Professional Documents

Culture Documents

An Easy Guide To Taxation For Startup Entrepreneurs

An Easy Guide To Taxation For Startup Entrepreneurs

Uploaded by

Well BestOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Easy Guide To Taxation For Startup Entrepreneurs

An Easy Guide To Taxation For Startup Entrepreneurs

Uploaded by

Well BestCopyright:

Available Formats

An easy guide to taxation for startup entrepreneurs

Wanting to put up your own business but still confused how to get registered with the BI R? Are you still lost

and confused about tax filing? Now, it is made easier for you.

By: Christele J. Amoyan | May 19, 2014 20:00 pm

Taxation works as easy as RFP, says Rhea

Alamodin fromthe Bureau of Internal

Revenue (BIR) during a recent

entrepreneurship seminar facilitated by

the Department of Trade and Industry--Bureau

of Micro and Small Medium

Enterprise Development (DTI-BSMED). She

explained tax processing from registration to

filing, down to actual payment of tax return

rates.

Register-File-Pay or RFP is BIRs latest

campaign that provides better awareness to

taxpayers on their responsibility to pay taxes.

Moreover, this unified drive targets a P1.4 trillion-tax collection by the end of this year.

Register

If you are an individual who wishes to establish your own business or a self-employed professional,

it is a must go to your Revenue District Office (RDO) to register.

To register, you should have to first accomplish the following important documentary requirements:

1) Birth Certificate issued by the National Statistics Office (NSO); 2) Mayors Permit; 3) DTI

Certificate of Business Name; 4) Professional Regulation Commission (PRC) ID; and 5) Payment of

Professional Tax Receipt (PTR).

Having all these document files at hand, submit

them together with a filled up BIR Form 1901 or

the Tax Treaty Relief Application to the RDO of

your town or city that has jurisdiction over your

business location.

There is a registration fee of P 500.00 to the

Authorized Agent Bank (AAB). Use the BIR

Form 0605 payment form for this transaction.

You should also attend the taxpayers briefing at

the RDO.

A Certificate of Registration will be issued to you. This is your access if you have to file tax

return and pay. Do not forget to ask for a receipt and then fill up BIR Form 1906 (Authority to Print).

Register books of accounts. Have your journal/ledger/subsidiary books of accounts stamped by your

registered RDO.

File

Tax return filing should be made even if there is no payment to be made. There are three types of

tax returns, so dont get confused, especially, on the deadlines.

Percentage tax. Percentage tax return is filed every 20th of the month with an accomplished BIR

Form No. 2551Q.

Income tax. This is due monthly, on the 20th day, and quarterly, on the 15th of April, August, and

November. Income tax is required for self-employed individuals, real estate, and trusts, including

those with both business and compensation income. For the quarterly filing, you are required to fill

up BIR Form No. 1701Q. For annual income tax filing, you are required to have BIR Form No. 1701.

Value added tax. You need to file for a value added tax return on or before the 20th day of every

following month. For a quarterly basis, filing is due on the 25th of the months of April, August, and

November.

Pay

Here is where the computation comes in for your tax payables.

Income tax. The rates may range from 5% to 32%. However, this is not yet fixed so it may vary

depending on your net taxable income. The income tax table is provided at the back of your ITR.

Allowable deductions. The method of allowable deduction allows taxpayers (businesses or

individuals in professional practices) to choose between optional and itemized deductions. For

the optional standard deduction (OSD), trimming

of an amount not exceeding 40% of gross sales

or receipts is allowed.

On the other hand, for the itemized deduction,

all the ordinary and necessary expenses paid or

incurred during the taxable year are deducted

from the gross income. It includes employees

benefits (salary and wages), employers share

(for SSS, Medicare, HDMF, and other

contributions), rentals, insurance expenses, and

other expenses stated in the Tax Code.

Personal exemptions. Personal, living, or family

expenses are items not deductible. This means

that there is no deduction from your gross income, unless otherwise proven with substantiated

evidence.

Expanded Withholding Tax (EWT). The Expanded Withholding Tax (EWT) serves as an advance

payment of the income tax of the income recipient. It can be credited against income tax due. In

other words, this is only partial and NOT the full payment of the income tax.

