Professional Documents

Culture Documents

Coso - Draft Framework Exec Summary PDF

Coso - Draft Framework Exec Summary PDF

Uploaded by

dushi2010Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Oscola Ireland 2011Document35 pagesOscola Ireland 2011Spencer Zhang ChengNo ratings yet

- United Feature vs. MunsingwearDocument2 pagesUnited Feature vs. MunsingwearErikEspino100% (1)

- TDA 1519cDocument21 pagesTDA 1519cCris VMNo ratings yet

- ZTWD ELt Ne USogw FDocument10 pagesZTWD ELt Ne USogw FSouravDeyNo ratings yet

- Motion For Preliminary InjunctionDocument16 pagesMotion For Preliminary InjunctionMajority In Mississippi blog100% (1)

- Claudio V Sps. SarazaDocument3 pagesClaudio V Sps. SarazaSittie Namraidah L Ali100% (1)

- Reflection On Sumilao CaseDocument3 pagesReflection On Sumilao CaseGyrsyl Jaisa GuerreroNo ratings yet

- Life Till Migration To Yasrib (Refrences)Document4 pagesLife Till Migration To Yasrib (Refrences)Umer AdnanNo ratings yet

- XL Axiata Partnership v4Document14 pagesXL Axiata Partnership v4eric.william1991No ratings yet

- Legal UpdatesDocument1 pageLegal UpdatesCharlotteNo ratings yet

- RA 10660 Sandiganbayan Full TextDocument4 pagesRA 10660 Sandiganbayan Full TextGracia SullanoNo ratings yet

- Ni Teststand: Getting Started With TeststandDocument89 pagesNi Teststand: Getting Started With TeststandAnwarNo ratings yet

- Benefits Available Under The Maternity Benefits ActDocument9 pagesBenefits Available Under The Maternity Benefits ActSumukh BNo ratings yet

- Commercial Law: Philip RawlingsDocument81 pagesCommercial Law: Philip RawlingsthomasNo ratings yet

- Alejandra Mina Et. Al. Vs Ruperta Pascual Et. Al. - G.R. No. L-8321Document6 pagesAlejandra Mina Et. Al. Vs Ruperta Pascual Et. Al. - G.R. No. L-8321Ivy VillalobosNo ratings yet

- New Microsoft Office Word DocumentDocument51 pagesNew Microsoft Office Word DocumentBasavaraj OkkundNo ratings yet

- Paula Salinger Fraud on the Court - Violations of State Law, Court Rules, Attorney Ethics, Moral Turpitude - Woodruff, O'Hair, Posner & Salinger Inc Sacramento - California State Bar Chief Trial Counsel Jayne Kim - California Supreme Court - Paula D. Salinger Judge Pro Tem Sacramento Superior Court - Sacramento Bar Association Family Law Section Officer Family Law Executive Committee - Judge Robert Hight - Judge James Mize Sacramento County Superior CourtDocument22 pagesPaula Salinger Fraud on the Court - Violations of State Law, Court Rules, Attorney Ethics, Moral Turpitude - Woodruff, O'Hair, Posner & Salinger Inc Sacramento - California State Bar Chief Trial Counsel Jayne Kim - California Supreme Court - Paula D. Salinger Judge Pro Tem Sacramento Superior Court - Sacramento Bar Association Family Law Section Officer Family Law Executive Committee - Judge Robert Hight - Judge James Mize Sacramento County Superior CourtCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas75% (4)

- People V GaraygayDocument1 pagePeople V GaraygaychiccostudentNo ratings yet

- Coa Mapping Int enDocument26 pagesCoa Mapping Int enMuhammad Javed IqbalNo ratings yet

- Agilent Technologies Singapore v. Integrated Silicon TechnologyDocument2 pagesAgilent Technologies Singapore v. Integrated Silicon TechnologyDerick Torres100% (1)

- Crim 1 Reviewer Art 95-99Document2 pagesCrim 1 Reviewer Art 95-99EcnerolAicnelavNo ratings yet

- 2022-2023 Pay Drawn Particulars of All Staffs - Palayamkottai Taluk PDFDocument187 pages2022-2023 Pay Drawn Particulars of All Staffs - Palayamkottai Taluk PDFM. IsmailNo ratings yet

- PolicyDocument7 pagesPolicyAbhie SLNo ratings yet

- Essential Requisites of Contracts: Classes of Elements of ContractDocument8 pagesEssential Requisites of Contracts: Classes of Elements of ContractLimuel MacasaetNo ratings yet

- Husbands Love Your WivesDocument4 pagesHusbands Love Your WivesKultar Deep Singh SandhuNo ratings yet

- Important Substantive - F8Document13 pagesImportant Substantive - F8Mansoor SharifNo ratings yet

- Passenger Guide and Octopus Fare 1005Document2 pagesPassenger Guide and Octopus Fare 1005water_thiefNo ratings yet

