Professional Documents

Culture Documents

Prudence

Prudence

Uploaded by

hillyoungOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prudence

Prudence

Uploaded by

hillyoungCopyright:

Available Formats

http://www.accountingtools.

com/questions-and-answers/what-is-the-

prudence-concept-in-accounting.html

What is the prudence concept in accounting?

Under the prudence concept, you should not overestimate the amount of revenues that

you record, nor underestimate the amount of expenses. You should also be

conservative in recording the amount of assets, and not underestimate liabilities. The

result should be conservatively-stated financial statements.

Another way of looking at prudence is to only record a revenue transaction or an asset

when it is certain, and to record an expense transaction or liability when it is probable.

Another aspect of the prudence concept is that you would tend to delay recognition of

a revenue transaction or an asset until you are certain of it, whereas you would tend to

record expenses and liabilities at once, as long as they are probable. Also, you should

regularly review assets to see if they have declined in value, and liabilities to see if

they have increased. n short, the tendency under the prudence concept is to either not

recogni!e profits or to at least delay their recognition until the underlying transactions

are more certain.

The prudence concept does not "uite go so far as to force you to record the absolute

least favorable position #perhaps that would be entitled the pessimism concept$%.

nstead, what you are striving for is to record transactions that reflect a realistic

assessment of the probability of occurrence. Thus, if you were to create a continuum

with optimism on one end and pessimism on the other, the prudence concept would

place you somewhat further in the direction of the pessimistic side of the continuum.

You would normally exercise prudence in setting up, for example, an allowance for

doubtful accounts or a reserve for obsolete inventory. n both cases, a specific item

that will cause an expense has not yet been identified, but a prudent person would

record a reserve in anticipation of a reasonable amount of these expenses arising.

&enerally Accepted Accounting 'rinciples incorporates the prudence concept in many

of its standards, which #for example% re"uire you to write down fixed assets when

their fair values fall below their book values, but which do not allow you to write up

fixed assets when the reverse occurs. nternational (inancial )eporting *tandards do

allow for the upward revaluation of fixed assets, and so do not adhere so rigorously to

the prudence concept.

The prudence concept is only a general guideline. Ultimately, you must use your best

+udgment in determining how and when to record an accounting transaction.

http://accountingexplained.com/financial/principles/prudence

Prudence Concept

Accounting transactions and other events are sometimes uncertain but in order to be

relevant we have to report them in time. ,e have to make estimates re"uiring

+udgment to counter the uncertainty. ,hile making +udgment we need to be cautious

and prudent. 'rudence is a key accounting principle which makes sure that assets and

income are not overstated and liabilities and expenses are not understated.

Examples

1. Bad debts are probable in many businesses, so they create a special

contra-account to accounts receivable called allowance for bad debts

which brings the accounts receivable balance to the amount which is

expected to be realied and hence prevents overstatement of assets.

!n expense called bad debts expense is also boo"ed to stop net

income from being overstated.

#. $ome liabilities are contingent upon future occurrence or non-

occurrence of an event such a law suit, etc. %e &udge the probability of

occurrence of that event and if it is more than '() we record a liability

and corresponding expense at the most li"ely amount. *ence, we stop

liability and expense from being understated.

+. ,eriodic evaluations of assets are made to ma"e sure their carrying

value does not exceed the benefits expected to be derived from the

asset, and if it does exceed, the impairment of fixed asset is recorded

by reducing its carrying amount.

You might also like

- Edita Food IndustriesDocument36 pagesEdita Food Industriesmohamed aliNo ratings yet

- The Determinants of Budget Deficit in EthiopiaDocument56 pagesThe Determinants of Budget Deficit in Ethiopiaasamino mulugeta91% (23)

- Summary Game TheoryDocument54 pagesSummary Game TheorytNo ratings yet

- Canada Immigration Consultants in BangaloreDocument17 pagesCanada Immigration Consultants in Bangaloreakkam immigrationNo ratings yet

- Project Report On Performance ManagmentDocument5 pagesProject Report On Performance ManagmentClarissa AntaoNo ratings yet

- Document 2Document1 pageDocument 2Mathew Justin RajuNo ratings yet

- Conservation Principle and Balance SheetDocument6 pagesConservation Principle and Balance SheetKumar RajeshNo ratings yet

- Nguyen Dinh KhanhDocument2 pagesNguyen Dinh KhanhDinhkhanh NguyenNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionssrinugudaNo ratings yet

- ConservatismDocument2 pagesConservatismNavodit MittalNo ratings yet

- Merged Fa Cwa NotesDocument799 pagesMerged Fa Cwa NotesAkash VaidNo ratings yet

- Accounting Concepts and Conventions Qualitative FeaturesDocument8 pagesAccounting Concepts and Conventions Qualitative FeaturesKhadejai LairdNo ratings yet

- Eleven Key Accounting ConceptsDocument6 pagesEleven Key Accounting ConceptsSyed Ikram Ullah ShahNo ratings yet

