Professional Documents

Culture Documents

Sample Forensic Audit 26045678

Sample Forensic Audit 26045678

Uploaded by

KNOWLEDGE SOURCE0 ratings0% found this document useful (0 votes)

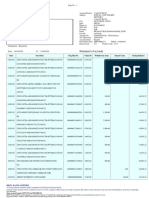

175 views15 pagesThis forensic audit report summarizes a $278,000 mortgage loan taken out by Roxana Bohana in 2006. The report found issues with the loan's underwriting, high interest rate of 8.125%, yield spread premium paid to the broker of $2,780, and potential violations of the Truth in Lending Act, Real Estate Settlement Procedures Act, and indicators of predatory lending. In total, the report identified 17 possible lending violations and recommended further discovery be conducted to determine the true owner of the loan.

Original Description:

AUDIT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis forensic audit report summarizes a $278,000 mortgage loan taken out by Roxana Bohana in 2006. The report found issues with the loan's underwriting, high interest rate of 8.125%, yield spread premium paid to the broker of $2,780, and potential violations of the Truth in Lending Act, Real Estate Settlement Procedures Act, and indicators of predatory lending. In total, the report identified 17 possible lending violations and recommended further discovery be conducted to determine the true owner of the loan.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

175 views15 pagesSample Forensic Audit 26045678

Sample Forensic Audit 26045678

Uploaded by

KNOWLEDGE SOURCEThis forensic audit report summarizes a $278,000 mortgage loan taken out by Roxana Bohana in 2006. The report found issues with the loan's underwriting, high interest rate of 8.125%, yield spread premium paid to the broker of $2,780, and potential violations of the Truth in Lending Act, Real Estate Settlement Procedures Act, and indicators of predatory lending. In total, the report identified 17 possible lending violations and recommended further discovery be conducted to determine the true owner of the loan.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 15

1

AJ STEPHENS AND ASSOCIATES, INC.

A CERTIFIED FORENSIC LOAN AUDITING FIRM

43 Sky line Drive Suite 3001Lake Mary, FL. 32746

Ph: 407-369-6671; Joseph@HomeSafeLoanAudits.com

www.HomeSafeLoanAudits.com

Forensic Audit Report

Prepared for:

Law Office of

Borrower(s): ROXANA BOHANA

Property: 1382 Humdinger Drive, Orlando, FL 32808

December 5, 2011

- 2 -

TABLE OF CONTENTS

Advisory Letter 3

Introduction 5

Report Summary 6

Summary of Loan Terms 7

Financial & Underwriting Analysis 8

Truth in Lending Act Analysis 10

HOEPA/Cal. Fin. Code 4970 Analysis 11

RESPA Analysis 12

Predatory Indicators 13

Additional Claims Analysis 14

- 3 -

12/05/2011

Attorney

Law Firm

Orlando, Florida

Re: Forensic Audit for Mrs. Roxana Bohana

Loan #: 26040258

Dear Audit Recipient:

The loan transaction for the above-referenced borrower/property has been audited

for violations

of the Truth in Lending Act [16 U.S.C. 1601] (TILA), Home Ownership Equity Protection

Act [12 C.F.R. 226.32 et seq.] (HOEPA), Florida Financial Code 658.12 - 658.995 et seq., the

Real Estate Settlement Procedures Act [12 U.S.C. 2601] (RESPA), and to the extent

applicable, violations of other state and federal laws discussed below.

This report was based exclusively on the documentation provided. It also required that we make

reasonable assumptions respecting disclosures and certain loan terms that, if erroneous, may

result in material differences between our findings and the loans actual compliance with

applicable regulatory requirements. While we believe that our assumptions provide a reasonable

basis for the review results, we make no representations or warranties respecting the

appropriateness of our assumptions, the completeness of the information considered, or the

accuracy of the findings.

The contents of this report are being provided with the understanding that we are not providing

legal advice, nor do we have any relationship, contractual or otherwise, with anyone other than

the recipient. We do not, in providing this report, accept or assume responsibility for any other

purpose.

Sincerely,

Paula Mooshagian

Senior Certified Forensic Loan Auditor

AJ STEPHENS AND ASSOCIATES, INC.

43 Sky line Drv. Suite 3001

Lake Mary, FL. 32746

407-369-6671

1

Please note that a complete mortgage servicing audit (i.e., audit for RESPA and/or breach of contract

violations for the entire servicing history of the loan) is not included in this audit; QWR recommended

before such audit can be accomplished.

- 4 -

THIS PAGE INTENTIONALLY LEFT BLANK.

- 5 -

INTRODUCTION

Interested Parties:

ORIGINAL MORTGAGE

LENDER/TABLE FUNDER:

ESCROW/TITLE:

MORTGAGE

NOMINEE/BENEFICIARY:

Pinnacle Direct Funding

Corporation

1500 Lee Road

Orlando, FL 32810

Sonoma Title of Florida, LLC.

290 Waymont Circle Suite 120

Lake Mary, FL 32746

MERS

Mortgage Electronic Registration

Systems, Inc. P.O. Box 2026

Flint, MI 48051

MORTGAGE BROKER: MORTGAGE TRUSTEE: SECURITIZATION:

Spectrum Global Finance

645 N. Garland Avenue Suite 210

Orlando, FL 32501

N/A

Likely.