- Part 3 - InsuranceDocument11 pagesPart 3 - InsuranceJohnSmithNo ratings yet

- Annex Transport Service Scope of Work and Rates 2021Document4 pagesAnnex Transport Service Scope of Work and Rates 2021Manansala, Noel RobertinoNo ratings yet

- AP LAWCET 2021 Application (Online) AP PGLCET Registration, SyllabusDocument12 pagesAP LAWCET 2021 Application (Online) AP PGLCET Registration, SyllabusVasavi ComputersNo ratings yet

Coso - Draft Framework Exec Summary PDF

Coso - Draft Framework Exec Summary PDF

Uploaded by

dushi2010Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coso - Draft Framework Exec Summary PDF

Coso - Draft Framework Exec Summary PDF

Uploaded by

dushi2010Copyright:

Available Formats

C o m m i t t e e o f S p o n s o r i n g O r g a n i z a t i o n s o f t h e T r e a d w a y C o m m i s s i o n

December 2011

Executi ve Summary

Internal Control Integrated Framework

Commi ttee of Sponsori ng Organi zati ons of the Treadway Commi ssi on

To submit comments on this Public Exposure Draft, please visit the www.ic.coso.org website. Responses are due by March 31, 2012.

Respondents will be asked to respond to a series of questions. Those questions may be found on-line at www.ic.coso.org and in

a separate document provided at the time of download. Respondents may upload letters through this site. Please do not send

responses by fax.

Written comments on the exposure draft will become part of the public record and will be available on-line until December 31, 2012.

Draft for Public Exposure

Draft for Public Exposure

2011 All Rights Reserved. No part of this publication may be reproduced, redistributed, transmitted or displayed in any

form or by any means without written permission. For information regarding licensing and reprint permissions please

contact the American Institute of Certied Public Accountants, licensing and permissions agent for COSO copyrighted

materials. Direct all inquiries to copyright@aicpa.org or to AICPA, Attn: Manager, Rights and Permissions, 220 Leigh Farm

Rd., Durham, NC 27707. Telephone inquiries may be directed to 888-777-7707.

C o m m i t t e e o f S p o n s o r i n g O r g a n i z a t i o n s o f t h e T r e a d w a y C o m m i s s i o n

December 2011

Executi ve Summary

Internal Control Integrated Framework

Commi ttee of Sponsori ng Organi zati ons of the Treadway Commi ssi on

To submit comments on this Public Exposure Draft, please visit the www.ic.coso.org website. Responses are due by March 31, 2012.

Respondents will be asked to respond to a series of questions. Those questions may be found on-line at www.ic.coso.org and in

a separate document provided at the time of download. Respondents may upload letters through this site. Please do not send

responses by fax.

Written comments on the exposure draft will become part of the public record and will be available on-line until December 31, 2012.

