Professional Documents

Culture Documents

Sunil

Sunil

Uploaded by

RinkuKashyapCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CPL Flight Planning ManualDocument94 pagesCPL Flight Planning ManualChina LalaukhadkaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MPA 12 EM - PMDDocument10 pagesMPA 12 EM - PMDRinkuKashyapNo ratings yet

- Observation StatementDocument3 pagesObservation Statementapi-241848470No ratings yet

- Tata Super Ace ReportDocument63 pagesTata Super Ace ReportRinkuKashyapNo ratings yet

- To Whom So Ever It May Concern:: "Study of Consumer Buying Behaviour and Sales Promotion of Khaitan Appliances"from16Document1 pageTo Whom So Ever It May Concern:: "Study of Consumer Buying Behaviour and Sales Promotion of Khaitan Appliances"from16RinkuKashyapNo ratings yet

- MPA 15 EM - PMDDocument9 pagesMPA 15 EM - PMDRinkuKashyapNo ratings yet

- MPA 14 EM - PMDDocument12 pagesMPA 14 EM - PMDRinkuKashyapNo ratings yet

- Imt 14 (Ob)Document5 pagesImt 14 (Ob)RinkuKashyapNo ratings yet

- "Research Is To See What Everybody Else Has Seen, and To Think What Nobody Else Has Thought". Albert SzentDocument9 pages"Research Is To See What Everybody Else Has Seen, and To Think What Nobody Else Has Thought". Albert SzentRinkuKashyapNo ratings yet

- International Division: at A GlanceDocument15 pagesInternational Division: at A GlanceRinkuKashyapNo ratings yet

- 7) Please Mention Any Name in Interview Ki Kiska Liya HaiDocument1 page7) Please Mention Any Name in Interview Ki Kiska Liya HaiRinkuKashyapNo ratings yet

- Role of Public Relations For Effective Communications in NgosDocument3 pagesRole of Public Relations For Effective Communications in NgosRinkuKashyapNo ratings yet

- Ramasubramanian 2009 AJoC LibreDocument18 pagesRamasubramanian 2009 AJoC LibreRinkuKashyapNo ratings yet

- Khaitan Project VivekDocument81 pagesKhaitan Project VivekRinkuKashyap100% (1)

- Abbreviations: Defense Agency For Technology and QualityDocument2 pagesAbbreviations: Defense Agency For Technology and QualityRinkuKashyapNo ratings yet

- DU LLB Entrance Exam Question Paper 2013 PDFDocument13 pagesDU LLB Entrance Exam Question Paper 2013 PDFParveen KumarNo ratings yet

- Certificate Cum Feedback Form: Summer Internship Program (SIP) (To Be Completed by The Company)Document1 pageCertificate Cum Feedback Form: Summer Internship Program (SIP) (To Be Completed by The Company)RinkuKashyapNo ratings yet

- Subject: India's Foreign Trade PolicyDocument1 pageSubject: India's Foreign Trade PolicyRinkuKashyapNo ratings yet

- AILET-2012 Question BookletDocument23 pagesAILET-2012 Question BookletVikram AdityaNo ratings yet

- 11 - Trigonometric IdentitiesDocument6 pages11 - Trigonometric IdentitiesQwert RNo ratings yet

- CABGDocument3 pagesCABGprofarmahNo ratings yet

- Assumptions of The StudyDocument2 pagesAssumptions of The StudyAnthony SaurinNo ratings yet

- HexWeb HRH10 DataSheet EuDocument6 pagesHexWeb HRH10 DataSheet EuMatijaNo ratings yet

- Information Systems For Healthcare Management Eighth Edition 8Th Edition Full ChapterDocument41 pagesInformation Systems For Healthcare Management Eighth Edition 8Th Edition Full Chapterarnold.kluge705100% (24)

- PSUR-PMSR UnterschiedDocument16 pagesPSUR-PMSR UnterschiedwNo ratings yet

- Week7Advanced Materials Electronic MaterialsDocument16 pagesWeek7Advanced Materials Electronic Materialsmarlon corpuzNo ratings yet

- Describing The Impact of Massive Open Online Course: Darielle Apilas-Bacayan Developer LessonDocument5 pagesDescribing The Impact of Massive Open Online Course: Darielle Apilas-Bacayan Developer LessonJhunel FernandezNo ratings yet

- Chemo Stability Chart - AtoKDocument59 pagesChemo Stability Chart - AtoKAfifah Nur Diana PutriNo ratings yet

- Ea 4 15 G PDFDocument22 pagesEa 4 15 G PDFshabanNo ratings yet

- Restaurant - : BusinessDocument7 pagesRestaurant - : BusinessRajan KashyapNo ratings yet

- Hemorragic CystDocument14 pagesHemorragic CystNyoman TapayanaNo ratings yet

- Separators of Different GenerationsDocument46 pagesSeparators of Different GenerationsISLAM I. Fekry100% (8)

- Case Study - SkyworksDocument46 pagesCase Study - SkyworksMohd Fadzli JiFadNo ratings yet

- Loop Switching PDFDocument176 pagesLoop Switching PDFshawnr7376No ratings yet

- MANUAL DESENVOLVIMENTO BSSV E24218Document146 pagesMANUAL DESENVOLVIMENTO BSSV E24218valdirsaraujoNo ratings yet

- Resume - Jacob WellsDocument2 pagesResume - Jacob Wellsapi-647095294No ratings yet

- What Is The Substation Automation System (SAS) and What You MUST Know About ItDocument24 pagesWhat Is The Substation Automation System (SAS) and What You MUST Know About Itዛላው መናNo ratings yet

- Feedback XI G PRA MID-TERM EP 2Document8 pagesFeedback XI G PRA MID-TERM EP 2Syifa KamilaNo ratings yet

- BER Performance of MU-MIMO System Using Dirty Paper CodingDocument4 pagesBER Performance of MU-MIMO System Using Dirty Paper CodingInternational Journal of Electrical and Electronics EngineeringNo ratings yet

- Flat Plate AnalysisDocument7 pagesFlat Plate AnalysisVikram MangaloreNo ratings yet

- Apostolic Fathers II 1917 LAKEDocument410 pagesApostolic Fathers II 1917 LAKEpolonia91No ratings yet

- Chapter 6 - ImplementationDocument8 pagesChapter 6 - ImplementationtadiwaNo ratings yet

- Nippon SteelDocument7 pagesNippon SteelAnonymous 9PIxHy13No ratings yet

- Literature Survey On Smart Surveillance SystemDocument4 pagesLiterature Survey On Smart Surveillance SystemMuhammed NayeemNo ratings yet

- Chapter 5Document17 pagesChapter 5firomsaguteta12No ratings yet

- Week 2 Pain ManagementDocument51 pagesWeek 2 Pain Managementعزالدين الطيارNo ratings yet

- SHRB-SN: 1" (25 MM) Deflection SHRB Spring Hanger With Neoprene and Bottom CupDocument1 pageSHRB-SN: 1" (25 MM) Deflection SHRB Spring Hanger With Neoprene and Bottom Cupsas999333No ratings yet

Sunil

Sunil

Uploaded by

RinkuKashyapCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sunil

Sunil

Uploaded by

RinkuKashyapCopyright:

Available Formats

INDIAN INSTITUTE OF PLANNING AND MANAGEMENT

NEW DELHI

THESIS REPORT ON

VOLATILITY & PRICING OF COMMODITY

DERIVATIVES

SUBMITTED TO:

PROF. VIJAY KUMAR BODDU

EXTERNAL GUIDE:

MR. NARENDRA BANSAL

SUBMITTED BY:

SUNIL KUMAR

PGP/SS/2009-11

REGISTRATION ID NO.: DS/09/11-F-220

PGP/SS/2009-11 DS/09/11-F220 ii

ABSTRACT

Commodities trading is now a buzzword among the investor community in India,

which is evident from the statistics that show how the trading volumes in

commodities trading has been steadily rising over the years outshining the more

popular and retail centric equities trading. The figures indicate that trading volumes

generated in commodities have grown in a steady upward trend and much faster than

that in equities during past couple of years.

Indias total commodity futures turnover on four national and 18 regional exchanges

during April 1 to 15, 2010 rose by 30% year-on-year at Rs.3.09 lakh crore. The

turnover in the commodities grew by 48% in the fiscal year 2009-10 to Rs.77.65 lakh

crore.

