Professional Documents

Culture Documents

Renaissance Securities (Cyprus) Limited Professional Clients & Eligible Counterparties

Renaissance Securities (Cyprus) Limited Professional Clients & Eligible Counterparties

Uploaded by

acehussain0 ratings0% found this document useful (0 votes)

99 views34 pagesThis document outlines the terms of an investment services agreement between Renaissance Securities (Cyprus) Limited and a customer. Some key details:

- Renaissance Securities (Cyprus) Limited is authorized and regulated by the Cyprus Securities & Exchange Commission to conduct investment business in Cyprus and the EU.

- The agreement defines terms such as "services", "assets", "associated firm", and outlines Renaissance's responsibilities to the customer and disclaims any fiduciary duties.

- Schedules may be added to the agreement to provide additional services requested by the customer. The agreement and schedules constitute the full terms governing the relationship.

Original Description:

Original Title

4aabe16b-0b00-402a-94c0-cc372ced8473

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the terms of an investment services agreement between Renaissance Securities (Cyprus) Limited and a customer. Some key details:

- Renaissance Securities (Cyprus) Limited is authorized and regulated by the Cyprus Securities & Exchange Commission to conduct investment business in Cyprus and the EU.

- The agreement defines terms such as "services", "assets", "associated firm", and outlines Renaissance's responsibilities to the customer and disclaims any fiduciary duties.

- Schedules may be added to the agreement to provide additional services requested by the customer. The agreement and schedules constitute the full terms governing the relationship.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

99 views34 pagesRenaissance Securities (Cyprus) Limited Professional Clients & Eligible Counterparties

Renaissance Securities (Cyprus) Limited Professional Clients & Eligible Counterparties

Uploaded by

acehussainThis document outlines the terms of an investment services agreement between Renaissance Securities (Cyprus) Limited and a customer. Some key details:

- Renaissance Securities (Cyprus) Limited is authorized and regulated by the Cyprus Securities & Exchange Commission to conduct investment business in Cyprus and the EU.

- The agreement defines terms such as "services", "assets", "associated firm", and outlines Renaissance's responsibilities to the customer and disclaims any fiduciary duties.

- Schedules may be added to the agreement to provide additional services requested by the customer. The agreement and schedules constitute the full terms governing the relationship.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 34

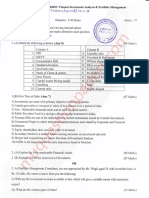

Renaissance Securities (Cyprus) Limited

Professional Clients & Eligible Counterparties

Version 1: October 2011

1

INVESTMENT SERVICES AGREEMENT

This Agreement is dated as of [ ] and is entered into between:

Renaissance Securities (Cyprus) Ltd, having its registered office is at 9

th

Floor, Capital Centre, 2-4 Archbishop Makarios III Avenue,

1505 Nicosia, Cyprus, (telephone number + 357 22 505800 and fax number is + 357 22 676755) authorized and regulated by the

Cyprus Securities & Exchange Commission (CySEC) under license number 053/04 ( + 357 22 875475 )for the conduct of designated

investment business in Cyprus and other jurisdictions, including the European Union (Renaissance); and

[Name of Customer] a company incorporated in [ ] with its registered office at [ ] (the Customer or you),

Together, the Parties and each individually a Party.

1. DEFINITIONS AND INTERPRETATION

1.1 This Agreement, which also includes and incorporates by reference the schedules hereto and any other schedules for the

provision of certain Services which you request us to provide to you from time to time (the Agreement and the Schedules),

sets out the terms on which we are willing to act for you. You hereby represent and warrant to us that you are aware that thi s

Agreement creates a contractual relationship that has legal consequences.

1.2 The Services we provide to you shall in no way give rise to any fiduciary or equitable duties on our part or that of any

Associated Firm acting in a dual capacity (either as principal or as agent) in respect of any Investments sold or purchased by

you, or prevent or hinder us or any Associated Firm in any other way in acting as provided in this Agreement.

1.3 In this Agreement unless the context will not allow:

references to we, us and similar expressions means Renaissance and / or, where the context so admits, any relevant

Associated Firm;

singular references will include the plural;

references to persons will include individuals, bodies corporate (wherever incorporated), unincorporated associations and

partnerships;

any reference to an enactment, statutory provision, rule or regulation is a reference to it as it may have been, or may from

time to time be, amended, modified, consolidated or re-enacted;

references to writing will include the transmission of text electronically;

where general words are followed by the expressions including, for example or such as and specific examples are given

the interpretation of the general words will not be limited to the examples given;

this Agreement and any present or future amendments or Schedules thereto, are constructed in the English language. In case

of differences between this document and any translation of it, the English version will prevail;

words that are defined in CySEC Directives and Circulars have the same meaning in this Agreement and the Customer

Document Pack unless the term is expressly defined therein; and

headings are for convenience only and will not affect the construction of this Agreement.

"Account Opening Pack" means the pack of documents provided to the Customer by Renaissance to be completed by the Customer

in order to open an account in the name of the Customer with Renaissance.

"Act of Insolvency" shall have the meaning ascribed to it in the Insolvency Act 1986, as amended from time to time, ) the

occurrence in any other jurisdiction of any procedure equivalent, analogous or similar.

Approved Bank means a central bank or a regulated bank and may also include Commercial Bank Renaissance Capital, our

affiliate bank operating in the Russian Federation under license and supervision by the Central Bank of the Russian Federation.

"Assets" means those Investments which we hold on your behalf in a Securities account with us.

2

"Associate" or "Associated Firm/s" means:

(i) with respect to Renaissance: any undertaking in the Renaissance Group of companies or subsidiary of Renaissance

Management Holdings Limited from time to time; and

(ii) with respect to the Customer: (i) any entity or person controlled directly or indirectly by the Customer, (ii) any entity or

person that controls directly or indirectly the Customer, (iii) any entity or person directly or indirectly under common

control with the Customer or (iv) any entity or person directly or indirectly controlled by one of the entities or person/s

included in (i) (iii) here above. For this purpose, "control" of any entity or person means any of the following (A) the power

(whether by way of ownership of shares or participatory interests or by way of proxy, contract, agency or otherwise, and

whether exercised legally, beneficially or de facto, directly or indirectly): (i) to cast, or control the casting of, more than one-

half of the maximum number of votes that might be cast at a general meeting of such entity or person; or (ii) to appoint or

remove all, or the majority, of the directors, management committee, supervisory committee or other equivalent officers of

such entity or person; or (iii) to appoint or remove the president, managing director or chief executive officer of such enti ty

or person; or (iv) to give directions with respect to such entity or person, which the president, managing director, chief

executive officer, directors, management committee, supervisory committee, or other equivalent officers of such entity are

obliged to comply with; or (v) otherwise to determine the activities of such entity or person; or (B) the holding, directly or

indirectly, legally or beneficially, of more than one-half of the issued share capital of or participatory interest in such entity

or person.

