Professional Documents

Culture Documents

Starhill Global REIT Ending 1Q14 On High Note

Starhill Global REIT Ending 1Q14 On High Note

Uploaded by

ventriaCopyright:

Available Formats

You might also like

- Astm A370 2020Document50 pagesAstm A370 2020امين100% (1)

- 5008S Fresenuis Service ManualDocument318 pages5008S Fresenuis Service ManualEslam Karam100% (10)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Capital Mall TrustDocument7 pagesCapital Mall TrustChan Weng HongNo ratings yet

- Singtel - : No Myanmar, No ProblemDocument4 pagesSingtel - : No Myanmar, No Problemscrib07No ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Ho Bee Investment LTD: Positive 1Q2013 ResultsDocument9 pagesHo Bee Investment LTD: Positive 1Q2013 ResultsphuawlNo ratings yet

- City DevelopmentsDocument6 pagesCity DevelopmentsJay NgNo ratings yet

- Kajaria Ceramics: Upgrade in Price TargetDocument4 pagesKajaria Ceramics: Upgrade in Price TargetSudipta BoseNo ratings yet

- SBI Offshore 1HFY2013 PresentationDocument17 pagesSBI Offshore 1HFY2013 PresentationWeR1 Consultants Pte LtdNo ratings yet

- Keppel Corp 090713 Research Report by DaiwaDocument5 pagesKeppel Corp 090713 Research Report by DaiwatansillyNo ratings yet

- AgilityDocument5 pagesAgilityvijayscaNo ratings yet

- OCBC Research Report 2013 July 9 by MacquarieDocument6 pagesOCBC Research Report 2013 July 9 by MacquarietansillyNo ratings yet

- Bakrie Sumatra Plantation: Perplexing End To A Confusing YearDocument5 pagesBakrie Sumatra Plantation: Perplexing End To A Confusing YearerlanggaherpNo ratings yet

- University of Wales and Mdis: Introduction To Accounting (Hk004)Document11 pagesUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNo ratings yet

- Ho Bee Investment LTD: Healthy Pre-Commitment For Office SpaceDocument9 pagesHo Bee Investment LTD: Healthy Pre-Commitment For Office SpacephuawlNo ratings yet

- Wing Tai Holdings: 2QFY11 Results ReviewDocument4 pagesWing Tai Holdings: 2QFY11 Results ReviewRaymond LuiNo ratings yet

- Ascendas Reit - DaiwaDocument5 pagesAscendas Reit - DaiwaTerence Seah Pei ChuanNo ratings yet

- Weekly S-Reit TrackerDocument4 pagesWeekly S-Reit TrackerChan Weng HongNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- CRISIL Event UpdateDocument4 pagesCRISIL Event UpdateAdarsh Sreenivasan LathikaNo ratings yet

- Nikko Spore Divd Fund FactsheetDocument2 pagesNikko Spore Divd Fund FactsheetSivakumar NityanandanNo ratings yet

- Oil - PL PDFDocument3 pagesOil - PL PDFDarshan MaldeNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- 7jul11 - Tiger AirwaysDocument3 pages7jul11 - Tiger AirwaysmelyeapNo ratings yet

- Samsung C&T: Growth Back On TrackDocument5 pagesSamsung C&T: Growth Back On TrackksathsaraNo ratings yet

- Comfort Delgro - NomuraDocument28 pagesComfort Delgro - NomuraTerence Seah Pei ChuanNo ratings yet

- Symphony LTD.: CompanyDocument4 pagesSymphony LTD.: CompanyrohitcoepNo ratings yet

- Jyoti Structures: Performance HighlightsDocument10 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- Media Chinese Intn'L: Company ReportDocument5 pagesMedia Chinese Intn'L: Company ReportAlan Chan Tee SiongNo ratings yet

- Derivatives Report 19th April 2012Document3 pagesDerivatives Report 19th April 2012Angel BrokingNo ratings yet

- Market Watch Daily 14.10Document1 pageMarket Watch Daily 14.10LBTodayNo ratings yet

- KKR Investor UpdateDocument8 pagesKKR Investor Updatepucci23No ratings yet

- Tat Hong Research 26 AprDocument4 pagesTat Hong Research 26 AprmervynteoNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- PTC India (POWTRA) : Disappointment On Tolling and Other IncomeDocument8 pagesPTC India (POWTRA) : Disappointment On Tolling and Other Incomedrsivaprasad7No ratings yet

