Professional Documents

Culture Documents

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Uploaded by

api-2394041080 ratings0% found this document useful (0 votes)

49 views14 pagesDownside risks have eased for primary insurers globally, but they have not gone away. Global economic conditions are improving after a period of uncertainty and instability in 2012-2013. Insurers' ratings are still constrained in Spain, Italy, Portugal, and Ireland, among others.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDownside risks have eased for primary insurers globally, but they have not gone away. Global economic conditions are improving after a period of uncertainty and instability in 2012-2013. Insurers' ratings are still constrained in Spain, Italy, Portugal, and Ireland, among others.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

49 views14 pagesDownside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Uploaded by

api-239404108Downside risks have eased for primary insurers globally, but they have not gone away. Global economic conditions are improving after a period of uncertainty and instability in 2012-2013. Insurers' ratings are still constrained in Spain, Italy, Portugal, and Ireland, among others.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

Downside Pressure Eases Mid-2014

For Most Global Insurance Key Risks

Primary Credit Analyst:

Michael J Vine, Melbourne (61) 3-9631-2102; michael.vine@standardandpoors.com

Secondary Contacts:

Rob C Jones, London (44) 20-7176-7041; rob.jones@standardandpoors.com

Mark Button, London (44) 20-7176-7045; mark.button@standardandpoors.com

Dennis P Sugrue, London (44) 20-7176-7056; dennis.sugrue@standardandpoors.com

Tracy Dolin, New York (1) 212-438-1325; tracy.dolin@standardandpoors.com

Angelica G Bala, Mexico City (52) 55-5081-4405; angelica.bala@standardandpoors.com

Ron A Joas, CPA, New York (1) 212-438-3131; ron.joas@standardandpoors.com

Table Of Contents

Negative Outlook Bias Eases

Interest Rates Remain At Low Levels Versus Historic Norms In Key

Markets

Global Economic Activity Is Slow To Recover

Global Reinsurers Ratings At Risk From Soft Pricing

Regulatory Uncertainty Creates Strategic And Operational Challenges

Sovereign Risks Continue To Impact Ratings

Related Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 1

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most

Global Insurance Key Risks

Downside risks have eased for primary insurers globally, but they have not gone away. Interest rates stagnating at low

levels or spiking too sharply on recovery remain key risks affecting insurers' credit quality in mid-2014. Global

economic conditions are improving after a period of uncertainty and instability in 2012-2013, but they are leveraged to

the U.S. recovery, and some negative economic and geopolitical pressures remain in a number of European countries.

While risk from a nasty China hard landing is now remote, and sovereign risks have largely subsided, insurers' ratings

are still constrained in Spain, Italy, Portugal, and Ireland, among others, and the negative outlook on Japan impacts

some insurers' ratings. Soft pricing in global reinsurance rates has benefited the primary market--but we believe that

the ratings-trend impact will be negative for the reinsurance sector after eight years of stability. Regulatory uncertainty

continues to pose strategic and operational challenge as Solvency II nears in Europe; and there is wider regulatory

reach into global systemically important insurers (G-SIIs) and business conduct regulation. Ratings stability has

increased markedly over the past year or so, and the negative bias has receded considerably. This suggests that global

risks continue to dissipate, in our view, and indicates that insurers, although less so reinsurers, are largely resilient to

the risk environment outlook.

Interest rates have risen from their lows over the past 18 months, providing some relief, but risk remains, especially for

life insurers seeking improved yield relative to guaranteed rates. Earnings pressure from low interest rates is prompting

some insurers to seek investments further down the ratings scale in order to increase yield. At the same time, more

illiquid assets are making their way into investment portfolios. Insurers can be exposed to risk when interest rates rise

too quickly, with a rapid move in rates tempting life policyholders to switch to other products that offer higher returns.

The resultant increase in surrenders could weaken the liquidity and financial profiles of some players if those

competitors are forced to realize losses on their bond portfolios. The U.S. Federal Reserve appears in no rush to raise

interest rates given inflation is at low levels, although strength in the labor market and ongoing economic recovery will

continue the trend to normalize monetary policy. We view the property & casualty market, and more specifically

global multiline insurers as more resilient to changing interest rate scenarios (see "Global Multiline Insurers Show

Ratings Resiliency To Interest Rate Swings").

OVERVIEW

Risks abate for global insurers, with a gradual lift in interest rates from troublesome lows and traction from

slowly improving economic conditions, particularly in the U.S.

