Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

25 viewsRatios

Ratios

Uploaded by

Chowdhury Mahin AhmedRatios.docx

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 27 Flights Controls PDFDocument186 pages27 Flights Controls PDFAaron Harvey100% (3)

- All TomorrowsDocument111 pagesAll Tomorrowshappyleet83% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CB Final Project On K&N'sDocument35 pagesCB Final Project On K&N'sGOHAR GHAFFARNo ratings yet

- Cyber Crime and Its Impact in BangladeshDocument22 pagesCyber Crime and Its Impact in BangladeshChowdhury Mahin Ahmed100% (1)

- Political EnvironmentDocument13 pagesPolitical EnvironmentChowdhury Mahin AhmedNo ratings yet

- Internship Report On Deposit of Shahjalal Islami Bank LTDDocument50 pagesInternship Report On Deposit of Shahjalal Islami Bank LTDChowdhury Mahin Ahmed0% (1)

- Process of Handling LoanDocument2 pagesProcess of Handling LoanChowdhury Mahin AhmedNo ratings yet

- Purchasing Power Parity (PPP)Document4 pagesPurchasing Power Parity (PPP)Chowdhury Mahin AhmedNo ratings yet

- Ratargul Swamp ForestDocument2 pagesRatargul Swamp ForestChowdhury Mahin AhmedNo ratings yet

- Meaning and Concept of Capital MarketDocument13 pagesMeaning and Concept of Capital MarketChowdhury Mahin AhmedNo ratings yet

- Dissolution of Partnership FirmDocument6 pagesDissolution of Partnership FirmChowdhury Mahin Ahmed60% (5)

- Trade Between Bangladesh and IndiaDocument14 pagesTrade Between Bangladesh and IndiaChowdhury Mahin Ahmed100% (2)

- Business Communication Class-1 Date-25/05/2009: MAHIN AHMED CHOWDHURY-0801010110 IDocument10 pagesBusiness Communication Class-1 Date-25/05/2009: MAHIN AHMED CHOWDHURY-0801010110 IChowdhury Mahin AhmedNo ratings yet

- Diffrence Between Conventional Bank and Islamic BankDocument1 pageDiffrence Between Conventional Bank and Islamic BankChowdhury Mahin Ahmed100% (1)

- Welcome To You All in Our PresentationDocument16 pagesWelcome To You All in Our PresentationChowdhury Mahin AhmedNo ratings yet

- Declaration of Independence of Bangladesh Original Speech by Ziaur RahmanDocument1 pageDeclaration of Independence of Bangladesh Original Speech by Ziaur RahmanChowdhury Mahin AhmedNo ratings yet

- Coke Vs PepsiDocument23 pagesCoke Vs PepsiChowdhury Mahin AhmedNo ratings yet

- Gonzales Gene08 Ethics Course SyllabusDocument7 pagesGonzales Gene08 Ethics Course SyllabusQueenie Gonzales-AguloNo ratings yet

- Determination of Molar Mass 1Document5 pagesDetermination of Molar Mass 1Pablo BernalNo ratings yet

- Cultural Psychology ReviewerDocument16 pagesCultural Psychology ReviewerKen JaurigueNo ratings yet

- Signed Off Understanding Culture11 q1 m2 Defining Culture and Politics v3 RemovedDocument24 pagesSigned Off Understanding Culture11 q1 m2 Defining Culture and Politics v3 Removedrhaybien vinluanNo ratings yet

- MSDS Full1 PDFDocument92 pagesMSDS Full1 PDFSunthron SomchaiNo ratings yet

- 2nd Q Tos and Test-Math3-2023-2024Document10 pages2nd Q Tos and Test-Math3-2023-2024Jessica MoranoNo ratings yet

- Data Warehousing Quick GuideDocument66 pagesData Warehousing Quick Guidejacktheking2010No ratings yet

- Ranajit Guha and Subaltern StudiesDocument4 pagesRanajit Guha and Subaltern StudiesPradipta KunduNo ratings yet

- Work Function: Applications MeasurementDocument10 pagesWork Function: Applications MeasurementshiravandNo ratings yet

