Professional Documents

Culture Documents

23 May 14 CPO Futures

23 May 14 CPO Futures

Uploaded by

ventriaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

23 May 14 CPO Futures

23 May 14 CPO Futures

Uploaded by

ventriaCopyright:

Available Formats

1

23 May 2014

Technical Analysis written by Jeremy Lim

Kindly refer to the Disclaimer at the end of this report.

Daily Market Commentary FCPO

Disclaimer: Daily Market Commentary report is made available as a complimentary service by Oriental Pacific Futures Sdn. Bhd. (OPF) to Bursa Malaysia Derivatives Bhd. No further redistribution is permitted

without written permission from OPF. If you have received this report in error and are not a designated recipient as defined above, then in addition and without prejudice, OPF shall not owe any duty or responsibility to

you. Daily Market Commentary is intended to provide factual information, reports, news, views and any other contents, but its accuracy cannot be guaranteed. All information, reports, news, views and any other

contents are provided on an As Is basis and are obtained from sources which OPF believes to be reliable. OPF makes no warranty or representation of any kind, expressed or implied, as to the accuracy,

completeness, and timeliness or otherwise of the information available to the user via this report. Under no circumstance shall any of the information provided be construed as a buy or sell recommendation or

investment advice of any kind. You understand and agree that all contents obtained through the use of this report is at your own discretion and risk and that you will be solely responsible for any damage or trading

losses that results from the use of this report. The writer and OPF will not be held liable for any damage or trading losses that result from the use of this article. OPF and its affiliated/related companies, their

associates, directors, connected parties and/or employees may own or have interests or positions in any of the contracts/products mentioned or referred to in this report, or any investment related thereto and may

from time to time add or dispose of or may be materially interested in any such contracts/products.

The FCPO active month contract snapped four days losses to end slightly higher on Thursday due to electronic soybean oil

prices traded higher during the Asian trading hours which has underpinned the FCPO prices. At the close, the price was up

17 points or 0.67% to 2,522.

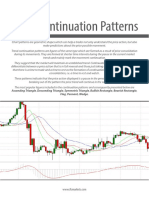

Looking at the chart from a technical point of view, s small positive candle with long lower wick has been formed on

Thursday where it indicated that price was supported at the intraday low level. Price gapped higher once it was opened but

later it fell to as low as 2,499 where the downside gap left in the morning trading session has covered. As we can see from

the chart, the price temporary supported near the support line as drawn on the chart. If the price is able stay above this

support line, the price may linger in a narrow range. However, if the price fails to stay above the support line, it may fall

further and the downside gap will be eyed.

Referring to the MACD histogram, it is building up in the negative zone.

Technical indicators:

2,515 -This is the level to measure the strength of the price movement. If the price is able to stay above the 2,515 level on

Friday, it may rise further. Otherwise, it may fall further and the downside support levels will be monitored if the price stays

below the 2,515 level.

Indicators: *Green = Positive , *Blue = Neutral , *Red = Negative , Market Trend ; *Green = (Retrace) * Blue = (Sideway) *Red = (Temporary Rebound)

MACD MACD HISTOGRAM DMI (ADX) MARKET TREND

You might also like

- Forex Trading Strategy: Trade Market Imbalance Using Supply & Demand StrategyFrom EverandForex Trading Strategy: Trade Market Imbalance Using Supply & Demand StrategyRating: 4 out of 5 stars4/5 (18)

- Vertex Trade StoryDocument15 pagesVertex Trade Storyquentin oliver100% (4)

- Nix2b StratergyDocument38 pagesNix2b StratergyAneeshAntony100% (1)

- Ebook New UpdatedDocument104 pagesEbook New UpdatedArun kumar50% (2)

- VSA NotesDocument15 pagesVSA Notesjunaid100% (1)

- Best Moving Average For Day TradingDocument10 pagesBest Moving Average For Day TradingPaolo BartoliNo ratings yet

