Professional Documents

Culture Documents

The Role of Currency Is Only As A Tool or A Means of Exchanging Goods

The Role of Currency Is Only As A Tool or A Means of Exchanging Goods

Uploaded by

jabbarbaigOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Role of Currency Is Only As A Tool or A Means of Exchanging Goods

The Role of Currency Is Only As A Tool or A Means of Exchanging Goods

Uploaded by

jabbarbaigCopyright:

Available Formats

ADVANCE RESEARCH METHOD

ROLE OF CURRENCY

Submitted to: Dr Tasneem Akhtar

Submitted By:

Name IDs

Jabbar Ahmad 10223006

Submission Date: 08 February, 2013

GIFT Business School

GIFT University

Executive Summary

The problem is the unstable regulation of currency lead towards disability of economies.

The foreign exchange value of a currency that either results in a sharp

depreciation or forces the authorities to defend the currency by selling foreign

exchange reserves or raising domestic interest rates. For an economy with a fixed

exchange rate regime, a currency crisis usually refers to a situation in which the

economy is under pressure to give up the prevailing exchange rate. I m identified

this problem research many articles and study many books and watch lot of

knowledgeable videos which I m see that every country suffer its currency. Many

countries facing currency like Malaysia, Singapore, and many other countries. In

recent Europe facing currency problem. I m providing this problem solution in the

sense of Islamic Thoughts. Where Islam teach that follow the gold system

(dirham and dinar) where the currency is not devalued. When the currency is not

devalued the country is not facing financial problems. My research study

respondents are many bankers, investors, brokers, and students. SPSS software for

the analysis of my study. The usefulness of this study is that when the economies

are following the Islamic Capital Market & Instruments. In this system the price

of currency is not devalued. The economy is not suffer the financial problems like

devaluation of money, inflation and balance of payment and many other problems

are not facing.

Acknowledgement

In the name of ALLHA ALMIGHITY the lord of the world who has bestowed us with abilities

and blessed with knowledge so that we can make best of opportunities provide to us. First

of all we are indebted toward ALLHA ALMIGHTY who has created us and made

capable enough to with stand in the competitive world.

Our deepest gratitude and warmest appreciation to our respected and worthy teacher

Dr. Tasneem Akhtar for his guidance and support in the duration of the study. His timely

guidance and motivation as well as his endless encouraging behavior throughout in the

duration of this course has been exemplary if words could pay gratitude then we would

like to pay our esteem gratitude. Last but not least we are thankful to our friends who

give us support and help us while collecting data which was actually not an easy task. We

are very grateful to every person who help us directly or indirectly to fulfill this

responsibility.

Table of Contents

Description Page #

Executive Summary 2

Acknowledgement 3

List of Tables 5

Introduction 6

Literature Review 8

Theory 10

Framework 11

Variable definition 12

Research Methodology 14

Data Analysis 15

Recommendations 17

References 17

Appendix 21

List of Tables

Descriptive Statistics

Model Summary

Coefficients

List of Figure

Framework

Introduction

The role of currency is only as a tool or a means of exchanging goods. Its value is derived from

the faith people have in the currency. For any currency to have a value people must be

able to accept it as a means which they will part or exchange other items for it. Currency

has no value. It is only how we perceive currency that gives it value.

In todays world, currency is bought and sold in the international currency market or foreign

exchange market for those not in the financial sector. National currencies are valued

independently due to the nation central banking system which is independent from one

another. However each currency in today market from the strongest to the weakest are all

dependent and interconnected with each other for purposes of value and stability. The

trading between national currencies is important in the overall value of a single country

currency. How active the foreign exchange market also tells the story of what the

financial community thinks of the global economy at that time. The foreign exchange is

often the barometer for influences on the world economy as it is often the first market to

react whenever there is a dip or boom in the global economy.

The players who are big in foreign exchange market are banks, large commercial entities hedge

fund investment firms and central banks of the nations. Hedge funds and central banks

are the two biggest influences on the foreign exchange market. Although not all central

banks do it but some central banks do trade in the foreign exchange market. They do this

for a multitude of reasons. Among the reasons include synchronizing the country interest

rates in line with the other countries and to stabilize the currency of the country so that

the import and export of goods can be completed in an orderly manner. Some central

banks also use the foreign exchange market to control fiscal issues like inflation. .