See discussion below.

Documents Provided for Review:

1

st

2

nd

X

Loan Application (Form 1003)

Loan Commitment Letter MISSING

Good Faith Estimate MISSING

X

Truth in Lending Disclosure Statement

N/A

(3-Day) Notice of Right to Cancel (may not find with purchase money loans)

X

HUD-1 (or HUD-1A) Settlement Statement

X

Note (with riders or attachments)

X

Mortgage

Underwriting and Transmittal Summary (Form 1008) MISSING

Appraisal Report MISSING

X

RESPA servicing disclosure

Hazard Insurance disclosure MISSING

Credit score disclosure MISSING

Lenders Closing Instructions MISSING

Affiliated Business Arrangement Disclosure MISSING

I/O and/or Neg-Am disclosure MISSING

N/A

ARM disclosure

- 6 -

REPORT SUMMARY

Total Potential TILA Violations (see p. 10): 6

Total Potential HOEPA Violations (see p. 11): 0

Total Potential RESPA Violations (see p. 12): 4

Total Predatory Lending Violations: (see p. 13): 7

Total Possible Lending Violations (this page) 17

CLAIM CONCLUSION DETAILS

Underwriting FAIL See p. 8.

TILA APR Tolerance Test PASS See pp. 10.

TILA Finance Charge Test FAIL See pp. 10.

TILA Right of Rescission N/A See pp. 10.

HOEPA PASS See p. 11.

RESPA FAIL See p. 12.

Predatory Indicators FAIL See p. 13.

Auditor's Summary:

*(Probability of Violations Ratings: No Evidence or Possible)

This is a purchase money transaction in the amount of $278,000.00. The loan is a 30 year fixed

rate mortgage with the first 10 years being Interest Only. The interest rate that the borrower

received was 8.125% with a corresponding initial Interest Only payment of $1,882.29. After

paying this amount for 120 months, the 121

st

month converts to a principal and interest

payment of $2,346.98.

The interest rate that the borrower received was higher than the national average rate at this

time. For the week ending 3/31/2006 which is approximately 30 days prior to this loans

closing date, a timeframe typically used by lenders to lock in rates, the national average rate

was 6.35%. At this rate the principal and interest payment would be $1,729.82 which is

$152.47 less than even the Interest Only payment the borrower received. However the real

difference between these two loan programs can be seen with the interest paid over the life of

the loan. With the loan program/interest rate the borrower received the interest paid would

be approximately $511,148.28 whereas with the 30 year FRM, no Interest Only and the

national average rate of 6.35% the interest paid would be approximately $344,730.25 or a

difference of $166,418.03

The purchase price of the subject property is listed as $278,000.00, the exact loan amount.

This makes this a 100% loan to value transaction where the borrower is highly leveraged from

the very start with no equity at all. The lender has created a situation whereby even the

slightest depreciation would leave the borrower with a financial obligation far greater than its

worth. Not only is the borrower highly leveraged but they are obligated to pay private

- 7 -

mortgage insurance in order to protect investors in case of default. The borrower is to pay

$361.40 for the first 120 months and then $46.33 until the loan to value reaches around 80%

(9/1/2023).

The disclosed finance charge ($563,559.28) is lower than the actual finance charge

($563,934.28) by ($375.00). For rescission after initiation of foreclosure, the Truth in Lending

Act considers the disclosed finance charge inaccurate if it is more than $35 below the actual

finance charge. (15 USC Sec. 1635 (i) (2)).

The following are suspect or excessive closing costs/fees that may be actionable for treble

damages pursuant to 12 U.S.C. 2607: Administration Fee (Lender): $695.00, Application Fee

(Broker): $365.00, Processing Fee (Broker): $500.00, Yield Spread Premium: $2,780.00 =

$4,340.00 Xs 3 = $13,020.00

The investor on this loan according to MERS is Bank of New York Mellon which means that

this loan was publicly securitized into a Trust.

We recommend a discovery request be made to the servicer to determine who the true and

correct owner of the note is. As defined under RESPA; 15 U.S.C. 1641 et seq.

TILA, RESPA and Predatory Lending are all possible violations of this loan.

- 8 -

SUMMARY OF LOAN TERMS

The essential loan terms were found to be as follows:

Type of Loan: Purchase

Loan Origination Date: 4/28/2006

Amount of Loans: $278,000.00

Originating Lender: Pinnacle Direct Funding Corporation

Loan Broker: Spectrum Global Finance

Current Servicer: Bank of America, N.A.

Current Note Holder: Like Securitized

1st Note (ARM) Terms:

Initial Fixed Rate: 8.125%

Term of Initial Rate: 30 Years

Initial Payment: $1,882.29

Payment Feature: 30 year Fixed Rate Mortgage with 10 Years

Interest Only

Index Measure: N/A

Index Rate: N/A

Margin: N/A

Fully Indexed Rate: N/A

Min/Max Rate: N/A

TILA disclosed APR: 9.449%

Total Closing Costs: $11,261.65

Total "Points and Fees" %: 4.05%

Prepayment Penalty: Yes 36 Months

Unsecured Debt Paid off by

Refinance:

$0

Loan Origination Fees: $2,780.00 1.00% (Paid to Broker)

Loan Discount Fees: $0

Total Broker Fees: $6,425.00 2.3% (Including $2,780.00 YSP)

- 8 -

FINANCIAL & UNDERWRITING ANALYSIS

Underwriting Standards

The purpose of an underwriter is to determine whether the borrowers can qualify for a loan and if the

borrowers have the ability to repay the loan. This determination of the ability to repay a loan is based

upon employment and income in large measure, which is proved by getting pay stubs, 1040s, W-2s and

a Verification of Employment and Income on the borrowers.