In India, investors showed an intelligent trend of investment in commodities as most

of the investment flow went for high return yielding commodities like bullion, crude

oil, energy and metals. Though, agricultural commodities too held a significant share

in the total commodities trading volumes.

Trading in commodity derivatives on exchange platforms is an instrument to achieve

price discovery, better price risk management, besides helping macro economy with

better resource allocation. Though the volume of commodity futures trade increased

exponentially after the withdrawal of prohibition in 2003, the functioning of futures

markets came under scrutiny during 200607 due to price rise and the government has

proposed to impose transaction tax by 0.017 per cent on trading volume in the 2008

09 budget.

The commodity market and the exchange takes place in Indian market are broadly

classified into two principle categories that is agriculture and non agriculture

commodity market.

The first part of the thesis work deals with the significance of commodity market. As

commodity market is the place where 2 parties agree to buy and sell a specified and

standardized quantity of a commodity at a certain time of future at a price agreed

upon at the time of agreement agreed upon irrespective of availing future price.

PGP/SS/2009-11 DS/09/11-F220 iii

Following the significance of commodity market is the history of the commodity

market. The root of commodity market is traced from Japan where Japanese

merchants used to store rice in ware houses and later on they have issued Rice

tickets. And as the time passes rice tickets are started to accepted as a currency.

Patterns of exchange that was prevailing in the market which was auction and the

pattern that is currently prevailing in the market which is future is discussed. Major

international and national players are described.

Various national and international markets and their features in brief are described.

The perspective of commodity market in which active and passive mode of

commodity market, volatility, liquidity of commodity market and their relation with

economy are discussed.

Benefits of future commodity markets to agriculturists, farmers are discussed in brief

along with price discovery, price risk management, import-export competitiveness,

improved product quality-market transparency etc. are discussed. The attractive

features of commodity market, various instruments those are available in the market

are listed.

Participants of the commodity market those are hedgers, speculators and arbitrators

their power and limitations, functioning etc. are described in brief.

At the end unresolved issues of commodity market and future prospect of commodity

market is written down.

PGP/SS/2009-11 DS/09/11-F220 iv

CERTIFICATE OF ORIGINALITY

This is to certify that the thesis titled Volatility & Pricing of Commodity

Derivatives was prepared and submitted by me to Indian Institute of Planning &

Management, New Delhi in partial fulfillment for the award of the Master Degree in

Business Administration, and this report has not been submitted elsewhere.

(Signature of Student)

PGP/SS/2009-11 DS/09/11-F220 v

CERTIFICATE FROM GUIDE

This is to certify that the thesis titled Volatility & Pricing of Commodity

Derivatives prepared by Mr. Sunil Kumar for the award of degree in Master of

Business Administration has been completed under my supervision & guidance. It is

an original piece of work based on primary as well as secondary data.

This work is satisfactory and complete in every respect. I wish him all the success for

his future endeavour.

Thanking you

Yours Sincerely

(Narendra Bansal)

PGP/SS/2009-11 DS/09/11-F220 vi

THESIS TOPIC APPROVAL LETTER

From: Thesis <thesis@iipm.edu>

Date: Thu, May 5, 2011 at 2:24 PM

Subject: Thesis Topic Approval (F) SS 09-11

To: suniliipm911@gmail.com

Dear Sunil Kumar,

This is to inform that your thesis proposal on Volatility & Pricing of Commodity

Derivatives, to be conducted under the guidance of Mr. Narendra Bansal is hereby

approved and the topic registration id number is DS/09/11-F-220

Make it a comprehensive thesis by ensuring that all the objectives as stated by you in

your synopsis are met using appropriate research design; a thesis should aim at adding

value to the existing knowledge base.

You are required to correspond with us by sending the thesis final draft to Prof. Vijay

Kr. Boddu at boddu.vijay@iipm.edu Ph.-0124-3350714 before the thesis submission.

NB:

1) A thesis would be rejected if there is any variation in the topic/title from the one

approved and registered with us.

2) The candidate needs to handwrite at least 1200 to 1500 words on the summary of

thesis at the time of viva

Regards,

Prof .Sumanta Sharma

Dean (Projects)

IIPM

Sumanta.sharma@iipm.edu

Phone:

+91 0124 3350701 (D)

+91 0124 3350715 (Board)

PGP/SS/2009-11 DS/09/11-F220 vii

THESIS SYNOPSIS

DETAILS OF THE STUDENT

Name : Sunil Kumar

Section : SF-1

Phone : +91-9582044577

Email : suniliipm911@gmail.com

Thesis Topic : Volatility & Pricing of Commodity Derivatives

Batch : PGP/SS/2009-2011

Specialization : Finance & Marketing

INTRODUCTION

Trading in derivatives first started to protect farmers from the risk of the value of their

crop going below the cost price of their produce. Derivative contracts were offered on

various agricultural products like cotton, rice, coffee, wheat, pepper, etc. Commodity

derivatives have had a long and a chequered presence in India. The commodity

derivative market has been functioning in India since the nineteenth century with

organised trading in cotton through the establishment of Cotton Trade Association in

1875. Over the years, there have been various bans, suspensions and regulatory

dogmas on various contracts. National Commodity and Derivatives Exchange

(NCDEX) is the largest commodity derivatives exchange.

Commodity derivatives, which were traditionally developed for risk management

purposes, are now growing in popularity as an investment tool. Most of the trading in

the commodity derivatives market is being done by people who have no need for the

commodity itself. They just speculate on the direction of the price of these

commodities, hoping to make money if the price moves in their favour. The

commodity derivatives market is a direct way to invest in commodities rather than

investing in the companies that trade in those commodities.

It is easier to forecast the price of commodities based on their demand and supply

forecasts as compared to forecasting the price of the shares of a company -- which

depend on many other factors than just the demand -- and supply of the products they

PGP/SS/2009-11 DS/09/11-F220 viii

manufacture and sell or trade in. Also, derivatives are much cheaper to trade in as

only a small sum of money is required to buy a derivative contract.

The most critical function in a commodity derivatives exchange is the settlement and

clearing of trades. Commodity derivatives can involve the exchange of funds and

goods. The exchanges have a separate body to handle all the settlements, known as

the clearing house.

RESEARCH OBJECTIVE

o To provide a introduction to commodity derivative products, including pricing,

hedging and structuring commodity derivatives.

o This study will cover both exchange traded and over the counter commodity

derivatives in addition to commodity derivative securities

Sub Objectives:

Special features of the underlying commodity as it relates to derivatives

Commodity structures from both issuer and investor / hedger perspective

Structuring, pricing, hedging and basic management of commodity derivatives

Commodity derivative structures designed to optimise risk / return profiles for

both issuer and purchaser

Structuring, pricing and hedging of OTC commodity derivatives

Structured securities with commodity linkage

RESEARCH METHODOLOGY

Sources of Secondary data : O Books on Commodity Markets

O Internet

O Trade Reports

Sources of Primary data :

Tool used : Questionnaire & Interview

Sampling method : Judgmental sampling

Sample size : 50 respondents

Target audience : Traders

PGP/SS/2009-11 DS/09/11-F220 ix

Corporate hedgers

Producers

Statistical Analysis : o Volatility Measurement for selected

commodities for the last quarter

o Price analysis of the selected

commodities

SCOPE OF THE WORK

The study will be limited to:

Economic issues in commodities markets

Commodity price and volume risk analysis

Modeling of commodity spot prices and forward curves in Indian Commodity

markets

Real options valuation and hedging of physical assets in the various industry

sectors.

JUSTIFICATION OF CHOOSING THE TOPIC

The last few years have been a watershed for the commodities, cash and derivatives

industry. New regulations and products have led to an explosion in the commodities

markets, creating a new asset for investors that includes hedge funds as well as

University endowments, and has resulted in a spectacular growth in spot and

derivative trading.

Producers need to manage their exposure to fluctuations in the prices for their

commodities. They are primarily concerned with fixing prices on contracts to sell

their produce. A gold producer wants to hedge his losses attributable to a fall in the

price of gold for his current gold inventory. A cattle farmer wants to hedge his

exposure to changes in the price of his livestock.

