Professional Documents

Culture Documents

CH 07

CH 07

Uploaded by

Ngọc NgốOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 07

CH 07

Uploaded by

Ngọc NgốCopyright:

Available Formats

Problems: Set C 1

Problems: Set C

P7-1C The Soccer Club decided to sell coupon books as a fund-raising activity. The books

allow users to enjoy restaurants, entertainment, and services such as oil changes, at sub-

stantial discounts. The club bought 100 books for $16 each, and members will sell them

for $20. About 20 members attended the last club meeting, and most took one or two

books to sell. Since the club had already paid for the books and didnt have other imme-

diate cash needs, members do not have to pay for the books until they sell them.

Extra books are stored on a book shelf in the clubs on-campus office. The office is

in a great location with plenty of student traffic. It is shared with the Marketing and

Information Systems clubs. Each club has four sets of keys that are used by its officers

and members.

As students sell books, they bring the cash or checks to the clubs office. Students

with unusual class schedules who arrive when the office is locked can put payments un-

der the door. Payments are stored in a desk drawer until the treasurer has time to make

a bank deposit. Students can pick up more books to sell as needed.

Instructions

(a) Indicate the weaknesses in internal accounting control in the clubs fund-raising plan.

(b) Indicate improvements in internal control procedures for the clubs fund-raising plan.

Identify internal control

weaknesses for cash receipts.

(SO 1, 2)

Prepare a bank reconciliation

and adjusting entries.

(SO 4)

(a) Cash bal. $6,063

Identify internal control

weaknesses in cash receipts

and cash disbursements.

(SO 1, 2, 3)

P7-2C Tom Hall has worked for Dr. Johnson for several years. Tom demonstrates a loy-

alty that is rare among employees. He is always willing to cover for other employees and

hasnt taken a vacation in three years.

One of Toms primary duties at the dental office is to open the mail, list checks re-

ceived, and prepare the bank deposit form.

He also collects cash from patients at the cashier window as patients leave. At times,

it is so hectic that Tom doesnt bother to give patients a receipt for the cash paid on their

accounts. He assures them he will see to it that they receive the proper credit. He is so

well known by most patients that no one has ever complained.

When traffic is slow in the office, Tom offers to help another employee, Sue, post the

payments to patients accounts receivable. Dr. Johnson installed a computerized account-

ing program that requires a user ID and password to log in, but Tom and Sue have found

that it is more efficient to just leave the computer on and the receivables file open all the

time, and minimize the file when it is not in use.

Instructions

Identify the principles of internal control that may be violated in this situation.

P7-3C On March 31, 2012, Taggert Company had a cash balance per books of $5,174.20.

The statement from Western Bank on that date showed a balance of $6,041.40. A

comparison of the bank statement with the cash account revealed the following facts.

1. The bank service charge for March was $28.

2. The bank collected a note receivable of $2,000 for Taggert Company on March 15, plus

$115 of interest. The bank made a $20 charge for the collection. Taggert has not ac-

crued any interest on the note.

3. The March 31 receipts of $1,481.60 were not included in the bank deposits for March.

These receipts were deposited by the company in a night deposit vault on March 31.

4. Company check No. 1245 issued to T. Gilroy, a creditor, for $672 that cleared the bank

in March was incorrectly entered in the cash payments journal on March 8 for $627.

5. Checks outstanding on March 31 totaled $1,360.00.

6. On March 31 the bank statement showed an NSF charge of $1,033.20 for a check

received by the company from R. Fross, a customer, on account.

Instructions

(a) Prepare the bank reconciliation as of March 31.

(b) Prepare the necessary adjusting entries at March 31.

Kimmel_Financial_6e_Set_C_Problems_Ch07.qxd 4/29/11 2:12 PM Page 1

The cash records per books for August showed the following.

2 chapter 7 Internal Control and Cash

The adjusted cash balance per bank agreed with the cash balance per books at July 31.

The August bank statement showed the following checks and deposits.