Currency crises have large, measurable costs on an economy, but the ability to predict the timing

and magnitude of crises. Sudden speculative attack on a fixed exchange rate, even though it

appears to be an irrational change in expectations, can result from rational behavior by

investors.(Krugman). Currency crises have explored how problems in the banking and

financial system interact with currency crises, and how crises can have real effects on the

rest of the economy.

Problem definition

A currency crisis may be defined as a speculative attack on the foreign exchange value of a

currency that either results in a sharp depreciation or forces the authorities to defend the

currency by selling foreign exchange reserves or raising domestic interest rates. For an

economy with a fixed exchange rate regime, a currency crisis usually refers to a situation

in which the economy is under pressure to give up the prevailing exchange rate peg or

regime.

A currency crisis, which is also called a balance-of-payments crisis, is a speculative attack in the

foreign exchange market.

Unstable regulation of currency lead towards disability of economies

Objectives

To explore the role of currency note in economies

Research Questions

Does currency no play any role in economics ups and downs in a country?

What is role of currency note in case of inflation?

Do we debt rid of foreign debt if currency note abolished?

Hypothesis

Currency note is causing negative impact on economic cycle

Literature Review

There are two broad traditions with respect to the economic theories of regulation. The first

tradition assumes that regulators have sufficient information and enforcement powers to

effectively promote the public interest. This tradition also assumes that regulators are

benevolent and aim to pursue the public interest. Economic theories that proceed from

these assumptions are therefore often called public interest theories of regulation.

Another tradition in the economic studies of regulation proceeds from different

assumptions. Regulators do not have sufficient information with respect to cost, demand,

quality and other dimensions of firm behavior. They can therefore only imperfectly, if at

all, promote the public interest when controlling firms or societal activities. Within this

tradition, these information, monitoring and enforcement cost also apply to other

economic agents, such as legislators, voters or consumers. And, more importantly, it is

generally assumed that all economic agents pursue their own interest, which may or may

not include elements of the public interest. Under these assumptions there is no reason to

conclude that regulation will promote the public interest. The differences in objectives of

economic agents and the costs involved in the interaction between them may effectively

make it possible for some of the agents to pursue their own interests, perhaps at the cost

of the public interest. Economic theories that proceed from these latter assumptions are

therefore often called private interest theories of regulation. Fundamental to public

interest theories are market failures and efficient government intervention. Some

researchers consider and evaluate various definitions and attempt through systematization

to make the term amenable to further analysis (Baldwin and Cave, 1999; Morgan and

Yeung, 2007; Ogus, 2004). Others almost entirely abstain from an exact definition of

regulation (Ekelund, 1998; Joskow and Noll, 1981; Spulber, 1989; Train, 1997). These

theories are often thought to be normative theories as positive analysis (Joskow and

Noll, 1981), implying that the evaluative theoretical and empirical analysis of markets

has been used to explain actual regulatory institutions in practice. The public interests

theories of regulation are described as rationalizing existing regulations while private

interest theories are discussed as theories that explain existing regulation (for example

Ogus, 2004). Models of currency crises suggest that weak or unsustainable economic

policies are the cause of exchange rate instability. These models provide a partial

explanation of the Asian currency crisis but they cannot account for its severity. A more

comprehensive view of the turmoil in Asia takes into account the interaction of policy

and volatile capital markets. Weak policy makes a country vulnerable to abrupt shifts in

investor confidence; the sudden rise of investor expectations of a crisis can force a policy

response that validates the original expectations. Two additional factors help explain the

severity of the Asia crisis: inadequate supervision of the banking and financial sectors in

the affected countries and the rapid transmission of the crisis through structural links and

spillover effects among the countries. Their financial and banking systems did not suffer

from the same structural weaknesses and fragility observed in the crisis countries. And

finally, they were perhaps less exposed to forms of so-called crony capitalism with

intermingled interests among financial institutions, political leaders, and corporate elite.