If an underwriter has evaluated the loan properly, then there should be no question of the ability of the

borrower to repay the loan. Debt ratios will have been evaluated, credit reviewed and a proper

determination of risk made in relation to the loan amount. Approvals and denials would be made based

upon a realistic likelihood of repayment.

Automated Underwriting Systems

The underwriters role in approving loans has been delegated to a support role in the past decade.

Automated Underwriting Systems became the normal approval method. An underwriter or even a loan

officer would simply input the data and the Automated System would give an approval or denial. Any

documents requested would be gathered and then loan documents drawn and signed.

The real issue with the automated systems is that they were not designed to be the final word in

approval. The system approval was designed to be a guide, a preliminary approval and nothing more.

After approval was received, the underwriter would then be expected to extensively review the file,

closely examining the documents for final approval.

DISCUSSION: Borrowers financial status at the time of the loan is taken from the loan application. An

analysis of borrowers financial status at the time of the loan reveals the following: The following

figures are based on the information from the Loan Application and have not been verified.

Gross

Monthly

Income

Mortgage

Payment

(PITI)

Other

Monthly

Debt

Total

Monthly

Debt

Debt-to-

income ratio

N/A

N/A

$2,647.69

(I/O)

$3,112.38

(P&I)

$769.00

$769.00

$3,416.69

$3,881.38

TBD

TBD

CONCLUSION: Normal underwriting practices include analysis for a 28/36% debt-to-income

ratio. During 2003 to 2006, subprime lending involved higher DTI ratios, from 33/38% to

38/50%. There was no gross monthly income listed on the application which means that

the lender/broker used a No Income/No Assets Verification underwriting process. Given

this the lender/broker has no way of knowing if in fact the borrower will be able to afford

the mortgage payment. They have a fiduciary responsibility to ensure that the borrower

is not in harms way however this type of underwriting process does in fact place the

borrower in a precarious financial situation to where the ability to repay this loan could

be very low. W-2s or tax returns would be necessary in order to perform additional

analysis around the borrowers debt to income ratios.

- 9 -

THIS PAGE INTENTIONALLY LEFT BLANK.

- 10 -

TRUTH IN LENDING ACT ANALYSIS

APPLICATION: The TILA applies because the transaction involves the extension of credit to a consumer for

personal, family or household purposes that is subject to a finance charge and/or payable by written agreement i n

more than four installments. 15 U.S.C. 1601-1666.

Pass Fail

N/A

Notice of Right to Cancel (2 copies per borrower; filled out completely). 12 C.F.R. 226.23(b).

X TIL Disclosure Statement provided. 12 C.F.R. 226.17, 226.18.

X Payment Schedule correctly identified on TIL. 12 C.F.R. 226.18(g), (h).

X Interest rate consistent and properly disclosed: Loan app-GFE-Commitment-TIL; variable rate.

12 CFR 226.17-18. MISSING GFE & COMMITMENT

X Delivered good faith estimates of disclosures (preliminary TILDS) within 3 days of loan

application. 12 C.F.R. 226.19(a). NO EVIDENCE IN FILE

N/A Consumer Handbook on Adjustable Rate Mortgages (CHARM) provided within 3 days of

application. [Or equivalent disclosure - see 12 CFR 226.19(b)].

X Interest-only payment feature adequately disclosed. 15 U.S.C. 1638, 12 C.F.R. 226.17-18.

NO EVIDENCE IN FILE

N/A Negative-amortization payment feature adequately disclosed. 15 U.S.C. 1638, 12 C.F.R.

226.17-18.

X Itemization of amount financed. 12 C.F.R. 226.18(c).[RESPA-GFE may be substituted]

X Property/Hazard Insurance disclosure provided (choice by consumer). 12 C.F.R. 226.4(d)(2).

NO EVIDENCE IN FILE

X Prepayment Penalty disclosed. 12 C.F.R. 226.18(k).

X

APR Calculation

See Note 1 below for further

discussion.

1

ST

Lien Result

Disclosed: 9.449%

vs.

Actual: 9.4730%

Difference = <0.024%>

2

ND

Lien Result

Disclosed:

vs.

Actual:

Difference = .<. >

X

Finance Charge Calculation

See Note 2 below for further

discussion.

1

ST

Lien Result

Disclosed: $563,559.28

vs.

Actual: $563,934.28

Difference = <$375.00>

2

ND

Lien Result

Disclosed:

vs.

Actual:

Difference = <$>

X

All disclosures accurately reflect the legal obligation between the parties; 15 U.S.C. 1638, 12

C.F.R. 226.17(c).