Ratings stability is more evident compared with a year ago, as eurozone sovereign outlooks resolve, offset

somewhat by Eastern Europe, and we assess greater capital and earnings certainty.

Reinsurance sector risks heighten after a long period of stability, as we expect earlier soft market- pricing

conditions to continue into the June/July renewal season.

Regulatory uncertainty around the impact of G-SIIs, Solvency II, and business conduct regulation, amongst

others, continues to pose strategic and operational challenge.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 2

1323386 | 300510290

The recovery in the U.S. is back on track after a short intermission in the first quarter, and appears to be doing O.K.

Credit conditions are largely favorable, helped by improved consumer spending despite a miserable winter, some

traction in labor market, and a revival in the manufacturing sector. While the economic recovery is now evident in the

eurozone, it is very uneven and fragile. Markets still faced with economic, political and financial difficulty, however,

have already seen ratings adjustment in line with sovereign rating downgrades over 2013. The risk of a China hard

landing scenario is easing, with GDP growth likely to settle around 7% over the next few years as policymakers shift

from higher investment and credit fuelled growth to consumption growth, although financial sector risks in shadow

banking and wealth management products simmer away (see "Cracks in the Fortress? Challenges Rise Within China's

Financial Sector" and "China Walks Policy Tightrope In The Midst Of Rising Financial Pressure"). Potential

destabilizing risks are increased vulnerability of emerging markets worldwide and unpredictable geopolitical flare-ups,

such as an escalation of the Ukraine-Russia crisis (see "Standard & Poor's Says Global Credit Conditions Are

Improving, But Some Risks Are Shifting To Emerging Markets" and "Russia-Ukraine: An Unfolding Crisis").

Table 1

Key Risks

Risk Trend

Interest rates remain at low levels versus historic norms in key markets Decreasing

Global economic activity is slow to recover. Decreasing

Global reinsurers ratings at risk from soft pricing Increasing

Regulatory uncertainty creates strategic and operational challenges Increasing

Sovereign risks continue to impact ratings Decreasing

After a long cycle of ratings stability in the global reinsurance sector we see a possible negative ratings trend in 2014,

following evidence of competition in premium rates and conditions that we believe will weaken profitability in 2014

and 2015 (see "Past The Tipping Point: Competition And Soft Pricing Could Lead To Rating Pressure For Global

Reinsurers"). Further evidence emerged in the form of headline rates being down 10%-15% in the April 1 renewal; U.S.

property catastrophe rates are poised to retreat further at the June and July 1 renewals.

Regulatory developments continue to feature prominently in 2014. Detailed guidance on Solvency II will emerge later

in 2014, and the changes could be implemented in 2016 after the political agreement at the end of 2013. New federal

regulatory bodies are also beginning to influence the U.S. insurance market. Consequences of the capital and earnings

impact and risk requirements for G-SIIs remain unclear, while we see growing business-conduct regulation imposing

on insurers. Smaller insurance companies, especially in emerging markets where variations of Solvency II are going to

be implemented could also suffer. Their technological, operational, and cost structures may prove insufficient for

meeting requirements and fostering a trend to consolidation.

The U.S. regulatory environment has increased in its complexity and uncertainty. There is a now a plethora of

regulatory agencies, entities, and departments responsible for providing oversight at the Federal level, in addition to

the pre-existing state-based system. The Federal Reserve is currently developing its views on capital standards that

should be applied to the systemically important financial institutions; however, there are concerns that banking-style

capital requirements could be introduced into the insurance sector, which may not address the risks and liabilities

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 3

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

taken on by insurance companies, nor the means of managing those risks insurance companies have developed over

the years.

Negative Outlook Bias Eases

Around 81% of Standard & Poor's Ratings Services' ratings on insurers globally had a stable outlook at the start of May

2014, compared with about 73% at the start of 2013, indicating our expectation that insurance ratings will be largely

resilient to the risk environment outlook. Outlook drivers are biased toward capital and earnings expectations, the

influence of sovereign rating outlooks, and, to a lesser extent, merger and acquisition activity and expected changes in

competitive position metrics.

The negative cohort in ratings outlooks and CreditWatches has receded to about 11% from 20% over the 16 month

period, as economic conditions slowly mend, sovereign ratings stabilize in the eurozone, and the risk from low interest

rates declines. Ratings on positive outlook or CreditWatch comprise 8%, from 7% at the start of 2013. Overall, the

negative bias has improved markedly to only 3% at May 2014, from 5% at January 2014, and 13% at January 2013.

