Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

103 viewsGlutenfree Market Positioning

Glutenfree Market Positioning

Uploaded by

samdhathriThe document summarizes a Mintel report finding that the growth of the gluten-free market is being driven more by consumers who view gluten-free foods as healthier or for weight loss rather than those with celiac disease. A survey found 65% of consumers avoiding gluten thought gluten-free foods were healthier while 27% thought they aided weight loss, despite no scientific evidence. Manufacturers are marketing gluten-free foods as natural and healthy to appeal to these consumers. Mintel predicts the US gluten-free market will grow 48% by 2016 to $15.6 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Grade 9 TLE 2nd Quarter DLLDocument4 pagesGrade 9 TLE 2nd Quarter DLLcantilan surigao94% (18)

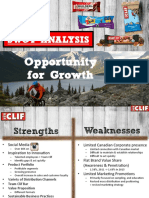

- Clif Bar Swot Analysis CanadaDocument3 pagesClif Bar Swot Analysis CanadaGregory James McNamaraNo ratings yet

- MT Chains Evolution - AUG'22Document16 pagesMT Chains Evolution - AUG'22Xuan Loc Mai100% (1)

- Bachour Antonio Recipes For The Professional ChefDocument138 pagesBachour Antonio Recipes For The Professional ChefSa Sugar100% (12)

- Competitor Analysis - Arla FoodsDocument94 pagesCompetitor Analysis - Arla FoodsRamsha Sheikh100% (1)

- Blue Apron Turning Around Struggling Meal Kit Market Leader Delivery - PDFDocument18 pagesBlue Apron Turning Around Struggling Meal Kit Market Leader Delivery - PDFShreyash Prasad100% (1)

- Petrozuata Financial ModelDocument3 pagesPetrozuata Financial Modelsamdhathri33% (3)

- Narvar - ConsumerStudy2019 - State OfOnlineReturns - 2019Document37 pagesNarvar - ConsumerStudy2019 - State OfOnlineReturns - 2019João Tiago Martins GirãoNo ratings yet

- B2B Market Attractiveness Evaluation How To Size Opportunities and Reduce RiskDocument21 pagesB2B Market Attractiveness Evaluation How To Size Opportunities and Reduce RiskpsyxicatNo ratings yet

- Assessment Whole Foods MarketDocument20 pagesAssessment Whole Foods MarketGerry HickmanNo ratings yet

- Recent Advances in The Formulation of Gluten-FreeDocument10 pagesRecent Advances in The Formulation of Gluten-FreeBeni HidayatNo ratings yet

- MealpalDocument14 pagesMealpalapi-464492750No ratings yet

- Blue Apron Final PresentationDocument28 pagesBlue Apron Final Presentationapi-344187823No ratings yet

- Communauto Case AnalysisDocument3 pagesCommunauto Case AnalysisGarry100% (1)

- Whole Foods Market Inc. SWOT AnalysisDocument9 pagesWhole Foods Market Inc. SWOT AnalysisAlbertWhatmough100% (1)

- BETR Amplify Brands Investor Presentation June 2017Document42 pagesBETR Amplify Brands Investor Presentation June 2017Ala BasterNo ratings yet

- Accenture Has A Relatively Flat Organizational StructureDocument1 pageAccenture Has A Relatively Flat Organizational StructuresamdhathriNo ratings yet

- AREC 323 Assignment 1.Document25 pagesAREC 323 Assignment 1.Ava MedNo ratings yet

- Lecture 11 - Price-Setting in B2B MarketsDocument36 pagesLecture 11 - Price-Setting in B2B MarketsMihaela Popazova100% (1)

- Bending The Cost Curve in Brick-And-Mortar RetailDocument6 pagesBending The Cost Curve in Brick-And-Mortar Retailavinish007No ratings yet

- Baked Goods in CanadaDocument12 pagesBaked Goods in CanadaInder MohanNo ratings yet

- Competitive Analysis Tool: InstructionsDocument12 pagesCompetitive Analysis Tool: InstructionsMongGiNo ratings yet

- AnnataDocument2 pagesAnnataDidi RKNo ratings yet

- The Warehouse Group Takeover Noel Leeming Group Critically AnalyseDocument21 pagesThe Warehouse Group Takeover Noel Leeming Group Critically AnalyseJatinder Sidhu50% (2)

- Service KPIs Formulas 2012Document17 pagesService KPIs Formulas 2012enjoythedocsNo ratings yet

- Planning For A New ProductDocument13 pagesPlanning For A New ProductEva Maria AlhambraNo ratings yet

- Innovation in Bakery and Cereals 2010Document124 pagesInnovation in Bakery and Cereals 2010reea_newNo ratings yet

- Kellogs Case StudyDocument22 pagesKellogs Case StudyAshish Kumar Banka100% (2)