- Unilever Thomson 19feb2011Document10 pagesUnilever Thomson 19feb2011Fahsaika JantarathinNo ratings yet

- CMT Ar 2009Document180 pagesCMT Ar 2009Sassy TanNo ratings yet

- Chip Eng Seng: Alexandra Central Profit Is Lower Than EstimatedDocument5 pagesChip Eng Seng: Alexandra Central Profit Is Lower Than EstimatedphuawlNo ratings yet

- BIMBSec - Digi Company Update - 20120502Document3 pagesBIMBSec - Digi Company Update - 20120502Bimb SecNo ratings yet

- Cordlife Group Limited: Results ReviewDocument10 pagesCordlife Group Limited: Results ReviewKelvin FuNo ratings yet

- Bartronics LTD (BARLTD) : Domestic Revenues Take A HitDocument4 pagesBartronics LTD (BARLTD) : Domestic Revenues Take A HitvaluelettersNo ratings yet

- Writting Assignement Unit 6Document3 pagesWritting Assignement Unit 6Paw Akou-edi100% (1)

- NTB - Quick View - 23.08.2013Document2 pagesNTB - Quick View - 23.08.2013Randora LkNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaNo ratings yet

- 110516-OSK-1QFY11 Results Review - Affected by External FactorsDocument4 pages110516-OSK-1QFY11 Results Review - Affected by External FactorsTodd BenuNo ratings yet

- Derivatives Report 31st DecDocument3 pagesDerivatives Report 31st DecAngel BrokingNo ratings yet

- Jyoti Structures 4Q FY 2013Document10 pagesJyoti Structures 4Q FY 2013Angel BrokingNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksrajdeeppawarNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- Head and Shoulders Broken: Punter's CallDocument5 pagesHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNo ratings yet

- 2013-5-13 Big OcbcDocument5 pages2013-5-13 Big OcbcphuawlNo ratings yet

- Wilmar International: Outperform Price Target: SGD 4.15Document4 pagesWilmar International: Outperform Price Target: SGD 4.15KofikoduahNo ratings yet

- Dubai Islamic Bank Results Update 16 AugustDocument4 pagesDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanNo ratings yet

- Sembawang Marine 3 August 2012Document6 pagesSembawang Marine 3 August 2012tansillyNo ratings yet

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocument20 pagesBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNo ratings yet

- Technics Oil & Gas: 3QFY12 Results ReviewDocument4 pagesTechnics Oil & Gas: 3QFY12 Results ReviewtansillyNo ratings yet

- File 28052013214151 PDFDocument45 pagesFile 28052013214151 PDFraheja_ashishNo ratings yet

- Birla Sun Life Cash ManagerDocument6 pagesBirla Sun Life Cash ManagerrajloniNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Artificial Intelligence Global Ex UsDocument28 pagesArtificial Intelligence Global Ex UsventriaNo ratings yet

- Insas BerhadDocument3 pagesInsas BerhadventriaNo ratings yet

- Small Caps: Singapore Small-Cap ConferenceDocument12 pagesSmall Caps: Singapore Small-Cap ConferenceventriaNo ratings yet

- Memtech International Not Rated: A Visit To China FactoriesDocument12 pagesMemtech International Not Rated: A Visit To China FactoriesventriaNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- 21 May Technical FocusDocument1 page21 May Technical FocusventriaNo ratings yet

- 23 May 14 Market OpnionDocument1 page23 May 14 Market OpnionventriaNo ratings yet

- Hang Seng Index FuturesDocument3 pagesHang Seng Index FuturesventriaNo ratings yet

- 23 May 14 CPO FuturesDocument1 page23 May 14 CPO FuturesventriaNo ratings yet

- Daily Market Commentary: FBMKLCI Futures: Technical AnalysisDocument1 pageDaily Market Commentary: FBMKLCI Futures: Technical AnalysisventriaNo ratings yet

- Frasers Commercial Trust: Charted TerritoryDocument2 pagesFrasers Commercial Trust: Charted TerritoryventriaNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Market Pulse 130619Document5 pagesMarket Pulse 130619ventriaNo ratings yet