"Best Execution" shall have the meaning ascribed to it in the Rules.

"Business Day" means a day on which Renaissance and banks in Nicosia, London and Moscow are generally open for the transaction

of business contemplated by this Agreement.

"Cash" means US Dollars (or any currency that Renaissance may agree in writing to accept for the purpose from time to time).

Account means the Clients account for holding Cash and/or Securities with Renaissance.

"Client Money Rules" means the rules set out by CySEC in relation to the handling of client money in connection with Investment

Services business as set out in Part VI of Directive DI144-2007-01 and in any successor or supplementary regulations.

"Corporate Action" means, without limitation, any conversion, subscription rights, subdivision, consolidation, redemption, merger,

rights relating to takeovers or other offers or capital re-organization, capitalization issue, rights issue, redenomination,

renominalization or other event similar to the foregoing. Corporate Action will not include any voting rights that are exercisable,

whether in connection with the foregoing, or otherwise.

Currency Sub-Account means a sub-Account opened in order to take cash deposits in USD, EUR, GBP or any other currencies as

are requested by the Customer and agreed to by Renaissance from time to time.

"Customer Document Pack" means this Agreement, the Account Opening Pack, any Schedules and any other documentation

provided to you during the Customer on-boarding process or sent to you and/or entered into with you from time to time which

relate to the Services provided under or in connection with this Agreement, whether or not the document(s) have been expressl y

incorporated into this Agreement.

"Designated Investment Business" or "General Dealing Services" means the investment services business that Cypriot Investment

Firms are permitted to carry out in accordance with the Law and the terms of their respective operating licenses as issued by CySEC.

"Electronic Services" means any and all services falling within the scope of or provided in accordance with the Electronic Services

Schedule.

"Equivalent Securities" or "Equivalent Assets" means, in relation to other securities, securities that are of the same issuer, part of

the same issue and of an identical type, nominal value, description and amount and that have the same rights as those other

securities (provided that where there has been a corporate action or similar event in relation to such securities we may reasonably

determine what securities (which may consist of and include money and other property) are equivalent for this purpose).

"Exchange" means any exchange, regulated market, multilateral trading facility, trading system or association of dealers in any part

of the world (and includes a successor body) on or through which Investments or assets underlying, derived from or otherwise

related directly or indirectly to Investments are bought and sold.

"GMRA" means either the 2002 or 2010 Global Master Repurchase Agreement of the International Capital Markets Association

along with any of its supporting annexes or other documentation.

3

"Income" means any interest, dividends or other distributions of any kind whatsoever with respect to any Investments.

"Investment(s)", "Products" or "Financial Instruments" means financial instruments, Securities or products that Renaissance may

be, under the terms of its operating license, entitled to provide from time to time, a (non-exhaustive and subject to change without

notice) list of which is available at http://www.renaissancegroup.com/InvestmentBanking/About/LegalInformation/RSLtd/.

"ISDA" means either the 1992 or 2002 ISDA Master Agreement of the International Swaps and Derivatives Association (ISDA) along

with any of its supporting annexes or other documentation.

"Law" means the Provision of Investment Services, the Exercise of Investment Activities, the Operation of Regulated Markets and

Other related Matters Law of 2007.

"MiFID" means the Markets in Financial Instruments Directive.

"Order Execution Policy" means Renaissances order execution policy available at

http://www.renaissancegroup.com/InvestmentBanking/About/LegalInformation/RSLtd/

"Professional Client" and "Eligible Counterparty" shall have the meanings ascribed to them in the Rules.

"Rules" means:

(a) all Cyprus and other applicable laws and any successor legislation, including without limitation, the rules and guidance

promulgated by the CySEC pursuant to the Law and any successor or supplementary legislation;

(b) rules, statements of principle and directives of CySEC and other competent authorities (including self regulating

organizations) responsible for the regulation of the investment services business including Directive DI144-2007-01 issued by

the CySEC in relation to the authorization and operating conditions of Cyprus Investment Firms and Directive DI144-2007-02

in relation to the professional competence of investment firms and of the natural persons employed by them;

(c) all statutory and other requirements relating to money laundering, including, without limitation, the Prevention and

Prohibition of Legalization of Proceeds of Criminal Activities Law of 2007, the CySEC Anti-Money Laundering Regulations of

2001, the CySEC Anti-Money Laundering Regulations of 2001, the CySEC Directive Regarding the Prevention of Money

Laundering and Terrorist Financing (144-2007-08) and any successor or supplementary legislation and regulations;

(d) the Processing of Personal Data (Protection of Individuals) Law of 2001;

(e) the Law on Insider Dealing and market manipulation (Market Abuse) of 2005 and any successor or supplementary legislation

and regulations; and

(f) all rules, regulations and by-laws of any relevant exchange and/or clearing institution and applicable accepted market

practice and custom.

"Security" means the security interest referred to in Clause 11 of this Agreement.

"Securities" means financial instruments such as shares and bonds, including fixed income (or fixed income related) and equity (or

equity related) investments, stocks, securities, debentures, certificates of deposit and other instruments (including, but not limited

to, options, forwards, derivatives and commodity-linked instruments).

"Services" means such services as Renaissance is licensed to provide to you by CySEC and as part of this Agreement which exclude

investment advice and portfolio management on a discretionary or advisory basis and which include, but are not limited to the

following:

Reception and transmission of orders in relation to one or more financial instruments;

Execution of orders on behalf of clients;

Dealing on own Account;

Safekeeping and administration of financial instruments for the account of clients, including custodianship and related

services such as cash/collateral management;

Granting credits or loans to clients to allow them to carry out transactions in one or more financial instruments where

Renaissance which grants the credit / loan is involved in the transaction; and

Foreign exchange services where these are connected to the provision of investment services.

We may, following a request from you to do so, provide you from time to time with additional Schedules setting out the terms on

which we will offer products to you in addition to those with which you have already been provided. In the event that we do so, any

such Schedules will be deemed to be incorporated by reference into this Customer Document Pack and shall be deemed, from the

4

date on which you first avail yourself of those Services, to have been accepted by you and have the same legal effect as if they had

been included in the Customer Document Pack originally provided to you.

"Spot Rate" means the applicable exchange rate as determined by Renaissance from time to time and in its absolute discretion.

"Taxes" means taxes, duties, imposts and fiscal and regulatory charges of any nature, wherever and whenever imposed including

value added taxes, stamp and other documentary taxes and Exchange, Clearing House, regulatory and industry levies.