- Dissertation For Organic Food IBNDocument79 pagesDissertation For Organic Food IBNHelloprojectNo ratings yet

- Plated FinalpaperDocument36 pagesPlated Finalpaperapi-300760395No ratings yet

- Whole FoodDocument9 pagesWhole FoodJahanzeb Hussain Qureshi100% (1)

- Nguyen Trang Nhung (k16 - HL) - Essay Test QuestionDocument4 pagesNguyen Trang Nhung (k16 - HL) - Essay Test QuestionNguyen Trang Nhung (K16HL)No ratings yet

- HistoryDocument24 pagesHistoryXainee ChNo ratings yet

- Value Chain Vs Supply ChainDocument2 pagesValue Chain Vs Supply ChainAnooshaNo ratings yet

- Towards Value-Based PricingDocument6 pagesTowards Value-Based Pricingfrancesco_rampiniNo ratings yet

- Kelloggs Balancing The Marketing Mix Through Creative and Innovative StrategiesDocument4 pagesKelloggs Balancing The Marketing Mix Through Creative and Innovative StrategiesAsra GulzarNo ratings yet

- Industry Life Cycle-Plant Based CaseDocument3 pagesIndustry Life Cycle-Plant Based CaseRachelle BrownNo ratings yet

- Market Segmentation and PositionDocument23 pagesMarket Segmentation and PositionsalmankhatriNo ratings yet

- GMA Shopper Marketing 3Document36 pagesGMA Shopper Marketing 3TT LNo ratings yet

- An Assignment On: The Marketing Plan of "Pure Honey"Document19 pagesAn Assignment On: The Marketing Plan of "Pure Honey"wasab negiNo ratings yet

- L.E.K. 4 Steps To Optimizing Trade Promotion EffectivenessDocument5 pagesL.E.K. 4 Steps To Optimizing Trade Promotion EffectivenessAditi JaitlyNo ratings yet

- Kano ModelDocument9 pagesKano ModelNikola SvorcanNo ratings yet

- DTL EWeek2017c08 Euromonitor enDocument31 pagesDTL EWeek2017c08 Euromonitor enVidhiNo ratings yet

- Trader Joe AnalysisDocument6 pagesTrader Joe Analysisapi-543422438No ratings yet

- COVID-19's Immediate and Long-Term Impact On The CPG Industry (IRI 2020) PDFDocument26 pagesCOVID-19's Immediate and Long-Term Impact On The CPG Industry (IRI 2020) PDFomsisdNo ratings yet

- Values and Perceptions of Graduate SchoolsDocument21 pagesValues and Perceptions of Graduate SchoolsKevin TameNo ratings yet

- Pros and Cons of Sampling An Effective Consumer Sales Promotion ToolDocument3 pagesPros and Cons of Sampling An Effective Consumer Sales Promotion ToolarcherselevatorsNo ratings yet

- Europe Caseins PDFDocument7 pagesEurope Caseins PDFallen BondNo ratings yet

- Soup Market Research 1996Document187 pagesSoup Market Research 1996fredmanntraNo ratings yet

- LifebuoyDocument10 pagesLifebuoyPradeep BandiNo ratings yet

- Managing The New Product Development Pro PDFDocument16 pagesManaging The New Product Development Pro PDFkashemNo ratings yet

- Marketing Plan For Nestle Kit KatDocument10 pagesMarketing Plan For Nestle Kit KatKevin kyle CadavisNo ratings yet

- Consumer Types FranceDocument52 pagesConsumer Types FranceAna Gs100% (3)

- Starbuck NewDocument72 pagesStarbuck NewTania UlricaNo ratings yet

- Category ManagementDocument9 pagesCategory ManagementMadhu Mahesh RajNo ratings yet

- Marketing MathDocument22 pagesMarketing MathMarketinggNo ratings yet

- Situation Analysis - 5CDocument2 pagesSituation Analysis - 5CDayalan Avinakshi SankaranNo ratings yet

- Zespri CaseDocument2 pagesZespri CasePiyush Agarwal33% (3)

- Final Imc Campaign Group 8 PDFDocument23 pagesFinal Imc Campaign Group 8 PDFapi-275931099No ratings yet

- Healthy Snacks For KidsDocument2 pagesHealthy Snacks For KidsVegan FutureNo ratings yet

- Flexin Marketing ReportDocument53 pagesFlexin Marketing ReportsayrafazalNo ratings yet

- Quinoa Cookbook: Over 50 Recipes of Healthy Gluten-Free Recipes to Lose Weight: Weight Loss CookingFrom EverandQuinoa Cookbook: Over 50 Recipes of Healthy Gluten-Free Recipes to Lose Weight: Weight Loss CookingNo ratings yet

- Leading Corporate Turnaround: How Leaders Fix Troubled CompaniesFrom EverandLeading Corporate Turnaround: How Leaders Fix Troubled CompaniesNo ratings yet