- Tut Sheet7Document2 pagesTut Sheet7Ekta SharmaNo ratings yet

- Lienard EquationDocument9 pagesLienard EquationmenguemengueNo ratings yet

- Partnership in Class Questions 2015Document3 pagesPartnership in Class Questions 2015Nella KingNo ratings yet

- Norton TheoremDocument18 pagesNorton TheoremZohaib NasirNo ratings yet

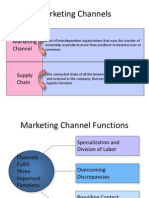

- Channel DecisionsDocument30 pagesChannel Decisionsuzmatabassum1996No ratings yet

- Worksheet Research-Title FINALDocument3 pagesWorksheet Research-Title FINALJierroe EvangelistaNo ratings yet

- SK Abyip - San Felipe Cy 2023Document9 pagesSK Abyip - San Felipe Cy 2023Cazy Mel EugenioNo ratings yet

- Chapter 1.2 Types of Organisation (Notes)Document5 pagesChapter 1.2 Types of Organisation (Notes)S RameshNo ratings yet

- B94-6 R1995 E1984Document21 pagesB94-6 R1995 E1984zojoNo ratings yet

- Rahmania Tbi 6 D Soe...Document9 pagesRahmania Tbi 6 D Soe...Rahmania Aulia PurwagunifaNo ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- FracShield Composite Frac PlugDocument3 pagesFracShield Composite Frac PlugJOGENDRA SINGHNo ratings yet

- Find Me Phoenix Book 6 Stacey Kennedy Full ChapterDocument67 pagesFind Me Phoenix Book 6 Stacey Kennedy Full Chaptercatherine.anderegg828100% (21)

- CCC-BMG MOON 3-2 - Within Dwarvenholm v2.0Document30 pagesCCC-BMG MOON 3-2 - Within Dwarvenholm v2.0MarianoNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- Onco, TSG & CancerDocument8 pagesOnco, TSG & Cancersumera120488No ratings yet

- BitBox CarList 2022 10 28Document97 pagesBitBox CarList 2022 10 28marcos hernandezNo ratings yet

- FACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksDocument3 pagesFACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksHasaan HussainNo ratings yet

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- Create Database Taller-AdalbertoDocument2 pagesCreate Database Taller-AdalbertoAdalberto GonzalezNo ratings yet

- Case 4.2 Comptronic CorporationDocument2 pagesCase 4.2 Comptronic CorporationThao NguyenNo ratings yet

- Apuntes Ingles b2Document25 pagesApuntes Ingles b2Arancha ManeiroNo ratings yet

- Organic Halides Introduction Class-1 NotesDocument15 pagesOrganic Halides Introduction Class-1 Notessiddhartha singhNo ratings yet

- WRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkDocument2 pagesWRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkFatmah El WardagyNo ratings yet

- Edc 2Document103 pagesEdc 2abhi_engg06No ratings yet

- Japanese Quality Tools and TechniquesDocument36 pagesJapanese Quality Tools and TechniquesNab JiNo ratings yet

- JF 2 14 PDFDocument32 pagesJF 2 14 PDFIoannis GaridasNo ratings yet

Starhill Global REIT Ending 1Q14 On High Note

Starhill Global REIT Ending 1Q14 On High Note

Uploaded by

ventriaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Starhill Global REIT Ending 1Q14 On High Note

Starhill Global REIT Ending 1Q14 On High Note

Uploaded by

ventriaCopyright:

Available Formats

Singapore | REITs

Asia Pacific Equity Research

STARHILL GLOBAL REIT | BUY

MARKET CAP: USD 1.4B AVG DAILY TURNOVER: USD 1M 30 Apr 2014 Company Update

ENDING 1Q14 ON HIGH NOTE

1Q14 DPU at 1.24 S cents 8.9%-11.7% reversions achieved Expect AEIs and capital recycling

BUY (maintain)

Fair value add: 12m dividend forecast versus: Current price 12m total return forecast S$0.90 S$0.051 S$0.82 17%

