Professional Documents

Culture Documents

Why China Will Implode: Its A Monumental Building Aberration, Not An Economy - David Stockman's Contra Corner

Why China Will Implode: Its A Monumental Building Aberration, Not An Economy - David Stockman's Contra Corner

Uploaded by

Ihwan LimantoCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Boeing 737 Nef Program and Procedures Manual Rev 4Document36 pagesBoeing 737 Nef Program and Procedures Manual Rev 4Adrian100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Barclays Bank Statement 2Document5 pagesBarclays Bank Statement 2zainabNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Citizens CharterDocument3 pagesCitizens CharterChona Dabu100% (1)

- CCU Basic Operations CourseDocument116 pagesCCU Basic Operations CourseRene GutierrezNo ratings yet

- Measurement of Line Impedances and Mutual Coupling of Parallel LinesDocument8 pagesMeasurement of Line Impedances and Mutual Coupling of Parallel LinesKhandai SeenananNo ratings yet

- ClientAlert 20100603 Tokyo EMIDocument3 pagesClientAlert 20100603 Tokyo EMIIhwan LimantoNo ratings yet

- PDQ Process - Process - ThyssenKrupp Industrial SolutionsDocument2 pagesPDQ Process - Process - ThyssenKrupp Industrial SolutionsIhwan LimantoNo ratings yet

- Coal Chapter 3Document24 pagesCoal Chapter 3Ihwan Limanto100% (1)

- Joikuspot Premium Symbian3 Edition User GuideDocument18 pagesJoikuspot Premium Symbian3 Edition User GuideIhwan LimantoNo ratings yet

- DLL Grade 12 q2 Week 3 Fabm2Document4 pagesDLL Grade 12 q2 Week 3 Fabm2Mirian De Ocampo0% (1)

- Punjab PoliceDocument20 pagesPunjab Policevinod512793No ratings yet

- Ace3 Unit8 TestDocument3 pagesAce3 Unit8 Testnatacha100% (3)

- Customer Satisfaction Employee InvolvementDocument35 pagesCustomer Satisfaction Employee InvolvementSARA JANE CAMBRONERONo ratings yet

- Biobase GoupDocument11 pagesBiobase Goupfrancheska bacaNo ratings yet

- BP 2009 Metro Availability PDFDocument66 pagesBP 2009 Metro Availability PDFEduardo LoureiroNo ratings yet

- Curriculum VitaeDocument3 pagesCurriculum Vitaenotapernota101100% (2)

- Module 3 Notes (1) - 1Document18 pagesModule 3 Notes (1) - 1PARZIVAL GAMINGNo ratings yet

- Final Broucher 11-4 NewDocument3 pagesFinal Broucher 11-4 Newmilan07No ratings yet

- Superbad (Film) - Wikipedia, The Free EncyclopediaDocument87 pagesSuperbad (Film) - Wikipedia, The Free Encyclopediaresearcher911No ratings yet

- Insights Bullish Near Term OutlookDocument62 pagesInsights Bullish Near Term OutlookHandy HarisNo ratings yet

- 9601/DM9601 Retriggerable One Shot: General Description FeaturesDocument6 pages9601/DM9601 Retriggerable One Shot: General Description FeaturesMiguel Angel Pinto SanhuezaNo ratings yet

- Brochure E-Catalogue Afias (Temporer)Document2 pagesBrochure E-Catalogue Afias (Temporer)Pandu Satriyo NegoroNo ratings yet

- Case Digest - Jao v. CA, 382 SCRA 407, GR 128314, May 29, 2002Document2 pagesCase Digest - Jao v. CA, 382 SCRA 407, GR 128314, May 29, 2002Lu CasNo ratings yet

- ICC Air 2009 CL387 - SrpskiDocument2 pagesICC Air 2009 CL387 - SrpskiZoran DimitrijevicNo ratings yet