Chart 1

Regional variation remains, with negative indicators at only 10% (negative bias 3%) in North America as insurers

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 4

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

benefit from the economy gaining steam. Western Europe comes in at 11% (positive bias 1%), on the back of greater

economic and sovereign stability, and 7% (neutral bias) is Asia-Pacific's negative rate, with solid growth fundamentals

offset by capital and earnings pressure in some markets and the Japan sovereign negative outlook. A higher negative

rate is in Central and Eastern Europe, the Middle East, and Africa (CEEMEA), at 20% (negative bias 12%), largely from

sovereign constraints; Latin America's is 19% (negative bias 13%).

This improved shift in outlook bias also came after the implementation of our new insurance criteria, with more than

91% of ratings affirmed, 7% raised, and 2% lowered in the second half of 2013. The ratio of upgrades to downgrades

was 2.2 to 1 over the course of 2013, reversing the negative bias in 2012, when there was acute economic and political

uncertainty and instability in many markets. The median stand-alone credit profile (SACP) for the insurance sector

remains at 'A-', despite this slight improvement in SACP and ratings distribution.

Interest Rates Remain At Low Levels Versus Historic Norms In Key Markets

Rates have risen in most developed markets from their lows over the course of 2013, but they remain a risk, especially

to life insurers' credit quality in markets such as Germany and Japan, which have low bond yields relative to

guaranteed rates. The extent of insurers' resilience to the current low interest rate environment differs according to the

market in which they operate and the strategic direction their managements take to manage interest-rate risk. Of the

large European markets, German life insurance is the most sensitive to low interest rates, but has managed this

exposure and maintained current ratings. We believe many rated European insurers will continue to implement

measures, such as changing business models and adding new products to prevent their credit quality from eroding

further. Other markets face similar issues, but the effects are mitigated either by product design (more unit-linked

products, more flexible policy bonus rates, lower guaranteed rates), shorter liability duration, and/or longer asset

duration. The Japanese market, having grappled for decades with both low interest rates and an aging population, has

gained growth from health-related and living benefits products such as cancer and long-term care insurance. The risk

of rates falling significantly from current very low levels in Japan is remote, but with some minor adjustment from the

current 0.6% 10 Year Japanese Government Bond yield possible.

Earnings pressure from low interest rates is prompting some insurers to seek investments further down the ratings

scale to increase yield. At the same time, more illiquid assets are making their way into investment portfolios, including

commercial mortgage loans, private placement bonds, asset-backed securities, infrastructure assets, and alternative

investments. Although such investments add risk to insurers' credit profiles, the moves have been relatively modest to

date, and have not affected ratings.

While interest rates are gradually rising, they remain below historical levels in most markets as governments and

central banks manage sluggish GDP growth and low inflation. In sophisticated markets, rating actions on insurers due

to interest rate risk have been limited because of the industry's asset-liability management (ALM) and enterprise risk

management (ERM) practices, which have generally improved since the onset of the global financial crisis. In our view,

insurers with well-constructed and well-implemented ERM programs generally minimize the risk of losses outside of

their predefined risk tolerances. Additionally, we deem insurers with strong ERM, including strong strategic risk

management, to be better equipped to manage changing macroeconomic circumstances. For example, in the U.S,,

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 5

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

since the global financial crisis we have seen an uptick in interest rate risk hedging for life insurers, which helps

stabilize economic results regardless of changes in interest rates, but may add accounting volatility to reported results.

Life insurers have also significantly reduced their offerings of the most interest-sensitive life, annuity, and long-term

care products while emphasizing fee-based products to reduce their interest-rate sensitivity. Within the property &

casualty sector, insurers--particularly those with longer-tail liabilities--have been preparing for a rise in interest rates by

keeping their asset durations shorter than their reserve durations. Our ratings on global multiline insurers were resilient

to our stressed interest rate scenarios (100 basis points higher and lower than our economists are forecasting).

Interest rates in Italy and Spain have moved in the opposite direction as perceived eurozone risk has receded, but have

now reached levels that are more consistent with their sovereign rating levels. This has eased the pressure on insurers'

marked-to-market balance sheets and solvency levels.