1Q14 growth distorted by Toshin arrears Starhill Global REIT (SGREIT) released its 1Q14 results last evening. Gross revenue came in at S$49.2m, down 8.3% YoY, while NPI tallied S$39.1m, down 6.7%. The headline growth figures, we note, were distorted by one-off receipt of net rental arrears from Toshin master lease in 1Q13. Excluding this, revenue and NPI would have climbed 1.8% and 2.5%, respectively. Similarly, DPU of 1.24 S cents was 9.5% lower. However, after stripping out the Toshin payout, DPU would have registered a 5.1% increase. We deem the results to be in line with expectations, as the quarterly distribution met 24.1%/24.8% of our/consensus full-year projections. Robust underlying performance The Singapore portfolio again hit a high note in 1Q, clocking a 7.6% growth in NPI (excluding Toshin arrears) as a result of improved occupancies and high secured rentals from both the retail and office segments. While Wisma Atria retail sales efficiency of S$130 psf was a tad lower than the S$138 seen in 2013 due to ongoing tenant relocations/renovations, a strong 8.9% rental reversion was achieved. For the Singapore offices, rents for leases committed during the quarter were also 11.7% higher than preceding contracted rates. In Australia, we note that SGREIT continued to benefit from incremental income from Plaza Arcade, thereby pushing the Australia assets NPI up 9.9% YoY. This helped to offset lower contribution from its Malaysia and China assets, which were impacted by weaker Malaysian Ringgit and intense competition respectively. Maintain BUY with unchanged fair value Looking ahead, SGREIT disclosed that it will continue to refine its portfolio and explore potential asset enhancement initiatives (AEIs). The redevelopment plans to tap unutilised space between David Jones building and Plaza Arcade are now in planning stage, and may be executed in 2H14 in our view. We are also positive on SGREITs recent move to divest Holon L in Japan. We do not rule out more divestments going forward, which would not only turn SGREIT into a more Singapore-centric landlord but also provide it with resources to implement its AEIs. Maintain BUY with unchanged S$0.90 fair value.

Key financial highlights Year Ended 31 Dec (S$ m) Gross revenue Total property expenses Net property income Amount available for distribution DPU per share (S cents) Cons. DPU (S cents) DPU yield (%) P/NAV (x) ROE (%) Gearing (%) FY12 186.0 -37.6 148.4 85.3 4.4 na 5.4 0.9 6.6 30.1 FY13 200.6 -42.8 157.9 107.8 5.0 na 6.1 0.9 13.5 28.7 FY14F 210.9 -42.4 168.5 110.6 5.1 5.0 6.3 0.9 6.6 28.6 FY15F 220.0 -44.4 175.6 117.2 5.4 5.1 6.7 0.9 6.9 28.3

Analysts Kevin Tan (Lead) +65 6531 9810 kevintan@ocbc-research.com Eli Lee +65 6531 9112 elilee@ocbc-research.com Key information Market cap. (m) Avg daily turnover (m) Avg daily vol. (m) 52-wk range (S$) Free float (%) Shares o/s. (m) Exchange BBRG ticker Reuters ticker ISIN code GICS Sector GICS Industry Top shareholder S$1,755 / USD1,397 S$2 / USD1 1.9 0.75 - 0.99 63.0 2,153.2 SGX SGREIT SP STHL.SI P4OU Financials REITs YTL Corp - 36.3% 1m 4 1 3m 7 0 12m -12 -12

Relative total return Company (%) STI-adjusted (%) Price performance chart

Sources: Bloomberg, OIR estimates

Industry-relative metrics

Note: Industry universe defined as companies under identical GICS classification listed on the same exchange. Sources: Bloomberg, OIR estimates

Please refer to important disclosures at the back of this document.

