Professional Documents

Culture Documents

SBI PO Study Material Complete

SBI PO Study Material Complete

Uploaded by

Nitin AryaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI PO Study Material Complete

SBI PO Study Material Complete

Uploaded by

Nitin AryaCopyright:

Available Formats

STATE BANK OF INDIA

The Origin of the State Bank of India goes back to the first decade of the 19

th

century with establishment of the Bank of

Calcutta in Calcutta on 2 June 1806. Three years later the bank received its charter and was re-designed as the Bank of

Bengal (2 January 1809). A unique institution, it was the first joint- stock bank of British India sponsored by The

Government of Bengal. The Bank of Bombay (15 April 1840) and the bank of Madras (1 July 1843) followed the Bank

of Bengal. These three banks remained at the apex of modern Banking in India till their Amalgamation as the Imperial Bank

of India on 27 January 1921.

Headquarters: Mumbai

Founded on: July 1

st

, 1956

Logo: State Bank of India is a blue circle with a small cut in the bottom that depicts perfection and the small man the common

man being the centre of the banks business

Tag Line: PURE BANKING, NOTHING ELSE, WITH YOU ALL THE WAY, A BANK OF THE COMMON MAN,

THE BANKER TO EVERY INDIAN, THE NATION BANKS ON US

Employees: 295,696 [2012]

Associate Banks:

1. State Bank of Bikaner and Jaipur Jaipur (Head Office)

2. State Bank of Hyderabad Hyderabad (Head Office)

3. State Bank of Mysore Bangalore (Head Office)

4. State Bank of Patiala Patiala (Head office)

5. State Bank of Travancore Poojappura, Thiruvananthapuram (Head Office)

Important Points about SBI

SBI is one of the big four banks of India, along with ICICI bank, Punjab National Bank and Bank of Baroda

SBI had 14,816 branches in India as on 31 March 2013

SBI is the first bank to open branch in China

15000

th

branch of the State Bank of India (SBI) at Sooranam (Tamil Nadu)

SBI has 21, 500 branches (including Assosiate Banks )

SBI has 99, 345 offices in India

SBI has 27000+ ATM and SBI Group (including Assosiate Banks ) has 32752 ATMs.

On October 7, 2013, Arundhati Bhattacharya became the first woman to be appointed Chairperson of the bank

SBI has become the first bank to install an ATM at Drass in the Jammu & Kashmir Kargil region. This was the Banks

27,032nd ATM on 27 July 2012.

List of Awards (2013-14)

1. The Banker (1) in the year 2009

2. IDRBT (3)

3. D & B Polaris (1)

4. SKOCH (3)

5. SKOCH CORPORATE EXCELLENCE

6. PC QUEST

7. EDGE AWARD (2)

8. Asias best CSR Practices Awards 2013-Singapore

9. Asian BFSI Awards 2013- Dubai

10. Indias Most Ethical Companies awards 2013

11. Asian Green Future Leadership Awards 2013

12. Best Public Sector Bank Award 2013

13. Won national award in the year 2012 for Prime Ministers Employment Generation Programme (PMEGP) scheme

14. Technology of the year by the IBA banking technology awards

15. Best online banking award in 2010 by IBA

16. Best rural banking initiative and best IT architecture

17. THE BEST BANK in cash management services in Asia

18. Pegasus Corporate Social Responsibility Award 2007

FIRST IN INDIA

First bank established in India: Bank of Hindustan in 1770

Second bank: General Bank of India, 1786

Oldest bank in India originated in the Bank of Calcutta in June 1806 which was still in existence State Bank of India

State Bank of India merged with three banks namely Bank of Bengal, Bank of Bombay and Bank of Madras in 1921 to form

the Imperial bank of India which was converted as State Bank of India

First Indian bank got ISO: Canara Bank

First India bank started solely with Indian capital investment is PNB (Punjab National Bank)

Founder of Punjab National Bank is Lala Lajpat Rai

Reserve bank of India (RBI) was instituted in 1935

First governor of RBI: Mr.Osborne Smith

First Indian Governor of RBI: Mr. C D Deshmukh

First bank to introduce savings account in India: Presidency Bank in 1833

First bank to introduce cheque system in India: Bengal Bank in 1833

First bank to introduce internet banking: ICICI bank

First bank to introduce mutual fund: State Bank of India

First bank to introduce credit card in India: Central Bank of India

Which cards are known as plastic money Credit Cards.

Open market operations are carried out by RBI

Capital market regulator is SEBI

Largest Commercial bank in India State Bank of India

The International Bank for Reconstruction and Development (IBRD) is known as World Bank

Indias First Financial Archive has been set up at Kolkata

CRR, SLR, Repo Rate, Reverse Repo rate are decide by RBI

Savings banks interest rates, fixed deposit interest rates, Loan Rates etc. are decided by individual banks

The bank which has launched Mobile Bank Accounts in association with Vodafones m paisa HDFC Bank

Minimum money transfer limit through RTGS: 2 Lakhs

Maximum money transfer limit through RTGS: No Limit

Minimum & Maximum money transfer limit through NEFT: No Limit

NABARD was established in July, 1982

Largest Public sector bank in India SBI

Largest Private sector bank in India ICICI Bank

Largest Foreign bank in India Standard Chartered Bank

First Indian bank to open branch outside India i.e. London in 1946: Bank of India

First RRB named Prathama Grameen Bank was started by: Syndicate Bank

First Bank to introduce ATM in India: HSBC in1987, Mumbai

Bank of Baroda has the maximum number of overseas branches

SBI holds the second position with maximum number of overseas branches

Premium credit cards exclusively for women launched recently by HDFC bank

Private Sector Bank that recently launched a product of Personal loan called SWIFT HDFC

The bank which approved loan of $500mn to help India improve Rail services Asian Development Bank

FDI limit for new banks 49%

FDI limit for private banks: 74%

Some Basic Economic Terms

Interest Rate Swaps: An interest rate swap is the transfer of contractually agreed between two counterparties of their

respective interest rate obligation. Interest rate swaps are commonly used as a means of converting fixed rate to floating rate

debt and vice versa.

Operating Ratio: A ratio that shows the efficiency of a companys management by comparing operating

expense to net sales. Calculated as

Operation ratio = Operating expense/net sales

Wholesale Price Index (WPI): WPI is taken into consideration while calculating the inflation. A change has recently been

made in the WPI. Its present base year will be taken as 2004-05 earlier it was 1993-34. Base year mean (2004-05 = 100).

Total articles taken into consideration will be 676 earlier these were 435.676 include 102 Primary Articles, 19 fuel & power,

and 555 of Manufacturing Products. Earlier WPI was calculated on Weekly basis but now it is calculated on Monthly Basis.

First time inflation was calculated in August 2010 (on new system).

Consumer Price Index (CPI) : Most advanced nations base their policies on retail price inflation but India uses wholesale

price inflation, CPI is largely a segmental and is superior to the WPI, CPI capture consumption price both at urban and rural

centers, as in WPI 676 items are covered and base year is taken as 2004-05 and for macroeconomic policies. Whereas in

CPI 320 items are taken from (CPI-IW) CPI industrial workers and 260 items are taken from both CPR rural laborers and CPI

agricultural laborers and the base year for calculation is taken as 2010.

Coupon Rate: Specified interest rate on a fixed maturity security fixed at the time of issue. The coupon rate of a bond is the

amount of interest paid per year as a percentage of the face value or principal.

NRO (Non Resident Ordinary a/c) : In this account , a person cannot repatriate income without RBI approval but can remit

Interest thereof.

NRNR (Non Resident Non Repatriable A/c ) : Under this account Principal amount in not permissible to repartriate but

interest can be.

Banking Terms

Repo Rate: Repo rate means a purchase and sale of agreement. It is a contract to buy securities and then sell them back at an

agreed future date and price. It is thus revenue for short term investment of surplus funds. From RBI point of view it is called

a short term lending and from banks point of view it is called short term borrowing.