- Growth Strategy Process Flow A Complete Guide - 2020 EditionFrom EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionNo ratings yet

- Hospital Management SystemDocument44 pagesHospital Management SystemsamdhathriNo ratings yet

- Hospital Management System DatabaseDocument18 pagesHospital Management System DatabasesamdhathriNo ratings yet

- Contract Staffing in IndiaDocument8 pagesContract Staffing in IndiasamdhathriNo ratings yet

- Hospital Management System: Presented by GroupDocument29 pagesHospital Management System: Presented by GroupsamdhathriNo ratings yet

- Dissertation TopicDocument19 pagesDissertation TopicsamdhathriNo ratings yet

- MCS Assignment 2: D. Srirama Samdhathri 2013PGPUAE012Document6 pagesMCS Assignment 2: D. Srirama Samdhathri 2013PGPUAE012samdhathriNo ratings yet

- Urinary Tract Infections PowerpointDocument22 pagesUrinary Tract Infections Powerpointsamdhathri100% (1)

- Ez Case StudyDocument9 pagesEz Case StudysamdhathriNo ratings yet

- Collections PaperDocument28 pagesCollections PapersamdhathriNo ratings yet

- Success Story Corporation BankDocument4 pagesSuccess Story Corporation BanksamdhathriNo ratings yet

- Swot Analysis Indian Banking: From The Selectedworks of Yogendra SisodiaDocument6 pagesSwot Analysis Indian Banking: From The Selectedworks of Yogendra SisodiasamdhathriNo ratings yet

- SWOT Analysis of Banking Sector in India: Strengths WeaknessDocument5 pagesSWOT Analysis of Banking Sector in India: Strengths WeaknesssamdhathriNo ratings yet

- CitibankDocument38 pagesCitibankmasandvishalNo ratings yet

- Updated WAC Assignment-WeGoogledYou 2013PGPUAE012Document7 pagesUpdated WAC Assignment-WeGoogledYou 2013PGPUAE012samdhathriNo ratings yet

- Look Ahead 2014 Industry BrochureDocument32 pagesLook Ahead 2014 Industry BrochuresamdhathriNo ratings yet

- WAC - We Googled YouDocument7 pagesWAC - We Googled Yousamdhathri100% (1)

- Core Competencies 2Document79 pagesCore Competencies 2Mariam Salonga100% (1)

- Chocolate From Cocoa - PPT 5.15Document21 pagesChocolate From Cocoa - PPT 5.15Sandhya ArulNo ratings yet

- Telling A Stellar Story: Published by BS CentralDocument6 pagesTelling A Stellar Story: Published by BS CentralBS Central, Inc. "The Buzz"No ratings yet

- AGK B MintafeladatDocument5 pagesAGK B MintafeladatPetra LovászNo ratings yet

- Formulation of Linear Programming Model - UpdatedDocument13 pagesFormulation of Linear Programming Model - UpdatedArslan HamidNo ratings yet

- Pepsi Blue: By: John DehmardanDocument37 pagesPepsi Blue: By: John DehmardanLuis Ma CrzNo ratings yet

- Compilation of Literary Pieces in Phil LitDocument92 pagesCompilation of Literary Pieces in Phil LitPierrene PineroNo ratings yet

- Harvestmoon Sunshine IslandDocument10 pagesHarvestmoon Sunshine IslandFlorencia Irena SuhandiNo ratings yet

- After Dinner Tricks GibsonDocument31 pagesAfter Dinner Tricks GibsonHatfulloftricks700100% (2)

- Pastry Rolls Filled With Almond + Cardamom From Cooking in Iran - Regional Recipes and Kitchen Secrets by Najmieh BatmanglijDocument4 pagesPastry Rolls Filled With Almond + Cardamom From Cooking in Iran - Regional Recipes and Kitchen Secrets by Najmieh BatmanglijrameshnaiduNo ratings yet

- Love, Dating & ReationshipsDocument8 pagesLove, Dating & ReationshipsRishita KayasthNo ratings yet

- Read About The 5 Best Restaurants in The World and Answer The QuestionsDocument3 pagesRead About The 5 Best Restaurants in The World and Answer The Questionssamuel samNo ratings yet

- Exercises SOME - ANY - NOTHINGDocument1 pageExercises SOME - ANY - NOTHINGDanielle SoaresNo ratings yet

- Tinker Tailor Soldier Spy Script PDFDocument128 pagesTinker Tailor Soldier Spy Script PDFAyu Gayatri100% (1)

- A Concept Note On Water Quality Test ProjectDocument3 pagesA Concept Note On Water Quality Test ProjectPadam Prasad Paudel100% (5)

- BC Business 2Document3 pagesBC Business 2SantiNo ratings yet

- Colorimetric TestDocument10 pagesColorimetric TestsamcbsivNo ratings yet

- 6001.alcohol Induced DementiaDocument4 pages6001.alcohol Induced Dementiajuan_bacha_1No ratings yet