End-users need to hedge the prices at which they can purchase these commodities. A

university might want to lock in the price at which it purchases electricity to supply its

air conditioning units for the upcoming summer months. An airline wants to lock in

PGP/SS/2009-11 DS/09/11-F220 x

the price of the jet fuel it needs to purchase in order to satisfy the peak in seasonal

demand for travel.

Speculators are funds or individual investors who can either buy or sell commodities

by participating in the global commodities market. While many may argue that their

involvement is fundamentally destabilizing, it is the liquidity they provide in normal

markets that facilitates the business of the producer and of the end-user.

The price risk in commodities is often more complex and volatile than that associated

with currencies and interest rates. Commodity markets may also be less liquid than

those for interest rates and currencies and, as a result, changes in supply and demand

can have a more dramatic effect on price and volatility. These market characteristics

can make price transparency and the effective hedging of commodities risk more

difficult.

ARTICLES AND BOOKS REFERRED

o Commodities and Commodity Derivatives: Modeling and Pricing for

Agriculturals, Metals and Energy, By Helyette Geman, Wiley

DETAILS OF THE EXTERNAL GUIDE

Name: Mr. Narendra Bansal, Chartered Accountant

Qualification: M.Com, F.C.A.

SUMMER TRAINING DETAILS

COMPANY : Kotak Mahindra Old Mutual Life Insurance

POSITION : Management Trainee

PERIOD OF WORK : 2 months

PROJECT DETAILS : Consumer behavior towards Financial Products

JOB PROFILE : Sales Executive

PGP/SS/2009-11 DS/09/11-F220 xi

ACKNOWLEDGEMENT

An Acknowledgement is the expression of ones thanks giving to the people who

have extended their help in every possible way. Help is a voluntary fulfillment of

duty, which, all the people mentioned below have performed it to their maximum

possible, in a way giving us & our research the utmost important.

At the onset, we wish to express our gratitude to Prof. Vijay Kr. Boddu, Academic

Coordinator, Indian Institute of Planning and Management for showing keen interest,

constant support & help in completing this report successfully.

I am thankful to my thesis guide Mr. Narendra Bansal for guiding me throughout

this study without his help this thesis would have not be completed.

We would also like to thanks to the authors, websites for providing us the related

information to our thesis subject.

I appreciate the co-ordination extended by my friends and also express my sincere

thankfulness to the entire faculty members of Indian Institute of Planning &

Management, Delhi, giving me the opportunity to do this project/study and also

assisting me for the same.

It was the light of there knowledge under which my thesis has been successfully

completed.

I owe everything in this life to my parents who are a constant source of inspiration

and pillars of support.

(Sunil Kumar)

PGP/SS/2009-11 DS/09/11-F220 xii

TABLE OF CONTENT

ABSTRACT ii

CERTIFICATE OF ORIGINALITY iv

CERTIFICATE FROM GUIDE v

THESIS TOPIC APPROVAL LETTER vi

THESIS SYNOPSIS vii

ACKNOWLEDGEMENT xi

CHAPTER-1 INTRODUCTION 1

CHAPTER-2 RESEARCH OBJECTIVE AND METHODOLOGY 3

CHAPTER-3 CONCEPTUAL FRAMEWORK 6

CHAPTER-4 ANALYSIS AND INTERPRETATION OF DATA 51

CHAPTER-5 SUMMARY OF FINDINGS AND SUGGESTIONS 95

CHAPTER-6 CONCLUSION 98

BIBILOGRAPHY 99

ANNEXURE 101

PGP/SS/2009-11 DS/09/11-F220 1

Chapter-1

INTRODUCTION

Organized futures markets in India are now 134 years old, with the first such

organization the Bombay Cotton Trade Association Ltd. been set up in 1875.

While India was gradually becoming the largest consumer of gold in the world, a

position it still enjoys, futures markets in bullion were inevitable and began to emerge

in Mumbai in 1920.

The vast geographical extent of India and her huge population is aptly complemented

by the size of her market. The broadest classification of the Indian Market can be

made in terms of the commodity market and the bond market.

The commodity market in India comprises of all palpable markets that we come

across in our daily lives. Such markets are social institutions that facilitate exchange

of goods for money. The cost of goods is estimated in terms of domestic currency.

India Commodity Market can be subdivided into the following two categories:

Wholesale Market

Retail Market

Considering the present growth rate, the total valuation of the Indian Retail Market is

estimated to cross Rs. 10,000 billion by the year 2014. Demand for commodities is

likely to become four times by 2014 than what it was in 2009.

MARKET

A market is conventionally defined as a place where buyers and sellers meet to

exchange goods or services for a consideration. This consideration is usually money.

In an Information Technology-enabled environment, buyers and sellers from different

locations can transact business in an electronic marketplace. Hence the physical

marketplace is not necessary for the exchange of goods or services for a

consideration. Electronic trading and settlement of transactions has created a

revolution in global financial and commodity markets.

PGP/SS/2009-11 DS/09/11-F220 2

COMMODITY

A commodity is a product that has commercial value, which can be produced, bought,

sold, and consumed. Commodities are basically the products of the primary sector of

an economy. The primary sector of an economy is concerned with agriculture and

extraction of raw materials such as metals, energy (crude oil, natural gas), etc., which

serve as basic inputs for the secondary sector of the economy.

COMMODITY EXCHANGE

A commodity exchange is an association or a company or any other body corporate

organizing futures trading in commodities for which license has been granted by

regulating authority.

PGP/SS/2009-11 DS/09/11-F220 3

Chapter-2

RESEARCH OBJECTIVE AND METHODOLOGY

RESEARCH OBJECTIVE

RESEARCH OBJECTIVE

o To provide a introduction to commodity derivative products, including pricing,

hedging and structuring commodity derivatives.

o This study will cover both exchange traded and over the counter commodity

derivatives in addition to commodity derivative securities

Sub Objectives:

Special features of the underlying commodity as it relates to derivatives

Commodity structures from issuer and investor / hedger perspective

Structuring, pricing, hedging and basic management of commodity derivatives

Commodity derivative structures designed to optimise risk / return profiles for

both issuer and purchaser

Structuring, pricing and hedging of OTC commodity derivatives

Structured securities with commodity linkage

HYPOTHESIS

The processors, manufacturers, exporters and other market functionaries, entering into

forward sale commitments in either the domestic or export markets, are exposed to

heavy risks from adverse price changes

RESEARCH METHODOLOGY

Primary Data

Primary data are those which the researcher collects directly by himself. In this

project work, primary data is collected by giving questionnaires. Respondents were

given Questionnaires and data were collected.

PGP/SS/2009-11 DS/09/11-F220 4

Secondary Data

Secondary data are those, which are got through reviewing primary data. The

various secondary data used in this work includes

1. Internet

2. Periodicals

3. Journals

4. Books related to Commodity Market etc.

Sampling:

Sampling Technique:

Convenient sampling- Researcher focuses on selected few commodities to study the

topic Convenience Sampling is being used. Under Convenience Sampling the

researcher will be taking sampling according to his or her convenience.

Sample Area: Mumbai city is Sample area for this project.

Population: All commodity traded in exchanges will form as the population of the

study

Sample size: Sample size of 40 stock brokers is used for this study.

Tools for Data Collection:

Data has been collected from two main sources:

Primary data:

The study is based on data collected from brokers of various companies with the help

of structured questionnaire. Questionnaire is included in appendix. Data on various

parameters was included like number of years in business, increase in number of

clients from past year, turnover per day were collected to access information

regarding growth in commodity market. Informal discussion is also carried with few

brokers to know their opinion.

PGP/SS/2009-11 DS/09/11-F220 5

Secondary data:

Websites:

www.karvy.com

www.karvycomtrade.com

www.mcxindia.com

www.ncdex.com

www.indianmba.com

www.icfaipress.org/books/commoditiesmarket

www.finance.indiamart.com/markets/commodity/traders_derivatives_market.html

Books and Magazines related to the study etc.

Method of Analysis:

Statistical Tools:

Statistical Tools like t-test and correlation are going to be used in addition to bar / pie

diagram using SPSS package to analyze the questionnaire and Excel sheet is used to

calculate Beta and Volatility calculations.

