Professional Documents

Culture Documents

A Demographic Analysis On Customer Acceptance Towards Islamic Pawnbroking

A Demographic Analysis On Customer Acceptance Towards Islamic Pawnbroking

Uploaded by

NoorAnnysahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Demographic Analysis On Customer Acceptance Towards Islamic Pawnbroking

A Demographic Analysis On Customer Acceptance Towards Islamic Pawnbroking

Uploaded by

NoorAnnysahCopyright:

Available Formats

Asian Social Science; Vol. 10, No.

2; 2014

ISSN 1911-2017 E-ISSN 1911-2025

Published by Canadian Center of Science and Education

27

A Demographic Analysis on Customer Acceptance towards Islamic

Pawn Broking in Malaysia

Norudin Mansor

1

, S. A. Bashir Ahmad

1

, Semanat Abu Bakar

2

& Irwan Ismail

1

1

Faculty of Business Management, Universiti Teknologi MARA Terengganu, Malaysia

2

Faculty of Management & Economic, Universiti Malaysia Terengganu, Malaysia

Correspondence: Norudin Mansor, Faculty of Business Management, Universiti Teknologi MARA Terengganu,

Malaysia. E-mail: norudinm@tganu.uitm.edu.my

Received: January 28, 2013 Accepted: November 18, 2013 Online Published: December 29, 2013

doi:10.5539/ass.v10n2p27 URL: http://dx.doi.org/10.5539/ass.v10n2p27

Abstract

This paper attempts to explore the demographic factors towards one of the dominant pawn brokers in Malaysia

named Ar-Rahnu that has led the growth of Islamic pawn broking system comprehensively. Specifically, this

study examines the demographic elements in capturing the customer acceptance towards Islamic pawn broking

offered by Maidam in the state of Terengganu. A total of 330 self-administered questionnaire instrument, were

distributed to the customer within the district of Dungun that had received financial assistance at Ar-Rahnu

Maidam. The sample was selected through quota samping and further executed by means of convenience

technique from the total customer of Ar-Rahnu Maidam Dungun. The result of the investigation demonstrated

that out of the eight selected demographic indicators, two of them which are marital status and occupational

sector demonstrated that there were significance differences among the group while the remaining six were not

significant. The evidence from the survey is expected to provide a limelight about the importance of Islamic

pawn broking in strengthening the industry.

Keywords: Ar-Rahnu, Maidam, pawn broking, demographic profile

1. Introduction

The main idea of the Islamic Pawn brooking set up is to provide the customer the option to obtain cash to fulfil

immediate financial needs through personal surety or pledge. With the understanding that Malaysia is known to

be one of the popular Islamic banking hub, the government continuously initiate several form of Islamic

financial instrument that are believed to be more competitive than the conventional financial instrument. As one

of the instrument been initiated by Malaysian Government, the establishment of Islamic Pawn Broking

(Ar-Rahnu) was made available to the Muslim public. For those who meet the requirement, it means that they

were given a backup financial assistance when needed. But in getting the assistance one need to pay for its

services. Thus it is the main objective of Ar Rahnu to help people who face financial difficulties and ensuring

them to be free from riba (Haron, 1996). For some institutions the amount would be reasonable but for some

others it would be much higher. From the view of Islam as a way of life, they need to help others as one of the

responsibilities that need to be address collectively.

Under the Syariah principle, by definition of Al-rahnu it possesses a guarantee. The Quran refers to the idea of

mortgage as mortgage with possession (rihanun maqbudha). Quran also supports the idea of furnishing a

pledge against a debt. It is through the initiative of Ar-Rahnu concept this institution developed its niche area of

offering a more flexible and convenience approach of giving financial assistance to the needy. As to the believed

whether it is allowable to the Islamic principle, the argument is very straight forward as explained by Khan and

Nisar (2004) where any valuable asset can be pledge as collateral for a debt.

The services provided through Ar-Rahnu scheme by MAIDAM is a societal marketing concept, purposely

designed for giving alternative to the Muslim especially during their hardship by giving them the debt with

collaterals (Mohd & Hashim, 1995). The important of helping the needy especially the poor has long been

emphasized in much of Islamic faith. Through the concept of Ar-Rahnu, the institution offers a more flexible and

convenience form of credit financing as governed by Syariah rules without having the element of interest in

the transaction. With the improving of religious belief, there is an increase trend that more Muslim communities

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

28

are not in favor of using the conventional pawn broking service as it is closely attached with the element of

interest or riba that will be imposed in return for disbursement of credit. Thus the main idea of providing

Ar-Rahnu as an alternative financial instrument is to ease the life of the needy. This is much better as the scheme

offers a reasonable fee charges.

1.1 Scope of Study

The approach taken for the study is purely quantitative. The investigation is in the district of Dungun, which is

very much nearby to the oil and gas industrial zone in the state of Terengganu which is in the east coast region of

Malaysia. The survey approach through personally administered questionnaire is expected to provide a

fundamental understanding of the societies toward Islamic pawn broking. The selection of 330 samples is

believed to be adequate to represent the population of the study. The data which had been collected on

cross-sectional basis were tested and analysed by using descriptive statistic for the purpose of explaining the

major differences encountered by the study groups.

1.2 Problem Statement

Understanding and obedience to the Islamic principle in most transaction is always close at heart to most Muslim

communities. In the process of sustaining obedience one cannot simply skip from experiencing economic and

financial difficulties. Thus in order to sustain the living, at time people rely on borrowing that are made available

either through conventional or Islamic system. The relative usefulness of this form of financing discovered to be

very relevant with the changing pattern of socio-economic development in Malaysia today. Despite of the

income increment from most of the sectors, people still seeking extra form of financial aid to support living cost.

