Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

139 viewsItaa 1997240

Itaa 1997240

Uploaded by

Patel BhargavThis document provides information about the structure and organization of the Income Tax Assessment Act 1997, including:

- The Act is organized in a pyramid structure moving from general core provisions to more specialized rules.

- Defined terms are usually identified with an asterisk directing the reader to definitions in section 995-1. However, some basic terms are not defined.

- The numbering system indicates the relationship between different levels or units within the Act.

- Guides and non-operative materials are not legally binding but provide assistance in navigating the Act.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You might also like

- Barclays MT199Document2 pagesBarclays MT199Cash monkey100% (1)

- Korea-Birth Registration-English PDFDocument2 pagesKorea-Birth Registration-English PDFkitderoger_391648570No ratings yet

- CBLM Oap Ncii Core MCCDocument101 pagesCBLM Oap Ncii Core MCCmario layan100% (5)

- JULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallyDocument8 pagesJULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallySeemaNaikNo ratings yet

- Income Tax Ordinance, 2001Document25 pagesIncome Tax Ordinance, 2001Naveed AnwarNo ratings yet

- Revenue RegulationsDocument13 pagesRevenue RegulationsErika AvedilloNo ratings yet

- Abakada Vs ErmitaDocument2 pagesAbakada Vs ErmitaLA AINo ratings yet

- In Come Tax 1979Document250 pagesIn Come Tax 1979averos12No ratings yet

- Bar Review GuideDocument18 pagesBar Review GuideAustin CharlesNo ratings yet

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaDocument14 pagesMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohNo ratings yet

- Ap Value Added Tax Act - 2005Document90 pagesAp Value Added Tax Act - 2005gantasri8No ratings yet

- CIN - SAP Configs SetupDocument11 pagesCIN - SAP Configs Setupdeepraj1983No ratings yet

- Solar SystemsDocument80 pagesSolar SystemssurendrasimhaNo ratings yet

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax NotesMaruSalvatierra100% (1)

- PEACE Bonds Matter PrimerDocument2 pagesPEACE Bonds Matter PrimerJesus FalcisNo ratings yet

- Goods and Services TaxDocument15 pagesGoods and Services TaxSeemaNaikNo ratings yet

- Umali Vs EstanislaoDocument2 pagesUmali Vs EstanislaoAiken Alagban LadinesNo ratings yet

- GG - Application Setup E-B Tax v1.2Document58 pagesGG - Application Setup E-B Tax v1.2Azhar AwadzNo ratings yet

- AF308 WK 10 TextDocument15 pagesAF308 WK 10 TextPrisha NarayanNo ratings yet

- Cebu Revenue CodeDocument151 pagesCebu Revenue CodeKendra Miranda LorinNo ratings yet

- Sop 2Document43 pagesSop 2naveengargnsNo ratings yet

- Foreign Investment Laws NewDocument17 pagesForeign Investment Laws NewkatnavNo ratings yet

- Memorandum: Articles AssociationDocument13 pagesMemorandum: Articles Associationaraza_962307No ratings yet

- Guidance Manual FinalDocument27 pagesGuidance Manual FinalrosdobNo ratings yet

- 2014 mlc703 AssignmentDocument6 pages2014 mlc703 AssignmentToral ShahNo ratings yet

- 2013 Q&A Outlined-Political LawDocument198 pages2013 Q&A Outlined-Political LawsweetcopNo ratings yet

- Chapter Xxi.cDocument12 pagesChapter Xxi.cdakshbajajNo ratings yet

- Rule 11 - Time To File Rspnsive PldngsDocument7 pagesRule 11 - Time To File Rspnsive PldngsbubblingbrookNo ratings yet

- Taxation 2 by Sababan Book Magic Amp Pink NotesDocument111 pagesTaxation 2 by Sababan Book Magic Amp Pink NotesSherily CuaNo ratings yet

- 7.4.14 Red Notes TaxDocument41 pages7.4.14 Red Notes TaxRey Jan N. VillavicencioNo ratings yet

- Income Tax (File - 1)Document5 pagesIncome Tax (File - 1)Nazim KhanNo ratings yet

- SAP CIN Customizing For Logistics - Condition Based Taxes (Taxinn)Document16 pagesSAP CIN Customizing For Logistics - Condition Based Taxes (Taxinn)santej05No ratings yet

- Ohse Subbypack Section Two OHSE Management Plan: Word Format VersionDocument43 pagesOhse Subbypack Section Two OHSE Management Plan: Word Format VersionAmr HalabyNo ratings yet

- Understanding Service Tax Concepts - June 2013Document280 pagesUnderstanding Service Tax Concepts - June 2013Pavan SharmaNo ratings yet

- Form No 15HDocument2 pagesForm No 15HPrajesh SrivastavaNo ratings yet

- Note On Import and Export of Services A.R. Krishnan 1. Situs of Taxation Territorial JurisdictionDocument15 pagesNote On Import and Export of Services A.R. Krishnan 1. Situs of Taxation Territorial Jurisdictionjain2007gauravNo ratings yet

- Joint VentureDocument12 pagesJoint VentureJeree Jerry AzreeNo ratings yet

- Order in The Matter of Greentouch Projects Ltd.Document15 pagesOrder in The Matter of Greentouch Projects Ltd.Shyam Sunder0% (1)

- Tax Send Up Aug 2011Document3 pagesTax Send Up Aug 2011Minhaj SikanderNo ratings yet

- Basic Tax Setups in E-Business Tax: Case Study - 1Document22 pagesBasic Tax Setups in E-Business Tax: Case Study - 1Madhu DevarasettiNo ratings yet

- Civ Pro OutlineDocument27 pagesCiv Pro Outlineeaespin2No ratings yet

- Guingona V Carague DigestDocument3 pagesGuingona V Carague DigestJackie CanlasNo ratings yet

- Works 4 07 Ev2Document358 pagesWorks 4 07 Ev2Kawchhar AhammedNo ratings yet

- Know More About Income TaxDocument5 pagesKnow More About Income TaxcanarayananNo ratings yet

- Requirement & Other Requirement: 2.311 Procedure For Accessing Applicable LegalDocument2 pagesRequirement & Other Requirement: 2.311 Procedure For Accessing Applicable Legalkirandevi1981No ratings yet

- Adjudication Order in The Matter of M D Overseas LimitedDocument17 pagesAdjudication Order in The Matter of M D Overseas LimitedShyam SunderNo ratings yet

- Policy: Statement of Policy and Procedure FN 1.03Document5 pagesPolicy: Statement of Policy and Procedure FN 1.03Irfan KhanNo ratings yet

- O o o o o O: Amortisation, Acquisition, Restructure Charges, In-Process R&D, Pension CurtailmentDocument18 pagesO o o o o O: Amortisation, Acquisition, Restructure Charges, In-Process R&D, Pension CurtailmentmkNo ratings yet

- Ch.33 BPOC Lesson PlanDocument3 pagesCh.33 BPOC Lesson PlanKelly HoffmanNo ratings yet

- Leame OSSDocument72 pagesLeame OSSFlavio SantanaNo ratings yet

- Cir Vs Sony Philippines Inc (GR 178697 November 17 2010)Document11 pagesCir Vs Sony Philippines Inc (GR 178697 November 17 2010)Brian BaldwinNo ratings yet

- Special Economic ZonesDocument9 pagesSpecial Economic ZonesSri Harsha KothapalliNo ratings yet

- Adjudication Order in The Matter of M/s. Essen Supplements India Ltd. (Now Known As Square Four Projects India LTD)Document12 pagesAdjudication Order in The Matter of M/s. Essen Supplements India Ltd. (Now Known As Square Four Projects India LTD)Shyam SunderNo ratings yet

- Revenue Memorandum Circular No. 17-06Document2 pagesRevenue Memorandum Circular No. 17-06Charmaine MejiaNo ratings yet

- Taxation System in IndiaDocument13 pagesTaxation System in IndiaTahsin SanjidaNo ratings yet

- Commissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Document7 pagesCommissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Vince LeidoNo ratings yet

