Professional Documents

Culture Documents

SIDBI Initiative For Promoting Energy Saving Projects in MSME Sector

SIDBI Initiative For Promoting Energy Saving Projects in MSME Sector

Uploaded by

Kapish SharmaCopyright:

Available Formats

You might also like

- Project Report On e BikesDocument57 pagesProject Report On e Bikesrh21940% (5)

- Battery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisDocument3 pagesBattery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisKapish SharmaNo ratings yet

- Battery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisDocument3 pagesBattery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisKapish SharmaNo ratings yet

- Under Armour Case Study AnalysisDocument42 pagesUnder Armour Case Study AnalysisAsif Ashraf100% (1)

- We Empower Msmes: Umesh Chandra Gaur General Manager, Eev, Sidbi, MumbaiDocument29 pagesWe Empower Msmes: Umesh Chandra Gaur General Manager, Eev, Sidbi, MumbaiSonamNo ratings yet

- Goap Programmes and Schemes For Msmes: Your LogoDocument9 pagesGoap Programmes and Schemes For Msmes: Your LogoChi ChanakyaNo ratings yet

- Final - EV - RSP - Advt For Hiring of Hiring of Program Lead PDFDocument8 pagesFinal - EV - RSP - Advt For Hiring of Hiring of Program Lead PDFVivek MishraNo ratings yet

- IIP India Financing LandscapeDocument84 pagesIIP India Financing LandscapePradeep AnejaNo ratings yet

- Indian Financial System 1Document3 pagesIndian Financial System 11100filesNo ratings yet

- 14 Nov MegasessionDocument25 pages14 Nov MegasessionPhysics UniverseNo ratings yet

- Policy & Support Mechanism: V. Chandrasekaran, Executive Director, SIDBIDocument20 pagesPolicy & Support Mechanism: V. Chandrasekaran, Executive Director, SIDBIJai GadhaviNo ratings yet

- Energy Efficiency Cluster Lending For Smes by Indian BanksDocument22 pagesEnergy Efficiency Cluster Lending For Smes by Indian BanksLokesh MoondNo ratings yet

- 3rd Week-1717992504521Document60 pages3rd Week-1717992504521reshpradi1996No ratings yet

- Click Here To Download The Careerscloud AppDocument21 pagesClick Here To Download The Careerscloud AppAnkit SharmaNo ratings yet

- Project 15 Draft SIPYamunotriDocument31 pagesProject 15 Draft SIPYamunotriKarthik RNo ratings yet

- 17th 18th 19th Feb PIB Lyst6804Document9 pages17th 18th 19th Feb PIB Lyst6804Suprio NandyNo ratings yet

- Cover StoryDocument7 pagesCover StoryBhavesh SwamiNo ratings yet

- Cover StoryDocument8 pagesCover StoryBhavesh SwamiNo ratings yet

- ESI NotesDocument59 pagesESI NotesdontkillgorillasNo ratings yet

- ESG Financing Framework 2023Document24 pagesESG Financing Framework 2023Lemma MuletaNo ratings yet

- JSW CompanyDocument45 pagesJSW CompanyVrudra GadakhNo ratings yet

- GMS and Sustainability ST PaulDocument23 pagesGMS and Sustainability ST PaulamritamonaNo ratings yet

- ManagementDocument2 pagesManagementSaloni Jain 1820343No ratings yet

- Organisation Design ReportDocument17 pagesOrganisation Design ReportMilindGuravNo ratings yet

- Understanding Investment Trade BatteryWaste ManagementDocument227 pagesUnderstanding Investment Trade BatteryWaste Managementjamesmagar1009No ratings yet

- Reliance Power Power Finance CorporationDocument5 pagesReliance Power Power Finance CorporationHrushikesh. ParulekarNo ratings yet

- 13th and 14th PIB Updated Lyst5650Document8 pages13th and 14th PIB Updated Lyst5650Suprio NandyNo ratings yet

- Greenco Rating System - Green & Ecological Sustainability 27 Sep Bangalore 2012 PDFDocument14 pagesGreenco Rating System - Green & Ecological Sustainability 27 Sep Bangalore 2012 PDFtickertapesNo ratings yet

- TOI News Analysis Swahili Rai Pgdmim4cm.2158Document23 pagesTOI News Analysis Swahili Rai Pgdmim4cm.2158Swahili RaiNo ratings yet

- Case Studies and Hot TopicsDocument24 pagesCase Studies and Hot TopicsAnit DevesiyaNo ratings yet

- ESG ReportDocument9 pagesESG ReportSourish BurmanNo ratings yet

- Current Affair Based QaDocument3 pagesCurrent Affair Based QaYakshitha . ANo ratings yet

- Indias Green Industrial PolicyDocument3 pagesIndias Green Industrial PolicymaharazaNo ratings yet

- Msmedi PuneDocument22 pagesMsmedi PuneSandipan ThombareNo ratings yet

- Policies and Schemes of Govt of India For The MSME SectorDocument23 pagesPolicies and Schemes of Govt of India For The MSME SectorVinay ChagantiNo ratings yet

- Business Ethics and Sustainability: Group AssignmentDocument7 pagesBusiness Ethics and Sustainability: Group AssignmentDipannita SadhukhanNo ratings yet

