Professional Documents

Culture Documents

EWT Lecture Notes by Soros1

EWT Lecture Notes by Soros1

Uploaded by

Shah Aia Takaful Planner100%(1)100% found this document useful (1 vote)

477 views131 pagesThe document discusses the Elliott Wave Principle for analyzing financial markets. It describes how markets move in recurring patterns of motive and corrective waves. Motive waves consist of 5 impulse waves in the direction of the main trend. Corrective waves consolidate price and can take the form of zigzags, flats, or triangles. Key characteristics of each wave type are explained along with guidelines on wave equality, alternation, depth, channeling, and Fibonacci relationships that can help predict market turning points.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the Elliott Wave Principle for analyzing financial markets. It describes how markets move in recurring patterns of motive and corrective waves. Motive waves consist of 5 impulse waves in the direction of the main trend. Corrective waves consolidate price and can take the form of zigzags, flats, or triangles. Key characteristics of each wave type are explained along with guidelines on wave equality, alternation, depth, channeling, and Fibonacci relationships that can help predict market turning points.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(1)100% found this document useful (1 vote)

477 views131 pagesEWT Lecture Notes by Soros1

EWT Lecture Notes by Soros1

Uploaded by

Shah Aia Takaful PlannerThe document discusses the Elliott Wave Principle for analyzing financial markets. It describes how markets move in recurring patterns of motive and corrective waves. Motive waves consist of 5 impulse waves in the direction of the main trend. Corrective waves consolidate price and can take the form of zigzags, flats, or triangles. Key characteristics of each wave type are explained along with guidelines on wave equality, alternation, depth, channeling, and Fibonacci relationships that can help predict market turning points.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 131

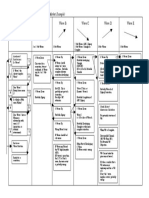

SEMINAR

How to Trade like a Pro

with

Elliott Wave

By

Elliott Wave Mastertrader

CONTENTS

1. Knowing the basic of Elliott Waves and Principles

2. Trading with Elliott Waves, Strategy and Target.

3. Trading System Penyu Bertelur

The Basics of the

Wave Principle

Presented by Elliot Wave MasterTrader

1.00 Introduction Ralph Nelson Elliotts Discovery

2.00 Motive Waves

3.00 Corrective Waves

4.00 Rules

5.00 Guidelines

6.00 Wave Personalities

7.00 Fibonacci Relationships

The Basics of the Wave Principle

1.01

Financial Market Behavior Characteristics

Emotional (Unconscious)

Subjective

Impulsive

Ignorance and Uncertainty

Herding

Values Cannot Revert To Anything

1.02

The Wave Principle

Financial Markets are Patterned

1.03

Ralph Nelson Elliott

(1871 1948)

Crowd behavior trends and reverses in recognizable patterns,

that he called waves.

These structures link together to form larger versions of the

same patterns and how those, in turn, become the building

blocks for patterns of the next larger size and so on.

In 1938, he coined this phenomenon The Wave Principle.

Natures Law The Secret of the Universe

1.04

1.05

1.06

1.07

1.08

1.09

A More Realistic Wave Depiction

1.10

1 2 3

4 5

6

1.11

6 5 7

1.12

Predict Market Direction

Identify turning Points

Provide Guidance for Entering and Exiting Positions

The Wave Principle

1.14

MOTIVE WAVES

MOTIVE WAVES

Key Characteristics

Five-wave structures, numbered 1-5

In the direction of the main trend of one larger degree

Wave 2 cannot retrace more than 100% of wave 1

Wave 3 can never be the shortest and is often the

longest

2.01

2.00

MOTIVE WAVES

Five-Wave Structures

Impulse

1. Extensions

2. Truncations

Diagonal Triangles

2.02

IMPULSE WAVES

Key Characteristics

Wave 4 never enters the price territory of wave 1.

Actionary waves 1, 3 and 5 are motive waves.

Wave 3 is always an impulse wave.

