Professional Documents

Culture Documents

Shift in The Market Demand For Cinema Ticket

Shift in The Market Demand For Cinema Ticket

Uploaded by

justlinhCopyright:

Available Formats

You might also like

- Problem Set ECON 550 RDocument5 pagesProblem Set ECON 550 RMoses Macharia80% (5)

- Venture StudioDocument6 pagesVenture StudioAnil Kumar PrasannaNo ratings yet

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Marketing Mix: ProductDocument20 pagesMarketing Mix: ProductBao HoNo ratings yet

- Uncle CheffyDocument8 pagesUncle CheffyKaly Rie100% (1)

- Electricians GuideDocument296 pagesElectricians Guidemaeid75% (4)

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Live Policy V2 (AR) .Document2 pagesLive Policy V2 (AR) .lola omarNo ratings yet

- Capital Budgeting SolDocument8 pagesCapital Budgeting SolSaad AteeqNo ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocNo ratings yet

- Costo Total: Location A Location B Location CDocument9 pagesCosto Total: Location A Location B Location COmara Díaz HerreraNo ratings yet

- Party Star Agency Host Policy - 2023.3Document3 pagesParty Star Agency Host Policy - 2023.3lola omar100% (1)

- Media-Commissioning-Fee-Guidelines-2013 WeeblyDocument5 pagesMedia-Commissioning-Fee-Guidelines-2013 Weeblyapi-459644775No ratings yet

- Parcor Formation Up To Operation Ans. KeyDocument14 pagesParcor Formation Up To Operation Ans. KeyWisha Mae CauilanNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- PNL Chilitos (Versión Mayo 2015)Document38 pagesPNL Chilitos (Versión Mayo 2015)alejandrosantizoNo ratings yet

- Cash Budget AnalysisDocument7 pagesCash Budget AnalysisZazaNo ratings yet

- Shortage and OverageDocument6 pagesShortage and Overagesherryl caoNo ratings yet

- Costs and Revenue of Tarangelic Riz:: Production & Cost Case StudyDocument3 pagesCosts and Revenue of Tarangelic Riz:: Production & Cost Case StudyVicky Kuroi BaraNo ratings yet

- Auditoria Modelo 2 Marzo 04 ResueltoDocument16 pagesAuditoria Modelo 2 Marzo 04 ResueltoMasha LeandraNo ratings yet

- Aguilar Jules QuizDocument4 pagesAguilar Jules QuizJules AguilarNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- Break Even PointDocument7 pagesBreak Even PointAndryan Adi WijayaNo ratings yet

- Fee StructureDocument4 pagesFee Structureapi-523244805No ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet

- Aa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerDocument6 pagesAa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerGarp BarrocaNo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- FINAL 6-01-20 Active Scratchers Prize Tier Odds TemplateDocument19 pagesFINAL 6-01-20 Active Scratchers Prize Tier Odds TemplateLarry MicksNo ratings yet

- Aacc 103 Summative Test p2 Answer KeyDocument2 pagesAacc 103 Summative Test p2 Answer Keydemo.nacario.cocNo ratings yet

- Nomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8Document2 pagesNomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8alfi jauharoNo ratings yet

- Axel Torres Mora: Grupo 4961Document3 pagesAxel Torres Mora: Grupo 4961Axel Antonio TorresNo ratings yet

- Prizes.: OTHER Winnings (Regardless of Amount)Document8 pagesPrizes.: OTHER Winnings (Regardless of Amount)Rosemarie CruzNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Quiz Liquidation SolutionDocument8 pagesQuiz Liquidation SolutionGrace RoqueNo ratings yet

- Creditors Oustanding StatementDocument4 pagesCreditors Oustanding StatementDilan Maduranga Fransisku ArachchiNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- This Study Resource Was: Ayu Nurfitriadi 4111711020Document7 pagesThis Study Resource Was: Ayu Nurfitriadi 4111711020naura syahdaNo ratings yet