- Guide AppDocument43 pagesGuide AppjonbelzaNo ratings yet

- Concept of IncomeDocument12 pagesConcept of IncomeCara HenaresNo ratings yet

- Industrial Disputes Act, 1947: Chapter Sections TitleDocument15 pagesIndustrial Disputes Act, 1947: Chapter Sections TitlerajdeeppawarNo ratings yet

- El ActsDocument4 pagesEl ActsSonia LawsonNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Chainsaw Training FlyerDocument2 pagesChainsaw Training Flyerthe TWOGNo ratings yet

- Navtor Navtracker User GuideDocument52 pagesNavtor Navtracker User GuideБобров ВиталийNo ratings yet

- Unit 5: Transition Paths: Manage Your Solution in The Configure Your SoluDocument1 pageUnit 5: Transition Paths: Manage Your Solution in The Configure Your Solushree.patil20028558No ratings yet

- ISO Metric Screw Thread - WikipediaDocument6 pagesISO Metric Screw Thread - WikipediamarceloNo ratings yet

- ShrsDocument16 pagesShrsKevin Patel100% (1)

- Fundamentals of Information Systems PDFDocument164 pagesFundamentals of Information Systems PDFharshithaNo ratings yet

- Panasonic th-50c300k 50c300m 50c300s 50c300t 50c300xDocument38 pagesPanasonic th-50c300k 50c300m 50c300s 50c300t 50c300xalfauzulNo ratings yet

- People of The Philippines v. Jamilosa, G.R. No. 169076Document15 pagesPeople of The Philippines v. Jamilosa, G.R. No. 169076Marchini Sandro Cañizares KongNo ratings yet

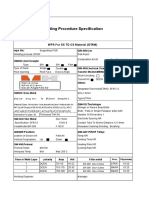

- Welding Procedure Specification: WPS For SS TO CS Material (GTAW)Document1 pageWelding Procedure Specification: WPS For SS TO CS Material (GTAW)Lipika GayenNo ratings yet

- OSHA Citations Against O&G and Ducci ElectricDocument107 pagesOSHA Citations Against O&G and Ducci ElectricRepublican-AmericanNo ratings yet

- 03 Positive Displacement Compressors RotaryDocument5 pages03 Positive Displacement Compressors RotaryLe Anh DangNo ratings yet

- Avc A1d enDocument2 pagesAvc A1d enenergiculNo ratings yet

- EVALUATING OTHERS DRAFT PowerPoint PresentationDocument16 pagesEVALUATING OTHERS DRAFT PowerPoint PresentationtrixiaagelzNo ratings yet

- Acting Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilDocument92 pagesActing Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilhariNo ratings yet

- (Digest) Ang Yu Asuncion vs. CA, 238 Scra 602 (FCD)Document2 pages(Digest) Ang Yu Asuncion vs. CA, 238 Scra 602 (FCD)RexNo ratings yet

- # Installation Guide PDFDocument1 page# Installation Guide PDFscarletNo ratings yet

- REVIEWERDocument3 pagesREVIEWERRuvy Jean Codilla-FerrerNo ratings yet

- ChevyDocument3 pagesChevysecretNo ratings yet

- Ipr Q&aDocument31 pagesIpr Q&aSumit BhardwajNo ratings yet

- Chapter 3 LeaDocument12 pagesChapter 3 LeaChakalo HapalonNo ratings yet

- ELCOMA Diractory 2021 2022Document28 pagesELCOMA Diractory 2021 2022Neeraj KumarNo ratings yet

- Biodiesel B20 - Cummins InformationDocument29 pagesBiodiesel B20 - Cummins InformationIng. Jon MorenoNo ratings yet

- MM 10 EngDocument4 pagesMM 10 EngdaniaufaNo ratings yet

- Pipeline Design, Operation and Maint. Proc. ManualDocument87 pagesPipeline Design, Operation and Maint. Proc. ManualImanPapalala100% (3)

- The HeckscherDocument6 pagesThe HeckscherLad Rahul LadNo ratings yet

- Kellogg's New Product LaunchDocument4 pagesKellogg's New Product Launcharpita nayakNo ratings yet

- 8 - Vakalatnama For High CourtDocument10 pages8 - Vakalatnama For High CourtPriya BhojaniNo ratings yet

Itaa 1997240

Itaa 1997240

Uploaded by

Patel Bhargav0 ratings0% found this document useful (0 votes)

139 views375 pagesThis document provides information about the structure and organization of the Income Tax Assessment Act 1997, including:

- The Act is organized in a pyramid structure moving from general core provisions to more specialized rules.

- Defined terms are usually identified with an asterisk directing the reader to definitions in section 995-1. However, some basic terms are not defined.

- The numbering system indicates the relationship between different levels or units within the Act.

- Guides and non-operative materials are not legally binding but provide assistance in navigating the Act.

Original Description:

ita

Original Title

itaa1997240

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information about the structure and organization of the Income Tax Assessment Act 1997, including:

- The Act is organized in a pyramid structure moving from general core provisions to more specialized rules.

- Defined terms are usually identified with an asterisk directing the reader to definitions in section 995-1. However, some basic terms are not defined.

- The numbering system indicates the relationship between different levels or units within the Act.

- Guides and non-operative materials are not legally binding but provide assistance in navigating the Act.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

139 views375 pagesItaa 1997240

Itaa 1997240

Uploaded by

Patel BhargavThis document provides information about the structure and organization of the Income Tax Assessment Act 1997, including:

- The Act is organized in a pyramid structure moving from general core provisions to more specialized rules.

- Defined terms are usually identified with an asterisk directing the reader to definitions in section 995-1. However, some basic terms are not defined.

- The numbering system indicates the relationship between different levels or units within the Act.

- Guides and non-operative materials are not legally binding but provide assistance in navigating the Act.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 375

251658240

Income Tax Assessment Act 1997

No. 38, 1997 as amended

Compilation start date: 18 March 2014

Includes amendments up to: Act No. 11, 2014

This compilation has been split into 11 volumes

Volume 1: sections 1-1 to 36-

Volume 2 sections 40-1 to 55-10

Volume ! sections 58-1 to 122-205

Volume 4 sections 124-1 to 152-4!0

Volume 5 sections 160-1 to 220-800

Volume 6 sections 2!0-1 to !12-15

Volume " sections !15#1 to 420#"0

Volume 8 sections 620-5 to "2"-$10

Volume $ sections "68-100 to $$5-1

Volume 10 %n¬es 1 to !

Volume 11 %n¬es 4 to 8

%ach volume has its o'n contents

(repare& b) the *++ice o+ (arliamentar) ,ounsel, ,anberra

A!out t"is compilation

T"is compilation

This is a compilation o+ the Income Tax Assessment Act 1997 as in +orce on

18 March 2014. -t inclu&es an) commence& amen&ment a++ectin. the le.islation

to that &ate.

This compilation 'as prepare& on 20 March 2014.

The notes at the en& o+ this compilation /the endnotes0 inclu&e in+ormation

about amen&in. la's an& the amen&ment histor) o+ each amen&e& provision.

#ncommenced amendments

The e++ect o+ uncommence& amen&ments is not re+lecte& in the te1t o+ the

compile& la' but the te1t o+ the amen&ments is inclu&e& in the en¬es.

Application, sa$in% and transitional pro$isions &or pro$isions and

amendments

-+ the operation o+ a provision or amen&ment is a++ecte& b) an application,

savin. or transitional provision that is not inclu&e& in this compilation, &etails

are inclu&e& in the en¬es.

'odi&ications

-+ a provision o+ the compile& la' is a++ecte& b) a mo&i+ication that is in +orce,

&etails are inclu&e& in the en¬es.

(ro$isions ceasin% to "a$e e&&ect

-+ a provision o+ the compile& la' has e1pire& or other'ise cease& to have

e++ect in accor&ance 'ith a provision o+ the la', &etails are inclu&e& in the

en¬es.