Limitations of the Study:

Man has done everything to make it come true but everything has its own limitation.

A uniform across risk model cannot be derived

The historical data available is in the date of the expiry of the contract.

In this study, only Futures are taken due to time and cost constraints.

One month data was taken for analysis.

The survey has been done within Mumbai city, which might fail to be

representative of total market.

A thorough in depth interview was not completely possible because of time

constraints of the respondents

PGP/SS/2009-11 DS/09/11-F220 6

Chapter-3

CONCEPTUAL FRAMEWORK

BRIEF HISTORY

Commodities future trading was evolved from need of assured continuous supply of

seasonal agricultural crops. The concept of organized trading in commodities evolved

in Chicago, in 1848. But one can trace its roots in Japan.

In 19th century Chicago in United States had merged as a major commercial hub. So

that wheat producers from Mid-west attracted here to sell their produce to dealers &

distributors. Due to lack of organized storage facilities, absence of uniform weighing

& grading mechanisms producers often confined to the mercy of dealers discretion.

These situations lead to need of establishing a common meeting place for farmers and

dealers to transact in spot grain to deliver wheat and receive cash in return.

Gradually sellers & buyers started making commitments to exchange the produce for

cash in future and thus contract for futures trading evolved; Whereby the producer

would agree to sell his produce to the buyer at a future delivery date at an agreed upon

price.

Trading of wheat in futures became very profitable which encouraged the entry of

other commodities in futures market. This created a platform for establishment of a

body to regulate and supervise these contracts. Thats why Chicago Board of Trade

(CBOT) was established in 1848. In 1870 and 1880s the New York Coffee, Cotton

and Produce Exchanges were born. Agricultural commodities were mostly traded but

as long as there are buyers and sellers, any commodity can be traded. In 1872, a group

of Manhattan dairy merchants got together to bring chaotic condition in New York

market to a system in terms of storage, pricing, and transfer of agricultural products.

The largest commodity exchange in USA is Chicago Board of Trade, The Chicago

Mercantile Exchange, the New York Mercantile Exchange, the New York

Commodity Exchange and New York Coffee, sugar and cocoa Exchange. Worldwide

there are major futures trading exchanges in over twenty countries including Canada,

England, India, France, Singapore, Japan, Australia and New Zealand.

PGP/SS/2009-11 DS/09/11-F220 7

COMMODITY MARKETS OF WORLD

Some of the exchanges of the world are:

Global Commodity Exchanges

1. New York Mercantile Exchange (NYMEX)

2. London Metal Exchange (LME)

3. Chicago Board of Trade (CBOT)

4. New York Board of Trade (NYBOT)

5. Kansas Board of Trade

6. Winnipeg Commodity Exchange, Manitoba

7. Dalian Commodity Exchange, China

8. Bursa Malaysia Derivatives exchange

9. Singapore Commodity Exchange (SICOM)

10. Chicago Mercantile Exchange (CME), US

11. London Metal Exchange

12. Tokyo Commodity Exchange (TOCOM)

13. Shanghai Futures Exchange

14. Sydney Futures Exchange

15. London International Financial Futures and Options Exchange (LIFFE)

16. Dubai Gold & Commodity Exchange (DGCX)

17. Dubai Mercantile Exchange (DME), (joint venture between Dubai holding and

the New York Mercantile Exchange (NYMEX))

PGP/SS/2009-11 DS/09/11-F220 8

HISTORY OF COMMODITY MARKET IN INDIA

The history of organized commodity derivatives in India goes back to the nineteenth

century when Cotton Trade Association started futures trading in 1875, about a

decade after they started in Chicago. Over the time derivatives market developed in

several commodities in India. Following Cotton, derivatives trading started in oilseed

in Bombay (1900), raw jute and jute goods in Calcutta (1912), Wheat in Hapur (1913)

and Bullion in Bombay (1920).

However many feared that derivatives fuelled unnecessary speculation and were

detrimental to the healthy functioning of the market for the underlying commodities,

resulting in to banning of commodity options trading and cash settlement of

commodities futures after independence in 1952. The parliament passed the Forward

Contracts (Regulation) Act, 1952, which regulated contracts in Commodities all over

the India. The act prohibited options trading in Goods along with cash settlement of

forward trades, rendering a crushing blow to the commodity derivatives market.

Under the act only those associations/exchanges, which are granted reorganization

from the Government, are allowed to organize forward trading in regulated

commodities.

The act envisages three tire regulations:

a) Exchange which organizes forward trading in commodities can regulate

trading on day-to-day basis;

b) Forward Markets Commission provides regulatory oversight under the powers

delegated to it by the central Government.

c) The Central Government- Department of Consumer Affairs, Ministry of

Consumer Affairs, Food and Public Distribution- is the ultimate regulatory

authority.

After Liberalization and Globalization in 1990, the Government set up a committee

(1993) to examine the role of futures trading. The Committee (headed by Prof. K.N.

Kabra) recommended allowing futures trading in 17 commodity groups. It also

recommended strengthening Forward Markets Commission, and certain amendments

to Forward Contracts (Regulation) Act 1952, particularly allowing option trading in

PGP/SS/2009-11 DS/09/11-F220 9

goods and registration of brokers with Forward Markets Commission. The

Government accepted most of these recommendations and futures trading was

permitted in all recommended commodities. It is timely decision since internationally

the commodity cycle is on upswing and the next decade being touched as the decade

of Commodities.

Commodity exchange in India plays an important role where the prices of any

commodity are not fixed, in an organized way.

PRESENT COMMODITY MARKET IN INDIA

Today, commodity exchanges are purely speculative in nature. Before discovering the

price, they reach to the producers, endusers, and even the retail investors, at a

grassroots level. It brings a price transparency and risk management in the vital

market. By Exchange rules and by law, no one can bid under a higher bid, and no one

can offer to sell higher than someone elses lower offer. That keeps the market as

efficient as possible, and keeps the traders on their toes to make sure no one gets the

purchase or sale before they do. Since 2002, the commodities future market in India

has experienced an unexpected boom in terms of modern exchanges, number of

commodities allowed for derivatives trading as well as the value of futures trading in

commodities, which crossed $ 1 trillion mark in 2006.

In India there are 25 recognized future exchanges, of which there are four national

level multi-commodity exchanges. After a gap of almost three decades, Government

of India has allowed forward transactions in commodities through Online Commodity

Exchanges, a modification of traditional business known as Adhat and Vayda Vyapar

to facilitate better risk coverage and delivery of commodities.

The four exchanges are:

a) National Commodity & Derivatives Exchange Limited (NCDEX) Mumbai,

b) Multi Commodity Exchange of India Limited (MCX) Mumbai and

c) National Multi- Commodity Exchange of India Limited (NMCEIL)

Ahmedabad.

d) Indian Commodity Exchange Limited (ICEX), Gurgaon

PGP/SS/2009-11 DS/09/11-F220 10

There are other regional commodity exchanges situated in different parts of India.

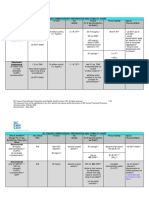

EXIHIBIT: INDIAN COMMODITY MARKET STRUCTURE

PGP/SS/2009-11 DS/09/11-F220 11

NATIONAL LEVEL COMMODITY EXCHANGES IN

INDIA

NMCE (NATIONAL MULTI COMMODITY EXCHANGE OF

INDIA LTD.)

NMCE is the first demutualised electronic commodity exchange of India granted the

National exchange on Govt. of India and operational since 26th Nov, 2002.

Promoters of NMCE are, Central warehousing corporation (CWC), National

Agricultural Cooperative Marketing Federation of India (NAFED), Gujarat Agro-

Industries Corporation Limited (GAICL), Gujarat state agricultural Marketing Board

(GSAMB), National Institute of Agricultural Marketing (NIAM) and Neptune

Overseas Ltd. (NOL). Main equity holders are PNB.

The Head Office of NMCE is located in Ahmedabad. There are various commodity

trades on NMCE Platform including Agro and non-agro commodities.

NCDEX (NATIONAL COMMODITY & DERIVATES EXCHANGE

LTD.)

NCDEX is a public limited co. incorporated on April 2003 under the Companies Act

1956, It obtained its certificate for commencement of Business on May 9, 2003. It

commenced its operational on Dec 15, 2003.