Reverse Repo rate : Reverse Repo Rate is an instrument of borrowing funds for a short period and involves selling a security

and simultaneously agreeing to repurchase it at a stated future date for slightly higher price. From RBI point of view it is

called a short term borrowing and from banks point of view it is called a short term lending.

Group Company : As per RBI for the purpose of FDI, two or more enterprise which , directly or indirectly , are in position

to exercise 26% or more of voting rights in other enterprise or appoint more than 50% of the members of the board of directors

in the other enterprises.

Branch Vs Subsidiary: A subsidiary is a separate legal entity from the parent company, although owned by parent company,

has a same legal identity as its parent company , from liability , on the other hand branch is not a separate legal entity of the

parent company and liability wise there is no limit to the parents companys liability , RBI has permitted to Foreign Banks to

change from Branch Mode to the Wholly Owned Subsidiaries.

NFS (National Financial Switch): It facilitates interconnectivity between banks switches and interbank payment Gateway

for authentication & routing the payment details of various E-commerce & E-Govt. activities (Retail Banking). Now NFS has

been overtaken by NPCI (National Payment Corporation of India).

SLR (Statutory Liquidity Ratio): This is a minimum Reserve which every bank has to maintain with itself in the most liquid

form to meet any demand of the depositors. Normally Government securities are purchased to maintain SLR.

Prime Lending Rate (PLR): The term originally indicates the rate of interest at which a bank lends to favored customers,

i.e. those with high credibility, though this is no longer always the case. Some variable interest rates may be expressed as a

percentage above or below prime rate.

Sub Prime Rate: In India when money is lent below the PLR is known as Sub Prime Rate whereas in USA when money is

lent at rate above the PLR is known as Sub Prime rate.

Base Rate: As per recommendation of Mr. Deepak Mohanty of RBI to bring a complete transparency in Banks lending

system, in Indian Banking system the loan were sanctioned to the large corporate houses even below the PLR and some time

it were fixed very low without any justification. A Base rate recommends that no bank will lend any money below the base

rate. With this there shall be no extra benefits to the large corporate houses. Base rate will be beneficial for the regulator RBI.

Now all Banks will either lend at Base rate or will park money with RBI, under LAF system. Base rate has been implemented

from 1

st

july, 2010.

GDRs (Global Depository Receipts): It is a dollor denominated instrument, an easy way of raising funds from foreign

countries. It is a mechanism that allows foreign investor to invest in Indian Companies. Represents a certain number of equity

shares on Indian companies. GDRs are issued by depository usually American Banks & Indian shares are held by custodian

in India (like ICICI). Traded in stock exchanges in Europe or in US or both.

IPO (Initial Public Offer): 1

st

sale of stock by a company to the public .IPOs offer issued by smaller younger co. seeking

the capital to extend. It can also be done by large company.

FPO (Follow on Public Offer ) : A public company already listed on an exchange, a supplementary shares made by a

company that is already publicly listed & has gone thru the IPO process, it is also called as secondary public offering

subsequent to the companys IPO.

Zero Liability Protection: It is a bank guarantee. If your card is lost or stolen you may not be responsible for unauthorized

purchases made with your card if you report the theft promptly. The Zero liability protection facility is free & automatically

available on all bank consumer Credit Cards.

Vostro Account: When a foreign Bank is opened in the India with Indian Currency is known as Vostro account e.g. Standard

Chartered Bank in India.

SWAPS: It is a transaction where the bank purchases or sells the foreign currency simultaneously, for different maturities,

say purchases of spot and sale of forward or vice versa. Swap contracts obligate 2 parties to swap or exchange certain specified

intervals. Swaps are not the instruments for raising funds rather they allow better management of existing funds.

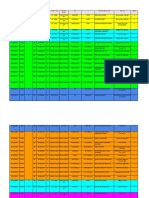

Important Details about Nationalized Banks in India

Sl.NO Name of the Bank Chairman Head Office

Year of

Commencement

1 Allahabad Bank

Shubhalakshmi

Panse

Kolkata 1865

2 Andhra Bank B.A. Prabhakara Hyderabad

20

th

November,

1923

3 Bank of Baroda S.S. Mundra

Baroda

(Vadodara)

20

th

July, 1908

4 Bank of India V R Iyer Mumbai

7

th

September,

1906

5 Bank of Maharashtra Narendra Singh Pune 1935

6 Canara Bank Rajiv Kishore Dubey Bangalore 1906

7 Central Bank of India Shri. Rajeev Rishi Mumbai

21 December,

1911

8 Corporation Bank Shri S.R. Bansal Mangalore 1906

9 Indian Bank T.M. Bhasin Chennai 1907

10 Indian Overseas Bank Shri M. Narendra Chennai

February 10

th

,

1937

11

Oriental Bank of

Commerce

Shri S.L. Bansal New Delhi

February 19

th

,

1943

12 Punjab National Bank Shri K.R Kamath New Delhi 1895

13 Punjab & Sind Bank SH. Devinder Singh New Delhi 1908

14 Syndicate Bank

Shri Sudhir Kumar

Jain

Mani pal 1925

15 UCO Bank Shri Arun Kaul Mumbai 6

th

January, 1943

16 Union Bank of India Shri D. Sarkar Kolkata

11

th

November,

1919

17 United Bank of India

Ms. Archana

Bhargava

Kolkata 1950

18 Vijaya Bank

Shri. H.S. Upendra

Kamath

Bangalore 1931

19 IDBI bank Mr. M.S. Raghavan Mumbai July, 1964

20 Dena Bank

Shri. Ashwani

Kumar

Mumbai 1938

21 ECGC Shri N Shankar Mumbai 30

th

July, 1957

Important Details about State Bank of India and their Subsidiaries

State Bank of India has 5 associate banks State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State

Bank of Mysore, State Bank of Patiala and State Bank of Travancore. State Bank of Saurashtra and State Bank

of Indore are merged into SBI. On October 7

th

, 2013 Arundhati Bhatacharya is appointed as the first lady

chairperson for SBI.

Sl.NO Name of the Bank Chairman Head Office

Year of

Commencement

1 State Bank of India

Arundhati

Bhattacharya

Mumbai 1

st

July, 1955

2

State Bank of

Hyderabad

Pratip Chaudhuri Hyderabad 8

th

August, 1941

3 State Bank of Mysore Pratip Chaudhuri Bangalore 2

nd

October, 1913

4 State Bank of Patiala Pratip Chaudhuri Patiala 1

st

April, 1960

5

State Bank of Bikaner

& Jaipur

Pratip Chaudhuri Jaipur 1963

6

State Bank of

Travancore

Pratip Chaudhuri Thiruvananthapuram

12

th

September,

1945

7

State Bank of

Saurashtra

Merged into SBI on 13

th

August, 2013

8 State Bank of Indore Merged into SBI on 2010

NABARD Important Banking Awareness

NABARD is an apex development bank in India established on 12 July, 1982 with an aim of providing services to rural India

by increasing the credit flow for evaluation of agriculture & rural non form sectors.

It was set up by the Reserve Bank of India (RBI) under the chairmanship of Shri B. Sivaraman.

NABARD is a development bank for providing and regulating credit and other facilities for the promotion and development

of cottages, small scale industries, development of agriculture, village industries, handicrafts and other rural crafts

With a view of promoting rural development and securing rural areas, NABARD is entrusted with

1. Providing refinance to lending institutions in rural areas

2. Bringing about or promoting institutional development and

3. Evaluating, monitoring and inspecting the client banks

RBI sold its stake in NABARD to the Government of India, which now holds 99% STAKE. NABARD is active in developing

financial inclusion policy.

Important Points about NABARD

Head Quarters: Mumbai

Established on: 12 July, 1982

Chairman: Dr. Harsh kumar Bhanwala

NABARD completed its 25 years on 12 July, 2007

NABARD is active in developing Financial Inclusion

It is Indias specialized bank developed by Shivaramans committee to provide credit in rural areas. It replaced the Agricultural

Credit Department (ACD) and Rural Planning and Credit Cell (RPCC) of Reserve bank of India, and Agricultural Refinance

and Development Corporation (ARDC).