,ontents

Income Tax Assessment Act 1997 3

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

An Act a!out income tax and related matters

C"apter 1-Introduction and core pro$isions

(art 1*1-(reliminar.

+i$ision 1-(reliminar.

Ta!le o& sections

1#1 6hort title

1#2 ,ommencement

1#! 7i++erences in st)le not to a++ect meanin.

1#" A&ministration o+ this Act

1*1 /"ort title

This Act ma) be cite& as the Income Tax Assessment Act 1997.

1*) Commencement

This Act commences on 1 8ul) 1$$".

1*3 +i&&erences in st.le not to a&&ect meanin%

/10 This Act contains provisions o+ the Income Tax Assessment Act

1936 in a re'ritten +orm.

/20 -+

/a0 that Act e1presse& an i&ea in a particular +orm o+ 'or&s9 an&

/b0 this Act appears to have e1presse& the same i&ea in a

&i++erent +orm o+ 'or&s in or&er to use a clearer or simpler

st)le9

the i&eas are not to be ta4en to be &i++erent :ust because &i++erent

+orms o+ 'or&s 'ere use&.

Note A public or private rulin. about a provision o+ the Income Tax

Assessment Act 1936 is ta4en also to be a rulin. about the

correspon&in. provision o+ this Act, so +ar as the 2 provisions e1press

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

4 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

the same i&eas see section !5"#85 in 6che&ule 1 to the Taxation

Administration Act 1953.

1*7 Administration o& t"is Act

The ,ommissioner has the .eneral a&ministration o+ this Act.

Note An e++ect o+ this provision is that people 'ho ac=uire in+ormation

un&er this Act are sub:ect to the con+i&entialit) obli.ations an&

e1ceptions in 7ivision !55 in 6che&ule 1 to the Taxation

Administration Act 1953.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 5

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

(art 1*)-A 0uide to t"is Act

+i$ision )-1o2 to use t"is Act

Ta!le o& /u!di$isions

2#A >o' to +in& )our 'a) aroun&

2#? >o' the Act is arran.e&

2#, >o' to i&enti+) &e+ine& terms an& +in& the &e+initions

2#7 The numberin. s)stem

2#% 6tatus o+ 5ui&es an& other non#operative material

/u!di$ision )*A-1o2 to &ind .our 2a. around

)*1 T"e desi%n

This Act is &esi.ne& to help )ou i&enti+) accuratel) an& =uic4l) the

provisions that are relevant to )our purpose in rea&in. the income

ta1 la'.

The Act contains tables, &ia.rams an& si.nposts to help )ou

navi.ate )our 'a).

@ou can start at 7ivision ! /Ahat this Act is about0 an& +ollo' the

si.nposts as +ar into the Act as )ou nee& to .o. @ou ma) also

encounter si.nposts to several areas o+ the la' that are relevant to

)ou. %ach one shoul& be +ollo'e&.

6ometimes the) 'ill lea& &o'n throu.h several levels o+ &etail. At

each successive level, the rules are structure& in a similar 'a).

The) 'ill o+ten be prece&e& b) a 5ui&e to the rules at that level.

The rules themselves 'ill usuall) &eal +irst 'ith the .eneral or

most common case an& then 'ith the more particular or special

cases.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

6 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

/u!di$ision )*3-1o2 t"e Act is arran%ed

)* T"e p.ramid

This Act is arran.e& in a 'a) that re+lects the principle o+ movin.

+rom the .eneral case to the particular.

-n this respect, the conceptual structure o+ the Act is somethin. li4e

a p)rami&. The p)rami& shape illustrates the 'a) the income ta1

la' is or.anise&, movin. &o'n +rom the central or core provisions

at the top o+ the p)rami&, to .eneral rules o+ 'i&e application an&

then to the more specialise& topics.

251658240

Core

Provisions

Checklists

Specialist Groupings

(examples only)

Rules for

particular

industries &

occupations

General Provisions

Corporate

taxpayers

& corporate

distriutions

Super-

annuation

!nternational

aspects of

income taxation

"inancial

transactions

#dministration

$ictionary of terms and concepts

Core

Provisions

Checklists

Specialist Groupings

(examples only)

Rules for

particular

industries &

occupations

General Provisions

Corporate

taxpayers

& corporate

distriutions

Super-

annuation

!nternational

aspects of

income taxation

"inancial

transactions

#dministration

$ictionary of terms and concepts

Note The Taxation Administration Act 1953 contains the provisions on

collection an& recover) o+ ta1 an& provisions on a&ministration.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 7

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

/u!di$ision )*C-1o2 to identi&. de&ined terms and &ind t"e

de&initions

Ta!le o& sections

2#10 Ahen &e+ine& terms are i&enti+ie&

2#15 Ahen terms are not i&enti+ie&

2#20 -&enti+)in. the &e+ine& term in a &e+inition

)*1, 4"en de&ined terms are identi&ied

/10 Man) o+ the terms use& in the income ta1 la' are &e+ine&.

/20 Most &e+ine& terms in this Act are i&enti+ie& b) an asteris4

appearin. at the start o+ the term as in B

<

businessC. The +ootnote

that .oes 'ith the asteris4 contains a si.npost to the 7ictionar)

&e+initions startin. at section $$5#1.

)*1 4"en terms are not identi&ied

/10 *nce a &e+ine& term has been i&enti+ie& b) an asteris4, later

occurrences o+ the term in the same subsection are not usuall)

asteris4e&.

/20 Terms are not asteris4e& in the non#operative material containe& in

this Act.

Note The non#operative material is &escribe& in 6ub&ivision 2#%.

/!0 The +ollo'in. basic terms use& throu.hout the Act are not

i&enti+ie& 'ith an asteris4. The) +all into 2 .roups

Key participants in the income tax system

Ite

m

T"is term: is de&ined in:

1. Australian resi&ent section $$5#1

2. ,ommissioner section $$5#1

!. compan) section $$5#1

4. entit) section $60#100

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

8 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

4A. +orei.n resi&ent section $$5#1

5. in&ivi&ual section $$5#1

6. partnership section $$5#1

". person section $$5#1

8. trustee section $$5#1

$. )ou section 4#5

Core concepts

Ite

m

T"is term: is de&ined in:

1. amount section $$5#1

2. assessable income 7ivision 6

!. assessment section $$5#1

4. &e&uct, &e&uction 7ivision 8

5. income ta1 section $$5#1

6. income )ear section $$5#1

". ta1able income section 4#15

8. this Act section $$5#1

)*), Identi&.in% t"e de&ined term in a de&inition

Aithin a &e+inition, the &e+ine& term is i&enti+ie& b) bold italics.

/u!di$ision )*+-T"e num!erin% s.stem

Ta!le o& sections

2#25 (urposes

2#!0 5aps in the numberin.

)*) (urposes

T'o main purposes o+ the numberin. s)stem in this Act are

D To in&icate the relationship bet'een units at &i++erent

levels.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 9

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

Eor e1ample, the number o+ (art 2#15 in&icates that the (art is in

,hapter 2. 6imilarl), the number o+ section 165#"0 in&icates that the

section is in 7ivision 165.

D To allo' +or +uture e1pansion o+ the Act. The main

techni=ue here is leavin. .aps bet'een numbers.

)*3, 0aps in t"e num!erin%

There are .aps in the numberin. s)stem to allo' +or the insertion

o+ ne' 7ivisions an& sections.

/u!di$ision )*5-/tatus o& 0uides and ot"er non*operati$e

material

Ta!le o& sections

2#!5 Non#operative material

2#40 5ui&es

2#45 *ther material

)*3 Non*operati$e material

-n a&&ition to the operative provisions themselves, this Act

contains other material to help )ou i&enti+) accuratel) an& =uic4l)

the provisions that are relevant to )ou an& to help )ou un&erstan&

them.

This other material +alls into 2 main cate.ories.

)*6, 0uides

The +irst is the B5ui&esC. A Guide consists o+ sections un&er a

hea&in. in&icatin. that 'hat +ollo's is a 5ui&e to a particular

6ub&ivision, 7ivision etc.