Based on this fact, the increasing popularity of Islamic pawn broking as means for financial assistance has

accelerated. Thus this paper proposed a comprehensive investigation by analysing demographic factors as to

what extent the issues of perceptual difference needed attention from the management of Maidam in ensuring the

favorable acceptance of customers at Ar-Rahnu Maidam.

1.3 Research Objective

The main concern of this paper attempted to investigate selected demographic factors towards customer

acceptance at Ar-Rahnu Maidam as their Islamic Pawn Broking. Specifically, the investigation is expected to

examine the possibility of significant differences among the selected profiles as related to the acceptance of

Ar-Rahnu.

1.4 Hypothesis

Hypothesis: There are significant differences between the selected profiles of the customers towards acceptance.

2. Literature Review

2.1 Customer Acceptance

Acceptance is adoption and continuing use of the product, service or idea. According to Rogers and Shoemaker

(1971), consumers go through a process of knowledge, persuasion, decision and confirmation before they are

ready to accept a product or service. Any attempt for drawing a conclusion from the perspective of customer as

well as the service institution should always considered a clear operational definition of customer acceptance

(Naylor & Greco, 2002). Understanding the motivations, expectations and desires of both provide a foundation

on how to provide best services to the customer by most businesses. The acceptance of the clients could also be

observed when they are willing to participate in anything that is related to the product or services offered

(Mansor et al., 2011a). It is agreeable that with the Increasing overall satisfaction it will leads to greater

repurchase intentions (Martin et al., 2008; Anderson & Sullivan, 1993) as well as actual repurchase behavior.

The operation of Ar-Rahnu to some extent is similar to most banking business where they provide financial

business transaction services to the customers. Customer acceptance on products or services offered is always

been associated with the familiarity and the degree of awareness and use of any given tool. The more people

using them, the more valuable they become. As such, the relevancy towards understanding customer acceptance

is vital as it act as a motivational drive for repeated selection (Holetzky, 2008) and will be favorably reflected by

the satisfaction indicated by the customers (Mansor et al., 2011b). In addition, as mentioned by Anderson and

Sullivan (1993) and Boulding et al. (1993), high customer satisfaction may lead to greater customer loyalty

which in turn leads to future revenue to the business operators.

2.2 Related Concept Associated with Customer Acceptance

Storage charge: As mentioned by Razak (2008), the concerned over higher interest rates as well as the

procedure of imposing higher interest rate by conventional pawnshop which are argued to be highly exploitative,

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

29

open up Alternative Avenue that influence customers to choose the facilities offered by Islamic Pawnshop. It

seems that there is a relative high degree of differences on charges that make a burden to the lower-income

group.

Referring to Nur Azura Sanusi & Mohamad Shukri Johari (2007), customers that does not having proper banking

account are eligible to get the service of Pawn Brooking, while they may has difficulties to borrow money from

most financial institutions without it. The above procedure is unnecessary when having transaction with

Ar-rahnu Maidam. Islamic Pawn Broking offered charges in term of storage facilities which are much lower

compared to interest charge by conventional financial institution. As mentioned by Ismail and Ahmad (1997)

charges imposed at pawn broking is only about 2 percent which is cheaper compared to conventional system.

This lower charges attracted more individual to pursuit pawn broking in getting quick cash. In fact Naim (2008)

pointed what attract more Muslim to get this form of financial assistance is due to the willingness to accept the

concept of sadaqah (helping others with the blessing of Allah).

Service quality: Several literatures that attempt to discuss the concept and theories of service quality perception

discovered that the findings were still debatable (Caceres et al., 2007; Brady & Cronin, 2001; Zeithaml, 2000;

Zins, 2001; Oliver, 1994). With rapidly advancing technologies especially in the product and services that were

provided by various business sectors, the general public will become more aware about the acceptable values of

product and services that were offered (Weisbord, 1987) and poised to develop relationship marketing in

consumers live, while offering mass product choice and customizing services at personnel level (Mansor et al.,

2011).

It is naturally happened that perception of the people relatively change as the economy, technology, and

resources evolved. These changes therefore consciously or unconsciously altered the perceived quality of

mankind (Parasuraman et al., 1985). Similarly within the context of organizational development, elements such

as the need to understand employees performance and the nature of work setting therefore continuously needed

attention by the service providers (Mansor, Hamdan, Mohd, & Razali, 2010). As such the research development

on most constructs involving service quality still remain unsolved (Carhuana et al., 2004).

Mohammed et al., (2005) highlighted the important of maintaining reliable and trustworthy service while one

way of establishing a quality relationship with customers is by respecting customers trust (Haryati & Ali et al.,

2013). Following the standard business service ethics, the Islamic-based pawnshop must maintain all the relevant

record of customers, while ensuring that the record are treated with full confidentiality. At the same time it is the

responsibility of the Islamic-based pawnshop to fairly treat the customers regardless of their religion, race or

whatever demographic characteristics attached to them. It is therefore essential to revisit the fact that most issues

governing customer service is very much related with the acceptance of the service providers involved (Amin et

al., 2007).