Draft for Public Exposure

Draft for Public Exposure

Committee of Sponsoring Organizations of

the Treadway Commission

Board Members Representative

COSO Chair David L. Landsittel

American Accounting Association Mark S. Beasley

Douglas F. Prawitt

American Institute of Certied Public Accountants Charles E. Landes

Financial Executives International Marie N. Hollein

Institute of Management Accountants Jeffrey C. Thomson

Sandra Richtermeyer

The Institute of Internal Auditors Richard F. Chambers

PwC

Author

Principal Contributors

Miles E.A. Everson (Project Leader) Partner New York, USA

Cara M. Beston Partner San Jose, USA

Charles E. Harris Partner Florham Park, USA

Stephen E. Soske Partner Boston, USA

J. Aaron Garcia Director San Diego, USA

Catherine I. Jourdan Director Paris, France

Frank J. Martens Director Vancouver, Canada

Jay A. Posklensky Director Florham Park, USA

Sallie Jo Perraglia Manager New York, USA

Draft for Public Exposure

Advisory Council

Sponsoring Organizations Representatives

Audrey A. Gramling Kennesaw State University Professor

Steven Jameson Community Trust Bank Executive Vice President and

Chief Internal Audit & Risk

Ofcer

Steve McNally Campbell Soup Finance Director/Controller -

Napoleon Operations

Ray Purcell Pzer Director of Financial Controls

Bill Schneider, Sr. AT&T Director of Accounting

Members at Large

Jim DeLoach Protiviti Managing Director

John Fogarty Deloitte Partner

Trent Gazzaway Grant Thornton Partner

Cees Klumper GAVI Alliance Director of Internal Audit

Thomas Montminy PwC Partner

Al Paulus E&Y Partner

Tom J. Ray KPMG Partner

Ken Vander Wal ISACA President

Regulatory Observers and Other Observers

James Dalkin Government Accountability

Ofce

Director in the Financial

Management and Assurance

Team

Harrison E. Greene, Jr. Federal Deposit Insurance

Corporation

Senior Policy Analyst

Christian Peo Securities and Exchange

Commission

Professional Accounting Fellow

Vincent Tophoff International Federation

of Accountants

Senior Technical Manager

Keith Wilson Public Company

Accounting Oversight

Board

Deputy Chief Auditor

Draft for Public Exposure

Additional PwC Contributors

Joseph Atkinson Partner New York, USA

Glenn Brady Partner St. Louis, USA

Jeffrey Boyle Partner Tokyo, Japan

James Chang Partner Beijing, China

Mark Cohen Partner San Francisco, USA

Andrew Dahle Partner Chicago, USA

Megan Haas Partner Hong Kong,China

Junya Hakoda Partner Tokyo, Japan

Diana Hillier Partner London, England

Steve Hirt Partner Boston, USA

Brian Kinman Partner St Louis, USA

Barbara Kipp Partner Boston, USA

Hans Koopmans Partner Singapore

Alan Martin Partner Frankfurt, Germany

Pat McNamee Partner Florham Park, USA

Jonathan Mullins Partner Dallas, USA

Simon Perry Partner London, England

Andrew Reinsel Partner Cincinnati, USA

Kristin Rivera Partner San Francisco, USA

Valerie Wieman Partner Florham Park, USA

Alexander Young Partner Toronto, Canada

David Albright Principal Washington, D.C., USA

Charles Yovino Principal Atlanta, USA

Eric M. Bloesch Managing Director Philadelphia, USA

Sachin Mandal Director Florham Park, USA

Christopher Michaelson Director Minneapolis, USA

Lisa Reshaur Director Seattle, USA

Tracy Walker Director Bangkok, Thailand

Draft for Public Exposure

Executive Summary

Foreword

In 1992 the Committee of Sponsoring Organizations of the Treadway Commission

(COSO) released its Internal ControlIntegrated Framework (the original framework).

The original framework has gained broad acceptance and is now widely used around

the world. It is recognized as a leading framework for designing, implementing, and

evaluating the effectiveness of internal control.

In the nearly twenty years since the inception of the original framework, business and

operating environments have changed dramatically, becoming increasingly complex,

technologically driven and global in scope. At the same time, stakeholders are more

engaged, seeking greater transparency and accountability for the integrity of systems of

internal control that support the business decisions and governance of the organization.

COSO believes this framework will enable organizations to effectively and efciently

develop and maintain systems of internal control that can enhance the likelihood of

achieving the entitys objectives and can adapt to changes in the business and operat-

ing environments. COSO is pleased to present this Internal ControlIntegrated Frame-

work (Framework).

The experienced reader will nd much that is familiar in the Framework, which builds

on what has proved useful in the original version. It retains the core denition of internal

control and the ve components of internal control. The broad criteria used to assess

the effectiveness of an internal control system also remain unchanged. This Framework

continues to emphasize the importance of management judgement in the design, appli-

cation, and assessment of effectiveness of a system of internal control.

At the same time, the Framework now includes important enhancements designed to

clarify concepts and ease use and application. One of the most signicant enhance-

ments is the codication of internal control concepts introduced in the original frame-

work into principles and attributes. These principles and attributes provide clarity for

the user in the design and development of systems of internal control. Principles and

attributes can also be used to support the assessment of the effectiveness of internal

controls. Other updates and enhancements to the Framework help the user address

changes in business and operating environments, including:

Expectations for governance oversight.

Globalization of markets and operations.

Changes in business models.

Demands and complexities in laws, rules, regulations, and standards.

Expectations for competencies and accountabilities.

Use of, and reliance on, evolving technologies.

Expectations relating to preventing and detecting corruption.

Internal Control Integrated Framework December 2011

i

1

2

3

4

5

Draft for Public Exposure

We are pleased to present this Framework in three volumes. The rst is an Executive

Summary: a high-level overview intended for the board of directors, chief executive

ofcer, other senior management, and regulators. The second volume, the Framework,

denes internal control and describes components of internal control including the

underlying principles and attributes. This volume also provides direction for all levels of

management to use in designing, implementing, conducting, and evaluating systems of

internal control. The third volume, Evaluation, provides guidance that may be useful in

evaluating to be the effectiveness of internal control.

In addition, a supplemental guide published concurrently with the Framework focuses

the discussion on internal control over external nancial reporting, providing practical

approaches and examples supporting the preparation of published nancial statements.

COSO may, in the future, issue other guidance to provide additional assistance in apply-

ing this Framework. However, neither the guidance on internal control over external

nancial reporting nor other future guidance take precedence over this Framework.

Finally, the COSO Board would like to thank the entire PwC team and the Advisory

Council for their contributions in developing the Framework. Their full consideration of

input provided by many stakeholders and their attention to detail were instrumental in

ensuring that the core strengths of the 1992 Internal ControlIntegrated Framework

were preserved, claried and strengthened.

Internal Control Integrated Framework December 2011

ii

6

7

8

Draft for Public Exposure

Executive Summary

Executive Summary

Internal control helps entities achieve important objectives and sustain and improve

performance. The COSO Internal ControlIntegrated Framework (Framework) enables

organizations to effectively and efciently develop systems of internal control and sup-

ports organizations as they sustain and improve performance with greater:

AgilityBy adapting to changing business and operating environments.