TRIAD IMPORTS, INC.

Bank Reconciliation

July 31, 2012

Cash balance per bank $ 9,596

Add: Deposits in transit 930

$10,526

Less: Outstanding checks

Check Number Check Amount

3151 $ 290

3170 812

3171 1,538

3172 1,000

3174 1,172 4,812

Adjusted cash balance per bank $ 5,714

Prepare a bank reconciliation

and adjusting entries from

detailed data.

(SO 4)

P7-4C The bank portion of the bank reconciliation for Triad Imports, Inc. at July 31,

2012, is shown below.

Bank Statement

Checks Deposits

Date Number Amount Date Amount

8-1 3170 $ 812 8-1 $ 930

8-2 3171 1,538 8-4 1,325

8-5 3174 1,172 8-8 1,152

8-4 3175 802 8-13 1,104

8-8 3176 132 8-18 1,587

8-10 3177 737 8-21 1,159

8-15 3179 1,325 8-25 1,054

8-18 3180 900 8-28 1,830

8-27 3181 596 8-30 1,067

8-30 3183 93

Total $11,208

8-29 3187 734

Total $8,841

Cash Payments Journal

Date Number Amount Date Number Amount

8-1 3175 $ 802 8-20 3183 $ 93

8-2 3176 132 8-22 3184 760

8-2 3177 737 8-23 3185 1,038

8-4 3178 1,598 8-24 3186 455

8-8 3179 1,325 8-29 3187 734

8-10 3180 900 8-30 3188 273

8-15 3181 569

Total $10,924

8-18 3182 1,508

Cash Receipts

Journal

Date Amount

8-3 $ 1,325

8-7 1,152

8-12 1,014

8-17 1,587

8-20 1,159

8-24 1,054

8-27 1,830

8-29 1,067

8-30 500

Total $10,668

Kimmel_Financial_6e_Set_C_Problems_Ch07.qxd 4/29/11 2:12 PM Page 2

The bank statement contained two bank memoranda:

1. A credit of $1,670 for the collection of a $1,600 note for Triad Imports plus interest of

$80 and less a collection fee of $10. Triad Imports has not accrued any interest on the

note.

2. A debit for the printing of additional company checks $70.

At August 31, the cash balance per books was $5,478, and the cash balance per bank

statement was $13,563. The bank did not make any errors, but Triad Imports, Inc. made

two errors.

Instructions

(a) Using the four steps in the reconciliation procedure described in the textbook, pre-

pare a bank reconciliation at August 31, 2012.

(b) Prepare the adjusting entries based on the reconciliation. (Note: The correction of

any errors pertaining to recording checks should be made to Accounts Payable. The

correction of any errors relating to recording cash receipts should be made to

Accounts Receivable.)

(a) Cash bal. $7,031

Problems: Set C 3

Prepare a bank reconciliation

and adjusting entries.

(SO 4)

(a) Cash bal. $5,330

CENTRAL BANK

Checks and Debits Deposits and Credits Daily Balance

XXX XXX 10-31 4,070

A comparison of the details on the bank statement with the details in the cash account

revealed the following facts.

1. The statement included a debit memo of $50 for the printing of additional company

checks.

2. Cash sales of $342 on October 6 were deposited in the bank. The cash receipts jour-

nal entry and the deposit slip were incorrectly made for $372. The bank credited Bug

Busters Company for the correct amount.

3. Outstanding checks at October 31 totaled $1,250, and deposits in transit were $2,390.

4. On October 13, the company issued check No. 4263 for $196 to T. Grey, on account.

The check, which cleared the bank in May, was incorrectly journalized and posted by

Bug Busters Company for $169.

5. A $1,000 note receivable was collected by the bank for Bug Busters Company on

October 31 plus $50 interest. The bank charged a collection fee of $15. No interest has

been accrued on the note.

6. Included with the cancelled checks was a check issued by Fig Leaf Company for $120

that was incorrectly charged to Bug Busters Company by the bank.