Most researchers agreed that service quality by nature is highly subjective concept. Since the quality of customer

service is determined and evaluated by the customer, and this affects the desirability of a relationship with the

organization. Thus the understanding of how the customer think about service quality is essential in ensuring

effective relationship management that will further enhance customer satisfaction (Mansor et al., 2011c; Bedi,

2010; Abdullah, 2010; Oliver, 1994)

Locality: The process of sustaining acceptance is always closely associated with the issues of locality. It is

through a good understanding of the concept, and then only locality may contribute a significant impact upon

virtually all products, services, markets and customers. However one should not underestimate the relevancy of

the selection of business locations which greatly depend on types of business itself (Malhotra, 2009). As

suggested by Kotler and Armstrong (2010), there is a need to address the issue of location decision as it involved

people as the market potential. Any elements involving location always remained important as the organization

agreed to commit resources before operating the services. McDaniel et al. (2011) further conclude that for any

business to remain competitive and keep on expanding, they should not ignore the need to carefully strategize

the right location for its operation. Although the previous literature on Islamic Pawn broking revealed that the

competitiveness level of pawn broking are not intense enough, but still the need for addressing the issue of

locality and positioning of its business operation should be seriously considered. It seems that, most of the

pawnshops are built in the town areas to facilitate the customer of doing transactions. However the setting up

pawnshops businesses are highly unevenly distributed across the Malaysian states (Ismail & Ahmad, 1997),

although the density of the community in certain areas was considered.

Management Practices: Management has to have power to do its job (Drucker, 1986) and requires a

comprehensive set of managerial skills (Goodman et al., 2007). The art of management involved multiple facet

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

30

process such formulating organizational strategic goals, utilization and managing competitive resources,

management of financial resources, and a few other activities that provide the right momentum for healthy

operation (David, 2009) It also includes the activities of administering data and other related information which

can be used and shared by the organization. The role and responsibilities for ensuring the effectiveness of

managing involved staff at all levels especially those at the managerial and supervisory levels. The main role of

management from Islamic perspective is to inculcate the Muslim communities towards continuing their living

throughout the world by offering alternative approach to Islamic ways of doing things. This scenario is vital to

the Muslim as they are not allowed to transact any business activities that are not in conformity with the Islamic

principles. Thus there is a religious demand for them to ensure that all transaction should be within the Islamic

values (Ahmad & Fontaine, 2011). Nevertheless in a broad perspective there are not much difference in the

operation of Islamic pawnshop transaction as to the conventional pawnshop. The major difference can be

observed based on the engagement of the contract whereby in the case of Islamic pawnshop the way a contarct is

enforced is based on the principle of aqad. With this approach, the basic principles need to be adhere involved;

al-qardhul Hassan (loan given should be free from interest), al-wadiah yadd hammanah (certain types of

valuable goods need to be produce by guarantee), al-ujrah (storage fees) and ar-rahn (collateral). The storage

fee which is normally much lower is been transacted based on the gold value rather than the actual amount of

loan lended (Appannan & Doris, 2010).

3. Methodology

3.1 Research Instrument

As the approach obtaining the data is through cross-sectional survey, the use of questionnaire is the main sources

to obtain the needed data. The pre-formulated questionnaires were divided into 2 sections. Section 1 consists of 7

items to describe the demographic profiles of the respondent. Section 2 focused on measure customers

acceptance. All questions in section 2 used likert scale for obtaining the responses.

3.2 Sampling Design

This study examines the customer of Ar-Rahnu in the district of Dungun. Based on the record generated by the

institution for the year ended 2010, there were approximately 2,700 clients that had received the service of the

Islamic Pawn Broking from the agency. Although a representation of 330 respondents were taken from the entire

population to form the desired sample size as suggested by Krejcie and Morgan (1970) but still this is a biased

sample as it is not adequate enough to reflect the broad cross section of customers distribution. The use of Quota

method and executed through convenience approach to some extent able to reflects the job or occupational sector.

In ensuring that the selection of sample at least able to meet the minimum representation of the population, the

controlled sample size were proportionately selected as follows: 35 of the 289 were from private sectors; 38 of

the 314 were from government sectors; 105 were selected to represent a total of 862 housewives; and another

152 samples were from the total of 1255 self-employed customers, thus making the total sample size to be 330

respondents. Majority of the respondents were male (61.8%) and the rest (38.2%) were female. 78.2% of

respondents have been married which is more than half. The percentage of 14.2% comes from single while the

lowest percentage comes from single parents which are 7.6.

4. Data Analysis

Prior to data analysis, all the collected questionnaires went through the process of editing, coding, and

transcribed into SPSS software for obtaining the expected results. In ensuring the reliability of items measuring

the concept, the data were initially tested through reliability analysis.

4.1 Reliability Analysis

All items measured for the study passed through the reliability assessment procedures where most of the item

was above the cronbach alpa value of > 0.7. As per suggested by Sekaran and Bougie (2010), when the alpha

scores is more than 0.70 then the measuring items are considered highly reliable for further analysis.

4.2 Frequency Analysis

As displayed in Table 1, majority of the customers were within the age bracket of 31 to 40 that made up 39.7%,

followed by 29.4% of those within the age group of 21 to 30 years old. For those from the age category of 41 to

50 made up the representation of 21.8%, and a small portion (7.3%) were those with the age of above 50 and the

young age group which is below 20 years old do participate in borrowing at the percentage of 1.8%. As been

stated by most literature those who are in need for small sum of money normally were among those who are

considered poor and low income earners. This is reflected in our sample where majority of the clients were

self-employed and other large representation were among the housewife representing 31.8%. There were also

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

31

borrowers from the government servant as well as from private institution which constitute to be 11.5% and

10.6% respectively. Our sample distribution further reflected the representation of low income earners. Most of

the borrowers from Ar-Rahnu were of those within the income bracket of below RM 1000 which accounted to be

53.6 % of the total sampled. There were also those customers that had an earned income between RM1001 to

RM2000 which is 24.2%. A total representation of 12.1% were those with an earned income within RM2001 to

RM3000, 7.9% within RM3001 to RM4000 while the remaining 2.1% were with an income of more than

RM4001 per month.