- Fusing Concurrent Orthogonal Wide-Aperture Sonar Images For Dense Underwater 3D ReconstructionDocument8 pagesFusing Concurrent Orthogonal Wide-Aperture Sonar Images For Dense Underwater 3D ReconstructionVincent WenNo ratings yet

- Product Specifications Product Specifications: HWXX HWXX - 6516DS1 6516DS1 - VTM VTMDocument2 pagesProduct Specifications Product Specifications: HWXX HWXX - 6516DS1 6516DS1 - VTM VTMcesarbayonaNo ratings yet

- Syngas TrainDocument4 pagesSyngas TrainShamshuddin TanekhanNo ratings yet

- SAP S/4HANA Supply Chain For Transportation Management 1809Document73 pagesSAP S/4HANA Supply Chain For Transportation Management 1809trishqNo ratings yet

- Collect and Analyze Troubleshooting DataDocument26 pagesCollect and Analyze Troubleshooting DataNixon MuluhNo ratings yet

- Cases Study of Kellogg's Failure in Indian Market FullDocument17 pagesCases Study of Kellogg's Failure in Indian Market FullAjay PillaiNo ratings yet

- ML Admin GuideDocument343 pagesML Admin GuidekarthiknehaNo ratings yet

- COCOMO II ExampleDocument26 pagesCOCOMO II ExampleQuốc ĐạiNo ratings yet

- Service Quality, Customer Satisfaction, and Behavioral Intentions in Fast-Food RestaurantsDocument19 pagesService Quality, Customer Satisfaction, and Behavioral Intentions in Fast-Food RestaurantsFelisitas AgnesNo ratings yet

- RTS DOC - User Manual - V1.10 (PT)Document207 pagesRTS DOC - User Manual - V1.10 (PT)DJ Jose DJ Pep LoverRememberSessionNo ratings yet

Why China Will Implode: Its A Monumental Building Aberration, Not An Economy - David Stockman's Contra Corner

Why China Will Implode: Its A Monumental Building Aberration, Not An Economy - David Stockman's Contra Corner

Uploaded by

Ihwan LimantoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Why China Will Implode: Its A Monumental Building Aberration, Not An Economy - David Stockman's Contra Corner

Why China Will Implode: Its A Monumental Building Aberration, Not An Economy - David Stockman's Contra Corner

Uploaded by

Ihwan LimantoCopyright:

Available Formats

15/5/14 10:26 pm Why China Will Implode: Its A Monumental Building Aberration, Not An Economy | David Stockman's Contra

Corner

Page 1 of 4 about:blank

davidstockmanscontracorner.com http://davidstockmanscontracorner.com/why-china-will-implode/

Why China Will Implode: Its A Monumental Building Aberration,

Not An Economy

The thing to understand about China is that it is not just another booming

EM economy that is momentarily struggling to cool-down its excesses

in fixed asset investment and make a transition to some kind of more

normal consumer-based economy. That comforting notion represents an

odd-confluence of propaganda from the comrades in Beijing and hopium

from Wall Street stock peddlers.

In fact, China is a grotesque economic aberration that bears no

relationship to prior economic history or any conventional economic

models-not even to the export-mercantilism model originally developed by

Japan, and which has now proven itself wholly unsustainable. Instead, China is a nation that has gone mad

building,speculating and borrowing on the back of a credit bubble so monumental (and dangerously unstable)

that its implications are resolutely ignored by observers deluded by the notion that China embodies

a unique economic model called red capitalism.

But when a nations debt outstanding explodes from $1 trillion to $25 trillion in 14 years, thats not capitalism,

even if its red. What it represents is monetary madness driven by the state.

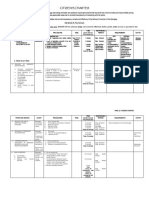

Occasionally a picture is worth a thousand words, and heres one buried in a Financial Times story on Chinas

rapidly deteriorating housing market. It seems that during the two-year period 2011-2012, which was the

peak of Chinas much praised aggressive stimulus response to the Great Recession in the DM world,

China consumed more cement than did the United States during the entire 20th century!