MCI (P) 004/06/2013

OCBC Investment Research Singapore Equities

Exhibit 1: Segmental performance

Source: REIT Manager

Exhibit 2: Occupancy rate breakdown by country

Source: REIT Manager

OCBC Investment Research Singapore Equities

Exhibit 3: Lease expiry profile

Source: REIT Manager

Exhibit 4: Debt maturity profile

Source: REIT Manager

OCBC Investment Research Singapore Equities

Exhibit 5: Quarterly financial highlights 1Q13 (S$m) 53.6 -11.7 41.9 -3.5 -0.7 0.1 -7.6 0.0 0.1 30.1 0.9 31.0 -1.1 29.9 -0.1 29.8 -2.3 -0.9 26.6 1Q14 (S$m) 49.2 -10.1 39.1 -3.7 -0.7 0.2 -7.4 0.0 0.3 27.9 0.0 27.9 -0.7 27.2 0.7 27.9 -0.3 -0.9 26.7 % Chg (YoY) -8.3% -13.7% -6.7% 4.4% 6.5% 62.8% -3.0% nm 253.7% -7.3% nm -9.9% -30.9% -9.1% nm -6.4% -88.7% 1.8% 0.3% 4Q13 (S$m) 49.1 -10.3 38.8 -3.6 -0.8 0.2 -7.4 0.0 0.0 27.1 0.7 165.4 0.1 165.4 -0.7 27.2 -0.3 -0.5 26.5 % Chg (QoQ) 0.3% -1.5% 0.8% 1.6% -13.6% 28.8% -0.6% nm nm 2.8% nm -83.1% nm -83.6% nm 2.3% -2.3% 85.1% 0.8%

Gross revenue Property operating expenses Net property income Management fees Trust expenses Finance income Finance costs Realised foreign exchange gain/(loss) Fair value adjustment on security deposits Net income Change in fair value of unrealised derivative instruments Total return for the year before income tax Income tax expense Total return for the year after income tax expense Non-tax deductible expenses, net and other adjustments Income available for distribution Less: CPU Holders Less: Other adjustments Amount available for distribution to unitholders

Source: REIT Manager

Exhibit 6: Valuation methodology Dividend Discount Model (DDM) Valuation Period Amount for distribution (S$ '000) DPU (S cents) Terminal value (S cents) Present value of DPU (S cents) Fair value (S$) Current price (S$) Potential upside (%) DPU yield (%) Total expected return (%)

Sources: OIR estimates

FY14F 110,594 5.14 4.75 0.90 0.82 10.4% 6.3% 16.7%

FY15F 117,231 5.44 4.66

FY16F 124,022 5.76 4.57

FY17F 130,807 6.07 4.46

FY18F 137,727 6.40 99.37 71.87

OCBC Investment Research Singapore Equities

Company financial highlights

Income statement Year Ended 31 Dec (S$ m) Gross revenue Total property expenses Net property income Net finance costs Manager's management fees Other expenses Net income Total return for the period Adjustments Amount available for distribution

FY12 186.0 -37.6 148.4 -32.1 -14.1 -1.7 100.6 111.1 -25.8 85.3

FY13 200.6 -42.8 157.9 -29.6 -14.2 -3.4 110.7 250.0 -142.1 107.8

FY14F 210.9 -42.4 168.5 -29.4 -14.9 -3.4 120.8 131.9 -21.3 110.6

FY15F 220.0 -44.4 175.6 -29.3 -15.0 -3.5 127.7 138.7 -21.5 117.2

Balance sheet As at 31 Dec (S$ m) Investment properties Properties under development Cash Total current assets Total assets Current liabilities ex debt Debt Total liabilities Unitholders' funds Total equity and liabilities

FY12 2,713.0 0.0 79.4 88.7 2,820.2 47.6 849.4 938.1 1,708.6 2,820.2

FY13 2,854.4 0.0 58.0 68.3 2,943.2 45.2 845.9 933.0 1,989.8 2,943.2

FY14F 2,868.7 0.0 64.5 73.0 2,962.5 44.5 845.9 934.0 2,008.1 2,962.5

FY15F 2,883.1 0.0 71.8 80.6 2,984.7 46.6 845.9 937.5 2,026.8 2,984.7

Cash flow statement Year Ended 31 Dec (S$ m) Total return Adjustments Operating income before working cap chgs Change in working capital Cash generated from operating activities Cashflow from investing activities Cashflow from financing activities Change in cash Cash at beginning of period Cash at end of period

FY12 135.6 -4.0 131.6 -15.7 115.8 -20.4 -121.0 -25.6 108.0 79.4

FY13 252.8 -111.8 141.0 0.1 141.1 -58.9 -101.8 -19.6 79.4 58.0

FY14F 135.3 14.9 150.2 -0.8 149.5 0.2 -143.2 6.5 58.0 64.5

FY15F 142.3 14.8 157.1 -0.4 156.7 0.3 -149.7 7.2 64.5 71.8

Key rates & ratios DPU per share (S cents) NAV per share (S cents) PER (x) P/NAV (x) NPI margin (%) Net income margin (%) Gearing (%) DPU yield (%) ROE (%) ROA (%) Sources: REIT Manager, OIR forecasts