"Tied Agents" means a person established in a member state, who, acting under the full and unconditional responsibility of only one

investment firm of a member state, on whose behalf it acts, promotes investment or/and ancillary services, attracts clients or

prospective clients, receives and transmits client orders in respect of investment services or financial instruments, places financial

instruments or/and provides advice to clients or prospective clients in respect of those financial instruments or services.

"Your Information" means the information you have provided to Renaissance with respect to your identity, your representatives,

your business, operating and financial and business standing your investment objectives which will be subject to the terms of this

Agreement with respect to Data Processing and Confidentiality, including that information contained in the Account Opening Pack.

2. Provision of Services

2.1 We may effect transactions that may commit you to further payment or liability (contingent liability transactions). These may

include options where you will be obliged to make payment or delivery if the option is exercised against you, or contracts for

differences such as swaps where you will be required to make variable payments depending on the performance of an index

or other factor specified in the contract.

2.2 Unless you have indicated otherwise, we may enter into transactions in options or contracts for differences which will, or

may, result in you having to provide a deposit of cash or securities as security for unrealized losses which have occurred or

may occur in relation to your Investments (margin payments). Payments may be required both on entering into a transaction

(initial margin) and on a daily basis throughout the life of the transaction if the value of the transaction moves against you

(variation margin). Details of our margining procedure are set out in the Margin Schedule, which forms part of this

Agreement.

2.3 We may enter into transactions with you governed by the terms of an ISDA, GMRA or other master agreement. If there is a

conflict between the terms of such master agreement and this Agreement in relation to any such transaction, then the terms

of the master agreement will prevail. Please note that certain services (for example investment advice, portfolio management

and underwriting / corporate finance advisory) are not covered by this Agreement. If you ask Renaissance to provide these

services and we agree, then such services will be subject to a separate agreement between the Parties.

2.4 Unless you expressly request, and we agree, we will not make any personal recommendation to you, nor advise you on the

merits of any transaction in Investments, including in relation to US issuers or financial instruments. We may provide you with

information about Investments, including their terms or performance, and we may provide you with trading ideas. However,

in providing such information and ideas we will not be making any personal recommendation to you or advising you on the

merits of any such Investment, including in relation to US issuers or financial instruments, and you will be responsible for

making your own assessment of such information and ideas. We cannot, and will not provide you with legal or tax advice, and

if you consider it necessary you should consult your own legal and tax advisers. We may discuss the terms of this Agreement

as well as the information and clauses of other documents included in the Customer Document Pack with you, however we

cannot advise you on and will not be liable to you for any opinion we may give in relation to this Agreement and /or the

Customer Document Pack.

2.5 For the purposes of this Agreement, you agree that we are categorizing you as either a Professional Client or as an Eligible

Counterparty (as defined in the Rules), and such categorization will be separately communicated to you. You have the right

ask Renaissance to change your classification either for individual services or for the whole relationship. If you do not agree

with your classification, please communicate this immediately to Renaissance in writing. We have an obligation under the

Rules, to assess the appropriateness of the Service or the investments which are the subject of such Service. There is,

however, no such obligation to do so if:

(a) you meet the requirements to be treated as an Eligible Counterparty or Professional Client (as defined in the Rules) and

therefore we are entitled to assume that you have the necessary experience and knowledge in order to understand the risks

involved in relation to particular services and / or Investments and / or transactions; and

(b) the Investments in which you wish to transact, irrespective of your client categorization, relate to shares admitted to trading

on a regulated market or in an equivalent third country market, money market instruments, bonds or other forms of

securitized debt (excluding those with an embedded derivative), UCITS or other non complex Financial Instruments; and

(c) you initiate the request for the Service irrespective of your client categorization.

5

2.6 As part of our Services we may give you quotations (which may be indicative or firm), execute transactions or otherwise

accept an order or an instruction from you but we will not have to, where we, in our discretion, decide not to do so. We will

use reasonable endeavors to notify you as soon as practicable if we decide not to provide a quote or accept an order or

instruction and we may, but will not have to, provide reasons for our decision.

2.7 We may, with your instruction, enter into transactions for you which commit you to underwriting, sub-underwriting or similar

obligations in connection with a new issue, offer for sale, rights issue, takeover or similar transaction. This authority extends

to such transactions in which we or an Associated Firm have been involved as sponsor, financial adviser, underwriter, lending

bank or in some other capacity.

2.8 We may undertake stock lending activity with or for you in relation to any Assets held by us for you and any further Assets as

from time to time agreed and on such terms as agreed between us and you.

2.9 Where we act as principal in executing a transaction in an Investment which is not a packaged product or a readily realizable

security, the unit price of the transaction shall either be (a) the market price for the Investment then available on the

Exchange on which such Investment is generally traded; or (b) if no such price is available, determined on a reasonable efforts

basis. Any reference in a confirmation to a market price shall be construed accordingly.

2.10 We may arrange for any of the Services you ask us to provide to be carried out by an Associated Firm or any third party (for

example, where we appoint a member of an Exchange to execute a transaction). We shall exercise reasonable skill, care and

diligence in their selection. We may also employ agents we reasonably select on terms we think appropriate. We shall

exercise reasonable skill, care and diligence in their selection. Neither we nor our respective directors, officers, employees or

agents will be liable to you for any act or omission of an intermediate broker or agent, save for the gross negligence, fraud or

willful deceit in the selection of such intermediate broker or agent. No responsibility will be accepted for intermediate

brokers or agents selected by you.

2.11 Subject to Clause 6.5, if agreed between the Customer and Renaissance, Renaissance may open in the name of the Customer

a Cash Account (which may include Currency Sub-Accounts for all and any moneys received by Renaissance or any sub-

custodian for the account of the Customer, whether by way of deposit or arising out of or in connection with any Financial

Instruments or transactions. Where any sum is received by Renaissance hereunder in any currency other than USD, such sum

shall be converted at the Spot Rate effective on the day of receipt of such sum by Renaissance and credited to the Cash

Account, unless the Customer has elected the Currency Sub-Accounts in the Account Opening Pack, in which case the sum

received shall be credited to the relevant Currency Sub-Account for the particular currency. Unless otherwise agreed

between the Parties, any sum payable to the Customer in the form of a dividend or similar corporate action payment shall be

credited to the Account. Currencies held in the Account may be converted by Renaissance into a different currency following

receipt by Renaissance of the Customers instructions. For the purpose of effecting such currency conversion, or valuing the

Customers cash balance, the Spot Rate shall be applied.

3. Compliance with Rules

3.1 Transactions between you and Renaissance may be subject to the Rules and customs of an Exchange, market or multilateral

trading facility and / or any clearing house through which the transactions are executed and to all applicable Rules.