CondenceBy mitigating risks to acceptable levels.

ClarityBy providing reliable information supporting sound decision-making.

Implementing a system of internal control can be challenging; operating that system

in an effective and efcient way can be daunting. New business models facilitated by

rapidly changing technology, increasing regulatory requirements and scrutiny, globaliza-

tion, and other challenges demand any system of internal control to be dynamic and

agile in adapting to changing business and operating environments.

An effective system of internal control demands more than rigorous adherence to policy,

procedure, and protocol. It requires the use of judgment. Boards of directors

1

and man-

agement use judgment to determine how much control is enough. Management and

other personnel use judgment on a daily basis as they design, implement, and operate

internal control across the entity. Management and internal auditors, among other per-

sonnel, apply judgment as they monitor and assess the effectiveness of the system of

internal control.

This Framework provides signicant assistance to management, boards of direc-

tors, external stakeholders, and others interacting with the entity without being overly

prescriptive. It does so by providing greater understanding of what constitutes internal

control and insight into when internal control is being applied effectively.

For management and boards of directors, this Framework provides:

An opportunity to expand the application of a recognized framework beyond

nancial reporting and to support a universal framework of internal control.

A means to apply internal control to any type of entity, regardless of industry

or legal structure, the entity, level of entity, operating unit, or function.

A principles-based approach that provides exibility and allows for judgment

in maintaining and improving internal controlprinciples that can be applied at

the entity, operating, and functional levels.

A basis for evaluating the effectiveness of internal control systems by consid-

ering components, principles, and attributes.

A means to identify and analyze risks, and develop and manage appropriate

responses to risks within acceptable levels and with a greater focus on anti-

fraud measures.

1 This Framework uses the term board of directors, which encompasses the governing body, including

board, board of trustees, general partners, owner, or supervisory board.

Internal Control Integrated Framework December 2011

1

9

10

11

12

13

Draft for Public Exposure

An opportunity to reduce costs by eliminating ineffective, redundant, or inef-

cient controls that provide minimal value in reducing risks to the achievement

of the entitys objectives.

For external stakeholders of an entity and others that interact with the entity, this Frame-

work provides:

Greater condence in the board of directors oversight over internal

control systems.

Greater condence in the organizations ability to respond to risk and changes

in the business and operating environments.

A greater understanding of the criteria used to design, implement, and evalu-

ate internal control.

Recognition that through the use of appropriate judgment, manage-

ment may be able to reduce costs by eliminating ineffective, redundant, or

inefcient controls.

A means to align internal control with other standards to develop an integrated

view of specic functions and other areas of focus.

The above considerations are compelling reasons why organizationsregardless of the

entitys legal structure, size, complexity, or purposewill want to apply the Framework

in designing, implementing, conducting, and evaluating their systems of internal control.

The remainder of this Executive Summary provides an overview of internal control,

including a denition, the requisite components of internal control and the underly-

ing principles and associated attributes, an approach for viewing objectives within

three categories, and considerations for determining when internal control is effec-

tive. It also includes a discussion of limitationsthe reasons why no system of internal

control can be perfect. Finally, it offers considerations on how various parties may use

the Framework.

Internal Control Integrated Framework December 2011

2

14

15

16

Draft for Public Exposure

Executive Summary

Dening Internal Control

Internal control is dened as follows:

Internal control is a process, effected by an entitys board of directors, manage-

ment, and other personnel, designed to provide reasonable assurance regarding

the achievement of objectives in the following categories:

Effectiveness and efciency of operations.

Reliability of reporting.

Compliance with applicable laws and regulations.

This denition reects certain fundamental concepts. Internal control is:

A process consisting of ongoing tasks and activities. It is a means to an end,

not an end in itself.

Effected by people. It is not merely about policy manuals, systems, and forms,

but people at every level of an organization that impact internal control.

Able to provide reasonable assurance, not absolute assurance, to an entitys

senior management and board.

Geared to the achievement of objectives in one or more categoriesopera-

tions, reporting, and compliance.

Adaptable to the entity structure.

This denition is intentionally broad. It captures key concepts fundamental to how enti-

ties and other organizations design, implement, conduct, and evaluate internal control,

providing a basis for application across organizations that may operate in different

entity structures, industries, and geographic regions. It also provides exibility in appli-

cation, allowing an entity to sustain internal control for the entire entity or a particular

subsidiary, division, operating or functional unit, or business process that is relevant for

operations, reporting, or compliance objectives, based on the entitys specic needs or

circumstances.

Objectives

The Framework sets forth three categories of objectives, which allow organizations to

focus on differing aspects of internal control:

Operations ObjectivesThese pertain to effectiveness and efciency of the

entitys operations, including operations and nancial performance goals and

safeguarding assets against loss.

Reporting ObjectivesThese pertain to the reliability of reporting. They

include internal and external nancial and non-nancial reporting.

Compliance ObjectivesThese pertain to adherence to laws and regulations

to which the entity is subject.