That astounding fact needs to sink in, and it is a factblessed by the U.S. Geological Survey. Stated differently,

imagine the whole urbanization and suburbanization of America over 100 years; the building of all the office

towers, skyscrapers and malls which festoon thousands of city landscapes from coast-to-coast; the building of all

the great public works of the 20th century including likes of the Hoover,TVA and Grand Coulee dams and all the

Army Corps locks, dams, navigation and flood control projects; the Interstate Highway system and all the

derivate highways and suburban sprawl which came with it; all the stadiums, auditoriums, airports, bus and train

stations, subways and parking lots that have ever been built in America; and keep imagining because the

underlying proposition is itself scarcely imaginable:

The FT reported overnight that In just two years, from 2011 to 2012, China produced more

cement than the US did in the entire 20th century, according to historical data from the US

Geological Survey and Chinas National Bureau of Statistics. We showed this two years ago -

little did we know that two years later the situation would be completely out of control.

Heres the thing. You cant look at Chinas entirely doctored and goal-seeked GDP accounts and have any

understanding of the thundering collapse which will actually occur when the building boom ends. The idea that

fixed asset investment at 50% of GDP is just some kind of economic ratio that the comrades in Beijing can

15/5/14 10:26 pm Why China Will Implode: Its A Monumental Building Aberration, Not An Economy | David Stockman's Contra Corner

Page 2 of 4 about:blank

shimmy down to normalitysay

25% which is still high by every

other economy in the worldfails

to comprehend what Chinas

economy really is. That is, its a

continent-wide construction

project in which everything flows

into obtaining, moving, fabricating

and erecting infrastructureboth

public and private, retail and

industrial.

So when the building stops

because the inflated prices of real

estate are collapsing and credit

expansion can no longer prop up

the bubble, the implosion will be

thunderous. Cement production

could drop from 2 billion tons per

year to 500 million; rebar consumption would crater proportionately; industrial fleets of cement trucks and steel

haulers would lie idle; demand for tires, engine parts and truck fuel would vaporize; vendors of all the services

that support this gigantic flow of cement and steel will be out of business; they empty apartment investments

held by their owners will be worthless.

Thats what will happen when the building stops. This article from the Telegraph suggest such a turn of event

might not be all that far down the road. As one observer ventured:

They can keep on building but no one will buy.

By Ambrose Evans-Pritchard

Chinas authorities are becoming increasingly nervous as the countrys property market flirts with

full-blown bust, threatening to set off a sharp economic slowdown and a worrying erosion of tax

revenues.

New housing starts fell by 15pc in April from a year earlier, with effects rippling through the steel

and cement industries. The growth of industrial production slipped yet again to 8.7pc and has

been almost flat in recent months. Land sales fell by 20pc, eating into government income. The

Chinese state depends on land sales and property taxes to fund 39pc of total revenues.

We really think this year is a tipping point for the industry, Wang Yan, from Hong Kong brokers

CLSA, told Caixin magazine. From 2013 to 2020, we expect the sales volume of the countrys

property market to shrink by 36pc. They can keep on building but no one will buy.

The Chinese central bank has ordered 15 commercial banks to boost loans to first-time buyers

15/5/14 10:26 pm Why China Will Implode: Its A Monumental Building Aberration, Not An Economy | David Stockman's Contra Corner

Page 3 of 4 about:blank

and expedite the approval and disbursement of mortgage loans, the latest sign that it is backing

away from monetary tightening.

The authorities are now in an analogous position to Western central banks following years of

stimulus: reliant on an asset boom to keep growth going. Each attempt to rein in Chinas $25

trillion credit bubble seems to trigger wider tremors, and soon has to be reversed.

Wei Yao, from Socit

Gnrale, said the

property sector makes up

20pc of Chinas economy

directly, but the broader

nexus is much larger.