3.2 We will comply with the Rules when providing Services to you, and, if there is a conflict, the Rules will take precedence over

this Agreement. Nothing in this Agreement shall oblige Renaissance to act in any way which it believes to be in contravention

of the Rules. You accept that Renaissance is entitled to act in accordance with those Rules and shall not be liable to you for

the consequences of so doing. Any action taken by Renaissance on your behalf in compliance with such Rules shall be binding

upon you.

3.3 You agree that we may do what we think reasonably necessary to ensure compliance with the Rules.

3.4 If we are required by any applicable Rule to file or disclose information relating to you, the Services we provide or

transactions we carry out for you to any Exchange, clearing house or regulatory or governmental authority, we may do so

without your further confirmation. If further information is required, then you undertake to provide Renaissance with such

information in order to allow Renaissance to comply with the Rules. If the Rules require you to file or disclose any such

information directly then you undertake to do so.

3.5 We may deal with you in circumstances in which the relevant transaction is not regulated by the Rules of any Exchange,

market or multilateral trading facility. We may provide Services which may include the execution of transactions in

unregulated collective investment schemes.

6

3.6 By executing this Agreement you confirm that you have been provided with details of all AML, KYC, Client Classification

documents (these are also available at:

http://www.renaissancegroup.com/InvestmentBanking/About/LegalInformation/RSLtd/) and all information and authorities

required to be provided in the Account Opening Pack which you are required to complete and return and that you have so

completed and returned these documents to Renaissance.

4. Dealing and Settlement Terms

4.1 When we deal with you, it will only be on the basis that only you are our Customer under this Agreement. If you act as agent

on behalf of a principal or as a trustee on behalf of a beneficiary, then regardless of, whether or not you identify them to

Renaissance, only you will be our customer and we will have no responsibility to your principal or beneficiary.

When we accept an order or execute a transaction for you (including programmed trades):

(i) we may act as agent, principal, or a combination of both unless it is unambiguously clear from the terms of the

order (and we accept those terms) or the Rules of an Exchange that we will act in a specific capacity or we may

arrange for execution of the transaction, at our absolute discretion, through one of our Associated Firms or any

third party broker; and

(ii) if any applicable Rules require Renaissance to act as your agent on an Exchange where we cannot act as principal,

then you undertake to sign and deliver any additional documents that we need to do so.

4.2 We may meet your objectives by accessing our own internal sources of liquidity (including, crossing against client order flow,

client facilitation, market making or proprietary trading), subject to you providing Renaissance with any relevant consent

where necessary or if we otherwise determine that it is in your best interests to do so. This may mean that we are trading as

your agent and as principal on our own behalf and your order may not be executed on an Exchanges central trading system,

but such trades will be reported if required in accordance with applicable Rules.

4.3 If you are a Professional Client, we will provide you with Best Execution in accordance with the terms of our Order Execution

Policy. By entering into this Agreement you confirm that you have read and accepted this policy, as amended from time to

time in our absolute discretion without requirement of notification or consent. If you are an Eligible Counterparty, we do not

owe to you, under the Rules, any Best Execution obligations.

4.4 Any limit order taken from you in respect of an Investment in which we act as market maker or otherwise as principal will be

on the basis that:

(i) such order will not be executed unless and until the Investment concerned reaches the same or a higher price than

that specified in the order (in the case of a sell order) or the same or a lower price than that specified in the order

(in the case of a buy order); and

(ii) we may for our own, an Associated Firms, or another clients account continue to buy or sell the Investment with

third parties at prices equal to, higher or lower (depending on the transaction direction) than specified in your limit

order.

4.5 We have the right, but not the obligation, to set limits and/or parameters to control your ability to place orders at our

absolute discretion. Such limits and/or parameters may be amended, increased, decreased, removed or added to by

Renaissance at our absolute discretion and may include (without limitation): (i) controls over maximum order amounts and

maximum order sizes; (ii) controls over our total exposure to you; (iii) controls over prices at which orders may be submitted

(to include (without limitation) controls over orders which are at a price which differs greatly from the market price at the

time the order is submitted to the order book); (iv) controls over the Services provided pursuant to the Electronic Services

Schedule (to include (without limitation) any verification procedures to ensure that any particular order(s) has come from

you); (v) closing out any one or more of your transactions in order to comply with the set limits and/or parameters; or (vi) any

other limits, parameters or controls which we deem necessary.

4.6 When entering into any transaction with or through Renaissance you should be satisfied that you fully understand the

transaction and the nature and extent of the potential risk of loss and rewards of that transaction (including the risks involved

in derivative trading and contingent liability transactions) and have independently determined (after taking independent

advice you consider necessary) that the transaction is appropriate for you in the light of your objectives, experience, financial

and operational resources and other relevant circumstances.

4.7 If any Exchange (or intermediate broker or agent, acting at the direction of, or as a result of action taken by, such Exchange)

or regulatory body takes any action which affects a transaction, then we may take any action which we, in our discretion,

consider desirable to correspond with such action or to mitigate any loss incurred as a result of such action. Any such action

shall be binding on you.

7

4.8 If we arrange for any transaction to be executed with or through ourselves or an Associated Firm or though the agency of any

intermediary broker who may or may not be an Associate of ours and may not be regulated in Cyprus, the European Union, or

at all, neither we, nor any Associated Firm will be liable to account to you for, or to disclose to you, any profit, or charges or

other remuneration, we or any Associated Firm makes or receives from, or by reason of, the transaction or any connected

transaction. However, we will disclose to you any charges which are payable to Renaissance by you. Neither Renaissance or

its respective directors, officers, employees or agents will be liable to you for any act or omission of an intermediate broker or

agent, save for the gross negligence, fraud or willful deceit in the selection of such intermediate broker or agent. No

responsibility will be accepted for intermediate brokers or agents selected by you.

4.9 We may, subject to this Agreement, purchase or sell any particular Investments for you in accordance with your instructions.

We shall not, however, be under any obligation to repurchase from you any Investments which you have bought from

Renaissance at any particular price, or at all, except on such terms as may be pre agreed between you and Renaissance.

4.10 Where transactions are introduced to Renaissance on your behalf by another broker for clearing and settlement by

Renaissance, then we will not owe any duties to you in relation to the execution of those transactions. Our sole

responsibilities will relate to the clearing and settlement of the transaction.

5. Aggregation and averaging

5.1 We may, in our sole discretion, but are in no way obligated to:

(a) aggregate or bunch orders for your account with orders for other clients accounts or accounts in which we or our

Associated Firms or their respective personnel have a beneficial interest and allocate the Investments or proceeds acquired

among the participating accounts in a manner that we believe is fair and equitable in accordance with applicable Rules; and

(b) permit the broker with whom the order is placed (whether ourselves, an Associated Firm or a third party broker), in

accordance with applicable Rules of any Exchange or market or multilateral trading facility, to combine or aggregate your

order with other orders.