FY12 4.4 87.9 12.9 0.9 79.8 54.1 30.1 5.4 6.6 3.9

FY13 5.0 92.4 6.8 0.9 78.7 55.2 28.7 6.1 13.5 8.7

FY14F 5.1 93.3 13.3 0.9 79.9 57.3 28.6 6.3 6.6 4.5

FY15F 5.4 94.1 12.6 0.9 79.8 58.1 28.3 6.7 6.9 4.7

Company financial highlights

OCBC Investment Research Singapore Equities

SHAREHOLDING DECLARATION: The analyst/analysts who wrote this report holds/hold NIL shares in the above security.

DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our written consent. This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations shall not be understood as neither given nor endorsed.

RATINGS AND RECOMMENDATIONS: - OCBC Investment Researchs (OIR) technical comments and recommendations are short-term and trading oriented. - OIRs fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIRs BUY rating indicates a total return in excess of 10% based on the current price; a HOLD rating indicates total returns within +10% and -5%; a SELL rating indicates total returns less than -5%.

Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd

Published by OCBC Investment Research Pte Ltd

Important disclosures

You might also like

- Astm A370 2020Document50 pagesAstm A370 2020امين100% (1)

- 5008S Fresenuis Service ManualDocument318 pages5008S Fresenuis Service ManualEslam Karam100% (10)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Capital Mall TrustDocument7 pagesCapital Mall TrustChan Weng HongNo ratings yet

- Singtel - : No Myanmar, No ProblemDocument4 pagesSingtel - : No Myanmar, No Problemscrib07No ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Ho Bee Investment LTD: Positive 1Q2013 ResultsDocument9 pagesHo Bee Investment LTD: Positive 1Q2013 ResultsphuawlNo ratings yet

- City DevelopmentsDocument6 pagesCity DevelopmentsJay NgNo ratings yet

- Kajaria Ceramics: Upgrade in Price TargetDocument4 pagesKajaria Ceramics: Upgrade in Price TargetSudipta BoseNo ratings yet

- SBI Offshore 1HFY2013 PresentationDocument17 pagesSBI Offshore 1HFY2013 PresentationWeR1 Consultants Pte LtdNo ratings yet

- Keppel Corp 090713 Research Report by DaiwaDocument5 pagesKeppel Corp 090713 Research Report by DaiwatansillyNo ratings yet

- AgilityDocument5 pagesAgilityvijayscaNo ratings yet

- OCBC Research Report 2013 July 9 by MacquarieDocument6 pagesOCBC Research Report 2013 July 9 by MacquarietansillyNo ratings yet

- Bakrie Sumatra Plantation: Perplexing End To A Confusing YearDocument5 pagesBakrie Sumatra Plantation: Perplexing End To A Confusing YearerlanggaherpNo ratings yet

- University of Wales and Mdis: Introduction To Accounting (Hk004)Document11 pagesUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNo ratings yet

- Ho Bee Investment LTD: Healthy Pre-Commitment For Office SpaceDocument9 pagesHo Bee Investment LTD: Healthy Pre-Commitment For Office SpacephuawlNo ratings yet

- Wing Tai Holdings: 2QFY11 Results ReviewDocument4 pagesWing Tai Holdings: 2QFY11 Results ReviewRaymond LuiNo ratings yet

- Ascendas Reit - DaiwaDocument5 pagesAscendas Reit - DaiwaTerence Seah Pei ChuanNo ratings yet

- Weekly S-Reit TrackerDocument4 pagesWeekly S-Reit TrackerChan Weng HongNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- CRISIL Event UpdateDocument4 pagesCRISIL Event UpdateAdarsh Sreenivasan LathikaNo ratings yet

- Nikko Spore Divd Fund FactsheetDocument2 pagesNikko Spore Divd Fund FactsheetSivakumar NityanandanNo ratings yet

- Oil - PL PDFDocument3 pagesOil - PL PDFDarshan MaldeNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- 7jul11 - Tiger AirwaysDocument3 pages7jul11 - Tiger AirwaysmelyeapNo ratings yet