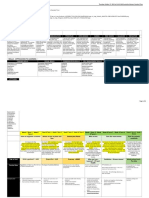

Table 1. Frequencies of respondents profile

Category Demographic (n=330) Frequency %

Gender

Male

Female

204

126

61.8%

38.2%

Age

Below 20 years

21-30 years

31-40 years

41-50 ears

Above 51

6

97

131

72

24

1.8%

29.4%

39.7%

21.8%

7.3%

Monthly Income Level

Below RM1,000

RM1,000-RM2, 000

RM2, 000-RM3, 000

RM3, 001-RM4, 000

Above RM4, 001

178

80

39

26

7

53.9%

24.2%

11.8%

7.9%

2.1%

Education Level

Primary School

SRP/PMR

SPM

STPM/Diploma

Degree and above

8

35

205

60

22

2.4%

10.6%

62.1%

18.2%

6.7%

Duration of customer relationship with Ar-Rahnu

Maidam

Less than 1 year

2-3 years

4-5 years

More than 6 years

61

134

85

50

18.5%

40.6%

25.8%

15.2%

Frequency of visiting in year

1 time

2-3 times

4-5 times

More than 6 times

98

138

63

31

29.7%

41.8%

19.1%

9.4%

Note 1: USD = RM 3.10

Reviewing on the levels of education the analysis demonstrated that, the highest representation of the sample

were among those who had obtained secondary school education background which is 62.1%, followed by those

with STPM/Diploma representing 18.2%, a small fraction (6.7%) of those who had obtained Degree education

level and another 13% were those with no formal education or others. Regularity of having transaction with the

institution to some extent will provide evidence for the understanding acceptance, loyalty and trust. The

distribution of sample in this aspect indicated that 29.7% of the respondent visited the institution only once,

followed by a total representation of 41.8% had been dealing with the institution for two or three times. About

one fifth of the sample had been dealing with the institution between four to five times while the remaining of

9.4% constitutes of those having transaction with Maidam for more than five times.

4.3 Chi-Square Analysis

Table 2 displayed the analysis between respondents demographic and Customer acceptance towards Ar-Rahnu

MAIDAM. The analysis revealed that only marital status and occupational sector had the value of Pearson

Chi-square below than 0.05. It indicated that marital status and occupational sector were significantly difference

in terms of their acceptance.

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

32

Table 2. Gender, marital status, age, monthly income, education level, occupational sector, duration of customer

relationship, frequency of visiting *customer acceptance

Customer Acceptance towards Ar-Rahnu Maidam Dungun

Strongly

Disagree

Disagree Uncertainty Agree

Strongly

Agree

Total

Chi

Square

Gender

Male 0(0%) 1(0.49%) 8(3.02%) 127(62.25%) 6(33.33%) 204(100%)

0.235

Female 1(0.79%) 0(0%) 3(2.38%) 68(53.97%) 54(42.86%) 126(100%)

Marital Status

Single 0(0%) 0(0%) 4(8.51%) 33(70.21%) 10(21.28%) 47(100%)

0.031 Married 1(0.39%) 1(0.39%) 7(2.71%) 145(56.20%) 104(40.31%) 258(100%)

Sgle Parents 0 (0%) 0 (0%) 0 (0%) 17 (68%) 8 (32%) 25(100%)

Age

< 20 years 0(0%) 0(0%) 1(16.66%) 4(66.67%) 1(16.67%) 6(100%)

0.767

21-30 years 0(0%) 1(1.03%) 5(5.15%) 56(57.73%) 35(36.08%) 97(100%)

31-40 years 1(0.76%) 0(0%) 4(4.58%) 72(54.96%) 54(41.22%) 131(100%)

41-50 years 0(0%) 0(0%) 1(1.39%) 50(69.44%) 21(29.17%) 72(100%)

>50 years 0(0%) 0(0%) 0(0%) 13(54.17%) 11(45.83%) 24(100%)

Education Level

Primary Sch 0(0%) 0(0%) 0(0%) 4(50%) 4(50%) 8(100%)

0.407

SRP/PMR 0(0%) 0(0%) 0(0%) 25(71.43%) 10(28.57%) 35(100%)

SPM 1(0.49%) 0(0%) 5(2.44%) 111(54.15%) 88(42.93%) 205(100%)

STPM/Dip 0(0%) 1(1.67%) 4(6.67%) 41(68.33%) 14(23.33%) 60(100%)

Degree

above

0(0%) 0(0%) 2(9.09%) 14(63.64%) 6(27.27%) 22(100%)

Occupational Sector

Government 0 (0%) 0 (0%) 6(15.7%) 26(68.42%) 6(15.79%) 38(100%)

0.000

Private 0 (0%) 0 (0%) 1(2.86%) 28(80%) 6(17.14%) 35(100%)

S/Employed 0 (0%) 1(0.66%) 1(0.66%) 88(57.89%) 62(40.79%) 152(100%)

Housewife 1(0.59%) 0 (0%) 3(2.86%) 53(50.48%) 48(45.71%) 105(100%)

Monthly Income Level

< RM1,000 1(0.56%) 0 (0%) 5(2.81%) 98(55.06%) 74(41.57%) 178(100%)

0.425

RM1,001-

RM2,000

0 (0%) 1(1.25%) 3(3.75%) 47(58.75%) 29(36.26%) 80(100%)

RM2,001-

RM3,000

0 (0%) 0 (0%) 1(2.56%) 27(69.23%) 11(28.21%) 39(100%)

RM3,001-

RM4,000

0 (0%) 0 (0%) 2(7.67%) 18(69.23%) 6(23.08%) 26(100%)