To get more details, visit BIRs official website at www.bir.gov.ph/.

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Bizmates Trainers' Briefing On BIR ComplianceDocument8 pagesBizmates Trainers' Briefing On BIR Compliancejoahnabulanadi100% (2)

- Secrets To Prevent BIR Audit and Eliminate Tax AssessmentsDocument49 pagesSecrets To Prevent BIR Audit and Eliminate Tax AssessmentsIamangel10100% (17)

- Itil 4 Co-Create Value and Drive Business Success in The Digital EraDocument16 pagesItil 4 Co-Create Value and Drive Business Success in The Digital EraĐoàn Đức ĐềNo ratings yet

- Taxes That Freelancers Working in The Philippines Must File and PayDocument2 pagesTaxes That Freelancers Working in The Philippines Must File and PayRon AlvaradoNo ratings yet

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Assignment of Corporate Tax Planning On Rules For Filing Income Tax ReturnDocument8 pagesAssignment of Corporate Tax Planning On Rules For Filing Income Tax ReturnShubhamNo ratings yet

- 10 Must-Do Things While Filing Your Income Tax Return: Print Email Bookmark/Share Save CommentDocument3 pages10 Must-Do Things While Filing Your Income Tax Return: Print Email Bookmark/Share Save CommentShyamala BabuNo ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument16 pagesAn Easy Guide To Taxation For Startup EntrepreneursChristine P. ToledoNo ratings yet

- Basic Things Professionals Need To Consider Tax WiseDocument3 pagesBasic Things Professionals Need To Consider Tax WiseVeraNataaNo ratings yet

- Small Business: Essential Tax GuideDocument8 pagesSmall Business: Essential Tax GuideAndile NtuliNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Tax GuideDocument8 pagesTax GuideGooglyNo ratings yet

- Tips To Legally Avoid Paying BIR Penalties During Tax MappingDocument2 pagesTips To Legally Avoid Paying BIR Penalties During Tax MappingLevi Lazareno EugenioNo ratings yet

- Business and Income TaxationDocument58 pagesBusiness and Income TaxationFrancisNo ratings yet

- Business Taxation MeaningDocument4 pagesBusiness Taxation MeaningSheila Mae AramanNo ratings yet

- Income Tax Return Filing Doubts Solution Ebook by JagoinvestorDocument13 pagesIncome Tax Return Filing Doubts Solution Ebook by Jagoinvestoranandakumar2810100% (1)

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- What Type of Information Is Necessary To Complete A Tax ReturnDocument4 pagesWhat Type of Information Is Necessary To Complete A Tax ReturnDianna RabadonNo ratings yet

- Tips To Legally Avoid Paying BIR Penalties During Tax MappingDocument3 pagesTips To Legally Avoid Paying BIR Penalties During Tax MappingMark Anthony CasupangNo ratings yet

- Step-By-Step Sole Proprietor Business RegistrationDocument4 pagesStep-By-Step Sole Proprietor Business Registrationjen mikeNo ratings yet

- Getting To Grips With Tax ReturnsDocument2 pagesGetting To Grips With Tax Returnsdavid selekaNo ratings yet

- How Do I Obtain A TIN For Personal Income Tax Ver 2Document2 pagesHow Do I Obtain A TIN For Personal Income Tax Ver 2lintang MahardaniNo ratings yet

- Notes: Mandatory Electronic Filing and Payment of Income TaxDocument8 pagesNotes: Mandatory Electronic Filing and Payment of Income TaxJose AlexanderNo ratings yet

- ARCH591 - 3. Where Do I Get Licenses and PermitsDocument27 pagesARCH591 - 3. Where Do I Get Licenses and PermitsJahzeel CubillaNo ratings yet

- How Did The Income Tax Start?: Irs - GovDocument6 pagesHow Did The Income Tax Start?: Irs - GovApurva BhargavaNo ratings yet

- How To Compute Income TaxDocument36 pagesHow To Compute Income TaxbrownboomerangNo ratings yet