2.03

2.04

2.05

2.06

2.08

EXTENSIONS

Key Characteristics

Elongated impulse wave

Appears in either wave 1, 3 or 5

Often seen in wave 3 for the stock market

Often seen in wave 5 in commodities

2.09

2.10

2.11

2.12

2.13

2.14

TRUNCATIONS

Key Characteristics

Wave 5 does not exceed the end of wave 3

Contains necessary five subwaves

Often occurs after a strong third wave

2.15

2.16

2.17

2.18

DIAGONAL TRIANGLES

Key Characteristics

Wave 4 almost always moves into the price

territory of wave 1

Waves 1, 3 and 5 are composed of three

subwaves, not five

Found at termination points of larger pattern,

indicating exhaustion of larger pattern

Normally has wedge shape within two

converging lines

2.19

Diagonal Triangles

2.20

2.21

2.23

2.24

2.25

2.26

SUMMARY

The Wave Principle = Graphic of Mass Psychology

Motive Waves = 5 Wave Structures, Main Trend of One Larger Degree

Types of Motive Waves = Impulse, Diagonal Triangle

Impulse: Waves 1, 3, 5 = 5 Impulse Subwaves

(Extensions, Truncations)

Wave 4 ! Price Territory of Wave 1

Diagonal Triangle: Waves 1, 3, 5 = 3 Subwaves

Wave 4 = Price Territory of Wave 1

Signal = Imminent Major Trend Reversal

2.27

CORRECTIVE WAVES

Characteristics of Corrective Waves

Zigzag

3.01

3.00

3.02

Characteristics of Corrective Waves

Flat

3.03

3.04

Triangle

3.05

Characteristics of Corrective Waves

Horizontal Triangles

3.06

Running Triangles

3.08

3.09

3.11

3.12

3.13

Characteristics of Corrective Waves

Combination

3.14

Combination

3.15

3.16

3.17

Corrective Waves Summary

A B C D E Shape Position

Zigzag 5 3 5 Sharp Wave 2

Flat 3 3 5 Sideways Wave 4

Triangle 3 3 3 3 3 Sideways Wave 4

Combination X wave Sideways Wave 4

3.18

Rules

Of waves 1, 3 and 5, wave 3 can never be the

shortest wave.

Wave 2 can never retrace more than 100% of

wave 1.

The end of wave 4 can never overlap the

orthodox end of wave 1.

Strong Guideline

No portion of wave 4 can enter the price territory

of wave 1 or wave 2.

4.00

Rules

4.01

Rules

4.02

Rules

This five-wave move

cannot be the start of

a new trend. It can be

wave C of a

corrective pattern.

4.03

Rules

What might this be?

Significant Bottom

4.04

Rules

What might this be?

4.05

Rules

Wave 3 is never the shortest of

waves 1, 3 and 5. This could be

part of a wave 3 extension.

4.06

Rules

What might this be?

Significant Bottom

4.07

Rules

What might this be?

4.08

Wave 4 does not overlap the price territory

of wave 1. This could be the start of a 3

rd

wave extension or an A-B-C correction.

Rules

4.09

Guidelines

Equality

Alternation

Depth

Channeling

Throw-Over

Volume

Post-Triangle Thrust

Measurement

5.00

Guidelines

Wave Equality

Two of the motive waves in a five-wave

sequence will tend toward equality in time and

magnitude.

This is generally true of the two non-extended

waves.

For example, if wave 3 is extended then waves

1 and 5 will tend toward equality.

5.01

Equality

5.02

Equality

5.03

Guidelines

Alternation

Within Impulse Waves

If wave 2 is a sharp correction, expect wave 4

to be a sideways correction, and vice versa.

Sharp corrections never include a new price

extreme. Example: Zigzags

Sideways corrections usually include a new

price extreme. Examples: Flats, Triangles, and

Combinations

Diagonal triangles do not display alternation in

subwaves 2 and 4.

5.04

Alternation within Impulse Waves

5.05

Alternation within Impulse Waves

5.06

Alternation within Impulse Waves

5.07

Alternation within Impulse Waves

5.08

Alternation within Impulse Waves

5.09

Guidelines

Alternation

Within Corrective Waves

If a correction begins with a flat a-b-c structure

for wave A, then expect a zigzag a-b-c

structure for wave B, and vice versa.

If a large correction begins with a simple a-b-c

zigzag for wave A, wave B will stretch out into a

more complex a-b-c zigzag.

5.10

Guidelines

Alternation within Corrective Waves

5.11

Guidelines

Alternation within Corrective Waves

5.12

Alternation within Corrective Waves

5.13

Alternation within Corrective Waves

5.14

Alternation within Corrective Waves

Zigzag

5-3-5

5.15

Guidelines

Depth of Corrective Waves

Corrections, especially when they are fourth

waves, tend to register their maximum

retracement within the span of travel of the

previous fourth wave of one lesser degree and

most commonly near its terminus.