NABARD undertakes the monitoring and evolution of projects will be refinanced by it

It provides training for the institutions working for the rural development.

NABARD keeps a check on client institutions

It regulates the cooperative banks and RRBs

It takes measures for improving credit delivery system, monitoring, schemes credit institutions, and training of personnel

Helps the state governments in reaching their targets of providing assistance to eligible institutions in agriculture and rural

development

BANKING OMBUDSMAN

Banking Ombudsman is a quasi judicial authority functioning under Banking Ombudsman Scheme 2006.It provides

independent, expeditious and inexpensive forum to aggrieved/Un-satisfied Bank customers. RBI introduced this Scheme

under powers granted U/s 35-A of Banking Regulation Act.

Complaints are accepted only if they are made within one year after the complaint has received the reply from

bank.

Types of Complaints :

1. Non-payment or inordinate delay in the payment or collection of cheques, drafts ,bills etc.

2. Non-acceptance, without sufficient cause, of coins tendered and for charging of commission for this service.

3. Non-acceptance without sufficient cause of small denomination notes tendered for any purpose and for charging of

commission for the service.

4. Failure to issue or delay in issue, of drafts pay orders or bankers cheque.

5. Non-adherence to prescribed working hours.

6. No payment or delay in payment of inward remittances.

7. Failure to honor guarantee or letter of credit commitments.

8. Failure to provide or delay in providing a banking facility promised in writing by a bank or its direct selling agents.

9. Delays, non-credit of proceeds to partiesaccounts, non-payment of deposit or non-observance of the Reserve Bank

directives, if any applicable to rate of interest on deposits in any savings, current or other account maintained with a bank.

10. Delays in receipts of export proceeds, handling of export bills, collection of bills etc. for exporters provided the said

complaints pertain to the Banks operations in India.

11. Refusal to open deposit accounts without any valid reason for refusal.

12. Levying of charges without adequate prior notice to the customers.

13. Non-adherence by the bank or its subsidiaries to the instructions of Reserve Bank on ATM/debit card operations or credit

card operations.

14. Non-disbursement or delay in disbursement of pension to the extent the grievance can be attributed to the action on the

part of the Bank concerned but not with regard to its employees.

15. Refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Government.

16. Customers should have complained to the concerned Bank first and wait for one month. Complaint to Ombudsman can

be writing or in electronic mode.

Award :

Ombudsman can give maximum award upto Rs.10 Lacs.

Appeal :

Any party can file appeal within 30 days on receiving appeal award or the Ombudsman rejecting his complaint to Appellate

authority. If the appeal is the bank, it should be made with approval of CMD or ED or CEO only.

E-banking

E-Banking

E- banking refers to electronic banking. It is like e-business in banking industry. E-banking is also called as virtual

banking or online banking. E-banking is a Result of the growing expectations of bank customers. E-banking involves

information technology based banking. Under this IT system the banking services are delivered by way of a computer-

controlled system. This system involves direct interface with the customers. The customers need not to visit bank premises

Popular services covered under E-banking

1. Automated teller machine

2. Credit card

3. Debit card

4. Smart card

5. Electronic funds Transfer system

6. Cheque truncation system

7. Mobile banking

8. Internet banking

9. Telephone banking

Automated teller machine

ATM is designed to perform the most important function of bank. it is operated plastic card with its special features.

The plastic card has replaced cheque Personal attendance of the customer banking hours restrictions and paper based

verification. These are debit cards. An ATM is an electronic funds Transfer terminal capable of handling cash deposits

Transfer between accounts balance enquires, cash withdrawals and pay bills. It may be online or Offline. Any customer

processing ATM card issued by the shared payment network system can go to any ATM linked to shared payment networks

and perform his transactions

Credit card/ Debit card

The Credit card holder is empowered to spend wherever and whenever he wants with his Credit card within the limits

fixed by his bank. Credit card is a post paid card. Debit card considered as a prepaid card with usage facility limited to the

balance in the linked deposit account of the cardholder. An individual has to open an account with the issuing bank which

gives debit card with a Personal identification number. When he makes purchases he enters his pin on shops pin pad. When

the card is slurped through the electronic terminal it dials the acquiring bank system -either master card or VISA that validates

the pin and finds out can never overspend because the system rejects any transactions which exceeds the balance in his

account. The bank never faces a default because the amount spent is debited immediately from the customers account.

Smart card

Banks are adding chips to their current magnetic stripe cards in order to enhance security and offer new services that

are called smart cards. Smart cards allow

Thousands of times of information storable on magnetic stripe cards. In addition these cards are highly secure, more reliable

and perform multiple functions. They hold a large amount of Personal information ranging from medical and health history

to Personal banking and personal preferences.

Services of E-banking

E-banking provides a multitude of services that are as follows

1. Bill payment service

E-banking facilitates the payment of electricity bills, telephone bills, Credit card, and insurance premium bills. And

the bank does not charge customers for online payments

2. Fund Transfer

You can Transfer any amount from one account to another of the same or any another bank. Customers can send

money anywhere in India.

3. Credit card customers

With internet banking customers cannot only pay their credit card bills online but also get a loan on their cards. In

case of loss of the credit card an online reporting can be done.

4. Investing through internet banking

Now, FD can be opened on line through funds Transfer and investors with interlinked demit account and bank account

can easily trade in the stock market.

5. Recharging prepaid mobile

By just selecting the operator name entering the mobile number and the amount of Recharge the mobile phones can

be back in action within few minutes.

6. RTGS fund Transfer

RTGS is an inter Bank funds Transfer system. Where are Transferred as end when the transactions are tiggered.

7. Shopping

Online Shopping can also be done with a range of all kind of products. Railway and air tickets can be bought through

the internet banking.

8. Online payment of taxes.

A customer can pay various taxes on line including excise and service tax direct tax etc.

Electronic funds Transfer

Electronic funds Transfer provides for electronic payments and collections. EFT is safe secure, efficient and less

expensive than paper check payments and collections . RBI EFT is a scheme introduced by RBI to help banks offering their

customers money Transfer service from account to account to any branch to any other bank branch in places where services

are offered.

Internet banking

Through internet banking you can check your transactions at any time of the day and as many times as you want to.

Where as in a traditional method you get quarterly statements from the bank. If the fund Transfer has to be demand outstation

where the bank does not have a branch the bank would demand outstation charges. Whereas with the help of online banking.

Mobile banking transactions

Now banks have started offering mobile banking and telemarking to their customers. The expansion in the use and

geographical reach of mobile phones has created new opportunities for banks to use this mode for banking transactions and

also provide an opportunity to expand banking facilities to the excluded sections of the society.

Financial Inclusion

Financial Inclusion

Financial inclusion or inclusive Financing is the delivery of financial service at affordable costs to sections of

disadvantaged and low income segments of society. Or we can say that financial inclusion may be defined as the process of

ensuring access to Financial inclusion in timely and adequate Credit when needed by vulnerable groups such as weaker

sections and low income groups at an affordable cost.

Unrestrained access to public goods and services is the sine qua of an open and efficient society. It is argued that as banking

services are in the nature of public good it is essential that availability of banking services and payment services to the nature

of public good it is essential that availability of banking and payment services to the entire population without discrimination

should be the prime objective of public policy. the term Financial inclusion has gained importance since the early 2000s and

is a Result of findings about Financial inclusion and it direct correlation to poverty. Financial inclusion is now a common

objective for many central banks among the Developing nations

Financial inclusion offers people the following things

1. Access to Financial markets

2. Access to Credit markets

3. Financial literacy

Objectives of Financial inclusion

1. Access at a reasonable cost for all house holds and enterprises to the range of Financial services for which they bankable

including savings , short and long term credit , leasing and factoring , mortgages , insurance , pensions, payment , local money

Transfers and international remittances.