Financial links includes

$2.5 trillion of bank

mortgages and direct

lending to developers; a

further $1 trillion of

shadow bank credit to

builders; $2.3 trillion of

corporate and local

government borrowing

collateralised on real

estate or revenues from land use.

The aggregate exposure of Chinas financial system to the property market is as much as 80pc of

GDP. This is not a sector that can go wrong if China wants to avoid a hard landing, she said. The

risk is that several cities will face a controlled crash along the lines of Wenzhou, where prices

have been falling non-stop for two years and have dropped 20pc.

President Xi Jinping has made a strategic decision to pop the bubble before it spins further out of

control, allowing bond defaults to instil market discipline. But the Communist party is in delicate

position and may already be trapped.

Reliance on fair weather land revenues to fund the budget is like the pattern in Ireland before its

housing bubble burst. The IMF says China is running a fiscal deficit of 10pc of GDP once the land

sales and taxes are stripped out.

Zhiwei Zhang, from Nomura, said the latest loosening measures are not enough to stop the

property slide, predicting two cuts in the reserve requirement ratio (RRR) for banks over the next

two quarters. He warned that any such move will merely store up further problems.

Nomura said the inventory of unsold properties in the smaller third and fourth tier cities which

make up 67pc of residential construction has reached 27 months supply. The bank warned in a

15/5/14 10:26 pm Why China Will Implode: Its A Monumental Building Aberration, Not An Economy | David Stockman's Contra Corner

Page 4 of 4 about:blank

recent report that the property slump could lead to a systemic crisis.

The Chinese state controls the banking system and has $3.9 trillion of foreign reserves that can

be deployed in a crisis. The RRR is extremely high at 20pc and can be slashed if necessary. A cut

to 6pc, the level in 1998, would inject $2 trillion in liquidity.

Nomura said residential construction has jumped fivefold since 2000 from 497m square metres to

2,596m last year. It is unclear whether fresh migrants will continue to pour into the cities and soak

up supply. Nomura said migrant numbers have already halved from 12.5m to 6.3m over the last

four years.

What is certain is that Chinas demographic profile is already changing the economic calculus.

The workforce contracted by 3.45m in 2012 and another 2.27m in 2013. For better or worse,

China is already starting to look very like Japan.

http://www.telegraph.co.uk/finance/china-business/10828912/China-reverts-to-credit-as-property-

slump-threatens-to-drag-down-economy.html

Copyright 2014 Conyers LLC . All Rights Reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Boeing 737 Nef Program and Procedures Manual Rev 4Document36 pagesBoeing 737 Nef Program and Procedures Manual Rev 4Adrian100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Barclays Bank Statement 2Document5 pagesBarclays Bank Statement 2zainabNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Citizens CharterDocument3 pagesCitizens CharterChona Dabu100% (1)

- CCU Basic Operations CourseDocument116 pagesCCU Basic Operations CourseRene GutierrezNo ratings yet

- Measurement of Line Impedances and Mutual Coupling of Parallel LinesDocument8 pagesMeasurement of Line Impedances and Mutual Coupling of Parallel LinesKhandai SeenananNo ratings yet

- ClientAlert 20100603 Tokyo EMIDocument3 pagesClientAlert 20100603 Tokyo EMIIhwan LimantoNo ratings yet

- PDQ Process - Process - ThyssenKrupp Industrial SolutionsDocument2 pagesPDQ Process - Process - ThyssenKrupp Industrial SolutionsIhwan LimantoNo ratings yet

- Coal Chapter 3Document24 pagesCoal Chapter 3Ihwan Limanto100% (1)

- Joikuspot Premium Symbian3 Edition User GuideDocument18 pagesJoikuspot Premium Symbian3 Edition User GuideIhwan LimantoNo ratings yet

- DLL Grade 12 q2 Week 3 Fabm2Document4 pagesDLL Grade 12 q2 Week 3 Fabm2Mirian De Ocampo0% (1)