- Full TextDocument256 pagesFull TextkanNo ratings yet

- Files-2-Lectures CH 05 Problem Definition and The Research ProposalDocument18 pagesFiles-2-Lectures CH 05 Problem Definition and The Research ProposalAl Hafiz Ibn HamzahNo ratings yet

- First Trimester TranslateDocument51 pagesFirst Trimester TranslateMuhammad Zakki Al FajriNo ratings yet

- Republic of The Philippines vs. Jose Bagtas, Felicidad BagtasDocument9 pagesRepublic of The Philippines vs. Jose Bagtas, Felicidad BagtasCyberR.DomingoNo ratings yet

- Hvpe Syl andDocument9 pagesHvpe Syl andosho_peaceNo ratings yet

- (Lesson2) Cultural, Social, and Political Institutions: Kinship, Marriage, and The HouseholdDocument5 pages(Lesson2) Cultural, Social, and Political Institutions: Kinship, Marriage, and The HouseholdPlat JusticeNo ratings yet

- Disturbed Sleep PatternDocument2 pagesDisturbed Sleep Patternmaria_magno_6100% (1)

- Kvs Split Up of Syllabus Class I & IIDocument9 pagesKvs Split Up of Syllabus Class I & IISanjeev MachalNo ratings yet

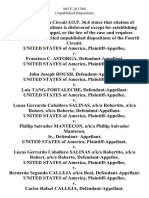

- 865 F.2d 1260 Unpublished DispositionDocument25 pages865 F.2d 1260 Unpublished DispositionScribd Government DocsNo ratings yet

- Virology The Study of VirusesDocument45 pagesVirology The Study of Virusesdawoodabdullah56100% (2)

- Bible Greek VpodDocument134 pagesBible Greek VpodEmanuel AlvarezNo ratings yet

- Pathophysiology of LeptospirosisDocument8 pagesPathophysiology of LeptospirosistomeyttoNo ratings yet

- IELTS SPEAKING - WorkDocument3 pagesIELTS SPEAKING - WorkQuỳnh Anh Nguyễn HồNo ratings yet

- Phoenix Curriculum - Science (Biology) .150899589Document2 pagesPhoenix Curriculum - Science (Biology) .150899589CanioNo ratings yet

- Senior High School 2010Document123 pagesSenior High School 2010John EltNo ratings yet

- The Walkthrough Method:an Approach To The Study OfappsDocument27 pagesThe Walkthrough Method:an Approach To The Study Ofappstan nguyenNo ratings yet

- Chapter 7 Fiduciary RelationshipDocument18 pagesChapter 7 Fiduciary RelationshipMarianne BautistaNo ratings yet

- O'Reilly - Managing Ip Networks With Cisco RoutersDocument366 pagesO'Reilly - Managing Ip Networks With Cisco RoutersJavier ColucciNo ratings yet

Ratios

Ratios

Uploaded by

Chowdhury Mahin Ahmed0 ratings0% found this document useful (0 votes)

25 views8 pagesRatios.docx

Original Title

Ratios.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRatios.docx

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views8 pagesRatios

Ratios

Uploaded by

Chowdhury Mahin AhmedRatios.docx

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 8

3.

OVERVIEW OF RATIO ANALYSIS

Ratio Analysis is a tool which is used as a way of analyzing the performance of any company or

organization. It is one of the most important techniques of financial analysis in which quantities are

converted into ratios for meaningful comparisons with past ratios and ratios of other firms in the

same or different industries. Ratio analysis determines trends and exposes strengths or weaknesses of

a firm.

3.1 TYPES OF FINANCIAL RATIOS

Ratio analysis is done to compare or evaluate the performance over the years. This analysis mainly

deals with some fields those are liquidity ratio, leverage ratio, profitability ratio, and efficiency ratio

and so on.

3.1.1 LIQUIDITY RATIOS

These ratios are used to measure the short-term solvency of an organization. These ratios show the

ability of the organization to convert quickly its assets into cash to pay its different types of short-

term debts. The higher the ratios the company is more liquid and the lower the ratios, the less liquid

the company is which may experience the company financial distress to pay its short-term debt.