Promoters shareholders are: Life Insurance Corporation of India (LIC), National Bank

for Agriculture and Rural Development (NABARD) and National Stock Exchange of

India (NSE) other shareholder of NCDEX are: Canara Bank, CRISIL limited,

Goldman Sachs, Intercontinental Exchange (ICE), Indian farmers fertilizer

corporation Ltd (IFFCO) and Punjab National Bank (PNB).

NCDEX is located in Mumbai and currently facilitates trading in 57 commodities

mainly in Agro product.

MCX (MULTI COMMODITY EXCHANGE OF INDIA LTD.)

Headquartered in Mumbai, MCX is a demutualised nation wide electronic commodity

future exchange. Set up by Financial Technologies (India) Ltd. permanent recognition

PGP/SS/2009-11 DS/09/11-F220 12

from government of India for facilitating online trading, clearing and settlement

operations for future market across the country. The exchange started operation in

Nov, 2003.

MCX equity partners include, NYSE Euronext,, State Bank of India and its

associated, NABARD NSE, SBI Life Insurance Co. Ltd. , Bank of India, Bank of

Baroda, Union Bank of India, Corporation Bank, Canara Bank, HDFC Bank, etc.

MCX is well known for bullion and metal trading platform.

ICEX (INDIAN COMMODITY EXCHANGE LTD.)

ICEX is latest commodity exchange of India Started Function from 27 Nov, 09. It is

jointly promote by Indiabulls Financial Services Ltd. and MMTC Ltd. and has Indian

Potash Ltd. KRIBHCO and IFC among others, as its partners having its head office

located at Gurgaon (Haryana).

BSE is also planning to set up a Commodity exchange.

UNIQUE FEATURES OF NATIONAL LEVEL COMMODITY EXCHANGES

The unique features of national level commodity exchanges are:

They are demutualized, meaning thereby that they are run professionally and

there is separation of management from ownership. The independent

management does not have any trading interest in the commodities dealt with

on the exchange.

They provide online platforms or screen based trading as distinct from the

open outcry systems (ring trading) seen on conventional exchanges. This

ensures transparency in operations as everyone has access to the same

information.

They allow trading in a number of commodities and are hence multi-

commodity exchanges.

They are national level exchanges which facilitate trading from anywhere in

the country. This corollary of being an online exchange.

PGP/SS/2009-11 DS/09/11-F220 13

MAJOR REGIONAL COMMODITY EXCHANGES IN INDIA

a) BATINDA COMMODITY & OIL EXCHANGE LTD.

b) THE BOMBAY COMMODITY EXCHANGE

c) THE RAJKOT SEEDS OIL AND BULLION MERCHAT

d) THE KANPUR COMMODITY EXCHANGE

e) THE MEERUT AGRO COMMODITY EXCHANGE THE SPICES AND

OILSEEDS EXCHANGE (SANGI)

f) AHEMDABAD COMMODITY EXCHANGE

g) VIJAY BEOPAR CHAMBER LTD. (MUZAFFARNAGAR)

h) INDIA PEPPERS AND SPICE TRADE ASSOCIATION ( KOCHI )

i) RAJDHANI OILS AND SEEDS EXCHANGE ( DELHI )

j) THE CHAMBER OF COMMERCE (HAPUR)

k) THE EAST INDIA COTTON ASSOCIATION (MUMBAI)

l) THE CENTRAL COMMERCIAL EXCHANGE ( GWALIOR )

m) THE EAST INDIA JUTE & HESSIAN EXCHANGE OF INDIA

(KOLKATA)

n) FIRST COMMODITY EXCHANGE OF INDIA ( KOCHI )

o) BIKANER COMMODITY EXCHANGE LTD. ( BIKANER )

p) THE COFEE FUTURE EXCHANGE LTD. ( BANGALORE )

q) E SUGAR INDIA LTD. (MUMBAI)

PGP/SS/2009-11 DS/09/11-F220 14

COMMODITIES TRADED IN INDIA

EXHIBIT: COMMODITIES IN WHICH FUTURES TRADING IS BEING

CONDUCTED IN INDIA

FIBRES AND MANUFACTURERS

1. Kapas

.V797Kapas

2. Hessian

3. IndianCotton

PGP/SS/2009-11 DS/09/11-F220 15

S06LSCottonAhmedabad

CottonKadi

Indian31mmcotton

indian28mmcotton

J34MSCottonBhatinda

CottonAbohar

4. SttapleFibreYarn

5. Sacking

Jute(Btwill-665Gms)-Kollata

6. Gram

Gram(Chana)-NewDelhi

7. cottonbales

8. cottonseeds

undecorticatedcottonseedoilcake

9. LongStapleCotton

10. MediumStappleCotton

NEWMEDIUMSTAPLECOTTON

11. Silk

MulberryRawSilk-Bangalore

MulberryGreenCocoons-Ramnagar

12. MulberryRawSilk

13. MulberryGreenCocoons

14. Coffee-Arabica

15. CottonLongKadi

16. CottonMedAbohar

PGP/SS/2009-11 DS/09/11-F220 16

17. CottonShortStaple

18. Sugar(S-30)

19. MuatardseedOilcake

20. PPTQ

21. Cement

22. Mediumcottonyarn

23. Polyvinchlorid

SPICES

1. Pepper Domestic-MG1

2. Turmeric

Turmeric -Nizamabad

3. Pepper Domestic-500g/l

4. Black Pepper Int'l-MLS ASTA

5. Black Pepper Int'l-VB ASTA

6. Black pepper Int'l FAQ

7. Pepper

Pepper Dommestic-MG1.

Black Pepper Int'l VB ASTA.

Black Pepper Int'l-MLS ASTA.

Black Pepper Int'l FAQ.

Pepper Dommestic-500g/L.

Pepper -Kochi

8. Cardamom

9. Pepper 550 G/L

10. Red Chilly

PGP/SS/2009-11 DS/09/11-F220 17

Chilli (Paala) Guntur

Chilli (Paala) LCA 334

11. Jeera

12. Rubber RSS4

13. Jeera Unjha

14. CUMINSEED

15. Arecanut

EDIBLE OILSEEDS AND OIL

1. RBD Pamolein

RBD P'Olein -Kakinada

2. Groundnut Oil

Groundnut Expeller Oil

3. Sunflower Oil

4. Rapeseed/Mustardseed

Rapeseed -42

Rape/Mustard seed -Jaipur

5. Rapeseed/Mustardseed Oil

EXP R/M oil -Jaipur

Expeller mustard oil -Sri Ganganagar

6. Rapeseed/Mustardseed oil-Cake

7. Soy bean

Soy bean -Indore

8. Soy Meal

Soy Meal -Indore

Yellow Soybean Meal (Export)

PGP/SS/2009-11 DS/09/11-F220 18

9. Soy Oil

Ref Soya oil -Indore

10. Copra

11. CottonSeed

Cottonbales

12. Safflower

13. Groundnut

Groundnut(shell)

14. Castor oil-Int'l

15. Coconut oil

16. Copra cake

17. Groundnut oilCack

18. Cottonseed oil

19. Sesamum (Til or Jiljili)

Whitish Sesame Seed Rajkot

20. Sesamum oil

21. Sesamum OilCake

22. Safflower OilCake

23. Rice Bran

24. Rice Bran Oil

25. Rice Bran OilCake

26. Safflower Oil

27. Sanflower OilCake

28. Sunflower Seed

29. Crude Palm Oil

PGP/SS/2009-11 DS/09/11-F220 19

Crude Palm oil Kandla

30. Cottonseed Oilcake

Cotton Seed Oilcake Akola

31. Vanaspati

32. Soybean Oilcake

33. Linseed

34. Linseed Oil

35. Linseed Oilcake

36. Coconut Oilcake

37. Mustard Seed

38. Mustard Seed Jaipur

39. Sesame Seed ( Natural 99.1)

40. Castorseed-Disa

41. Mustardseed Oilcake

42. KAPASKHALI

43. Middle east crude oil

44. Refined sunflower oil

PULSES

1. Masoor

masoor grain bold

2. Urad

Urad -Mumbai

3. Tur / Arhar

Lemon Tur -Mumbai

Maharashtra Lal Tur -Akola

PGP/SS/2009-11 DS/09/11-F220 20

4. Moong

5. Yellow Peas

Yellow Peas -Mumbai

6. Chana

ENERGY PRODUCTS

1. Crude Oil

2. Brent Crude Oil

3. Furnace Oil

4. Natural Gas

VEGETABLES

1. Potato

METALS

1. Aluminium Ingots

2. Nickel

3. Copper

Copper Cathode

4. Zinc

5. Lead

6. Tin

7. Gold

Gold-M

Pure Gold -Mumbai

Kilo -Gold

Gold -HNI

PGP/SS/2009-11 DS/09/11-F220 21

SONA995MUM

Pure Gold -Mumbai -1 Kg

8. Silver

Silver-M

Pure Silver -New Delhi -30 Kg (Mega)