- Punjab PoliceDocument20 pagesPunjab Policevinod512793No ratings yet

- Ace3 Unit8 TestDocument3 pagesAce3 Unit8 Testnatacha100% (3)

- Customer Satisfaction Employee InvolvementDocument35 pagesCustomer Satisfaction Employee InvolvementSARA JANE CAMBRONERONo ratings yet

- Biobase GoupDocument11 pagesBiobase Goupfrancheska bacaNo ratings yet

- BP 2009 Metro Availability PDFDocument66 pagesBP 2009 Metro Availability PDFEduardo LoureiroNo ratings yet

- Curriculum VitaeDocument3 pagesCurriculum Vitaenotapernota101100% (2)

- Module 3 Notes (1) - 1Document18 pagesModule 3 Notes (1) - 1PARZIVAL GAMINGNo ratings yet

- Final Broucher 11-4 NewDocument3 pagesFinal Broucher 11-4 Newmilan07No ratings yet

- Superbad (Film) - Wikipedia, The Free EncyclopediaDocument87 pagesSuperbad (Film) - Wikipedia, The Free Encyclopediaresearcher911No ratings yet

- Insights Bullish Near Term OutlookDocument62 pagesInsights Bullish Near Term OutlookHandy HarisNo ratings yet

- 9601/DM9601 Retriggerable One Shot: General Description FeaturesDocument6 pages9601/DM9601 Retriggerable One Shot: General Description FeaturesMiguel Angel Pinto SanhuezaNo ratings yet

- Brochure E-Catalogue Afias (Temporer)Document2 pagesBrochure E-Catalogue Afias (Temporer)Pandu Satriyo NegoroNo ratings yet

- Case Digest - Jao v. CA, 382 SCRA 407, GR 128314, May 29, 2002Document2 pagesCase Digest - Jao v. CA, 382 SCRA 407, GR 128314, May 29, 2002Lu CasNo ratings yet

- ICC Air 2009 CL387 - SrpskiDocument2 pagesICC Air 2009 CL387 - SrpskiZoran DimitrijevicNo ratings yet

- Fusing Concurrent Orthogonal Wide-Aperture Sonar Images For Dense Underwater 3D ReconstructionDocument8 pagesFusing Concurrent Orthogonal Wide-Aperture Sonar Images For Dense Underwater 3D ReconstructionVincent WenNo ratings yet

- Product Specifications Product Specifications: HWXX HWXX - 6516DS1 6516DS1 - VTM VTMDocument2 pagesProduct Specifications Product Specifications: HWXX HWXX - 6516DS1 6516DS1 - VTM VTMcesarbayonaNo ratings yet

- Syngas TrainDocument4 pagesSyngas TrainShamshuddin TanekhanNo ratings yet

- SAP S/4HANA Supply Chain For Transportation Management 1809Document73 pagesSAP S/4HANA Supply Chain For Transportation Management 1809trishqNo ratings yet

- Collect and Analyze Troubleshooting DataDocument26 pagesCollect and Analyze Troubleshooting DataNixon MuluhNo ratings yet

- Cases Study of Kellogg's Failure in Indian Market FullDocument17 pagesCases Study of Kellogg's Failure in Indian Market FullAjay PillaiNo ratings yet

- ML Admin GuideDocument343 pagesML Admin GuidekarthiknehaNo ratings yet

- COCOMO II ExampleDocument26 pagesCOCOMO II ExampleQuốc ĐạiNo ratings yet

- Service Quality, Customer Satisfaction, and Behavioral Intentions in Fast-Food RestaurantsDocument19 pagesService Quality, Customer Satisfaction, and Behavioral Intentions in Fast-Food RestaurantsFelisitas AgnesNo ratings yet

- RTS DOC - User Manual - V1.10 (PT)Document207 pagesRTS DOC - User Manual - V1.10 (PT)DJ Jose DJ Pep LoverRememberSessionNo ratings yet