Professional Documents

Culture Documents

Insurance Defintions

Insurance Defintions

Uploaded by

AbbasLiaqatQureshi0 ratings0% found this document useful (0 votes)

41 views6 pagesInsurance is defined as a contract between two parties where one party agrees to take on the risk of another in exchange for regular payments called premiums. There are two main types of insurance: life insurance and general insurance. Life insurance provides a monetary benefit to the insured's beneficiaries if they die, while general insurance covers various risks like health issues, vehicle accidents, home damage, and more. State Life Insurance Corporation of Pakistan (SLIC) is a major life insurance company that offers various individual and group life insurance plans to citizens. Its products include whole life assurance plans and savings-oriented plans like Sadabahar that provide lump sums at different stages.

Original Description:

State Life

Original Title

Insurance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInsurance is defined as a contract between two parties where one party agrees to take on the risk of another in exchange for regular payments called premiums. There are two main types of insurance: life insurance and general insurance. Life insurance provides a monetary benefit to the insured's beneficiaries if they die, while general insurance covers various risks like health issues, vehicle accidents, home damage, and more. State Life Insurance Corporation of Pakistan (SLIC) is a major life insurance company that offers various individual and group life insurance plans to citizens. Its products include whole life assurance plans and savings-oriented plans like Sadabahar that provide lump sums at different stages.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

41 views6 pagesInsurance Defintions

Insurance Defintions

Uploaded by

AbbasLiaqatQureshiInsurance is defined as a contract between two parties where one party agrees to take on the risk of another in exchange for regular payments called premiums. There are two main types of insurance: life insurance and general insurance. Life insurance provides a monetary benefit to the insured's beneficiaries if they die, while general insurance covers various risks like health issues, vehicle accidents, home damage, and more. State Life Insurance Corporation of Pakistan (SLIC) is a major life insurance company that offers various individual and group life insurance plans to citizens. Its products include whole life assurance plans and savings-oriented plans like Sadabahar that provide lump sums at different stages.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

INSURANCE DEFINTIONS:

Financial protection against loss or harm

"Insurance is a contract between two parties whereby one

party called insurer Undertakesin exchange for a fixed sum

called premiums, to pay the other party called insured a

fixedamount of money on the happening of a certain

event."According to the U.S. Life Office

Management Association Inc. (LOMA), life insurance

is defined as follows: Life insurance provides a

some of money if the person who is

insured dies whilst the policy is in effect.Insurance is a

contract between two parties whereby one par

ty agrees to undertake therisk of another in exchange for

consideration known as premium and promises to pay afixed

sum of money to the other party on happening of an uncertain

event (death) or afterthe expiry of a certain period in case of

life insurance or to indemnify the other party onhappening of

an uncertain event in case of general insurance. The party

bearing the risk isknown as the ' insurer' or ' assurer' and

the party whose risk is covered is known as the

' insured' or ' assured'

TYPES OF INSURANCE

There are two main types of insurance which are as follows. 1)

Life insurance2) General insurance

Life Insurance:

Life insurance provides a monetary benefit to a decedents family or

other designated

beneficiary, and may specifically provide for income to an

insured person' s family, burial,funeral and other final

expenses. Life insurance policies often allow the option of

havingthe proceeds paid to the beneficiary either in a lump

sum cash payment or an annuity.Annuities provide a stream of

payments and are generally classified as insurance becausethey

are issued by insurance companies and regulated as

insurance and require the samekinds of actuarial and

investment management expertise that life insurance

requires.Annuities and pensions that pay a benefit for life are

sometimes regarded as insuranceagainst the possibility that a

retiree will outlive his or her financial resources. In that sense,

they are the complement of life insurance and, from an underwriting

perspective,are the mirror image of life insurance.Certain life

insurance contracts accumulate cash values, which may be

taken by theinsured if the policy is surrendered or which may

be borrowed against. Some policies,such as annuities and

endowment policies, are financial instruments to accumulate

orliquidate wealth when it is needed

General insurance:

General insurance is basically an insurance policy that

protects you against losses anddamages other than those

covered by life insurance. For more comprehensive coverage,

itis vital for you to know about the risks covered to ensure

that you and your family areprotected from unforeseen

losses.General insurance include following types of insurance.

Vehicle insurance

Health insurance

Home insurance

Property insurance

Liability insurance

Credit insurance

Marine insurance

Aviation insurance

Travel insurance

Professional indemnity

OBJECTIVES

To run life insurance business on sound line.