The unwinding of quantitative easing in the U.S. has also proven to have an impact on foreign exchange and interest

rates around the globe, particularly in emerging markets. A disorderly response by financial markets to the unwinding

of quantitative easing remains a shared and moderate risk for credit conditions around the world. The return to more

normal monetary policy in the U.S. could lead to disruptive effects, and markets' reaction to shifting policy

expectations could still create some financial volatility, particularly in emerging markets. Even without this volatility, a

shift in policy could weigh on credit conditions because it would likely make for higher borrowing costs for consumers

and businesses, weaker collateral performance, and losses for financial institutions if interest rate increases aren't

accompanied by strengthening GDP growth. Still, we expect the U.S. Fed is likely to continue to wind down its

bond-purchase program throughout 2014, with an end date likely in October. Economic instability in emerging

markets could reduce the attractiveness of them to global insurers that are looking to expand. This could slow

insurance penetration in those markets, and increase saturation and depress pricing in developed markets as insurers

struggle to deploy capital elsewhere.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 6

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Chart 2

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 7

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Chart 3

Global Economic Activity Is Slow To Recover

The global economy continues to improve in 2014 after a period of uncertainty and instability through 2012-2013.

Downside credit risks are improving, in our view, but some risks are shifting to emerging markets. We view the top

global risks to be geopolitical developments that could result in financial crisis or economic shock, such as an

escalation of the Ukraine-Russia crisis, unexpected turbulence in China's financial sector around the repricing of risk,

and financial market reaction to a disorderly exit from quantitative easing, particularly on emerging markets.

Especially vulnerable to the U.S. fiscal policy uncertainty are some emerging markets, including Brazil, Argentina,

India, and Indonesia, although this time around, a lot of adjustment has already taken place, and interest rate and

foreign exchange rate impact may be less severe. Risks from the eurozone remain high, with several European markets

still suffering from high unemployment and weak disposable incomes that will weigh on revenue growth for the

insurance sector. The risk of a China hard landing scenario is easing, as policymakers seek to gradually shift to growth

fuelled by consumption rather than investment and credit. Risks from China's financial sector, particularly in local

government debt and shadow banking, including wealth management products, remain but are viewed as manageable.

Japan's stimulus measures have increased insurance revenues in Japan, with the sector also benefiting from improved

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 8

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

investment markets. The risk of these benefits eroding from adverse effects of the consumption tax hike and inflation

pressure are yet to be fully tested, but promising at this stage.

The U.S. economy is likely to continue gaining momentum after a false start first quarter as it emerges from the deep

winter, with a resilient private sector, housing rebound, and gradually strengthening job market. We expect less fiscal

drag in 2014 with debt ceiling negotiations extended until March 2015, although 2014 elections could alter the debate

on budget, debt and stimulus measures. Low interest rates, which remain the primary impediment to life insurers'

earnings, appear poised to increase.

Economic conditions are stabilizing in the eurozone, assisted by the Outright Monetary Transactions (OMT)

purchasing program of the European Central Bank. Credit conditions in Central and Eastern Europe generally continue

to have a negative bias, with worsening economic, political, geopolitical and financial system risks in several markets

over 2013 already factored into our ratings via sovereign downgrades. The risk level has moderated in 2014 as

economic conditions slowly improve, but a strong recovery is not in sight. Sluggish and fragile economic conditions

are likely to prevail as structural weaknesses, high levels of indebtedness and unemployment, and broken credit

channels fail to subside.

Asia-Pacific's credit conditions remain largely unchanged in second quarter 2014, with Chinese GDP growth gradually

moderating in line with policymakers' desire to rebalance the economy and rein in financial excesses. China's growth

has stabilized at around 7%-7.5%, and authorities have indicated that, although they are intent on engineering a more

sustainable growth rate, they are not going to allow a sharp downturn (widely understood to be growth of below 7%)

to threaten China's development or social stability. Japan's growth should also moderate as the initial boost from

Abenomics subsides. As a trade-oriented region, Asia-Pacific continues to face the risk of lack of resistance in the U.S.

economic recovery, but its trade dependent economies should benefit as the U.S. and possibly Europe improves.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 9

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Chart 4

Global Reinsurers Ratings At Risk From Soft Pricing

After eight solid years of ratings stability in the global reinsurance sector, Standard & Poor's believes that there'll be a

negative ratings trend in 2014. The tipping point came in early January, when we observed increasingly competitive

behavior between reinsurance companies. This trend has continued through the year:

Headline rates in the April 1 renewal were down 10%-15%;

There are early indications from issuers of more significant pricing decreases in U.S. property catastrophe rates at

the June and July 1 renewals; and

Market reports indicate that soft-market pricing conditions are affecting rates in other casualty and specialty lines.