7. On October 31, the bank statement showed an NSF charge of $230 for a check issued

by Jon Simpson, a customer, to Bug Busters Company on account.

Instructions

(a) Prepare the bank reconciliation at October 31, 2012.

(b) Prepare the necessary adjusting entries for Bug Busters Company at October 31, 2012.

P7-5C Bug Busters Company provides insect extermination services. On October 31,

2012, the companys cash account per its general ledger showed a balance of $4,632.

The bank statement from Central Bank on that date showed the following balance.

Cash $ 19,000

Accounts receivable 47,600

Inventory 21,000

Property, plant, and equipment, net of depreciation 70,400

Accounts payable 18,200

Common stock 110,000

Retained earnings 21,800

P7-6C You are provided with the following information taken from Items Inc.s May 31,

2012, balance sheet.

Prepare a cash budget.

(SO 7)

Kimmel_Financial_6e_Set_C_Problems_Ch07.qxd 4/29/11 2:12 PM Page 3

4 chapter 7 Internal Control and Cash

January February

Sales $260,000 $318,000

Purchases 112,000 120,000

Salaries 72,000 78,000

Administrative expenses 58,000 60,000

Selling expenses 30,000 36,000

All sales and purchase are on account. Budgeted collections and disbursement data are

given below. All other expenses are paid in the month incurred except for administrative

expenses, which include $2,000 of depreciation per month.

Other data:

1. Collections from customers: January $279,500; February $298,000.

2. Payment for purchases: January $106,000; February $116,000.

3. Other receipts January: collection of December 31, 2011, interest receivable $7,500;

February: proceeds from sale of securities $8,000

4. Other disbursementsJanuary: pay $35,000 note payable due January 1, 2012;

February: pay $5,000 cash dividend

5. The companys cash balance on January 1, 2012 is expected to be $52,000. The com-

pany wants to maintain a minimum cash balance of $40,000.

Instructions

Prepare a cash budget for January and February.

Prepare a cash budget.

(SO 7)

P7-7C Noble Corporation prepares monthly cash budgets. Here are relevant data from

operating budgets for 2012.

Additional information concerning Items Inc. is as follows.

1. Gross profit is 40% of sales.

2. Actual and budgeted sales data:

May (actual) $68,000

June (budgeted) 60,000

3. Sales are both cash and credit. Cash collections expected in June are:

May $47,600 (70% of $68,000)

June 18,000 (30% of $60,000)

$65,600

4. Half of a months purchases are paid for in the month of purchase and half in the fol-

lowing month. Cash disbursements expected in June are:

Purchases May $18,200

Purchases June 27,500

$45,700

5. Cash operating costs are anticipated to be $21,300 for the month of June.

6. Equipment costing $6,000 will be purchased for cash in June.

7. The company wishes to maintain a minimum cash balance of $11,000. An open line

of credit is available at the bank. All borrowing is done at the beginning of the month,

and all repayments are made at the end of the month. The interest rate is 9% per year,

and interest expense is accrued at the end of the month and paid in the following

month.

Instructions

Prepare a cash budget for the month of June. Determine how much cash Items Inc. must

borrow, or can repay, in June.

Kimmel_Financial_6e_Set_C_Problems_Ch07.qxd 4/29/11 2:12 PM Page 4

Problems: Set C 5

P7-8C Elite Service Company is a very profitable small business. It has not, however,

given much consideration to internal control. For example, in an attempt to keep cleri-

cal and office expenses to a minimum, the company has combined the jobs of cashier

and bookkeeper. As a result, Steve Evans handles all cash receipts, keeps the accounting

records, and prepares the monthly bank reconciliations.

The balance per the bank statement on March 31, 2012, was $5,931.51. Outstanding

checks were: No. 206 for $358.53, No. 441 for $292, No. 590 for $283.00, No. 781 for

$286.00, No. 782 for $319.47, and No. 783 for $303.14. Included with the statement

was a credit memorandum of $175 indicating the collection of a note receivable for Elite

Service Company by the bank on March 21. This memorandum has not been recorded

by Elite Service.