- Basic Underlying Accounting PrinciplesDocument67 pagesBasic Underlying Accounting Principlesraymond guintibanoNo ratings yet

- Sensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsDocument26 pagesSensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsFeni Ayu LestariNo ratings yet

- HR Budget 2024Document8 pagesHR Budget 2024YashwanthNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- ActivitiesDocument4 pagesActivitiesUnknowingly AnonymousNo ratings yet

- Assignment 3.1Document8 pagesAssignment 3.1Jules AguilarNo ratings yet

- Breakeven Chart For AttaDocument6 pagesBreakeven Chart For AttaMeet LapasiaNo ratings yet

- Profit and LossDocument9 pagesProfit and LossAlbiyara MannNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- (Q 16,17 PS3), (Q 1 PS4)Document4 pages(Q 16,17 PS3), (Q 1 PS4)asaNo ratings yet

- Module 2 - Laboratory Exercise 1Document10 pagesModule 2 - Laboratory Exercise 1Joana TrinidadNo ratings yet

- Cash Priority Program For 4T Partnership Illustrative ProblemDocument4 pagesCash Priority Program For 4T Partnership Illustrative ProblemHoney OrdoñoNo ratings yet

- Chapter 05Document26 pagesChapter 05slee11829% (7)

- SolutionDocument3 pagesSolutionYameteKudasaiNo ratings yet

- Accounting Equation: Under The Guidance ofDocument7 pagesAccounting Equation: Under The Guidance ofAcademic BunnyNo ratings yet

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- Class No. of Schools No. of Students Year (2019-20) Year (2020-21) Year (2021-22)Document5 pagesClass No. of Schools No. of Students Year (2019-20) Year (2020-21) Year (2021-22)Akhilesh JainNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Tuscany Year 1 Year 2Document9 pagesTuscany Year 1 Year 2juri kimNo ratings yet

- NEW Unit 2 Article Review - MaiDocument4 pagesNEW Unit 2 Article Review - MaijustlinhNo ratings yet

- Unit 7 Code of EthicsDocument7 pagesUnit 7 Code of EthicsjustlinhNo ratings yet

- Unit8 Williams Sonoma Case StudyDocument7 pagesUnit8 Williams Sonoma Case StudyjustlinhNo ratings yet

- Mr. Linh Nguyen Cuong: Email AddressDocument1 pageMr. Linh Nguyen Cuong: Email AddressjustlinhNo ratings yet

- Per CourseDocument8 pagesPer CoursejustlinhNo ratings yet

- CSU MBA 6301 SyllabusDocument8 pagesCSU MBA 6301 SyllabusNicole BaxterNo ratings yet

- Avon Strategic ManagementDocument6 pagesAvon Strategic ManagementjustlinhNo ratings yet

- Coca ColaDocument22 pagesCoca ColajustlinhNo ratings yet

- CPA Program Guide - Professional Level 2013 © CPA Australia 2013Document45 pagesCPA Program Guide - Professional Level 2013 © CPA Australia 2013Lookat MeeNo ratings yet

- Ibpm 4Document64 pagesIbpm 4Miguel Angel HernandezNo ratings yet

- Problem Set 1 - Review On Basic Soil Mech FormulasDocument2 pagesProblem Set 1 - Review On Basic Soil Mech FormulasKenny SiludNo ratings yet

- Network Nagbhid Shalini-1Document27 pagesNetwork Nagbhid Shalini-1Jayanth Kumar KanuriNo ratings yet

- Exhibitor List Foam ExpoDocument7 pagesExhibitor List Foam Expohijero7692No ratings yet

- Brian Cooksey - An Introduction To APIs-Zapier Inc (2014)Document100 pagesBrian Cooksey - An Introduction To APIs-Zapier Inc (2014)zakaria abbadiNo ratings yet

- Advanced Enzymes White PaperDocument16 pagesAdvanced Enzymes White PaperAnubhav TripathiNo ratings yet