This downward pressure on reinsurers' top lines leads us to think there will be weakened profitability in 2014 and

2015. In our opinion, these competition-related risks are the most prominent threat to the sector, usurping, for now at

least, the macroeconomic risks we highlighted in September 2013. We estimate that nearly half of our global

reinsurance ratings are materially exposed to these pressures. Companies that are unable to navigate the difficult new

landscape could experience negative rating actions.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 10

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Capturing the risk, capital allocation, and pricing of un-modelled catastrophe risk is an issue for reinsurers, as it

generally represents 10%-15% of the average reinsurer's capital. We suggest that insurance penetration in developing

markets will outpace modelers' ability to generate reliable models for those perils/regions, so the amount of

un-modeled risk on primary and reinsurance companies' books could increase in coming years, adding to risk profiles.

There could be a paradigm shift for the reinsurance market in 2014, as reinsurers will be forced to differentiate

themselves in order to succeed. A benign catastrophe loss year in 2013 coupled with continued inflow of new capital

has kept capacity/supply near all-time highs, further pressuring pricing. Against this backdrop, it is the reinsurers who

are able to leverage their expertise, scope, diversification, and global reach, which will thrive. We are beginning to see

signs of a bifurcation in the reinsurance renewals for 2014, with larger, higher-rated reinsurers seeing more business at

more favorable terms. Complacency is a real risk, and if insurers don't innovate and maintain their relevance to the

marketplace, they risk being marginalised or swallowed up by a competitor.

Regulatory Uncertainty Creates Strategic And Operational Challenges

Regulatory developments will continue to feature prominently in 2014, especially in Europe. Eight of the nine groups

the Financial Stability Board (FSB) classified as G-SIIs in July 2013 are rated global multiline insurers (GMIs): AIG,

Allianz, Aviva, AXA, Generali, Metlife, U.S.-based Prudential Financial, and U.K.-based Prudential PLC. Ping An is the

only non-GMI on the list. The consequences of being a G-SII remains unclear. It may include higher capitalization,

resolution plans, more detailed risk reporting, or stricter supervision. Consequently, the GMIs' designation as G-SIIs

has had no immediate consequences for their ratings. In any event, we believe any incremental capital requirements

are unlikely to be imposed until 2019 at the earliest. This might put G-SIIs at a disadvantage relative to other insurers.

On the other hand, G-SIIs may benefit from a more favorable perception of their status in the market, for example

because of the implied potential for government support. That said, we do not currently reflect potential government

support in our insurance ratings, other than for government-related entities.

We expect that the FSB will indicate which, if any, reinsurers it will designate as G-SIIs this November. The

International Association of Insurance Supervisors is also due to elaborate on its basic capital requirements (BCR) by

November. These will be applied to G-SIIs first and as a part of the IAIS's Common Framework (ComFrame) for the

supervision of (approximately 50) internationally active insurance groups. The development of the BCR is to inform

the development of the international capital standards due in 2019 for internationally active insurance groups,

requirements which may ultimately filter out to the broader insurance industry globally.

Whereas the regulatory environment in the U.S. has always been somewhat dynamic, the current environment has

increased in complexity and uncertainty. With the passage of the Dodd-Frank Act in 2010, a number of new agencies,

departments, and entities are now involved in providing oversight for the industry, including the Financial Stability

Oversight Council (FSOC), the Federal Insurance Office (FIO), and the Federal Reserve Board (Fed), to name a few.

This is in addition to the pre-existing state-based system of commissioners and superintendents. The increase in

regulatory oversight has raised concerns within the industry as to how effective regulators might be, and whether

confusion versus certainty would result from the various regulators' involvement, should another financial crisis occur.

Equally concerning to market participants is the fact that the Fed is responsible for the capital standards that would

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 11

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

apply to systemically important financial institutions (SIFIs). By some interpretations of the Dodd-Frank Act, the Fed

does not have the ability to interpret the Act in a way that would allow for flexibility in setting capital standards for

these insurance companies they regulate. As a result, some market participants are concerned about the possible

introduction of bank-style capital requirements into the insurance industry. Such an approach may not fully address

the risks and liabilities being managed by insurance companies, or the compensating risk-management techniques.