The companys ledger showed one cash account with a balance of $6,889.53. The

balance included undeposited cash on hand. Because of the lack of internal controls,

Steve took for personal use all of the undeposited receipts in excess of $1,591.63. He

then prepared the following bank reconciliation in an effort to conceal his theft of

cash.

Cash balance per books, March 31 $6,889.53

Add: Outstanding checks

No. 781 $286.00

No. 782 319.47

No. 783 303.14 808.61

7,698.14

Less: Undeposited receipts 1,591.63

Unadjusted balance per bank, March 31 6,106.51

Less: Bank credit memorandum 175.00

Cash balance per bank statement, March 31 $5,931.51

Instructions

(a) Prepare a correct bank reconciliation. (Hint: Deduct the amount of the theft from the

adjusted balance per books.)

(b) Indicate the three ways that Steve attempted to conceal the theft and the dollar amount

involved in each method.

(c) What principles of internal control were violated in this case?

Prepare a comprehensive

bank reconciliation with

theft and internal control

deficiencies.

(SO 1, 2, 3, 4)

(a) Cash bal. $5,681.00

Kimmel_Financial_6e_Set_C_Problems_Ch07.qxd 4/29/11 2:12 PM Page 5

You might also like

- Derivative Markets Solutions PDFDocument30 pagesDerivative Markets Solutions PDFSteven Hyosup KimNo ratings yet

- Size and Structure of The Clothing IndustryDocument9 pagesSize and Structure of The Clothing IndustryDisha DewaniNo ratings yet

- Latihan Acca v02Document17 pagesLatihan Acca v02Indriyanti KrisdianaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CH 08Document4 pagesCH 08vivienNo ratings yet

- Bank Reconciliation Statements (With Answers) : Advanced LevelDocument21 pagesBank Reconciliation Statements (With Answers) : Advanced LevelPrassanna Kumari100% (2)

- Cash and Cash Equivalents Sample ProblemsDocument7 pagesCash and Cash Equivalents Sample ProblemsCamille Donaire LimNo ratings yet

- CM 03 Bank ReconciliationDocument7 pagesCM 03 Bank ReconciliationDanicaEsponilla67% (3)

- Chapter 4 OrganizingDocument22 pagesChapter 4 OrganizingTweenie RodriguezNo ratings yet

- Presentation On Vegetron Limited: A Case Study On Financial ProjectionsDocument17 pagesPresentation On Vegetron Limited: A Case Study On Financial ProjectionsNishant Anand100% (2)

- IRM 501 School Finance and Material Resource ManagementDocument15 pagesIRM 501 School Finance and Material Resource ManagementRaymund P. CruzNo ratings yet

- Sba Form 413Document2 pagesSba Form 413David WaringNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- ACC101 Chapter6newxcxDocument18 pagesACC101 Chapter6newxcxAhmed RawyNo ratings yet

- Bank Reconciliation Statement - Principles of AccountingDocument8 pagesBank Reconciliation Statement - Principles of AccountingAbdulla MaseehNo ratings yet

- Accounting Cash Internal ControlsDocument14 pagesAccounting Cash Internal ControlsDave A ValcarcelNo ratings yet

- Essay A Essay B: Totals $569,000 $386,000Document4 pagesEssay A Essay B: Totals $569,000 $386,000Tosin YusufNo ratings yet

- 07 - Petty Cash Fund and Bank ReconciliationDocument2 pages07 - Petty Cash Fund and Bank ReconciliationCy Miolata100% (2)

- n.202 General Accounting ExercisesDocument7 pagesn.202 General Accounting ExercisesMohanad EmadNo ratings yet

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- Bank ReconciliationDocument10 pagesBank ReconciliationKhawaja SohailNo ratings yet

- Chapter 7 Question Review PDFDocument12 pagesChapter 7 Question Review PDFChit ComisoNo ratings yet