Total Potential TI LA C.F.R. 226.17 Violations: 6

- 11 -

HOEPA AND FLORIDA FINANCIAL CODE 658.12 - 658.995 et seq. ANALYSIS

APPLICATION: Neither statute like applies as the estimated APR [~xx] would not exceed 8% over the

comparable yield on Treasury securities [~10], nor do the total points and fees exceed 8% or 6%,

respectively, of the loan amount.

Pass Fail

N/A

APR disclosed. 12 CFR 226.32(c)(2)

3 days prior to closing, the APR and disclosure statement similar to the following: "You are not

required to complete (HOEPA).

3 days prior to closing, disclosure: "CONSUMER CAUTION AND HOME OWNERSHIP

COUNSELING NOTICE (4970).

disclosed the amount of the borrowers regular monthly payment. 12 CFR 226.32(c)(3).

If variable, includes a statement that the interest rate and monthly payment may increase and the

maximum payment that could be reached. 12 CFR 226.32(c)(4).

No balloon payments prior to ten years. 12 CFR 226.32(d)(1)(i)-(iii).

Disclosed amount of any balloon payment. 12 CFR 226.32(c)(3).

No prepayment penalty after first 5 years, source of funds is not refinance by creditor, and

consumers total monthly is no more than 50% of DTI. 12 CFR 226.32(d)(7).

No increase in the interest rate in the event of default. 12 CFR 226.32(d)(4).

No negative amortization. 12 CFR 226.32(d)(2).

No refinance within one year. 12 CFR 226.34.

No prepaid payments. 12 CFR 226.32(d)(3).

Engaging in a pattern or practice of extending such credit to a borrower based on the borrower's

collateral rather than considering the borrower's current and expected income, current obligations,

and employment status to determine whether the borrower is able to make the scheduled payments

to repay the obligation, is in violation of Section 129(h) of TILA, 15 U.S.C. 1639(h), and see

also, Regulation Z, 12 C.F.R. 226.32.

If refinance transaction, disclosed total amount borrowed and if the loan amount includes

premiums or other charges for optional credit insurance or debt cancellation coverage, that fact

shall be stated. 12 CFR 226.32 (c)(5).

Total Potential HOEPA/4970 Violations: 0

POTENTIAL REMEDIES FOR VIOLATIONS: All TILA remedies, plus all finance charges and fees

if material violation, pursuant to 15 U.S.C. 1640(a)(4).

- 12 -

REAL ESTATE SETTLEMENT PROCEDURES ACT ANALYSIS

APPLICATION: The RESPA applies because lender regularly extends federally related mortgage loans

aggregating more than $1 million per year, and intended for the purchase of a one- to four-family

residential property. 12 U.S.C. 2601-2617.

Pass Fail

X Informed borrower of intention to transfer the servicing of the loan and/or failed to inform the

borrower of the actual transfer within fifteen (15) days before the effective date of the transfer. 24

C.F.R. 3500.21.

X Did not require deposit of funds in escrow in excess of the statutorily permitted amounts. 24

C.F.R. 3500.17.

X Purchase Money: Provided the Special Information Booklet explaining the settlement costs

within three (3) business days after consumer submitted loan application. 24 C.F.R. 3500.6.

NO EVIDENCE IN FILE

X No fees charged for preparation of the settlement statement, escrow account statement, and/or the

TILA disclosure statement. 24 C.F.R. 3500.12.

X Disclosed all affiliated business arrangements. 24 C.F.R. 3500.15. NO EVIDENCE IN FILE

X Did not give, provide or receive a hidden fee or thing of value for the referral of settlement

business, including but not limited to, kickbacks, hidden referral fees, and/or yield spread

premiums. 24 C.F.R. 3500.14. YSP $2,780.00

TBD

Properly and timely paid for property taxes, insurance and other charges for which Defendants

are collecting within an escrow impound account; or other servicing violations. 24 C.F.R.

3500.17.

X HUD-1 provided at closing (or 1 day before if requested) and accurate. 24 C.F.R. 3500.8(b).

X No fees charged in excess of the reasonable value of goods provided and/or services rendered. NO

EVIDENCE IN FILE

TBD Purchase Money: Seller did not impose use of particular service provider. 24 C.F.R. 3500.16.

Total Potential RESPA Violations: 4

FURTHER RECOMMENDATIONS: QWR/discovery re mortgage servicing for potential servicing

violations or breach of contract.

POTENTIAL REMEDIES FOR VIOLATIONS: Actual damages, statutory (up to $1000 if show

pattern and practice), and treble damages for excessive portion of fees (below), plus attorneys fees and

costs for violations noted.

The following are suspect or excessive closing costs/fees that may be actionable for treble damages

pursuant to 12 U.S.C. 2607: Administration Fee (Lender): $695.00, Application Fee (Broker):

$365.00, Processing Fee (Broker): $500.00, Yield Spread Premium: $2,780.00 = $4,340.00 Xs 3

= $13,020.00

- 13 -

PREDATORY LOAN INDICATORS

Predatory lending is a general term used to describe unfair, deceptive, or fraudulent practices of lenders

during the loan origination process. Predatory lending is often a combination of several factors that can

only be evaluated in the context of the overall lending transaction. Typically, no single factor can be

relied upon to consider it a predatory loan.