5.2 It is unlikely that the aggregation of orders and transactions will work to your overall disadvantage, however, you

acknowledge that aggregation of orders for your account with orders for other clients accounts or own proprietary trading,

may work to your disadvantage in relation to a particular order. You agree that where we have aggregated orders for your

account with other orders, we may allocate the Investments concerned as soon as is reasonably practicable. Further details

about our policy on order allocation may be found in our Order Execution Policy. Where orders or transactions are

aggregated with own property trading, your orders or transactions will take priority.

6. Settlement

6.1 We will not settle transactions for you unless we have received all necessary documents, Securities or funds. We shall credit

any Investments and/or money received for you on settlement of a transaction to the appropriate account or accounts or

otherwise as you direct.

6.2 If we are acting as your agent we will pay proceeds of sale or deliver or transfer documents or Investments to you or to your

account only if we have received these from the other party to the transaction.

6.3 All amounts payable by Renaissance to you and vice versa will be payable on a delivery-versus-payment basis unless we

expressly agree, or Rules or market practice require, otherwise. However, we may in our commercially reasonable discretion

effect settlement with you on a net basis.

6.4 If either party is required to deliver any asset, they will execute and deliver all necessary documents and give all necessary

instructions to procure that all rights, title and interest in the asset will pass to the transferee free from all liens, charges and

encumbrances. Delivery and transfer of title will take place in accordance with the requirements applicable to that asset.

6.5 We will only accept funds in settlement of your transactions from Approved Banks and from your own account with such

Approved Banks. We reserve the right to return to you or refuse to accept funds forwarded to Renaissance in settlement of

your purchase transactions from any other third party on your behalf, even if such funds were remitted through any

Approved Bank. We will only pay you funds in settlement of your sale transactions or as a result of any income received for

your benefit (and provided that all your outstanding obligations towards us are settled) to your own accounts (or otherwise

at our own discretion) held at an Approved Bank with your written request.

6.6 You agree that where Investments are required to be returned, retransferred or redelivered to you, these need not be the

actual Investments originally deposited, transferred, delivered or charged but maybe Equivalent Investments.

7. Reporting

8

7.1 Unless reporting arrangements relating to a specific market or Financial Instruments are in place, upon execution of a

transaction we will confirm the transaction details to you promptly. Any additional information relating to the execution of

the transaction will be provided to you upon request. The use of any durable medium for such communications has the same

legal effect as if served in written hard copy.

7.2 You agree that for trades introduced or arranged by Renaissance, a confirmation sent by the Renaissance shall be sufficient

for this purpose. All contracts, confirmations or statements issued by Renaissance shall bind you unless a detailed written

objection is received by Renaissance within two Business Days of dispatch.

7.3 We are not obliged to send to you periodic statements in compliance with the Rules in respect of every account, which

include or may include open positions with Renaissance. Where we provide custody services to you, we shall, on an at least

annual basis and no later than the two months following the end of the relevant calendar year, provide you with a statement

of your Investments and funds under our custody unless such a statement has been provided in any other periodic statement

provided by Renaissance. This statement will include details of all your Assets and funds and the extent of which any of these

are subject to Securities financing transactions including the benefits of these transactions. Such statement issued by

Renaissance shall bind you unless a detailed written objection is received by Renaissance within ten Business Days of

dispatch.

7.4 We shall endeavour to agree the form of daily reporting with you. Where no form has been agreed, our reporting to you will

be as provided in the first confirmation received by you from Renaissance or as agreed between Renaissance from time to

time. Where an order is executed in tranches, we shall provide you an average execution price. Any of the above reports can

be provided by electronic means as detailed further in the Electronic Services Schedule.

7.5 Any of the above reports can be provided by electronic means. Where you have provided Renaissance with an electronic mail

address, we shall consider this as an authority to Renaissance to forward reports, documents relating to this Agreement and

transactions / services arising therefrom to this electronic mail address.

8. Charges and payments

8.1 We will notify our charges to you separately from time to time. Our charges may include a commission, mark-up or

markdown and/or, where we use our internal sources of liquidity, a spread.

8.2 Fees and charges will also include those fees and charges which are necessary to enable Renaissance to provide you with

general advisory and dealing services, such as custody fees, settlement and exchange fees, regulatory levies and legal fees.

The current Schedule of charges will be provided to you separately.

8.3 Unless we agree otherwise, all money payable under this Agreement will be paid promptly using immediately available, freely

transferable and convertible funds in the relevant currency. You undertake to pay any amount that is payable (including the

purchase price for Investments) under or in connection with this Agreement on the due date regardless of any right of equity,

set-off or counterclaim that you may allege against Renaissance.

8.4 We will charge you in United States Dollars or in any other currency that we may agree from time to time. Where the initial

transaction is in any other local currency and we agree to invoice you in United States Dollars, we shall apply the mid rate of

exchange from such local currency to United States Dollars, as this is published by the relevant central bank on the date of

transaction or of invoice.

9. Interest

9.1 We will not pay you interest on client money or other money that we receive from you or hold for you unless we agree this

with you through a separate schedule to this Agreement. If you fail to pay any sum when due under this Agreement, then

interest will be payable on the unpaid sum until payment (before, as well as after, any court judgment). Interest will be

calculated as a percentage charge annually at a rate to be determined by Renaissance in its sole discretion.

10. Money held on your behalf

10.1 We shall treat money held by Renaissance on your behalf as client money (as defined in the Client Money Rules in the

relevant CySEC Directive). Among other things, and unless you notify Renaissance in writing to the contrary, we will hold your

money in a separate dedicated account at an Approved Bank. For the avoidance of doubt, any money which is transferred to

Renaissance for the purpose of securing or otherwise covering present or future, actual, contingent or prospective obligations

is not client money. Unless separately agreed with you, we retain discretion as to whether or not to treat money transferred

to Renaissance for the purpose of securing or otherwise covering present, future, actual, contingent or prospective

obligations as client money.

10.2 Unless you notify Renaissance otherwise in writing, we may place client money in a qualifying money market fund. If we

provide custody of units as such we will do so in accordance with CySECs custody Rules and not with the Client Money Rules.

9

In certain cases in order to provide the Services you have requested under this Agreement, we may be required to hold client

money and/or Assets with a third party in a country outside the European Union which does not regulate the holding and

safekeeping of money and/or Assets and you agree to Renaissance doing so.

10.3 You agree that we may freeze your account and cease to treat your money as client money and, accordingly, release it from

the dedicated client bank account(s) if there has been no movement in your balance for a period of at least two years

(notwithstanding any payments or receipts of charges, interest or similar items) and we have taken reasonable steps to trace

you and return the balance. Throughout the duration of the freezing period we will not provide you with any client

statements. We undertake to make good any valid claim against released balances.