Internal Control Integrated Framework December 2011

3

17

18

19

20

Draft for Public Exposure

Components of Internal Control

Internal Control consists of ve integrated components.

Control Environment

The control environment is the set of standards, processes, and structures that provide

the basis for carrying out internal control across the organization. The board of directors

and senior management establish the tone at the top regarding the importance of inter-

nal control, including expected standards of conduct. Management reinforces expecta-

tions at the various levels of the organization. The control environment comprises the

integrity and ethical values of the organization; the parameters enabling the board of

directors to carry out its governance responsibilities; the organizational structure and

assignment of authority and responsibility; the process for attracting, developing, and

retaining competent individuals; and the rigor around performance measures, incen-

tives, and rewards to drive accountability for performance. The resulting control envi-

ronment has a pervasive impact on the overall system of internal control.

Risk Assessment

Every entity faces a variety of risks from external and internal sources. Risk is dened as

the possibility that an event will occur and adversely affect the achievement of objec-

tives. Risk assessment involves a dynamic and iterative process for identifying and

assessing risks to the achievement of objectives. Risks to the achievement of these

objectives from across the entity are considered relative to established risk tolerances.

Thus, risk assessment forms the basis for determining how risks will be managed. A

precondition to risk assessment is the establishment of objectives, linked at different

levels of the entity. Management species objectives within categories of operations,

reporting, and compliance with sufcient clarity to be able to identify and assess risks

to those objectives. Risk assessment also requires management to consider the impact

of possible changes in the external environment and within its own business model that

may render internal control ineffective.

Control Activities

Control activities are the actions established through policies and procedures that help

ensure that managements directives to mitigate risks to the achievement of objectives

are carried out. Control activities are performed at all levels of the entity, at various

stages within business processes, and over the technology environment. They may be

preventive or detective in nature and may encompass a range of manual and automated

activities such as authorizations and approvals, verications, reconciliations, and busi-

ness performance reviews. Segregation of duties is typically built into the selection and

development of control activities. Where segregation of duties is not practical, manage-

ment selects and develops alternative control activities.

Internal Control Integrated Framework December 2011

4

21

22

23

Draft for Public Exposure

Executive Summary

Information and Communication

Information is necessary for the entity to carry out internal control responsibilities in

support of the achievement of its objectives. Management obtains or generates and

uses relevant and quality information from both internal and external sources to support

the functioning of other components of internal control. Communication is the continual,

iterative process of providing, sharing, and obtaining necessary information. Internal

communication is the means by which information is disseminated throughout the orga-

nization, owing up, down, and across the entity. It enables personnel to receive a clear

message from senior management that control responsibilities must be taken seriously.

External communication is twofold: it enables inbound communication of relevant exter-

nal information and provides information to external parties in response to requirements

and expectations.

Monitoring Activities

Ongoing evaluations, separate evaluations, or some combination of the two are used

to ascertain whether each of the ve components of internal control, including controls

to effect the principles within each component are present and functioning. Ongoing

evaluations built into business processes at different levels of the entity, provide timely

information. Separate evaluations, conducted periodically, will vary in scope and

frequency depending on assessment of risks, effectiveness of ongoing evaluations,

and other management considerations. Findings are evaluated against managements

criteria and deciencies are communicated to management and the board of directors

as appropriate.

Internal control is not a serial process, where one component affects only the next. It is

a multidirectional, iterative process in which each component can and does inuence

another. The components apply to all entities: large, mid-size, small, for prot, and not-

forprot, and government bodies. However, each organization may choose to implement

internal control differently. For instance, a smaller company may be less formal and less

structured, yet still have effective internal control.

Internal Control Integrated Framework December 2011

5

24

25

26

Draft for Public Exposure

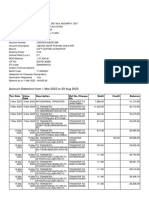

Relationship of Objectives and Components

A direct relationship exists between objectives (which are what an entity strives to

achieve) and the components (which represent what is needed to achieve them). The

relationship can be depicted in the form of a cube.

The three categories of objectives

operations, reporting, and compliance

are represented by the columns.

The ve components are represented by

the rows.

An entitys organizational structure is

represented by the third dimension.

This cube portrays the ability to focus on

the entirety of an entitys internal control, or

by objectives, components, entity units, or

any subset.

Principles and Attributes

This Framework sets out ve components of internal control. It also sets out seventeen

principles representing the fundamental concepts associated with each component. All

seventeen principles apply to each category of objective, as well as to individual objec-

tives within a category. Because these seventeen principles are drawn directly from

the components, an entity can achieve effective internal control by applying all of the

underlying principles. All principles apply to each category of objectives.