- Acct 200 FinalDocument6 pagesAcct 200 FinalLương Thế CườngNo ratings yet

- Seminar 3S212 - 13 PDFDocument4 pagesSeminar 3S212 - 13 PDFShweta SridharNo ratings yet

- MODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsDocument8 pagesMODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsJake Bundok100% (1)

- f3 Class TestDocument5 pagesf3 Class TestNadir MuhammadNo ratings yet

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Document5 pagesPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaNo ratings yet

- Bank Reconciliations C1 - Activities CDocument8 pagesBank Reconciliations C1 - Activities CSuy YanghearNo ratings yet

- BANK RECONCILIATION STATEMENTS HandoutDocument14 pagesBANK RECONCILIATION STATEMENTS HandoutKiri chrisNo ratings yet

- Chapter 7 Question Review 11th EdDocument12 pagesChapter 7 Question Review 11th EdKryzzel Anne JonNo ratings yet

- Bank Reconciliation: Everett Community College Tutoring CenterDocument3 pagesBank Reconciliation: Everett Community College Tutoring Centerehab_ghazallaNo ratings yet

- Chapter 12 - Bank ReconciliationDocument29 pagesChapter 12 - Bank Reconciliationshemida100% (7)

- Draft 2220DE Mid-Term SolutionDocument6 pagesDraft 2220DE Mid-Term SolutionJordanBetelNo ratings yet

- Audit of CashDocument6 pagesAudit of CashMark Lord Morales Bumagat100% (2)

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- WorksheetsDocument1 pageWorksheetsMarie Sol GalingNo ratings yet

- AP - Audit of CashDocument4 pagesAP - Audit of CashRose CastilloNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationFem FataleNo ratings yet

- Chapter 5 - Cash Book & Bank ReconciliationsDocument6 pagesChapter 5 - Cash Book & Bank ReconciliationskundiarshdeepNo ratings yet

- Intermediate Accounting 1Document14 pagesIntermediate Accounting 1cpacpacpa100% (1)

- Accounting Questions 22Document3 pagesAccounting Questions 22rln0518No ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- Chapter 6 ICADocument5 pagesChapter 6 ICAAndrew MarchukNo ratings yet

- Step BankDocument4 pagesStep BankSamrawit MewaNo ratings yet

- Bank Reconciliation RevisionDocument4 pagesBank Reconciliation RevisionFadzir AmirNo ratings yet

- BU8101 Sem3 - Group 11Document63 pagesBU8101 Sem3 - Group 11Shweta SridharNo ratings yet

- Quizzer (Cash To Inventory Valuation) KeyDocument10 pagesQuizzer (Cash To Inventory Valuation) KeyLouie Miguel DulguimeNo ratings yet

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- Module 9. Bank ReconciliationDocument22 pagesModule 9. Bank ReconciliationValerie De los ReyesNo ratings yet

- Problems Set CDocument5 pagesProblems Set CDiem Khoa PhanNo ratings yet

- Acc 106 Quiz BR and Ar NoakDocument8 pagesAcc 106 Quiz BR and Ar Noakhoneyjoy salapantanNo ratings yet

- Financial Accounting Test One (01) James MejaDocument21 pagesFinancial Accounting Test One (01) James MejaroydkaswekaNo ratings yet

- Bank ReconciliationDocument21 pagesBank Reconciliationehab_ghazallaNo ratings yet

- Cash Book - Principles of AccountingDocument13 pagesCash Book - Principles of AccountingAbdulla MaseehNo ratings yet

- Unit - 3 Bank Reconciliation StatementDocument21 pagesUnit - 3 Bank Reconciliation StatementMrutyunjay SaramandalNo ratings yet

- F CFAS-EXAM - Docx 143874436Document48 pagesF CFAS-EXAM - Docx 143874436Athena AthenaNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationp12400No ratings yet