Conversely, the Asian countries that came under speculative attack in 1997 Thailand,

Malaysia, Indonesia, the Philippines, and South

Koreahad the largest current account deficits throughout the 1990s. Although the degree of

real appreciation over the 1990s differed widely across Asian countries, all the currencies

that crashed in 1997, with the important exception of Koreas, had experienced a real

appreciation (Corsetti, Pesenti, and Roubini 1999b and Tornell 1999). The major

fundamental weakness of the Asian countries consisted of the exposed position of the

banking and corporate sectors in an environment of limited prudential supervision.

Indeed, it has been argued that the Asian miracle occurred despite significant distortions

of the market mechanism in the financial sector. In the presence of extensive controls and

limits on foreign borrowing, these distortions did not translate into high domestic

vulnerability to external shocks.

Theory

According to this theory, when there is free market situation, the exchange rates are determined

by the market forces i.e. demand for and supply of the foreign exchange. This theory is

based on simple market mechanism in which the price of any commodity is determined.

the term 'balance of payments' is used in the sense of a market balance. If the demand for

a country's currency falls at a given rate of exchange, we can speak of a deficit in its

balance of payments. A deficit balance of payments leads to a fall or depreciation in the

external value of the country's currency. A surplus balance of payments leads to an

increase or appreciation in the external value of the country's currency.

Financial crises have been pervasive phenomena throughout history. Bordo et al. (2001) find that

their frequency in recent decades has been double that of the Bretton Woods Period

(1945-1971) and the Gold Standard Era (1880-1993), comparable only to the Great

Depression. Nevertheless, the financial crisis that started in the summer of 2007 came as

a great surprise to most people. Diamond and Rajan (2006) introduce money and nominal

deposit contracts into the model in Diamond and Rajan (2001) to investigate whether

monetary policy can help alleviate this problem. They assume there are two sources of

value for money. The first arises from the fact that money can be used to pay taxes (the

fiscal value). The second arises from the role of money in facilitating transactions (the

transactions demand. Makarov and Plantin (2009) analyze changes in house prices in an

economy where banks grant mortgages to liquidity-constrained households to finance a

fixed supply of homes. Households aggregate debt capacity drives the aggregate demand

for homes. Home supply at a given date stems from foreclosures in case of default, sales

motivated by the acquisition of a larger home, and sales that follow exogenous moving

decisions.

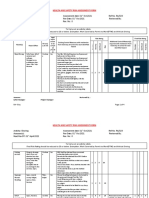

Framework

Unstable regulation

of currency lead

towards disability

of economies

Political

Instability

Inflation in

economy

Debt Rate

Devaluation of

money

Exchange rate

Variable definition

Currency devaluation

A deliberate downward adjustment in the official exchange rates established, or pegged, by a

government against a specified standard, such as another currency or gold.

Devaluation in modern monetary policy is a reduction in the value of a currency with respect to

those goods, services or other monetary units with which that currency can be exchanged.

Devaluation means official lowering of the value of a country's currency within a fixed

exchange rate system, by which the monetary authority formally sets a new fixed rate

with respect to a foreign reference currency.

Political instability

the uncertainty associated with an unstable political environment may reduce investment and the

speed of economic development. On the other hand, poor economic performance may

lead to government collapse and political unrest.

Exchange rate

Exchange rates allow you to determine how much of one currency you can exchange for another.

The price of one country's currency expressed in another country's currency. In other

words, the rate at which one currency can be exchanged for another. For example, the

higher the exchange rate for one euro in terms of one yen, the lower the relative value of

the yen.

Debt Rate

Debt capital divided by total assets. It is conventional to consider both current and non-current

debt and assets. The less risky the company is since excessive debt can lead to a very

heavy interest and principal repayment burden. A debt rate is defined as a situation when

either or both of following conditions occur: (1) there are arrears of principal or interest

on external obligations towards commercial creditors (banks or on dholders) of more than

5 percent of total commercial debt outstanding(2) there is a rescheduling or debt

restructuring agreement with commercial creditors as listed in Global Development

Finance (World Bank). The 5 percent minimum threshold is to rule out cases in which the

share of debt in default is negligible, while the second criterion is to include countries

that are not technically in arrears because they reschedule or restructure their debt

obligations before defaulting.Detragiache and Spilimbergo (2001).

