Professional Documents

Culture Documents

Ch06Hull Fund7eTestBank

Ch06Hull Fund7eTestBank

Uploaded by

Julio InterianoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch06Hull Fund7eTestBank

Ch06Hull Fund7eTestBank

Uploaded by

Julio InterianoCopyright:

Available Formats

Test Bank: Chapter 6 Interest Rate Futures 1.

Which of following is applicable to corporate bonds in the United States (circle one) (a) Actual/360 (b) Actual/Actual (c) 30/360 (d) Actual/36 !. "t is #a$ 1. %he &uoted price of a bond with an Actual/36 da$ count and 1!' per annu( coupon in the United States is 10 . "t has a face )alue of 100 and pa$s coupons on April 1 and *ctober 1. What+ to two deci(al place accurac$+ is the cash price, - - - - - 3. What difference would it (a.e to $our answer to &uestion 3 if the bond/s da$ count were 30/360, - - - - - 0. %he &uoted futures price is 103. . Which of the following four bonds is cheapest to deli)er (circle one) (a) 1uoted price 2 1103 con)ersion factor 2 1.0000. (b) 1uoted price 2 1603 con)ersion factor 2 1. !00. (c) 1uoted price 21313 con)ersion factor 2 1.! 00. (d) 1uoted price 2 1033 con)ersion factor 2 1.3 00. . Which of the following is not an option open to the part$ with a short position in the %reasur$ bond futures contract (circle one) (a) %he abilit$ to deli)er an$ of a nu(ber of different bonds (b) %he wild card pla$ (c) %he fact that deli)er$ can be (ade an$ ti(e during the deli)er$ (onth (d) %he interest rate used in the calculation of the con)ersion factor 6. A trader enters into a long position in one 4urodollar futures contract. 5ow (uch does the trader gain when the futures price &uote increases b$ 6 basis points, -----6. A co(pan$ in)ests 71+000 in a fi)e8$ear 9ero8coupon bond and 70+000 in a ten8 $ear 9ero8coupon bond. What is the duration of the portfolio, - - - - - :. %he (odified duration of a bond portfolio worth 71 (illion is $ears. ;$ appro<i(atel$ how (uch does the )alue of the portfolio change if all $ields increase b$ basis points, "ndicate whether the dollar a(ount $ou calculate is an increase or a decrease - - - - - - - - - - - - -

=. A portfolio is worth 7!0+000+000. %he futures price for a %reasur$ note futures contract is 110 and each contract is for the deli)er$ of bonds with a face )alue of 7100+000. *n the deli)er$ date the duration of the bond that is e<pected to be cheapest to deli)er is 6 $ears and the duration of the portfolio will be . $ears. 5ow (an$ contracts are necessar$ for hedging the portfolio, - - - - - - -

10. Which of the following is true (circle one) (a) %he futures rates calculated fro( a 4urodollar futures &uote is alwa$s less than the corresponding forward rate (b) %he futures rates calculated fro( a 4urodollar futures &uote is alwa$s greater than the corresponding forward rate (c) %he futures rates calculated fro( a 4urodollar futures &uote should e&ual the corresponding forward rate (d) %he futures rates calculated fro( a 4urodollar futures &uote is so(eti(es greater than and so(eti(es less than the corresponding forward rate

You might also like

- FRM Financial Markets and Products Test 1Document9 pagesFRM Financial Markets and Products Test 1ConradoCantoIIINo ratings yet

- Ch03Hull Fund7eTestBankDocument2 pagesCh03Hull Fund7eTestBankJulio InterianoNo ratings yet

- Bond Quiz (Q&A)Document3 pagesBond Quiz (Q&A)Mega Pop LockerNo ratings yet

- Sleepless L.A. - Case AnalysisDocument6 pagesSleepless L.A. - Case AnalysisSreenandan NambiarNo ratings yet

- FINS5513 Security Valuation and Portfolio Selection Sample ExamDocument8 pagesFINS5513 Security Valuation and Portfolio Selection Sample Examoniiizuka100% (1)

- Test Bank Financial InstrumentDocument13 pagesTest Bank Financial InstrumentMasi100% (1)