2. Sound institutions guided by appropriate internal management systems, industry performance standards and performance

monitoring by the market as well as sound prudential regulation wherever required.

3. Financial and institutional sustainability as a means of providing access to Financial services over time.

4. Multiple provides of Financial services wherever feasible so as to bring cost effective and a wide variety of alternatives to

customers

Financially excluded sections largely comprise of the following activities.

1. Marginal farmers

2. Landless laborers

3. Oral lessees

4. Self Employed and unorganized sector enterprises

5. Urban slum dwellers

6. Migrants

7. Ethnic minorities and society excluded groups

8. Senior citizens

9. Women

The north east eastern and central regions of India contain most of the Financially excluded population.

Benefits of inclusive financial growth

The benefits of inclusive financial growth can be described

1. Growth with equity:- In the path of becoming super power we the Indians need to achieve the growth of our country with

equality. It is provided by inclusive finance.

2. Getting rid of poverty:- To remove poverty from the Indian context everybody will have to be given access to formal

Financial services . Because if they borrow loans for business or Education or any other purpose then that will pave the way

for their Development.

3. Financial transactions made easy:- Inclusive finance will provide banking related Financial transactions in an easy and

speedy way.

4. Safe savings along with Financial services:- People will have safe savings along with other allied services like insurance

cover, entrepreneurial loans payment and settlement facility etc.

5. Increasing National income:- boosting business opportunities will definitely increase GDP that will be reflected in our

National income growth.

6. Becoming global player:- Financial access will attract global market players to our country that would Result in increased

Employment and business oppurtunities.

FUND TRANSFER SYSTEMS

There are two ways for transferring funds

RTGS (Real Time Gross Settlement)

NEFT (National Electronic Fund Transfer)

Real Time Gross Settlement (RTGS)

RTGS is one of the fastest mode of fund transfer in India through banking channel

RTGS is nothing but transferring of money in real time on gross basis from one bank to other without netting. This

RTGS is mainly used for large transactions, Minimum amount to be remitted through this RTGS is 2 Lakhs and

there is no any upper limit

Through RTGS system, money will be remitted for beneficiary account within 2 hours of receiving the fund

transfer message

Main advantage of fund transferring through RTGS is remitting bank will receive the conformation message from

RBI that money have been transferred to beneficiarys account

Timings for Transferring Funds through RTGS:

Normal Days: 09:00 hours to 16:30 hours

Week Days: 09:00 hours to 14:00 hours

Processing/Service Charges for RTGS Fund Transfer

Inward Transactions: No Charge

Outward Transactions: Rs.2lakhs to Rs.5lakhs: Rs.30/-

Above Rs.5lakhs: Rs.55/-

Essential Information for RTGS Fund Transfer

Amount to be remitted

Remitting Customers account number which is to be debited

Name of the beneficiary bank and branch

Name of the beneficiary customer

Account number of the beneficiary customer

Sender to receiver information

IFSC (Indian Financial System Code) of the receiving branch

This RTGS fund transfer is not available for all branches of banks in India; one can check the availability of RTGS system

through http://rbidocs.rbi.org.in/rdocs/RTGS/DOCs/RTGEB0112.xls.

National Electronic Fund Transfer (NEFT)

NEFT is an electronic fund transfer system on DNS (Deferred Net Settlement) basis through netting. This NEFT will be done

in 12 settlements

Timings for Transferring Funds through NEFT:

Normal Days: 08:00 am to 07:00 pm

Week Days: 08:00 am to 01:00 pm

Processing/Service Charges for NEFT Fund Transfer

Inward Transactions: No Charge

Outward Transactions:

Up to Rs.10, 000: Rs.2.50/- + Service Tax

Rs.10, 000 to RS.1lakh: Rs.5/- + Service Tax

RS.1lakh to RS.2lakhs: Rs.15/- + Service Tax

Above RS.2lakhs: Rs.25/- + Service Tax

ADVANTAGES:

Remitter need not send the cheque or DD to the beneficiary

Beneficiary need not visit the bank for depositing

Beneficiary need not to worry about the loss / theft of physical instruments

Cost effective

Credit confirmation of the remittances sent by SMS or email

Remitter can initiate the remittances from home/ place of work through Internet Banking also

Secure

Essential Things for NEFT Fund Transfer:

Both originating and destination bank branches should be a part of the NEFT system

Name of the beneficiary bank and branch

Name of the beneficiary customer

Account number of the beneficiary customer

Account type of the beneficiary customer

IFSC (Indian Financial System Code) of the beneficiary bank

Indian Financial System Code (IFSC)

IFSC (Indian Financial System Code) is an alpha-numeric code that uniquely identifies bank branch participating in the

NEFT system.

IFSC is an 11-digit code with the first four Alpha characters representing the bank, and the last 6 characters representing the

branch. The 5

th

character is 0 (Zero)

In this IFSC code SBTR0000143, SBTR represents bank name State Bank of Travancore, Last 6 digits 000143 is the

branch code

USES:

Main aim of using this IFSC code is to identify the originating/destination banks and branches and also to route the messages

to the concerned banks/branches appropriately

Some Financial Institutions

Introduction

Securities Exchange Board of India (SEBI): It is regulatory authority of stock exchanges and protects

investors from Fraudulent dealings. It was established in April 1988 and awarded statutory status by Act of

parliament in 1992.

Chairman: UK Sinha

Head quarters : Mumbai

Insurance Regulatory & Development Authority (IRDA) : It is apex body formed under Sec.4 of IRDA

Act 1999 to protect the interests of the policyholders to regulate promote and ensure orderly growth of the

insurance industry in India

Financial Stability & Development Council : This is the apex financial regulator of our country. Headed by

Finance Minister, it coordinates and regulates to four financial regulators of the country i.e. RBI,SEBI,IRDA

and PFRDA to ensure that all of them operate and function in harmony to promote the growth and stability of

Indian Economy.

Indian Banks Association (IBA) : It is the official association of all the banks operating in India. It acts as a

bridge between banks on one hand and government and staff unions on the other. Presetly Mr. K.R. Kamath,

CMD of Punjab National Bank is Chairman of IBA.

Non Banking Financial Company (NBFC): These are companies which have functions similar to banking

like accepting deposits and making loans. However they do not have license for banking, although they are

regulated by RBI.

Deposit Insurance & Credit Guarantee Corp.(DI&CGC) : It is a wholly owned subsidiary of RBI which

provides an insurance cover of Rs.1lakh per depositor per bank in case of bank failure.It also provides

guarantee of repayment amount in default of small loans given by banks.

Export Credit Guarantee Corporation of India (ECGC): ECGC is a Govt. body which provides export

credit insurance facilities to exporters and banks in India. It encourages Indian exporters by giving them credit

insurance covers.

Banking Codes and Standards Board of India: It is a industry watch dog set up by RBI to monitor and

assess the compliance with codes and minimum standards of service to individual customers, as prescribed by

the RBI.

Credit Information Report: A Credit Information Report is a factual record of a borrowers credit payment

history compiled from information received from different credit grantors. Its purpose is to help credit grantors

make informed lending decisions-quickly and objectively.

Credit Rating: Credit Rating is an assessment of the probability of default on payment of interest and

principal on a debt instrument. In simple words, it ranks the company or countrys ability to meet their debt

obligations.

Negotiable Instrument

There are certain documents used for payment in business transactions and are Transferred freely from one

person to another. Such documents are called negotiable Instruments like cheque, bank draft, bill of exchange,

promissory notes etc. Thus we can say negotiable Instruments are a transferable document where negotiable

means transferable and Instrument means document. According to section 13 of the negotiable Instruments

act 1881. A negotiable Instrument means promissory note bill of exchange or cheque payable either to order

or to bearer.

Features of a Negotiable Instrument

1. It is a written document

2. A negotiable Instrument payable to bearer is transferable merely by delivery whereas a Negotiable

Instrument payable to order is transferable by endorsement and delivery.