CURRENT RATIO

The ratio is considered to observe the liquidity status of an organization. This ratio is obtained by

dividing the total current assets of a company by its total current liabilities. It expresses the working

capital relationship of current assets available to meet the company's current obligations.

The formula:

Current Ratio = Total Current Assets/ Total Current Liabilities

QUICK RATIO

The ratio is also considered to observe the liquidity status of an organization. This ratio is obtained

by dividing the total quick assets of a company by its total current liabilities. This is an important

ratio because sometimes a company may have heavy inventory as part of its current assets which

might be obsolete or slow moving. For that reason eliminating those inventories from current assets

is doing to measure this ratio. The ratio is regarded as an acid test ratio. It expresses the true working

capital relationship which includes accounts receivables, prepaid and notes receivables available to

meet with the company's current obligations.

The formula:

Quick Ratio = Total Quick Assets/ Total Current Liabilities

Quick Assets = Total Current Assets Inventory

3.1.2 LEVERAGE RATIOS

Leverage Ratios are used to measure the extent of the company's financing with debt relative to

equity and its ability to cover interest and other fixed charges. These ratios address the company's

long-term ability to meet its financial leverage. The higher the ratios the more indebtedness the

company owes. This higher results signal the possibility the company will be unable to earn enough

to satisfy its debt obligations.

LONG-TERM DEBT TO EQUITY RATIO

In the risk analysis this ratio is a way to determine a company's leverage. The ratio is calculated by

taking the company's long-term debt and dividing it by the total value of its preferred and common

stock. The company who has higher ratio is thought to be more risky because it has more liabilities

and less equity.

The formula:

Long-term Debt to Equity Ratio = Long-term Debt / Equity

TOTAL DEBT TO EQUITY RATIO

This ratio is obtained by dividing the total liability or debt of a company by its total equity. The ratio

measures how the company is leveraging its debt against the capital employed by its owners. If the

liabilities exceed the net worth then in that case the creditors have more stake than the shareholders.

The formula:

Total Debt to Equity Ratio = Total Debt / Equity

TOTAL DEBT TO TOTAL ASSET RATIO

The debt to total assets ratio is an indicator of financial leverage. It tells the percentage of total assets

that were financed by its total debt. The debt to total assets ratio is calculated by dividing a

companys total liabilities by its total assets. The lower the result of this ratio the better off the

company is.

The formula:

Total Debt to Total Asset Ratio = Total Debt / Total Asset

TOTAL EQUITY TO TOTAL ASSET RATIO

Total Equity to Total Asset ratio used to help to determine how much shareholders would receive in

the event of companywide liquidation. The ratio is expressed as a percentage which is calculated by

dividing total equity by total assets of the company. It represents the amount of assets on which

shareholders have a residual claim.

The formula:

Total Equity to Total Asset Ratio = Total Equity / Total Asset

3.1.3 PROFITABILITY RATIOS

Profitability Ratios measure the overall earnings performance of a company and its efficiency in

utilizing assets, liabilities and equity.

NET PROFIT MARGIN

The Profit Margin of a company determines its ability to survive in competition and adverse

conditions like rising costs, falling prices or declining sales in the future. The ratio measures the

percentage of profits earned per taka of sales or net interest income. Thus this ratio is a measure of

efficiency of a company.

The formula:

Net Profit Margin = Net Profit after Taxation / Net interest Income

RETURN ON EQUITY (ROE)

Return on equity (ROE) is a measure of profitability ratio that calculates how many taka of profit a

company generates with each taka of shareholders' equity. The Return on Equity of a company

measures the ability of the management of the company to generate adequate returns for the capital

invested by the owners of a company.

The formula:

Return on Equity = Net Profit after Taxation / Equity

RETURN ON ASSETS

The Return on Assets of a company determines its ability to utilize the assets employed in that

company efficiently and effectively to earn a good return. Return on assets measures the amount of

profit that the company generates as a percentage of the value of its total assets. A company's return

on assets (ROA) is calculated as the ratio of its net income in a given period to the total value of its

assets.

The formula:

Return on Assets = Net Profit after Taxation / Total Assets

3.1.4 EFFICIENCY RATIOS

Efficiency Ratios demonstrate how efficiently the company uses its assets and how efficiently the

company manages its operations.