- Chap 013Document56 pagesChap 013saud1411100% (10)

- Assignment 3 SolutionsDocument5 pagesAssignment 3 SolutionsFaas1337No ratings yet

- Ch03Hull Fund7eTestBankDocument2 pagesCh03Hull Fund7eTestBankJulio InterianoNo ratings yet

- Futures 201107 enDocument11 pagesFutures 201107 ensuxessNo ratings yet

- Chap11 11e MicroDocument45 pagesChap11 11e Microromeo626laNo ratings yet

- A Project Report On Online Trading FinalDocument96 pagesA Project Report On Online Trading FinalAnuj Bansal71% (7)

- How We Work Across Businesses - Things Remembered - Case StudyDocument11 pagesHow We Work Across Businesses - Things Remembered - Case StudyRavi Chaurasia100% (1)

- ADM3352 - Final (Fall 2008)Document10 pagesADM3352 - Final (Fall 2008)Tony536No ratings yet

- Financial Markets and Risk Management Class Sheet 7Document4 pagesFinancial Markets and Risk Management Class Sheet 7gujji1No ratings yet

- F494 Pretest: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument7 pagesF494 Pretest: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionJosann WelchNo ratings yet

- MC SampleDocument2 pagesMC SampleKaren Holly LeeNo ratings yet

- DRM Quiz2 AnswersDocument4 pagesDRM Quiz2 Answersde4thm0ng3rNo ratings yet

- Practice Quiz3Document5 pagesPractice Quiz3scribdwtNo ratings yet

- University Name Gujarat University Course Name MBA-Financial Services Semester 4Document11 pagesUniversity Name Gujarat University Course Name MBA-Financial Services Semester 4patelshreyasNo ratings yet

- Futures & Options MidtermDocument12 pagesFutures & Options MidtermLaten CruxyNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch06Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch06Kevin Molly KamrathNo ratings yet

- Chapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1Document16 pagesChapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1samuel_dwumfourNo ratings yet

- International Finance, HedgeDocument7 pagesInternational Finance, HedgeJasmin HallNo ratings yet

- Chap 011Document48 pagesChap 011saud1411100% (3)

- The Foreign Exchange Market NoteDocument12 pagesThe Foreign Exchange Market Noteరఘువీర్ సూర్యనారాయణNo ratings yet

- Answers On Financial ManagementDocument4 pagesAnswers On Financial ManagementArjunSharmaNo ratings yet

- Derivatives Problem SetDocument6 pagesDerivatives Problem SetNiyati ShahNo ratings yet

- University of Toronto Rotman School of Management MGT 337Y Problem Set #5Document2 pagesUniversity of Toronto Rotman School of Management MGT 337Y Problem Set #5hatemNo ratings yet

- EserciziDocument6 pagesEserciziAlessandro d'IserniaNo ratings yet

- This Study Resource Was: Test Bank: Chapter 7Document4 pagesThis Study Resource Was: Test Bank: Chapter 7nidhivijay2507No ratings yet

- 03 PS4 FFDocument3 pages03 PS4 FFhatemNo ratings yet

- Quiz 1 SolutionDocument5 pagesQuiz 1 SolutionPritesh GehlotNo ratings yet

- Derivatives 2nd Edition Sundaram Test BankDocument7 pagesDerivatives 2nd Edition Sundaram Test Bankgrayflyfarrandipsar100% (25)

- Hw4 AKDocument4 pagesHw4 AKrjhav1025No ratings yet

- Concept Questions 10Document3 pagesConcept Questions 10Mark ChenNo ratings yet

- Econ ExamDocument4 pagesEcon ExamAngel OmlasNo ratings yet

- QuizzDocument57 pagesQuizzvitza1No ratings yet

- CFA630Document15 pagesCFA630Cfa Pankaj KandpalNo ratings yet

- Chapter 06 Efficient DiversificationDocument50 pagesChapter 06 Efficient Diversificationsaud141192% (12)

- Bond Portfolio ManagementDocument20 pagesBond Portfolio ManagementJasiz Philipe OmbuguNo ratings yet