- Sale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered UnderDocument26 pagesSale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered Undernaveen KumarNo ratings yet

- Chapter One 1.0 History of Herbs: ST THDocument48 pagesChapter One 1.0 History of Herbs: ST THAbu Solomon100% (1)

- Section Capacity Section Capacity: AbutmentDocument4 pagesSection Capacity Section Capacity: AbutmentGajendra SNo ratings yet

- AHU Air Handling Unit FundamentalsDocument48 pagesAHU Air Handling Unit Fundamentalsniakinezhad50% (2)

- Swot NBPDocument8 pagesSwot NBPWajahat SufianNo ratings yet

- No. Student Name: Nadil Use A Tick To Confirm Your Subject ÜDocument2 pagesNo. Student Name: Nadil Use A Tick To Confirm Your Subject ÜNadil AdhikariwattageNo ratings yet

- Customer LoyaltyDocument10 pagesCustomer LoyaltyCarlos PacaviraNo ratings yet

- Beach-Barrier Islands System PDFDocument26 pagesBeach-Barrier Islands System PDFShilpa Patil100% (1)

- Establishing A Change RelationshipDocument10 pagesEstablishing A Change Relationshipravelyn bresNo ratings yet

- AOS-S and AOS-CX Transceiver GuideDocument138 pagesAOS-S and AOS-CX Transceiver GuideBoweeNo ratings yet

- AADE 05 NTCE 52 - PatilDocument8 pagesAADE 05 NTCE 52 - PatilAhmad Reza FarokhiNo ratings yet

- Lexi BDocument62 pagesLexi BPetruss RonyyNo ratings yet

- Sso Test 20 Questions EnglishDocument2 pagesSso Test 20 Questions EnglishPanagiwtis M.No ratings yet

- Orifice Meter Is Type of Variable Head MeterDocument2 pagesOrifice Meter Is Type of Variable Head MeterMourougapragash SubramanianNo ratings yet

- GA Weather Decision-Making Dec05 PDFDocument36 pagesGA Weather Decision-Making Dec05 PDFPete AndreNo ratings yet

- Hq004 Hq006 Oplusm Manual Rev BDocument7 pagesHq004 Hq006 Oplusm Manual Rev BadrianioantomaNo ratings yet

- Dee Deng's PresentationDocument31 pagesDee Deng's PresentationИгорь МореходовNo ratings yet

- Steyr S MaticDocument6 pagesSteyr S Maticclcasal0% (1)

- Doordash Agreement Contract October 25Document13 pagesDoordash Agreement Contract October 25wagaga papapaNo ratings yet

- Letter VirajDocument1 pageLetter VirajPratyushAgarwalNo ratings yet

Shift in The Market Demand For Cinema Ticket

Shift in The Market Demand For Cinema Ticket

Uploaded by

justlinhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shift in The Market Demand For Cinema Ticket

Shift in The Market Demand For Cinema Ticket

Uploaded by

justlinhCopyright:

