Professional Documents

Culture Documents

Buying - How To Find The Big Winners in The Stock Market (Point and Figure Charts)

Buying - How To Find The Big Winners in The Stock Market (Point and Figure Charts)

Uploaded by

mmc1711100%(1)100% found this document useful (1 vote)

124 views17 pagesThis document discusses strategies for identifying "big winner" stocks that produce outsized returns. It notes that the distribution of stock market returns has "fat tails", meaning extreme positive and negative returns are more common than would be expected from a normal distribution. It recommends focusing on stocks in the positive right tail of 10-20% of stocks that have produced the best returns. It describes several screening tools used to identify stocks showing strong relative strength trends, momentum, and patterns that may foreshadow future outperformance. It also provides guidelines for managing positions in big winner stocks, such as selling when trends weaken or a stock falls below technical support levels.

Original Description:

Illustrative examples

Original Title

Buying - How to Find the Big Winners in the Stock Market (Point and Figure Charts)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses strategies for identifying "big winner" stocks that produce outsized returns. It notes that the distribution of stock market returns has "fat tails", meaning extreme positive and negative returns are more common than would be expected from a normal distribution. It recommends focusing on stocks in the positive right tail of 10-20% of stocks that have produced the best returns. It describes several screening tools used to identify stocks showing strong relative strength trends, momentum, and patterns that may foreshadow future outperformance. It also provides guidelines for managing positions in big winner stocks, such as selling when trends weaken or a stock falls below technical support levels.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(1)100% found this document useful (1 vote)

124 views17 pagesBuying - How To Find The Big Winners in The Stock Market (Point and Figure Charts)

Buying - How To Find The Big Winners in The Stock Market (Point and Figure Charts)

Uploaded by

mmc1711This document discusses strategies for identifying "big winner" stocks that produce outsized returns. It notes that the distribution of stock market returns has "fat tails", meaning extreme positive and negative returns are more common than would be expected from a normal distribution. It recommends focusing on stocks in the positive right tail of 10-20% of stocks that have produced the best returns. It describes several screening tools used to identify stocks showing strong relative strength trends, momentum, and patterns that may foreshadow future outperformance. It also provides guidelines for managing positions in big winner stocks, such as selling when trends weaken or a stock falls below technical support levels.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 17

W.

Clay Allen CFA Page 1 1/22/2003

How to find the big winners in the stock market.

Big Winners = Stocks in the positive right-hand tail of the distribution

of returns

Positive fat tail in

the observed

distribution

Negative fat tail in

the observed

distribution

Narrow

peak in the

observed

distribution

Distribution of returns Normal vs. Fat Tails

Theoretical distribution Observed distribution

Region occupied by major winners in the stock market

The far right tail of the distribution of returns is the province of major winners.

As a stock departs from the central part of the distribution the relative strength improves. In my

opinion the trend of relative strength gives an early indication of significant improvement before

the long-term relative strength ranking systems pick up the change.

Many times the movement away from the center of the distribution will be dramatic and will

register as a substantial event in relative strength on the Market Dynamics System. The key

question remaining is how long the stock will participate in the far right-hand portion of the

distribution. This cannot be known with any certainty ahead of time. As long as the stock

performs in the acceptable region it is OK when the stock falls out of the acceptable region a

replacement should be found.

Managing a position in a big winner is somewhat different than managing a less dynamic

position.

Stocks in the right-

hand tail

W. Clay Allen CFA Page 2 1/22/2003

Big Winners - Returns best 10% to 20% of all stocks!

The far right-hand tail of the theoretical normal distribution holds about 2.0% of

the total population. In the stock market, recent studies indicate that the region

under the curve at the same level of extreme as measured by +2.0 standard

deviations holds about 5 to 10 times as many members of the population as the

theoretical normal distribution. Therefore the far right-hand tail holds 10% to 20%

of the population. Major winners are far more prevalent in the stock market than

they would be if the distribution of returns from stocks was an exactly normal

distribution.

This is also true for the left-hand tail in that 10% to 20% of the total population lie

in the extremes on the left side of the distribution. Major disasters tend to form

more frequently than they should if the stock market was distributed in an exactly

normal fashion.