Pure Silver -New Delhi

Silver -HNI

CHANDIDEL

9. Steel

Steel -Long

Steel -Flat

Mild Steel Ingots -Ghaziabad

10. Steel Long Bhavnagar

11. Steel Long Govindgarh

12. sponge iron

13. GOLD AHMEDABAD

14. GOLD DELHI

15. GOLD KOLKATA

16. GOLD MUMBAI

17. GOLD MINI DELHI

18. GOLD MINI KOLKATA

19. GOLD MINI MUMBAI

20. GOLD MINI AHMEDABAD

OTHERS

1. Gur

PGP/SS/2009-11 DS/09/11-F220 22

Gur-chaku -Muzaffarnagar

2. Coffee-Plantation A

3. Potato

4. Sugar

Sugar M Grade -Muzaffarnagar

Sugar S Grade -Vashi

Sugar S Grade

Sugar Grade -M

Sugar Grade -S

5. Coffee-Robusta Cherry AB

6. Raw Coffee Arabica Parchment

7. Raw Coffee Robusta Cherry

8. Castorseed

Castorseed-5

Castorseed -Disa

9. Castor-oil

10. Coffee

Coffee-Plantation A.

Coffee-Robusta Cherry AB.

Raw Coffee Robusta Cherry.

Raw Coffee Arabica Parchment.

Arabica Coffee -Hassan

Robusta Coffee -Kushalnagar

Arabica Coffee -Hassan (New)

Robusta Coffee -Kushalnagar (New)

PGP/SS/2009-11 DS/09/11-F220 23

11. Guarseed

Guarseed -Jodhpur

Guarseed -BND

12. CastorOil Cake

13. Rubber

Rubber -Kottayam

14. Rice

Basmati Rice

Grade A Parboiled Rice Delhi

Common Parboiled Rice Delhi

Indian Raw Rice Parmal

Indian Parboiled Rice IR-36/IR-64

Grade A Raw Rice Delhi

Common Raw Rice Delhi

15. Wheat

Wheat -New Delhi SMQ

Wheat Delhi (New)

16. Raw Jute

Raw Jute -Kolkata

17. GuarGum

GuarGum -Jodhpur

18. Guarseed Bandhani

19. Maize

Yellow Red Maize -Nizamabad

20. Guar Gum Bandhani

PGP/SS/2009-11 DS/09/11-F220 24

21. CASHEW KERNEL W320

Cashew W 320 -Kollam

22. Sugar S

23. Sugar M

24. Sarbati Rice

25. Coffee-Arabica Plantation A

26. Cashews W-320-Kollam

27. Mentha Oil

28. Sugar (S30)

29. HIGH DENSITY POL

30. Gurchaku

31. cardamom

32. ISABGULSEED

33. Isabgul

PGP/SS/2009-11 DS/09/11-F220 25

WORKING OF COMMODITY MARKET

There are two kinds of trades in commodities. The first is the spot trade, in which one

pays cash and carries away the goods. The second is futures trade. The underpinning

for futures is the warehouse receipt. A person deposits certain amount of say, good X

in a ware house and gets a warehouse receipt. Which allows him to ask for physical

delivery of the good from the warehouse. But some one trading in commodity futures

need not necessarily posses such a receipt to strike a deal. A person can buy or sale a

commodity future on an exchange based on his expectation of where the price will go.

Futures have something called an expiry date, by when the buyer or seller either

closes (square off) his account or give/take delivery of the commodity. The broker

maintains an account of all dealing parties in which the daily profit or loss due to

changes in the futures price is recorded. Squiring off is done by taking an opposite

contract so that the net outstanding is nil.

For commodity futures to work, the seller should be able to deposit the commodity at

warehouse nearest to him and collect the warehouse receipt. The buyer should be able

to take physical delivery at a location of his choice on presenting the warehouse

receipt. But at present in India very few warehouses provide delivery for specific

commodities.

Following diagram gives a fair idea about working of the Commodity market.

PGP/SS/2009-11 DS/09/11-F220 26

Today Commodity trading system is fully computerized. Traders need not visit a

commodity market to speculate. With online commodity trading they could sit in the

confines of their home or office and call the shots.

The commodity trading system consists of certain prescribed steps or stages as

follows:

I. Trading: - At this stage the following is the system implemented-

- Order receiving

- Execution

- Matching

- Reporting

- Surveillance

- Price limits

- Position limits

II. Clearing: - This stage has following system in place-

- Matching

- Registration

- Clearing

- Clearing limits

- Notation

- Margining

- Price limits

- Position limits

- Clearing house.

III. Settlement: - This stage has following system followed as follows-

- Marking to market

PGP/SS/2009-11 DS/09/11-F220 27

- Receipts and payments

- Reporting

- Delivery upon expiration or maturity.

PRICING COMMODITY FUTURES

The process of arriving a figure at which a person buys and another sells a futures

contract for a specific expiration date is called price discovery. The process of price

discovery continues from the market's opening until its close and also free flow of

information is also very important in an active future market. Futures exchanges act as

a focal point for the collection and distribution of statistics on supplies, transportation,

storage, purchases, exports, imports, currency values, interest rates and other relevant

formation. As a result of this free flow of information, the market determines the best

estimate of today and tomorrow's prices and it is considered to be the accurate

reflection of the supply and demand for the underlying commodity. Price discovery

facilitates this free flow of information, which is essential to the effective functioning

of futures market.

We try to understand the pricing of commodity futures contracts and look at how the

futures price is related to the spot price of the underlying asset. We study the cost - of

- carry model to understand the dynamics of pricing that constitute the estimation of

fair value of futures.

Investment assets versus consumption assets

When we are studying futures contracts, it is essential to distinguish between

investment assets and consumption assets. An investment asset is an asset that is held

for investment purposes by most investors. Stocks, bonds, Gold and silver are

examples of investment assets. However investment assets do not always have to be

held entirely for investment. As we saw earlier silver for example, have a number of

industrial uses. However to classify as investment assets, these assets have to satisfy

the requirement that they are held by a large number of investors solely for

investment. A consumption asset is an asset that is held primarily for consumption. It

is not usually held for investment. Examples of consumption assets are commodities

such as copper, oil, and pork bellies.

PGP/SS/2009-11 DS/09/11-F220 28

We can use arbitrage arguments to determine the futures prices of an investment asset

from its spot price and other observable market variables. For pricing consumption

assets, we need to review the arbitrage arguments a little differently. We look at the

cost of carry model and try to understand the pricing of futures contracts on

investment assets.

The cost of carry model:-

For pricing purposes we treat the forward and the futures market as one and the same.

A futures contract is nothing but a forward contract that is exchange traded and that is

settled at the end of each day. The buyer who needs an asset in the future has the

choice between buying the underlying asset today in the spot market and holding it, or

buying it in the forward market. If he buys it in the spot market today it involves

opportunity costs. He incurs the cash outlay for buying the asset and he also incurs

costs for storing it. If instead he buys the asset in the forward market, he does not

incur an initial outlay.

The basis for the cost of carry model where the price of the futures contract is

defined as:

Eq (1)

Where

F = Future price C = Holding cost or carrying cost S = Spot price

The fair value of future contracts can also be expressed as:

. Eq (2)

Where:

R = percentage cost of financing

T = time till expiration

Whenever the futures price moves away from the fair value, there

would be opportunities for arbitrage. If F > S (1+r)

t

or F < S (1+r)

t

arbitrage would

exit. We know that what is Spot price and what are future price. We should know that

F = S + C

F = S (1+r)

t

PGP/SS/2009-11 DS/09/11-F220 29

what are the components of the holding cost? The components of holding cost vary

with contracts on different assets. Sometimes holding cost may even be negative. In

case of commodity futures, the holding cost is the cost of financing plus cost of

storage and insurance purchased. In case of equity futures, the holding cost is the cost

of financing minus the dividends returns.