Available Formats

Maket demand of cinema ticket

QD Price of ticket

- $ 50

10 $ 40

20 $ 30

30 $ 20

40 $ 10

50 $ -

QD= -p+ 50

QD2= -p+40

QD3= -p+60

Price of ticket QD2 QD1

60 - -

50 - -

40 0 10

30 10 20

20 20 30

10 30 40

0 40 50

20

30

40

50

60

70

P

Shift in the market demand for cinema ticket

U.S

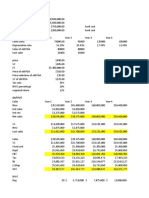

Income tax rate 40%

Revenue (1000 units) TR TR=Q*P=1000*750 750,000

Input 500000

Cost of production TC= 10000*10+1000 11,000

Gross profit Pr= TR-TC 739,000

Operating expenses //

Profit before taxes 739,000

Income taxes Ci Ci=Pr*40% 295,600

Profit after taxes 443,400

Combined result Taxes

Profit

Income tax rate 40%

Revenue (1000 units) TR

US

=Q*P=1000*750 750,000

Cost of production TC

US

= 10000*10+1000 11,000

Profit before taxes Pr

US

= TR

US

-TC

US

739,000

Income taxes Ci Ci

US

=Pr

US

*40% 295,600

Profit after taxes

For each market

Tax Combined result

U.S

443,400

-

10

20

0 10 20 30

QD3

Price of

ticket

0

10 $ 10 50

20 40 40

30 30 30

40 50 20

50 10

60 0

$-

$10

$20

$30

$40

$50

$60

- 10 20 30 40

Series1

$-

$10

$20

$30

$40

$50

$60

- 20 40 60

Q

Market demand of

cinema ticket

QD

0

10

20

30

40

50

60

$- $5 $10 $15

Axis Title

Shift in the market demand for cinema ticket

QD2

QD1

QD3

Country M

20%

TR=Q*P=500*1000 500,000

TC= FC+VC= 10000+325 10,325

489,675

//

489,675

Ci=Pr*20% 97,935

391,740

335,140

835,140

20%

TR

M

=Q*P=600*1000 600,000

TC

M

= FC+VC= 10000+325 10,325

Pr

M=

TR

M

- TC

M

589,675

Ci

M

=Pr*20% 117,935

315,140

Country M

471,740

Axis Title

40 50 60 70

Q

QD3

#REF!

#REF!

#REF!

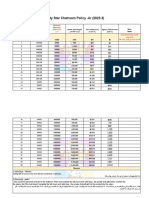

Machine A Machine B Machine C

15,000.00 $ 22,500.00 $ 37,500.00 $

Cash In Flow Year 1 6,000.00 $ 12,000.00 $ - $ 10,500.00 $

Cash In Flow Year 2 9,000.00 $ 12,000.00 $ 30,000.00 $ 750.00 $

=0 at the end of

Second years years

= 0 at the time

1.88 year

Cash In Flow Year 3 3,000.00 $ 10,500.00 $ 30,000.00 $ 0.25

= 0 at the time 3.25 year

Cash In Flow Year 4 - $ 10,500.00 $ 15,000.00 $

Cash In Flow Year 5 - $ - $ 15,000.00 $

Depreciation-Old

Helicopter

Investment

depreciation

Value 350000 60,000 $

Year 1 20% 70000 13,500 $

Year 2 32% 112000 13,500 $

Year 3 19.20% 67200 13,500 $

Year 4 11.52% 40320 13,500 $

Year 5 11.52% 40320 6,000 $

Year 6 5.76% 20160

42000

288000

Depreciation-New Helicopter

(using the 5-year MACRS schedule)