> RM4,001 0 (0%) 0 (0%) 0(0%) 5(71.43%) 2(28.57%) 7(100%)

Duration of customer relationship with Ar-Rahnu Maidam

< 1 year 1(1.64%) 0 (0%) 2(3.28%) 38(62.30%) 20(32.79%) 61(100%)

0.131

2-3 years 0 (0%) 1(0.75%) 5(3.73%) 75(55.97%) 53(39.55%) 134(100%)

4-5 years 0 (0%) 0 (0%) 3(3.53%) 54(63.53%) 28(32.94%) 85(100%)

> 6 years 0 (0%) 0 (0%) 1 (2%) 28(56%) 21(42%) 50(100%)

Frequency of visiting

< 1 time 1(1.02%) 0 (0%) 3(3.06%) 59(60.2%) 35(35.71%) 98(100%)

0.531

2 -3 times 0 (0%) 1(0.72%) 6(4.35%) 83(60.14%) 48(34.78%) 138(100%)

4-5 times 0 (0%) 0(0%) 2(3.17%) 33(52.38%) 28(44.44%) 63(100%)

> 6 times 0 (0%) 0 (0%) 0 (0%) 20(64.52%) 11(35.48%) 21(100%)

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

33

Analysis between gender and customer acceptance showed that majority of the respondents agreed that

Ar-Rahnu MAIDAM were accepted by customer. However, the value of Pearson Chi-square indicated that it was

not significant as indicated by the value of 0.235.

Analysis between marital status and customer acceptance towards Ar-Rahnu MAIDAM showed that majority of

the respondent with divorced status agreed that Ar-Rahnu scheme offered by MAIDAM are acceptable. For

married respondents, majority (96.51%) of them agreed, 2.71% were uncertain and only 0.78% did not indicate

their acceptance towards Ar-Rahnu scheme offered by MAIDAM. Similarly as for the respondents with single

status, 91.49% agreed and only 8.51% were uncertain that Ar-Rahnu scheme offered were acceptable by them.

The Chi-Square column shows that the result is significant at 0.031. It can be assumed that married respondents

are burden with many responsibilities and commitment towards their family.

Analysis between age and customer acceptance towards Ar-Rahnu MAIDAM showed that 100% of the

respondent above 51 years old found that Ar-Rahnu MAIDAM were acceptable. For the respondent between

41-50 years old, majority (98.61%) of them agreed and only 1.39% of them were uncertain about their

acceptance towards Ar-Rahnu MAIDAM. For the respondent between the age of 31-40 years old, 93.81% agreed,

5.15% were uncertain and 1.03% indicated their disagreement about their acceptance. 83.34% of the respondent

age below 20 years old indicated their acceptance of Ar-Rahnu MAIDAM and only 16.66% were uncertain about

their status of acceptance at Ar-Rahnu MAIDAM. The Chi-Square column shows that the result demonstrated

that there is no significant difference (0.767) as to the age group.

Further analysis between occupational sector and customer acceptance towards Ar-Rahnu MAIDAM was

performed. The analysis showed that 98.68% of the respondent from self-employed and only 0.66% of them was

uncertain about their acceptance towards Ar-Rahnu scheme offered by MAIDAM. For private sector respondent,

97.14% of them agreed and only 2.86% were uncertain about their acceptance of Ar-Rahnu scheme. 96.19% of

respondent from housewife agreed to accept Ar-Rahnu Maidam, 0.59% disagreed and 2.86% were uncertain, for

government respondents, 84.21% agreed and only 15.79% were uncertain about their acceptance towards

Ar-Rahnu Maidam. The Chi-Square column shows that the result is significant differences at 0.000. The

researcher concluded majority of self-empolyed comes to Ar-Rahnu Maidam because they know that Ar-Rahnu

scheme is a place where they can get cash immediately, to help them operating their business. This point strongly

supported by Appannan and Doris (2010). They said Islamic pawnshop (Ar-Rahnu scheme) is the most

appropriate mechanism as it provides a financial product for the lower-income group and small businesses which

usually have limited capital or have been excluded from the mainstream financial system.

For the analysis between monthly income level and customer acceptance towards Ar-Rahnu Maidam, the result

revealed that 100% of the respondent with an income group of above RM4, 001 agreed with Ar-Rahnu scheme

offer by Maidam. 97.44% of the respondent between the monthly income level of RM2,001-RM3,000 agreed

and only 2.56% were uncertain about the acceptance of the scheme offered. Of the respondent with monthly

income level below RM1,000, 96.63% agreed; only 0.56% and 2.81% did not agree and uncertain towards the

acceptance of Ar-Rahnu scheme offered. 95% of respondent between monthly income level of

RM1,001-RM2,000 agreed 1.25% of them disagreed and 3.75% were uncertain about their acceptance of

Ar-Rahnu Maidam. For those with monthly income of RM3,001-RM4,000, 92.31% agreed and only 7.67% were

uncertain on the status of their acceptance. The Chi-Square column shows that the result is not significant

differences at 0.425.

Table 2 further displayed the analysis between educational level and customer acceptance towards Ar-Rahnu

Maidam showed that majority 100% of the respondents with the Primary school and SRP/PMR (Lower Level

certificate) qualification. Of those from the SPM (Secondary School Level certificate), STPM (Higher School

certificate)/Diploma and Degree holder, the result demonstrated that 97.08%, 01.66% and 90.91% agreed with

the Ar-Rahnu scheme offer by Maidam. The Chi-Square column shows that the result is not significant

differences at 0.407.