- 5 - APV Membrane ProcessingDocument81 pages5 - APV Membrane ProcessingAlexandra ChavezNo ratings yet

- RRL and RSDocument22 pagesRRL and RSJalen Nano100% (1)

- Factors Affecting Food ChoicesDocument24 pagesFactors Affecting Food Choicesspartanstar100% (1)

- OB Project Group 4 Section DDocument27 pagesOB Project Group 4 Section DJayantwin KatiaNo ratings yet

- Sports DrinksDocument2 pagesSports DrinksWeronika PNo ratings yet

- Uncountable and C Level 2Document10 pagesUncountable and C Level 2Lou EmmaNo ratings yet

- (Chọn đáp án đúng nhất A, B, hoặc C để hoàn thành câu) : I. Choose the best answer A, B, or C to complete the sentencesDocument4 pages(Chọn đáp án đúng nhất A, B, hoặc C để hoàn thành câu) : I. Choose the best answer A, B, or C to complete the sentencesDuy PhướcNo ratings yet

- 02 Doctrine of SignaturesDocument161 pages02 Doctrine of SignaturesVázsonyi Júlia100% (2)

- Study Guide 1Document9 pagesStudy Guide 1api-367990381No ratings yet

- Lesson 2: Preparing and Portioning MeatDocument46 pagesLesson 2: Preparing and Portioning Meatunknown PersonNo ratings yet

Glutenfree Market Positioning

Glutenfree Market Positioning

Uploaded by

samdhathri0 ratings0% found this document useful (0 votes)

103 views3 pagesThe document summarizes a Mintel report finding that the growth of the gluten-free market is being driven more by consumers who view gluten-free foods as healthier or for weight loss rather than those with celiac disease. A survey found 65% of consumers avoiding gluten thought gluten-free foods were healthier while 27% thought they aided weight loss, despite no scientific evidence. Manufacturers are marketing gluten-free foods as natural and healthy to appeal to these consumers. Mintel predicts the US gluten-free market will grow 48% by 2016 to $15.6 billion.

Original Description:

Market positioning

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes a Mintel report finding that the growth of the gluten-free market is being driven more by consumers who view gluten-free foods as healthier or for weight loss rather than those with celiac disease. A survey found 65% of consumers avoiding gluten thought gluten-free foods were healthier while 27% thought they aided weight loss, despite no scientific evidence. Manufacturers are marketing gluten-free foods as natural and healthy to appeal to these consumers. Mintel predicts the US gluten-free market will grow 48% by 2016 to $15.6 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

103 views3 pagesGlutenfree Market Positioning

Glutenfree Market Positioning

Uploaded by

samdhathriThe document summarizes a Mintel report finding that the growth of the gluten-free market is being driven more by consumers who view gluten-free foods as healthier or for weight loss rather than those with celiac disease. A survey found 65% of consumers avoiding gluten thought gluten-free foods were healthier while 27% thought they aided weight loss, despite no scientific evidence. Manufacturers are marketing gluten-free foods as natural and healthy to appeal to these consumers. Mintel predicts the US gluten-free market will grow 48% by 2016 to $15.6 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

A new Mintel report provides further evidence that the gluten-free market is being

propelled by consumers avoiding gluten for perceived health benets or as a weight

management strategy rather than those with celiac disease or gluten sensitivity.

Mintel: 'The view that these foods and beverages are healthier than their gluten-containing

counterparts is a major driver for the market'

According to a June 2013 survey of 2,000 adults commissioned by Mintel, 247 people said

they ate gluten-free foods for reasons other than celiac disease or gluten intolerance.

Of these, 65% said they did so because they thought gluten-free foods were healthier,

while 27% did so because they felt gluten-free foods assisted weight loss efforts.

Manufacturers are increasingly appealing to consumers who see gluten-free as just part of

a broader set of claims associated with natural or healthier foods

The positioning of gluten-free products as having multiple health benets is also

contributing to consumer perceptions that gluten-free products are healthier than products

that contain gluten, said Mintel food analyst Amanda Topper.

Meanwhile, the fact that many manufacturers are increasingly appealing to consumers

who see gluten-free as just part of a broader set of claims associated with natural or

healthier foods is increasingly evident from the positioning - and repositioning - of many

brands in the marketplace.

In some respects, this should not come as a surprise, said Topper, given that many gluten-

free products also happen to be all-natural, organic and non-GMO, and many gluten-free

products are also sold in the natural food channel, or natural foods sections of mainstream

retailers, which consumers often associate with healthier products.

Consumers think gluten-free foods are healthier and can help them lose weight

She added: Its really interesting to see that consumers think gluten-free foods are

healthier and can help them lose weight because theres been no research afrming these

beliefs.