3. The holder of a Negotiable Instrument can sue upon it in his own name.

4. Its works in the same manner as money and like money it may also be transferred from one person to

another.

5. The Transferor does not need to give notice to any person at the time of transferring the Instrument.

6. It is the simplest and most convenient mode of assignment of a debt.

7. The tittle to the Instrument received by a bonafide transferee is not affected by defect in the title of the

transferor.

A. Negotiable Instruments

1. Promissory note

2. Bill of exchange

3. Cheque

4. Exchequer bill

5. Circular note

6. Dividend warrant

7. Share warrant

8. Bearer debenture

9. Bank note

10. Bank draft

B. Non Negotiable Instruments

1. Money order

2. Postal order

3. Deposit receipt

4. Share certificate

C. Quasi Negotiable Instruments

1. Bill of lading

2. Dock warrant

3. Carriers receipt

4. Letters of credit

5. Railway receipt

Types of Negotiable Instruments

According to the negotiable Instruments act 1881 there are just three types of Negotiable Instruments example

promissory note, bill of exchange and cheque. However many other documents have also been recognized as

negotiable instruments on the basis of custom and usage like treasury bills, share warrant etc. They posses the

features of Negotiability

Promissory note

A promissory note is an Instrument in writing containing an unconditional undertaking signed by the

maker to pay a certain sum of money to or to the other of a certain person. This type of a document is called

a promissory note.

Features of promissory note

1. A promissory note is unconditional

2. It is always in writing a verbal promise to pay a specified sum of money is not a promissory note.

3. It is made and signed by the debtor.

4. A promissory note is made as payable in the Currency of the country

5. A promissory note drawn for a specified duration should be adequately stamped According to its value.

6. A promissory note should be drawn for the payment of a specified sum.

Bill of exchange

A bill of exchange is an Instrument in writing, unconditional order signed by the maker directing a

certain person to pay a certain sum of money only to or to the other of a certain person or to the bearer of the

Instrument.

Features of bill of exchange

1. A bill must be in writing, duly signed by its drawer accepted by its drawee and properly stamped as per

Indian stamp act.

2. It must contain an order to pay words like please pay rs.5000 on demand and oblige are not used.

3. The order must be unconditional.

4. The order must be to pay money and money alone.

5. The sum payable mentioned must be certain or capable of being made certain.

6. The parties to bill must be certain.

Cheque

A cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise

than on demand. It is an unconditional order in writing be drawn by a customer on his bank. Requesting the

specifying bank to pay on demand a certain sum of money to a person named in the cheque or to the bearer or

to the order of a stated person.

A cheque being a bill of exchange must possess the following requirements.

1. A cheque must be drawn upon a specified banker

2. A cheque must be payable on demand.

3. A cheque must be signed by the drawer.

4. A cheque must be an unconditional order to pay a certain amount of money.

5. A cheque be dated.

Types of cheque

1. Open cheque:- A cheque is called open when it is possible to get cash over the counter at the bank.

2. Crossed cheque:- Since open cheque is subject to risk of theft it is dangerous to issue such cheques. This

risk can be avoided by issuing other types of cheque called crossed cheque.

3. Bearer cheque:- A cheque which is Payable to any person who presents it for payment at the bank counter

is called bearer cheque.

4. Order cheque:- An order cheque is one which is payable to a particular person. In such a cheque the word

bearer may be cut out or cancelled and the word order may be written. The payee can transfer an order cheque

to someone else by singing his or her name on the back of it..

Quasi Negotiable Instruments

Quasi Negotiable Instruments are those Instruments which can be transferred by endorsement and delivery

but the transferee does not get a better tittle that of the transferor. Therefore they cannot be classified as

negotiable Instruments and hence the negotiable Instruments act is not applicable to them.

Technology Used in ATMs

Automated Teller Machine (ATM)

Automated Teller Machine (ATM) is a computerized machine that provides the customers the facility of checking balance,

withdrawing and transferring the funds without visiting the branch of the bank

Important Points to Remember:

Technology Used: Broadband Integrated Service Digital network (BISDN)

Operating systems used in ATMs Primarily: Windows XP Professional and Windows XP Embedded

Communication Mode: Both Data and Voice

Operates on: layer 2 in OSI Model (Data Link Layer)

Connection Mode: Point-to-Point

Size of ATM Cells: 53 Bytes (48 bytes of data and 5 bytes of header information)

Facilities available at ATMs

Account Information

Cash Deposit

Regular bills payment

Purchase of Re-load Vouchers for Mobiles

Mini/Short Statement

Loan account enquiry

There are two types of cards supported by ATM

ATM Debit Card

Credit Card

ATM Debit Card:

ATM Debit Card is card given by bank to access your account easily using a machine called Automated Teller Machine

(ATM). Debit cards can be used for shopping purposes, without carrying the money. You can use Debit cards while

purchasing, but you must have money in your account. Purchased amount will be deducted immediately from your account.

Advantages:

No need to carry money with you

You can use it for shopping purpose

No need of filling withdrawal and deposit slips

Money Security: No one can access it without knowing PIN Number

You can access your account from any corner of the world, no need to visit bank branch

Availability (24*7 Services)

Disadvantages:

Sometimes you may face Server-Down Problem

Forgetting of Pin Number

Fees charged for using card in different bank may be expensive

Limitation of cash withdrawal

Credit Card:

Credit card is different from debit card, in debit card you must have money for using it. But for using credit cards, its not

necessary. If you use credit card for purchasing purposes it does not deduct your money immediately.

Bank will pay the vendors and sends the bill to the customer every month.