11. Security

11.1 In the course of using the Services provided by Renaissance under this Agreement you will incur obligations and liabilities to

Renaissance. This will be the case particularly where the Services include those performed with respect to derivative Financial

Instruments, as you will incur liabilities to Renaissance under the derivatives contracts that we trade with you.

11.2 As continuing security for all obligations and liabilities you may incur under this Agreement, Renaissance shall have a lien,

right of retention and power of sale on (a) to (f) here below, and you hereby charge to Renaissance for itself and as trustee

for Renaissance by way of first fixed charge and in the case of any defect in such fixed charge, then you hereby grant to

Renaissance a floating charge over (a) to (f) here below, with full title guarantee and free of any adverse interest:

(a) all right, title and interest in all Investments which are from time to time held by or with Renaissance or any Associated Firm

or now or at any time held by or registered with its agents, custodians or nominees pursuant to this Agreement; and

(b) all cash which is from time to time credited to an account with Renaissance or any Associated Firm or third party appointed

by Renaissance pursuant to this Agreement; and

(c) all sums of money held by Renaissance for you, or any Associated Firm or third party appointed by Renaissance, the benefit

of all accounts in which any such money may be held and all your rights, title and interest under any trust relating to such

money or to such accounts; and

(d) all proceeds in relation to Investments held by Renaissance for you; and

(e) documents of title; and

(f) certificates and other Assets, whether in sole or joint names.

11.3 You agree that you will not withdraw or seek to withdraw any property which is subject to the above Security interest or in

any way encumber, assign, transfer or deal with such property without the prior consent of Renaissance which shall not be

unreasonably withheld.

11.4 Unless otherwise agreed, Renaissance shall not accept instructions to deliver cash and/or Investments that are subject to the

Security from an account with Renaissance to a third party for purposes of settlement or for any other purpose. Such request

is subject to the provisions of the Security and this Agreement. If we permit delivery of such cash and/or Investments to a

third party, the relevant cash and/or Investments will be automatically released from the Security on delivery. Permitting any

withdrawal of cash and/or Investments will not commit Renaissance to agreeing to subsequent withdrawals.

11.5 As further Security for your obligations and liabilities under this Agreement, we will have the right to retain your Investments

or other property which we hold, and to sell or otherwise dispose of such Investments and property to discharge your

obligations and liabilities to Renaissance. Renaissance may apply any property which is subject to the above Security interest

together with (if applicable) any interest thereon whether or not credited in reduction or discharge of your outstanding

liabilities pursuant to this Agreement and for that purpose Renaissance may realize any such property without prior notice to

you and generally exercise any remedies of a secured creditor. You will only obtain a beneficial interest in the Investments

that you purchase when you have paid the purchase price.

11.6 Except for the Security, you will not create or have outstanding any other security interest whatsoever on or over the

Investments, cash or other things which are subject to the Security.

11.7 Subject to the terms of this Agreement, the Customer may, at any time, by giving written instructions, request redelivery to it

of any its funds or Assets. In such event Renaissance shall redeliver to the Customer (or shall procure such redelivery) of the

funds, and Assets so requested (or pursuant to Clause 12.2 below, any corresponding Equivalent Securities), within ten

Business Days of receipt of such instructions, subject to Renaissance agreeing, in its absolute discretion, to release such funds

or Assets from the Security and having the right to retain sufficient funds to comply with prior commitments in respect of any

instructions and/or to apply such funds (by debiting your client account with Renaissance) towards the satisfaction of any

costs and expenses reasonably incurred by Renaissance in arranging such withdrawal of funds held by Renaissance on your

10

behalf and always provided that any obligation Renaissance may have to redeliver any funds or Asset (or procure such

redelivery) shall be conditional upon Renaissance being fully satisfied that all of your obligations under this Agreement or any

ISDA or transaction have been discharged in full. Redelivery shall be at the expense and risk of the Customer.

12. Right of use

12.1 In respect of Investments that are subject to the Security, you hereby authorise Renaissance from time to time to sell,

borrow, lend or otherwise transfer or use for its own purposes and account such Investments either for itself, or as a broker

for another person (including without limitation any Associated Firms) as if it were the owner thereof without giving any

further notice of such use to you. Such Investments shall then become legally and beneficially the property of Renaissance or

its transferee, subject to an obligation to transfer Investments of an identical type, nominal value, description and amount in

relation thereto to the Customer. For the purposes of this Clause:

(a) Renaissance may, without notice to the Customer, re-transfer any such Investments (or Equivalent Securities) so used by

delivering such Investments or Equivalent Securities into an account where upon any such Investments will become

Investments held pursuant to these terms, including without limitation the Security; and

(b) Renaissance may retain for its own account all fees, profits, and other benefits received in connection with any such

borrowing, loan, transfer or use.

12.2 We may deliver Equivalent Securities, by causing such Equivalent Securities to be transferred, appropriated or designated to

your account(s) in which the relevant Investments were held or, if not possible, to such other of your accounts as we

determine, and following delivery they will again become subject to the provisions of this Agreement.

13. Power of set off, to sell or close out

13.1 If you (or any of your Associates) fail to pay any sums, amounts, securities or other obligation whatsoever in respect of any

transaction due under this Agreement or any agreement between you and an Associated Firm, Renaissance may close out

any positions which you may have without prior reference to you and apply any proceeds thereof to payment of any amounts

due to Renaissance or the Associated Firm and for these purposes Renaissance may exercise all the rights of a secured

creditor without prior notice to you and free of any interest you may have in the margin or the collateral, including by

registering, selling, realizing or otherwise dealing with any Securities upon such terms as it may in its absolute discretion think

fit (without being responsible for any loss or diminution in price) and for the purposes of carrying out the activities set out

above, you appoint Renaissance as your attorney to execute any transfer on your behalf.

13.2 Renaissance reserves the right to retain, or make deductions from, any amounts which Renaissance owes to, or is holding for

you, if any amounts are due from you to Renaissance or any of its Associated Firms. You authorize Renaissance, at

Renaissance's discretion, at any time and without notice or liability to you, to sell, apply, set-off and/or charge in any manner

any or all of your property and/or the proceeds of any of the same of which Renaissance or any of its Associated Firms or

agents has custody or control, in order to discharge all or any of your obligations to Renaissance or to its Associated Firms.