5ui&es +orm part o+ this Act but are 4ept separate +rom the

operative provisions. -n interpretin. an operative provision, a

5ui&e ma) onl) be consi&ere& +or limite& purposes. These are set

out in section $50#150.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

10 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

)*6 7t"er material

The other cate.or) consists o+ material such as notes an&

e1amples. These also +orm part o+ the Act. The) are &istin.uishe&

b) t)pe siFe +rom the operative provisions, but are not 4ept

separate +rom them.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 11

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

+i$ision 3-4"at t"is Act is a!out

Ta!le o& sections

!#5 Annual income ta1

!#10 @our other obli.ations as a ta1pa)er

!#15 @our obli.ations other than as a ta1pa)er

3* Annual income tax

/10 -ncome ta1 is pa)able +or each )ear b) each in&ivi&ual an&

compan), an& b) some other entities.

Note 1 -n&ivi&uals 'ho are Australian resi&ents, an& some trustees, are also

liable to pa) Me&icare lev) +or each )ear. 6ee the Medicare e!y Act

1986 an& (art V--? o+ the Income Tax Assessment Act 1936.

Note 2 -ncome ta1 is impose& b) the Income Tax Act 1986 an& the other Acts

re+erre& to in the &e+inition o+ income tax in section $$5#1.

/20 Most entities have to pa) insta"ments o+ income ta1 be+ore the

income ta1 the) act#a""y have to pa) can be 'or4e& out.

/!0 This Act ans'ers these =uestions

1. Ahat instalments o+ income ta1 &o )ou have to pa)G Ahen

an& ho' &o )ou pa) themG

6ee 6che&ule 1 to the Taxation Administration Act 1953.

2. >o' &o )ou 'or4 out ho' much income ta1 )ou must pa)G

6ee 7ivision 4, startin. at section 4#1.

!. Ahat happens i+ )our income ta1 is more than the

instalments )ou have pai&G Ahen an& ho' must )ou pa) the

restG

6ee 7ivision 5 o+ this Act an& (art 4#15 in 6che&ule 1 to the Taxation

Administration Act 1953.

4. Ahat happens i+ )our income ta1 is "ess than the instalments

)ou have pai&G >o' &o )ou .et a re+un&G

6ee 7ivision !A o+ (art --? o+ the Taxation Administration Act 1953.

5. Ahat are )our other obli.ations as a ta1pa)er, besi&es pa)in.

instalments an& the rest o+ )our income ta1G

6ee section !#10.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

1$ Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

6. 7o )ou have an) other obli.ations un&er the income ta1 la'G

6ee section !#15.

". -+ a &ispute bet'een )ou an& the ,ommissioner o+ Ta1ation

cannot be settle& b) a.reement, 'hat proce&ures +or

ob:ection, revie' an& appeal are availableG

6ee (art -V, /sections 14H2 to 14HH60 o+ the Taxation

Administration Act 1953.

3*1, 8our ot"er o!li%ations as a taxpa.er

/10 ?esi&es pa)in. instalments an& the rest o+ )our income ta1, )our

main obli.ations as a ta1pa)er are

/a0 to 4eep recor&s an& provi&e in+ormation as re=uire& b)

D the Income Tax Assessment Act 19369 an&

D 7ivision $00 /'hich sets out substantiation rules0 o+ this

Act9 an&

/b0 to lo&.e income ta1 returns as re=uire& b)

D the Income Tax Assessment Act 1936.

Tax %i"e n#m&ers

/20 In&er (art VA o+ the Income Tax Assessment Act 1936, a ta1 +ile

number can be issue& to )ou. @ou are not obli.e& to appl) +or a ta1

+ile number. >o'ever, i+ )ou &o not =uote one in certain situations

D )ou ma) become liable +or instalments o+ income

ta1 that 'oul& not other'ise have been pa)able9

D the amount o+ certain o+ )our instalments o+

income ta1 ma) be increase&.

3*1 8our o!li%ations other than as a taxpa.er

@our main obli.ations un&er the income ta1 la', other than as a

ta1pa)er are

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 13

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

D in certain situations, to &e&uct +rom mone) )ou

o'e to another person, an& to remit to the

,ommissioner, instalments o+ income ta1 pa)able

b) that person.

6ee (art 4#5 /,ollection o+ income ta1 instalments0,

startin. at section "50#1.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

14 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

(art 1*3-Core pro$isions

+i$ision 6-1o2 to 2or9 out t"e income tax pa.a!le on

.our taxa!le income

Ta!le o& sections

4#1 Aho must pa) income ta1

4#5 Meanin. o+ yo#

4#10 >o' to 'or4 out ho' much income ta1 )ou must pa)

4#15 >o' to 'or4 out )our ta1able income

4#25 6pecial provisions +or 'or4in. out )our basic income ta1 liabilit)

6*1 4"o must pa. income tax

-ncome ta1 is pa)able b) each in&ivi&ual an& compan), an& b)

some other entities.

Note The actual amount o+ income ta1 pa)able ma) be nil.

Eor a list o+ the entities that must pa) income ta1,

see 7ivision $, startin. at section $#1.

6* 'eanin% o& you

-+ a provision o+ this Act uses the e1pression you, it applies to

entities .enerall), unless its application is e1pressl) limite&.

Note 1 The e1pression you is not use& in provisions that appl) onl) to entities

that are not in&ivi&uals.

Note 2 Eor circumstances in 'hich the i&entit) o+ an entit) that is a mana.e&

investment scheme +or the purposes o+ the Corporations Act $001 is

not a++ecte& b) chan.es to the scheme, see 6ub&ivision $60#% o+ the

Income Tax 'Transitiona" (ro!isions) Act 1997.

6*1, 1o2 to 2or9 out "o2 muc" income tax .ou must pa.

/10 @ou must pa) income ta1 +or each

<

+inancial )ear.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 15

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

/20 @our income ta1 is 'or4e& out b) re+erence to )our ta1able income

+or the income year. The income )ear is the same as the

<

+inancial

)ear, e1cept in these cases

/a0 +or a compan), the income )ear is the pre!io#s +inancial )ear9

/b0 i+ )ou have an accountin. perio& that is not the same as the

+inancial )ear, each such accountin. perio& or, +or a

compan), each previous accountin. perio& is an income )ear.

Note 1 The ,ommissioner can allo' )ou to a&opt an accountin. perio&

en&in. on a &a) other than !0 8une. 6ee section 18 o+ the Income Tax

Assessment Act 1936.

Note 2 An accountin. perio& en&s, an& a ne' accountin. perio& starts, 'hen

a partnership becomes, or ceases to be, a V,2(, an %6V,2(, an

AE*E or a V,M(. 6ee section 18A o+ the Income Tax Assessment Act

1936.

/!0 Aor4 out )our income ta1 +or the

<

+inancial )ear as +ollo's

251658240

Method statement

6tep 1. Aor4 out )our ta1able income +or the income )ear.

To &o this, see section 4#15.

6tep 2. Aor4 out )our basic income ta1 liabilit) on )our

ta1able income usin.

/a0 the income ta1 rate or rates that appl) to )ou +or

the income )ear9 an&

/b0 an) special provisions that appl) to 'or4in. out

that liabilit).

6ee the Income Tax *ates Act 1986 an& section 4#25.

6tep !. Aor4 out )our ta1 o++sets +or the income )ear. A tax

offset re&uces the amount o+ income ta1 )ou have to

pa).

Eor the list o+ ta1 o++sets, see section 1!#1.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

16 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

6tep 4. 6ubtract )our

<

ta1 o++sets +rom )our basic income ta1

liabilit). The result is ho' much income ta1 )ou o'e

+or the

<

+inancial )ear.

Note 1 7ivision 6! e1plains 'hat happens i+ )our ta1 o++sets e1cee& )our

basic income ta1 liabilit). >o' the e1cess is treate& &epen&s on the

t)pe o+ ta1 o++set.