5.16

Guidelines

Depth of Corrective Waves

5.17

Depth of Corrective Waves

5.18

Depth of Corrective Waves

5.19

Guidelines

Channeling

A parallel trend channel typically marks the

upper and lower boundaries of impulse waves

and zigzag corrective waves.

5.20

Guidelines

Channeling in Impulse Waves

5.21

Channeling in Impulse Waves

5.22

Channeling in Impulse Waves

5.23

Channeling in Impulse Waves

5.24

Channeling in Impulse Waves

5.25

Channeling in Impulse Waves

5.26

Channeling in Impulse Waves

5.27

Guidelines

Channeling in Zigzags

5.28

Channeling in Corrective Waves

5.29

Channeling in Corrective Waves

5.30

Channeling in Corrective Waves

5.31

Guidelines

Throw-Over

5.32

Throw-Over

5.33

Guidelines Volume

Waves < Primary Degree

Normally, 3

rd

wave volume > 5

th

wave volume

5

th

wave volume > 3

rd

wave volume = 5

th

wave extension

Waves > Primary Degree

Higher volume in 5

th

waves

All-time high volume at terminal points in bull markets

Volume often spikes briefly at the throw-over point of a

parallel trend channel line or a diagonal triangle resistance

line.

Volume contracts in corrective waves.

5.34

Volume

5.35

Post-Triangle Thrust Measurement

5.36

5.38

Summary

Two motive waves in a five wave sequence will

tend toward equality.

If the second wave is sharp, then the fourth wave is

usually sideways, and vice versa.

Corrective waves usually end in the span of the

previous fourth wave of one lesser degree.

Impulse waves tend to be bounded by a channel

composed of two parallel lines.

A throw-over/throw-under occurs when wave 5

terminates beyond the trend channel.

The post-triangle thrust measurement estimates

price target for the next wave in the pattern of one

larger degree.

5.39

Wave Personality

6.00

Wave Personality

6.01

The Golden Ratio

PHI "

.618 or 1.618

Fibonacci Relationships In Financial Markets

7.00

Golden Ratio, PHI, "

7.01

Golden Ratio, PHI, "

7.02

Fibonacci Relationships are Seen

in Time and Amplitude

Retracements

Multiples

7.03

Retracements

7.04

Retracements

7.05

Retracements

7.06

Retracements

7.07

Retracements

7.08

Fibonacci Time Relationships

7.14

Fibonacci Time Relationships

7.15

Summary

The Fibonacci Ratio (!), an irrational number approximating .618,

known as the Golden Ratio, is found in nature, human biology,

human thought, and aggregate human behavior such as the stock

market.

The Wave Principle is a robust fractal governed by Fibonacci

mathematics.

Sharp wave corrections tend to retrace 61.8% or 50% of the

previous wave.

Sideways corrections tend to retrace 38.2% of the previous wave.

Subdivisions of impulse waves tend to be related by Fibonacci

numbers .618, 1.0, 1.618 and 2.618.

Subdivisions of corrective waves tend to be related by Fibonacci

numbers .382, .618, 1.0 and 1.618.

7.16

Alternation within Corrective Waves

8.08

Depth of Corrective Waves

8.09

Channeling in Impulse Waves

8.10

Throw-Over

8.11

Wave Personality

8.14

The Golden Ratio

PHI "

.618 or 1.618

Fibonacci Relationships In Financial Markets

8.15

Retracements

8.16

You might also like

- Elliott Wave - Fibonacci High Probability Trading: Master The Wave Principle And Market Timing With Proven StrategiesFrom EverandElliott Wave - Fibonacci High Probability Trading: Master The Wave Principle And Market Timing With Proven StrategiesRating: 4.5 out of 5 stars4.5/5 (10)

- Elliot Wave Cheat SheetDocument1 pageElliot Wave Cheat Sheetajayvmehta96% (26)

- Elliot Wave Ebook Compressed PDFDocument29 pagesElliot Wave Ebook Compressed PDFTimileyin Adediran89% (9)

- Pring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationFrom EverandPring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationNo ratings yet