For the analysis between duration of customer relationship and customer acceptance, the result showed that 98%

of the respondent had been Ar-Rahnu Maidam Dungun customer more than 6 years, agreed and only 2% were

uncertain that Ar-Rahnu Maidam had accepted by them. As for the respondent who had been Ar-Rahnu Maidm

Dungun customer between 4-5 years, 2-3 years and less than 1 year of them agreed and only 3.53%, 3.73% and

3.28% were uncertain about customer acceptance at Ar-Rahnu Maidam Dungun. The Chi-Square column shows

that the result is not significant differences at 0.131.

Analysis between frequencies of yearly visiting and acceptance towards Ar-Rahnu Maidam revealed that 100%

of the respondent in group more than 6 times agreed, 96.82% of those with 4-5 times visits and 3.17% were

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

34

uncertain about their acceptance. Respondent with frequency of visiting less than 1 time (95.91%) agreed, while

only 1.02% and 3.28% disagreed and uncertain about the statue of their acceptance. As for the respondents who

had been visiting between 2-3 times, 94.92% of them agreed, 4.35% uncertain and 0.72% disagreed about their

acceptance at Ar-Rahnu Maidam. The Chi-Square column shows that the result is not significant differences at

0.531.

5. Conclusion and Recommendation

The issue of understanding differences is always remain relevant for most industrial practitioners. Any related

findings as to the above is very useful as it will provide evidence to those parties involved in formulating

strategies that attempted to accommodate difference characteristics of the public which could possibly end up

with better acceptance of the services rendered. Revisiting back the result from correlation analysis (Ahmad et

al., 2012), researcher discovered that several dimensions such as storage charge, service quality, locality, and

management practice indicated the significant relationship with the customer acceptance. Thus the need to

understand differences of customers profile should not be neglected. The effort taken to understand customer

acceptance is very much related toward the enculturation of Customer relationship Management (Mansor et al.,

2011c). In shaping the acceptance it will not be feasible to leave out earlier theory of service quality by

Parasuraman et al. (1985) and Bolton (1998); observing the efficient management practices (Ahmad & Fontaine,

2011) and considering the impact of locality and storage issues (McDaniel et al., 2011; Kotler, 1986; McCarthy

& Perreault, 1984; Laufer, 1979). Our finding in the case of Ar-Rahnu suggested that it is crucial to measure the

differences of the acceptance level as most literature demonstrated that the findings are inconsistent with each

other.

Reviewing back the mission statement of Ar-Rahnu, it seems that the approach taken to provide financial

assistance to the lower income group are getting popular response from the public from year to year. In fact the

public are highly confident with the services offered by the institutions. The public are very happy with the fees

charged on the principle borrowed as it is not too burdened in sustaining their living.

The management of the institution had been made to understand that the need of customers has to be satisfied,

while at the same time the obligation to assist the needy has to be equitably performed. The findings concerning

the inequality of acceptance based on occupational sectors as well as on the marital status needed serious

attention if Ar-rahnu Maidam is to remain relatively well accepted by the consumers.

This research was investigated only in one of the branches of Ar-Rahnu Maidam. There were several other

branches in the state, thus the findings may not be able to generalize the entire operation of Ar-Rahnu Maidam.

However the findings and the discussion on this study still found to be useful for the management of Ar-rahnu

MAIDAM in assessing the more appropriate strategies for handling the customers. For some cases one approach

may be good enough while some other group, several strategies may be considered to be more effective.

References

Ahmad, K., & Fonatine, R. (2011). Management from an Islamic Perspective (2nd ed.). Pearson Custom

Publishing, Malaysia.

Ahmad, S. A. B., Mansor, N., & Nadiah, A. N. (2012). Customer Acceptance on Islamic Pawn Broking: A

Malaysian Case. Interdisciplinary Journal of Contemporary Research in Business, 3(10), 748-763.

Ali, S. H. S., Mansor, N., & Abdullah, Z. (2013). Respect Your Customers and Earn Their Trust: An Empirical

Evidence. Human Resource Management Research, 3(1), 16-20.

Amin, H., Chong, R., Dahlan, H., & Supinah, R. (2007). An Ar-Rahnu Shop Acceptance Model (ARSAM).

Labuan E-Journal of Muamalat and Society, 1(1), 88-101.

Anderson, E. W., & Sullivan, M. (1993). The antecedents and consequences of customer satisfaction for firms.

Marketing Science, 12, 125-143. http://dx.doi.org/10.1287/mksc.12.2.125

Appannan, S., & Doris, G. (2010). A study on Islamic pawn broking awareness and factors influencing the

scheme in Sungai Petani, Kedah. 2

nd

International Conference on Business and Economics Research

Proceeding, 389(2

nd

ICBER), 2141-2148.

Bedi, M. (2010). An integrated framework for service quality, customer satisfaction and behavioral responses in

Indian banking industry: A comparison of public and private sector banks. Journal of Service Research,

10(1), 157-172.

Bolton, R. N. (1998). A Dynamic Model of the Duration of the Customers Relationship with a Continuous

Service Provider. Marketing Science, 17(1), 45-66. http://dx.doi.org/10.1287/mksc.17.1.45

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

35

Boulding, W., Kalra, A., Staelin, R., & Zeithaml, V. A. (1993). A dynamic process. British Food Journal, 109(10),

765-776.

Brady, M. K., & Cronin, J. J. Jr. (2001). Some Thoughts on Conceptualizing Perceived Service Quality: A

Hierarchical Approach. Journal of Marketing, 65(3), 34-49. http://dx.doi.org/10.1509/jmkg.65.3.34.18334

Caceres, R. C., & P., N. C. (2007). Service Quality, Relationship Satisfaction, Trust, Commitment and

Busines-to-business Loyalty. European Journal of Marketing, 41(7/8), 836-867.

http://dx.doi.org/10.1108/03090560710752429

Carhuana, A., Erwing, M. T., & Ramasheshan, B. (2004). Assessment of the Three-Column Format SERVQUAL:

An Experimental Approach. Journal of Business Research, 49(1), 57-65.

http://dx.doi.org/10.1016/S0148-2963(98)00119-2

David, F. R. (2009). Strategic Management, Concept & Cases (12th ed.). Pearson International Edition, Upper

Saddle River, New Jersey, United State of America.