Note 2 -n a&&ition to the income ta1 'or4e& out un&er this section, )ou ma)

also have to pa) a&&itional income ta1 /4no'n as temporar) +loo& an&

c)clone reconstruction lev)0 +or the 2011#12 +inancial )ear. 6ee

section 4#10 o+ the Income Tax 'Transitiona" (ro!isions) Act 1997.

Income tax +or,ed o#t on another &asis

/40 Eor some entities, some or all o+ their income ta1 +or the

<

+inancial

)ear is 'or4e& out b) re+erence to somethin. other than ta1able

income +or the income )ear.

6ee section $#5.

6*1 1o2 to 2or9 out .our taxa!le income

/10 Aor4 out )our taxable income +or the income )ear li4e this

251658240

Method statement

6tep 1. A&& up all )our assessable income +or the income )ear.

To +in& out about )our assessable income, see 7ivision 6.

6tep 2. A&& up )our &e&uctions +or the income )ear.

To +in& out 'hat )ou can &e&uct, see 7ivision 8.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 17

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

6tep !. 6ubtract )our &e&uctions +rom )our assessable income

/unless the) e1cee& it0. The result is )our ta1able

income. /-+ the &e&uctions e=ual or e1cee& the

assessable income, )ou &onJt have a ta1able income.0

Note -+ the &e&uctions e1cee& the assessable income, )ou ma) have a ta1

loss 'hich )ou ma) be able to utilise in that or a later income )ear

see 7ivision !6.

/20 There are cases 'here ta1able income is 'or4e& out in a special

'a)

Ite

m

:or t"is case ... /ee:

1. A compan) &oes not maintain

continuit) o+ o'nership an& control

&urin. the income )ear an& &oes not

satis+) the same business test

6ub&ivision 165#?

1?.

An entit) is a

<

member o+ a

<

consoli&ate& .roup at an) time in the

income )ear

(art !#$0

2. A compan) becomes a (7E /poole&

&evelopment +un&0 &urin. the income

)ear, an& the (7E component +or the

income )ear is a nil amount

section 124HTA o+

the Income Tax

Assessment Act 1936

!. A shipo'ner or charterer

has its principal place o+ business

outsi&e Australia9 an&

carries passen.ers, +rei.ht or mail

shippe& in Australia

section 12$ o+ the

-ncome Tax

Assessment Act 1936

4. An insurer 'ho is a +orei.n resi&ent

enters into insurance contracts

connecte& 'ith Australia

sections 142 an& 14!

o+ the Income Tax

Assessment Act 1936

5. The ,ommissioner ma4es a &e+ault or

special assessment o+ ta1able income

sections 16" an& 168

o+ the Income Tax

Assessment Act 1936

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

18 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

6. The ,ommissioner ma4es a

&etermination o+ the amount o+ ta1able

income to prevent &ouble ta1ation in

certain treat) cases

section 24 o+ the

Internationa" Tax

A-reements Act 1953

Note A li+e insurance compan) can have a ta1able income o+ the compl)in.

superannuationKE>6A class an&Kor a ta1able income o+ the or&inar)

class +or the purposes o+ 'or4in. out its income ta1 +or an income

)ear see 6ub&ivision !20#7.

6*) /pecial pro$isions &or 2or9in% out .our !asic income tax

lia!ilit.

The +ollo'in. provisions ma) increase )our basic income ta1

liabilit) be)on& the liabilit) 'or4e& out simpl) b) appl)in. the

income ta1 rates to )our ta1able income

/a0 6ub&ivision !55#59

/b0 subsection !$2#!5/!0.

Note 1 6ub&ivision !55#5 increases some entitiesJ ta1 liabilit) b) re=uirin.

them to pa) e1tra income ta1 on .overnment recoupments relatin. to

3L7 activities +or 'hich entitlements to ta1 o++sets arise un&er

7ivision !55.

Note 2 6ubsection !$2#!5/!0 increases some primar) pro&ucersJ ta1 liabilit)

b) re=uirin. them to pa) e1tra income ta1 on their avera.in.

components 'or4e& out un&er 6ub&ivision !$2#,.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 19

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

+i$ision -1o2 to 2or9 out 2"en to pa. .our income tax

Ta!le o& /u!di$isions

5ui&e to 7ivision 5

5#A >o' to 'or4 out 'hen to pa) )our income ta1

0uide to +i$ision

*1 4"at t"is +i$ision is a!out

-+ )our assesse& income ta1 liabilit) e1cee&s the cre&its

available to )ou un&er the (A@5 s)stem, this 7ivision e1plains

+hen )ou must pa) the e1cess to the ,ommissioner.

-+ )our assessment is amen&e& so that )ou must pa) income ta1,

or pa) more income ta1 than un&er the previous assessment, this

7ivision e1plains

/a0 +hen )ou must pa) the a&&itional ta19 an&

/b0 +hen an) associate& interest char.es must be

pai&.

Note Eor provisions about the collection an& recover) o+

income ta1 an& other ta1#relate& liabilities, see

(art 4#15 in 6che&ule 1 to the Taxation

Administration Act 1953.

/u!di$ision *A-1o2 to 2or9 out 2"en to pa. .our income

tax

Ta!le o& sections

5#5 Ahen income ta1 is pa)able

5#10 Ahen short+all interest char.e is pa)able

5#15 5eneral interest char.e pa)able on unpai& income ta1 or short+all interest

char.e

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

$0 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

* 4"en income tax is pa.a!le

.cope

/10 This section tells )ou 'hen income ta1 )ou must pa) +or a

<

+inancial )ear is &ue an& pa)able.

Note The ,ommissioner ma) &e+er the time at 'hich the income ta1 is &ue

an& pa)able see section 255#10 in 6che&ule 1 to the Taxation

Administration Act 1953.

/20 The income ta1 is onl) &ue an& pa)able i+ the ,ommissioner

ma4es an

<

assessment o+ )our income ta1 +or the )ear.

/!0 >o'ever, i+ the ,ommissioner &oes ma4e an

<

assessment o+ )our

income ta1 +or the )ear, the ta1 ma) be ta4en to have been &ue an&

pa)able at a time be+ore )our assessment 'as ma&e.

Note This is to ensure that .eneral interest char.e be.ins to accrue +rom the

same &ate +or all li4e entities. 5eneral interest char.e on unpai&

income ta1 is calculate& +rom 'hen the ta1 is &ue an& pa)able, not

+rom 'hen the assessment is ma&e see section 5#15.

/ri-ina" assessments0se"%1assessment entities

/40 -+ )ou are a

<

sel+#assessment entit), the income ta1 is &ue an&

pa)able on the +irst &a) o+ the si1th month a+ter the en& o+ the

income )ear.

%1ample -+ )our income )ear is the same as the +inancial )ear, )our income ta1

'oul& be &ue an& pa)able on 1 7ecember.

/ri-ina" assessments0other entities

/50 -+ )ou are not a

<

sel+#assessment entit), the income ta1 is &ue an&

pa)able 21 &a)s a+ter the &a) /the return day0 on or be+ore 'hich

)ou are re=uire& to lo&.e )our

<

income ta1 return 'ith the

,ommissioner.

Note Eor rules about income ta1 returns an& 'hen the) are &ue, see (art -V

o+ the Income Tax Assessment Act 1936.

/60 >o'ever, i+ )ou lo&.e )our return on or &e%ore the return &a) an&

the ,ommissioner .ives )ou a notice o+

<

assessment /other than an

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 $1

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

amen&e& assessment0 a%ter the return &a), the income ta1 is &ue

an& pa)able 21 &a)s a+ter the ,ommissioner .ives )ou the notice.

Amended assessments

/"0 -+ the ,ommissioner amen&s )our

<

assessment, an) e1tra income

ta1 resultin. +rom the amen&ment is &ue an& pa)able 21 &a)s a+ter

the &a) on 'hich the ,ommissioner .ives )ou notice o+ the

amen&e& assessment.