ASSETS TURNOVER

Asset turnover measures a firm's efficiency at using its assets in generating revenue and the higher

the number of ratio the company is in better position. It also indicates pricing strategy as the

company with low profit margins tends to have high asset turnover and those with high profit

margins have low asset turnover.

The formula:

Assets Turnover = Net interest Income / Total Assets

FIXED ASSET TURNOVER

The fixed asset turnover ratio is the ratio of revenue to net fixed assets. A high ratio indicates that a

company is doing an effective job of generating sales with a relatively small amount of fixed assets.

On the other hand if the ratio is declining over time the company has either overinvested in fixed

assets or it needs to issue new products to revive its sales.

The formula:

Fixed Asset Turnover = Net interest Income / Fixed Assets

3.1.5 MARKET VALUE RATIOS

Market Value Ratios are used for value comparison. These ratios relate the market price of the firm's

common stock and the financial statement figures.

PRICE EARNINGS RATIO

The price earnings ratio is the price currently paid on the open market for a share of a company's

stock divided by its earnings per share. The price earnings ratio represents those earnings in which

the investment community is willing to pay to its own company's stock. A very high multiple

indicates that investors believe the company's earnings will improve dramatically while a low

multiple indicates the reverse.

The formula:

Price Earnings Ratio = Stock Price per Share / Earnings per Share (EPS)

3.1.6 ADEQUACY RATIO

The following ratios are used to assess the adequacy of the liquidity of the banks and ensure the

banks have adequate cash flow to meet all obligations in a timely and cost-effective manner.

CAPITAL ADEQUACY RATIO

Capital Adequacy Ratio is a measure of a bank's capital which is expressed as a percentage of a

bank's risk weighted credit exposures. This ratio is also known as "Capital to Risk Weighted Assets

Ratio (CRAR). This ratio is used to protect depositors and promote the stability and efficiency of

financial systems around the world. Two types of capital are measured one is tier one capital which

can absorb losses without a bank being required to conclude its trading and another is tier two capital

which can absorb losses in the event of a winding-up and it provides a lesser degree of protection to

depositors.

TIER I CAPITAL

Tier I Capital is a term used to describe the capital adequacy of a bank. Tier I capital is the core

capital which includes equity capital and disclosed reserves. Equity capital includes instruments that

can't be redeemed at the option of the holder which includes common equity, retained earnings, paid-

in capital and disclosed capital reserves.

TIER II CAPITAL

Tier II Capital is a term used to describe the capital adequacy of a bank. Tier II capital is secondary

bank capital that includes items such as undisclosed reserves, general loss reserves, subordinated

term debt, and more.

The formula:

Capital Adequacy Ratio = Capital Base (Tier I + Tier II) / Risk-weighted Assets

CORE CAPITAL ADEQUACY RATIO

Core Capital Ratio is a comparison between a banking firm's core equity capital and total risk-

weighted assets. A firm's core equity capital is known as its Tier I capital which is the measure of a

bank's financial strength based on the sum of its equity capital and disclosed reserves, and sometimes

non-redeemable, non-cumulative preferred stock. A firm's risk-weighted assets include all assets that

the firm holds that are systematically weighted for credit risk. Central banks typically develop the

weighting scale for different asset classes, such as cash and coins, which have zero risk, versus a

letter or credit, which carries more risk.

The formula:

Core Capital Adequacy Ratio = Core Capital (Tier- I) / Risk-weighted Assets

SUPPLEMENTARY CAPITAL ADEQUACY RATIO

Supplementary Capital Ratio is a comparison between a banking firm's supplementary equity capital

and total risk-weighted assets. A firm's supplementary equity capital is known as its Tier II capital

which is the measure of a bank's financial strength based on the sum of its capital which includes

loan loss reserve or undisclosed capital reserves, preferred stocks with maturity of at least 20 years,

certain revaluation reserves and general loan provisions, subordinated debt with an original maturity

of at least 7 years.

The formula:

Supplementary Capital Adequacy Ratio = Supplementary Capital (Tier- II) / Risk-weighted Assets

3.2 BENEFITS OF RATIO ANALYSIS

This ratio analysis gives quick financial information to a financial institution. By giving a glance

anyone will be able to take any decision regarding the financial statement. Therefore managers,

shareholders, creditors etc. all take interest in ratio analysis.