The view that these foods and beverages are healthier than their gluten-containing

counterparts is a major driver for the market, as interest expands across both gluten-

sensitive and health-conscious consumers.

Almost a quarter of consumers now eat, or have someone in their household who eats,

gluten-free foods, claimed Topper, adding: Three quarters (75%) of consumers who do

not have celiac disease or sensitivity to gluten eat these foods because they believe they

are healthier, despite the lack of any scientic research conrming the validity of this

theory.

Market predicted to grow 48% in 2013-2016 to reach $15.6bn, predicts Mintel

Mintel predicts that US retail sales of gluten-free foods and beverages are estimated to

reach $10.5bn in 2013.

In 2011-13, the market experienced growth of 44%, says Mintel, which predicts that it will

grow at an even faster rate of 48% from 2013-16, to $15.6bn, at current prices.

Asked what was driving the growth, Topper told FoodNavigator-USA: Bread products,

cookies, and snacks hold the largest market share at 23.9%.

Dairy and dairy alternatives make up the second-largest gluten-free food segment with

$2.2bn in sales in 2013. This segment had the second-highest increase in market share

from 2011-2013, with current market share at 21.3%.

Sales of the gluten-free prepared foods segment reached $689m in sales in 2013,

representing a sales increase of 48.7% from 2011-13.

Gluten-free pizza

She added: In terms of new products or categories in the gluten-free space, many new

pizza launches have been hitting the market. Several manufacturers are experimenting

with adding unique topping combinations to add bursts of avor, as well as different

sources for creating great-tasting pizza doughs.

Because gluten-free consumers want to be able to eat typically gluten-containing foods,

the demand for baking mixes for consumers to make these products in the convenience of

their home has increased.

Betty Crocker has expanded its line of gluten-free mixes to include a sugar cookie mix, as

well as a rice our blend that can be used in baking a variety of items such as cakes and

breads. The brand seeks to appeal to families who want the ease of baking tasty gluten-

free desserts that apply to everyone.

Hartman Group: We thought gluten-free was a passing fad. We were wrong

The Mintel survey data squares with a 2012 survey conducted by Packaged Facts which

says the conviction that gluten-free products are generally healthier is the top motivation

for purchase.

According to Packaged Facts, 35% of consumers that buy gluten-free products say they

do so because they are "generally healthier", 27% "to manage my weight", 21% because

they are "generally low-carb" and 15% because a member of the household has a gluten

or wheat intolerance.

Just 7% of consumers surveyed buy gluten-free products because a household member

has celiac disease.

In a recent video on the Hartbeat Vista multimedia platform, Hartman Group SVP of

business development Shelley Balanko said the gluten-free trend is here to stay:

Admittedly when we rst weighed in, we dismissed gluten-free as a passing fad that was

indicative of an enduring and underlying interest in digestive health.

Well, time has proven that we were wrong and we were right. We were wrong about

gluten-free foods being a passing fancy, but weve been right about consumers enduring

quest for digestive health, as it is deemed foundational to their overall wellness

Technomic: Gluten-free items are now positioned as simply better-for-you choices

According to January 2013 consumer survey by The NPD Group, 30% of American adults

say they are trying to reduce or exclude gluten from their diets.

Meanwhile, a recent analysis of orders from GrubHubs database of 20,000+ restaurants in

more than 500 US cities showed a signicant increase in gluten-free takeout orders, while

Technomic claims there has been an explosion of gluten-free items on menus at limited

service restaurants (LSRs) in the past two years.

In its January 2013 Healthy Eating Consumer Trend Report , Technomic said: Essentially

non-existent as a health claim on mainstream menus just two years ago, there are now

hundreds of LSR menu items described as gluten-free.

Once promoted as a menu alternative to the small segment of the population that suffers

from celiac disease, gluten-free items are now positioned as simply better-for-you choices

that are generally perceived by consumers to be lighter fare.

Click here to read about where Boulder Brands (which owns the Udi's and Glutino gluten-

free brands) thinks the next big opportunities are in the gluten-free market.

You might also like

- Grade 9 TLE 2nd Quarter DLLDocument4 pagesGrade 9 TLE 2nd Quarter DLLcantilan surigao94% (18)

- Clif Bar Swot Analysis CanadaDocument3 pagesClif Bar Swot Analysis CanadaGregory James McNamaraNo ratings yet

- MT Chains Evolution - AUG'22Document16 pagesMT Chains Evolution - AUG'22Xuan Loc Mai100% (1)

- Bachour Antonio Recipes For The Professional ChefDocument138 pagesBachour Antonio Recipes For The Professional ChefSa Sugar100% (12)

- Competitor Analysis - Arla FoodsDocument94 pagesCompetitor Analysis - Arla FoodsRamsha Sheikh100% (1)