A large number of agencies and consumer organizations recognize predatory lending, including, for

example, the Department of Housing and Urban Development, Federal Deposit Insurance Corporation,

National Consumer Law Center, California Department of Real Estate, Fannie Mae, National Association

of Consumer Advocates, Association of Community Organizations for Reform Now, National Home

Equity Mortgage Association, and Center for Responsible Lending.

The predatory lending factors present in the subject transaction were found to be as follows:

Pass Fail

N/A Solicitation for refinance.

X Mortgage broker and corresponding lender involved. YSP & OTHER BROKER FEES

TBD Borrower was a minority and/or the transaction was conducted in a foreign language.

X Loan-to-value ratio above 80%. 100% LTV

TBD Debt-to-income ratio above 28/36%.

X Teaser rate involved.

X Interest rate on 1

st

was more than 2 points above: 6.08% (2.77 margin) [average US 5/1 ARM

rate] or 6.4% [average 30-year fixed]. (source: Freddie Mac 1/2003-12/2006)

X Excessive Closing Costs/Fees. SEE RESPA FOR FEE BREAKDOWN

X Prepayment Penalty. 36 MONTHS

X Interest-Only Payments. 10 YEARS

N/A Negative Amortization Payments.

X Broker Compensation >2% (including yield spread premium). 2.3%

N/A Loan Flipping refinance within 3 years of previous loan.

N/A Balloon Payments.

TBD Unsecured Debt Shifted to Secured (i.e., credit cards).

TBD Unnecessary insurance and other products offered in closing.

X Mandatory arbitration clause in Note.

TBD Bait & Switch e.g., borrower initially offered lower rate than final Note.

X Other unfair, deceptive, or fraudulent practices in transaction.

Total Predatory I ndicators: 7

- 14 -

The disclosed finance charge ($563,559.28) is lower than the actual finance charge

($563,934.28) by ($375.00). For rescission after initiation of foreclosure, the Truth in

Lending Act considers the disclosed finance charge inaccurate if it is more than $35

below the actual finance charge. (15 USC Sec. 1635 (i) (2)).

15 U.S.C. 1635(a) provides Except as otherwise provided in this section, in the case of

any consumer credit transaction (including opening or increasing the credit limit for an

open end credit plan) in which a security interest, including any such interest arising by

operation of law, is or will be retained or acquired in any property which is used as the

principal dwelling of the person to whom credit is extended, the obligor shall have the

right to rescind the transaction until midnight of the third business day following the

consummation of the transaction or the delivery of the information and rescission forms

required under this section together with a statement containing the material disclosures

required under this title, whichever is later, by notifying the creditor, in accordance with

regulations of the Board, of his intention to do so. The creditor shall clearly and

conspicuously disclose, in accordance with regulations of the Board, to any obligor in a

transaction subject to this section the rights of the obligor under this section. The creditor

shall also provide, in accordance with regulations of the Board, appropriate forms for the

obligor to exercise his right to rescind any transaction subject to this section.

15 U.S.C. 1635(e) states that This section does not apply to-- (1) a residential mortgage

transaction as defined in section 103(w); (2) a transaction which constitutes a refinancing

or consolidation (with no new advances) of the principal balance then due and any

accrued and unpaid finance charges of an existing extension of credit by the same

creditor secured by an interest in the same property; (3) a transaction in which an agency

of a State is the creditor; . . . .

15 U.S.C. 1635(i) provides RESCISSION RIGHTS IN FORECLOSURE.--(2)

TOLERANCE FOR DISCLOSURES.--Notwithstanding section 106(f), and subject to

the time period provided in subsection (f), for the purposes of exercising any rescission

rights after the initiation of any judicial or nonjudicial foreclosure process on the

principal dwelling of the obligor securing an extension of credit, the disclosure of the

finance charge and other disclosures affected by any finance charge shall be treated as

being accurate for purposes of this section if the amount disclosed as the finance charge

does not vary from the actual finance charge by more than $35 or is greater than the

amount required to be disclosed under this title.

You might also like

- Fcra Section 609 and 605 LetterDocument15 pagesFcra Section 609 and 605 LetterKNOWLEDGE SOURCE96% (53)

- Egypt National Bank of EgyptDocument1 pageEgypt National Bank of Egyptالبرنس اليمني0% (1)

- Delete Judgements and Accounts CraDocument6 pagesDelete Judgements and Accounts CraKNOWLEDGE SOURCE100% (31)

- Delete Judgements and Accounts CraDocument6 pagesDelete Judgements and Accounts CraKNOWLEDGE SOURCE100% (31)

- Nurse Change-Of-Shift Report PolicyDocument2 pagesNurse Change-Of-Shift Report Policyapi-235633705No ratings yet

- Securitization Audit Report SampleDocument0 pagesSecuritization Audit Report SampleCFLA, IncNo ratings yet

- Property Securitization Memorandum: Consumer Defense ProgramsDocument31 pagesProperty Securitization Memorandum: Consumer Defense ProgramsFrederick DeMarques Thomas100% (3)

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetFrom EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNo ratings yet

- Network Design Rules NBNDocument82 pagesNetwork Design Rules NBNSharmila JainNo ratings yet

- 2004 Report On Predatory Lending & Servicing Practices & Their Effect On Corporate Compliance, Conduct, Ethics & AccountingDocument29 pages2004 Report On Predatory Lending & Servicing Practices & Their Effect On Corporate Compliance, Conduct, Ethics & AccountingForeclosure FraudNo ratings yet