- SMEV Press Conference 22 July 2014Document20 pagesSMEV Press Conference 22 July 2014nareshvartakNo ratings yet

- Manual On Best Practices in Indian and Intl Cement Plants-FinalDocument144 pagesManual On Best Practices in Indian and Intl Cement Plants-FinalRajan Singh TanwarNo ratings yet

- Msme EdDocument32 pagesMsme EdAgnet TomyNo ratings yet

- New & Renewable Energy: Presentation byDocument30 pagesNew & Renewable Energy: Presentation byDebasmita PandaNo ratings yet

- Going Green MalaysiaDocument7 pagesGoing Green MalaysiaezlynxNo ratings yet

- Dilip Limaye - The Emerging Model of The Public Super ESCODocument22 pagesDilip Limaye - The Emerging Model of The Public Super ESCOAsia Clean Energy ForumNo ratings yet

- ProjectManagementReport G-11Document19 pagesProjectManagementReport G-11Ishika RatnamNo ratings yet

- Go Green: Carbon ConsultancyDocument37 pagesGo Green: Carbon ConsultancySohail AhmadNo ratings yet

- WiproDocument6 pagesWiprovatsala mishraNo ratings yet

- Up PresentDocument43 pagesUp PresentPrashanth CNo ratings yet

- North Central Indiana WIRED Network Purdue University Quarterly Narrative Progress Report Q2, 2009Document13 pagesNorth Central Indiana WIRED Network Purdue University Quarterly Narrative Progress Report Q2, 2009api-25885483No ratings yet

- Biogas For Better Life Business Plan 2006 2020Document30 pagesBiogas For Better Life Business Plan 2006 2020Spring MiaNo ratings yet

- SFM Cia 1Document13 pagesSFM Cia 1thememeswala7546No ratings yet

- UNIDO-GEF GCIP Awards Ceremony 2016Document32 pagesUNIDO-GEF GCIP Awards Ceremony 2016Zikrea SaleahNo ratings yet

- Crossword 9 - 10 JuneDocument16 pagesCrossword 9 - 10 JuneJasleen KaurNo ratings yet

- IGBC AP & One Day Green Buildings Training Programme - Colleges (Proposal)Document8 pagesIGBC AP & One Day Green Buildings Training Programme - Colleges (Proposal)Mahindra ChoudaryNo ratings yet

- E Nerge: Electric Energe (PVT) LTDDocument3 pagesE Nerge: Electric Energe (PVT) LTDAamir AzizNo ratings yet

- Case Study by ONERGYDocument5 pagesCase Study by ONERGYakhileshguptamnreNo ratings yet

- 2025-2028 Rdip V2Document58 pages2025-2028 Rdip V2Jet EvascoNo ratings yet

- Ipo For Rec: Financial Services and Institutions AssignmentDocument34 pagesIpo For Rec: Financial Services and Institutions AssignmentarchitkhareNo ratings yet

- Current Affairs October 18 2023 PDF by AffairsCloud 1Document27 pagesCurrent Affairs October 18 2023 PDF by AffairsCloud 1taniroymvpNo ratings yet

- Sustainability Report ReviewDocument5 pagesSustainability Report ReviewArpit YadavNo ratings yet

- Kashish POWERGRIDDocument3 pagesKashish POWERGRIDkashish khediaNo ratings yet

- Biz PlanDocument4 pagesBiz Planapi-3700769No ratings yet

- Session 3 - Investment Pitch - CEDBL - 8 Feb 2013 - RevisedDocument9 pagesSession 3 - Investment Pitch - CEDBL - 8 Feb 2013 - RevisedEnergy for AllNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Climate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresFrom EverandClimate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresNo ratings yet

- GST Digest: Chief PatronDocument39 pagesGST Digest: Chief PatronKapish SharmaNo ratings yet

- P McGowan Daily and Weekly Checks V1Document49 pagesP McGowan Daily and Weekly Checks V1Kapish SharmaNo ratings yet

- SL No Circle Sap ID Site Name StateDocument6 pagesSL No Circle Sap ID Site Name StateKapish SharmaNo ratings yet

- 1 Floor, Orion Tower, Christian Basti, G.S.ROAD, GUWAHATI - 781005Document1 page1 Floor, Orion Tower, Christian Basti, G.S.ROAD, GUWAHATI - 781005Kapish SharmaNo ratings yet

- User ManualDocument53 pagesUser ManualKapish SharmaNo ratings yet

- December Secondary Sales 2014Document42 pagesDecember Secondary Sales 2014Kapish SharmaNo ratings yet

- Sub: Quotation For ScrapDocument1 pageSub: Quotation For ScrapKapish SharmaNo ratings yet

- Nesa - Secondary - Rep (January - 2015) SoDocument57 pagesNesa - Secondary - Rep (January - 2015) SoKapish SharmaNo ratings yet

- S S Target Vs Achv Dec 14 - NESADocument2 pagesS S Target Vs Achv Dec 14 - NESAKapish SharmaNo ratings yet