- Blue Apron Turning Around Struggling Meal Kit Market Leader Delivery - PDFDocument18 pagesBlue Apron Turning Around Struggling Meal Kit Market Leader Delivery - PDFShreyash Prasad100% (1)

- Petrozuata Financial ModelDocument3 pagesPetrozuata Financial Modelsamdhathri33% (3)

- Narvar - ConsumerStudy2019 - State OfOnlineReturns - 2019Document37 pagesNarvar - ConsumerStudy2019 - State OfOnlineReturns - 2019João Tiago Martins GirãoNo ratings yet

- B2B Market Attractiveness Evaluation How To Size Opportunities and Reduce RiskDocument21 pagesB2B Market Attractiveness Evaluation How To Size Opportunities and Reduce RiskpsyxicatNo ratings yet

- Assessment Whole Foods MarketDocument20 pagesAssessment Whole Foods MarketGerry HickmanNo ratings yet

- Recent Advances in The Formulation of Gluten-FreeDocument10 pagesRecent Advances in The Formulation of Gluten-FreeBeni HidayatNo ratings yet

- MealpalDocument14 pagesMealpalapi-464492750No ratings yet

- Blue Apron Final PresentationDocument28 pagesBlue Apron Final Presentationapi-344187823No ratings yet

- Communauto Case AnalysisDocument3 pagesCommunauto Case AnalysisGarry100% (1)

- Whole Foods Market Inc. SWOT AnalysisDocument9 pagesWhole Foods Market Inc. SWOT AnalysisAlbertWhatmough100% (1)

- BETR Amplify Brands Investor Presentation June 2017Document42 pagesBETR Amplify Brands Investor Presentation June 2017Ala BasterNo ratings yet

- Accenture Has A Relatively Flat Organizational StructureDocument1 pageAccenture Has A Relatively Flat Organizational StructuresamdhathriNo ratings yet

- AREC 323 Assignment 1.Document25 pagesAREC 323 Assignment 1.Ava MedNo ratings yet

- Lecture 11 - Price-Setting in B2B MarketsDocument36 pagesLecture 11 - Price-Setting in B2B MarketsMihaela Popazova100% (1)

- Bending The Cost Curve in Brick-And-Mortar RetailDocument6 pagesBending The Cost Curve in Brick-And-Mortar Retailavinish007No ratings yet

- Baked Goods in CanadaDocument12 pagesBaked Goods in CanadaInder MohanNo ratings yet

- Competitive Analysis Tool: InstructionsDocument12 pagesCompetitive Analysis Tool: InstructionsMongGiNo ratings yet

- AnnataDocument2 pagesAnnataDidi RKNo ratings yet

- The Warehouse Group Takeover Noel Leeming Group Critically AnalyseDocument21 pagesThe Warehouse Group Takeover Noel Leeming Group Critically AnalyseJatinder Sidhu50% (2)

- Service KPIs Formulas 2012Document17 pagesService KPIs Formulas 2012enjoythedocsNo ratings yet

- Planning For A New ProductDocument13 pagesPlanning For A New ProductEva Maria AlhambraNo ratings yet

- Innovation in Bakery and Cereals 2010Document124 pagesInnovation in Bakery and Cereals 2010reea_newNo ratings yet

- Kellogs Case StudyDocument22 pagesKellogs Case StudyAshish Kumar Banka100% (2)

- Dissertation For Organic Food IBNDocument79 pagesDissertation For Organic Food IBNHelloprojectNo ratings yet

- Plated FinalpaperDocument36 pagesPlated Finalpaperapi-300760395No ratings yet

- Whole FoodDocument9 pagesWhole FoodJahanzeb Hussain Qureshi100% (1)

- Nguyen Trang Nhung (k16 - HL) - Essay Test QuestionDocument4 pagesNguyen Trang Nhung (k16 - HL) - Essay Test QuestionNguyen Trang Nhung (K16HL)No ratings yet

- HistoryDocument24 pagesHistoryXainee ChNo ratings yet

- Value Chain Vs Supply ChainDocument2 pagesValue Chain Vs Supply ChainAnooshaNo ratings yet

- Towards Value-Based PricingDocument6 pagesTowards Value-Based Pricingfrancesco_rampiniNo ratings yet

- Kelloggs Balancing The Marketing Mix Through Creative and Innovative StrategiesDocument4 pagesKelloggs Balancing The Marketing Mix Through Creative and Innovative StrategiesAsra GulzarNo ratings yet

- Industry Life Cycle-Plant Based CaseDocument3 pagesIndustry Life Cycle-Plant Based CaseRachelle BrownNo ratings yet

- Market Segmentation and PositionDocument23 pagesMarket Segmentation and PositionsalmankhatriNo ratings yet

- GMA Shopper Marketing 3Document36 pagesGMA Shopper Marketing 3TT LNo ratings yet