Equation (2) uses the concept of discrete compounding, i.e. where

interest rates are compounded at discrete intervals like annually or semiannually.

Pricing of options and other complex derivative securities requires the use of

continuously compounded interest rates. Most books on derivatives use continuous

compounding for pricing futures too.

When we use continuous compounding, equation (2) is expressed as:

Eq (3)

Where:

r = Cost of financing (Using continuously compounding interest rate)

T = Time till expiration

e = 2.71828

Let us take an example of a future contract on commodity and we work

out the price of the contract. Let the spot price of gold is RS. 1376310gms. If the

cost of financing is 15% annually, then what should be the future price of 10gms of

gold one month later? Let us assume that we are on 1 Jan 2009. How would we

compute the price of gold future contract expiring on 30 January? Let us first try to

work out the components of cost of carry model.

1. What is the spot price of gold?

The spot price of gold, S = 13763/ 10gms.

2. What is the cost of financing for month?

e

0.15 30/365

3. What are the holding costs?

F = S e

rT

PGP/SS/2009-11 DS/09/11-F220 30

Let us assume that the storage cost = 0

F = S e

rT

= 13763 e

0.15 30/365

= 13933.73

If the contract was for a three months period i.e. expiring on 30th March, the

cost of financing would increase the futures price. Therefore, the futures price would

be F = 13763 e

0.15 90/365

= Rs 14281.58

Pricing futures contracts on investment commodities

In the example above we saw how a futures contract on gold could be

raised using cost of carry model. In the example we considered, the gold contract

was for 10 grams of gold, hence we ignored the storage costs. However, if the one

month contract was for a 100kgs of gold instead of 10gms, then it would involve non-

zero holding costs which would include storage and insurance costs. The price of the

futures contract would then be Rs.14281.58 plus the holding costs.

The above table gives the indicative warehouse charges for qualified

warehouses that will function as delivery centers for contracts that trade on the

NCDEX. Warehouse charges include a fixed charge per deposit of commodity into

the warehouse, and as per unit per week charge. Per unit charges include storage costs

and insurance charges. We saw that in the absence of storage costs, the futures price

of a commodity that is an investment asset is given by F = S e

rT

Storage

Costs add to the cost of carry. If U is the present value of all the storage costs that will

be incurred during the life of a futures contract, it follows that the futures price will be

equal to

Eq (4)

Where:

r = Cost of financing (annualized)

T = Time till expiration

U = Present value of all storage costs

For understanding the above formula let us consider a one year future

contract of gold. Suppose the fixed charge is Rs.310 per deposit up to 500kgs and the

F = (S+U) e

rT

PGP/SS/2009-11 DS/09/11-F220 31

variable storage costs are Rs.55 per week, it costs Rs.3170 to store one kg of gold for

a year (52 weeks). Assume that the payment is made at the beginning of the year.

Assume further that the spot gold price is Rs.13763 per 10 grams and the risk free

rate is 7% per annum. What would the price of one year gold futures be if the delivery

unit

F = (S+U) e

rT

= (1376300 + 310 + 2860) e

0.07 1

= 1379470 e

0.07 1

= 1379470 1.072508

= 1479493

We see that the one year futures price of a kg of gold would be Rs.1479493. The one

year futures price for 10 grams of gold would be about Rs.14794.93.

Now let us consider a three month futures contract on gold. We make

the same assumptions that the fixed charge is Rs.310 per deposit up to 500kgs, and

the variable storage costs are Rs.55 per week. It costs Rs.1025 to store one kg of gold

for three months (13 weeks). Assume that the storage costs are paid at the time of

deposit. Assume further that the spot gold price is Rs 13763per 10 grams and the risk

free rate is 7% per annum. What would the price of three month gold futures if the

delivery unit is one kg?

F = (S+U) e

rT

= (1376300 + 310 + 715) e

0.07 0.25

= 1377325 1.017654

= 1401640.30

We see that the three month futures price of a kg of gold would be Rs. 1401640.30.

The three month futures price for 10 grams of gold would be about Rs. 14016.40

Pricing futures contracts on consumption commodities

We used the arbitrage argument to price futures on investment commodities. For

commodities that are consumption commodities rather than investment assets, the

arbitrage arguments used to determine futures prices need to be reviewed carefully.

Suppose we have

PGP/SS/2009-11 DS/09/11-F220 32

Eq (5)

To take advantage of this opportunity, an arbitrager can implement the following

strategy:

I. Borrow an amount S + U. at the risk free interest rate and use

it to purchase one unit of the commodity.

II. Short a forward contract on one unit of the commodity.

If we regard the futures contract as a forward contract, this strategy leads to a profit of

F - (S+U) e

rT

at the expiration of the futures contract. As arbitragers exploit this

opportunity, the spot price will increase and the futures price will decrease until

Equation (5) does not hold good.

Suppose next that

Eq (6)

In case of investment assets such as gold and silver, many investors hold the

commodity purely for investment. When they observe the inequality in equation 6,

they will find it profitable to trade in the following manner:

I. Sell the commodity, save the storage costs, and invest the proceeds at

the risk free interest rate.

II. Take a long position in a forward contract.

This would result in a profit at maturity of (S+U) e

rT

F relative to the position that

the investors would have been in had they held the underlying commodity. As

arbitragers exploit this opportunity, the spot price will decrease and the futures price

will increase until equation 6 does not hold well. This means that for investment

assets, equation 4 holds good. However, for commodities like cotton or wheat that are

held for consumption purpose, this argument cannot be used. Individuals and

companies who keep such a commodity in inventory, do so, because of its

consumption value not because of its value as an investment. They are reluctant to

sell these commodities and buy forward or futures contracts because these contracts

cannot be consumed. Therefore there is unlikely to be arbitrage when equation 6 holds

good. In short, for a consumption commodity therefore

F > (S+U) e

rT

F < (S+U) e

rT

PGP/SS/2009-11 DS/09/11-F220 33

Eq (7)

That is the futures price is less than or equal to the spot price plus the cost of carry.

CLEARING, SETTLEMENT AND RISK MANAGEMENT

Clearing and settlement

Most futures contracts do not lead to the actual physical delivery of the

underlying asset. The settlement is done by closing out open positions, physical

delivery or cash settlement. All these settlement functions are taken care of by an

entity called clearing house or clearing corporation. National Securities Clearing

Corporation Limited (NSCCL) undertakes clearing of trades executed on the

NCDEX. The settlement guarantee fund is maintained and managed by NCDEX.

Clearing

Clearing of trades that take place on an exchange happens through the exchange

clearing house. A clearing house is a system by which exchanges guarantee the

faithful compliance of all trade commitments undertaken on the trading floor or

electronically over the electronic trading systems. The main task of the clearing house

is to keep track of all the transactions that take place during a day so that the net

position of each of its members can be calculated. It guarantees the performance of

the parties to each transaction.

Typically it is responsible for the following:

Effecting timely settlement

Trade registration and follow up.

Control of the evolution of open interest.

Financial clearing of the payment flow.

Physical settlement (by delivery) or financial settlement (by price

difference) of contracts.

Administration of financial guarantees demanded by the participants.

The clearing house has a number of members, who are mostly financial institutions

responsible for the clearing and settlement of commodities traded on the exchange.

The margin accounts for the clearing house members are adjusted for gains and losses

at the end of each day (in the same way as the individual traders keep margin accounts

with the broker). On the NCDEX, in the case of clearing house members only the

F (S+U) e

rT

PGP/SS/2009-11 DS/09/11-F220 34

original margin is required (and not maintenance margin), Every day the account

balance for each contract must be maintained at an amount equal to the original

margin times the number of contracts outstanding. Thus depending on a day's

transactions and price movement, the members either need to add funds or can

withdraw funds from their margin accounts at the end of the day. The brokers who are

not the clearing members need to maintain a margin account with the clearing house

member through whom they trade in the clearing house.