Note 6hort+all interest char.e ma) be pa)able, on an) amount o+ e1tra

income ta1 pa)able as a result o+ the amen&e& assessment, +or each

&a) in the perio& that

/a0 starts at the time income ta1 'as &ue an& pa)able on )our

ori.inal assessment9 an&

/b0 en&s the &a) be+ore the &a) on 'hich the ,ommissioner .ives

)ou notice o+ the amen&e& assessment.

*1, 4"en s"ort&all interest c"ar%e is pa.a!le

An amount o+

<

short+all interest char.e that )ou are liable to pa) is

&ue an& pa)able 21 &a)s a+ter the &a) on 'hich the ,ommissioner

.ives )ou notice o+ the char.e.

Note 6hort+all interest char.e is impose& i+ the ,ommissioner amen&s an

assessment an& the amen&e& assessment results in an increase in some

ta1 pa)able. Eor provisions about liabilit) +or short+all interest char.e,

see 7ivision 280 in 6che&ule 1 to the Taxation Administration Act

1953.

*1 0eneral interest c"ar%e pa.a!le on unpaid income tax or

s"ort&all interest c"ar%e

-+ an amount o+ income ta1 or

<

short+all interest char.e that )ou are

liable to pa) remains unpai& a+ter the time b) 'hich it is &ue to be

pai&, )ou are liable to pa) the

<

.eneral interest char.e on the

unpai& amount +or each &a) in the perio& that

/a0 starts at the be.innin. o+ the &a) on 'hich the amount 'as

&ue to be pai&9 an&

/b0 +inishes at the en& o+ the last &a) on 'hich, at the en& o+ the

&a), an) o+ the +ollo'in. remains unpai&

/i0 the income ta1 or short+all interest char.e9

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

$$ Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

/ii0 .eneral interest char.e on an) o+ the income ta1 or

short+all interest char.e.

Note 1 The .eneral interest char.e is 'or4e& out un&er (art --A o+ the

Taxation Administration Act 1953.

Note 2 6hort+all interest char.e is 'or4e& out un&er 7ivision 280 in

6che&ule 1 to that Act.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 $3

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

+i$ision 6-Assessa!le income and exempt income

0uide to +i$ision 6

Ta!le o& sections

6#1 7ia.ram sho'in. relationships amon. concepts in this 7ivision

7perati$e pro$isions

6#5 -ncome accor&in. to or&inar) concepts /ordinary income0

6#10 *ther assessable income /stat#tory income0

6#15 Ahat is not assessable income

6#20 %1empt income

6#2! Non#assessable non#e1empt income

6#25 3elationships amon. various rules about or&inar) income

6*1 +ia%ram s"o2in% relations"ips amon% concepts in t"is +i$ision

Non-assessable

Exempt income

Assessableincome

Ordinaryincome

Statutoryincome

non-exempt income

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

$4 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

/10 Assessable income consists o+ or&inar) income an& statutor)

income.

/20 6ome or&inar) income, an& some statutor) income, is e1empt

income.

/!0 %1empt income is not assessable income.

/40 6ome or&inar) income, an& some statutor) income, is neither

assessable income nor e1empt income.

Eor the e++ect o+ the 56T in 'or4in. out assessable income, see 7ivision 1".

/50 An amount o+ or&inar) income or statutor) income can have onl)

one status /that is, assessable income, e1empt income or

non#assessable non#e1empt income0 in the han&s o+ a particular

entit).

*perative provisions

6#5 -ncome accor&in. to or&inar) concepts /ordinary income0

/10 @our assessable income inclu&es income accor&in. to or&inar)

concepts, 'hich is calle& ordinary income.

Note 6ome o+ the provisions about assessable income liste& in section 10#5

ma) a++ect the treatment o+ or&inar) income.

/20 -+ )ou are an Australian resi&ent, )our assessable income inclu&es

the

<

or&inar) income )ou

<

&erive& &irectl) or in&irectl) +rom all

sources, 'hether in or out o+ Australia, &urin. the income )ear.

/!0 -+ )ou are a +orei.n resi&ent, )our assessable income inclu&es

/a0 the

<

or&inar) income )ou

<

&erive& &irectl) or in&irectl) +rom

all

<

Australian sources &urin. the income )ear9 an&

/b0 other

<

or&inar) income that a provision inclu&es in )our

assessable income +or the income )ear on some basis other

than havin. an

<

Australian source.

/40 -n 'or4in. out 'hether )ou have derived an amount o+

<

or&inar)

income, an& /i+ so0 'hen )ou derived it, )ou are ta4en to have

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 $5

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

receive& the amount as soon as it is applie& or &ealt 'ith in an)

'a) on )our behal+ or as )ou &irect.

6#10 *ther assessable income /stat#tory income0

/10 @our assessable income also inclu&es some amounts that are not

<

or&inar) income.

Note These are inclu&e& b) provisions about assessable income.

Eor a summar) list o+ these provisions, see section 10#5.

/20 Amounts that are not

<

or&inar) income, but are inclu&e& in )our

assessable income b) provisions about assessable income, are

calle& statutory income.

Note 1 Althou.h an amount is statutor) income because it has been inclu&e&

in assessable income un&er a provision o+ this Act, it ma) be ma&e

e1empt income or non#assessable non#e1empt income un&er another

provision see sections 6#20 an& 6#2!.

Note 2 Man) provisions in the summar) list in section 10#5 contain rules

about or&inar) income. These rules &o not chan.e its character as

or&inar) income.

/!0 -+ an amount 'oul& be

<

statutor) income apart +rom the +act that

)ou have not receive& it, it becomes statutor) income as soon as it

is applie& or &ealt 'ith in an) 'a) on )our behal+ or as )ou &irect.

/40 -+ )ou are an Australian resi&ent, )our assessable income inclu&es

)our

<

statutor) income +rom all sources, 'hether in or out o+

Australia.

/50 -+ )ou are a +orei.n resi&ent, )our assessable income inclu&es

/a0 )our

<

statutor) income +rom all

<

Australian sources9 an&

/b0 other

<

statutor) income that a provision inclu&es in )our

assessable income on some basis other than havin. an

<

Australian source.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

$6 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

6#15 Ahat is not assessable income

/10 -+ an amount is not

<

or&inar) income, an& is not

<

statutor) income,

it is not assessable income /so )ou &o not have to pa) income ta1

on it0.

/20 -+ an amount is

<

e1empt income, it is not assessable income.

Note -+ an amount is e1empt income, there are other conse=uences besi&es

it bein. e1empt +rom income ta1. Eor e1ample

0< the amount ma) be ta4en into account in 'or4in. out the amount

o+ a ta1 loss /see section !6#1009

1< )ou cannot &e&uct as a .eneral &e&uction a loss or out.oin.

incurre& in &erivin. the amount /see 7ivision 809

2< capital .ains an& losses on assets use& solel) to pro&uce e1empt

income are &isre.ar&e& /see section 118#120.

/!0 -+ an amount is

<

non#assessable non#e1empt income, it is not

assessable income.

Note 1 @ou cannot &e&uct as a .eneral &e&uction a loss or out.oin. incurre&

in &erivin. an amount o+ non#assessable non#e1empt income /see

7ivision 80.

Note 2 ,apital .ains an& losses on assets use& to pro&uce some t)pes o+

non#assessable non#e1empt income are &isre.ar&e& /see

section 118#120.

6#20 %1empt income

/10 An amount o+

<

or&inar) income or

<

statutor) income is exempt

income i+ it is ma&e e1empt +rom income ta1 b) a provision o+ this

Act or another

<

,ommon'ealth la'.

Eor summar) lists o+ provisions about e1empt income,

see sections 11#5 an& 11#15.

/20

<

*r&inar) income is also exempt income to the e1tent that this Act

e1clu&es it /e1pressl) or b) implication0 +rom bein. assessable

income.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 $7

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

/!0 ?) contrast, an amount o+

<

statutor) income is exempt income

onl) i+ it is ma&e e1empt +rom income ta1 b) a provision o+ this

Act outsi&e this 7ivision or another

<

,ommon'ealth la'.

/40 -+ an amount o+

<

or&inar) income or

<

statutor) income is

<

non#assessable non#e1empt income, it is not exempt income.