This seems to explain why the stock market follows the Pareto Principle. The

Pareto Principle says that approximately the best 20% of a portfolio accounts for

approximately 80% of the portfolios return. This principle has also been called the

rule of retailing.

This observation has extremely practical implications for portfolio management.

1. Stocks in the left-hand tail (left 20%) must be avoided.

2. Stocks in the middle 60% of the distribution are of little interest until they

start to out-perform.

3. Stocks in the right-hand 20% of the distribution are the most desirable

holdings for the portfolio but only as long as they continue to record excess

returns as measured by relative strength.

4. These opportunities seem to exist continuously in the stock market.

Care must be exercised, however, to maintain adequate industry and sector

diversification in the portfolio. Many times stocks in the far right-hand tail of the

distribution of returns may share common fundamental characteristics. When this

is the case these stocks may all reverse direction and turn down together.

In highly speculative markets the population of the far right-hand tail will be

among the most speculatively priced issues in the market. In the recent major bull

market, the relative strength trajectory for many of these issues became nearly

vertical and suggested a blow off. Portfolio managers must keep in mind that in

highly speculative stocks a reversal of the relative strength trend often occurs

very quickly and positions should be sold at the slightest sign of trouble.

W. Clay Allen CFA Page 3 1/22/2003

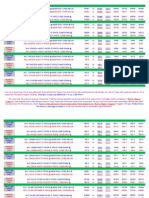

Market Dynamics screens -identify as the movement begins all of

these screens are on the lists drop-down menu

Part 1 relative strength screens

covering various time frames

Part 3 Screens for stocks

showing various buy patterns on

the relative strength point &

figure charts.

Most of these screens are prepared and distributed daily with the database update over the

Internet. These screens always appear in alphabetical sequence when using the Lists drop-

down menu on the Market Dynamics System.

An effective way to use the screens is to review the screen quickly and when an interesting

pattern appears the chart should be sent to the printer for later study.

These lists are stored in files in the \MDRS\ folder. The files are text files that are composed of

one ticker symbol per line. Some users copy these lists to other systems for review in a

different format

Part 1 - Filenames:

Bigwnrs.dat

Highrs.dat

Hirs1mo.dat

Part 3 - Filenames:

Rankjump.dat

Buylists.dat

Tenboxup.dat

Uprs.dat

Bullpulb.dat

W. Clay Allen CFA Page 4 1/22/2003

Highest relative strength over the past month

This chart is an example drawn from the Market

Dynamics screen for the highest relative

strength charts over the prior month. This is a

list of one hundred stocks and it is updated

daily.

45-degree bullish support

line

W. Clay Allen CFA Page 5 1/22/2003

Highest relative strength over the past three months

This is an example drawn from the Market Dynamics screen

for the best relative strength stocks over the prior three

months. One hundred stocks are included in this screen

and it is updated daily.

W. Clay Allen CFA Page 6 1/22/2003

Highest increase in relative strength rank past three weeks

This stock is an example drawn from the screen

that ranks the stocks by the biggest jump in

relative strength rank over the past three weeks.

There are 50 stocks on this list and it is updated

daily.

Ten Xs

straight up

W. Clay Allen CFA Page 7 1/22/2003

Stocks with a pattern on ten Xs up

Big moves often start with a bang! This screen identifies

stocks with a column of ten Xs straight up. We cant tell

for sure whether the move will continue but at least we

know we are observing a dynamic move up. The entire

database is scanned for this condition. The list will vary in

length depending upon how many stocks meet the

condition. The screen is updated daily.

Ten Xs

straight up

W. Clay Allen CFA Page 8 1/22/2003

Triple top buy signals

A triple top buy signal is a common condition that is associated

with the beginning and development of major up moves. This

screen shows all stocks with this buy signal pattern. The list

varies in length depending on the number of stocks that meet

the criteria.

W. Clay Allen CFA Page 9 1/22/2003

Best time for entry - during market oversold extremes

A stock that can develop a strong buy pattern or high relative strength during a

deep oversold condition in the overall market is an attractive candidate for

purchase provided it is of average or above average volatility.

Oversold conditions can be identified by various oscillators on market averages

such as intermediate to long-term Wilder RSI or stochastics. Trend condition

indicators that gauge the trend status of a broad list of stocks will also give valid

oversold readings at favorable times in the market.