Drucker, P. F. (1986). The Frontiers of Management. Butterworth Heinemann, Great Britain.

Goodman, A. H., Fandt, P. M., Michlitsch, J. F., & Lewis, P. S. (2007). Management Challenges for Tomorrows

Leaders (5th ed.). Thomas Learning Academic, Mason Ohio, United State of America.

Haron, S. (1996). Prinsip dan Operasi Perbankan Islam. Berita Publishing Sdn. Bhd. Malaysia.

Holetzky, S. (2008). What is customer Loyalty. Retrieved September 2, 2011, from

http://www.wisegeck.com/what-is-customer-loyalty

Ismail, A. G., & Ahmad, N. Z. (1997). Pawnshop as an instrument of microenterprise credit in Malaysia.

International Journal of Social Economics, 24(11), 1343-1352.

http://dx.doi.org/10.1108/03068299710193633

Kassim, N., & Abdullah, N. A. (2010). The effect of perceived service quality dimensions on customer

satisfaction, trust and loyalty in e-commerce settings: A cross cultural analysis. Asia Pacific Journal of

Marketing and Logistics, 22(3), 123-128. http://dx.doi.org/10.1108/13555851011062269

Khan, J. A., & Nisar, S. (2004). Collateral (Al-Rahn) as practiced by Muslim funds of North India, J. Kau.

Islamic Economics, 17(1), 17-34.

Kotler, P. (1986). Principles of Marketing (3rd ed.). Prentice Hall International, New Jersey, United States of

America.

Kotler, P., & Armstrong, G. (2010). Principles of Marketing (13th ed.). Pearson Education, Inc., Upper saddle

River, New Jersey.

Krejcie, R., & Morgan, D. (1970). Determining Sample Size for Research Activities. Education and

Physiological Measurement, 30, 607-610.

Laufer, A. C. (1979). Operations Management (2nd ed.). South-Western Publishing, Cincinnati, United States of

America.

Malhotra, N. K. (2009). Basic Marketing Research: A Decision Making Approach (3rd ed.). Pearson Prentice

Hall, USA.

Mansor, N., & Razali, C. H. C. M. (2010). Customers Satisfaction towards Counter Service of Local Authority

in Terengganu, Malaysia. Asian Social Science, 6(8), 197-208.

Mansor, N., Abdullah, Z., & Rahim, N. A. (2011c). The significant Role of CRM in Banking Service: Do

demographic indicators differs. Asian Journal of Management Sciences, (4), 114-127.

Mansor, N., Daud, R., Zakaria, Z., & Daud, N. M. (2011b). The evaluation of Customer Satisfaction on Service

delivery by Post Offices in Malaysia: A Service quality and Service Feature Perspective. In W. D. Nelson

(Ed.), Advances in Business and Management (Vol. 1). 1st quarter, Nova Science Publishers Inc. USA.

Mansor, N., Hamid, A. C., & Muda, W. A. M. W. (2011a). The Acceptance of Proposed Tourism Development

Project in Newly Developed District. International Journal of Business and Social Science, 2(20), 106-115.

Martin, D., O Neil, M., Hubbard, S., & Palmer, A. (2008). The role of emotion in explaining consumer

satisfaction and future behavioral intention. Journal of Services Marketing, 22(3), 224-236.

http://dx.doi.org/10.1108/08876040810871183

www.ccsenet.org/ass Asian Social Science Vol. 10, No. 2; 2014

36

McCarthy, E. J., & Perreault, Jr. W. D. (1984). Basic Marketing (8th ed.). Richard d Irwin Inc., Illinios, United

State of America.

McDaniel, C., Lamb, C. W., & Hair, Jr. J. F. (2011). Introduction to Marketing (International ed.).

South-Western Cengage learning, China.

Mohammed, N., Daud, N. M. M., & Sanusi, N. A. (2005). Analisis skim Ar-Rahnu: Satu kajian perbandingan

dengan pajak gadai konvensional. Prosiding Seminar Kewangan dan Ekonomi Islam: Pengukuhan

danTransformasi Ekonomi dan Kewangan Islam, 29-30 Ogos, Esset-Bangi, Selangor Darul Ehsan,

Malaysia.

Naim, A. M. (2004). Sistem Gadaian Islam. Islamiyyat: International Journal of Islamic Studies, 26(2), 39-57.

Naylor, M., & Greco, S. (2002). Customer Chemistry: How to Keep the Customers You Want and Say

"Good-bye" to the Ones You Don't, McGraw-Hill. Chicago.

Oliver, L. (1994). Perceived Service quality as a customer-based performance measure: An empirical

examination of organizational barriers using an extended service quality model. Human Resource

Management, 30(3), 335-364.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1985). A Conceptual Model of Service Quality and Its

Implications for Future Research. Journal of Marketing, 49, 41-50. http://dx.doi.org/10.2307/1251430

Razak, A. A. (2008). Malaysian Practice of Ar-Rahnu scheme: Trends and development, 1-10.

Rogers, E. M., & Shoemaker, F. F. (1971). Communication of innovations. The Free Press, New York.