Supporting each principle are attributes, representing characteristics associated with

the principle. Although each attribute generally is expected to be present within an

entity, it may be possible to have a principle present and functioning without every

attribute being present. For instance, management may be able to determine that Prin-

ciple 1, The organization demonstrates a commitment to integrity and ethical values,

is present and functioning based on an assessment that only three of the four related

attributes are present and functioning. The organization may set the tone at the top,

evaluate adherence to standards of conduct, and address deviations in a timely manner,

but it does not formally dene the expectations of management and the board of direc-

tors in the entitys standards of conduct. However, in the absence of an attribute being

present and functioning, a deciency may still exist.

The principles supporting the Framework are listed below. This list is not meant to imply

a binary checklist. Rather, principles are meant to enable effective operation of the com-

ponents and the overall system of internal controls, with appropriate use of manage-

ment judgment.

2

2 For purposes of this Framework, in describing these principles we use the term the organization. This

term is used to collectively capture the board, management, and other personnel, as reected in the

denition of internal control.

Control Environment

Risk Assessment

Control Activities

Information & Communication

Monitoring Activities

O

p

e

r

a

t

i

o

n

s

E

n

t

i

t

y

L

e

v

e

l

D

i

v

i

s

i

o

n

O

p

e

r

a

t

i

n

g

U

n

i

t

F

u

n

c

t

i

o

n

R

e

p

o

r

t

i

n

g

C

o

m

p

l

i

a

n

c

e

Internal Control Integrated Framework December 2011

6

27

28

29

30

31

Draft for Public Exposure

Executive Summary

Control Environment

1. The organization demonstrates a commitment to integrity and ethical values.

2. The board of directors demonstrates independence of management and exercises

oversight for the development and performance of internal control.

3. Management establishes, with board oversight, structures, reporting lines, and

appropriate authorities and responsibilities in the pursuit of objectives.

4. The organization demonstrates a commitment to attract, develop, and retain com-

petent individuals in alignment with objectives.

5. The organization holds individuals accountable for their internal control responsibili-

ties in the pursuit of objectives.

Risk Assessment

6. The organization species objectives with sufcient clarity to enable the identica-

tion and assessment of risks relating to objectives.

7. The organization identies risks to the achievement of its objectives across

the entity and analyzes risks as a basis for determining how the risks should

be managed.

8. The organization considers the potential for fraud in assessing risks to the achieve-

ment of objectives.

9. The organization identies and assesses changes that could signicantly impact the

system of internal control.

Control Activities

10. The organization selects and develops control activities that contribute to the miti-

gation of risks to the achievement of objectives to acceptable levels.

11. The organization selects and develops general control activities over technology to

support the achievement of objectives.

12. The organization deploys control activities as manifested in policies that establish

what is expected and in relevant procedures to effect the policies.

Internal Control Integrated Framework December 2011

7

Draft for Public Exposure

Information and Communication

13. The organization obtains or generates and uses relevant, quality information to

support the functioning of other components of internal control.

14. The organization internally communicates information, including objectives and

responsibilities for internal control, necessary to support the functioning of other

components of internal control.

15. The organization communicates with external parties regarding matters affecting

the functioning of other components of internal control.

Monitoring Activities

16. The organization selects, develops, and performs ongoing and/or separate

evaluations to ascertain whether the components of internal control are present

and functioning.

17. The organization evaluates and communicates internal control deciencies in a

timely manner to those parties responsible for taking corrective action, including

senior management and the board of directors, as appropriate.

Efectiveness

An effective system of internal control provides reasonable assurance regarding

achievement of an entitys objectives. To have an effective system of internal control

relating to one, two, or all three categories of objectives, each of the ve components

must be present and operate together in a manner that reduces, to an acceptable level,

the risk of not achieving an objective. Further, the existence of any material weakness or

major non-conformity would preclude an organization from concluding that the entitys

system of internal control is effective.

Effectiveness of internal control is assessed relative to the ve components of internal

control. Determining whether an overall system of internal control is effective is a sub-

jective judgment resulting from an assessment of whether each of the ve components

is present and whether the ve components are operating together.

When internal control is determined to be effective in each of the three categories of

objectives (operations, reporting, and compliance), management and the board of direc-

tors have reasonable assurance, relative to the application within the entity structure,

that the organization:

Understands the extent to which operations are managed effectively

and efciently.

Prepares reliable reports.

Complies with applicable laws and regulations.

Evaluating each component of internal control requires consideration of how it is being

applied by the entity within the system of internal control, and not whether it is effec-

tive on its own. Components should not be viewed discretely. Rather the components

Internal Control Integrated Framework December 2011

8

32

33

34

35

Draft for Public Exposure

Executive Summary

should be viewed as an integrated system working together to attain effective

internal control.

In assessing whether the system of internal control is effective, senior management and

the board of directors determine to what extent the principles and, in turn, the corre-

sponding attributes associated with each component are present and functioning. This

evaluation entails considering how the principles and attributes are being applied. When

a principle is deemed not present or functioning, an internal control deciency exists.

Management applies judgment in evaluating whether a deciency prevents the entity

from concluding that a component of internal control is present and functioning.

Similarly, even though attributes are expected to be present and functioning, it may be

possible to determine that the corresponding principle is present and functioning, and

thus a component can be present and functioning without every attribute being present.