- 51.903 Texas Government CodeDocument5 pages51.903 Texas Government CodeJeff Wilner100% (2)

- Foreclosure Manual For Judges - Wa AppleseedDocument240 pagesForeclosure Manual For Judges - Wa AppleseedJanet Reiner100% (1)

- Assigment 2Document8 pagesAssigment 2Gabriela LueiroNo ratings yet

- Your North Carolina Wills, Trusts, & Estates Explained Simply: Important Information You Need to Know for North Carolina ResidentsFrom EverandYour North Carolina Wills, Trusts, & Estates Explained Simply: Important Information You Need to Know for North Carolina ResidentsNo ratings yet

- Credit Repair Retainer AgreementDocument3 pagesCredit Repair Retainer AgreementKNOWLEDGE SOURCE100% (2)

- 6 Non Response Creditor Refused To RespondDocument2 pages6 Non Response Creditor Refused To RespondKNOWLEDGE SOURCE100% (3)

- SAMPLE - Forensic Underwriting AuditDocument15 pagesSAMPLE - Forensic Underwriting AudithgghNo ratings yet

- Forensic Loan Audit Report - Sample Report 4-2009Document47 pagesForensic Loan Audit Report - Sample Report 4-2009boufninaNo ratings yet

- Forensic AuditDocument4 pagesForensic AuditScarlett Singleton RogerNo ratings yet

- Forensic Audit Report - 2 Abc ProductionsDocument6 pagesForensic Audit Report - 2 Abc Productionsspeed deamonNo ratings yet

- Mortgage Compliance Investigators - Chain of Title AnalysisDocument31 pagesMortgage Compliance Investigators - Chain of Title AnalysisBilly BowlesNo ratings yet

- Sample Securitization AuditDocument73 pagesSample Securitization AuditRandy Rosado100% (1)

- Mortgage Fraud PresentationDocument5 pagesMortgage Fraud Presentation92589258No ratings yet

- 65 Signs That Your Foreclosure Documents Could Be Fraudulent Wo LetterheadDocument4 pages65 Signs That Your Foreclosure Documents Could Be Fraudulent Wo Letterheadrrcdontuse1100% (1)

- Proof of Ongoing Foreclosure Fraud and Mortgage Document Fabrication in Five EmailsDocument6 pagesProof of Ongoing Foreclosure Fraud and Mortgage Document Fabrication in Five EmailseliforuNo ratings yet

- Default and Enforcement: NtroductionDocument20 pagesDefault and Enforcement: NtroductionSeniorNo ratings yet

- Securitization Audits Are Helping Win Against Foreclosure in CourtDocument2 pagesSecuritization Audits Are Helping Win Against Foreclosure in CourtCharlton ButlerNo ratings yet

- Forensic Accounting FinDocument33 pagesForensic Accounting FinakanshagNo ratings yet

- SSRN Id2288280Document47 pagesSSRN Id2288280Foreclosure FraudNo ratings yet

- 100 Introductory Facts About Mortgage Securitization: 4closurefraudDocument17 pages100 Introductory Facts About Mortgage Securitization: 4closurefraudscottyup8No ratings yet

- THE RESPA BOMB SECTION 6 2605 Kevelighan, Et Al. v. Trott & Trott, Et Al PDFDocument30 pagesTHE RESPA BOMB SECTION 6 2605 Kevelighan, Et Al. v. Trott & Trott, Et Al PDFHelpin Hand100% (2)

- FRAUDULENT Foreclosure Action BY F.D.I.C. SEIZED BANKUNITED, FSBDocument11 pagesFRAUDULENT Foreclosure Action BY F.D.I.C. SEIZED BANKUNITED, FSBAlbertelli_Law100% (1)

- Interrogatory AnswersDocument2 pagesInterrogatory AnswersaccessadvantageNo ratings yet

- The Case Against Allowing Mortgage Electronic Registration Systems, Inc. (MERS) To Initiate Foreclosure ProceedingsDocument34 pagesThe Case Against Allowing Mortgage Electronic Registration Systems, Inc. (MERS) To Initiate Foreclosure ProceedingsForeclosure FraudNo ratings yet

- NJ Request For Production - ForeclosureDocument7 pagesNJ Request For Production - Foreclosurewinstons2311100% (1)

- Ben Carter - Foreclosure Continuing Legal EducationDocument48 pagesBen Carter - Foreclosure Continuing Legal EducationGlenn AugensteinNo ratings yet

- JP Morgan Chase V US Dept of TreasuryDocument11 pagesJP Morgan Chase V US Dept of TreasuryForeclosure Fraud100% (1)

- Merscorp, Inc. Rules of Membership: Vfebruary2012 1Document47 pagesMerscorp, Inc. Rules of Membership: Vfebruary2012 1Annemieke TennisNo ratings yet

- What Is Fraud - Definition, Types, and ConsequencesDocument5 pagesWhat Is Fraud - Definition, Types, and ConsequencesNURUL SYAZANA SOFIAN MBE211096No ratings yet