Stocks that hold up and do well during market declines are very strong stocks and

the demand for these shares must be very strong. The exceptions to this rule are

low volatility stocks that dont go down because of their low volatility these are

usually thought of as defensive issues.

It is probably not good portfolio strategy to delay the purchase of a very strong

stock to wait for a market oversold. The entry price may not be improved that

much and big winners may get away while waiting for the oversold.

Potentially big stocks will usually demonstrate their future performance capability

during an oversold condition in the market.

W. Clay Allen CFA Page 10 1/22/2003

Managing the position - Use the High performance Bullish Support line

Big winners will often run for many columns above the high

performance bullish support line. These stocks may have serious

corrections and still remain above this line. The volatility of these

stocks is usually quite high so the relative strength point and figure

chart may cover less than a year. The high performance bullish

support line also provides a rough estimate of the risk to support

should a correction take place. Should the portfolio manager decide

the risk to support is too great - then a sale into strength can be

made.

High performance bullish support

line

W. Clay Allen CFA Page 11 1/22/2003

Managing the position - Use the rule of nine

High performance bullish support line

The rule of nine is derived from the literature on Japanese kagi charts. Kagi

charts are very similar to point and figure in construction and the rule of nine

seems to hold for relative strength point and figure charts.

It is not a hard and fast rule but is based on the frequently observed tendency

for stocks to make nine columns that record new highs during a major move up.

This example shows exactly nine columns with new highs.

The portfolio manager can use this rule to judge the maturity of the trend under

observation. After 7 or 8 columns with new highs the stocks relative strength plot

should be watched closely for signs of a reversal or a loss of momentum.

If the stock is very volatile and the gain is substantial the portfolio manager may

use the rule of nine to sell into strength.

W. Clay Allen CFA Page 12 1/22/2003

Managing the position - Use up trending channels

Sell on approaching the

upper bullish resistance

channel line

Upward trending channel lines are a useful guide to taking

profits. The move has been significant and the objective is to

capture profits while the stock is still strong. Does this

guarantee that the stock will reverse absolutely not but the

objective of taking profits while the stock is still strong has been

fulfilled.

If the upper channel is bring touched at a level that matches

historic resistance then the sell decision is reinforced.

Resistance

W. Clay Allen CFA Page 13 1/22/2003

Managing the position - Buy on pullbacks if possible

High performance bullish support line

This big winner started its move with an upside breakout at roughly column 3 and ran to the

ultimate peak in column 8. There were at least 10 pullbacks that moved the relative strength

back toward the HPBSL during the move up. The congestion zone between column 5 and 6

provided an excellent opportunity to buy this stock. The level of the underlying HPBSL

always defines the risk of the situation.

This move terminated after 8 columns of new highs. The rule of nine was not far off!

Triple bottom sell signal

1

2

3

4

5

6

7

8

Columns that made

new highs are

numbered

W. Clay Allen CFA Page 14 1/22/2003

Managing the position - If trend starts to stall switch to another

candidate loss of upside momentum correction or reversal?????

Significant loss of upside

momentum followed by a

triple bottom sell signal

The stock market represents a stochastic process where there are no hard and fast

rules. The future is almost completely unknown. We just have to operate on the

best guess we can muster at the time. Once the opportunity is gone it may be gone

forever! We cannot regret that we didnt sell at the very top.

We must be satisfied if we choose to protect a significant profit from the unknown

and unknowable future. Profits may disappear and not come back.

We dont want to hastily accept small profits but big gains should be taken at the first

sign of trouble!

A loss of upside momentum is usually a warning of an impending change in trend.

W. Clay Allen CFA Page 15 1/22/2003

When to take profits

This chart is shown with multiple high performance bullish support

lines drawn as the stock moved higher. This is one way a portfolio

manager can crowd a big winner and be more or less confident of

getting out on the first significant reaction that violates the last HPBSL.

Many times the major winners experience a blow-off and a top reversal

is formed very quickly. These stocks are speculative per se so a

quick exit is required to nail down the hard-won profits.

Multiple high performance

bullish support lines

Sell on this penetration

W. Clay Allen CFA Page 16 1/22/2003

Big Winners - Summary

The best ways to find the big winners of the future are the relative strength

screens shown in Part 1 and the buy-pattern screens shown in part 3 of the drop-

down menu.