- Saha Bhaskar C.VDocument3 pagesSaha Bhaskar C.VKapish SharmaNo ratings yet

- 5.CH-2 Project ManagementDocument9 pages5.CH-2 Project ManagementKapish SharmaNo ratings yet

- Assam Public Service Commission: Journal Entry Confirmation DetailsDocument1 pageAssam Public Service Commission: Journal Entry Confirmation DetailsKapish SharmaNo ratings yet

- Cost Annalysis of Optional Work (For 3 Rooms) Items Rates P/SF AreaDocument4 pagesCost Annalysis of Optional Work (For 3 Rooms) Items Rates P/SF AreaKapish SharmaNo ratings yet

- Cls17 DMD ForcstdDocument32 pagesCls17 DMD ForcstdKapish SharmaNo ratings yet

- Development of Small Battery Powered Three Wheeler Using PM Hub Motor Prototype IDocument4 pagesDevelopment of Small Battery Powered Three Wheeler Using PM Hub Motor Prototype IKapish SharmaNo ratings yet

- Spare PartsDocument46 pagesSpare PartsKapish SharmaNo ratings yet

- Centering and Shuttering Including Propping Etc. and Removal of Form For Colm., Slab, Beam ..EtcDocument8 pagesCentering and Shuttering Including Propping Etc. and Removal of Form For Colm., Slab, Beam ..EtcKapish SharmaNo ratings yet

- ) JKJJ, JJasdasdDocument2 pages) JKJJ, JJasdasdKapish SharmaNo ratings yet

- Sub:-Conversion From Lease Hold To Free Hold of Flats Constructed by Group Housing Societies On Land Allotted by DDADocument1 pageSub:-Conversion From Lease Hold To Free Hold of Flats Constructed by Group Housing Societies On Land Allotted by DDAKapish SharmaNo ratings yet

- Sl. Mechanical Labour Deptt. Rate Day Hrs. Day Hrs. Day HrsDocument160 pagesSl. Mechanical Labour Deptt. Rate Day Hrs. Day Hrs. Day HrsKapish SharmaNo ratings yet

- Strategic ForesightFTI Value Network - 2024Document8 pagesStrategic ForesightFTI Value Network - 2024Adele AbdallaNo ratings yet

- TransactionSummary 911020052462352 160523030859-q4Document25 pagesTransactionSummary 911020052462352 160523030859-q4RAJNo ratings yet

- Business English I Revision Crossword Puzzle - PDFDocument1 pageBusiness English I Revision Crossword Puzzle - PDFAna Rita FaustinoNo ratings yet

- Quick Profitable Trader PDFDocument6 pagesQuick Profitable Trader PDFNitin GarjeNo ratings yet

- eBILL Oct2016 1.48527906Document8 pageseBILL Oct2016 1.48527906norezanharudinNo ratings yet

- CBMC Retail Lighting GuideDocument24 pagesCBMC Retail Lighting GuideMegan CamayaNo ratings yet

- Formation and Powers of SEBIDocument20 pagesFormation and Powers of SEBIMohd YasinNo ratings yet

- Isu-Isu Semasa Pengurusan Keselamatan Dan KesihatanDocument8 pagesIsu-Isu Semasa Pengurusan Keselamatan Dan KesihatanAzlyn SyafikahNo ratings yet

- Press Note No.3-2007 SeriesDocument4 pagesPress Note No.3-2007 SeriesPari BasuNo ratings yet

- Employee RelationDocument26 pagesEmployee RelationTiviz RoobanNo ratings yet

- 7th Motilal Oswal Wealth Creation StudyDocument28 pages7th Motilal Oswal Wealth Creation StudyarjbakNo ratings yet

- A2 Final Written TestDocument5 pagesA2 Final Written TestLan NguyenNo ratings yet

- Tyre Trade News June2013Document60 pagesTyre Trade News June2013vinayksNo ratings yet

- 2011 Spring Sports TabDocument20 pages2011 Spring Sports TabmcchronicleNo ratings yet

- Ace Company ProfileDocument7 pagesAce Company ProfileMalvin KachomboNo ratings yet

- NHPCDocument61 pagesNHPCSatyendra N Yadaw100% (2)

- Example For Shipping DocumentsDocument29 pagesExample For Shipping DocumentsNicolai GosvigNo ratings yet

- GCN Kak0130Document6 pagesGCN Kak0130Charlie TejNo ratings yet

- Services Marketing EnvironmentDocument15 pagesServices Marketing Environmentdjay sharmaNo ratings yet

- Date Sheet Ignou Jun - 2013Document6 pagesDate Sheet Ignou Jun - 2013Amit Kumar Singh100% (1)

- Chapter - 01Document6 pagesChapter - 01shreeNo ratings yet

- Investors' Perception Towards Commodity MarketsDocument9 pagesInvestors' Perception Towards Commodity MarketsJotpal SinghNo ratings yet

- WINLEN India Localisation: SAP AG 2005Document206 pagesWINLEN India Localisation: SAP AG 2005vmannethNo ratings yet

- Presentation On RubberDocument27 pagesPresentation On Rubberstudent_1013No ratings yet

- TBS - S17 - Syllabus - Final - Tax and Business StrategyDocument5 pagesTBS - S17 - Syllabus - Final - Tax and Business StrategysalnasuNo ratings yet