- An Assignment On: The Marketing Plan of "Pure Honey"Document19 pagesAn Assignment On: The Marketing Plan of "Pure Honey"wasab negiNo ratings yet

- L.E.K. 4 Steps To Optimizing Trade Promotion EffectivenessDocument5 pagesL.E.K. 4 Steps To Optimizing Trade Promotion EffectivenessAditi JaitlyNo ratings yet

- Kano ModelDocument9 pagesKano ModelNikola SvorcanNo ratings yet

- DTL EWeek2017c08 Euromonitor enDocument31 pagesDTL EWeek2017c08 Euromonitor enVidhiNo ratings yet

- Trader Joe AnalysisDocument6 pagesTrader Joe Analysisapi-543422438No ratings yet

- COVID-19's Immediate and Long-Term Impact On The CPG Industry (IRI 2020) PDFDocument26 pagesCOVID-19's Immediate and Long-Term Impact On The CPG Industry (IRI 2020) PDFomsisdNo ratings yet

- Values and Perceptions of Graduate SchoolsDocument21 pagesValues and Perceptions of Graduate SchoolsKevin TameNo ratings yet

- Pros and Cons of Sampling An Effective Consumer Sales Promotion ToolDocument3 pagesPros and Cons of Sampling An Effective Consumer Sales Promotion ToolarcherselevatorsNo ratings yet

- Europe Caseins PDFDocument7 pagesEurope Caseins PDFallen BondNo ratings yet

- Soup Market Research 1996Document187 pagesSoup Market Research 1996fredmanntraNo ratings yet

- LifebuoyDocument10 pagesLifebuoyPradeep BandiNo ratings yet

- Managing The New Product Development Pro PDFDocument16 pagesManaging The New Product Development Pro PDFkashemNo ratings yet

- Marketing Plan For Nestle Kit KatDocument10 pagesMarketing Plan For Nestle Kit KatKevin kyle CadavisNo ratings yet

- Consumer Types FranceDocument52 pagesConsumer Types FranceAna Gs100% (3)

- Starbuck NewDocument72 pagesStarbuck NewTania UlricaNo ratings yet

- Category ManagementDocument9 pagesCategory ManagementMadhu Mahesh RajNo ratings yet

- Marketing MathDocument22 pagesMarketing MathMarketinggNo ratings yet

- Situation Analysis - 5CDocument2 pagesSituation Analysis - 5CDayalan Avinakshi SankaranNo ratings yet

- Zespri CaseDocument2 pagesZespri CasePiyush Agarwal33% (3)

- Final Imc Campaign Group 8 PDFDocument23 pagesFinal Imc Campaign Group 8 PDFapi-275931099No ratings yet

- Healthy Snacks For KidsDocument2 pagesHealthy Snacks For KidsVegan FutureNo ratings yet

- Flexin Marketing ReportDocument53 pagesFlexin Marketing ReportsayrafazalNo ratings yet

- Quinoa Cookbook: Over 50 Recipes of Healthy Gluten-Free Recipes to Lose Weight: Weight Loss CookingFrom EverandQuinoa Cookbook: Over 50 Recipes of Healthy Gluten-Free Recipes to Lose Weight: Weight Loss CookingNo ratings yet

- Leading Corporate Turnaround: How Leaders Fix Troubled CompaniesFrom EverandLeading Corporate Turnaround: How Leaders Fix Troubled CompaniesNo ratings yet

- Growth Strategy Process Flow A Complete Guide - 2020 EditionFrom EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionNo ratings yet

- Hospital Management SystemDocument44 pagesHospital Management SystemsamdhathriNo ratings yet

- Hospital Management System DatabaseDocument18 pagesHospital Management System DatabasesamdhathriNo ratings yet

- Contract Staffing in IndiaDocument8 pagesContract Staffing in IndiasamdhathriNo ratings yet

- Hospital Management System: Presented by GroupDocument29 pagesHospital Management System: Presented by GroupsamdhathriNo ratings yet

- Dissertation TopicDocument19 pagesDissertation TopicsamdhathriNo ratings yet

- MCS Assignment 2: D. Srirama Samdhathri 2013PGPUAE012Document6 pagesMCS Assignment 2: D. Srirama Samdhathri 2013PGPUAE012samdhathriNo ratings yet

- Urinary Tract Infections PowerpointDocument22 pagesUrinary Tract Infections Powerpointsamdhathri100% (1)

- Ez Case StudyDocument9 pagesEz Case StudysamdhathriNo ratings yet

- Collections PaperDocument28 pagesCollections PapersamdhathriNo ratings yet

- Success Story Corporation BankDocument4 pagesSuccess Story Corporation BanksamdhathriNo ratings yet

- Swot Analysis Indian Banking: From The Selectedworks of Yogendra SisodiaDocument6 pagesSwot Analysis Indian Banking: From The Selectedworks of Yogendra SisodiasamdhathriNo ratings yet