The real problem is how to narrow these lists down to a managable number.

Step 1 Drop all stocks that are locked into trading ranges. These stocks will

probably not develop into big winners in the future. Trading range stocks can

provide exceptional performance if the trading range is wide enough but probably

not very often.

Step 2 - Drop all stocks that are mature, well-established businesses that

probably wont enjoy enough fundamental improvement to develop into big

winners.

Step 3 Concentrate further analysis on stocks that have something new in their

fundamental picture the N in CANSLIM by Bill ONeil. This could be a new

business, new product, new management or some other substantially new

development in their fundamental picture.

______________________________________________________________________

Time Frames - The upward trajectory for a big winner usually lasts two years

sometimes three. Speculative blowoff up moves will probably be substantially

shorter. It is impossible to forecast the length of time required for the big winner

to complete its move. You can only track the stock on the relative strength point &

figure charts and be ready to sell as the trend reverses direction. Use the upward

sloping trend channel to estimate upside targets. Use the rule of nine to gauge

the maturity of the trend being observed.

______________________________________________________________________

High Performance Bullish Support Line - The best tool for the successful

management of big winners in the stock market is the high performance bullish

support line. The slope of +1.5 provides a high hurdle rate of return to assure

performance from the holding. The user is free to apply an even steeper support

line that he/she feels is appropriate to gauge the performance of the stock. Slopes

greater than +1.5 will probably result in higher turnover but may also increase

performance.

It must be remembered that managing stock portfolios is a very dynamic process

that is not based on scientific mathematical relationships. The effective

management of stock positions is more dependent on statistical thinking. Trends

run until they reverse and the relative strength point & figure system seems to be

an effective observational tool to spot these reversals of trend.

W. Clay Allen CFA Page 17 1/22/2003

To return to the tutorial table of contents click mdtutor.pdf

303-804-0507 or FAX @ 303-804-0513

clayallen@msn.com

THIS IS NOT IN ANY SENSE A SOLICITATION OR OFFER OF THE PURCHASE OR

SALE OF SECURITIES. THE FACTUAL STATEMENTS HEREIN HAVE BEEN TAKEN

FROM SOURCES WE BELIEVE TO BE RELIABLE BUT SUCH STATEMENTS ARE

MADE WITHOUT ANY REPRESENTATION AS TO ACCURACY OR OTHERWISE.

OPINIONS EXPRESSED ARE OUR OWN UNLESS OTHERWISE STATED. FROM

TIME TO TIME WE MAY BUY AND SELL THE SECURITIES REFERRED TO HEREIN,

AND MAY HAVE A LONG OR SHORT POSITION THEREIN. PRICES SHOWN ARE

APPROXIMATE.

You might also like

- Wca-16 Rolls Royce - 250 TV Bow & Stern Tunnel Thrusters PDFDocument115 pagesWca-16 Rolls Royce - 250 TV Bow & Stern Tunnel Thrusters PDFANo ratings yet

- TradingView AddOnsDocument12 pagesTradingView AddOnsgogozdNo ratings yet

- Combining Technical and Fundamental AnalysisDocument11 pagesCombining Technical and Fundamental AnalysisMuhammad RazaNo ratings yet

- Blast Off - TraderencyclopediaDocument4 pagesBlast Off - TraderencyclopediaPatrick LeGuignol100% (1)

- Alphatrends Swing Training GuideDocument7 pagesAlphatrends Swing Training Guideart03322No ratings yet

- High Probability ETF Trading For AllDocument18 pagesHigh Probability ETF Trading For Alljbiddy7890% (1)

- Relative Strength RankingDocument12 pagesRelative Strength Rankingscriberone0% (1)

- Think or Swim ManualDocument0 pagesThink or Swim ManualpkattulaNo ratings yet

- NCFM Tecnical Analusis ModuleDocument172 pagesNCFM Tecnical Analusis ModuleDeepali Mishra86% (7)

- Relative Strength IndexDocument53 pagesRelative Strength Indexmmc171167% (3)

- Structure Loadbearing Crosswall PDFDocument41 pagesStructure Loadbearing Crosswall PDFSKhandelwalNo ratings yet

