Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsModule 8 Week 2 - DQ 1

Module 8 Week 2 - DQ 1

Uploaded by

Osunsokomy work

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Van Engen Theology of MissionDocument10 pagesVan Engen Theology of MissionprochitayNo ratings yet

- Abbreviation Rules: General AbbreviationsDocument15 pagesAbbreviation Rules: General AbbreviationsGopalakrishnan Kuppuswamy100% (1)

- Packet Tracer - Lab 1: Basic Switch Setup: Network DiagramDocument3 pagesPacket Tracer - Lab 1: Basic Switch Setup: Network DiagramjohnNo ratings yet

- Curriculum Vitae-FaithDocument3 pagesCurriculum Vitae-FaithFranklin Rotich100% (1)

- CTU 592-assignment-Al-Istihsan'...Document15 pagesCTU 592-assignment-Al-Istihsan'...Sarah AzlanNo ratings yet

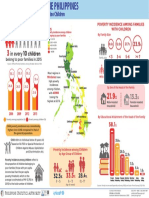

- Eradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesDocument1 pageEradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesJoulesNo ratings yet

- Law - Pralege - Case DgestDocument1 pageLaw - Pralege - Case DgestNardz AndananNo ratings yet

- What Is A BondDocument2 pagesWhat Is A BondKau MilikkuNo ratings yet

- Understanding The Self Week 1Document3 pagesUnderstanding The Self Week 1Athena AlabadoNo ratings yet

- Module 3 Copy of MBA 620 Company A Financials-1Document10 pagesModule 3 Copy of MBA 620 Company A Financials-1Benedict OnyangoNo ratings yet

- Loanwords in Uyghur in A Historical and Socio-CulturalDocument39 pagesLoanwords in Uyghur in A Historical and Socio-CulturaloqyaNo ratings yet

- Mirajul Islam - Internship ReportDocument41 pagesMirajul Islam - Internship ReportThomas HarveyNo ratings yet

- EA AssignmentDocument11 pagesEA AssignmentDhen Velez LargoNo ratings yet

- List of Medical CollegesDocument262 pagesList of Medical CollegesAmit VermaNo ratings yet

- PLEDGE Meaning Essentials - 26-05-2020Document3 pagesPLEDGE Meaning Essentials - 26-05-2020sony dakshuNo ratings yet

- Musk ARCDocument84 pagesMusk ARCCarlosNo ratings yet

- MUID Letter NAH-Encampment Dec2018Document2 pagesMUID Letter NAH-Encampment Dec2018Minnesota Public RadioNo ratings yet

- New Request Section 4 SupportDocument5 pagesNew Request Section 4 Supportalonsoayala8No ratings yet

- Chapter 8Document19 pagesChapter 8Kenneth MaimotNo ratings yet

- Recount ExamplesDocument7 pagesRecount ExamplesTc NorNo ratings yet

- Chapter 4 - Deductions From Gross EstateDocument6 pagesChapter 4 - Deductions From Gross EstatekaedelarosaNo ratings yet

- Effects of Smoking Answer Key PDFDocument1 pageEffects of Smoking Answer Key PDFnellytusiimeNo ratings yet

- Module 5 Ethics in AssessmentDocument17 pagesModule 5 Ethics in AssessmentJesusa SudariaNo ratings yet

- Piers PlowmanDocument4 pagesPiers Plowmanjovanovskiklik0% (1)

- Underpass Box Culvert 1Document40 pagesUnderpass Box Culvert 1SWL100% (1)

- DNCG01CG Dungeonology Rulebook v12 EN Web PDFDocument32 pagesDNCG01CG Dungeonology Rulebook v12 EN Web PDFShannon LewisNo ratings yet

- OBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Document1 pageOBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Stenris AnthonyNo ratings yet

- Asian Institute Technology Education: I-ObjectivesDocument6 pagesAsian Institute Technology Education: I-ObjectivesYlodia Rosales AsiloNo ratings yet

- A Meditation On Mary, Mother of GodDocument4 pagesA Meditation On Mary, Mother of GodAndreas Saragih SimarmataNo ratings yet

- Hat To Do On Specific WeekdaysDocument25 pagesHat To Do On Specific WeekdaysHoracio TackanooNo ratings yet

Module 8 Week 2 - DQ 1

Module 8 Week 2 - DQ 1

Uploaded by

Osunsoko0 ratings0% found this document useful (0 votes)

18 views4 pagesmy work

Original Title

Module 8 Week 2 – Dq 1 -

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmy work

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views4 pagesModule 8 Week 2 - DQ 1

Module 8 Week 2 - DQ 1

Uploaded by

Osunsokomy work

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

WEEK 2 DQ 1 - NIGERIA MARKET DEVELOPMENT

WORD COUNT: 751

INTRODUCTION

Countries go through different phases in their quest for

development across different indices social, economic,

political etc. The fact that no country was born

developed suggests that these developmental phases

cannot be short-circuited. Off all the developmental

indices, economic development sits at the heart of them

all. In the developmental process, counties and endowed

with certain opportunities and face definite challenges.