- How To Become A Plaintiff-Lawsuit Alleges Biggest Money-Laundering Network in Us History-The Abeel Case by Spire Law-April 2012-Homeowners Across Usa Sue Bank Servicers andDocument394 pagesHow To Become A Plaintiff-Lawsuit Alleges Biggest Money-Laundering Network in Us History-The Abeel Case by Spire Law-April 2012-Homeowners Across Usa Sue Bank Servicers and83jjmack100% (1)

- Forensic Audit InfoDocument2 pagesForensic Audit InfoBlaqRubiNo ratings yet

- Forensic Audit: IntroductionDocument8 pagesForensic Audit: IntroductionSYED ADNAN4220No ratings yet

- Congressional Oversight Panel Report On Foreclosure FraudDocument127 pagesCongressional Oversight Panel Report On Foreclosure FraudForeclosure FraudNo ratings yet

- MERS - ComplaintDocument25 pagesMERS - ComplaintForeclosure Fraud100% (1)

- 12-20-09 Why Banks Always Foreclose - Indymac - Onewest PDFDocument6 pages12-20-09 Why Banks Always Foreclose - Indymac - Onewest PDFpower_No ratings yet

- Memorandum Ny Trust Law Aspect, Strict Construction and Perfect Delivery RuleDocument8 pagesMemorandum Ny Trust Law Aspect, Strict Construction and Perfect Delivery RuleRONALDRYAN100% (1)

- Ocwen ComplaintDocument39 pagesOcwen ComplaintForeclosure Fraud100% (3)

- Lender Processing Services (F/k/a FIS) Newsletter The Summit Dec. '07Document20 pagesLender Processing Services (F/k/a FIS) Newsletter The Summit Dec. '07lizinsarasota50% (2)

- Complaint RICO Case Against JP Morgan-Chase - LINDA ZIMMERMAN V JPMORGAN CHASE BANK NA Foreclosure Fraud - Fighting Foreclosure Fraud by Sharing The KnowledgeDocument16 pagesComplaint RICO Case Against JP Morgan-Chase - LINDA ZIMMERMAN V JPMORGAN CHASE BANK NA Foreclosure Fraud - Fighting Foreclosure Fraud by Sharing The Knowledgefreddiefletcher24830% (1)

- Forensic Audit in NPA PDFDocument16 pagesForensic Audit in NPA PDFPooja FuliaNo ratings yet

- 10-10-08 A) AP - Bank of America Issues Nationwide Moratorium On Foreclosures, B) CNBC - Foreclosure PrimerDocument12 pages10-10-08 A) AP - Bank of America Issues Nationwide Moratorium On Foreclosures, B) CNBC - Foreclosure PrimerHuman Rights Alert - NGO (RA)No ratings yet

- Mortgage Fraud Web Front Page 07-24-07Document4 pagesMortgage Fraud Web Front Page 07-24-07Houston Criminal Lawyer John T. FloydNo ratings yet

- May Shall MustDocument8 pagesMay Shall MustAllen Carlton Jr.88% (8)

- Hendricks v. U.S. BankDocument7 pagesHendricks v. U.S. Bankrichdebt100% (2)

- How Bank of America and Ginnie Mae Concocted A Foreclosure Scam Against Taylor, Bean & Whitaker HomeownersDocument8 pagesHow Bank of America and Ginnie Mae Concocted A Foreclosure Scam Against Taylor, Bean & Whitaker HomeownersIsabel Santamaria100% (1)

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.From EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.No ratings yet

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- American Foreclosure: Everything U Need to Know About Preventing and BuyingFrom EverandAmerican Foreclosure: Everything U Need to Know About Preventing and BuyingNo ratings yet

- ConqeringDocument5 pagesConqeringKNOWLEDGE SOURCENo ratings yet

- Nimrod TeachingDocument10 pagesNimrod TeachingKNOWLEDGE SOURCENo ratings yet

- Top Kicking ValidationDocument7 pagesTop Kicking ValidationKNOWLEDGE SOURCE60% (5)

- Remove My Name From Mailing List 4Document1 pageRemove My Name From Mailing List 4KNOWLEDGE SOURCE100% (3)

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Why Credit Restoration WorksDocument3 pagesWhy Credit Restoration WorksKNOWLEDGE SOURCE100% (3)

- Interrogatories RequestDocument6 pagesInterrogatories RequestKNOWLEDGE SOURCE100% (1)

- Use For Mortgage CompanyDocument4 pagesUse For Mortgage CompanyKNOWLEDGE SOURCE100% (6)

- Form 96Document3 pagesForm 96KNOWLEDGE SOURCE0% (1)

- Bankster in Dishonour - Updated: Notice of Acceptance For ValueDocument56 pagesBankster in Dishonour - Updated: Notice of Acceptance For ValueKNOWLEDGE SOURCE100% (4)

- Untitled 1 3Document13 pagesUntitled 1 3KNOWLEDGE SOURCE100% (2)

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- 08 ReinertDocument29 pages08 ReinertKNOWLEDGE SOURCENo ratings yet

- Transunion Follow UpDocument1 pageTransunion Follow UpKNOWLEDGE SOURCE100% (1)

- 12 2 10KeatingOnAngelaStarkDocument3 pages12 2 10KeatingOnAngelaStarkKNOWLEDGE SOURCE100% (11)

- 623 To Third PartyDocument2 pages623 To Third PartyKNOWLEDGE SOURCENo ratings yet