- UPSC New Syllabus & Tips To Crack IAS Preliminary & Mains Exam PDFDocument59 pagesUPSC New Syllabus & Tips To Crack IAS Preliminary & Mains Exam PDFPrateek SahniNo ratings yet

- Tutorial Chapter 1 - 0 ThermodynamicDocument2 pagesTutorial Chapter 1 - 0 ThermodynamicSufferedMuchNo ratings yet

- (Alexei Lapkin, David Constable) Green Chemistry Me (B-Ok - CC) PDFDocument337 pages(Alexei Lapkin, David Constable) Green Chemistry Me (B-Ok - CC) PDFAlex Sustaita100% (1)

- Options for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesFrom EverandOptions for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesNo ratings yet

- Stock Screener 123 Free Form TutorialDocument29 pagesStock Screener 123 Free Form TutorialHomer315No ratings yet

- Opening Range Breakout - Weekly Bars: Sensitivity TestDocument8 pagesOpening Range Breakout - Weekly Bars: Sensitivity TestOxford Capital Strategies LtdNo ratings yet

- Traders TipsDocument30 pagesTraders TipsShreePanicker100% (1)

- Bollinger Bandit Trading StrategyDocument4 pagesBollinger Bandit Trading Strategyvaldez944360No ratings yet

- Core Point and Figure Chart PatternsDocument18 pagesCore Point and Figure Chart Patternslimlianpeng100% (2)

- The Volatility Index: by David C. StendahlDocument3 pagesThe Volatility Index: by David C. StendahlKöster KamNo ratings yet

- 03 - The Reality of Trading - What Most Traders Will Never Find Out PDFDocument14 pages03 - The Reality of Trading - What Most Traders Will Never Find Out PDFextreme100% (1)

- Stock Market Miracle EbookDocument38 pagesStock Market Miracle EbookYagnesh PatelNo ratings yet

- Trend Vs No TrendDocument3 pagesTrend Vs No TrendpetefaderNo ratings yet

- System Trader 2Document26 pagesSystem Trader 2Aggelos KotsokolosNo ratings yet

- Volatility-Based T Hi La L I Technical Analysis: Strategies For Trading The Invisble Kirk NorthingtonDocument48 pagesVolatility-Based T Hi La L I Technical Analysis: Strategies For Trading The Invisble Kirk Northingtonbhuneshwar100% (1)

- Point and Figure Charts PDFDocument5 pagesPoint and Figure Charts PDFCarlos Daniel Rodrigo CNo ratings yet

- A Great Volatility TradeDocument3 pagesA Great Volatility TradeBaljeet SinghNo ratings yet

- Building A SystemDocument24 pagesBuilding A SystemchowhkNo ratings yet

- Reflex A New Zero-Lag IndicatorDocument4 pagesReflex A New Zero-Lag IndicatorKhánh Trịnh100% (2)

- MR MarketDocument64 pagesMR MarketIan CarrNo ratings yet

- MasteringMetastockManual PDFDocument84 pagesMasteringMetastockManual PDFvkumaran100% (1)

- Trading ProcessDocument3 pagesTrading ProcessecuamantisNo ratings yet

- Three Secrets For Profitable Straddle TradingDocument10 pagesThree Secrets For Profitable Straddle TradingFour Lanterns0% (1)

- Momentum InvestingDocument38 pagesMomentum InvestingTushar Rane0% (1)

- Option Spreads 0307Document17 pagesOption Spreads 0307sauravkgupta5077No ratings yet

- BassettiDocument25 pagesBassettiSargun.Singh. SethiNo ratings yet

- Iron Butterfly - Mango - Guidelines: SetupDocument1 pageIron Butterfly - Mango - Guidelines: SetupharicoolestNo ratings yet

- Gamma HuntingDocument7 pagesGamma HuntingTrentNo ratings yet

- 2001.01.06 - Elliott Wave Theorist - Bear Market StrategiesDocument3 pages2001.01.06 - Elliott Wave Theorist - Bear Market StrategiesBudi MulyonoNo ratings yet