- MFIN6003 AssignmentsDocument4 pagesMFIN6003 AssignmentscccNo ratings yet

- Practice QuestionsDocument8 pagesPractice QuestionschrisNo ratings yet

- SOA 30 Sample Problems On Derivatives MarketsDocument24 pagesSOA 30 Sample Problems On Derivatives MarketsSilvioMassaro100% (1)

- Sample MidTerm Multiple Choice Spring 2018Document3 pagesSample MidTerm Multiple Choice Spring 2018Barbie LCNo ratings yet

- Ushtrime Te ZgjidhuraDocument16 pagesUshtrime Te ZgjidhuraDenisa Allushaj Kuqari100% (4)

- Dwnload Full Options Futures and Other Derivatives 8th Edition Hull Test Bank PDFDocument35 pagesDwnload Full Options Futures and Other Derivatives 8th Edition Hull Test Bank PDFwhalemanfrauleinshlwvz100% (13)

- Multiple Choice Questions Chap 8 - Options FuturesDocument6 pagesMultiple Choice Questions Chap 8 - Options FuturesThao LeNo ratings yet

- International Finance Problem Set 3 (Chapter 7)Document2 pagesInternational Finance Problem Set 3 (Chapter 7)Nico FernandoNo ratings yet

- SOA - FM - Sample Questions - Financial EconomicsDocument41 pagesSOA - FM - Sample Questions - Financial Economicsputra.stat11No ratings yet

- FI1Document6 pagesFI1vincenzo21010100% (1)

- Finance Exercise BondDocument2 pagesFinance Exercise Bonddinoo1898No ratings yet

- Answers For Chapter 5Document2 pagesAnswers For Chapter 5Wan MP WilliamNo ratings yet

- CH 10 Derivitives Questions For Class With AnswersDocument4 pagesCH 10 Derivitives Questions For Class With AnswerschrisNo ratings yet

- Finance 21 QuestionsDocument10 pagesFinance 21 QuestionsAmol Bagul100% (1)

- Key Mcqs - 2 - ProblemsDocument8 pagesKey Mcqs - 2 - ProblemsPadyala SriramNo ratings yet

- Essay QuestionsDocument5 pagesEssay QuestionsJully GonzalesNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- Chapter 11 Purchasing Power Parity Quiz: True-False QuestionsDocument14 pagesChapter 11 Purchasing Power Parity Quiz: True-False QuestionsSara KhanNo ratings yet

- Derivatives 1st Edition Sundaram Test BankDocument7 pagesDerivatives 1st Edition Sundaram Test Bankryanrhodestobgjkeicr100% (34)

- Chapter 2: Asset Classes and Financial Instruments: Problem SetsDocument6 pagesChapter 2: Asset Classes and Financial Instruments: Problem SetsBiloni KadakiaNo ratings yet

- Chapter 006 - Valuing Stocks: True / False QuestionsDocument9 pagesChapter 006 - Valuing Stocks: True / False QuestionskheymiNo ratings yet

- Final Correction International Finance 2022 - CopieDocument7 pagesFinal Correction International Finance 2022 - Copieschall.chloeNo ratings yet

- CH 06Document44 pagesCH 06Carla CalahanNo ratings yet

- Treasury Finance and Development Banking: A Guide to Credit, Debt, and RiskFrom EverandTreasury Finance and Development Banking: A Guide to Credit, Debt, and RiskNo ratings yet

- Major Flamingo Breeding Event Begins On Lake NatronDocument1 pageMajor Flamingo Breeding Event Begins On Lake NatronJulio InterianoNo ratings yet

- Resume SamplesDocument6 pagesResume SamplesKartikay5No ratings yet

- Microbio TestDocument3 pagesMicrobio TestJulio InterianoNo ratings yet

- S/how Geothermal Energy Works - HTMLDocument2 pagesS/how Geothermal Energy Works - HTMLJulio InterianoNo ratings yet

- Pcp1 Homework Abstracts 2Document2 pagesPcp1 Homework Abstracts 2Julio InterianoNo ratings yet

- SOA Sample AnswersDocument61 pagesSOA Sample AnswerschiggomanillaNo ratings yet

- CH 16 Wiley Kimmel Homework QuizDocument13 pagesCH 16 Wiley Kimmel Homework Quizmki100% (1)