Ratio analysis simplifies the financial statements.

It helps any institution to compare with different companies of different size with each other

into an industry as well as outside of the industry.

It helps in trend analysis which involves comparing a single company over a period of time

and also forecast the future performance.

The liquidity ratio can be helpful in measuring the liquidity position of any institution and

also shows whether an institution will able to meet its obligations or not.

The profitability ratios help to find out the operation efficiency of any institution and also

whether that institution using the resources wisely or not.

As ratios are easy to understand it becomes easy for a company to communicate the ratios to

those who are interested in the financial performance of the company.

It highlights important information in simple form quickly. Anyone can easily judge an

institution by just looking at few numbers instead of reading the whole financial

3.3 DRAWBACKS OF RATIO ANALYSIS

Despite usefulness financial ratio analysis has some disadvantages too. Some of the drawbacks of

ratio analysis are

Ratio analysis explains relationships between past information while users are more

concerned about current and future information.

Ratio analysis doesnt consider inflation.

Ratios may give false results because many institutions show more profit and accounting data

to attract the investors or creditors.

Ratio analysis always deals with the numbers. It doesnt talk about product quality, customer

service, employee morale and so on which are important for better financial performance.

Ratios are mostly used to compare performance over a long period of time or against the

rivalry performance. To do those ratios enough information may not available always.

Different institutions operate in different industries each having different environmental

conditions such as regulation, market structure, etc. Such factors are so significant that a

comparison of two institutions from different industries might be misleading.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 27 Flights Controls PDFDocument186 pages27 Flights Controls PDFAaron Harvey100% (3)

- All TomorrowsDocument111 pagesAll Tomorrowshappyleet83% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CB Final Project On K&N'sDocument35 pagesCB Final Project On K&N'sGOHAR GHAFFARNo ratings yet

- Cyber Crime and Its Impact in BangladeshDocument22 pagesCyber Crime and Its Impact in BangladeshChowdhury Mahin Ahmed100% (1)

- Political EnvironmentDocument13 pagesPolitical EnvironmentChowdhury Mahin AhmedNo ratings yet

- Internship Report On Deposit of Shahjalal Islami Bank LTDDocument50 pagesInternship Report On Deposit of Shahjalal Islami Bank LTDChowdhury Mahin Ahmed0% (1)

- Process of Handling LoanDocument2 pagesProcess of Handling LoanChowdhury Mahin AhmedNo ratings yet

- Purchasing Power Parity (PPP)Document4 pagesPurchasing Power Parity (PPP)Chowdhury Mahin AhmedNo ratings yet

- Ratargul Swamp ForestDocument2 pagesRatargul Swamp ForestChowdhury Mahin AhmedNo ratings yet

- Meaning and Concept of Capital MarketDocument13 pagesMeaning and Concept of Capital MarketChowdhury Mahin AhmedNo ratings yet

- Dissolution of Partnership FirmDocument6 pagesDissolution of Partnership FirmChowdhury Mahin Ahmed60% (5)

- Trade Between Bangladesh and IndiaDocument14 pagesTrade Between Bangladesh and IndiaChowdhury Mahin Ahmed100% (2)

- Business Communication Class-1 Date-25/05/2009: MAHIN AHMED CHOWDHURY-0801010110 IDocument10 pagesBusiness Communication Class-1 Date-25/05/2009: MAHIN AHMED CHOWDHURY-0801010110 IChowdhury Mahin AhmedNo ratings yet

- Diffrence Between Conventional Bank and Islamic BankDocument1 pageDiffrence Between Conventional Bank and Islamic BankChowdhury Mahin Ahmed100% (1)

- Welcome To You All in Our PresentationDocument16 pagesWelcome To You All in Our PresentationChowdhury Mahin AhmedNo ratings yet

- Declaration of Independence of Bangladesh Original Speech by Ziaur RahmanDocument1 pageDeclaration of Independence of Bangladesh Original Speech by Ziaur RahmanChowdhury Mahin AhmedNo ratings yet