- Canslim PullbacksDocument4 pagesCanslim Pullbacksfredtag4393No ratings yet

- Example: Crude CMP 5000 Than 1 % SL Is 50/ PointDocument4 pagesExample: Crude CMP 5000 Than 1 % SL Is 50/ PointTrading IdeasNo ratings yet

- Reversal Trading - A Beginner's Guide Forex4noobsDocument8 pagesReversal Trading - A Beginner's Guide Forex4noobsVasco JosephNo ratings yet

- Linear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Document8 pagesLinear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Oxford Capital Strategies LtdNo ratings yet

- Supply and Demand Trading - How - Frank Miller - Flip Ebook Pages 1-50 - AnyflipDocument153 pagesSupply and Demand Trading - How - Frank Miller - Flip Ebook Pages 1-50 - AnyflipAmbadiNo ratings yet

- Metastock RSC Exploration PDFDocument5 pagesMetastock RSC Exploration PDFRaam Mk100% (1)

- Breakaway GapsDocument4 pagesBreakaway GapsNikos PasparakisNo ratings yet

- Can SlimDocument1 pageCan SlimkarthipriyaNo ratings yet

- Jegadeesh and Titman (1993)Document43 pagesJegadeesh and Titman (1993)mubasheralijamroNo ratings yet

- Index Option Trading Activity and Market ReturnsDocument59 pagesIndex Option Trading Activity and Market ReturnsRamasamyShenbagaraj100% (1)

- Simple Ideas For A Mean Reversion Strategy With Good ResultsDocument37 pagesSimple Ideas For A Mean Reversion Strategy With Good ResultsVAIBHAV BUNTYNo ratings yet

- Why Do Option Prices Predict Stock ReturnsDocument49 pagesWhy Do Option Prices Predict Stock ReturnsSanket Patel100% (1)

- TradeGuider VSA SymposiumDocument2 pagesTradeGuider VSA SymposiumeffrontesNo ratings yet

- Metastock Breakout FormulasDocument5 pagesMetastock Breakout FormulassterisathNo ratings yet

- Green Line Breakout (GLB) Explained GMI Remains GreenDocument9 pagesGreen Line Breakout (GLB) Explained GMI Remains GreenChris BoumaNo ratings yet

- Moving Average ConvergenceDocument8 pagesMoving Average ConvergenceGhouse PashaNo ratings yet

- SR Trend Lines ChannelsDocument7 pagesSR Trend Lines ChannelsicycokesNo ratings yet

- G Avin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)Document11 pagesG Avin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)vipmen143No ratings yet

- Option Profit AcceleratorDocument129 pagesOption Profit AcceleratorlordNo ratings yet

- The Value and Momentum Trader: Dynamic Stock Selection Models to Beat the MarketFrom EverandThe Value and Momentum Trader: Dynamic Stock Selection Models to Beat the MarketNo ratings yet

- Full View Integrated Technical Analysis: A Systematic Approach to Active Stock Market InvestingFrom EverandFull View Integrated Technical Analysis: A Systematic Approach to Active Stock Market InvestingNo ratings yet

- The StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsFrom EverandThe StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsRating: 5 out of 5 stars5/5 (1)

- 5 Minutes a Week Winning Strategies: Trading SPY in Bull & Bear MarketFrom Everand5 Minutes a Week Winning Strategies: Trading SPY in Bull & Bear MarketRating: 2.5 out of 5 stars2.5/5 (3)

- Relative Strength Index - IndicatorDocument16 pagesRelative Strength Index - Indicatormmc1711No ratings yet

- Can Wave 2 Ever Be A TriangleDocument1 pageCan Wave 2 Ever Be A Trianglemmc1711No ratings yet

- Weekly Technical Analysis 29th Dec, 2009Document7 pagesWeekly Technical Analysis 29th Dec, 2009mmc1711No ratings yet

- Md. Rizwanur Rahman - CVDocument4 pagesMd. Rizwanur Rahman - CVHimelNo ratings yet

- Case 621F, 721F Tier 4 Wheel Loader AxelDocument15 pagesCase 621F, 721F Tier 4 Wheel Loader AxelJose CarmonaNo ratings yet