1,500.00 $ 125.00 $

0.88 $

Year 0 Year 1 Year 2 Year 3

Value of New helicopter 350,000.00 $

Depreciation-New

Helicopter 20% 32% 19.20% 11.52%

Depreciation-New

Helicopter

(using the 5-year MACRS

schedule) 70,000 $ 112,000 $ 67,200 $ 40,320 $

Depreciation-Old

Helicopter 13,500 $ 13,500 $ 13,500 $

Investment depreciation 70,000 $ 98,500 $ 53,700 $ 26,820 $

Total Depreciation Tax

Shield 23,800 $ 33,490 $ 18,258 $ 9,119 $

Year 0 Year 1 Year 2 Year 3

Value of New helicopter 350,000.00 $

Cash from sellling old

helicopter 68000

Cash from buying new

helicopter (350,000) $ (350,000) $ (350,000) $ (350,000) $

Cash from saving fuel 62,000 $ 62,000 $ 62,000 $

Year 4 Year 5

11.52% 5.76%

40,320 $ 20,160 $

13,500 $

26,820 $ 20,160 $

9,119 $ 6,854 $

Year 4 Year 5

(350,000) $ (350,000) $

62,000 $ 62,000 $

Probability Cash Flow

0.15 60,000 9,000

0.25 85,000 21,250

0.45 110,000 49,500

0.15 130,000 19,500

Total Expect cash flow 99,250

Out Comes Probability of Outcome Assumption

5,250 $ 25% pessimistic

7,800 $ 45% moderarely successful

13,500 $ 30% optimistic

0 1 2 3 4 5 6 7 8

Free cash flow -625000 99,250 99,250 99,250 99,250 99,250 99,250 99,250 99,250

Project cost of capital 10%

Discount factor 1 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467

PV of Free cash flow -625000 90227 82025 74568 67789 61626 56024 50931 46301

Salvage value 50000

NPV 34848

Year

9 10

99,250 99,250

0.424 0.386

42092 38265

Year

Probabilit

y

Cash

flow

R1

Probabilit

y

Cash

flow

R2

3.33% 400 13.33 5% 300 15

90.00% 500 450.00 5% 500 25

6.67% 700 46.67 90% 700 630

510 670

0.25 500 125 0.3 300 90

0.5 600 300 0.5 500 250

0.25 700 175 0.2 700 140

600 480

Expected Value

Year 0 Year 1 Year 2

-1,000

R

k = 0.07

61.83946196

-20.00174688

You might also like

- Problem Set ECON 550 RDocument5 pagesProblem Set ECON 550 RMoses Macharia80% (5)

- Venture StudioDocument6 pagesVenture StudioAnil Kumar PrasannaNo ratings yet

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Marketing Mix: ProductDocument20 pagesMarketing Mix: ProductBao HoNo ratings yet

- Uncle CheffyDocument8 pagesUncle CheffyKaly Rie100% (1)

- Electricians GuideDocument296 pagesElectricians Guidemaeid75% (4)

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Live Policy V2 (AR) .Document2 pagesLive Policy V2 (AR) .lola omarNo ratings yet

- Capital Budgeting SolDocument8 pagesCapital Budgeting SolSaad AteeqNo ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocNo ratings yet

- Costo Total: Location A Location B Location CDocument9 pagesCosto Total: Location A Location B Location COmara Díaz HerreraNo ratings yet

- Party Star Agency Host Policy - 2023.3Document3 pagesParty Star Agency Host Policy - 2023.3lola omar100% (1)

- Media-Commissioning-Fee-Guidelines-2013 WeeblyDocument5 pagesMedia-Commissioning-Fee-Guidelines-2013 Weeblyapi-459644775No ratings yet

- Parcor Formation Up To Operation Ans. KeyDocument14 pagesParcor Formation Up To Operation Ans. KeyWisha Mae CauilanNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- PNL Chilitos (Versión Mayo 2015)Document38 pagesPNL Chilitos (Versión Mayo 2015)alejandrosantizoNo ratings yet

- Cash Budget AnalysisDocument7 pagesCash Budget AnalysisZazaNo ratings yet

- Shortage and OverageDocument6 pagesShortage and Overagesherryl caoNo ratings yet

- Costs and Revenue of Tarangelic Riz:: Production & Cost Case StudyDocument3 pagesCosts and Revenue of Tarangelic Riz:: Production & Cost Case StudyVicky Kuroi BaraNo ratings yet

- Auditoria Modelo 2 Marzo 04 ResueltoDocument16 pagesAuditoria Modelo 2 Marzo 04 ResueltoMasha LeandraNo ratings yet

- Aguilar Jules QuizDocument4 pagesAguilar Jules QuizJules AguilarNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- Break Even PointDocument7 pagesBreak Even PointAndryan Adi WijayaNo ratings yet

- Fee StructureDocument4 pagesFee Structureapi-523244805No ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet

- Aa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerDocument6 pagesAa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerGarp BarrocaNo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- FINAL 6-01-20 Active Scratchers Prize Tier Odds TemplateDocument19 pagesFINAL 6-01-20 Active Scratchers Prize Tier Odds TemplateLarry MicksNo ratings yet

- Aacc 103 Summative Test p2 Answer KeyDocument2 pagesAacc 103 Summative Test p2 Answer Keydemo.nacario.cocNo ratings yet

- Nomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8Document2 pagesNomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8alfi jauharoNo ratings yet

- Axel Torres Mora: Grupo 4961Document3 pagesAxel Torres Mora: Grupo 4961Axel Antonio TorresNo ratings yet

- Prizes.: OTHER Winnings (Regardless of Amount)Document8 pagesPrizes.: OTHER Winnings (Regardless of Amount)Rosemarie CruzNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Quiz Liquidation SolutionDocument8 pagesQuiz Liquidation SolutionGrace RoqueNo ratings yet

- Creditors Oustanding StatementDocument4 pagesCreditors Oustanding StatementDilan Maduranga Fransisku ArachchiNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- This Study Resource Was: Ayu Nurfitriadi 4111711020Document7 pagesThis Study Resource Was: Ayu Nurfitriadi 4111711020naura syahdaNo ratings yet

- Basic Underlying Accounting PrinciplesDocument67 pagesBasic Underlying Accounting Principlesraymond guintibanoNo ratings yet

- Sensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsDocument26 pagesSensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsFeni Ayu LestariNo ratings yet

- HR Budget 2024Document8 pagesHR Budget 2024YashwanthNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- ActivitiesDocument4 pagesActivitiesUnknowingly AnonymousNo ratings yet

- Assignment 3.1Document8 pagesAssignment 3.1Jules AguilarNo ratings yet

- Breakeven Chart For AttaDocument6 pagesBreakeven Chart For AttaMeet LapasiaNo ratings yet

- Profit and LossDocument9 pagesProfit and LossAlbiyara MannNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- (Q 16,17 PS3), (Q 1 PS4)Document4 pages(Q 16,17 PS3), (Q 1 PS4)asaNo ratings yet

- Module 2 - Laboratory Exercise 1Document10 pagesModule 2 - Laboratory Exercise 1Joana TrinidadNo ratings yet

- Cash Priority Program For 4T Partnership Illustrative ProblemDocument4 pagesCash Priority Program For 4T Partnership Illustrative ProblemHoney OrdoñoNo ratings yet

- Chapter 05Document26 pagesChapter 05slee11829% (7)

- SolutionDocument3 pagesSolutionYameteKudasaiNo ratings yet

- Accounting Equation: Under The Guidance ofDocument7 pagesAccounting Equation: Under The Guidance ofAcademic BunnyNo ratings yet

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- Class No. of Schools No. of Students Year (2019-20) Year (2020-21) Year (2021-22)Document5 pagesClass No. of Schools No. of Students Year (2019-20) Year (2020-21) Year (2021-22)Akhilesh JainNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Tuscany Year 1 Year 2Document9 pagesTuscany Year 1 Year 2juri kimNo ratings yet

- NEW Unit 2 Article Review - MaiDocument4 pagesNEW Unit 2 Article Review - MaijustlinhNo ratings yet

- Unit 7 Code of EthicsDocument7 pagesUnit 7 Code of EthicsjustlinhNo ratings yet

- Unit8 Williams Sonoma Case StudyDocument7 pagesUnit8 Williams Sonoma Case StudyjustlinhNo ratings yet

- Mr. Linh Nguyen Cuong: Email AddressDocument1 pageMr. Linh Nguyen Cuong: Email AddressjustlinhNo ratings yet

- Per CourseDocument8 pagesPer CoursejustlinhNo ratings yet

- CSU MBA 6301 SyllabusDocument8 pagesCSU MBA 6301 SyllabusNicole BaxterNo ratings yet

- Avon Strategic ManagementDocument6 pagesAvon Strategic ManagementjustlinhNo ratings yet