Clearing banks: NCDEX has designated clearing banks

Through whom funds to be paid and / or to be received must be settled. Every

clearing member is required to maintain and operate a clearing account with any one

of the designated clearing bank branches. The clearing account is to be used

exclusively for clearing operations i.e., for settling funds and other obligations to

NCDEX including payments of margins and penal charges. A clearing member can

deposit funds into this account, but can withdraw funds from this account only in his

self-name. A clearing member having funds obligation to pay is required to have clear

balance in his clearing account on or before the stipulated pay in day and the

stipulated time. Clearing members must authorize their clearing bank to access their

clearing account for debiting and crediting their accounts as per the instructions of

NCDEX, reporting of balances and other operations as may be required by NCDEX

from time to time. The clearing bank will debit/ credit the clearing account of clearing

members as per instructions received from NCDEX. The following banks have been

designated as clearing banks. ICICI Bank Limited, Canarabank, UTI Bank Limited

and HDFC Bank ltd

Depository participants: Every clearing member is required to maintain and operate

a CM pool account with any one of the empanelled depository participants. The CM

pool account is to be used exclusively for clearing operations i.e., for effecting and

receiving deliveries from NCDEX.

Settlement

Futures contracts have two types of settlements,

The MTM settlement which happens on a continuous basis at the end of each day

And the final settlement which happens on the last trading day of the futures

contract.

PGP/SS/2009-11 DS/09/11-F220 35

On the NCDEX, daily MTM settlement and final MTM settlement in respect of

admitted deals in futures contracts are cash settled by debiting/ crediting the clearing

accounts of CMs with the respective clearing bank. All positions of a CM, either

brought forward created during the day or closed out during the day, are marked to

market at the daily settlement price or the final settlement price at the close of trading

hours on a day.

Daily settlement price: Daily settlement price is the consensus closing price as

arrived after closing session of the relevant futures contract for the trading

day. However, in the absence of trading for a contract during closing session,

daily settlement price is computed as per the methods prescribed by the

exchange from time to time.

Final settlement price: Final settlement price is the closing price of the

underlying commodity on the last trading day of the futures contract. All open

positions in a futures contract cease to exist after its expiration day.

Settlement Methods: Settlement of futures contracts on the NCDEX can be done in

three ways. By physical delivery of the underlying asset, by closing out open

positions and by cash settlement. We shall look at each of these in some detail. On the

NCDEX all contracts settling in cash are settled on the following day after the

contract expiry date. All contracts materialising into deliveries are settled in a period

2.7 days after expiry. The exact settlement day for each commodity is specified by the

exchange.

When a contract comes to settlement, the exchange provides alternatives like delivery

place, month and quality specifications. Trading period, delivery date etc. are all

defined as per the settlement calendar. A member is bound to provide delivery

information. If he fails to give information, it is closed out with penalty as decided by

the exchange. A member can choose an alternative mode of settlement by providing

counter party clearing member and constituent. The exchange is however not

responsible for, nor guarantees settlement of such deals. The settlement price is

calculated and notified by the exchange. The delivery place is very important for

commodities with significant transportation costs. The exchange also specifies the

accurate period (date and time) during which the delivery can be made.

PGP/SS/2009-11 DS/09/11-F220 36

Closing out by offsetting positions

Most of the contracts are settled by closing out open positions. In closing out, the

opposite transaction is effected to close out the original futures position. A buy

contract is closed out by a sale and a sale contract is closed out by a buy. For example,

an investor who took a long position in two gold futures contracts on the January 30,

2009 at 14402 can close his position by selling two gold futures contracts on February

27, 2004 at Rs.15445. In this case, over the period of holding the position, he has

gained an amount of Rs.1043 per unit. This loss would have been debited from his

margin account over the holding period by way of MTM at the end of each day, and

finally at the price that he closes his position, that is Rs. 15445 in this case.

Cash settlement

Contracts held till the last day of trading can be cash settled. When a contract is

settled in cash, it is marked to the market at the end of the last trading day and all

positions are declared closed. The settlement price on the last trading day is set equal

to the closing spot price of the underlying asset ensuring the convergence of future

prices and the spot prices. For example an investor took a short position in five long

staple cotton futures contracts on December 15 at Rs.6950. On 20

th

February, the last

trading day of the contract, the spot price of long staple cotton is Rs.6725. This is the

settlement price for his contract. As a holder of a short position on cotton, he does not

have to actually deliver the underlying cotton, but simply takes away the profit of

Rs.225 per trading unit of cotton in the form of cash.

Risk management

NCDEX has developed a comprehensive risk containment mechanism for its

commodity futures market. The salient features of risk containment mechanism are:

The financial reliability of the members is the key to risk management. Therefore,

the requirements for membership in terms of capital adequacy (net worth, security

deposits) are quite stringent.

NCDEX charges an open initial margin for all the open positions of a member. It

specifies the initial margin requirements for each futures contract on a daily basis.

It also follows value-at-risk (VAR) based margining through SPAN. The PCMs

and TCMs in turn collect the initial margin from the TCMs and their clients

respectively.

PGP/SS/2009-11 DS/09/11-F220 37

The open positions of the members are marked to market based on contract

settlement price for each contract. The difference is settled in cash on a T+1 basis.

A member is alerted of his position to enable him to adjust his exposure or bring

in additional capital. Position violations result in withdrawal of trading facility for

all TCMs of a PCM in case of a violation by the PCM.

A separate settlement guarantee fund for this segment has been created out of the

capital of members.

UNRESOLVED ISSUES

Even though the commodity derivatives market has made good progress in the last

few years, the real issues facing the future of the market have not been resolved.

Agreed, the number of commodities allowed for derivative trading have increased, the

volume and the value of business has zoomed, but the objectives of setting up

commodity derivative exchanges may not be achieved and the growth rates witnessed

may not be sustainable unless these real issues are sorted out as soon as possible.

Some of the main unresolved issues are discussed below.

a. Commodity Options: Trading in commodity options contracts has been

banned since 1952. The market for commodity derivatives cannot be called

complete without the presence of this important derivative. Both futures and

options are necessary for the healthy growth of the market. While futures

contracts help a participant (say a farmer) to hedge against downside price

movements, it does not allow him to reap the benefits of an increase in prices.

No doubt there is an immediate need to bring about the necessary legal and

regulatory changes to introduce commodity options trading in the country. The

matter is said to be under the active consideration of the Government and the

options trading may be introduced in the near future.

b. The Warehousing and Standardization: For commodity derivatives market to

work efficiently, it is necessary to have a sophisticated, cost-effective, reliable

and convenient warehousing system in the country. The Habibullah (2003)

task force admitted, A sophisticated warehousing industry has yet to come

about. Further, independent labs or quality testing centers should be set up in

each region to certify the quality, grade and quantity of commodities so that

PGP/SS/2009-11 DS/09/11-F220 38

they are appropriately standardized and there are no shocks waiting for the

ultimate buyer who takes the physical delivery. Warehouses also need to be

conveniently located. Central Warehousing Corporation of India (CWC:

www.fieo.com) is operating 500 Warehouses across the country with a storage

capacity of 10.4 million tonnes. This is obviously not adequate for a vast

country. To resolve the problem, a Gramin Bhandaran Yojana (Rural

Warehousing Plan) has been introduced to construct new and expand the

existing rural godowns. Large scale privatization of state warehouses is also

being examined.

c. Cash versus Physical Settlement: It is probably due to the inefficiencies in the

present warehousing system that only about 1% to 5% of the total commodity

derivatives trade in the country is settled in physical delivery. Therefore the

warehousing problem obviously has to be handled on a war footing, as a good

delivery system is the backbone of any commodity trade. A International

Research Journal of Finance and Economics - Issue 2 (2006) 161 particularly

difficult problem in cash settlement of commodity derivative contracts is that

at present, under the Forward Contracts (Regulation) Act 1952, cash

settlement of outstanding contracts at maturity is not allowed. In other words,

all outstanding contracts at maturity should be settled in physical delivery. To

avoid this, participants square off their positions before maturity. So, in

practice, most contracts are settled in cash but before maturity. There is a need

to modify the law to bring it closer to the widespread practice and save the

participants from unnecessary hassles.