Limitations

While internal control provides important benets, limitations do exist. Limitations may

result from:

The quality and suitability of objectives established as a precondition to inter-

nal control.

The realities that human judgment in decision making can be faulty.

Breakdowns that can occur because of human failures such as simple errors

or mistakes.

Controls that can be circumvented by collusion of two or more people.

The ability of management to override internal control decisions.

These limitations preclude the board and management from having absolute assurance

of the achievement of the entitys objectivesthat is, controls provide reasonable, but

not absolute assurance.

Roles and Responsibilities

Everyone in an organization has some responsibility for internal control. The board of

directors or equivalent oversight body guides and directs management in the devel-

opment and performance of internal control. Management is responsible for the

establishment and performance of the entitys internal control system, with the chief

executive ofcer, supported by senior management, being ultimately responsible.

Various business-enabling functions communicate, enable, and evaluate adherence

to requirements dened by external laws, regulations, standards, internal policies, and

standards of conduct. Internal auditors evaluate the effectiveness of internal control and

recommend improvements.

While external auditors and reviewers are not responsible for the effectiveness of the

internal control system, they provide another independent view on the reliability of the

entitys external reporting. Likewise, other external parties, such as outsourced service

providers, may be delegated tasks to sustain and promote internal control, but the

responsibility for internal control remains with the delegating management.

Internal Control Integrated Framework December 2011

9

36

37

38

39

40

41

Draft for Public Exposure

Using of This Report

How this report can be used will depend on position and role of the parties involved:

The Board of DirectorsThe board should discuss with senior manage-

ment the state of the entitys internal control system and provide oversight as

needed. Senior management is accountable to the board of directors, and

the board needs to establish the guidelines on how it will be kept informed

and what it wants to see as part of its oversight of internal control. The board

should be kept apprised of the risks to the achievement of the entitys objec-

tives, evaluations of control deciencies, actions management is taking to

mitigate such deciencies, and how management determines that the entitys

internal control system remains effective. The board should ask the tough

questions, as necessary, of management, seek input and support from inter-

nal auditors, and seek input from external auditors and others.

Senior ManagementSenior management should assess the entitys internal

control system in relation to this Framework, focusing on how the organiza-

tion has applied the seventeen principles and developed attributes in support

of the components of internal control. Where management applied the 1992

edition of the Internal ControlIntegrated Framework, it should review in detail

the changes made in this version (as noted in Appendix B of the Framework),

and consider possible implications of those changes on the entitys system

of internal control. Management may use the Evaluation Tools as part of this

initial comparison, and its ongoing evaluation of the overall effectiveness of

the entitys system of internal control.

Other PersonnelManagers and other personnel should consider how they

are conducting their responsibilities in light of this Framework and discuss

with more senior personnel ideas for strengthening internal control. Internal

auditors should consider the breadth of their focus on internal control.

Internal AuditorsInternal auditors should review their internal audit plans and

how they applied the 1992 edition of the Internal ControlIntegrated Frame-

work. Internal auditors also should review in detail the changes made to this

version and consider possible implications of those changes on audit plans,

evaluations, and any reporting on the entitys system of internal control.

External AuditorsIn some jurisdictions, an auditor is engaged to audit or

examine the effectiveness of the internal control, particularly internal control

over external nancial reporting. Auditors can assess the entitys internal

control system in relation to this Framework, focusing on how the organiza-

tion has applied the seventeen principles and developed attributes in support

of the components of internal control. Auditors, similar to management, may

use the Evaluation Tools as part of this evaluation of the overall system of

internal control.

RegulatorsThis Framework can help to sustain the ongoing understanding

of internal control, including what it can do and its limitations. Regulators may

refer to this Framework in establishing expectations, whether by rule or guid-

ance or in conducting examinations, for entities they oversee.

Internal Control Integrated Framework December 2011

10

42

Draft for Public Exposure

Other Professional OrganizationsOther professional organizations providing

guidance on operations, reporting, and compliance may consider their stan-

dards and guidance in comparison to this Framework. To the extent diversity

in concepts and terminology is eliminated, all parties benet.

EducatorsWith the presumption that this Framework attains broad accep-

tance, its concepts and terms should nd their way into university curricula.

To submit comments on this Public Exposure Draft, please visit the www.ic.coso.org website.

Responses are due by March 31, 2012.

Respondents will be asked to respond to a series of questions. Those questions may be found on-line

at www.ic.coso.org and in a separate document provided at the time of download. Respondents may

upload letters through this site. Please do not send responses by fax.

Written comments on the exposure draft will become part of the public record and will be available on-

line until December 31, 2012.