- Assignment Fundamentals of Book - Keeping & AccountingDocument19 pagesAssignment Fundamentals of Book - Keeping & AccountingmailonvikasNo ratings yet

- FAQs For F&a InterviewsDocument13 pagesFAQs For F&a InterviewsVamsi Chowdary KolliNo ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- Overview of Financial Reports: 1. Balance SheetDocument5 pagesOverview of Financial Reports: 1. Balance SheetAhmer SohailNo ratings yet

- Accounting Concepts F5Document7 pagesAccounting Concepts F5Tinevimbo NdlovuNo ratings yet

- Basic Concepts and ConventionsDocument5 pagesBasic Concepts and ConventionsAhmet BabayevNo ratings yet

- What Are The Accounting Concepts and ConventionsDocument3 pagesWhat Are The Accounting Concepts and ConventionsPriyanka PatilNo ratings yet

- Accounting Policies Can Be Used To Legally Manipulate EarningsDocument7 pagesAccounting Policies Can Be Used To Legally Manipulate EarningsKisitu MosesNo ratings yet

- Accounting PrudenceDocument11 pagesAccounting PrudenceloyNo ratings yet

- Accounting Concepts and ConventionsDocument5 pagesAccounting Concepts and ConventionsSam SamNo ratings yet

- The Conservatism PrincipleDocument2 pagesThe Conservatism PrinciplePankaj JindalNo ratings yet

- Finman2b ReportDocument6 pagesFinman2b ReportLey MiclatNo ratings yet

- Aldridge State High School Es6 - Internal ControlsDocument10 pagesAldridge State High School Es6 - Internal ControlsJiim Paoolo BlaascoNo ratings yet

- AccountingDocument7 pagesAccountingShiela RescoNo ratings yet

- 2 Accounting Concepts and ConventionsDocument5 pages2 Accounting Concepts and Conventionsazra khanNo ratings yet

- Types of RisksDocument3 pagesTypes of RisksSalik HussainNo ratings yet

- 3.5 ConceptsDocument7 pages3.5 Conceptsattaelahi804No ratings yet

- LiquidityDocument5 pagesLiquidityMobin ShaleeNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionsSaumitra TripathiNo ratings yet

- Ov Ov Ov OvDocument8 pagesOv Ov Ov Ovdeepak_rathod_5No ratings yet

- ACCA Principles of AccountingDocument6 pagesACCA Principles of Accountingourwork2626No ratings yet

- Accounting ConceptsDocument8 pagesAccounting ConceptsBajra VinayaNo ratings yet

- Auditing NotesDocument73 pagesAuditing Notesvivekrawatsingh9084No ratings yet

- Accounting Concepts and Principles PDFDocument9 pagesAccounting Concepts and Principles PDFDennis LacsonNo ratings yet

- Chapter 3 Analyzing Transactions To Start A BusinessDocument3 pagesChapter 3 Analyzing Transactions To Start A BusinessPaw VerdilloNo ratings yet

- HBS - Financial AccountingDocument3 pagesHBS - Financial Accountingrahul2014mehtaNo ratings yet

- Conventions: Convention of DisclosureDocument5 pagesConventions: Convention of DisclosureAiswarya ShanmugamNo ratings yet

- Financial Health: What Is 'Working Capital'Document6 pagesFinancial Health: What Is 'Working Capital'Abhishek BanerjeeNo ratings yet

- Module 5 - Adjusting AccountsDocument16 pagesModule 5 - Adjusting AccountsMJ San PedroNo ratings yet

- Accounts PresentationDocument22 pagesAccounts PresentationSenthil Kumar N GNo ratings yet

- Table of ContentsDocument57 pagesTable of ContentsAbhishek AbhiNo ratings yet

- Keeping ScoreDocument95 pagesKeeping ScoreVijay KumarNo ratings yet

- Meaning and Nature of Accounting Principle: Veena Madaan M.B.A (Finance)Document25 pagesMeaning and Nature of Accounting Principle: Veena Madaan M.B.A (Finance)JenniferNo ratings yet

- Accounting Concepts: 1. The Entity ConceptDocument3 pagesAccounting Concepts: 1. The Entity ConceptNormanRockfellerNo ratings yet

- Accounting TerminologyDocument71 pagesAccounting TerminologyBiplob K. SannyasiNo ratings yet

- Module 2 - Financial Accounting PrinciplesDocument13 pagesModule 2 - Financial Accounting PrinciplesVimbai MusangeyaNo ratings yet

- Going Concern Concept: Accounting ConceptsDocument4 pagesGoing Concern Concept: Accounting ConceptsDalton McleanNo ratings yet

- Chapter 5Document8 pagesChapter 5Janah MirandaNo ratings yet

- 06 ReceivableDocument104 pages06 Receivablefordan Zodorovic100% (4)

- Accounting PrinciplesDocument12 pagesAccounting PrinciplesTooba HashmiNo ratings yet

- Definition of The 'Going Concern' Concept: AccountingDocument4 pagesDefinition of The 'Going Concern' Concept: Accountingmhrscribd014No ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesKenneth RamosNo ratings yet