To run life insurance business on sound line.

To provide more efficient service to the policyholders.

To maximize the return to the policyholders by

economizing on expenses andincreasing the yield on

investment.

To make life insurance a more effective means

of mobilizing national savings.

To widen the area of operat ion of life insurance

and making it available to as largea section of the

population as possible, extending it from the

comparatively moreaffluent sections of society to the

common man in towns and villages.

To use the policyholders fund in the wider interest of the

Community

ORGANIZATIONAL STRUCTURE

It is headed by chairman who is a CHIEF EXECUTIVE of the

corporation and appointedby the government the other

administrative level and authorities is given below

Board of directors:

It comprises of 7 members who are responsible for making

plans and policies to achievethe set goals of the organization.

Executive Directors:

It comprises of 4 members responsible for implementation of

policies and directivesof the board of directors.

Regions:

There are 4 regions in Pakistan headed by regional chiefs

responsible for looking afterall the zones under

his administration.

Zones: There are 26 zones in Pakistan headed by the zonal head

responsible for procurementof business to achieve the

set business target of the organization.The basic structure of

the Corporation consists of Four Regional Offices, Twenty-

SixZonal Offices, a few Sub-Zonal Offices, 111 Sector

Offices, and a network of 461 AreaOffices across the country

for Individual Life Insurance; Four Zonal Offices and 6

SectorOffices with 20 Sector Heads for Group & Pension are

involved in the Marketing of LifeInsurance.

Plans policies and products offered by State Life and a Principal Office.

The ZonalOffices deal exclusively with Sales and Marketing.

Underwriting of Life Insurance

Policies and the Policyholders Services. Regional Office

s, each headed by a RegionalChief, supervise business activities of

the Zones functioning under them. The PrincipalOffice, based

at Karachi, is responsible for corporate activities such as

investment, realestate, actuarial, overseas operations, etc

PRODUCTS

As we know that SLIC has dominated life insurance market and it

acquires about90%market share of life insurance. So it has

introduced a great number of products and itis offering

products appropriate for every inhabitant of PakistanLets have a

glance on products of SLIC which have take over market and are so

presumed

INDIVIDUAL LIFE PLANS:

SLIC is offering a wide range of products for every clas s

of persons which are as follows

WHOLE LIFE ASSURANCE:

It is a matchless arrangement of protection and savings at

a very reasonable premium.Death at any time before age 85

years come to an end payment of premiums and the suminsured

and attachedbonusesbecome payable. In the event the insured

survives to thepolicy anniversary at age 85 years, the

policy matures and the sum insured plus bonusesbecome

payable. Under this plan the rates of bonuses are usually much

higher than theother plans and they help in increasing not only

protection but also the investment elementof the policy

substantially. This plan is best suited for youngsters who

have at initialstages of their careers and cannot afford to pay high

premiums. Individuals who anticipaterequirement of a lump sum in

far future can also choose this plan

SADABAHAR PLAN:Features:

Sadabahar is an anticipated endowment type of plan and it is

with-profit plan that provideslump sum benefit at certain

stages during the premium-paying term or these all benefitsare

paid in earlier death. In addition, this plan has included Accidental Death

Benefit(ADB) rider so that the policyholder gets an additional

sum assured in case of death due toan accident.This plan is a

safe instrument for cash provision at the time of need. With

this plan, thepolicyholder can secure greater protection and

sustain prosperity for the family at anreasonable

cost.Admissible Ages and Terms this plan is available t o

all members of the general public,aged from 20 to 60 years

nearest birthday. Both males and females may purchase

thisplan. Terms offered under this plan are 12, 15, 18, 21, 24,

27 and 30 years.

Survival Benefits:

On completion of one third of the policy term, 20% of basic

sum assured can be taken bythe policyholder. Another 20% of

the sum assured can be taken on completion of two-third of the

policy term and the remaining 60% of basic sum assured plus

accrued bonuses(if any) shall be payable at the end of

the policy term in the event of survival of theassured.If the

option to withdraw an installment of 20% sum assured is not

exercised on the due orwithin 6 months after the due date, a

special bonus will automatically be added to thepolicy at the

end of 6 months. In this event on death of the assured while

the policy is in

force, the special bonus will be payable in addition to Basic Sum

Assured ,Other Bonusesaccrued on the policy and the amount

of any installment left with State Life.On the maturity date,

the special bonus will be payable together with all the

installmentsof the sum assured remaining with State Life, in

addition to regular reversionary bonusesaccrued on the

policy.So long as the policy remains in force, the policyholder

may surrender the unclaimedinstallment of sum assured

together with the related special bonus.