Draft for Public Exposure

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Oscola Ireland 2011Document35 pagesOscola Ireland 2011Spencer Zhang ChengNo ratings yet

- United Feature vs. MunsingwearDocument2 pagesUnited Feature vs. MunsingwearErikEspino100% (1)

- TDA 1519cDocument21 pagesTDA 1519cCris VMNo ratings yet

- ZTWD ELt Ne USogw FDocument10 pagesZTWD ELt Ne USogw FSouravDeyNo ratings yet

- Motion For Preliminary InjunctionDocument16 pagesMotion For Preliminary InjunctionMajority In Mississippi blog100% (1)

- Claudio V Sps. SarazaDocument3 pagesClaudio V Sps. SarazaSittie Namraidah L Ali100% (1)

- Reflection On Sumilao CaseDocument3 pagesReflection On Sumilao CaseGyrsyl Jaisa GuerreroNo ratings yet

- Life Till Migration To Yasrib (Refrences)Document4 pagesLife Till Migration To Yasrib (Refrences)Umer AdnanNo ratings yet

- XL Axiata Partnership v4Document14 pagesXL Axiata Partnership v4eric.william1991No ratings yet

- Legal UpdatesDocument1 pageLegal UpdatesCharlotteNo ratings yet

- RA 10660 Sandiganbayan Full TextDocument4 pagesRA 10660 Sandiganbayan Full TextGracia SullanoNo ratings yet

- Ni Teststand: Getting Started With TeststandDocument89 pagesNi Teststand: Getting Started With TeststandAnwarNo ratings yet

- Benefits Available Under The Maternity Benefits ActDocument9 pagesBenefits Available Under The Maternity Benefits ActSumukh BNo ratings yet

- Commercial Law: Philip RawlingsDocument81 pagesCommercial Law: Philip RawlingsthomasNo ratings yet

- Alejandra Mina Et. Al. Vs Ruperta Pascual Et. Al. - G.R. No. L-8321Document6 pagesAlejandra Mina Et. Al. Vs Ruperta Pascual Et. Al. - G.R. No. L-8321Ivy VillalobosNo ratings yet

- New Microsoft Office Word DocumentDocument51 pagesNew Microsoft Office Word DocumentBasavaraj OkkundNo ratings yet

- Paula Salinger Fraud on the Court - Violations of State Law, Court Rules, Attorney Ethics, Moral Turpitude - Woodruff, O'Hair, Posner & Salinger Inc Sacramento - California State Bar Chief Trial Counsel Jayne Kim - California Supreme Court - Paula D. Salinger Judge Pro Tem Sacramento Superior Court - Sacramento Bar Association Family Law Section Officer Family Law Executive Committee - Judge Robert Hight - Judge James Mize Sacramento County Superior CourtDocument22 pagesPaula Salinger Fraud on the Court - Violations of State Law, Court Rules, Attorney Ethics, Moral Turpitude - Woodruff, O'Hair, Posner & Salinger Inc Sacramento - California State Bar Chief Trial Counsel Jayne Kim - California Supreme Court - Paula D. Salinger Judge Pro Tem Sacramento Superior Court - Sacramento Bar Association Family Law Section Officer Family Law Executive Committee - Judge Robert Hight - Judge James Mize Sacramento County Superior CourtCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas75% (4)

- People V GaraygayDocument1 pagePeople V GaraygaychiccostudentNo ratings yet

- Coa Mapping Int enDocument26 pagesCoa Mapping Int enMuhammad Javed IqbalNo ratings yet

- Agilent Technologies Singapore v. Integrated Silicon TechnologyDocument2 pagesAgilent Technologies Singapore v. Integrated Silicon TechnologyDerick Torres100% (1)

- Crim 1 Reviewer Art 95-99Document2 pagesCrim 1 Reviewer Art 95-99EcnerolAicnelavNo ratings yet

- 2022-2023 Pay Drawn Particulars of All Staffs - Palayamkottai Taluk PDFDocument187 pages2022-2023 Pay Drawn Particulars of All Staffs - Palayamkottai Taluk PDFM. IsmailNo ratings yet

- PolicyDocument7 pagesPolicyAbhie SLNo ratings yet

- Essential Requisites of Contracts: Classes of Elements of ContractDocument8 pagesEssential Requisites of Contracts: Classes of Elements of ContractLimuel MacasaetNo ratings yet

- Husbands Love Your WivesDocument4 pagesHusbands Love Your WivesKultar Deep Singh SandhuNo ratings yet

- Important Substantive - F8Document13 pagesImportant Substantive - F8Mansoor SharifNo ratings yet

- Passenger Guide and Octopus Fare 1005Document2 pagesPassenger Guide and Octopus Fare 1005water_thiefNo ratings yet

- Part 3 - InsuranceDocument11 pagesPart 3 - InsuranceJohnSmithNo ratings yet

- Annex Transport Service Scope of Work and Rates 2021Document4 pagesAnnex Transport Service Scope of Work and Rates 2021Manansala, Noel RobertinoNo ratings yet

- AP LAWCET 2021 Application (Online) AP PGLCET Registration, SyllabusDocument12 pagesAP LAWCET 2021 Application (Online) AP PGLCET Registration, SyllabusVasavi ComputersNo ratings yet