- Chapter 3Document7 pagesChapter 3Tasebe GetachewNo ratings yet

- Generally Accepted Accounitng Princinples (GAAP)Document8 pagesGenerally Accepted Accounitng Princinples (GAAP)Eng Abdikarim WalhadNo ratings yet

- Financial Ratio TutorialDocument41 pagesFinancial Ratio Tutorialabhi2244inNo ratings yet

- Advanced Study For Accountancy Week 1Document3 pagesAdvanced Study For Accountancy Week 1Rose Ann GuevarraNo ratings yet

- 6 Accounting Concepts and PrinciplesDocument25 pages6 Accounting Concepts and Principlesapi-26702351283% (6)

- Midterm LecturesDocument21 pagesMidterm LecturesRachel LozadaNo ratings yet

- Accounting Concepts and Conventions.: MaterialityDocument4 pagesAccounting Concepts and Conventions.: MaterialityGuru NathanNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)From EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)No ratings yet

- Essay On Load Shedding in Pakistan (Rolling Blackout)Document4 pagesEssay On Load Shedding in Pakistan (Rolling Blackout)Sajid HanifNo ratings yet

- Marketing Awareness 2012Document29 pagesMarketing Awareness 2012Vinod Kumar AyilalathNo ratings yet

- Jinja UgandaDocument4 pagesJinja Ugandaxsa ssdsadNo ratings yet

- After Capitalism New Critical TheoryDocument110 pagesAfter Capitalism New Critical TheoryEsteban Arias100% (1)

- Income Taxation Outline and CasesDocument7 pagesIncome Taxation Outline and CasesChicklet ArponNo ratings yet

- CNFC Media PVT LTDDocument21 pagesCNFC Media PVT LTDshekhar_cnfcmedia100% (1)

- Mobile Crane Lifting PermitDocument2 pagesMobile Crane Lifting PermitMusadiq HussainNo ratings yet

- Mohit Dixit Training ReportDocument84 pagesMohit Dixit Training ReportAnonymous DJybroNXNo ratings yet

- Characteristics of The 3rd World CountriesDocument13 pagesCharacteristics of The 3rd World CountriesMaddy Lee80% (5)

- Green Accounting: A Conceptual Framework: Tony Greenham, 24 September 2010Document17 pagesGreen Accounting: A Conceptual Framework: Tony Greenham, 24 September 2010ririanNo ratings yet

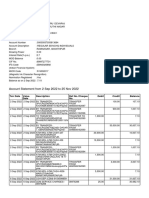

- Account Statement From 2 Sep 2022 To 25 Nov 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 2 Sep 2022 To 25 Nov 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRaju BhaiNo ratings yet

- E 07 H 1 SalaryDocument8 pagesE 07 H 1 SalaryMintNo ratings yet

- MGT520 Mid Term Solved Subjective Downloaded Form VurankDocument4 pagesMGT520 Mid Term Solved Subjective Downloaded Form VurankHamzaNo ratings yet

- Budget Artikel ExcelDocument8 pagesBudget Artikel ExcelnugrahaNo ratings yet

- Homes4Wiltshire To Rent Aug14Document7 pagesHomes4Wiltshire To Rent Aug14nameNo ratings yet

- Jute BAGDocument4 pagesJute BAGETERNAL CONSULTANCY AND SERVICESNo ratings yet

- Third Party and Fourth Party LogisticsDocument113 pagesThird Party and Fourth Party LogisticsHenry Bastian C100% (1)

- Uttam Patra Project NewDocument33 pagesUttam Patra Project NewDeepak KumarNo ratings yet

- Endorsement Schedule: LC0000000619 Intermediary Code Name M/S.Policybazaar Insurance Brokers Private LimitedDocument1 pageEndorsement Schedule: LC0000000619 Intermediary Code Name M/S.Policybazaar Insurance Brokers Private LimitedPrakhar ShuklaNo ratings yet

- NOA 9x8Document5 pagesNOA 9x8David PazmiñoNo ratings yet

- Ent300 Project Assignment: Case StudyDocument70 pagesEnt300 Project Assignment: Case StudyTaqiTazali100% (3)

- EXPRESSCALL, 5 R. Padilla Street, Cebu City, Cebu, Philippines Telephone Nos. (032) 512-7194/ 268-6625/ 262-6687Document12 pagesEXPRESSCALL, 5 R. Padilla Street, Cebu City, Cebu, Philippines Telephone Nos. (032) 512-7194/ 268-6625/ 262-6687Anen Dotcamul BinigayNo ratings yet

- KLD From Gin Girls To ScavengersDocument9 pagesKLD From Gin Girls To ScavengersShipShapeNo ratings yet

- Communication Regarding Corporate RestructuringDocument2 pagesCommunication Regarding Corporate RestructuringANURAG RAJAKNo ratings yet

- Policy Brief On Aquaculture in Ebonyi StateDocument6 pagesPolicy Brief On Aquaculture in Ebonyi StateOkoro Nwenyi100% (1)