivate: Anarchy and InventionMischa ByruckNo ratings yet

- SME Banking MasterclassDocument8 pagesSME Banking MasterclassJoan MilokNo ratings yet

- Flat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarDocument1 pageFlat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarSatvant Singh SarwaraNo ratings yet

- Hiring PolicyDocument3 pagesHiring PolicyEhtesham ShoukatNo ratings yet

- Fin Man HeavenDocument6 pagesFin Man HeavenJoshelFlorentinoNo ratings yet