- PP V Kee Ah BahDocument9 pagesPP V Kee Ah Bahmuzhaffar_razak100% (2)

- Case Interview Success Sample by Tom RochtusDocument22 pagesCase Interview Success Sample by Tom RochtusangelsynaNo ratings yet

- Birds BarbershopDocument31 pagesBirds BarbershopAndrea SolomonNo ratings yet

- Letter of Complaint Claim and Taking Dictation: Afkar Ahsani Usman 1600026140 Nadia Rahmatika 1714026005Document8 pagesLetter of Complaint Claim and Taking Dictation: Afkar Ahsani Usman 1600026140 Nadia Rahmatika 1714026005Afkar Ahsani UsmanNo ratings yet

SIDBI Initiative For Promoting Energy Saving Projects in MSME Sector

SIDBI Initiative For Promoting Energy Saving Projects in MSME Sector

Uploaded by

Kapish SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SIDBI Initiative For Promoting Energy Saving Projects in MSME Sector

SIDBI Initiative For Promoting Energy Saving Projects in MSME Sector

Uploaded by

Kapish SharmaCopyright:

Available Formats

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

SIDBI Initiative for promoting Energy

Saving projects in MSME Sector

11

Sept 23, 2010

New Delhi

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

SIDBI

SIDBI

Background

Background

2

Constitution

Set up in 1990 SIDBI Act

Paid-up Rs. 450 Crore (USD 95.74 million)

Shares held by 35 GoI owned/controlled Banks, Insurance

Companies and FIs

Financials

Net worth of Rs.5612 Crore (USD 1194.04 millions)

Profit making and dividend paying since inception

Lines of Credit from Multilateral/Bilateral Institutions for MSME

National Presence

6 Zonal offices

103 Branches across all the states

Mandate

Promotion, financing and development of MSMEs and to co-

ordinate the functions of institutions serving the sector.

Nodal Agency for government of India Schemes.

The Beginning

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

3

PRODUCTS & SERVICES

PRODUCTS & SERVICES

REFINANCE

WORKING CAPITAL

FINANCE

RECEIVABLE

FINANCE

MICRO

CREDIT

PROMOTIONAL &

DEVELOPMENTAL

ACTIVITIES

TECHNOLOGY

UPGRADATION,

CLUSTER

DEVELOPMENT

RISK

CAPITAL

PROJECT

FINANCE

SIDBI

One Stop Shop

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

4

SIDBI

SIDBI

Associates

Associates

Credit Guarantee Fund Trust for Micro and Small Credit Guarantee Fund Trust for Micro and Small

Enterprises (CGTMSE) Enterprises (CGTMSE)

SME Rating Agency of India Ltd. (SMERA) SME Rating Agency of India Ltd. (SMERA)

SIDBI Venture Capital Ltd. SIDBI Venture Capital Ltd. (SVCL) (100% subsidiary) (SVCL) (100% subsidiary)

SIDBI Trusteeship Company Ltd SIDBI Trusteeship Company Ltd (100% subsidiary) (100% subsidiary)

India SME Technology Services Ltd. (ISTSL) India SME Technology Services Ltd. (ISTSL)

India SME Asset Reconstruction Co. Ltd. (ISARC) India SME Asset Reconstruction Co. Ltd. (ISARC)

SIDBI one stop shop

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

PART 2

Promoting Clean & Energy Efficiency Projects

in MSME Clusters

55

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

Approach to promotion of

Energy Saving lending

MSMEs are in all major industries & spread across the country in

clusters.

Approach

Industry based approach identifying high energy intensive industrial

sectors

Cluster based approach - identifying potential MSME clusters in high

energy intensive sectors

Methodology adopted

Study of technological level of MSMEs in identified industrial sector / cluster

Energy audit to benchmark the energy consumption for each sector/ cluster

Identifying energy saving potential in each sector / cluster.

Availability of equipments / technologies suitable for the sector.

Estimating capital expenditure on energy saving equipment / processes

6

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

Major Initiatives of SIDBI

EE financing

J ICA (fully utilised)

KFW

AFD

Partnering with Govt. of India

MOU with BEE

MSME financing & Development Project

WB-GEF Project

7

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

MOU with BEE

8

SIDBI & BEE signed MoU on March 4, 2009

To promote energy efficiency measures in 30 SME

clusters.

Provide support to consultants of BEE through

trainings on preparation of bankable project reports.

The MOU is expected to facilitate availability of

finance to about 400 investment grade proposals for

energy efficiency

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

MSME financing & Development Project

EE promotion in 18 MSME clusters

Awareness creation

4 handbooks and a tip sheet and posters

seminars

Walk through audits

Detailed energy audits

Result documentation and demonstration

During FY 2010, 108 walk-through audits and 25 detailed audits

supported by the project.

Estimated savings of about Rs 55 mio per annum against

project expenditure of about Rs 3.7 million

Implementing energy audit recommendations has not only

helped to save energy but has also reduced maintenance costs

as well as down time

9

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

WB-GEF Project

10

The World Bank in conjunction with SIDBI and BEE is implementing a new

initiative on financing Energy Efficiency (EE) in MSME Industrial Clusters to

improve EE and reduce Green House Gas (GHG) emissions from MSMEs

utilizing increased commercial financing for EE.