Inflation

The term "inflation" to refer to a rise in the price level. An increase in the money supply may be

called monetary inflation, to distinguish it from rising prices, which may also for clarity

be called 'price inflation. (Michael F. Bryan). The essence of inflation is not a general rise

in prices but an increase in the supply of money, which in turns sets in motion a general

increase in the prices of goods and services. "Inflation, as this term was always used

everywhere and especially in this country, means increasing the quantity of money and

bank notes in circulation and the quantity of bank deposits subject to check. But people

today use the term `inflation' to refer to the phenomenon that is an inevitable

consequence of inflation, that is the tendency of all prices and wage rates to rise.

Unstable regulation of currency lead towards disability of economies

Traditional models of currency crises suggest that weak or unsustainable economic policies

are the cause of exchange rate instability

Research Methodology

Sample size and technique

For our research project, we choose sample size of 150 respondents within Sialkot, Gujranwala

and Lahore region. Technique which is going to use in our project is convenient

sampling.

Population Frame

Population frame of our research project is Sialkot, Lahore and Gujranwala region

Unit of analysis

In our project we are using questionnaire as a unit of analysis through which we are collecting

data related to our research study.

Type of study

Our research study type is exploratory because we are going to explore the currency problems.

Data Collection method

We are collection data from questionnaire which are filled bankers, investors, business students.

We are using questionnaire as a primary source through data collected.

Data analysis tools

After collecting data we are using multiple regression method through we can evaluate the

change in dependent variable which brings because of change in independent variables.

Im use multinomial logit model.

Data Analysis

Descriptive Statistics

Mean Std. Deviation

INF 4.8529 .59697

DVv 5.4851 .36916

DT 5.5168 .40127

PI 5.4535 .39989

EX 5.4843 .41975

UNCRDE 5.1980 .46276

Interpretation

From above calculation we interpret that, first variable Inflation in the economy average value is

4.8529 which shows the average respondents agree or strongly agreed on that inflation on

economy lead the currency towards disability of economies. The results show that there is

.59697 deviations among that data with mean value. The mean value of the dependent

variable change in currency lead to disability of economy, its average value is 5.19 which

show that average respondents are strongly agreed on that deregulation in the currency

lead the disability of economy.

Regression

As dependent variable is quantitative , so by applying the least square method, regression on the

study model.

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .304

a

.58 .53 .44654

a. Predictors: (Constant), EX, INF, PI, DVv, DT

From above table, we conclude that overall model 58% explain the study or impact on the

main factors. Whereas according to adjusted R square we conclude that all

factors which include in the study explain the dependent by 53%.

Coefficients

a

Model

Unstandardized Coefficients

Standardized

Coefficients

T Sig. B Std. Error Beta

1 (Constant) 3.019 1.049

2.877 .005

INF .212 .076 .279 2.788 .006

DVv .061 .129 .050 .477 .634

DT .011 .120 .010 .092 .927

PI .088 .116 .078 .764 .447

EX .051 .120 .046 .424 .004

a. Dependent Variable: UNCRDE

From above table we conclude that if the all factors are zero then dependent variable

deregulation of currency still disability the economy by 3.019. Furthermore, if the first

variable inflation change with one unit then the currency deregulated by the .212 and if

the devaluation of money change by the one unit then the currency deregulated change

the .061 and other factors explain as same.

According to the significance value if the value is between 0-0.1 then it is significant and we

accept the hypothesis. Inflation and exchange rate show the significant result but other

variable are insignificant that s y, we reject them.

Recommendations

I m recommend to this one hypothesis is our study is accepted and other hypothesis is

rejected. The accepted hypothesis is inflation and exchange rate of currency.

Those economies are follows the western banking system and exchange that

economies are suffered. We recommend that Islamic Capital Market &

Instruments. In Islamic currency which is dirham and dinar.

Reference

Krugman P., (2000), Currency Crises University of Chicago Press, 0-226-45462-2.