- Tax SecretsDocument16 pagesTax SecretsVenkat SairamNo ratings yet

- Self Employed DocumentDocument11 pagesSelf Employed DocumentapproachdirectNo ratings yet

- UntitledDocument5 pagesUntitledsubhajit sahaNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- How To Prevent Bir Open CasesDocument6 pagesHow To Prevent Bir Open Casesmggaylan77No ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- ARCH591 - 4. What Are The Reportorial RequirementsDocument88 pagesARCH591 - 4. What Are The Reportorial Requirementskayl mamolangNo ratings yet

- What Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14Document8 pagesWhat Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14EstherNalubegaNo ratings yet

- Tax AccountingDocument4 pagesTax Accountinguymaxx3No ratings yet

- Ben Fits of It FilingDocument3 pagesBen Fits of It Filingptnagarjuna55No ratings yet

- BIR Form 2550M-WPS OfficeDocument3 pagesBIR Form 2550M-WPS OfficeShem LihaylihayNo ratings yet

- The 8% Tax For Self-Employed IndividualsDocument2 pagesThe 8% Tax For Self-Employed IndividualsFatima NacarNo ratings yet

- rc1 15eDocument5 pagesrc1 15erouzbeh1797No ratings yet

- Corporation - BIR Registration Process in The PhilippinesDocument4 pagesCorporation - BIR Registration Process in The PhilippinesPineNo ratings yet

- Publication 583 by My StyleDocument39 pagesPublication 583 by My StyleNassif El DadaNo ratings yet

- Income Tax Return Forms ArdraDocument25 pagesIncome Tax Return Forms ArdraGangothri AsokNo ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Business Start Up & Help GuideDocument7 pagesBusiness Start Up & Help GuidenowayNo ratings yet

- The 8% Tax For Self-EmployedDocument3 pagesThe 8% Tax For Self-EmployedFatima NacarNo ratings yet

- UntitledDocument40 pagesUntitledJagdish PatelNo ratings yet

- Why File Tax ReturnsDocument3 pagesWhy File Tax ReturnsanadiguptaNo ratings yet

- Basic Guide To Payroll A4 Booklet 2017Document7 pagesBasic Guide To Payroll A4 Booklet 2017waqasNo ratings yet

- BIR Form 0605 UsesDocument4 pagesBIR Form 0605 UsesCykee Hanna Quizo LumongsodNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- 10 Easy Steps To Tax FilingDocument8 pages10 Easy Steps To Tax FilingChandan VirmaniNo ratings yet

- Lecture 1 - Introduction To Income TaxDocument27 pagesLecture 1 - Introduction To Income TaxMimi kupiNo ratings yet

- Business Income TaxDocument8 pagesBusiness Income TaxAngelica Orion PanchoNo ratings yet

- Theorypresentation 170218171210Document66 pagesTheorypresentation 170218171210SumitNo ratings yet

- Small Businessmen BookletDocument27 pagesSmall Businessmen Bookletstephen_debique9455No ratings yet

- E-File IT Returns For Your Clients. It's FREE.: Accounts and AuditDocument7 pagesE-File IT Returns For Your Clients. It's FREE.: Accounts and Auditsundeep tayalNo ratings yet

- 15 Tax Deductions You Should Know - E-Filing GuidanceDocument32 pages15 Tax Deductions You Should Know - E-Filing GuidanceErin LamNo ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- BIR Revenue Memorandum Order 10-2014Document17 pagesBIR Revenue Memorandum Order 10-2014PortCalls100% (4)

- Mict Arrastre TariffDocument8 pagesMict Arrastre TariffWell BestNo ratings yet

- System Wiring Diagrams A/C Circuit (2 of 2)Document1 pageSystem Wiring Diagrams A/C Circuit (2 of 2)Well BestNo ratings yet

- System Wiring Diagrams A/C Circuit (1 of 2)Document1 pageSystem Wiring Diagrams A/C Circuit (1 of 2)Well BestNo ratings yet

- 123Document10 pages123Aryan SanezNo ratings yet

- Online Entrance Test Instructions For CandidatesDocument20 pagesOnline Entrance Test Instructions For Candidatesshamimshafeb2005No ratings yet