However, economic challenges and economic

opportunities are not necessarily opposed to each other.

The countries that have achieved greatness today are

the ones that saw challenges as opportunities. Different

schools of thoughts have posited that the government

must, from time to time; intervene in economic

dynamics and act as a market stabilizing force

particularly during crisis. Others think that the

government has no business doing business or to

interfere in the markets. Keegan (2012) cited John

Maynard Keynes and Friedrich August von Hayek as

being at the forefronts of these schools of thought

respectively.

NIGERIA

Economic:

By the definition in Keegan (2013), Nigeria is clearly a

lower-middle-income country with a GDP of USD262

billion divided among its USD168 million population

and per capita GNI of USD1, 555. Schwab (2012)

equally categorized Nigeria as a Factor-driven, stage 1

economy. He equally ranked it 115

th

on global

competitiveness index among 144 countries. However,

it is also important to note that unlike quite a number

of other countries particularly the high income ones,

Nigeria has a very large shadow economy which is

the part of Nigerian economy that is difficulty to capture

or account for because it is informal, unregulated,

unreported or under-reported. Schneider et al (2010)

puts Nigerias shadow economy at close to 60% as of

2007. For this reasons, I will want to categorize Nigeria

as an upper-middle-income country because this

reflects the on-the-ground reality of things. The

attractiveness of the market is partly responsible for the

large influx of several multinationals into Nigeria as well

as increasing FDI. Transformationwatch (2013) puts FDI

into Nigeria at USD7 billion in 2012, topping FDI into

Africa.

Following the entry of most multinationals into Nigeria,

we have also seen in creasing cases of profitability and

break-even that is earlier than anticipated. The

consumption rate of luxury goods in Nigeria reflects a

classification that is higher than that which the books

say and comparable to that of upper-middle-income

countries like Malaysia, Brazil etc. There are a lot of

investments in the Nigeria oil industry. Oil is the single

largest foreign exchange earner for Nigeria.

Political:

In terms of its leadership, Nigeria has spent more than

half (28+ years) of its 54 post-independence years under

military dictatorship. This has not gone without

attendant consequences on freedom and human rights,

ballooning corruption and broken down infrastructure

among others. While all these have negatively impacted

per capital GNI, the Nigerian economy remains so strong

on account of its macro and micro economic indicators.

Social:

With 3 key tribes (Hausa, Yoruba and Ibos) and more

than 400 ethic groups and languages, Nigeria is among

the most diverse countries of the world. As a multi-

ethnic, multi-religious society, the diversity of

orientation found in Nigeria is not unexpected. This

diversity has partly contributed to the current instability

both in government policies as well as the security of

lives and property. Gourley (2012) has linked the Boko

Haram terrorists group with headquarters in Nigeria to

the dreaded Al-Qaeda. The activities of Boko Haram

have nearly paralyzed all economic activities in Northern

Nigeria in the last 18 to 36 months.

RISKS

Maplecroft (2012) ranked Nigeria 11

th

on its list of

countries with the highest political risks as of 2012.

There have also been reports that Nigeria will

disintegrate by 2015

(http://www.thenigerianvoice.com/nvnews/76341/1/di

sintegration-of-nigeria-by-2015-as-predicted-by-.html).

This is not unconnected how the 2015 presidential

election is playing out with the masses.

Lewis (2011) identifies 3 stress points that could

destabilize Nigeria as (i) economic inequality and

corruption (ii) social tensions and (iii) poor governance.

The Niger-Delta militants are also

STRATEGIC MARKET IMPLICATIONS AND

CONCLUSIONS

Companies and multinational as well as global

corporations weigh their risks before considering entry

into any country. While it is true that the chances of a

good reward and high ROI increases with increasing

risks, sudden and unexpected reversal of fortunes could

result in huge, unbearable losses for the companies.

Should the worst happens, all the positive economic

predictions for Nigeria will crumble. The best case

scenario will be for Nigeria to still remain stagnant in

terms of development or even retrogress.

REFERENCE:

Schneider, F.; Buehn, A. and Montenegro, C.E. (2010)

Shadow Economies All over the World, New Estimates

for 162 Countries from 1999 to 2007. Policy Research

Working Paper 5356. Available Online:

http://elibrary.worldbank.org/doi/pdf/10.1596/1813-

9450-5356. Accessed 28th March 2014

Transformationwatch (2013) UNCTAD REPORT: Nigeria

Tops List of Foreign Direct Investments in Africa despite

21% drop. Available Online:

http://transformationwatch.com/author/transformationw

atch/. Accessed 28th March 2014

Salawu, B. (2010) Ethno-Religious Conflicts in Nigeria:

Causal Analysis and Proposals for New Management

Strategies. European Journal of Social Sciences

Volume 13, Number 3 (2010) 345. Available Online:

http://www.eisf.eu/resources/library/ejss_nigconflict_1.p

df. Accessed 28th March 2014

Gourley, S.M. (2012) Linkages Between Boko Haram

and al Qaeda: A Potential Deadly. Global Security

Studies, Summer 2012, Volume 3, Issue 3. Available

Online:

http://globalsecuritystudies.com/Gourley%20Boko%20Ha

ram.pdf. Accessed 28th March 2014

Keegan, W.J. & Green, M.C. (2013) Global marketing.