5 clusters viz. Kolhapur, Pune, Tirunelveli, Ankaleswhwar and Faridabad in

India were included through provision of assistance for completion of Energy

Audits, preparation of DPRs and support in mobilization of financing

Impacts of WB-GEF project on Energy Efficiency in SME World:

Increase in Energy Efficiency investments

About 500 investment grade proposals from MSME sector

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

Implementation of the JICA ES Project

Launched awareness campaigns in MSME clusters.

Identified list of equipments / technologies for each sector.

Introduced lending Scheme for promoting ES project in MSME sector.

Circulated Scheme brochure through SIDBI branches, industry

associations, BEE, business meet.

Circulated technical brochure for each cluster in respective cluster.

Created a separate Energy Efficiency Lending Cell for handling business

operations and queries pertaining to energy saving projects.

Launched a website exclusively for information dissemination for energy

saving project in MSME sector. (www.jica.org.in)

11

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

12 12

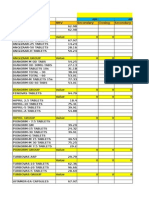

EEBusinessataglance(Rs.inmn.)

(AsonJuly31,2010)

Sr.No. Category No. Sanctioned

Amnt

Disbursed

Amnt

A.

DirectCredit

(Retail)

2028 8836 7293

B. IndirectCredit

i) StateFinancial

Corporations(SFCs)

886 1950 1950

ii) Bank 525 4250 4250

iii) NBFCs(IREDA) 25 2000 2000

TOTAL 3464

17036 15493

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

Direct Business-Sectoral Distribution

7%

22%

8%

3%

3%

10%

3%

6%

5%

27%

3%

3%

Machine Tools/ Macinery Textiles

Auto Food Processing Chemicals

Ceramics Metals

Electricals and Electronics Iron and Steel

Plastic Packaging

Transport Others

13

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

14

EEDirectBusinessLoanSizedistribution

173

9%

946

46%

444

22%

465

23%

upto Rs.1 mn >Rs. 1 mn to <= Rs.2.5 mn.

> Rs.2.5 mn to <= Rs.10 mn > Rs.10 mn

Total No. of cases-2028

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

15

Partners in promoting clean & EE lending

Mumbai Taxidrivers Associations More than 800 taxi drivers in Mumbai

were provided collateral free micro loans to phase out their old taxis under a

structured arrangement with Taxidrivers Associations and Maruti Suzuki.

Micro Finance Institutions (MFIs) Partnered with Friends of Womens

World Banking (FWWB), a MFI based at Ahmedabad, for on lending to its

partner organizations for extending loans to the ultimate beneficiaries in

Manipur for purchasing 20,000 solar lamps.

NBFCs Bank partnered with Electronic Finance Ltd., a Pune based NBFC, to

channel loan to MSEs to acquire energy efficient equipments under a simplified

credit delivery mechanism without any collateral security.

Banks / SFCs Bank is partnering with banks / SFCs to promoter EE in MSME

Sector. Bank provides resource support, technical service & training to banks /

SFCs for lending for EE projects in MSME sector.

Machine manufacturers- Bank has partnered with select manufacturers of

EE machinery, equipment for providing assistance to MSMEs for buying these

equipments in a simplified credit delivery arrangement without any collaterals.

15

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

New Credit Facilities for EE

Euro 50 mio

Existing units in identified

16 sectors

Energy saving potential

important parameter for

credit decision

Machinery / process

modifications and related

civil work

Interest rate of 9.5-10%

Euro 50 mio

Existing & greenfield

Energy saving potential

assessment tool

Retrofits / machinery/

renewable / related other

items

Interest rate of 9.5-10%

16

KfW LOC for EE

AFD LOC for EE

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

New Initiatives

during FY 2011

Supported SMERA to develop Green Rating model for MSMEs. Green Rating for

Steel sector developed and for other sectors is in offing.

Bank will provide concession in interest rate upto 50 bps to the MSMEs availing

loan and obtaining min. Green Rating of SMERA Green Rating -3 & above.

A new product Green Loan Scheme for MSMEs [a Short term loan with fast credit

delivery mechanism & flexible terms has been started.

Training on EE lending, CDM project. First program at Mumbai in J uly 2010.

Studying the possibility of launching pCDM in one or two clusters.

A workshop for ESCOs is planned shortly to develop synergy & working

mechanism for EE projects.