- Operating Process For Access To Gas Insulated SwitchgearDocument19 pagesOperating Process For Access To Gas Insulated SwitchgearMaharajaNo ratings yet

- Ves Se NigerriaDocument16 pagesVes Se NigerriaWadadiNo ratings yet

- CST Math 2015 - Day 2 - Functions Part IIDocument22 pagesCST Math 2015 - Day 2 - Functions Part IIapi-245317729No ratings yet

- ION Intelligent Metering Device and Revenue Meter: Applications SummaryDocument2 pagesION Intelligent Metering Device and Revenue Meter: Applications SummaryjocemirferstNo ratings yet

- Geberit HDPE Installation GuideDocument71 pagesGeberit HDPE Installation GuideinstalbuzauNo ratings yet

- Operator'S Manual: 9 In. Band SawDocument26 pagesOperator'S Manual: 9 In. Band SawMustafa KutanisNo ratings yet

- Blood and Body Fluid SpillageDocument4 pagesBlood and Body Fluid SpillageSony AntonyNo ratings yet

- MSG® TURBO-AIR® NX 12000 Centrifugal Air Compressor: FeaturesDocument3 pagesMSG® TURBO-AIR® NX 12000 Centrifugal Air Compressor: Featureschergui.adelNo ratings yet

- 1.5 ThyristorDocument15 pages1.5 ThyristorKhairul NaimNo ratings yet

- Scott Meech Etec 500 Journal AssignmentDocument7 pagesScott Meech Etec 500 Journal Assignmentapi-373684092No ratings yet

- Module 5: Building The Teaching Portfolio Related To The Implementation of The ModalitiesDocument2 pagesModule 5: Building The Teaching Portfolio Related To The Implementation of The Modalitiesrom keroNo ratings yet

- Documents - Pub Internship Report Presentation On Cloud ComputingDocument31 pagesDocuments - Pub Internship Report Presentation On Cloud ComputingYashvi KankarwalNo ratings yet

- Networked World ReadinessDocument8 pagesNetworked World ReadinessJane MoracaNo ratings yet

- Hyponic Full Catalog WEBDocument144 pagesHyponic Full Catalog WEBIsidro Pale CordobaNo ratings yet

- Thar Crde Repair ManualDocument261 pagesThar Crde Repair ManualSugathan AnandanNo ratings yet

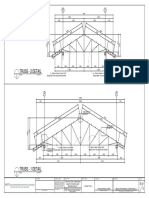

- Truss - 2 Detail: Scale 1: 50 MTRSDocument1 pageTruss - 2 Detail: Scale 1: 50 MTRSGerald MasangayNo ratings yet

- Solution Manual For Computer and Communication Networks 2 e Nader F MirDocument35 pagesSolution Manual For Computer and Communication Networks 2 e Nader F Mirconcreteprimula2ppwr100% (17)

- MFC-L9570CDW Brochure PDFDocument2 pagesMFC-L9570CDW Brochure PDFAnonymous n80oQosNo ratings yet

- MCQon PM PDFDocument11 pagesMCQon PM PDFKathirrveluSubramainanNo ratings yet

- Most Expensive Watch Brands 2024Document5 pagesMost Expensive Watch Brands 2024norahughes162No ratings yet

- Forensic AccountingDocument29 pagesForensic AccountingBharath ChootyNo ratings yet

- in 0000 Sa 00001Document1 pagein 0000 Sa 00001Ananthan SrijithNo ratings yet

- Metrics Transformation in Telecommunications EF0117Document20 pagesMetrics Transformation in Telecommunications EF0117shru294No ratings yet

- Pole W Solar Panel - Design ReportDocument62 pagesPole W Solar Panel - Design ReportGaurav Sharma100% (4)

- Adh DemolitionDocument10 pagesAdh Demolitionruel solteroNo ratings yet

- General Bearing Requirements and Design CriteriaDocument6 pagesGeneral Bearing Requirements and Design Criteriaapi-3701567100% (2)

- Gutindex 2009Document170 pagesGutindex 2009Lankesh ZadeNo ratings yet