Brown S., Goetzmann W., and Park J, (1998), HEDGE FUNDS AND THE ASIAN

CURRENCY CRISIS OF 1997 Natioanal Bureau Of Economic Research 1.2563.

Dornbusch R., (1998), FINANCIAL MARKETS AND BUSINESS CYCLES

LESSONS FROM AROUND THE WORLD A PANEL DISCUSSION

Burnside C., Eichenbaum M., and Rebelo S., (1998), Prospective Deficits And The

Asian Currency Crisis Natioanal Bureau Of Economic Research. 2.654.

Rogoff K., (1999), INTERNATIONAL INSTITUTIONS FOR REDUCING GLOBAL

FINANCIAL INSTABILITY National Bureau Of Economic Research. 3.1452

Xiaochuan Z., ( 2009), Reform the International Monetary System

Dornbusch R., Park Y., and Claessens S,(2000), Contagion: How it spreads and

How it can be stopped?*

Wyplosz C., (1998), Globalised Financial Markets and Financial Crises Regulatory and

Supervisory Challenges in a New Era of Global Finance FONDAD.

Sachs J., Tornell A., Velasco A., (1996), Financial Crisis in emerging Markets: The

Lessons from 1995 Natioanal Bureau Of Economic Research.5.3652

Eichengreen R., Rose K., and Wyplosz C., (1996), CONTAGIOUS CURRENCY

CRISES Natioanal Bureau Of Economic Research.6.1424.

Mishkin F., (2004), CAN INFLATION TARGETING WORK IN EMERGING

MARKET COUNTRIES? Natioanal Bureau Of Economic Research.4.3241.

YUDISTIRA D., (2004), EFFICIENCY IN ISLAMIC BANKING: AN EMPIRICAL

ANALYSIS OF EIGHTEEN BANKS Islamic Economic Studies,12

Bley J., and Kuehn K., (2003), CONVENTIONAL VERSUS ISLAMIC FINANCE:

STUDENT KNOWLEDGE AND PERCEPTION IN THE UNITED ARAB

EMIRATES International Journal of Islamic Financial Services Vol. 5 No.4

SIDDIQI M., (2006), ISLAMIC BANKING AND FINANCE IN THEORY AND

PRACTICE: A SURVEY OF STATE OF THE ART Islamic Economic Studies Vol. 13,

No. 2

Ahmad K., (2000), Islamic Finance and Banking: The Challenge and Prospects Review

of Islamic Economics 9

Uzair M., (1985), Interest Free Banking Journal of Research in Islamic Economics,

Volume 2.

Halim A., Hamid A., Azmin N., and Nordin M., (1998), A STUDY ON ISLAMIC

BANKING EDUCATION AND STRATEGY FOR THE NEW MILLENIUM -

MALAYSIAN EXPERIENCE International Journal of Islamic Financial Services Vol.

2 No.4

Dhumale R., and Sapcanin A., (2000), An Application of Islamic Banking Principles to

Microfinance United Nations Development Programme.4.1424.

Chapra M., (2008), THE GLOBAL FINANCIAL CRISIS: CAN ISLAMIC FINANCE

HELP INIMIZE THE SEVERITY AND FREQUENCY OF SUCH A CRISIS IN THE

FUTURE? Forum on the Global Financial Crisis to be held at the Islamic Development

Bank.

Trabelsi M., (2011), The impact of the financial crisis on the global economy: can the

Islamic financial system help? Journal of Risk Finance.2.3.1421.

Khan M., (2008), Development in Islamic banking: a financial risk-allocation approach

Derudder B., Hoyler M., and Taylor P., (2010), Goodbye Reykjavik: international

banking centres and the global financial crisis Journal compilation Royal Geographical

Society , Volume 43, Issue 2, pages 173182.

Ahmed A., (2010), Global financial crisis: an Islamic finance perspective Emerald

Group Publishing Limited.3.2351.

Farooq M., (2009), Global Financial Crisis and the Link Between the Monetary and

Real Sector: Moving Beyond the Asset-Backed Islamic Finance

Bassens D, Derudder B, Witlox F, (2009), Searching for the Mecca of finance: Islamic

financial services and the world city network Emerald Group Publishing Limited.