Note An amount o+ non#assessable non#e1empt income is not ta4en into

account in 'or4in. out the amount o+ a ta1 loss.

6#2! Non#assessable non#e1empt income

An amount o+

<

or&inar) income or

<

statutor) income is

non-assessable non-exempt income i+ a provision o+ this Act or o+

another

<

,ommon'ealth la' states that it is not assessable income

an& is not

<

e1empt income.

Note ,apital .ains an& losses on assets use& to pro&uce some t)pes o+

non#assessable non#e1empt income are &isre.ar&e& /see

section 118#120.

Eor a summar) list o+ provisions about non#assessable non#e1empt income, see

6ub&ivision 11#?.

6#25 3elationships amon. various rules about or&inar) income

/10 6ometimes more than one rule inclu&es an amount in )our

assessable income

D the same amount ma) be

<

or&inar) income an& ma) also

be inclu&e& in )our assessable income b) one or more

provisions about assessable income9 or

D the same amount ma) be inclu&e& in )our assessable

income b) more than one provision about assessable

income.

Eor a summar) list o+ the provisions about assessable income,

see section 10#5.

>o'ever, the amount is inclu&e& onl) once in )our assessable

income +or an income )ear, an& is then not inclu&e& in )our

assessable income +or an) other income )ear.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

$8 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

/20 Inless the contrar) intention appears, the provisions o+ this Act

/outsi&e this (art0 prevail over the rules about

<

or&inar) income.

Note This Act contains some speci+ic provisions about ho' +ar the rules

about or&inar) income prevail over the other provisions o+ this Act.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 $9

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

7ivision 8M7e&uctions

Table o+ sections

8#1 5eneral &e&uctions

8#5 6peci+ic &e&uctions

8#10 No &ouble &e&uctions

8#1 5eneral &e&uctions

/10 @ou can deduct +rom )our assessable income an) loss or out.oin.

to the e1tent that

/a0 it is incurre& in .ainin. or pro&ucin. )our assessable income9

or

/b0 it is necessaril) incurre& in carr)in. on a

<

business +or the

purpose o+ .ainin. or pro&ucin. )our assessable income.

Note 7ivision !5 prevents losses +rom non#commercial business activities

that ma) contribute to a ta1 loss bein. o++set a.ainst other assessable

income.

/20 >o'ever, )ou cannot &e&uct a loss or out.oin. un&er this section

to the e1tent that

/a0 it is a loss or out.oin. o+ capital, or o+ a capital nature9 or

/b0 it is a loss or out.oin. o+ a private or &omestic nature9 or

/c0 it is incurre& in relation to .ainin. or pro&ucin. )our

<

e1empt

income or )our

<

non#assessable non#e1empt income9 or

/&0 a provision o+ this Act prevents )ou +rom &e&uctin. it.

Eor a summar) list o+ provisions about &e&uctions, see section 12#5.

/!0 A loss or out.oin. that )ou can &e&uct un&er this section is calle& a

general deduction.

Eor the e++ect o+ the 56T in 'or4in. out &e&uctions, see 7ivision 2".

Note -+ )ou receive an amount as insurance, in&emnit) or other recoupment

o+ a loss or out.oin. that )ou can &e&uct un&er this section, the

amount ma) be inclu&e& in )our assessable income see

6ub&ivision 20#A.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

30 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

8#5 6peci+ic &e&uctions

/10 @ou can also deduct +rom )our assessable income an amount that a

provision o+ this Act /outsi&e this 7ivision0 allo's )ou to &e&uct.

/20 6ome provisions o+ this Act prevent )ou +rom &e&uctin. an amount

that )ou coul& other'ise &e&uct, or limit the amount )ou can

&e&uct.

/!0 An amount that )ou can &e&uct un&er a provision o+ this Act

/outsi&e this 7ivision0 is calle& a specific deduction.

Note -+ )ou receive an amount as insurance, in&emnit) or other recoupment

o+ a &e&uctible e1pense, the amount ma) be inclu&e& in )our

assessable income see 6ub&ivision 20#A.

Eor a summar) list o+ provisions about &e&uctions, see section 12#5.

8#10 No &ouble &e&uctions

-+ 2 or more provisions o+ this Act allo' )ou &e&uctions in respect

o+ the same amount /'hether +or the same income )ear or &i++erent

income )ears0, )ou can &e&uct onl) un&er the provision that is

most appropriate.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 31

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

(art 1#4M,hec4lists o+ 'hat is covere& b) concepts

use& in the core provisions

7ivision $M%ntities that must pa) income ta1

Table o+ sections

$#1A %++ect o+ this 7ivision

$#1 2ist o+ entities

$#5 %ntities that 'or4 out their income ta1 b) re+erence to somethin. other than

ta1able income

$#1A %++ect o+ this 7ivision

This 7ivision is a

<

5ui&e.

$#1 2ist o+ entities

-ncome ta1 is pa)able b) the entities liste& in the table.

(rovisions o+ the Income Tax Assessment Act 1997 are i&enti+ie& in

normal te1t. The other provisions, in !old, are provisions o+ the

Income Tax Assessment Act 1936.

Ite

m

Income tax is pa.a!le !. t"is 9ind o&

entit.:

!ecause o& t"is

pro$ision:

1 An in&ivi&ual section 4#1

2 A compan), that is

a bo&) corporate9 or

an unincorporate& bo&) /e1cept a

partnership0

section 4#1

! A compan) that 'as a member o+ a

'holl)#o'ne& .roup i+ a +ormer subsi&iar) in

the .roup is treate& as havin. &ispose& o+

lease& plant an& &oes not pa) all o+ the

income ta1 resultin. +rom that treatment

section 45#25

4 A superannuation provi&er in relation to a

compl)in. superannuation +un&

sections 2$5#5

an& 2$5#605

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

3$ Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

5 A superannuation provi&er in relation to a

non#compl)in. superannuation +un&

sections 2$5#5

an& 2$5#605

6 A superannuation provi&er in relation to a

compl)in. approve& &eposit +un&

section 2$5#5

" A superannuation provi&er in relation to a

non#compl)in. approve& &eposit +un&

section 2$5#5

8 The trustee o+ a poole& superannuation trust section 2$5#5

8A An E>6A provi&er in relation to an E>6A

trust

section !45#5

$ A corporate limite& partnership section 96;

10 A mutual insurance association /as &escribe&

in section 1210

section 1)1

11 A trustee /e1cept one covere& b) another

item in this table0, but onl) in respect o+

some 4in&s o+ income o+ the trust

sections 98, 99,

99A and 1,)

12 The trustee o+ a corporate unit trust section 1,)<

1! The trustee o+ a public tra&in. trust section 1,)/

$#5 %ntities that 'or4 out their income ta1 b) re+erence to somethin.

other than ta1able income

/10 Eor some entities, some or all o+ their income ta1 +or the

<

+inancial

)ear is 'or4e& out as &escribe& in the table.

(rovisions o+ the Income Tax Assessment Act 1997 are i&enti+ie& in

normal te1t. The other provisions, in !old, are provisions o+ the

Income Tax Assessment Act 19362

Ite

m

T"is 9ind o& entit. is lia!le to pa.

income tax 2or9ed out !. re&erence to:

/ee:

1 A compan) that 'as a member o+ a

'holl)#o'ne& .roup is :ointl) an&

severall) liable to pa) an amount o+

income ta1 i+ a +ormer subsi&iar) in the

.roup is treate& as havin. &ispose& o+

lease& plant an& &oes not pa) all o+ the

income ta1 resultin. +rom that treatment.

section 45#25

2 A superannuation provi&er in relation to a sections 2$5#5

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 33

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

compl)in. superannuation +un& is to be

assesse& an& is liable to pa) income ta1 on

no#TEN contributions income as 'ell as on

ta1able income.

an& 2$5#605

! A superannuation provi&er in relation to a

non#compl)in. superannuation +un& is to

be assesse& an& is liable to pa) income ta1

on no#TEN contributions income as 'ell as

on ta1able income.

sections 2$5#5

an& 2$5#605

4 An 36A provi&er is to be assesse& an& is

liable to pa) income ta1 on no#TEN

contributions income as 'ell as on ta1able

income.

sections 2$5#5,

2$5#605 an&

!20#155

4A An entit) is liable to pa) e1tra income ta1

on .overnment recoupments relatin. to

3L7 activities +or 'hich entitlements to

ta1 o++sets arise un&er 7ivision !55.