Important Books And Authors List

BOOKS AUTHOR

Wings of Fire, Ignited Minds, Target 3 Million, The

luminous Spark, India 2020, Mission India,

Indomitable Spirit, The Life Tree, India My Dream,

Inspiring Thoughts, Thoughts for Change, Spirit of

India, Evolution of Enlightened Societies, India Wins

Freedom, You are Born to Blossom, Turning Point

A.P.J. Abdul Kalam

The 3 Mistakes of My Life, Five Point Someone, Two

States, Revolution 2020, One Night at the Call Center

Chetan Bhagat

Inspired Talks, The Sleeping Giant, Living at the

State, Way of the Saint, Jnana Yoga, Raja Yoga, My

Master, Women of India, Vedanta Philosophy

Swami Vivekananda

Lipika, Chandralika, Chitra, Geethanjali, Gora,

Ghare, Broken Ties, Malini, Sacrifice, Two Sisters ,

Bhaire, Chaturanga

Rabindranath Tagore

Arthashastra Koutilya

My Days, The Guide, Malgudi days, Waiting for the

Mahatma, The Dark Room, The Bachelors of Art, The

English Teacher, The Financial Expert

R.K. Narayanan

My Truth Indira Gandhi

My Life in Action Jackie Chan

Glimpses of World History Jawaharlal Nehru

My Struggle E K Nayanar

Arthashastra Kautilya

Ashtadhyayi Panini

Ayodhya P. V. Narasimha Rao

Bhagwad Gita, Mahabharata Veda Vyas

Ramayana Valmiki

Panchatantra Vishnu Sharma

Megdoot, kumarasambhava, Swapnavasavadatta,

Malavikagnimitra

Kalidasa

Broken Wing Sarojini Naidu

End of the Era C.S. Pandit

Eternal India Mrs. Indira Gandhi

Imagining India Nandan Nilekani

A Better India A Better World N.R. Narayan Murthy

Fasting, Feasting Anita Desai

Forty Nine Days Amrita Pritam

Golden Threshold Sarojini Naidu

Indian Philosophy Dr. S. Radhakrishnan

Life of Pi Yann Martel

When Loss is Gain Diplomat Pavan K.Varma

One Day Wonders Sunil Gavaskar

My life and Times V.V. Giri

Kalpana Chawla A Life Anil Padmanaban

Kamasutra Vatsayana

War and Piece Leo Tolstoy

Devdas Sharat Chandra Chatterjee

Half a Life V.S Naipoul

Unhappy India Lala Lajpat Rai

Jyoti punj Narendra Modi

The Adventures of Sherlock Holmes Sir Arthur Conan Doyle

Economic History of India R. C. Dutt

The book of Indian Birds Dr. Salim Ali

Living with Honour Shiv Khera

We Indians, Train To Pakistan, Women and Men in

My Life

Khuswant Singh

The Discovery of India Jawaharlal Nehru

Indian Philosophy Dr. S. RadhaKrishnan

Gulliver Travels Jonathan Swift

My Nation My Life L.K. Advani

Independence S.K. Banerjee

Last Days of Nethaji G.D. Khosla

My Experiments with Truth Mahatma Gandhi

The God of Small Things Arundhati Roy

War and Piece Tolstoy

Wakeup India Annie Besant

Two Lives, The Golden Gate, A Suitable Boy, Arion

and The Dolphin, An Equal Music, From Heaven

Lake:Travels

Vikram Seth

India First K. R. Malkani

My Life Bill Clinton

Dreams From My Father Barack Obama

The Future of India Dr. Bimal Jalan

Hamlet, Othello, Macbeth, King Lear Shakespeare

Marketing Questions for SBI PO Exam 2014

Welcome to edugeeks.in. Friends here is our first set of marketing questions we designed these questions from

various previous year question papers, hence you are recommended to take this test to make your SBI PO

exam preparation very easy.

Marketing is one of the toughest parts that every candidate will feel but form this area you will face very basic

questions hence practice marketing online tests provided by us to give the best. Here you go

Marketing Questions for SBI PO 2014

1. Marketing Concept is based on

A. Customer-Oriented

B. Product-oriented and centred

C. Profit

D. Loss

E. None of these

2. Which of the following Bank is based on new marketing concept?

A. Union Bank of India

B. State Bank of India

C. UCO Bank

D. PNB

E. All of these

3. In marketing CRM stands for

A. Case Role Management

B. Customer Relationship management

C. Customer Role in Market

D. None of these

4. Which is the term of Digital Marketing

A. Blocked

B. Cost

C. Plan

D. Brand

E. Utility

5. What is the element of Marketing Concept?

A. Consumer Satisfaction

B. Goal of the Organization

C. Plan

D. Market

E. None of these

6. RSS stands for

A. Real Save System

B. Role saver system

C. Real simple syndication

D. Real saver system

E. None of these

7. Marketing Concept earns the profit with

A. Customer Satisfaction of Bank

B. Staff

C. Product

D. Building

E. ATM

8. Which is customer and society-oriented concept of marketing?

A. Product Concept of Marketing

B. Society Marketing Concept

C. Product Concept

D. Marketing Concept

9. Which is the pillar of Marketing Concept

A. Financial Planning and control

B. Customer Orientation

C. Plant

D. Fixed Cost

E. Sales

10. Customerisation means

A. Promotion

B. Goods offer

C. Sales

D. Relation

E. None of these

ANSWERS:

1) A 2) E 3) B 4) A 5) D

6) C 7) A 8) B 9) B 10) D

SBI PO IMPORTANT MARKETING QUESTIONS

1. Marketing will not happen unless:

A. E-commerce is flourishing.

B. Facilitators are present to simplify exchange.

C. Middlemen are present to facilitate exchange.

D. Two or more parties each have something they want to exchange for something else.

E. An economy is market-directed rather than planned.

2. MACRO-marketing:

A. Is a social process.

B. Tries to overcome discrepancies of quantity and discrepancies of assortment.

C. Tries to effectively match supply and demand.

D. Tries to overcome the many separations between producers and consumers.

E. All of the above are true statements.

3. The three basic ideas in the marketing concept are:

A. Customer satisfaction, resource efficiency, sales maximization.

B. Customer satisfaction, total company effort, sales growth.

C. Resource efficiency, sales growth, profit maximization.

D. Customer satisfaction, marketing manager as chief executive, profit.

E. Customer satisfaction, total company effort, profit.

4. A marketing strategy specifies

A. A marketing mix.

B. A target market and a related marketing mix.

C. A target market.

D. The resources needed to implement a marketing mix.

E. both A and D.

5. The four Ps of a marketing mix are:

A. Production, Personnel, Price, and Physical Distribution

B. Promotion, Production, Price, and People

C. Potential customers, Product, Price, and Personal Selling

D. Product, Price, Promotion, and Profit

E. Product, Place, Promotion, and Price

6. A marketing plan is:

A. A marketing program.

B. A marketing strategy.

C. A marketing strategyplus the time-related details for carrying it out.

D. A target market and a related marketing mix.

E. A plan that contains the necessary operational decisions.

7. Market segmentation:

A. Means the same thing as marketing strategy planning.

B. Assumes that most submarkets can be satisfied by the same marketing mix.

C. Is the same thing as positioning.

D. Tries to identify homogeneous submarkets within a product-market.

E. All of the above are true.

8. Positioning is a marketing management aid which refers to:

A. A products ability to provide both immediate satisfaction and social responsibility.

B. How customers think about proposed and/or present brands in a market.

C. A firms ability to distribute products through middlemen who are in the right position to

reach target customers.

D. How a firm approaches customer relationship management.

E. All of the above.

9. Rising costs and inflation are part of the uncontrollable ______________ environment.

A. technological

B. economic

C. competitive

D. legal

E. cultural and social

10. Product means

A. All the services needed with a physical good

B. A physical good with all its related services

C. The need-satisfying offering of a firm

D. All of a firms producing and distribution activities

E. A well-packaged item with a well-advertised brand name

ANSWERS:

1) D 2) E 3) E 4) B 5) E

6) C 7) D 8) B 9) B 10) C

More Questions

1. The balance sheet of an organisation gives information regarding-

(a) Result of operations for a particular period

(b) The financial position as on a particular date

(c) The operating efficiency of the firm

(d) Financial position during a particular period

(e) The operating health of the firm

ANS: (b)

2. ESOP stands for-

(a)Efficient Service of Promises

(b)Employees Service Option Projects

(c)Effective System of Projects

(d)Employees Stock Option Plan

(e)Essential Security of Police

ANS: (d)

3. I understand marketing as

(a) Only selling

(b) Meeting human and social needs profitably

(c) To focus on customer

(d) To focus only on producing goods and services

(e) Only (b) and (c)

ANS: (e)

4. USP in marketing means-

(a)Unique Selling Practices

(b)Uniform Selling Practices

(c)United Sales Person

(d)Unique Selling Proposition

(e)Useful Sales Person

ANS: (d)

5. Who is called a Referral -

(a) Sales person

(b) All customers

(c) Lead provided by operation staff

(d) Calling the existing purchasers

(e) All purchasers

ANS: (c)

6. DSA in marketing means

(a)Direct Selling Agent

(b)Delivery Staff Agency

(c)Direct Supplier Agent

(d)Distribution and Supply Agency

(e)Driving Sales Ahead

ANS: (a)

7. Digital Marketing is similar to

(a) Online marketing

(b) Cold calling

(c) Web designing

(d) Market fore-cast

(e) Outdoor marketing

ANS: (a)

8. Diversification means

(a) Dividing the market into small segments

(b) Dividing energy of sales persons

(c) Marketing of diverse products

(d) All of these

(e) None of these

ANS: (c)

9. Market research is required for-

(a) Deciding sales volume

(b) Deciding production levels

(c) Deciding market strategies

(d) Deciding sales team members

(e) All of these

ANS: (c)

10. Networking makes marketing-

(a) Very difficult

(b) Very cumbersome

(c) Easy to handle

(d) Has no role in marketing

(e) None of these

ANS: (c)

1. Consumer information sources are-

(a) Personal source and commercial source

(b) Public source

(c) Experiential source

(d) All the above

(e) Only (a) and (b)

ANS: (d)

2. Zero-Based Budgeting (ZBB) means-

(a) A tool for marketing cost analysis

(b) A tool for financial analysis

(c) Each year, budgeting starts from a scratch

(d) A certain percentage of sales

(e) Only (a) and (b)

ANS: (c)

3. The advantages of telephone-interview are

(a) Relatively low cost per interview

(b) Good for reaching important people who are inaccessible

(c) Securing co-operation which is not always possible

(d) All of these

(e) Only (a) and (b)

ANS: (d)

4. The abbreviation ISP stands for-

(a)International Spy Project

(b)Indian Social Planning

(c)Initial Service Provider

(d)Internet Service Provider

(e)None of these

ANS: (d)

5. The best advertisement is

(a) Glow sign boards

(b) On internet

(c) T.V Media

(d) Print Media

(e) Which satisfies a customer.