Volume 42, Issue 1, pages.2-4

Khan M., (2008), Islamic banking and finance: on its way to globalization Emerald

Group Publishing Limited.4.1-5.

Kuran T., (2001), The Islamic Commercial Crisis: Institutional Roots of the Delay in the

Middle Easts Economic Modernization (2001)

Salehi M., Mansouri A., and Pirayesh R., (2009), Banking Crisis: Empirical Evidence

of Iranian Bankers Pakistan Journal of Commerce and Social Sciences, volume 2

Weissv D., (2007), THE STRUGGLE FOR A VIABLE ISLAMIC ECONOMY The

Muslim World

Ayse, and Yuce, (2003), Islamic financial houses in Turkey.

Journal of Academy of Business and Economics Publisher, ISSN: 1542-8710.

Hassan A., (2007), The Global Financial Crisis and Islamic Banking

Usman M., (2010), GLOBAL FINANCIAL CRISIS: ITS IMPACT ON DEVELOPING

COUNTRIES AND LESSONS FOR PAKISTAN IPRI Journal X, no.1

Alam M., (1998), ISLAMIC BANKING IN BANGLADESH: A CASE STUDY OF

IBBL International Journal of Islamic Financial Services Vol. 1 No.4

Kenneth R., (1985), "Can International Monetary Cooperation be Counterproductive?"

Journal of International Economics.2.3-8.

Glick R., and Andrew R,( 1998), Contagion and Trade: Why Are Currency Crises

Regional? Center for Economic and Policy Research Discussion Paper no. 1947.

Morris S., and Hyun S (1998), Unique Equilibrium in a Model of Self-Fulfilling

Currency Attacks. American Economic Review 88 (June): 587-97

Krugman, Paul (1979), A Model of Balance-of-Payments Crises. Journal of Money,

Credit, and Banking 11 (August): 311-25

Bairoch P, (1998), Economics and World History: Myths and Paradoxes.

Chicago. University of Chicago Press.

Bernanke B., (2011),International capital flows and the returns to safe assets

in the United States, 20032007. Financial Stability Review. 15. Banque de

France. February.

Bhagwati J., (1998), The capital myth. Foreign Affairs

Bhagwati J, and Srinivasan T., (1999), Outward orientation and development:

Are revisionists right? Yale University Economic Growth Centre discussion

paper no. 806.

Boyce R., (2009), The Great Interwar Crisis and the Collapse of

Globalization. Palgrave Macmillan.

Bradford C., (2005), Prioritizing economic growth: enhancing macroeconomic policy

choice. G-24 discussion paper series, no. 37. Geneva.

Harrod, F and F Roy (1933), International Economics,Cambridge Economic

Handbooks.

Helpman E., and Krugman P., (1989),Trade Policy and Market Structure (Cambridge,

MA: MIT Press).

Jomo K., (2005), The Pioneers of Development Economics

Jomo K., and Reinert E., (2005), The Origins of Development Economics

Alesina A.,(1996), Political Instability and Economic Growth. NBER WORKING PAPER

SERIES.4173

Fourans A., and Franck R.,(2003),Currency Crises A Theoretical and Empirical

Perspective,

Cheltenham, UK Northampton, MA, USA: Edward Elgar.

Fostel A and Geanakoplos J., (2008), Leverage Cycles and the Anxious Economy,

American

Economic Review 98, 1211-1244.

Freixas X.,and Holthausen C., (2005), Interbank Market Integration under Asymmetric

Information, Review of Financial Studies 18, 459-490.

He, Z. and A. Krishnamurthy (2008). A Model of Capital and Crises, working paper

University of Chicago.

Heider F, Hoerova M and C., Holthausen, (2009), Liquidity Hoarding and Interbank

Market

Spreads The Role of Counterparty Risk, mimeo

Herring R and Wachter S, (2003), Bubbles in Real Estate Markets, Asset Price

Bubbles, The

Implications for Monetary, Regulatory, and International Policies edited by William C.

Holmstrm B and Tirole J, (1998), Private and Public Supply of Liquidity, Journal of

Political Economy 106, 1-40.