13.3 Renaissance may (without prejudice to any other rights which Renaissance may have under this Agreement or under Cyprus

law or otherwise) take certain actions stated herein:

(a) if you fail to make any payment, fail to do any other act or thing required by, or commit any other material breach of this

Agreement;

(b) if you fail to remit funds necessary to enable Renaissance to take delivery under any contract on the first due date;

(c) if you fail to provide assets for delivery, or take delivery of assets, under any contract on the first due date;

(d) if an application is made in your respect for an interim order pursuant to any applicable insolvency act or a receiver, trustee,

administrative receiver or similar officer is appointed;

(e) if you become, or appear to be, unable to pay your debts as they fall due or to fulfill any obligation for the repayment of

borrowed monies or convene a meeting of your creditors or propose or make any composition or arrangement with or any

assignment for the benefit of any of your creditors or an order or petition is presented for your winding up or liquidation or

proceedings are commenced in respect of your insolvency, bankruptcy or similar matters (including the appointment of a

receiver or administrator) other than for the purposes of amalgamation or reconstruction with the prior written approval of

Renaissance;

(f) if any distress, execution or other process is levied against any of your property and is not removed, discharged or paid within

seven days;

(g) if any security created by any mortgage or charge becomes enforceable against you and the mortgagee or chargee takes

steps to enforce the security or charge;

(h) if any of your indebtedness or that of any of your subsidiaries becomes immediately due and payable, or capable of being

declared so due and payable, prior to its stated maturity by reason of your default (or that of any of your subsidiaries) or you

(or any of your subsidiaries) fail to discharge any indebtedness on its due date;

11

(i) if any of the representations or warranties given by you are, or become, untrue;

(j) if Renaissance or you are requested to close out a contract (or any part of a contract) by any regulatory agency or authority;

(k) if Renaissance reasonably considers it necessary for its own protection or the protection of its Associated Firms including, but

not limited to suffering a material adverse change in your financial condition;

(l) if fulfillment of any of your obligations becomes contrary to the Rules or laws of the country in which such obligations must

be performed; and

(m) if you or any of your Associates fail to meet any monetary or non-monetary obligations or default under an ISDA, GMRA or

any other agreement which you or any of your Associates may have with Renaissance or any other Associated Firm.

13.4 Upon the occurrence of any of the events described in Clause 13.3, Renaissance shall have the right, but not the obligation,

acting in its sole and absolute discretion:

(a) to sell or charge in any way any or all of your Assets and property which may from time to time be in the possession or

control of Renaissance or any of Renaissance's Associated Firms or agents or call on any guarantee;

(b) to buy any Investment where this is, or is in the reasonable opinion of Renaissance likely to be, necessary in order for

Renaissance to fulfill its obligations under any contract. You shall reimburse Renaissance immediately for the full amount of

the purchase price plus any associated costs and expenses;

(c) to deliver any investment to any third party, or otherwise take any action Renaissance considers to be desirable in order to

close out any contract;

(d) to require you to immediately close out and settle a contract in such manner as Renaissance may in its absolute discretion

request;

(e) to enter into any foreign exchange transaction, at such rates and times as Renaissance may determine, in order to meet

obligations incurred under a contract;

(f) to invoice back all or part of any Assets standing to the debit or credit of any account (this involves commuting Renaissance's

or your obligation to deliver an asset into an obligation to pay an amount equal to the market value of the asset (determined

by Renaissance in its absolute discretion on the date invoicing back takes place); and/or

(g) to treat any outstanding contracts as cancelled and terminated.

13.5 If Renaissance elects to close-out any open contract pursuant to this Clause, then without prejudice to amounts which have

become due and payable there under, all other open obligations shall be accelerated and immediately due and payable, and

each such contract shall be discharged by the calculation of the market value of such contract as estimated or determined by

Renaissance in good faith.

13.6 The market values for all accelerated contracts and any amounts due and payable but unpaid in respect of such contract shall

be aggregated and netted against each other, so that a single liquidated amount is immediately due and payable by one party

to the other, subject to our rights to apply any cash margin or other collateral (including the liquidated value of non-cash

collateral) held by Renaissance by way of set-off. Interest will be payable on all outstanding sums due to Renaissance.

13.7 You authorize Renaissance to take any or all of the steps described in this clause without notice to you and acknowledge that

Renaissance shall not be responsible for any consequences of it taking any such steps. The rights described in this clause are

in addition to any other rights which Renaissance or any of its Associated Firms may have against you. You shall execute such

documents and take such other action as Renaissance may request in order to protect the rights of Renaissance and its

Associated Firms under this Agreement and/or under any other relevant agreement you may have with any of them.

13.8 If Renaissance exercises its rights to sell any of your Assets under this clause, it will affect such sale, without notice or liability

to you, on your behalf and apply the proceeds of sale in or towards discharge of any or all of your obligations to Renaissance

or to its Associated Firms and shall be under no obligation to obtain the best value on the market.

13.9 Without prejudice to Renaissance's other rights, Renaissance may, at any time and without notice, combine or consolidate all

or any of your accounts with Renaissance or any of its Associated Firms and off-set any and all amounts owed to, or by,

Renaissance or any of its affiliates in such manner as Renaissance may determine.

14. Conflicts of interest

14.1 In accordance with CySECs Rules and Renaissances Conflicts of Interest Policy, we have in place arrangements to manage

conflicts of interest that arise between ourselves and our clients and between our different clients. Renaissance or other

persons connected with Renaissance including Associated Firms may have an interest, relationship or arrangement that is

material in relation to any transaction effected under this Agreement. Such interests, relationships or arrangements will not

necessarily be separately disclosed to you at or prior to the time of the transaction If however, we do not consider that the

arrangements under our Conflicts of Interest Policy are sufficient to manage a particular conflict, we will inform you of the

nature of the conflict so that you can decide how to proceed. A copy of Renaissances Conflicts of Interest Policy, which

12

forms part of this Agreement and is deemed to be incorporated by reference into this clause, is available at

http://www.renaissancegroup.com/InvestmentBanking/About/LegalInformation/RSLtd/.

15. Disclosures in our research

15.1 Renaissance disseminates research that has been prepared by it and / or other Associated Firms. Our research contains a

number of regulatory disclosures designed to meet CySEC requirements, including also the requirements of the Law on

Insider Dealing and Market Manipulation Law of 2005 of the Republic of Cyprus.

15.2 Unless agreed in writing, we will not provide you with specific investment advice or manage (either on a discretionary or an

advisory basis) your investment portfolio.

16. Security and set off

16.1 This Clause shall apply subject to any other charge or security documentation agreed between Renaissance applying to the

Assets in question. Renaissance may apply any property which is subject to the above security interest together with (if

applicable) any interest thereon whether or not credited in reduction or discharge of your outstanding liabilities pursuant to

this Agreement and for that purpose Renaissance may realize any such property without prior notice to you and generally

exercise any remedies of a secured creditor.