- Elliott Wave Timing Beyond Ordinary Fibonacci MethodsFrom EverandElliott Wave Timing Beyond Ordinary Fibonacci MethodsRating: 4 out of 5 stars4/5 (21)

- MY BASICS - Sales Compliance Training (Part 1) : AIA Premier AcademyDocument91 pagesMY BASICS - Sales Compliance Training (Part 1) : AIA Premier AcademyShah Aia Takaful Planner0% (2)

- Elliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More TradesFrom EverandElliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More TradesRating: 1 out of 5 stars1/5 (2)

- Elliott Wave Cheat SheetsDocument56 pagesElliott Wave Cheat SheetsXuân Bắc100% (5)

- Trading The Elliott Wave Indicator. Winning Strategies For Timing Entry & Exit Moves. R. Prechter. EWI - mp4Document2 pagesTrading The Elliott Wave Indicator. Winning Strategies For Timing Entry & Exit Moves. R. Prechter. EWI - mp4laxmicc33% (3)

- Elliott Wave SummarizedDocument1 pageElliott Wave SummarizedNd Reyes100% (7)

- Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesFrom EverandMastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesRating: 4 out of 5 stars4/5 (3)

- Elliott Wave Rules&GuidelinesDocument10 pagesElliott Wave Rules&Guidelineschankyakutil80% (15)

- Elliott Wave UnveiledDocument150 pagesElliott Wave Unveiledsoc597269100% (34)

- Elliot Wave and Fibo All in OneDocument17 pagesElliot Wave and Fibo All in OneSATISH100% (4)

- 28 Elliot Wave PDFDocument14 pages28 Elliot Wave PDFRavikumar GandlaNo ratings yet

- Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureFrom EverandHarmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureRating: 3 out of 5 stars3/5 (1)

- Advanced Level Elliott Wave Analysis GuideDocument64 pagesAdvanced Level Elliott Wave Analysis GuideMohd Harraz Abbasy100% (3)

- Elliot Wave - The Ending Diagonal TriangleDocument9 pagesElliot Wave - The Ending Diagonal TriangleAngela WilsonNo ratings yet

- Elliott Waves Tips +++Document31 pagesElliott Waves Tips +++Mihut Gregoretti100% (13)

- Elliott Wave Rules and GuidelinesDocument4 pagesElliott Wave Rules and Guidelineskacraj100% (1)

- Elliott Wave Final ProjectDocument81 pagesElliott Wave Final Projectrinekshj100% (2)

- Corrective WaveDocument1 pageCorrective WaveMoses ArgNo ratings yet

- Cheat Sheet 1: Elliott Wave Dna: Wave 3 Buy Conservative SetupDocument12 pagesCheat Sheet 1: Elliott Wave Dna: Wave 3 Buy Conservative SetupPranshu gupta100% (2)

- Walker, Myles Wilson - How To Indentify High-Profit Elliott Wave Trades in Real Time PDFDocument203 pagesWalker, Myles Wilson - How To Indentify High-Profit Elliott Wave Trades in Real Time PDFPaul Celen100% (11)

- Fibonacci and Elliott WaveDocument94 pagesFibonacci and Elliott Waveicemansva80% (15)

- Elliott & FibboDocument17 pagesElliott & FibboSATISH100% (2)

- Pivot Trading 1Document5 pagesPivot Trading 1Shah Aia Takaful Planner100% (1)

- EWSD ArchitectureDocument57 pagesEWSD Architecturejingjongkingkong100% (1)

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain Adnan100% (1)

- Elliot Waves NotesDocument21 pagesElliot Waves Notesfreemee11100% (2)

- Elliott Wave 2Document29 pagesElliott Wave 2francisblesson100% (2)

- EW Fibonacci ManualDocument198 pagesEW Fibonacci Manualstephane83% (6)

- Elliott WAVe SimpleDocument22 pagesElliott WAVe Simplel3ohit100% (1)

- The Amazing Elliott's Wave3 PDFDocument99 pagesThe Amazing Elliott's Wave3 PDFFlukii Polo100% (1)

- Guideline 1: How To Draw Elliott Wave On ChartDocument6 pagesGuideline 1: How To Draw Elliott Wave On ChartAtul Mestry100% (2)

- Basics Gorman WaveDocument150 pagesBasics Gorman WaveHiren Mandaliya100% (1)