Hong J and Xiong W., (2008), Advisors and Asset prices: A model of the

Origins of Bubbles, Journal of Financial Economics 89.

Huang J and Wang J., (2008), Liquidity and Market Crashes, Review of Financial

Studies,

forthcoming.

Huang J and Wang J., (2008), Market Liquidity, Asset Prices and Welfare, Journal of

Financial Economics, forthcoming.

Jorion P and Zhang G., (2009), Credit Contagion from Counterparty Risk, Journal of

Finance

Appendix

Strongly

Disagree

Moderately

Disagree

Disagree Neutral Agree Moderately

agree

Strongly

Agree

1 2 3 4 5 6 7

Role of Currency

We are conducting a research study on Role of Currency. Please give us some time to fill this

questionnaire. Thank you

Inflation

1. Do you have inflation in your country? 1 2 3 4 5 6 7

2. Does inflation impact your life style? 1 2 3 4 5 6 7

3. Does your government take any measure to

control inflation?

1 2 3 4 5 6 7

4. Does inflation impact the currency? 1 2 3 4 5 6 7

5. Do you believe that money supply and

inflation are interrelated?

1 2 3 4 5 6 7

Devaluation

1. Is your currency devalued? 1 2 3 4 5 6 7

2. Do you believe that export of the country is

related to devaluation?

1 2 3 4 5 6 7

3. Does devaluation increase the inflation? 1 2 3 4 5 6 7

4. Devaluation of currency is good for country? 1 2 3 4 5 6 7

5. Does devaluation impact common person? 1 2 3 4 5 6 7

Debt

1. Debt and inflation are interrelated 1 2 3 4 5 6 7

2. Does debt increase the devaluation? 1 2 3 4 5 6 7

3. Does debt change your life style? 1 2 3 4 5 6 7

4. Does debt impact the currency? 1 2 3 4 5 6 7

5. Does your policy maker use debt in a right

way?

1 2 3 4 5 6 7

Political Instability

1. Is political instability impact the country? 1 2 3 4 5 6 7

2. Does political instability impacts common

person?

1 2 3 4 5 6 7

3. Does political instability impact country

economy?

1 2 3 4 5 6 7

4. Does political instability impacts foreign

investment?

1 2 3 4 5 6 7

5. Do you think political instability impact stock

exchange?

1 2 3 4 5 6 7

Exchange Rate

1. Does exchange rate impact the currency? 1 2 3 4 5 6 7

2. Does exchange rate devalued the currency? 1 2 3 4 5 6 7

Unstable regulation of currency lead

towards disability of economy

1. Do you believe that unstable regulation

of currency impact the monetary policy of

country?

1 2 3 4 5 6 7

2. Do you believe that unstable regulation

of currency impact the interest rate?

1 2 3 4 5 6 7

3. Does unstable regulation of currency

disable the economy?

1 2 3 4 5 6 7

4. Do you believe that the deregulation of

currency are basic problem of inflation?

1 2 3 4 5 6 7

3. Do you believe that exchange rate is causing

inflation?

1 2 3 4 5 6 7

4. Does exchange rate is effect the balance of

payment?

1 2 3 4 5 6 7

5. Does exchange rate the cause the currency

crisis?

1 2 3 4 5 6 7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Easy Security and Mergetool Pricing v9.6 WebDocument1 pageEasy Security and Mergetool Pricing v9.6 WebUsama AhmadNo ratings yet

- In-Class Exercise On Option Strategies (Chapter 3) : 1. Long Call and A. Long Put With The Same Strike Price (Straddle)Document4 pagesIn-Class Exercise On Option Strategies (Chapter 3) : 1. Long Call and A. Long Put With The Same Strike Price (Straddle)Hins LeeNo ratings yet

- Taxation Residency Certificate (TRC) User Guide - Registration and Certificates RequestDocument15 pagesTaxation Residency Certificate (TRC) User Guide - Registration and Certificates RequestCA Ravi KumarNo ratings yet

- Moot Court Tutorial 1Document8 pagesMoot Court Tutorial 1rushi sreedharNo ratings yet