- Advice For Closing MortgagesDocument4 pagesAdvice For Closing MortgagesMegan McAuley83% (6)

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- 609 2Document2 pages609 2KNOWLEDGE SOURCE67% (3)

- 9 01 2005 FTB Hop 2Document9 pages9 01 2005 FTB Hop 2KNOWLEDGE SOURCENo ratings yet

- 2nd Letter To BureauDocument8 pages2nd Letter To BureauKNOWLEDGE SOURCENo ratings yet

- Affidavit 3Document5 pagesAffidavit 3KNOWLEDGE SOURCE100% (2)

- Sample Credit Repair Letters For Items in Credit Reports - Inaccurately ReportedDocument12 pagesSample Credit Repair Letters For Items in Credit Reports - Inaccurately ReportedKNOWLEDGE SOURCE100% (1)

- DemandDocument7 pagesDemandKNOWLEDGE SOURCENo ratings yet

- The Allocation of Catastrophe RiskDocument12 pagesThe Allocation of Catastrophe RiskAlex PutuhenaNo ratings yet

- Receipt WPS OfficeDocument3 pagesReceipt WPS OfficeTHEODORANo ratings yet

- 2 Marks Important Questions With Solution Herbal Drug Technology B Pharmacy 6th Semester by Latest Learn PharmacyDocument13 pages2 Marks Important Questions With Solution Herbal Drug Technology B Pharmacy 6th Semester by Latest Learn PharmacyAli100% (1)

- Eps Scanner 81806039Document14 pagesEps Scanner 81806039ahsan.oman1103No ratings yet

- Cost Control Part 3Document21 pagesCost Control Part 3Eunice MbekaNo ratings yet

- Rnis College of Insurance: New Ic 33 - Model Test 4Document6 pagesRnis College of Insurance: New Ic 33 - Model Test 4Raj Kumar DepalliNo ratings yet

- Project Report of Hotel IndustryDocument29 pagesProject Report of Hotel IndustryPankaj SharmaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepranav chauhanNo ratings yet

- ACC 206 Test 2 2023Document9 pagesACC 206 Test 2 2023tawanaishe shoniwaNo ratings yet

- Ruijie Reyee-Hotel Solution Cookbook (V1.0)Document77 pagesRuijie Reyee-Hotel Solution Cookbook (V1.0)juragan.it100% (1)

- RTN 380AX: Application ScenariosDocument2 pagesRTN 380AX: Application ScenariosAlfonso Rodrigo Garcés GarcésNo ratings yet

- Brokers Ahmedabad 201..Document51 pagesBrokers Ahmedabad 201..sarthakNo ratings yet

- Agarwal Packers and Movers LimitedDocument8 pagesAgarwal Packers and Movers LimitedNeeraj GargNo ratings yet

- Sales Promotions at MallsDocument19 pagesSales Promotions at MallsIlhan KhanNo ratings yet

- Best Digital Marketing Services - Digi MarketerDocument10 pagesBest Digital Marketing Services - Digi MarketerDaniel W. RomeroNo ratings yet

- Moroccan National Office of TourismDocument10 pagesMoroccan National Office of TourismHajar So0% (1)

- Packet Tracer 5.3 - IP Telephony Basic Configuration Tutorial DescriptionDocument4 pagesPacket Tracer 5.3 - IP Telephony Basic Configuration Tutorial DescriptionJoseOctavioGonzalezNo ratings yet

- JKT200392777Document2 pagesJKT200392777kcs flimNo ratings yet

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- Ų.Ș. Ťǿ Ťǻķě Ǿvěř ǺİĢ Įň $85 Bįŀŀįǿň Bǻįŀǿųť Čěňťřǻŀ Bǻňķș İňjěčť Čǻșħ Ǻș Čřěđįť Đřįěș ŲpDocument7 pagesŲ.Ș. Ťǿ Ťǻķě Ǿvěř ǺİĢ Įň $85 Bįŀŀįǿň Bǻįŀǿųť Čěňťřǻŀ Bǻňķș İňjěčť Čǻșħ Ǻș Čřěđįť Đřįěș ŲpRaphael CorreaNo ratings yet

- Pillars of Financial Inclusion-V1-ScotchDocument18 pagesPillars of Financial Inclusion-V1-ScotchKamzalian Tomging100% (3)

- FILE 20231105 224350 KIỂM-TRA-T6Document60 pagesFILE 20231105 224350 KIỂM-TRA-T6vanpth20404cNo ratings yet

- The Reserve Bank of India Is The Apex Organisation in The Indian Money MarketDocument8 pagesThe Reserve Bank of India Is The Apex Organisation in The Indian Money MarketRaunak MotwaniNo ratings yet

- 51369-Intuit-QB-Core Glossary-V02-RJCDocument14 pages51369-Intuit-QB-Core Glossary-V02-RJCgayle aldoNo ratings yet

- Stancy SlipsDocument10 pagesStancy SlipsVikas SoniNo ratings yet

- Email Mobile Database of Frequent Flyers SampleDocument9 pagesEmail Mobile Database of Frequent Flyers SampleSurvi SharmaNo ratings yet

- Cash MGMT in Bank of IndiaDocument58 pagesCash MGMT in Bank of Indiasanjay_tiwari100% (8)