Death Benefits

The full basic sum insured plus accrued bonuses are payable

on death of insured any timewhile the policy is in force. In

addition, if death occurs as a result of an accident,additional

amount equal to one basic sum assured, subject to maximum

limit, will be paid. The usual maximum on the ADB of Rs. 4 million

will apply and premium will becalculated accordingly

Bonuses

This policy will participate in State Li

fes surplus. Rates of bonus applicable will be 25%

higher than those on anticipated endowment plan

.

You might also like

- Dixie General StoreDocument6 pagesDixie General StoreJoneceNo ratings yet

- Home Page: Online Telephone Directory BSNLDocument3 pagesHome Page: Online Telephone Directory BSNLkamini25% (4)

- Life Insurance Kotak Mahindra Group Old MutualDocument16 pagesLife Insurance Kotak Mahindra Group Old MutualKanchan khedaskerNo ratings yet

- INSURANCE Asss PrachiDocument3 pagesINSURANCE Asss Prachivbs522No ratings yet

- Basic Information About LIC PoliciesDocument6 pagesBasic Information About LIC PoliciesskumarshopperNo ratings yet

- Whole Life InsuranceDocument16 pagesWhole Life Insuranceemilda_samuel211No ratings yet

- My ProjectDocument94 pagesMy ProjectSunil RawatNo ratings yet

- Insurance Products: Debi DattaDocument25 pagesInsurance Products: Debi Dattamav7788No ratings yet

- Company Profile BirlaDocument31 pagesCompany Profile BirlaShivayu VaidNo ratings yet

- A Interim Report 1Document28 pagesA Interim Report 1Mayank MahajanNo ratings yet

- Unit - 3 Bilp Types of Life Insurance - Features - ConditionsDocument9 pagesUnit - 3 Bilp Types of Life Insurance - Features - ConditionsYashika GuptaNo ratings yet

- Project On Insurence MajorDocument81 pagesProject On Insurence MajordarshansinghwaraichNo ratings yet

- Introduction On Insurance Fund ManagementDocument9 pagesIntroduction On Insurance Fund Managementsawariya786No ratings yet

- Meaning of InsuranceDocument7 pagesMeaning of InsuranceSannidhi MukeshNo ratings yet

- InsuranceDocument7 pagesInsuranceAustin MathiasNo ratings yet

- Types of InsuranceDocument2 pagesTypes of InsuranceS GaneshNo ratings yet

- Table & ContentDocument43 pagesTable & Contentsweety coolNo ratings yet

- Internship Report FinalDocument40 pagesInternship Report FinalNeha GaiNo ratings yet

- Presentation: State Life Insurance Corporation of PakistanDocument16 pagesPresentation: State Life Insurance Corporation of PakistanAlee HulioNo ratings yet

- Executive SummaryDocument25 pagesExecutive SummaryRitika MahenNo ratings yet

- Project - Report HDFCDocument73 pagesProject - Report HDFCBaltej singhNo ratings yet

- INSURANCE LAW - ImpromptuDocument7 pagesINSURANCE LAW - ImpromptuDiya MirajNo ratings yet

- 3-Financial Services - Non Banking Products-Part 2Document47 pages3-Financial Services - Non Banking Products-Part 2Kirti GiyamalaniNo ratings yet

- Whole Life InsuranceDocument14 pagesWhole Life InsuranceSushma DudyallaNo ratings yet

- Insurance ....Document8 pagesInsurance ....SanyaNo ratings yet

- Life Insurance ContentDocument60 pagesLife Insurance ContentpiudiNo ratings yet

- 04 Insurance CompanyDocument38 pages04 Insurance CompanyAnuska JayswalNo ratings yet

- Mission and VissionDocument11 pagesMission and VissionPradeep Kumar V PradiNo ratings yet

- Importance of Life and General InsuranceDocument22 pagesImportance of Life and General InsuranceBhavik JainNo ratings yet

- Introduction of Bank: BanksDocument45 pagesIntroduction of Bank: BanksKunal NagNo ratings yet

- Life Insuranc (Sem - LLL)Document20 pagesLife Insuranc (Sem - LLL)Milton Rosario MoraesNo ratings yet

- NavdeepDocument18 pagesNavdeepSnehal LadeNo ratings yet

- Need For Life InsuranceDocument9 pagesNeed For Life InsuranceDeepak NayakNo ratings yet