- University of Phoenix Dissertation FormatDocument5 pagesUniversity of Phoenix Dissertation FormatPaperWritingServiceCollegeBuffalo100% (1)

- TKMH Group4 CaMauDocument81 pagesTKMH Group4 CaMau2254060579No ratings yet

- Sheet Metal Workers Union Local 2 $15k Grant Contest Rules (2021)Document5 pagesSheet Metal Workers Union Local 2 $15k Grant Contest Rules (2021)Cole MotzNo ratings yet

- MC - Purchaseorder 38755Document1 pageMC - Purchaseorder 38755David BoardmanNo ratings yet

- Financial ControllershipDocument5 pagesFinancial ControllershipJamille Rey DirectoNo ratings yet

- 48 Laws of Money (MR Overpaid)Document132 pages48 Laws of Money (MR Overpaid)amrou kasmiNo ratings yet

- SWE351-20-WSM-Execution II, Followup, Monitoring and EvaluationDocument22 pagesSWE351-20-WSM-Execution II, Followup, Monitoring and EvaluationAnil KumarNo ratings yet

- Corporate Seal & Dutch Legal EntitiesDocument2 pagesCorporate Seal & Dutch Legal EntitiesXhanieNo ratings yet

- P&P Computer Shop: Business PlanDocument5 pagesP&P Computer Shop: Business PlanAnn Claudeth MaboloNo ratings yet

- TOSHIBA ACCOUNTING SCANDAL - Mini CaseDocument5 pagesTOSHIBA ACCOUNTING SCANDAL - Mini CaseNicholas AlexanderNo ratings yet

- Ass 2 - PASS - Dinh Khanh HuyenDocument23 pagesAss 2 - PASS - Dinh Khanh HuyenNguyen Minh Thanh (FGW HCM)No ratings yet

- Jayshree Periwal International School Grade 11 COMPUTER SCIENCE Python Programming AssignmentDocument1 pageJayshree Periwal International School Grade 11 COMPUTER SCIENCE Python Programming Assignmentkisna agarwalNo ratings yet

- Excavation and EarthworkDocument15 pagesExcavation and EarthworkLalith RohanaNo ratings yet

- Odyssey Park, Inc., Petitioner, V. Honorable Court of Appeals and Union Bank of THE PHILIPPINES, RespondentsDocument4 pagesOdyssey Park, Inc., Petitioner, V. Honorable Court of Appeals and Union Bank of THE PHILIPPINES, RespondentsDanielleNo ratings yet

- Investments Handouts MCDocument14 pagesInvestments Handouts MCSnow TurnerNo ratings yet

- Liste de Pièces de RechangeDocument4 pagesListe de Pièces de RechangeGERALD SIMONNo ratings yet

- Full Costing Dan Metode Activity Based Costing DalamDocument11 pagesFull Costing Dan Metode Activity Based Costing DalamMulik Afiani SilmiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)DRAGO GAMINGNo ratings yet

- Sample Test Executive MBA 2020Document8 pagesSample Test Executive MBA 2020iftikharhassanNo ratings yet

- Swati Kumar - Jet AirwaysDocument11 pagesSwati Kumar - Jet AirwaysNikhil BudhirajaNo ratings yet

- Health and Safety Risk Assessment FormDocument4 pagesHealth and Safety Risk Assessment Formbasil aliNo ratings yet

- Class X Foundation WorksheetDocument3 pagesClass X Foundation WorksheetKriday MisriNo ratings yet

- Brand Image On Customer LoyaltyDocument8 pagesBrand Image On Customer LoyaltysengguruhNo ratings yet

- Quality Assurance (Unplanned Inspections) : Scenario OverviewDocument7 pagesQuality Assurance (Unplanned Inspections) : Scenario OverviewJulian Moreno LunaNo ratings yet

- INTL 3003 Module 9 Inventory ManagementDocument68 pagesINTL 3003 Module 9 Inventory ManagementManish SadhuNo ratings yet

- U-3, Microbiology, Carewell PharmaDocument22 pagesU-3, Microbiology, Carewell PharmaRahul NikumbhNo ratings yet