- Asylum-Insanity Hybrid CalendarDocument1 pageAsylum-Insanity Hybrid CalendarJulio InterianoNo ratings yet

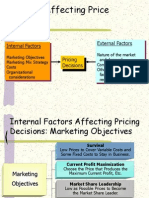

- Internal Factors External Factors Pricing DecisionsDocument17 pagesInternal Factors External Factors Pricing DecisionssaurabhsaggiNo ratings yet

- Icici Bank: by Janagaraj Kumar - 05 (Iipm) Udaya Shankar - 09 (Isbe) Rahmanrazik - 14 (Iipm)Document20 pagesIcici Bank: by Janagaraj Kumar - 05 (Iipm) Udaya Shankar - 09 (Isbe) Rahmanrazik - 14 (Iipm)harihararajanNo ratings yet

- A Project Report ON Portfolio Management & Investment: Company AnalysisDocument9 pagesA Project Report ON Portfolio Management & Investment: Company AnalysispurnitNo ratings yet

- Nordic EquitiesDocument2 pagesNordic EquitiesBeing VikramNo ratings yet

- Trading Strategies Involving OptionsDocument19 pagesTrading Strategies Involving OptionsPatriciaNo ratings yet

- Functionary of Capital MarketDocument17 pagesFunctionary of Capital MarketRehan EhsanNo ratings yet

- Project Report: International School of Informatics and ManagementDocument46 pagesProject Report: International School of Informatics and Managementdeepakpatni11No ratings yet

- Nse National Stock ExchangeDocument5 pagesNse National Stock Exchangealen paulNo ratings yet

- Options Report PDFDocument40 pagesOptions Report PDFMatthew EnglandNo ratings yet

- IBF - Qeststions For Test 1Document30 pagesIBF - Qeststions For Test 1Pardeep Singh DhaliwalNo ratings yet

- As 90986 Marking Schedule 2011 Version 2Document8 pagesAs 90986 Marking Schedule 2011 Version 2api-220013388No ratings yet

- Analysis of Icici and PNB Marketing EssayDocument13 pagesAnalysis of Icici and PNB Marketing EssayRonald MurphyNo ratings yet

- Monopolistic CompetitionDocument10 pagesMonopolistic CompetitionBhushanNo ratings yet

- Strategy Formulation: Functional Strategy & Strategic Choice PresentationDocument17 pagesStrategy Formulation: Functional Strategy & Strategic Choice PresentationKenneth Maimot100% (1)

- Channel ManagementDocument23 pagesChannel ManagementSajal SainiNo ratings yet

- Bank of AmericaDocument113 pagesBank of AmericaMarketsWikiNo ratings yet

- Active Bond Management StrategiesDocument15 pagesActive Bond Management StrategiesNeeraj BhartiNo ratings yet

- Stock Market OperationDocument7 pagesStock Market OperationMayank MauryaNo ratings yet

- Marketing Strategy For GreatWhite Electricals PVTDocument9 pagesMarketing Strategy For GreatWhite Electricals PVTankurgupta61No ratings yet

- Punjab National Bank - Wikipedia, The Free EncyclopediaDocument8 pagesPunjab National Bank - Wikipedia, The Free EncyclopediaPurushotam SharmaNo ratings yet

- Ecw2731 PR ExamDocument7 pagesEcw2731 PR Examjaylaw12No ratings yet

- Geojit. Online Trading On Commodity Market With Respect To GoldDocument122 pagesGeojit. Online Trading On Commodity Market With Respect To GoldAnil YoungNo ratings yet

- Arguto Value Investing 2010 10-18-978Document23 pagesArguto Value Investing 2010 10-18-978Henry So E Diarko100% (1)

- Banking On Port: Tushar Patel (3925) Bhavesh Chavada (3903)Document19 pagesBanking On Port: Tushar Patel (3925) Bhavesh Chavada (3903)AnkitNo ratings yet

- EABD Chapter 2 Part One - 1443179670700Document44 pagesEABD Chapter 2 Part One - 1443179670700meghapatel79100% (1)

- Only Problems BetaDocument4 pagesOnly Problems BetaSupriya Rane0% (1)