Accordingly, capital requirements could be impacted, as could the products and costs to the market more broadly.

Solvency II should be implemented in 2016 after the 2013 political agreement. However, many details are uncertain,

and could still adversely affect solvency ratios and the ability of insurers to invest in long term asset classes. Solvency

modernization is also prominent in the U.S., with ORSA, principles-based reserving and group solvency being hot

topics. The U.S. Fed has little experience in overseeing insurers, but it has assumed responsibility for the group

supervision of U.S.-based G-SIIs and Domestic-SIIs. Smaller insurance companies, especially in the emerging markets

in which a variation of Solvency II is going to be implemented, could suffer. Their technological, operational, and cost

structures may prove insufficient to meet requirements. This could result in consolidation in some countries to meet

the requirements of regulatory change.

Alongside these developments in prudential regulation, we see a growing focus on conduct-of-business regulation.

This responds to a growing consumer lobby and the separation of prudential and market conduct regulation in some

markets. We expect the changing regulatory landscape will create operational challenges for insurers and could have

strategic and financial implications for certain entities. This poses an event risk for some companies, in our opinion.

Market-conduct regulation is likely to become more prominent in 2014, which might curb the sales of some products,

increase selling costs in others and resulting in more damaging misselling issues. This has been an evolving issue for

example in Australia, with earlier focus on unit pricing and misselling issues now largely resolved through industry

consultation and enforceable undertakings.

Sovereign Risks Continue To Impact Ratings

Sovereign risks in the 18 member-state eurozone have stabilized over the course of 2013 and into 2014, and risks have

generally moderated. Country/sovereign risk constrains some ratings in Spain, Italy, Portugal, and Ireland; however,

eurozone outlooks are stable or positive, except those on Italy and, more recently, Finland. This is mirrored in insurer

outlooks that are now more evenly balanced between the upside and downside. Japan's sovereign negative outlook

continues to constrain some ratings.

Under Standard & Poor's policies, only a Rating Committee can determine a Credit Rating Action (including a Credit

Rating change, affirmation or withdrawal, Rating Outlook change, or CreditWatch action). This commentary and its

subject matter have not been the subject of Rating Committee action and should not be interpreted as a change to, or

affirmation of, a Credit Rating or Rating Outlook.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 12

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

Related Research

Insurance Industry And Country Risk Assessment Update: May 2014, May 14, 2014

Global Multiline Insurers Show Ratings Resiliency To Interest Rate Swings, April 14, 2014.

Credit Conditions: Financial Market Volatility Will Continue To Constrain Latin America's Credit And Economic

Growth, March 26, 2014

Credit Conditions: Largely Stable In Asia-Pacific, With A Dash Of Negative And A Focus On China's Financial

Sector Risks, March 26, 2014

Credit Conditions: North America's Credit Conditions Remain Largely Favorable Despite Fed Tapering, March 21,

2014

Credit Conditions: Europe Is On A More Stable Path, Amid Turbulence In Emerging Markets, March 21, 2014

Cracks in the Fortress? Challenges Rise Within China's Financial Sector, published March 3, 2014

Past The Tipping Point: Competition And Soft Pricing Could Lead To Rating Pressure For Global Reinsurers,

published Jan. 20, 2014

Possible Ratings Implications For Global Systemically Important Insurers, published July 19, 2013

Standard & Poor's (Australia) Pty. Ltd. holds Australian financial services licence number 337565 under the Corporations Act 2001. Standard &

Poor's credit ratings and related research are not intended for and must not be distributed to any person in Australia other than a wholesale

client (as defined in Chapter 7 of the Corporations Act).

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 13

1323386 | 300510290

Downside Pressure Eases Mid-2014 For Most Global Insurance Key Risks

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P

reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com

(subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information

about our ratings fees is available at www.standardandpoors.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P

Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any

damage alleged to have been suffered on account thereof.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Copyright 2014 Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial. All rights reserved.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 28, 2014 14

1323386 | 300510290

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Fabozzi-Foundations of Financial Markets and Institutions 4eDocument18 pagesFabozzi-Foundations of Financial Markets and Institutions 4eMariam Mirzoyan100% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2021 August StatementDocument7 pages2021 August StatementJawad AhmedNo ratings yet

- Cash Budgeting Examples.Document21 pagesCash Budgeting Examples.Muhammad azeem83% (6)