- Samsung C&T: Growth Back On TrackDocument5 pagesSamsung C&T: Growth Back On TrackksathsaraNo ratings yet

- Comfort Delgro - NomuraDocument28 pagesComfort Delgro - NomuraTerence Seah Pei ChuanNo ratings yet

- Symphony LTD.: CompanyDocument4 pagesSymphony LTD.: CompanyrohitcoepNo ratings yet

- Jyoti Structures: Performance HighlightsDocument10 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- Media Chinese Intn'L: Company ReportDocument5 pagesMedia Chinese Intn'L: Company ReportAlan Chan Tee SiongNo ratings yet

- Derivatives Report 19th April 2012Document3 pagesDerivatives Report 19th April 2012Angel BrokingNo ratings yet

- Market Watch Daily 14.10Document1 pageMarket Watch Daily 14.10LBTodayNo ratings yet

- KKR Investor UpdateDocument8 pagesKKR Investor Updatepucci23No ratings yet

- Tat Hong Research 26 AprDocument4 pagesTat Hong Research 26 AprmervynteoNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- PTC India (POWTRA) : Disappointment On Tolling and Other IncomeDocument8 pagesPTC India (POWTRA) : Disappointment On Tolling and Other Incomedrsivaprasad7No ratings yet

- Unilever Thomson 19feb2011Document10 pagesUnilever Thomson 19feb2011Fahsaika JantarathinNo ratings yet

- CMT Ar 2009Document180 pagesCMT Ar 2009Sassy TanNo ratings yet

- Chip Eng Seng: Alexandra Central Profit Is Lower Than EstimatedDocument5 pagesChip Eng Seng: Alexandra Central Profit Is Lower Than EstimatedphuawlNo ratings yet

- BIMBSec - Digi Company Update - 20120502Document3 pagesBIMBSec - Digi Company Update - 20120502Bimb SecNo ratings yet

- Cordlife Group Limited: Results ReviewDocument10 pagesCordlife Group Limited: Results ReviewKelvin FuNo ratings yet

- Bartronics LTD (BARLTD) : Domestic Revenues Take A HitDocument4 pagesBartronics LTD (BARLTD) : Domestic Revenues Take A HitvaluelettersNo ratings yet

- Writting Assignement Unit 6Document3 pagesWritting Assignement Unit 6Paw Akou-edi100% (1)

- NTB - Quick View - 23.08.2013Document2 pagesNTB - Quick View - 23.08.2013Randora LkNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaNo ratings yet

- 110516-OSK-1QFY11 Results Review - Affected by External FactorsDocument4 pages110516-OSK-1QFY11 Results Review - Affected by External FactorsTodd BenuNo ratings yet

- Derivatives Report 31st DecDocument3 pagesDerivatives Report 31st DecAngel BrokingNo ratings yet

- Jyoti Structures 4Q FY 2013Document10 pagesJyoti Structures 4Q FY 2013Angel BrokingNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksrajdeeppawarNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- Head and Shoulders Broken: Punter's CallDocument5 pagesHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNo ratings yet

- 2013-5-13 Big OcbcDocument5 pages2013-5-13 Big OcbcphuawlNo ratings yet

- Wilmar International: Outperform Price Target: SGD 4.15Document4 pagesWilmar International: Outperform Price Target: SGD 4.15KofikoduahNo ratings yet

- Dubai Islamic Bank Results Update 16 AugustDocument4 pagesDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanNo ratings yet

- Sembawang Marine 3 August 2012Document6 pagesSembawang Marine 3 August 2012tansillyNo ratings yet

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocument20 pagesBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNo ratings yet

- Technics Oil & Gas: 3QFY12 Results ReviewDocument4 pagesTechnics Oil & Gas: 3QFY12 Results ReviewtansillyNo ratings yet

- File 28052013214151 PDFDocument45 pagesFile 28052013214151 PDFraheja_ashishNo ratings yet

- Birla Sun Life Cash ManagerDocument6 pagesBirla Sun Life Cash ManagerrajloniNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Artificial Intelligence Global Ex UsDocument28 pagesArtificial Intelligence Global Ex UsventriaNo ratings yet