7th ed. Upper Saddle River: Prentice Hall.

Political Risk 2012. Available Online: .

http://maplecroft.com/media/v_maplecroft-

23122010_112502/updatable/email/marsh/Political_

Risk_2012_Poster_MARSH.pdf. Accessed 28th March

2014

Lewis, P.M (2012) Nigeria: Assessing Risks to Stability.

Centre for Strategic and International Studies.

https://csis.org/files/publication/110623_Lewis_Niger

ia_Web.pdf. Accessed 28th March 2014

Schwab, K. (2012) The Global Competitiveness Report

20122013. World Economic Forum. Available Online

http://www3.weforum.org/docs/WEF_GlobalCompetit

ivenessReport_2012-13.pdf. Accessed 28th March

2014

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Van Engen Theology of MissionDocument10 pagesVan Engen Theology of MissionprochitayNo ratings yet

- Abbreviation Rules: General AbbreviationsDocument15 pagesAbbreviation Rules: General AbbreviationsGopalakrishnan Kuppuswamy100% (1)

- Packet Tracer - Lab 1: Basic Switch Setup: Network DiagramDocument3 pagesPacket Tracer - Lab 1: Basic Switch Setup: Network DiagramjohnNo ratings yet

- Curriculum Vitae-FaithDocument3 pagesCurriculum Vitae-FaithFranklin Rotich100% (1)

- CTU 592-assignment-Al-Istihsan'...Document15 pagesCTU 592-assignment-Al-Istihsan'...Sarah AzlanNo ratings yet

- Eradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesDocument1 pageEradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesJoulesNo ratings yet

- Law - Pralege - Case DgestDocument1 pageLaw - Pralege - Case DgestNardz AndananNo ratings yet

- What Is A BondDocument2 pagesWhat Is A BondKau MilikkuNo ratings yet

- Understanding The Self Week 1Document3 pagesUnderstanding The Self Week 1Athena AlabadoNo ratings yet

- Module 3 Copy of MBA 620 Company A Financials-1Document10 pagesModule 3 Copy of MBA 620 Company A Financials-1Benedict OnyangoNo ratings yet

- Loanwords in Uyghur in A Historical and Socio-CulturalDocument39 pagesLoanwords in Uyghur in A Historical and Socio-CulturaloqyaNo ratings yet

- Mirajul Islam - Internship ReportDocument41 pagesMirajul Islam - Internship ReportThomas HarveyNo ratings yet

- EA AssignmentDocument11 pagesEA AssignmentDhen Velez LargoNo ratings yet

- List of Medical CollegesDocument262 pagesList of Medical CollegesAmit VermaNo ratings yet

- PLEDGE Meaning Essentials - 26-05-2020Document3 pagesPLEDGE Meaning Essentials - 26-05-2020sony dakshuNo ratings yet

- Musk ARCDocument84 pagesMusk ARCCarlosNo ratings yet

- MUID Letter NAH-Encampment Dec2018Document2 pagesMUID Letter NAH-Encampment Dec2018Minnesota Public RadioNo ratings yet

- New Request Section 4 SupportDocument5 pagesNew Request Section 4 Supportalonsoayala8No ratings yet

- Chapter 8Document19 pagesChapter 8Kenneth MaimotNo ratings yet

- Recount ExamplesDocument7 pagesRecount ExamplesTc NorNo ratings yet

- Chapter 4 - Deductions From Gross EstateDocument6 pagesChapter 4 - Deductions From Gross EstatekaedelarosaNo ratings yet

- Effects of Smoking Answer Key PDFDocument1 pageEffects of Smoking Answer Key PDFnellytusiimeNo ratings yet

- Module 5 Ethics in AssessmentDocument17 pagesModule 5 Ethics in AssessmentJesusa SudariaNo ratings yet

- Piers PlowmanDocument4 pagesPiers Plowmanjovanovskiklik0% (1)

- Underpass Box Culvert 1Document40 pagesUnderpass Box Culvert 1SWL100% (1)

- DNCG01CG Dungeonology Rulebook v12 EN Web PDFDocument32 pagesDNCG01CG Dungeonology Rulebook v12 EN Web PDFShannon LewisNo ratings yet

- OBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Document1 pageOBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Stenris AnthonyNo ratings yet

- Asian Institute Technology Education: I-ObjectivesDocument6 pagesAsian Institute Technology Education: I-ObjectivesYlodia Rosales AsiloNo ratings yet

- A Meditation On Mary, Mother of GodDocument4 pagesA Meditation On Mary, Mother of GodAndreas Saragih SimarmataNo ratings yet

- Hat To Do On Specific WeekdaysDocument25 pagesHat To Do On Specific WeekdaysHoracio TackanooNo ratings yet