- Australian Infrastructure Funding: Making StridesDocument5 pagesAustralian Infrastructure Funding: Making Stridesapi-239404108No ratings yet

- Credit Conditions: Challenges Remain For Some Asia-Pacific Sectors in Q2 2014Document16 pagesCredit Conditions: Challenges Remain For Some Asia-Pacific Sectors in Q2 2014api-239404108No ratings yet

- Ratings On New Zealand Unaffected by Government's 2015 BudgetDocument3 pagesRatings On New Zealand Unaffected by Government's 2015 Budgetapi-239404108No ratings yet

- UntitledDocument8 pagesUntitledapi-239404108No ratings yet

- Asia-Pacific Economic Outlook: China Embraces Risk and Japan Provides An Unexpected BoostDocument12 pagesAsia-Pacific Economic Outlook: China Embraces Risk and Japan Provides An Unexpected Boostapi-239404108No ratings yet

- Ratings On Australia Not Affected by Government's Fiscal 2015 BudgetDocument3 pagesRatings On Australia Not Affected by Government's Fiscal 2015 Budgetapi-239404108No ratings yet

- Credit Conditions: Asia-Pacific Growth Is Mostly Stable, But Some Lagging Credit Risks Remain For 2014Document18 pagesCredit Conditions: Asia-Pacific Growth Is Mostly Stable, But Some Lagging Credit Risks Remain For 2014api-239404108No ratings yet

- India's Election Is Pivotal For Its Sovereign CreditworthinessDocument9 pagesIndia's Election Is Pivotal For Its Sovereign Creditworthinessapi-239404108No ratings yet

- 23 Asia-Pacific (Ex-Japan) Corporate Issuer Ratings On Watch Positive and Eight On Watch Negative, On Revised CriteriaDocument7 pages23 Asia-Pacific (Ex-Japan) Corporate Issuer Ratings On Watch Positive and Eight On Watch Negative, On Revised Criteriaapi-239404108No ratings yet

- Is China's Economy Really Besting Japan's? A Look Beyond GDPDocument9 pagesIs China's Economy Really Besting Japan's? A Look Beyond GDPapi-239404108No ratings yet

- Asia-Pacific Credit Trends 2014: Transportation Infrastructure Faces Policy Uncertainty Utilities Deal With High Energy Costs and Green PowerDocument7 pagesAsia-Pacific Credit Trends 2014: Transportation Infrastructure Faces Policy Uncertainty Utilities Deal With High Energy Costs and Green Powerapi-239404108No ratings yet

- Asia-Pacific 2014: Risks Narrow As Growth Grinds Higher: Economic ResearchDocument11 pagesAsia-Pacific 2014: Risks Narrow As Growth Grinds Higher: Economic Researchapi-239404108No ratings yet

- Ansell Ltd. Outlook Revised To Negative After Barriersafe Acquisition Rating Affirmed at 'BBB-'Document6 pagesAnsell Ltd. Outlook Revised To Negative After Barriersafe Acquisition Rating Affirmed at 'BBB-'api-239404108No ratings yet

- Ratings On Australian State of New South Wales Affirmed at 'AAA/A-1+' Outlook Remains NegativeDocument3 pagesRatings On Australian State of New South Wales Affirmed at 'AAA/A-1+' Outlook Remains Negativeapi-239404108No ratings yet

- The Risk/Reward Pendulum of Wholesale Funding Diversification Swings For Australia's MutualsDocument10 pagesThe Risk/Reward Pendulum of Wholesale Funding Diversification Swings For Australia's Mutualsapi-239404108No ratings yet

- Asia Pacific Credit Trends 2014: Telcos Look To The Cloud in Search of GrowthDocument5 pagesAsia Pacific Credit Trends 2014: Telcos Look To The Cloud in Search of Growthapi-239404108No ratings yet

- Asia-Pacific Credit Trends 2014: Real Estate Developers Wrestle With Regulatory Curbs Reits Hunt For M&AsDocument5 pagesAsia-Pacific Credit Trends 2014: Real Estate Developers Wrestle With Regulatory Curbs Reits Hunt For M&Asapi-239404108No ratings yet

- Australia's Developing Crisis-Management Framework For Banks Could Moderate The Government Support Factored Into RatingsDocument8 pagesAustralia's Developing Crisis-Management Framework For Banks Could Moderate The Government Support Factored Into Ratingsapi-239404108No ratings yet