- Elliott IndicatorDocument160 pagesElliott IndicatorEmmanuelUhuru100% (1)

- Elliott Wave Patterns & Fibonacci Relationships Core Reference GuideDocument33 pagesElliott Wave Patterns & Fibonacci Relationships Core Reference GuideStephen MungaiNo ratings yet

- Practical Elliott Wave Trading StrategiesDocument0 pagesPractical Elliott Wave Trading StrategiesGeorge Akrivos100% (2)

- Elliott Wave Crib SheetDocument5 pagesElliott Wave Crib SheetKKenobi100% (7)

- Elliott Wave - Elite Trader's SecretDocument83 pagesElliott Wave - Elite Trader's Secretisaac100% (2)

- 17.dear FriendsDocument18 pages17.dear FriendsSATISHNo ratings yet

- 05 - Class 05 - Elliot Wave and FibonacciDocument11 pages05 - Class 05 - Elliot Wave and FibonacciChandler BingNo ratings yet

- Practical Ew StrategiesDocument48 pagesPractical Ew Strategiesanudora100% (2)

- Ultimate Guide To Elliott Wave 1 1Document22 pagesUltimate Guide To Elliott Wave 1 1enver88% (8)

- 50 KWord EbookDocument247 pages50 KWord EbookLio PermanaNo ratings yet

- 3 Step To Trade Elliot Wave PDFDocument19 pages3 Step To Trade Elliot Wave PDFadalahtriNo ratings yet

- Elliott Wave Analysis - Works Like Magic!Document6 pagesElliott Wave Analysis - Works Like Magic!Ramki Ramakrishnan50% (8)

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Elliott Wave Crash CourseDocument23 pagesElliott Wave Crash CourseRoshni Mahapatra100% (4)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocument148 pagesHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerNo ratings yet

- Fibonacci and Elliottwave Relationships.Document11 pagesFibonacci and Elliottwave Relationships.Fazlan SallehNo ratings yet

- The New Elliot Wave RuleDocument40 pagesThe New Elliot Wave RuleUlisses76100% (3)

- GuideToElliottWaveAnalysisAug2012 PDFDocument5 pagesGuideToElliottWaveAnalysisAug2012 PDFvhugeat50% (2)

- 1 5089578216180416934Document145 pages1 5089578216180416934Bruce wayne100% (3)

- New Elliott Wave Rule PDFDocument40 pagesNew Elliott Wave Rule PDFSimon Eduerte100% (1)

- Wave WorkbookDocument58 pagesWave Workbookbeattiedr100% (2)

- Become A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersFrom EverandBecome A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersNo ratings yet

- MY TOOLS - Presentation Book: AIA Premier AcademyDocument23 pagesMY TOOLS - Presentation Book: AIA Premier AcademyShah Aia Takaful PlannerNo ratings yet

- MY TOOLS - Goal Setting: AIA Premier AcademyDocument12 pagesMY TOOLS - Goal Setting: AIA Premier AcademyShah Aia Takaful PlannerNo ratings yet

- My Tools: Telephone Approach Word TrackDocument18 pagesMy Tools: Telephone Approach Word TrackShah Aia Takaful PlannerNo ratings yet

- My Job: AIA Premier AcademyDocument60 pagesMy Job: AIA Premier AcademyShah Aia Takaful PlannerNo ratings yet

- MY BASICS - Sales Compliance Training (Part 2) : AIA Premier AcademyDocument58 pagesMY BASICS - Sales Compliance Training (Part 2) : AIA Premier AcademyShah Aia Takaful Planner100% (1)

- The Day Trade Forex System PDFDocument45 pagesThe Day Trade Forex System PDFgigiLombricoNo ratings yet

- FX Trading SessionDocument1 pageFX Trading SessionShah Aia Takaful PlannerNo ratings yet

- Dealing Hours The Dealing Desk Is Open Between Sunday 16:00 To Friday 16:30 Eastern Standard Time (GMT-5) - Currency PairsDocument1 pageDealing Hours The Dealing Desk Is Open Between Sunday 16:00 To Friday 16:30 Eastern Standard Time (GMT-5) - Currency PairsShah Aia Takaful PlannerNo ratings yet

- Is-Pr40101 API Gateway & Bulk Sms - Xox - 20100629Document5 pagesIs-Pr40101 API Gateway & Bulk Sms - Xox - 20100629Shah Aia Takaful PlannerNo ratings yet