ANS: (e)

6. According to product life cycle theory, the profit is maximum in-

(a) Developed stage

(b) Early stage

(c) Matured stage

(d) Declined stage

(e) None of these

ANS a)

7. In banks ROA means

(a) Rate of Allocation

(b) Return on Assets

(c) Return on Advances

(d) Ratio of Assets

(e) Only (b) and (c)

ANS: (b)

8. In the context of globalisation BPO means-

(a)British Petroleum Organisation

(b)British Passport Office

(c)Budgeting Process Orientation

(d)Business Process Orientation

(e)Business Process Outsourcing

ANS: (e)

9. SWOT Analysis refers to-

(a) Marketing tool to understand constraints and potentials of self and competitor

(b) External environment analysis

(c) Internal environment analysis

(d) Strategic planning for selling product

(e) South-west organisation for trade

ANS: (a)

10. For an economic organisation, MIS stands for

(a) Middle Income Scheme

(b) Management Information System

(c) Management of Information and Science

(d) Marketing Information System

(e) Only (b) and (c)

ANS: (b)

Marketing Study Material for SBI PO 2014

5 Cs of Marketing

Five Cs of marketing are

1. Customers

2. Company

3. Competitors

4. Collaborators

5. Context

Customer needs: What needs does the firm seek to satisfy?

Company Skills: What special competence does the firm possess to meet those needs?

Competition: Who competes with the firm in meeting those needs?

Collaborators: Whom should the firm enlist to help it and how can the firm motivate them?

Context: Which cultural, technological, and legal factors limit the possibilities?

Bases of Marketing:

Markets can be segmented in a variety of ways, among those most widely used bases are

Demographic: age, income, gender, occupation

Geographic: nation, region of country, urban vs rural

Lifestyle: hedonistic vs. value oriented

These three types of bases demographic, geographic, and lifestyle are general descriptors of consumers

Marketing Mix:

Marketing mix is used to describe the set of activities comprising a firms marketing program

Below twelve marketing terms are determined as marketing mix

1. Merchandising / product planning

2. Pricing

3. Branding

4. Channel of Distribution

5. Personal selling

6. Advertising

7. Promotions

8. Packaging

9. Display

10. Servicing

11. Physical Handling

12. Fact finding and analysis / market research

Aggregation and regrouping of these elements has become popular

Four Ps of Marketing:

Four Ps of marketing are

1. Product

2. Place (Channel of distribution)

3. Promotion ( communication strategy)

4. Pricing

Six Ms of Marketing:

Six Ms of Marketing are

Market: To whom is the communication to be addressed?

Mission: What is the objective of the communication?

Message: What are the specific points to be communicated?

Media: Which vehicles will be used to convey the message?

Money: How much will be spent in the effort?

Measurement: How will impact be accessed after the campaign?

Product Definition:

Product decision starts with understanding of what a product is namely, the product offering is not the thing

itself, but rather the total package of benefits obtained by the customer.

For marketing strategy development purposes, the product has to be considered from the point of view of

value delivered to the customer

Value of product is delivered from

1. The physical product itself

2. Brand Name

3. Company reputation

4. Presale education provided by salespeople

5. Postsale technical support

6. Repair service

7. Financing plans

8. Financing plans

9. Convenient availability

10. Word-of-mouth references from earlier adopters of the product

11. Reputation of the outlet where the product was purchased

Product Line Planning Decisions:

There are three types of product line planning decisions

1. Product line length

2. Product line breadth

3. Product line depth

Product Development Process:

If you want to develop a new product then you should go for the below five step process

1. Opportunity identification

2. Design

3. Testing

4. Product introduction

5. Life cycle management

Marketing Channel

Marketing channel is a set of mechanisms or the network vis which a firms goes to market that is in touch

with its customer for a variety of tasks ranging from demand generation to physical delivery of the goods.

Here are eight generic channel functions that serve as a staring place for assessing needs in a particular context

1. Product information

2. Product customization

3. Product quality assurance

4. Lot size

5. Product assortment

6. Availability

7. After sale service

8. Logistics

Sales Promotions:

Sales promotions include things such as samples, coupons and contests, some major types of sales promotions

are

1. Consumer promotions

2. Trade promotions

3. Retail promotions

MARKETING IMPORTANT TERMS

After having a look on this material you are recommended to go through the online aptitude tests provided in our site to

improve your time management which is one of the success factor in competitive examinations. You should practice good

number of online exams to get confidence hence you are recommended to go through the online test for SBI PO for various

sections like computer knowledge, general awareness, arithmetic and reasoning. Here you go

Analysis In marketing and other social science disciplines, a variety of statistical and non-statistical methods are used to

analyze data, instead of sheer intuition, or simple descriptive

Statistics which have been the norm in the library filed.

Aggregation A concept of market segmentation that assumes that most consumers are alike.

Advertising The placement and purchase of announcements and persuasive messages in time or space in any of the mass

media by business firms, non-profit organizations. This has not been a traditional method for libraries of informing the public,

but rather public service announcements, which are placed at no cost, are the norm.

Activities, interests, and opinions (AIO) A measurable series of psychographic (as opposed to demographic) variables

involving the interests and beliefs of users. Note, because psychographics are usually expensive to gather, yet offer a more

precise profile of users, demographic variables are usually relied upon.

Acquisitions value The users perception of the relative worth of a product or service to them. Formally defined as the

subjectively weighted difference between the most a buyer would be willing to pay for the product or service, less the actual

price of the item. Time user must spend to acquire is often used as a surrogate for relative worth or price paid, in library

research. For example, a user might be willing to expend drive time and a brief time in the library to check out a best seller,

but not wait two weeks for a copy to be returned.

Accountability Libraries like private sector businesses are increasingly called upon to make all units accountable for results.

Growing funds are needed for technology as opposed to only books. Funders often cut the library budget first, in favour of

other agencies such as police and fire or other seemingly, more necessary agencies. Libraries are developing better

performance measures within the present day control systems to offer better accountability.

Audience The number and/or characteristics of the persons or households who are exposed to a particular type of advertising

media or media vehicle. In a library this could be a certain number of people that attend a library program.

Audit The process of reviewing the librarys strengths and weaknesses (internally), and opportunities and threats (externally)

to shed light on the agencys performance.

Balanced stock The composition of merchandise inventory in the colors, sizes, styles and other assortment characteristics

that will satisfy user wants. For the library this would mean, services and materials based upon users wants and needs.

Barcode An information technology application that uniquely identifies various aspects of product characteristics, increasing

speed, accuracy, and productivity of distribution process. Most library materials are barcoded for security.

Brand A name, term, design, symbol, or any other feature that identifies one sellers good or service as distinct from those

of other sellers. The legal term for brand is trademark. A brand may identify one item, a family of items, or all items of that

seller. If used for the firm as a whole, the preferred term is trade name. Library could be considered a trade name.

Channel of distribution An organized network of agencies and institutions which in combination perform all the functions

required to link producers with end customers to accomplish the marketing task. For a library this would include vendors,

publishers as well as library facilities.