- C02-Fundamentals of Financial Accounting: Sample Exam PaperDocument15 pagesC02-Fundamentals of Financial Accounting: Sample Exam PaperIshak AnsarNo ratings yet

- Tugas PA 2Document2 pagesTugas PA 2Fadhilah HazimahNo ratings yet

- Week 2 Leap FabmDocument7 pagesWeek 2 Leap FabmDanna Marie EscalaNo ratings yet

- Cash and Accounts ReceivableDocument11 pagesCash and Accounts ReceivablePat ClosaNo ratings yet

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- Chapter 7 - Corporate DiversificationDocument30 pagesChapter 7 - Corporate DiversificationHitesh NaikNo ratings yet

- Term Paper TopicsDocument2 pagesTerm Paper TopicsShalini BhattacharyaNo ratings yet

- FCFE Vs DCFF Module 8 (Class 28)Document9 pagesFCFE Vs DCFF Module 8 (Class 28)Vineet AgarwalNo ratings yet

- Orris Aster Court Price ListDocument4 pagesOrris Aster Court Price ListGreen Realtech Projects Pvt LtdNo ratings yet

- Qut Blueshift Business Case Competition 2017 WorkbookDocument18 pagesQut Blueshift Business Case Competition 2017 WorkbookK59 Tran Duc TriNo ratings yet

- Sales Promotion of Reliance GSM ServicesjituDocument61 pagesSales Promotion of Reliance GSM ServicesjituDutikrushna SahuNo ratings yet

- Cardinal and Ordinal UtilityDocument9 pagesCardinal and Ordinal UtilityArun KumarNo ratings yet

- Puja Kumari Pandey MRP PresentationDocument17 pagesPuja Kumari Pandey MRP PresentationSAKET RATHI IPS Academy IndoreNo ratings yet

- The Transformationof Japans Foreign Aid PolicyDocument7 pagesThe Transformationof Japans Foreign Aid PolicyVeni YulianingsihNo ratings yet

- Challenges of Modern Personnel Manager (Autosaved)Document27 pagesChallenges of Modern Personnel Manager (Autosaved)mohd_abdulmajed0% (1)

- HRM Practices in Private Commercial Banking Factor AIB PLCDocument82 pagesHRM Practices in Private Commercial Banking Factor AIB PLCABC Computer R.SNo ratings yet

- American Economic Association The American Economic ReviewDocument10 pagesAmerican Economic Association The American Economic ReviewkNo ratings yet

- Feasibility Study Organic Cocoa - Togo and CameroonDocument46 pagesFeasibility Study Organic Cocoa - Togo and CamerooncobbymarkNo ratings yet

- STRATHRM Lesson 1 - Development of Human ResourcesDocument33 pagesSTRATHRM Lesson 1 - Development of Human ResourcesOCHOADA, Micah Danille S.No ratings yet

- IAS 23 - SemDocument3 pagesIAS 23 - SemMeo MeoNo ratings yet

- CELCOMDocument10 pagesCELCOMMon LuffyNo ratings yet

- Manager Analytics - LMG JDDocument4 pagesManager Analytics - LMG JDMANMEET MALKOTRANo ratings yet

- How Do I Study Indian Economy by Ramesh SinghDocument6 pagesHow Do I Study Indian Economy by Ramesh Singhmanchorus100% (2)

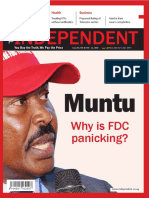

- THE INDEPENDENT Issue 541Document44 pagesTHE INDEPENDENT Issue 541The Independent MagazineNo ratings yet

- Crisis of MasculinityDocument7 pagesCrisis of MasculinityStevie VorceNo ratings yet

- Commercial Law Memory Aid AteneoDocument44 pagesCommercial Law Memory Aid Ateneo'yapayaw Matago TagoNo ratings yet

- OPEC MOMR March 2023Document94 pagesOPEC MOMR March 202311: 11No ratings yet

- UntitledDocument6 pagesUntitledudhayaa_145No ratings yet