6ub&ivision !55#

5

5 An Australian resi&ent in&ivi&ual 'ith

eli.ible +orei.n remuneration un&er

section 2!AE9 or

+orei.n earnin.s un&er section 2!A59

/+rom 'or4in. in a +orei.n countr)0 is

liable to pa) income ta1 'or4e& out b)

re+erence to his or her assessable income

less some o+ his or her &e&uctions.

section )3A: or

)3A0

6 A trustee covere& b) item 11 in the table in

section $#1 is liable to pa) income ta1

'or4e& out b) re+erence to the net income

o+ the trust +or the income )ear.

sections 98, 99

and 99A

" The trustee o+ a corporate unit trust is

liable to pa) income ta1 'or4e& out b)

re+erence to the net income o+ the trust +or

the income )ear.

section 1,)<

8 The trustee o+ a public tra&in. trust is

liable to pa) income ta1 'or4e& out b)

re+erence to the net income o+ the trust +or

the income )ear.

section 1,)/

$ An entit) that is liable to pa) income ta1

/'or4e& out b) re+erence to ta1able

section 1)11

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

34 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

income or other'ise0 is also liable to pa)

income ta1 'or4e& out b) re+erence to

&iverte& income or &iverte& trust income

+or the income )ear.

10 An Australian insurer that re#insures

overseas can elect to pa), as a.ent +or the

re#insurer, income ta1 'or4e& out b)

re+erence to the amount o+ the re#insurance

premiums.

section 168

/20 Eor entities covere& b) an item in the table in subsection /10, the

income year is the same as the

<

+inancial )ear, e1cept in these

cases

/a0 +or a compan), or an entit) covere& b) item 2 or ! in the

table, the income )ear is the pre!io#s +inancial )ear9

/b0 i+ an entit) has an accountin. perio& that is not the same as

the +inancial )ear, each such accountin. perio& or, +or a

compan), each previous accountin. perio& is an income )ear.

Note 1 The ,ommissioner can allo' an entit) to a&opt an accountin. perio&

en&in. on a &a) other than !0 8une. 6ee section 18 o+ the Income Tax

Assessment Act 1936.

Note 2 An accountin. perio& en&s, an& a ne' accountin. perio& starts, 'hen

a partnership becomes, or ceases to be, a V,2(, an %6V,2(, an

AE*E or a V,M(. 6ee section 18A o+ the Income Tax Assessment Act

1936.

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 35

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

7ivision 10M(articular 4in&s o+ assessable income

10#1 %++ect o+ this 7ivision

This 7ivision is a

<

5ui&e.

10#5 2ist o+ provisions about assessable income

The provisions set out in the table

D inclu&e in )our assessable income amounts that are not

<

or&inar) income9 an&

D var) or replace the rules that 'oul& other'ise appl) +or

certain 4in&s o+

<

or&inar) income.

(rovisions o+ the Income Tax Assessment Act 1997 are i&enti+ie& in

normal te1t. The other provisions, in !old, are provisions o+ the

Income Tax Assessment Act 19362

Accrue& leave trans+er pa)ments

................................................................................

15#5

alienate& personal services income

................................................................................

86#15

allo'ances

see emp"oyment

annual leave

see "ea!e payments

annuities

................................................................................

)71

approve& &eposit +un& /A7Es0

see s#perann#ation

attributable income

see contro""ed %orei-n corporations

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

36 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

avoi&ance o+ ta1

.eneral

................................................................................

177:

&iversion o+ income

................................................................................

1)11

see also trans%ers o% income

ba& &ebts

see reco#pment

balancin. a&:ustment

see capita" a""o+ances, in!estments, *34, scienti%ic

research an& tax exempt entities

ban4in.

o++shore ban4in. activities, income +rom

................................................................................

1)150=1>

o++shore ban4in. unit, &eeme& interest on pa)ments

to b) o'ner

................................................................................

1)15<

barter transactions

..........

................................................................................

)1, )1A, 15#2

bene+iciaries

see tr#sts

bene+its

business, non#cash

................................................................................

)1A

consi&eration, non#cash

................................................................................

)1

meals )ou provi&e in an in#house &inin. +acilit)

................................................................................

!2#"0

see also emp"oyment an& s#perann#ation

bonus shares

see shares

bounties

..........

................................................................................

15#10

capital allo'ances

e1cess o+ termination value over a&:ustable value

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 37

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

.enerall)

....................................................................

40#285

+or some cars

....................................................................

40#!"0

&epreciatin. asset in lo'#value pool

................................................................................

40#445/20

e1pen&iture in so+t'are &evelopment pool

................................................................................

40#460

recover) o+ petroleum resource rent ta1

................................................................................

40#"50/!0

capital .ains

................................................................................

102#5

see also ins#rance

car e1penses

cents per 4ilometres reimbursement o+

................................................................................

15#"0

carrie& interests

carrie& interests, not or&inar) income

................................................................................

118#21

,E,s

see contro""ed %orei-n corporations

charters

see shippin-

chil&

non#trust income o+, unearne&

................................................................................

1,)A5

trust income o+, unearne&

................................................................................

1,)A0

collectin. societies

pa)ments o+ ro)alties b) cop)ri.ht collectin.

societies

................................................................................

15#22

pa)ments o+ ro)alties b) resale ro)alt) collectin.

societ)

................................................................................

15#2!

compan)

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

38 Income Tax Assessment Act 1997

2iabilit) rules o+ .eneral application C"apter )

3ules about &e&uctibilit) o+ particular 4in&s o+ amounts (art )*

5i+ts or contributions +i$ision 3,

6ection !0#5

see contro""ed %orei-n corporations, co1operati!e

company, directors, di!idends, "i5#idation,

shareho"ders an& shares

compensation

live stoc4 or trees, recoveries +or loss o+

................................................................................

!85#1!0

pro+its or income, insurance or in&emnit) +or loss o+

................................................................................

15#!0

receive& b) lessor +or lesseeJs non#compliance 'ith

lease obli.ation to repair

................................................................................

15#25

tra&in. stoc4, insurance or in&emnit) +or loss o+

................................................................................

"0#115

see also ins#rance, "i!e stoc,, reco#pment an&

scienti%ic research

consi&eration

see &ene%its

consoli&ate& .roups an& M%, .roups

Assets in relation to 7ivision 2!0 +inancial

arran.ement

................................................................................

"01#61/!0

controlle& +orei.n corporations /,E,s0

attributable income o+

................................................................................

66 to 69A

see also di!idends an& taxes

co#operative compan)

receipts o+

................................................................................

119

cre&it union

see co1operati!e company

currenc) .ains

see %orei-n exchan-e

currenc) losses

see reco#pment

&eath

see tr#sts

&ebtKe=uit) s'ap

see shares an& #nits

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

<

To +in& &e+initions o+ asteris4e& terms, see the 7ictionar), startin. at section $$5#1.

Income Tax Assessment Act 1997 39

C"apter ) 2iabilit) rules o+ .eneral application

(art )* 3ules about &e&uctibilit) o+ particular 4in&s o+ amounts

+i$ision 3, 5i+ts or contributions

6ection !0#10

&e+ence +orces

allo'ances an& bene+its +or service as a member o+

................................................................................

15#2

&epreciation

see capita" a""o+ances

&irectors

e1cessive remuneration or retirement pa)ment +rom

compan)

................................................................................

1,9

&istributions

see di!idends

&ivi&en&s

bene+it o+ 2-, capital .ain throu.h a trust or

partnership

................................................................................

115#280

.eneral

................................................................................

66=1>

&istribution +rom a controlle& +orei.n corporation