- Reflective Essay Using GIBBs ModelDocument14 pagesReflective Essay Using GIBBs Modelchristopher mwangi50% (2)

- Relationship of New Issue Market and Stock Exchange-Skill TestDocument26 pagesRelationship of New Issue Market and Stock Exchange-Skill TestbhavanabhuratNo ratings yet

- Is-Lm Analysis AND Aggregate Demand: Dr. Laxmi NarayanDocument36 pagesIs-Lm Analysis AND Aggregate Demand: Dr. Laxmi NarayanHappy MountainsNo ratings yet

- Diaz Vs Sec. of Finance, G.R. No. 193007Document7 pagesDiaz Vs Sec. of Finance, G.R. No. 193007R.A. GregorioNo ratings yet

- d8cx8lqt6 Activity Chapter 13 Partnership DissolutionDocument1 paged8cx8lqt6 Activity Chapter 13 Partnership DissolutionLyra Mae De BotonNo ratings yet

- M08 - Gitman14 - MF - C08 Risk and ReturnDocument71 pagesM08 - Gitman14 - MF - C08 Risk and ReturnLeman SingleNo ratings yet

- Form GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDocument5 pagesForm GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDSPNo ratings yet

- 01 Mindset, Poor, RichDocument23 pages01 Mindset, Poor, RichJoy Superales SalaoNo ratings yet

- 1601 CDocument2 pages1601 CChedrick Fabros SalguetNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationKrizia Mae Flores100% (1)

- Comparative and Common Size Financial StatementsDocument24 pagesComparative and Common Size Financial StatementsTanish Bohra100% (2)

- Pass Papers CAC 4201Document26 pagesPass Papers CAC 4201tαtmαn dє grєαtNo ratings yet

- CA Assignment No. 5 Part 2 ABCDocument6 pagesCA Assignment No. 5 Part 2 ABCMethlyNo ratings yet

- Chapter 4 Systems Design: Process Costing: Multiple Choice QuestionsDocument3 pagesChapter 4 Systems Design: Process Costing: Multiple Choice QuestionsС. БатболдNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument69 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancefuturefinance2017No ratings yet

- NIDC Vs AquinoDocument2 pagesNIDC Vs AquinoJennilyn TugelidaNo ratings yet

- Resume Template - Fresh GraduatesDocument3 pagesResume Template - Fresh Graduatestayush811No ratings yet

- Agency, Trust & Partnership Reviewer - 1810-1836 (Cambri Notes)Document6 pagesAgency, Trust & Partnership Reviewer - 1810-1836 (Cambri Notes)Arvin Figueroa100% (1)

- Mercantile Law) Practical Exercises by Justice Vitug) Made 2003) by SU Law (Daki) ) 23 PagesDocument24 pagesMercantile Law) Practical Exercises by Justice Vitug) Made 2003) by SU Law (Daki) ) 23 PagesbubblingbrookNo ratings yet

- The Future of Tax Research From An Accounting Professor's Perspective - Terry ShevlinDocument7 pagesThe Future of Tax Research From An Accounting Professor's Perspective - Terry ShevlinRising PKN STANNo ratings yet

- Difference Between Real, Nominal, Personal AccountsDocument1 pageDifference Between Real, Nominal, Personal Accountsirfan ullah khanNo ratings yet

- Pete407 HW1Document4 pagesPete407 HW1Alwaleed ANo ratings yet

- Foreclosure v. Pactum CommissoriumDocument79 pagesForeclosure v. Pactum CommissoriumJon Gilbert MagnoNo ratings yet

- Fee Structure: Phd. Admission (2018-19)Document1 pageFee Structure: Phd. Admission (2018-19)Shaktiyavesh SinghNo ratings yet

- Lesson 2 - Transactions and Accounting EquetionDocument5 pagesLesson 2 - Transactions and Accounting EquetionMazumder SumanNo ratings yet

- NPV Calculation of Euro DisneylandDocument5 pagesNPV Calculation of Euro DisneylandRama SubramanianNo ratings yet

- Invoice 9773221286Document1 pageInvoice 9773221286sivakumarNo ratings yet

- Beaumont ISD Declaration of Financial ExigencyDocument3 pagesBeaumont ISD Declaration of Financial ExigencyBryan WeatherfordNo ratings yet