17

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

GO Green with SIDBI

Thank You

18 18 18

You might also like

- Project Report On e BikesDocument57 pagesProject Report On e Bikesrh21940% (5)

- Battery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisDocument3 pagesBattery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisKapish SharmaNo ratings yet

- Battery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisDocument3 pagesBattery Rickshaw Dealership Agreement This Dealership Agreement Is Made at (Place) On ThisKapish SharmaNo ratings yet

- Under Armour Case Study AnalysisDocument42 pagesUnder Armour Case Study AnalysisAsif Ashraf100% (1)

- We Empower Msmes: Umesh Chandra Gaur General Manager, Eev, Sidbi, MumbaiDocument29 pagesWe Empower Msmes: Umesh Chandra Gaur General Manager, Eev, Sidbi, MumbaiSonamNo ratings yet

- Goap Programmes and Schemes For Msmes: Your LogoDocument9 pagesGoap Programmes and Schemes For Msmes: Your LogoChi ChanakyaNo ratings yet

- Final - EV - RSP - Advt For Hiring of Hiring of Program Lead PDFDocument8 pagesFinal - EV - RSP - Advt For Hiring of Hiring of Program Lead PDFVivek MishraNo ratings yet

- IIP India Financing LandscapeDocument84 pagesIIP India Financing LandscapePradeep AnejaNo ratings yet

- Indian Financial System 1Document3 pagesIndian Financial System 11100filesNo ratings yet

- 14 Nov MegasessionDocument25 pages14 Nov MegasessionPhysics UniverseNo ratings yet

- Policy & Support Mechanism: V. Chandrasekaran, Executive Director, SIDBIDocument20 pagesPolicy & Support Mechanism: V. Chandrasekaran, Executive Director, SIDBIJai GadhaviNo ratings yet

- Energy Efficiency Cluster Lending For Smes by Indian BanksDocument22 pagesEnergy Efficiency Cluster Lending For Smes by Indian BanksLokesh MoondNo ratings yet

- 3rd Week-1717992504521Document60 pages3rd Week-1717992504521reshpradi1996No ratings yet

- Click Here To Download The Careerscloud AppDocument21 pagesClick Here To Download The Careerscloud AppAnkit SharmaNo ratings yet

- Project 15 Draft SIPYamunotriDocument31 pagesProject 15 Draft SIPYamunotriKarthik RNo ratings yet

- 17th 18th 19th Feb PIB Lyst6804Document9 pages17th 18th 19th Feb PIB Lyst6804Suprio NandyNo ratings yet

- Cover StoryDocument7 pagesCover StoryBhavesh SwamiNo ratings yet

- Cover StoryDocument8 pagesCover StoryBhavesh SwamiNo ratings yet

- ESI NotesDocument59 pagesESI NotesdontkillgorillasNo ratings yet

- ESG Financing Framework 2023Document24 pagesESG Financing Framework 2023Lemma MuletaNo ratings yet

- JSW CompanyDocument45 pagesJSW CompanyVrudra GadakhNo ratings yet

- GMS and Sustainability ST PaulDocument23 pagesGMS and Sustainability ST PaulamritamonaNo ratings yet

- ManagementDocument2 pagesManagementSaloni Jain 1820343No ratings yet

- Organisation Design ReportDocument17 pagesOrganisation Design ReportMilindGuravNo ratings yet

- Understanding Investment Trade BatteryWaste ManagementDocument227 pagesUnderstanding Investment Trade BatteryWaste Managementjamesmagar1009No ratings yet

- Reliance Power Power Finance CorporationDocument5 pagesReliance Power Power Finance CorporationHrushikesh. ParulekarNo ratings yet

- 13th and 14th PIB Updated Lyst5650Document8 pages13th and 14th PIB Updated Lyst5650Suprio NandyNo ratings yet

- Greenco Rating System - Green & Ecological Sustainability 27 Sep Bangalore 2012 PDFDocument14 pagesGreenco Rating System - Green & Ecological Sustainability 27 Sep Bangalore 2012 PDFtickertapesNo ratings yet

- TOI News Analysis Swahili Rai Pgdmim4cm.2158Document23 pagesTOI News Analysis Swahili Rai Pgdmim4cm.2158Swahili RaiNo ratings yet

- Case Studies and Hot TopicsDocument24 pagesCase Studies and Hot TopicsAnit DevesiyaNo ratings yet

- ESG ReportDocument9 pagesESG ReportSourish BurmanNo ratings yet

- Current Affair Based QaDocument3 pagesCurrent Affair Based QaYakshitha . ANo ratings yet

- Indias Green Industrial PolicyDocument3 pagesIndias Green Industrial PolicymaharazaNo ratings yet

- Msmedi PuneDocument22 pagesMsmedi PuneSandipan ThombareNo ratings yet

- Policies and Schemes of Govt of India For The MSME SectorDocument23 pagesPolicies and Schemes of Govt of India For The MSME SectorVinay ChagantiNo ratings yet

- Business Ethics and Sustainability: Group AssignmentDocument7 pagesBusiness Ethics and Sustainability: Group AssignmentDipannita SadhukhanNo ratings yet

- SMEV Press Conference 22 July 2014Document20 pagesSMEV Press Conference 22 July 2014nareshvartakNo ratings yet

- Manual On Best Practices in Indian and Intl Cement Plants-FinalDocument144 pagesManual On Best Practices in Indian and Intl Cement Plants-FinalRajan Singh TanwarNo ratings yet

- Msme EdDocument32 pagesMsme EdAgnet TomyNo ratings yet

- New & Renewable Energy: Presentation byDocument30 pagesNew & Renewable Energy: Presentation byDebasmita PandaNo ratings yet