Sanusi, N. A., & Johari, M. S. (2007). Permintaan Perkhidmatan Pajak Gadai: Perspektif Pengguna. (Demand of

Pawn Shop Service: Consumers Perspective). Malaysian Journal of Consumer and Family Economic, 10,

20-29.

Sekaran, U., & Bougie, R. (2010). Research Methods for Business: A Skill Building Approach (5th ed.). John

Wiley & Sons, West Sussex, United Kingdom.

Weisbord, M. (1987). Toward Third-Wave Managing and Consulting. Organizational Dynamics, 15(3), 4-25.

http://dx.doi.org/10.1016/0090-2616(87)90035-0

Yusri, C. M., & Hashim, C. (1995). Pelopor Sistem Gadaian Islam. Jurnal Dewan Ekonomi, 16-17.

Zeithaml, V. (2000). Service quality, Profitability and the Economic Worth of the Consumers. Journal of the

Academy of Marketing, 28(1), 67-85. http://dx.doi.org/10.1177/0092070300281007

Zins, A. H. (2001). Relative Attitudes and Commitment in Consumer Loyalty models: Some Experiences in

Commercial Airline Industry. International Journal of Service Industry Management, 12(3), 269-294.

http://dx.doi.org/10.1108/EUM0000000005521

Copyrights

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution

license (http://creativecommons.org/licenses/by/3.0/).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Eyes Open 2Document6 pagesEyes Open 2Yoncé Ivy Knowles0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- OptiX PTN 960 V100R005C01 Hardware Description 02Document228 pagesOptiX PTN 960 V100R005C01 Hardware Description 02Michael WongNo ratings yet

- Basic Physics For Radiology ExamsDocument12 pagesBasic Physics For Radiology Examsnikhilpatel1986No ratings yet

- 1Document16 pages1mercuriusNo ratings yet

- hw1 EconometricsDocument2 pageshw1 EconometricsVarun AnbualaganNo ratings yet

- Lecture Notes-Multiple Antennas For MIMO Communications - Basic TheoryDocument48 pagesLecture Notes-Multiple Antennas For MIMO Communications - Basic TheorygowthamkurriNo ratings yet

- Manual UltrapipeDocument10 pagesManual UltrapipevalentinNo ratings yet

- Coop 6.29.17 PDFDocument1 pageCoop 6.29.17 PDFNHRSportsNo ratings yet

- 2019 Planning OverviewDocument7 pages2019 Planning Overviewapi-323922022No ratings yet

- MV Capacitor and Voltage Divider DsDocument4 pagesMV Capacitor and Voltage Divider DsCristiano BruschiniNo ratings yet

- Continuous Casting of Aluminium: Supplement 3Document27 pagesContinuous Casting of Aluminium: Supplement 3Alejandro Méndez ArmadaNo ratings yet

- Cultural Diversity and Globalisation: An Intercultural Hermeneutical (African) PerspectiveDocument4 pagesCultural Diversity and Globalisation: An Intercultural Hermeneutical (African) PerspectivedevaNo ratings yet

- World Market Environment - Social & CulturalDocument12 pagesWorld Market Environment - Social & CulturalRica de los SantosNo ratings yet

- Image of The CityDocument7 pagesImage of The Cityradhika goel100% (1)

- ASL - Sourcing Rule Whitepaper1Document30 pagesASL - Sourcing Rule Whitepaper1Zamrud BashaNo ratings yet

- Resume 2016Document2 pagesResume 2016api-308313181No ratings yet

- 2 DFDDocument13 pages2 DFDEdrilyn Rocillo FortunoNo ratings yet

- Grade 6 Q2 Performance Task W7W8Document6 pagesGrade 6 Q2 Performance Task W7W8Joy Carol MolinaNo ratings yet

- Drying Characteristics of Mango Slices Using The Refractance Window™ Technique PDFDocument7 pagesDrying Characteristics of Mango Slices Using The Refractance Window™ Technique PDFcedu126No ratings yet

- WALT International Relations One World Many Theories PDFDocument18 pagesWALT International Relations One World Many Theories PDFFrancisco Mango100% (1)

- Whats New in CADWorx 2019 SP2Document6 pagesWhats New in CADWorx 2019 SP2Juan AliagaNo ratings yet

- Scientific American Supplement, No. 299, September 24, 1881 by VariousDocument83 pagesScientific American Supplement, No. 299, September 24, 1881 by VariousGutenberg.orgNo ratings yet

- Questionário de Esquemas de Young - Forma Breve - Valiando para o Brasil. (YSQ-S3)Document5 pagesQuestionário de Esquemas de Young - Forma Breve - Valiando para o Brasil. (YSQ-S3)rodrigoNo ratings yet

- Schmidt Bender Datasheet Gen II XR FFP 5 25x56 PM IIDocument3 pagesSchmidt Bender Datasheet Gen II XR FFP 5 25x56 PM IIJo BanaroNo ratings yet

- 2) X-Ray ImagingDocument37 pages2) X-Ray ImagingRadiologyreception front office100% (2)

- Strategy, Hang On, Here We Go!Document17 pagesStrategy, Hang On, Here We Go!Madhuri SheteNo ratings yet

- Whiteboard Pack - Make Your Own Story by Mister Horse v1Document6 pagesWhiteboard Pack - Make Your Own Story by Mister Horse v1ers_my7738No ratings yet

- EIT Course Gas Turbine Engineering CGT Brochure Rev3Document3 pagesEIT Course Gas Turbine Engineering CGT Brochure Rev3gochi best100% (1)

- PDFDocument7 pagesPDFHairin NaDhamiaNo ratings yet

- Automotive Engineering - Oxford Brookes UniversityDocument7 pagesAutomotive Engineering - Oxford Brookes UniversityFrancesco DonatoNo ratings yet