- Potential of Life Insurance Industry in Sarita Vihar MarketDocument7 pagesPotential of Life Insurance Industry in Sarita Vihar MarketAjeet KumarNo ratings yet

- InsuranceDocument2 pagesInsurancefahim_ibaNo ratings yet

- Project Report ON: University of MumbaiDocument55 pagesProject Report ON: University of MumbaiNayak SandeshNo ratings yet

- Presentation On InsuranceDocument40 pagesPresentation On InsurancedevvratNo ratings yet

- Insurance ServiceDocument31 pagesInsurance Servicepjsv12345No ratings yet

- Stages in Policy IssuanceDocument9 pagesStages in Policy IssuanceNeha AmitNo ratings yet

- Macquarie FutureWiseDocument80 pagesMacquarie FutureWiseLife Insurance AustraliaNo ratings yet

- Need Based Investme NT Solution: Six Weeks Industry TrainingDocument32 pagesNeed Based Investme NT Solution: Six Weeks Industry Trainingshettyaakash66No ratings yet

- What Is Life InsuranceDocument5 pagesWhat Is Life InsuranceTeja AndeNo ratings yet

- Elements of Good Life Insurance PolicyDocument4 pagesElements of Good Life Insurance PolicySaumya JaiswalNo ratings yet

- Fabozzi FoFMI4 CH06Document15 pagesFabozzi FoFMI4 CH06Jion DiazNo ratings yet

- Functions of InsuranceDocument26 pagesFunctions of InsurancenikschopraNo ratings yet

- Insurance Promotion - IIDocument12 pagesInsurance Promotion - IIAditi JainNo ratings yet

- 1 Types of Life Insurance Plans & ULIPSDocument40 pages1 Types of Life Insurance Plans & ULIPSJaswanth Singh RajpurohitNo ratings yet

- Share ICICI PrudentialsDocument63 pagesShare ICICI PrudentialsMadhushreeNo ratings yet

- Insurance AssignmentDocument15 pagesInsurance AssignmentRashdullah Shah 133No ratings yet

- Origin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The StudyDocument32 pagesOrigin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The Studypav_deshpande8055No ratings yet

- Q1. What Is InsuranceDocument5 pagesQ1. What Is InsuranceDebasis NayakNo ratings yet

- Life InsuranceDocument5 pagesLife InsuranceAditya SharmaNo ratings yet

- Insurance Fm2accDocument4 pagesInsurance Fm2accyabaneifflemaurNo ratings yet

- Introduction To Insurance IndustriesDocument37 pagesIntroduction To Insurance IndustriesNishaTambeNo ratings yet

- Islamic InsuranceDocument22 pagesIslamic InsuranceAbdifatah AbdilahiNo ratings yet

- Chapter - I Introduction and Literature ReviewDocument54 pagesChapter - I Introduction and Literature Reviewabhishek nairNo ratings yet

- Handbook On Life InsuranceDocument17 pagesHandbook On Life InsuranceDeeptiNo ratings yet

- Insurance: Institute of Productivity & ManagementDocument39 pagesInsurance: Institute of Productivity & ManagementishanchughNo ratings yet

- Ibis Unit 03Document28 pagesIbis Unit 03bhagyashripande321No ratings yet

- Product & ServiceDocument11 pagesProduct & ServicefarrukhNo ratings yet

- Hum ADocument119 pagesHum Ajyoti8mishra100% (2)

- History of ORIX Leasing Pakistan LimitedDocument10 pagesHistory of ORIX Leasing Pakistan LimitedAbbasLiaqatQureshiNo ratings yet

- Muhammad Abbas Liaqat: Street #11, House #26, Block T, New Multan, Pakistan - Cell: 03036544590Document1 pageMuhammad Abbas Liaqat: Street #11, House #26, Block T, New Multan, Pakistan - Cell: 03036544590AbbasLiaqatQureshiNo ratings yet

- Report of Meezan BankDocument15 pagesReport of Meezan BankAbbasLiaqatQureshiNo ratings yet

- Foundation of Individual Behaviour: by Joylyn SilveiraDocument25 pagesFoundation of Individual Behaviour: by Joylyn SilveiraAbbasLiaqatQureshiNo ratings yet

- Qasim & Copretion Statement of CGS For The Period 2009Document1 pageQasim & Copretion Statement of CGS For The Period 2009AbbasLiaqatQureshiNo ratings yet