- Coca ColaDocument22 pagesCoca ColajustlinhNo ratings yet

- CPA Program Guide - Professional Level 2013 © CPA Australia 2013Document45 pagesCPA Program Guide - Professional Level 2013 © CPA Australia 2013Lookat MeeNo ratings yet

- Ibpm 4Document64 pagesIbpm 4Miguel Angel HernandezNo ratings yet

- Problem Set 1 - Review On Basic Soil Mech FormulasDocument2 pagesProblem Set 1 - Review On Basic Soil Mech FormulasKenny SiludNo ratings yet

- Network Nagbhid Shalini-1Document27 pagesNetwork Nagbhid Shalini-1Jayanth Kumar KanuriNo ratings yet

- Exhibitor List Foam ExpoDocument7 pagesExhibitor List Foam Expohijero7692No ratings yet

- Brian Cooksey - An Introduction To APIs-Zapier Inc (2014)Document100 pagesBrian Cooksey - An Introduction To APIs-Zapier Inc (2014)zakaria abbadiNo ratings yet

- Advanced Enzymes White PaperDocument16 pagesAdvanced Enzymes White PaperAnubhav TripathiNo ratings yet

- Sale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered UnderDocument26 pagesSale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered Undernaveen KumarNo ratings yet

- Chapter One 1.0 History of Herbs: ST THDocument48 pagesChapter One 1.0 History of Herbs: ST THAbu Solomon100% (1)

- Section Capacity Section Capacity: AbutmentDocument4 pagesSection Capacity Section Capacity: AbutmentGajendra SNo ratings yet

- AHU Air Handling Unit FundamentalsDocument48 pagesAHU Air Handling Unit Fundamentalsniakinezhad50% (2)

- Swot NBPDocument8 pagesSwot NBPWajahat SufianNo ratings yet

- No. Student Name: Nadil Use A Tick To Confirm Your Subject ÜDocument2 pagesNo. Student Name: Nadil Use A Tick To Confirm Your Subject ÜNadil AdhikariwattageNo ratings yet

- Customer LoyaltyDocument10 pagesCustomer LoyaltyCarlos PacaviraNo ratings yet

- Beach-Barrier Islands System PDFDocument26 pagesBeach-Barrier Islands System PDFShilpa Patil100% (1)

- Establishing A Change RelationshipDocument10 pagesEstablishing A Change Relationshipravelyn bresNo ratings yet

- AOS-S and AOS-CX Transceiver GuideDocument138 pagesAOS-S and AOS-CX Transceiver GuideBoweeNo ratings yet

- AADE 05 NTCE 52 - PatilDocument8 pagesAADE 05 NTCE 52 - PatilAhmad Reza FarokhiNo ratings yet

- Lexi BDocument62 pagesLexi BPetruss RonyyNo ratings yet

- Sso Test 20 Questions EnglishDocument2 pagesSso Test 20 Questions EnglishPanagiwtis M.No ratings yet

- Orifice Meter Is Type of Variable Head MeterDocument2 pagesOrifice Meter Is Type of Variable Head MeterMourougapragash SubramanianNo ratings yet

- GA Weather Decision-Making Dec05 PDFDocument36 pagesGA Weather Decision-Making Dec05 PDFPete AndreNo ratings yet

- Hq004 Hq006 Oplusm Manual Rev BDocument7 pagesHq004 Hq006 Oplusm Manual Rev BadrianioantomaNo ratings yet

- Dee Deng's PresentationDocument31 pagesDee Deng's PresentationИгорь МореходовNo ratings yet

- Steyr S MaticDocument6 pagesSteyr S Maticclcasal0% (1)

- Doordash Agreement Contract October 25Document13 pagesDoordash Agreement Contract October 25wagaga papapaNo ratings yet

- Letter VirajDocument1 pageLetter VirajPratyushAgarwalNo ratings yet