- Going Green MalaysiaDocument7 pagesGoing Green MalaysiaezlynxNo ratings yet

- Dilip Limaye - The Emerging Model of The Public Super ESCODocument22 pagesDilip Limaye - The Emerging Model of The Public Super ESCOAsia Clean Energy ForumNo ratings yet

- ProjectManagementReport G-11Document19 pagesProjectManagementReport G-11Ishika RatnamNo ratings yet

- Go Green: Carbon ConsultancyDocument37 pagesGo Green: Carbon ConsultancySohail AhmadNo ratings yet

- WiproDocument6 pagesWiprovatsala mishraNo ratings yet

- Up PresentDocument43 pagesUp PresentPrashanth CNo ratings yet

- North Central Indiana WIRED Network Purdue University Quarterly Narrative Progress Report Q2, 2009Document13 pagesNorth Central Indiana WIRED Network Purdue University Quarterly Narrative Progress Report Q2, 2009api-25885483No ratings yet

- Biogas For Better Life Business Plan 2006 2020Document30 pagesBiogas For Better Life Business Plan 2006 2020Spring MiaNo ratings yet

- SFM Cia 1Document13 pagesSFM Cia 1thememeswala7546No ratings yet

- UNIDO-GEF GCIP Awards Ceremony 2016Document32 pagesUNIDO-GEF GCIP Awards Ceremony 2016Zikrea SaleahNo ratings yet

- Crossword 9 - 10 JuneDocument16 pagesCrossword 9 - 10 JuneJasleen KaurNo ratings yet

- IGBC AP & One Day Green Buildings Training Programme - Colleges (Proposal)Document8 pagesIGBC AP & One Day Green Buildings Training Programme - Colleges (Proposal)Mahindra ChoudaryNo ratings yet

- E Nerge: Electric Energe (PVT) LTDDocument3 pagesE Nerge: Electric Energe (PVT) LTDAamir AzizNo ratings yet

- Case Study by ONERGYDocument5 pagesCase Study by ONERGYakhileshguptamnreNo ratings yet

- 2025-2028 Rdip V2Document58 pages2025-2028 Rdip V2Jet EvascoNo ratings yet

- Ipo For Rec: Financial Services and Institutions AssignmentDocument34 pagesIpo For Rec: Financial Services and Institutions AssignmentarchitkhareNo ratings yet

- Current Affairs October 18 2023 PDF by AffairsCloud 1Document27 pagesCurrent Affairs October 18 2023 PDF by AffairsCloud 1taniroymvpNo ratings yet

- Sustainability Report ReviewDocument5 pagesSustainability Report ReviewArpit YadavNo ratings yet

- Kashish POWERGRIDDocument3 pagesKashish POWERGRIDkashish khediaNo ratings yet

- Biz PlanDocument4 pagesBiz Planapi-3700769No ratings yet

- Session 3 - Investment Pitch - CEDBL - 8 Feb 2013 - RevisedDocument9 pagesSession 3 - Investment Pitch - CEDBL - 8 Feb 2013 - RevisedEnergy for AllNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Climate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresFrom EverandClimate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresNo ratings yet

- GST Digest: Chief PatronDocument39 pagesGST Digest: Chief PatronKapish SharmaNo ratings yet

- P McGowan Daily and Weekly Checks V1Document49 pagesP McGowan Daily and Weekly Checks V1Kapish SharmaNo ratings yet

- SL No Circle Sap ID Site Name StateDocument6 pagesSL No Circle Sap ID Site Name StateKapish SharmaNo ratings yet

- 1 Floor, Orion Tower, Christian Basti, G.S.ROAD, GUWAHATI - 781005Document1 page1 Floor, Orion Tower, Christian Basti, G.S.ROAD, GUWAHATI - 781005Kapish SharmaNo ratings yet

- User ManualDocument53 pagesUser ManualKapish SharmaNo ratings yet

- December Secondary Sales 2014Document42 pagesDecember Secondary Sales 2014Kapish SharmaNo ratings yet

- Sub: Quotation For ScrapDocument1 pageSub: Quotation For ScrapKapish SharmaNo ratings yet

- Nesa - Secondary - Rep (January - 2015) SoDocument57 pagesNesa - Secondary - Rep (January - 2015) SoKapish SharmaNo ratings yet

- S S Target Vs Achv Dec 14 - NESADocument2 pagesS S Target Vs Achv Dec 14 - NESAKapish SharmaNo ratings yet

- Saha Bhaskar C.VDocument3 pagesSaha Bhaskar C.VKapish SharmaNo ratings yet

- 5.CH-2 Project ManagementDocument9 pages5.CH-2 Project ManagementKapish SharmaNo ratings yet

- Assam Public Service Commission: Journal Entry Confirmation DetailsDocument1 pageAssam Public Service Commission: Journal Entry Confirmation DetailsKapish SharmaNo ratings yet

- Cost Annalysis of Optional Work (For 3 Rooms) Items Rates P/SF AreaDocument4 pagesCost Annalysis of Optional Work (For 3 Rooms) Items Rates P/SF AreaKapish SharmaNo ratings yet

- Cls17 DMD ForcstdDocument32 pagesCls17 DMD ForcstdKapish SharmaNo ratings yet

- Development of Small Battery Powered Three Wheeler Using PM Hub Motor Prototype IDocument4 pagesDevelopment of Small Battery Powered Three Wheeler Using PM Hub Motor Prototype IKapish SharmaNo ratings yet