- Batch 2010-12: Literature of BATADocument18 pagesBatch 2010-12: Literature of BATAAbbasLiaqatQureshiNo ratings yet

- Bahasa Inggris Ganjil Kelas X ABCDocument12 pagesBahasa Inggris Ganjil Kelas X ABCNazwarNo ratings yet

- Keerthi Question BankDocument65 pagesKeerthi Question BankKeerthanaNo ratings yet

- Essence: By: Bisma Kalsoom and Adeen MumtaazDocument8 pagesEssence: By: Bisma Kalsoom and Adeen MumtaazBisma KalsoomNo ratings yet

- Business Law ModuleDocument177 pagesBusiness Law ModulePatricia Jiti100% (1)

- Open The Book-Bible Quiz ChildrenDocument4 pagesOpen The Book-Bible Quiz ChildrenradhikaNo ratings yet

- Definition of Science FictionDocument21 pagesDefinition of Science FictionIrene ShatekNo ratings yet

- Province Tourist Destinations Festivals: REGION XI - Davao RegionDocument13 pagesProvince Tourist Destinations Festivals: REGION XI - Davao Regionaaron manaogNo ratings yet

- Mga Bilang 1-100 Tagalog With Symbol and PronunciationDocument2 pagesMga Bilang 1-100 Tagalog With Symbol and PronunciationJanice Tañedo PancipaneNo ratings yet

- Assignment 2 MGT501Document1 pageAssignment 2 MGT501Aamir ShahzadNo ratings yet

- EA and HalachaDocument63 pagesEA and HalachaAvraham EisenbergNo ratings yet

- Turbo-Couplings-Fluid Couplings-with-Constant-Fill - Operating-ManualDocument108 pagesTurbo-Couplings-Fluid Couplings-with-Constant-Fill - Operating-ManualCarollina AzevedoNo ratings yet

- Kemapoxy 150Document2 pagesKemapoxy 150Mosaad KeshkNo ratings yet

- Advisory Board By-LawsDocument3 pagesAdvisory Board By-LawsViola GilbertNo ratings yet

- SG20KTL Data SheetDocument2 pagesSG20KTL Data SheetPaulo Cesar M CostaNo ratings yet

- Micro Mythos - лайт версияDocument2 pagesMicro Mythos - лайт версияKate KozhevnikovaNo ratings yet

- Microbes in Ferment@3Document13 pagesMicrobes in Ferment@3T Vinit ReddyNo ratings yet

- Nursing Care Plan: HyperbilirubinemiaDocument5 pagesNursing Care Plan: HyperbilirubinemiaJanelle Gift SenarloNo ratings yet

- Doctype HTMLDocument30 pagesDoctype HTMLAndreiNo ratings yet

- DPP - (19) 13th IOC - (E) - WADocument1 pageDPP - (19) 13th IOC - (E) - WAassadfNo ratings yet

- UCD Otolayrngology GuideDocument95 pagesUCD Otolayrngology GuideJames EllisNo ratings yet

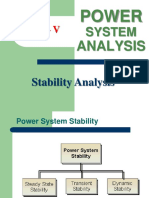

- Unit - V: PowerDocument32 pagesUnit - V: PowerVaira PerumalNo ratings yet

- 14.0 - ELC501 Forum Discussion GuidelinesDocument34 pages14.0 - ELC501 Forum Discussion GuidelinesiraNo ratings yet

- Chikmagalur RtiDocument10 pagesChikmagalur RtiSK Business groupNo ratings yet

- Daily Report DPT & Urugan Tanah BMM - 20 Juni 2023Document1 pageDaily Report DPT & Urugan Tanah BMM - 20 Juni 2023Rumah DesainNo ratings yet

- Writing Is A Great For Money OnlineDocument6 pagesWriting Is A Great For Money OnlineRisna SaidNo ratings yet

- Political Science P2 – Past Papers Analysis (CSS 2016-2020)Document4 pagesPolitical Science P2 – Past Papers Analysis (CSS 2016-2020)Afnan TariqNo ratings yet

- How Payal Kadakia Danced Her Way To A $600 Million Start-Up - The New York TimesDocument4 pagesHow Payal Kadakia Danced Her Way To A $600 Million Start-Up - The New York TimesRadhika SwaroopNo ratings yet

- Bali Tour Package 7 Days 6 Nights ItineraryDocument4 pagesBali Tour Package 7 Days 6 Nights ItineraryHartadi WijayaNo ratings yet