- Solution Manual For Fundamentals of Semiconductor Fabrication Gary S May Simon M Sze Isbn 0471232793 Isbn 978-0-471 23279 7 Isbn 9780471232797Document16 pagesSolution Manual For Fundamentals of Semiconductor Fabrication Gary S May Simon M Sze Isbn 0471232793 Isbn 978-0-471 23279 7 Isbn 9780471232797warepneumomxkhf100% (17)

- 3B Reactions of Alcohols and ThiolsDocument27 pages3B Reactions of Alcohols and ThiolsAnloraine GonzalesNo ratings yet

- CR Unit 1 &11 (Part A &B)Document12 pagesCR Unit 1 &11 (Part A &B)durai muruganNo ratings yet

- 4 Poisonous & Venomous AnimalsDocument47 pages4 Poisonous & Venomous AnimalsAnyi Yulieth AMPUDIA MURILLONo ratings yet

- HPB21-0457 FINAL Submittal 09-07-2021 - Ritz Sagamore LOIDocument13 pagesHPB21-0457 FINAL Submittal 09-07-2021 - Ritz Sagamore LOIthe next miamiNo ratings yet

- 5 25 17 Migraines PowerPointDocument40 pages5 25 17 Migraines PowerPointSaifi AlamNo ratings yet

- NASA NOAA Earth Sciences Letter To TrumpDocument6 pagesNASA NOAA Earth Sciences Letter To TrumpMelissa Meehan BaldwinNo ratings yet

- Brochure Keor S GBDocument8 pagesBrochure Keor S GBFernando CespedesNo ratings yet

- Bristol Comp Catalog 4Document102 pagesBristol Comp Catalog 4Popica ClaudiuNo ratings yet

- Business Presentation YAKULTDocument12 pagesBusiness Presentation YAKULTJosuaNo ratings yet

- Stages of SleepDocument2 pagesStages of SleepCamilia Hilmy FaidahNo ratings yet

- Gas Pressure Reducing: Gas Pressure Reducing & Shut-Off Valve & Shut-Off Valve Series 71P11A Series 71P11ADocument4 pagesGas Pressure Reducing: Gas Pressure Reducing & Shut-Off Valve & Shut-Off Valve Series 71P11A Series 71P11AĐình Sơn HoàngNo ratings yet

- (12942) Sheet Chemical Bonding 4 Theory eDocument8 pages(12942) Sheet Chemical Bonding 4 Theory eAnurag SinghNo ratings yet

- Ciclo Di Verniciatura: Proprieta' Tecniche Vedi Schede Tecniche AllegateDocument1 pageCiclo Di Verniciatura: Proprieta' Tecniche Vedi Schede Tecniche AllegateMaffone NumerounoNo ratings yet

- Background of Philippine Art and Literature in Romantic RealismDocument2 pagesBackground of Philippine Art and Literature in Romantic RealismRaldz CoyocaNo ratings yet

- CWAG Rectangular CoordinatesDocument52 pagesCWAG Rectangular CoordinatesRolando MerleNo ratings yet

- Comm - Name Comm - Code Comm - WT Index20122013 I Primary Articles (A) - Food ArticlesDocument48 pagesComm - Name Comm - Code Comm - WT Index20122013 I Primary Articles (A) - Food ArticlesNavin SanjeevNo ratings yet

- (2001) (Sun) (Two-Group Interfacial Area Transport Equation For A Confined Test Section)Document367 pages(2001) (Sun) (Two-Group Interfacial Area Transport Equation For A Confined Test Section)Erol BicerNo ratings yet

- HP Deskjet D1600 Printer SeriesDocument13 pagesHP Deskjet D1600 Printer SeriesRizki JuliadiNo ratings yet

- Research Progress of The Arti Ficial Intelligence Application in Wastewater Treatment During 2012 - 2022: A Bibliometric AnalysisDocument17 pagesResearch Progress of The Arti Ficial Intelligence Application in Wastewater Treatment During 2012 - 2022: A Bibliometric AnalysisjinxiaohuibabaNo ratings yet

- TSB-1139 8SC Wiring DiagramDocument2 pagesTSB-1139 8SC Wiring Diagramxavier marsNo ratings yet

- Industrial RoboticsDocument77 pagesIndustrial RoboticsIslam Fouad100% (4)

- Schiavi Enc Met Page015Document1 pageSchiavi Enc Met Page015Adel AdelNo ratings yet