Circulation The number of copies of a print advertising medium that are distributed. For the library field, this is numbers of

items checked out by users.

Consumer The ultimate user of goods, ideas or services. Also the buyer or decision maker, for example, the parent selecting

childrens books is the consumer.

Core product The central benefit or purpose for which a consumer buys a product or service. The core product varies from

purchaser to purchaser. For a library user the core benefit of checking out a book, may be for one user that there is no charge,

and to another the availability of a work which can no longer be purchased.

Customer The actual or prospective purchaser of products or services. The library user is the librarys customer.

Decision support system (DSS) A decision support system (marketing definition) is a systematic collection of data,

techniques and supporting software and hardware by which an organization gathers and interprets relevant information from

business and the environment and turns it into a basis for making management decisions. A DSS differs from a management

information system in that it is designed to answer precise questions and what/if questions. An example would be, What

affect on system library use will there be if Branch X is closed?

DE marketing The process of reducing the demand for a productor decreasing consumption. For example, the library

discontinues offering income tax assistance and forms.

Direct marketing Marketing efforts, in total directed toward a specific targeted groupdirect selling, direct mail, catalog or

cablefor soliciting a response from customer. A library may mail a library registration card to every new mother in the

hospital.

Dwell time The amount of time a customer/user spends in time waiting in line. For a library user this is a price expended.

Eighty-twenty principle The situation in which a disproportionately small number (e.g., 20%) of staff, products or users

generate a disproportionately large amount (e.g., 80%) of a firms use/profits. A use analysis should be conducted to determine

what the cause is.

Exchange All activities associated with receiving something from someone by giving something voluntarily in return. This

is the heart of the marketing process. A library user gives time instead of money to borrow materials, but it is still an exchange

Goods A product that has tangible form in contrast to services that are intangible. A book versus a story read.

Market The set of actual or potential users/customers.

Market area A geographical area containing the customers/users of a particular firm/library for specific goods or services.

This would be determined by geocoding library users addresses and determining the boundaries of the primary geographic

market.

Market demand The total volume of a product or service bought/used by a specific group of customers/users in a specified

market area during a specified period. For example, the demand for best sellers during the fall.

Market development Expanding the total market served by 1) entering new segments, 2) converting nonusers, 3) increasing

use by present users.

Market positioning Positioning refers to the users perceptions of the place a product or brand occupies in a market segment.

Or how the company/librarys offering is differentiated from the competitions. For a library a competitor may be another

public agency competing for public funds. What unique niche does the library serve when competing against police for same

$$

Market profile A breakdown of a facilitys market area according to income, demography, and life style (often.)

Market research The systematic gathering, recording and analyzing of data with respect to a particular market, where market

refers to a specific user group in a specific geographic area.

Market segmentation The process of subdividing a market into distinct subsets of users that behave in the same way or have

similar needs. Segments for the library could be demographic (Asian); geographic (branch-level); psychographics (leisure-

oriented); customer size (largest user group area); benefits (have children in the home learning to read.)

Market share A proportion of the total sales/use in a market obtained by a given facility or chain. Branch A has 35% of the

systems circulation.

Marketing The process of planning and executing the conception, pricing, promotion, and distribution of ideas, goods, and

services to create exchanges that satisfy individual and organizational goals.

Marketing channel A set of institutions necessary to transfer the title to goods and to move goods from the point of

consumption. (Vendors, publishers, library facilities.)

Marketing mix The mix of controllable variables that the firm/library uses to reach desired use/sales level in target market,

including price, product, place and promotion- 4 Ps. For a library this would be embodied in price of users time to access

goods, a product would be a book or story time, place is a branch or bookmobile, and promotion is publicity, displays etc.

Marketing opportunity An attractive arena of relevant marketing action in which a particular organization is likely to

enjoy a superior and competitive advantage. The library is selected to host the community heritage festival which is funded

by the city.

Marketing plan A document composed of an analysis of the current marketing situation, opportunities and threats, analysis,

marketing objectives, marketing strategy, action programs, and projected income statement. This could be very similar to a

librarys long range plan.

Maturity stage of product life cycle Initial rapid growth is over and use/sales level off.

Non-profit marketing The marketing of a product or service in which the offer itself is not intended to make a monetary

profit for the marketer.

Penetrated market Actual set of users actually consuming the product/service.

Point-of-purchase Promotional materials placed at the contact sales point designed to attract user interest or call attention to

a special offer, e.g., Sign up for Summer Reading Program.

Point-of-sale (POS) A data collection system that electronically receives and stores bar code information derived from a sales

transaction. This could the zip codes for library users, facilitating the library in determining geographic market are that users

reside in.

Potential market Set of users who profess some level of interest in a designed market offer.

Price The formal ratio that indicates the quantities of money goods or services needed to acquire a given quantity of goods

or services. For a library user price may come in the form of time the library users must expend to obtain library materials or

services.

Private sector Activities outside the public sector that are independent of government control, usually, but not always carried

on for a profit.

Product A bundle of attributes or features, functions, benefits and uses capable of exchange, usually in tangible or intangible

forms. The librarys products include materials to use, questions answered, storyhours, online searching, etc.

Product life cycle The four stages products go through from birth to death: introductory, growth, maturity, and decline.

Product mix The full set of products offered by an organization e.g., books, videos, storyhours, etc.

Product positioning The way users/consumers view competitive brands or types of products. This can be manipulated by the

organization/library. The librarys video collection, available for free, is competitive with local video stores that charge, if

video collections are comparable. If the collections are not, the library is differentiating the video collection from the video

store.

Quality control An ongoing analysis of operations, to verify goods or service meet specified standards, or to better answer

customer/user complaints. Libraries have been criticized for not employing more quality control standards on library services.

Quality of life Sometimes measured by income, wealth, safety, recreation and education facilities, education health,

aesthetics, leisure time and the like.

Quantity discount A reduction in price for volume purchases.

Shopping good Goods and products can be classified as convenience, shopping or specialty. A shopping good is one that

more time is spent selecting (browsing) than a quick convenience good. Example, a certain type of mystery book.

Slogan The verbal or written portion of an advertising message that summarizes themain idea in a few memorable wordsa

tag line.

Social advertising The advertising designed to education or motivate target audiences toundertake socially desirable actions.

Social class A status hierarchy by which groups and individuals are classified on the basis of esteem and prestige.

Social indicator The data and information that facilitate the evaluation of how well a society or institution is doing.

Specialty advertising The placement of advertising messages on a wide variety of items of interest to the target markets such

as calendars, coffee cups, pens, hats, note paper, t-shirts, etc. These are widely given out to librarians at professional

conferences from vendors. Libraries may use these items as well, but are usually sold in library gift shops.

Target market The particular segment of a total population on which the retailer focuses its merchandising expertise to

satisfy that sub market in order to accomplish its profit objectives. Or for the library, a target market might be within the

market area served, children 5-8 years old, for summer reading programs, to increase juvenile use and registration

Value The power of any good to command other goods in peaceful and voluntary exchange.

Values The beliefs about the important life goals that consumers are trying to achieve. The important enduring ideals or

beliefs that guide behavior within a culture or for a specific person.

Word of mouth communication (WOM) This occurs when people share information about products or promotions with

friendsresearch indicate WOM is more likely to be negative

MARKETING ABBREVIATIONS

Ad- Advertising

MKT Marketing

B2B Business to Business

SME Subject Matter Expert

F500- Fortune 500

EM- Email

DM Direct Mail

ABM Account Based marketing

TAP Targeted account programs

DM Digital Marketing

SE Search Engine

SERP Search Engine Results Page

SEM Search Engine Marketing

SEO - Search Engine Optimization

SMM Social Media Marketing

SMO Social Media Optimization

PPC pay per click

PPA Pay Per Action

PPI Pay Per Impression

PPL Pay Per Lead

CTR Click through rate

CPC Cost Per Click

CPL Cost Per Lead

CPS Cost Per Sale

CMS Content Management System

CRM Content Relationship Management