- Spare PartsDocument46 pagesSpare PartsKapish SharmaNo ratings yet

- Centering and Shuttering Including Propping Etc. and Removal of Form For Colm., Slab, Beam ..EtcDocument8 pagesCentering and Shuttering Including Propping Etc. and Removal of Form For Colm., Slab, Beam ..EtcKapish SharmaNo ratings yet

- ) JKJJ, JJasdasdDocument2 pages) JKJJ, JJasdasdKapish SharmaNo ratings yet

- Sub:-Conversion From Lease Hold To Free Hold of Flats Constructed by Group Housing Societies On Land Allotted by DDADocument1 pageSub:-Conversion From Lease Hold To Free Hold of Flats Constructed by Group Housing Societies On Land Allotted by DDAKapish SharmaNo ratings yet

- Sl. Mechanical Labour Deptt. Rate Day Hrs. Day Hrs. Day HrsDocument160 pagesSl. Mechanical Labour Deptt. Rate Day Hrs. Day Hrs. Day HrsKapish SharmaNo ratings yet

- Strategic ForesightFTI Value Network - 2024Document8 pagesStrategic ForesightFTI Value Network - 2024Adele AbdallaNo ratings yet

- TransactionSummary 911020052462352 160523030859-q4Document25 pagesTransactionSummary 911020052462352 160523030859-q4RAJNo ratings yet

- Business English I Revision Crossword Puzzle - PDFDocument1 pageBusiness English I Revision Crossword Puzzle - PDFAna Rita FaustinoNo ratings yet

- Quick Profitable Trader PDFDocument6 pagesQuick Profitable Trader PDFNitin GarjeNo ratings yet

- eBILL Oct2016 1.48527906Document8 pageseBILL Oct2016 1.48527906norezanharudinNo ratings yet

- CBMC Retail Lighting GuideDocument24 pagesCBMC Retail Lighting GuideMegan CamayaNo ratings yet

- Formation and Powers of SEBIDocument20 pagesFormation and Powers of SEBIMohd YasinNo ratings yet

- Isu-Isu Semasa Pengurusan Keselamatan Dan KesihatanDocument8 pagesIsu-Isu Semasa Pengurusan Keselamatan Dan KesihatanAzlyn SyafikahNo ratings yet

- Press Note No.3-2007 SeriesDocument4 pagesPress Note No.3-2007 SeriesPari BasuNo ratings yet

- Employee RelationDocument26 pagesEmployee RelationTiviz RoobanNo ratings yet

- 7th Motilal Oswal Wealth Creation StudyDocument28 pages7th Motilal Oswal Wealth Creation StudyarjbakNo ratings yet

- A2 Final Written TestDocument5 pagesA2 Final Written TestLan NguyenNo ratings yet

- Tyre Trade News June2013Document60 pagesTyre Trade News June2013vinayksNo ratings yet

- 2011 Spring Sports TabDocument20 pages2011 Spring Sports TabmcchronicleNo ratings yet

- Ace Company ProfileDocument7 pagesAce Company ProfileMalvin KachomboNo ratings yet

- NHPCDocument61 pagesNHPCSatyendra N Yadaw100% (2)

- Example For Shipping DocumentsDocument29 pagesExample For Shipping DocumentsNicolai GosvigNo ratings yet

- GCN Kak0130Document6 pagesGCN Kak0130Charlie TejNo ratings yet

- Services Marketing EnvironmentDocument15 pagesServices Marketing Environmentdjay sharmaNo ratings yet

- Date Sheet Ignou Jun - 2013Document6 pagesDate Sheet Ignou Jun - 2013Amit Kumar Singh100% (1)

- Chapter - 01Document6 pagesChapter - 01shreeNo ratings yet

- Investors' Perception Towards Commodity MarketsDocument9 pagesInvestors' Perception Towards Commodity MarketsJotpal SinghNo ratings yet

- WINLEN India Localisation: SAP AG 2005Document206 pagesWINLEN India Localisation: SAP AG 2005vmannethNo ratings yet

- Presentation On RubberDocument27 pagesPresentation On Rubberstudent_1013No ratings yet

- TBS - S17 - Syllabus - Final - Tax and Business StrategyDocument5 pagesTBS - S17 - Syllabus - Final - Tax and Business StrategysalnasuNo ratings yet

- PP V Kee Ah BahDocument9 pagesPP V Kee Ah Bahmuzhaffar_razak100% (2)

- Case Interview Success Sample by Tom RochtusDocument22 pagesCase Interview Success Sample by Tom RochtusangelsynaNo ratings yet

- Birds BarbershopDocument31 pagesBirds BarbershopAndrea SolomonNo ratings yet

- Letter of Complaint Claim and Taking Dictation: Afkar Ahsani Usman 1600026140 Nadia Rahmatika 1714026005Document8 pagesLetter of Complaint Claim and Taking Dictation: Afkar Ahsani Usman 1600026140 Nadia Rahmatika 1714026005Afkar Ahsani UsmanNo ratings yet