- Technical Stock PickDocument3 pagesTechnical Stock PickGauriGanNo ratings yet

- Equities: Nifty & DJIA - at Crucial Support LevelsDocument4 pagesEquities: Nifty & DJIA - at Crucial Support LevelsSubodh GuptaNo ratings yet

- Stock To Watch:: Nifty ChartDocument2 pagesStock To Watch:: Nifty ChartSoundara Moorthy GunasekaranNo ratings yet

- Technical Pick: Weekly ChartDocument2 pagesTechnical Pick: Weekly ChartGauriGanNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- HSL - Emargin Stock Pick - LA OPALADocument3 pagesHSL - Emargin Stock Pick - LA OPALAViswanathan SundaresanNo ratings yet

- Technical Stock PickDocument3 pagesTechnical Stock PickGauriGanNo ratings yet

- Daily Chart: Technical PicksDocument2 pagesDaily Chart: Technical PicksGauriGanNo ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeaumaganNo ratings yet

- Stock To Watch:: Nifty ChartDocument2 pagesStock To Watch:: Nifty ChartSrinivas KaraNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Diwali Technical Stock Pick: Retail ResearchDocument2 pagesDiwali Technical Stock Pick: Retail ResearchumaganNo ratings yet

- PCG Technical Stock Pick RCF 12 MARCH 2019Document3 pagesPCG Technical Stock Pick RCF 12 MARCH 2019Surjit singhNo ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeaumaganNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Daily Morning Update 22 Dec 2011Document3 pagesDaily Morning Update 22 Dec 2011Devang VisariaNo ratings yet

- Derivative Positional Pick - 24-05-21-Muthootfin June FutureDocument3 pagesDerivative Positional Pick - 24-05-21-Muthootfin June FutureManjunath JavaregowdaNo ratings yet

- Derivative Stock PickDocument2 pagesDerivative Stock PickPrashantKumarNo ratings yet

- Technical Stock PicksDocument4 pagesTechnical Stock PicksumaganNo ratings yet

- Daily Technical Snapshot: September 03, 2015Document3 pagesDaily Technical Snapshot: September 03, 2015GauriGanNo ratings yet

- Weekly Trading Highlights & OutlookDocument5 pagesWeekly Trading Highlights & OutlookDevang VisariaNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Special Technical Report - GOLD: Retail ResearchDocument3 pagesSpecial Technical Report - GOLD: Retail ResearchshobhaNo ratings yet

- Weekly Chart: Technical PicksDocument2 pagesWeekly Chart: Technical PicksGauriGanNo ratings yet

- Diwali Technical Stock Pick: Private Client GroupDocument2 pagesDiwali Technical Stock Pick: Private Client GroupumaganNo ratings yet

- Fkli & Fcpo: Technical AnalyzerDocument5 pagesFkli & Fcpo: Technical AnalyzerRiksan RiksanNo ratings yet

- Adani Enterprises - MTF Stock Pick - 06 Aug 2021Document3 pagesAdani Enterprises - MTF Stock Pick - 06 Aug 2021Manik AroraNo ratings yet

- Top Technical Catch - Aegischem LTDDocument2 pagesTop Technical Catch - Aegischem LTDrupesh4286No ratings yet

- HDFC Securities Technical Pick - BEMLDocument3 pagesHDFC Securities Technical Pick - BEMLManish SinghNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Momentum Pick - CHALETDocument3 pagesMomentum Pick - CHALETSourav PalNo ratings yet

- Weekly Momentum Stock Pick: Rs.555 Rs.617 Rs.480/445 1-2 MonthsDocument2 pagesWeekly Momentum Stock Pick: Rs.555 Rs.617 Rs.480/445 1-2 MonthsGauriGanNo ratings yet

- Frasers Commercial Trust: Charted TerritoryDocument2 pagesFrasers Commercial Trust: Charted TerritoryventriaNo ratings yet

- VENKYS - E-Margin Positional Pick - HSL - 281221Document3 pagesVENKYS - E-Margin Positional Pick - HSL - 281221destinationsunilNo ratings yet