- Insas BerhadDocument3 pagesInsas BerhadventriaNo ratings yet

- Small Caps: Singapore Small-Cap ConferenceDocument12 pagesSmall Caps: Singapore Small-Cap ConferenceventriaNo ratings yet

- Memtech International Not Rated: A Visit To China FactoriesDocument12 pagesMemtech International Not Rated: A Visit To China FactoriesventriaNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- 21 May Technical FocusDocument1 page21 May Technical FocusventriaNo ratings yet

- 23 May 14 Market OpnionDocument1 page23 May 14 Market OpnionventriaNo ratings yet

- Hang Seng Index FuturesDocument3 pagesHang Seng Index FuturesventriaNo ratings yet

- 23 May 14 CPO FuturesDocument1 page23 May 14 CPO FuturesventriaNo ratings yet

- Daily Market Commentary: FBMKLCI Futures: Technical AnalysisDocument1 pageDaily Market Commentary: FBMKLCI Futures: Technical AnalysisventriaNo ratings yet

- Frasers Commercial Trust: Charted TerritoryDocument2 pagesFrasers Commercial Trust: Charted TerritoryventriaNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Market Pulse 130619Document5 pagesMarket Pulse 130619ventriaNo ratings yet

- Tut Sheet7Document2 pagesTut Sheet7Ekta SharmaNo ratings yet

- Lienard EquationDocument9 pagesLienard EquationmenguemengueNo ratings yet

- Partnership in Class Questions 2015Document3 pagesPartnership in Class Questions 2015Nella KingNo ratings yet

- Norton TheoremDocument18 pagesNorton TheoremZohaib NasirNo ratings yet

- Channel DecisionsDocument30 pagesChannel Decisionsuzmatabassum1996No ratings yet

- Worksheet Research-Title FINALDocument3 pagesWorksheet Research-Title FINALJierroe EvangelistaNo ratings yet

- SK Abyip - San Felipe Cy 2023Document9 pagesSK Abyip - San Felipe Cy 2023Cazy Mel EugenioNo ratings yet

- Chapter 1.2 Types of Organisation (Notes)Document5 pagesChapter 1.2 Types of Organisation (Notes)S RameshNo ratings yet

- B94-6 R1995 E1984Document21 pagesB94-6 R1995 E1984zojoNo ratings yet

- Rahmania Tbi 6 D Soe...Document9 pagesRahmania Tbi 6 D Soe...Rahmania Aulia PurwagunifaNo ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- FracShield Composite Frac PlugDocument3 pagesFracShield Composite Frac PlugJOGENDRA SINGHNo ratings yet

- Find Me Phoenix Book 6 Stacey Kennedy Full ChapterDocument67 pagesFind Me Phoenix Book 6 Stacey Kennedy Full Chaptercatherine.anderegg828100% (21)

- CCC-BMG MOON 3-2 - Within Dwarvenholm v2.0Document30 pagesCCC-BMG MOON 3-2 - Within Dwarvenholm v2.0MarianoNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- Onco, TSG & CancerDocument8 pagesOnco, TSG & Cancersumera120488No ratings yet

- BitBox CarList 2022 10 28Document97 pagesBitBox CarList 2022 10 28marcos hernandezNo ratings yet

- FACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksDocument3 pagesFACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksHasaan HussainNo ratings yet

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- Create Database Taller-AdalbertoDocument2 pagesCreate Database Taller-AdalbertoAdalberto GonzalezNo ratings yet

- Case 4.2 Comptronic CorporationDocument2 pagesCase 4.2 Comptronic CorporationThao NguyenNo ratings yet

- Apuntes Ingles b2Document25 pagesApuntes Ingles b2Arancha ManeiroNo ratings yet

- Organic Halides Introduction Class-1 NotesDocument15 pagesOrganic Halides Introduction Class-1 Notessiddhartha singhNo ratings yet

- WRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkDocument2 pagesWRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkFatmah El WardagyNo ratings yet

- Edc 2Document103 pagesEdc 2abhi_engg06No ratings yet

- Japanese Quality Tools and TechniquesDocument36 pagesJapanese Quality Tools and TechniquesNab JiNo ratings yet

- JF 2 14 PDFDocument32 pagesJF 2 14 PDFIoannis GaridasNo ratings yet