- Energy Efficient Manet ProtocplsDocument7 pagesEnergy Efficient Manet ProtocplsSuhas KapseNo ratings yet

- ControlingDocument19 pagesControlingAhmad SanusiNo ratings yet

- Recent Development in The Banking Sector: Presented by Shilpa Mishra Bba 5 SemesterDocument15 pagesRecent Development in The Banking Sector: Presented by Shilpa Mishra Bba 5 SemesterDipak K. SahNo ratings yet

- Ceilli1 SQ en Eah PDFDocument24 pagesCeilli1 SQ en Eah PDFLeevya GeethanjaliNo ratings yet

- Synthesis Essay Final DraftDocument5 pagesSynthesis Essay Final Draftapi-575352411No ratings yet

- Difference Between Banks & NBFCDocument8 pagesDifference Between Banks & NBFCSajesh BelmanNo ratings yet

- Breakout On Gold Future (GC) or Gold Spot (XAUUSD) : Trading Risk DisclosureDocument2 pagesBreakout On Gold Future (GC) or Gold Spot (XAUUSD) : Trading Risk Disclosurehenry prabowoNo ratings yet

- Notice Annual Membership Fees For The Financial Year 2022-23Document4 pagesNotice Annual Membership Fees For The Financial Year 2022-23APNo ratings yet

- Workshop 2 - TVM-time Value of Money in ExcelDocument6 pagesWorkshop 2 - TVM-time Value of Money in ExcelAdriana MartinezNo ratings yet

- Bill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Document6 pagesBill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Akram YasinNo ratings yet

- Dec 2019 Revised Scheme For Dealers - WORD FILE - 231219Document1 pageDec 2019 Revised Scheme For Dealers - WORD FILE - 231219Ravi K Bisht100% (1)

- Armenian Banking Sector Overview For Q1 2019 1559853297Document39 pagesArmenian Banking Sector Overview For Q1 2019 1559853297Anush GrigoryanNo ratings yet

- Bond Analysis - Bond Return / Bond YieldDocument34 pagesBond Analysis - Bond Return / Bond YieldIsm KurNo ratings yet

- Trademark Info Corp PDFDocument1 pageTrademark Info Corp PDFHoward KnopfNo ratings yet

- MR Sivapragasam Sri Skanda 4 Farm Road Sutton Surrey Sm2 5huDocument2 pagesMR Sivapragasam Sri Skanda 4 Farm Road Sutton Surrey Sm2 5huSriskanda SivapragasamNo ratings yet

- (VIII) Chapter 3 (Financial Analysis and SWOT Analysis)Document14 pages(VIII) Chapter 3 (Financial Analysis and SWOT Analysis)Swami Yog BirendraNo ratings yet

- How I Prepared CWM - LEVEL - 2 Exam in One Week? (June 2021)Document5 pagesHow I Prepared CWM - LEVEL - 2 Exam in One Week? (June 2021)scotmartinNo ratings yet

- Vanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundDocument4 pagesVanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundYanto TanNo ratings yet

- Chapter-2 Review of LiteratureDocument5 pagesChapter-2 Review of LiteratureRajesh BathulaNo ratings yet

- 12th Accountancy EM Important Questions English Medium PDF DownloadDocument4 pages12th Accountancy EM Important Questions English Medium PDF Downloadqueensmiling495No ratings yet

- INGENIO VERDE 1 Merged OrganizedDocument2 pagesINGENIO VERDE 1 Merged Organizeddapb1458No ratings yet

- Banjara ReportDocument96 pagesBanjara Reportvipin5678No ratings yet

- Time Value of MoneyDocument60 pagesTime Value of MoneyJash ChhedaNo ratings yet

- 2024 School Fee Structure Tatu City GirlsDocument8 pages2024 School Fee Structure Tatu City GirlsDora MuiaNo ratings yet

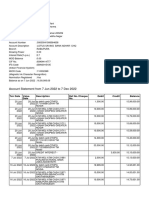

- Account Statement From 7 Jun 2022 To 7 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 7 Jun 2022 To 7 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRdb TalkNo ratings yet

- Reference BikashDocument15 pagesReference Bikashroman0% (1)

- FIN2004 - 2704 Week 2 SlidesDocument60 pagesFIN2004 - 2704 Week 2 SlidesGeena Bernadette LimNo ratings yet