- Techno-Funda Stock Pick: Private Client GroupDocument3 pagesTechno-Funda Stock Pick: Private Client GroupumaganNo ratings yet

- Future Trader-DTN-12th Oct 2011Document2 pagesFuture Trader-DTN-12th Oct 2011Snp PandeyNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchHimanshuNo ratings yet

- Daily Forex Report 5 MARCH 2013: WWW - Epicresearch.CoDocument6 pagesDaily Forex Report 5 MARCH 2013: WWW - Epicresearch.Coapi-196234891No ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeaumaganNo ratings yet

- Definedge Newsletter - 29th Aug 21Document11 pagesDefinedge Newsletter - 29th Aug 21Beyond TechnicalsNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Daily Chartist View: 7 March 2013Document5 pagesDaily Chartist View: 7 March 2013api-196234891No ratings yet

- Weekly Trading Highlights & OutlookDocument5 pagesWeekly Trading Highlights & OutlookDevang VisariaNo ratings yet

- HDFC Securities Retail Research Momentum Stock Pick 29 AUG 2023 - BUY ORIENT CEMENTDocument3 pagesHDFC Securities Retail Research Momentum Stock Pick 29 AUG 2023 - BUY ORIENT CEMENTTarun BhardwajNo ratings yet

- Daily Morning Update 20 Oct 2011Document2 pagesDaily Morning Update 20 Oct 2011Devang VisariaNo ratings yet

- Momentum Pick - VBL 05-06-24 - BUYDocument4 pagesMomentum Pick - VBL 05-06-24 - BUYvellumaramNo ratings yet

- MTF Stock Pick - RAIN IND 30082021Document3 pagesMTF Stock Pick - RAIN IND 30082021Keshav KhetanNo ratings yet

- Daily Morning Update 7dec 2011Document3 pagesDaily Morning Update 7dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 25 Oct 2011Document2 pagesDaily Morning Update 25 Oct 2011Devang VisariaNo ratings yet

- Daily Forex Report 28 February 2013: WWW - Epicresearch.CoDocument6 pagesDaily Forex Report 28 February 2013: WWW - Epicresearch.Coapi-196234891No ratings yet

- Technical Stock Idea: Retail ResearchDocument3 pagesTechnical Stock Idea: Retail ResearchumaganNo ratings yet

- Agri Technical WeeklyDocument4 pagesAgri Technical WeeklyAkshay WaghmareNo ratings yet

- Mentum Stocks: Positional Technical PickDocument2 pagesMentum Stocks: Positional Technical PickGauriGanNo ratings yet

- Technical Switch Trades: Retail ResearchDocument2 pagesTechnical Switch Trades: Retail ResearchumaganNo ratings yet

- Technical Switch Trades: Retail ResearchDocument2 pagesTechnical Switch Trades: Retail ResearchkhaniyalalNo ratings yet

- Long Term Technical Stock Pick - Buy PC JEWELLER - 131218Document4 pagesLong Term Technical Stock Pick - Buy PC JEWELLER - 131218VINOD KUMARNo ratings yet

- Technical Stock Idea: Retail ResearchDocument2 pagesTechnical Stock Idea: Retail ResearchumaganNo ratings yet

- 5 Minutes a Week Winning Strategies: Trading SPY in Bull & Bear MarketFrom Everand5 Minutes a Week Winning Strategies: Trading SPY in Bull & Bear MarketRating: 2.5 out of 5 stars2.5/5 (3)

- Artificial Intelligence Global Ex UsDocument28 pagesArtificial Intelligence Global Ex UsventriaNo ratings yet

- Insas BerhadDocument3 pagesInsas BerhadventriaNo ratings yet

- Small Caps: Singapore Small-Cap ConferenceDocument12 pagesSmall Caps: Singapore Small-Cap ConferenceventriaNo ratings yet