- Coke Vs PepsiDocument23 pagesCoke Vs PepsiChowdhury Mahin AhmedNo ratings yet

- Gonzales Gene08 Ethics Course SyllabusDocument7 pagesGonzales Gene08 Ethics Course SyllabusQueenie Gonzales-AguloNo ratings yet

- Determination of Molar Mass 1Document5 pagesDetermination of Molar Mass 1Pablo BernalNo ratings yet

- Cultural Psychology ReviewerDocument16 pagesCultural Psychology ReviewerKen JaurigueNo ratings yet

- Signed Off Understanding Culture11 q1 m2 Defining Culture and Politics v3 RemovedDocument24 pagesSigned Off Understanding Culture11 q1 m2 Defining Culture and Politics v3 Removedrhaybien vinluanNo ratings yet

- MSDS Full1 PDFDocument92 pagesMSDS Full1 PDFSunthron SomchaiNo ratings yet

- 2nd Q Tos and Test-Math3-2023-2024Document10 pages2nd Q Tos and Test-Math3-2023-2024Jessica MoranoNo ratings yet

- Data Warehousing Quick GuideDocument66 pagesData Warehousing Quick Guidejacktheking2010No ratings yet

- Ranajit Guha and Subaltern StudiesDocument4 pagesRanajit Guha and Subaltern StudiesPradipta KunduNo ratings yet

- Work Function: Applications MeasurementDocument10 pagesWork Function: Applications MeasurementshiravandNo ratings yet

- Full TextDocument256 pagesFull TextkanNo ratings yet

- Files-2-Lectures CH 05 Problem Definition and The Research ProposalDocument18 pagesFiles-2-Lectures CH 05 Problem Definition and The Research ProposalAl Hafiz Ibn HamzahNo ratings yet

- First Trimester TranslateDocument51 pagesFirst Trimester TranslateMuhammad Zakki Al FajriNo ratings yet

- Republic of The Philippines vs. Jose Bagtas, Felicidad BagtasDocument9 pagesRepublic of The Philippines vs. Jose Bagtas, Felicidad BagtasCyberR.DomingoNo ratings yet

- Hvpe Syl andDocument9 pagesHvpe Syl andosho_peaceNo ratings yet

- (Lesson2) Cultural, Social, and Political Institutions: Kinship, Marriage, and The HouseholdDocument5 pages(Lesson2) Cultural, Social, and Political Institutions: Kinship, Marriage, and The HouseholdPlat JusticeNo ratings yet

- Disturbed Sleep PatternDocument2 pagesDisturbed Sleep Patternmaria_magno_6100% (1)

- Kvs Split Up of Syllabus Class I & IIDocument9 pagesKvs Split Up of Syllabus Class I & IISanjeev MachalNo ratings yet

- 865 F.2d 1260 Unpublished DispositionDocument25 pages865 F.2d 1260 Unpublished DispositionScribd Government DocsNo ratings yet

- Virology The Study of VirusesDocument45 pagesVirology The Study of Virusesdawoodabdullah56100% (2)

- Bible Greek VpodDocument134 pagesBible Greek VpodEmanuel AlvarezNo ratings yet

- Pathophysiology of LeptospirosisDocument8 pagesPathophysiology of LeptospirosistomeyttoNo ratings yet

- IELTS SPEAKING - WorkDocument3 pagesIELTS SPEAKING - WorkQuỳnh Anh Nguyễn HồNo ratings yet

- Phoenix Curriculum - Science (Biology) .150899589Document2 pagesPhoenix Curriculum - Science (Biology) .150899589CanioNo ratings yet

- Senior High School 2010Document123 pagesSenior High School 2010John EltNo ratings yet

- The Walkthrough Method:an Approach To The Study OfappsDocument27 pagesThe Walkthrough Method:an Approach To The Study Ofappstan nguyenNo ratings yet

- Chapter 7 Fiduciary RelationshipDocument18 pagesChapter 7 Fiduciary RelationshipMarianne BautistaNo ratings yet

- O'Reilly - Managing Ip Networks With Cisco RoutersDocument366 pagesO'Reilly - Managing Ip Networks With Cisco RoutersJavier ColucciNo ratings yet