- SWOT Analysis of Banking Sector in India: Strengths WeaknessDocument5 pagesSWOT Analysis of Banking Sector in India: Strengths WeaknesssamdhathriNo ratings yet

- CitibankDocument38 pagesCitibankmasandvishalNo ratings yet

- Updated WAC Assignment-WeGoogledYou 2013PGPUAE012Document7 pagesUpdated WAC Assignment-WeGoogledYou 2013PGPUAE012samdhathriNo ratings yet

- Look Ahead 2014 Industry BrochureDocument32 pagesLook Ahead 2014 Industry BrochuresamdhathriNo ratings yet

- WAC - We Googled YouDocument7 pagesWAC - We Googled Yousamdhathri100% (1)

- Core Competencies 2Document79 pagesCore Competencies 2Mariam Salonga100% (1)

- Chocolate From Cocoa - PPT 5.15Document21 pagesChocolate From Cocoa - PPT 5.15Sandhya ArulNo ratings yet

- Telling A Stellar Story: Published by BS CentralDocument6 pagesTelling A Stellar Story: Published by BS CentralBS Central, Inc. "The Buzz"No ratings yet

- AGK B MintafeladatDocument5 pagesAGK B MintafeladatPetra LovászNo ratings yet

- Formulation of Linear Programming Model - UpdatedDocument13 pagesFormulation of Linear Programming Model - UpdatedArslan HamidNo ratings yet

- Pepsi Blue: By: John DehmardanDocument37 pagesPepsi Blue: By: John DehmardanLuis Ma CrzNo ratings yet

- Compilation of Literary Pieces in Phil LitDocument92 pagesCompilation of Literary Pieces in Phil LitPierrene PineroNo ratings yet

- Harvestmoon Sunshine IslandDocument10 pagesHarvestmoon Sunshine IslandFlorencia Irena SuhandiNo ratings yet

- After Dinner Tricks GibsonDocument31 pagesAfter Dinner Tricks GibsonHatfulloftricks700100% (2)

- Pastry Rolls Filled With Almond + Cardamom From Cooking in Iran - Regional Recipes and Kitchen Secrets by Najmieh BatmanglijDocument4 pagesPastry Rolls Filled With Almond + Cardamom From Cooking in Iran - Regional Recipes and Kitchen Secrets by Najmieh BatmanglijrameshnaiduNo ratings yet

- Love, Dating & ReationshipsDocument8 pagesLove, Dating & ReationshipsRishita KayasthNo ratings yet

- Read About The 5 Best Restaurants in The World and Answer The QuestionsDocument3 pagesRead About The 5 Best Restaurants in The World and Answer The Questionssamuel samNo ratings yet

- Exercises SOME - ANY - NOTHINGDocument1 pageExercises SOME - ANY - NOTHINGDanielle SoaresNo ratings yet

- Tinker Tailor Soldier Spy Script PDFDocument128 pagesTinker Tailor Soldier Spy Script PDFAyu Gayatri100% (1)

- A Concept Note On Water Quality Test ProjectDocument3 pagesA Concept Note On Water Quality Test ProjectPadam Prasad Paudel100% (5)

- BC Business 2Document3 pagesBC Business 2SantiNo ratings yet

- Colorimetric TestDocument10 pagesColorimetric TestsamcbsivNo ratings yet

- 6001.alcohol Induced DementiaDocument4 pages6001.alcohol Induced Dementiajuan_bacha_1No ratings yet

- 5 - APV Membrane ProcessingDocument81 pages5 - APV Membrane ProcessingAlexandra ChavezNo ratings yet

- RRL and RSDocument22 pagesRRL and RSJalen Nano100% (1)

- Factors Affecting Food ChoicesDocument24 pagesFactors Affecting Food Choicesspartanstar100% (1)

- OB Project Group 4 Section DDocument27 pagesOB Project Group 4 Section DJayantwin KatiaNo ratings yet

- Sports DrinksDocument2 pagesSports DrinksWeronika PNo ratings yet

- Uncountable and C Level 2Document10 pagesUncountable and C Level 2Lou EmmaNo ratings yet

- (Chọn đáp án đúng nhất A, B, hoặc C để hoàn thành câu) : I. Choose the best answer A, B, or C to complete the sentencesDocument4 pages(Chọn đáp án đúng nhất A, B, hoặc C để hoàn thành câu) : I. Choose the best answer A, B, or C to complete the sentencesDuy PhướcNo ratings yet

- 02 Doctrine of SignaturesDocument161 pages02 Doctrine of SignaturesVázsonyi Júlia100% (2)

- Study Guide 1Document9 pagesStudy Guide 1api-367990381No ratings yet

- Lesson 2: Preparing and Portioning MeatDocument46 pagesLesson 2: Preparing and Portioning Meatunknown PersonNo ratings yet