- Memtech International Not Rated: A Visit To China FactoriesDocument12 pagesMemtech International Not Rated: A Visit To China FactoriesventriaNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- 21 May Technical FocusDocument1 page21 May Technical FocusventriaNo ratings yet

- 23 May 14 Market OpnionDocument1 page23 May 14 Market OpnionventriaNo ratings yet

- Hang Seng Index FuturesDocument3 pagesHang Seng Index FuturesventriaNo ratings yet

- Daily Market Commentary: FBMKLCI Futures: Technical AnalysisDocument1 pageDaily Market Commentary: FBMKLCI Futures: Technical AnalysisventriaNo ratings yet

- Frasers Commercial Trust: Charted TerritoryDocument2 pagesFrasers Commercial Trust: Charted TerritoryventriaNo ratings yet

- Starhill Global REIT Ending 1Q14 On High NoteDocument6 pagesStarhill Global REIT Ending 1Q14 On High NoteventriaNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Market Pulse 130619Document5 pagesMarket Pulse 130619ventriaNo ratings yet

- NR7 Forex Trading Strategy: What Is The NR7 Pattern?Document5 pagesNR7 Forex Trading Strategy: What Is The NR7 Pattern?Nikos KarpathakisNo ratings yet

- Trend Continuation PatternsDocument10 pagesTrend Continuation PatternsJoão GabrielNo ratings yet

- Covered Call Expert ReportDocument50 pagesCovered Call Expert Reporttvadmaker100% (2)

- IchimokuDocument51 pagesIchimokujerry666a100% (1)

- بلا عنوانDocument13 pagesبلا عنوانsami mohamedNo ratings yet

- Appraisal GuidebookDocument48 pagesAppraisal Guidebookkintirgum100% (1)

- LBR On Volatility BreakoutDocument5 pagesLBR On Volatility Breakoutsiger66100% (1)

- How To Trade The ABCD PatternDocument8 pagesHow To Trade The ABCD PatternUtkarshNo ratings yet

- Nanningbob User GuideDocument10 pagesNanningbob User GuideKwok Nam LiNo ratings yet

- VPA by Anna CoullingDocument50 pagesVPA by Anna Coullingbonanzina8No ratings yet

- Appendix: Harmonic Pattern TradingDocument16 pagesAppendix: Harmonic Pattern TradingV KumarNo ratings yet

- Equity Research Fundamental and Technical Analysis and Its Impact On Stock PricesDocument82 pagesEquity Research Fundamental and Technical Analysis and Its Impact On Stock PricesNeel ModyNo ratings yet

- AB CD PatternDocument4 pagesAB CD Patternapi-2624705867% (3)

- The Wyckoff Method ExplainedDocument14 pagesThe Wyckoff Method ExplainedPro tube100% (2)

- 79009168099Document2 pages79009168099sangam sahaniNo ratings yet

- Price Action Reversal StrategiesDocument6 pagesPrice Action Reversal StrategiesHimanshu Pratap SinghNo ratings yet

- Option StrategiesDocument9 pagesOption StrategiesSatya Kumar100% (1)

- John Person CandlesticksDocument30 pagesJohn Person Candlestickstoneranger100% (3)

- Dave Landry - The Myth of Tight StopsDocument8 pagesDave Landry - The Myth of Tight Stopsdaytradar100% (1)

- Trading The LineDocument45 pagesTrading The LineAndi Hidayat100% (1)

- Ichimoku Kinko HyoDocument48 pagesIchimoku Kinko HyoJanny23SD100% (2)

- 1004mc Industry Update 5-4-09Document28 pages1004mc Industry Update 5-4-09KnoxGeexNo ratings yet

- Binary Options Strategy PDFDocument21 pagesBinary Options Strategy PDFByron Rodriguez0% (1)

- Formations XABCDDocument10 pagesFormations XABCDsueno8650% (2)

- Technical Analysis PresentationDocument73 pagesTechnical Analysis Presentationparvez ansari100% (1)