16.2 Renaissance or any Associate of Renaissance may (but is not obliged to), without prior notice to you, set-off any obligation

owing by you or any of your Associates to Renaissance or an Associate of Renaissance (whether or not arising under this

Agreement and/or any ISDA and/or a GMRA, matured or contingent, monetary or non-monetary and irrespective of the

currency, place of payment or place of booking of the obligation) against any obligation owing by Renaissance or any

Associate of Renaissance to you or an Associate of yours (whether or not arising under this Agreement and/or any ISDA,

whether matured or contingent, monetary or non-monetary and irrespective of the currency, place of payment or place of

booking of the obligation), so that only the net amount (the "Net Amount") shall be payable by the relevant party (for the

avoidance of doubt, if the aggregate amount owed by you which is the subject of this set off is greater than the aggregate

amount owed by Renaissance which is the subject of this set off, the Net Amount will be payable by you to Renaissance; if the

aggregate amount owed by Renaissance which is the subject of this set off is greater than the aggregate amount owed by you

which is the subject of this set off, the Net Amount will be payable by Renaissance; if such amounts are equal, the Net

Amount will be equal to zero).

If an obligation is unascertained or unliquidated, Renaissance may in good faith estimate the obligation and set off in respect

of the estimate, subject to the relevant party accounting to the other when the obligation is ascertained or liquidated. For

the avoidance of doubt, Renaissance or any Associate of Renaissance may set off in respect of an obligation owing by you or

any of your Associates even when that obligation is disputed by you or one of your Associates and has not yet been finally

established by settlement or adjudication. If the obligations are in different currencies, Renaissance may convert the

obligations at the Spot Rate determined by Renaissance in its reasonable discretion for the purposes of set-off.

16.3 You will indemnify Renaissance for any loss, damage, costs, claims and demands arising as a result of the operation of this

set-off. The rights conferred on Renaissance are continuing and outstanding liabilities are not to be considered satisfied by

any partial repayment.

17. Limitation of liability

17.1 If, in providing the Services to you under this Agreement, you suffer or incur loss, damage or liability as a result of our bad

faith or fraud, or that of our employees, officers or directors, then we will be liable to you for that loss, damage or liability.

However, we will not be liable for loss, damage or liability resulting from any other cause.

17.2 In no circumstances will we, or our employees, officers or directors be liable, whether in contract, tort (including negligence)

or otherwise, for any consequential, indirect or incidental losses, or special or punitive damages, however they arise, even if

advised of the possibility of such damages or losses.

17.3 We accept no responsibility or liability for any breaches you may incur with respect to any investment restrictions to which

you or your principal are subject, regardless of whether you have provided Renaissance with prior notice of such investment

restrictions.

17.4 We will not be liable to you for the solvency of, or loss caused by the actions or omissions by a third party including any

nominee, custodian, issuer, bank or other third party appointed by Renaissance in good faith on your behalf, unless such third

party is an Associated Firm (in which case we will only be liable to you where your loss results from our Associated Firms bad

faith or fraudulent activity). Upon your reasonable request we may, at our sole discretion, make available to you any rights

we may have against any third party that is not an Associated Firm. In case of insolvency of the third party and depending on

the laws of the jurisdiction of such third party, there is a risk that the relevant assets may be lost.

13

17.5 If a claim is made by or against Renaissance, our employees, officers or directors against or by any third party in connection

with this Agreement or the services provided under them, you will provide Renaissance or our employees, officers or

directors with such assistance as may reasonably be requested.

17.6 We may introduce you to an Associated Firm outside Cyprus. If such Associated Firm enters into transactions with or for you:

(a) you will have a direct relationship with the Associated Firm in relation to the services provided by that Associated Firm. If you

have a dispute with, or claim against, the Associated Firm that dispute or claim will be directly with the Associated Firm and

we will not have any responsibility or liability in relation to the dispute or claim; and

(b) we will be acting only as the agent of the Associated Firm, and not as your agent, in relation to transactions that you place

with Renaissance which are to be executed by such an Associated Firm.

17.7 Where you are entering into this Agreement with another person your liability and obligations under the Customer Document

Pack will be joint and several with that other person.

18. Indemnity

18.1 You will indemnify, and keep indemnified, Renaissance and any of its employees, officers and directors (each, for the

purposes of this Clause an Indemnified Person) against all present, future, contingent or other costs, expenses (including

reasonable legal expenses), damages, liabilities and losses which such Indemnified Person may suffer or incur in connection

with or arising out of this Agreement and any transaction effected on your instructions. You will not be required to indemnify

any Indemnified Person to the extent that any such costs, expenses, damages, liabilities and losses result directly from the

willful default or fraudulent actions of the Indemnified Person.

18.2 This indemnity shall survive termination of this Agreement or any other terms agreed between you and Renaissance.

18.3 Neither party shall be liable to the other:

(a) for any indirect or consequential loss suffered by the other party; or

(b) to the extent any loss exceeds the Payment Amount;

unless such loss is caused by a breach or delay in performance by one party of its obligations under the relevant agreement,

and such party has received notice in writing at any time before the breach or delay that such breach or delay could cause

such a loss to the other party, in which case, the breaching party shall be liable to the other party for such loss.

19. Specific performance and non-performance

19.1 Nothing contained in this Clause shall relieve the breaching party of the specific performance of its obligation, unless the

other party serves notice thereon of the termination of this Agreement pursuant to Clause 28.

19.2 A failure by either party to perform or delay in performing any of its obligations under this Agreement will be excused if

prevented by events beyond that partys control and affecting persons buying and selling the Securities generally. Such

events shall include, but not be limited to, any law, order, regulation or threat of any governmental or other authority

prohibiting activities which are the subject of this Agreement or which prevent completion of the transaction. They also

include failure of any relevant correspondent or other agent of Renaissance, sub-custodian, dealer, exchange, clearing house

or regulatory or self-regulatory organization for any reason to perform its obligations. The affected party shall use its best

efforts to limit, as far as possible, any negative consequences of the aforesaid events. If either party becomes aware of an

event as set out in this clause having taken place, it shall, on becoming so aware, notify the other party of the event.

20. Instructions, representations, warranties and undertakings

20.1 Renaissance shall not be bound to act in accordance with the instructions of any person other than the Customer (as

specified in the Customers Account Opening Form as amended from time to time) and the liabilities of Renaissance here

under shall be fully discharged by performing the same for the Customer, notwithstanding (a) any instructions that

Renaissance may receive from any principal, or (b) any notice that Renaissance may receive that the authority of the

Customer to act on behalf of its principal has been revoked or varied or is otherwise invalid and references to Customer in

this Agreement shall be construed accordingly.

20.2 You represent, warrant and undertake that:

(a) you have full power, authority and capacity to enter into and perform your obligations pursuant to this Agreement, to

instruct Renaissance in relation to any transaction(s) and to grant Renaissance the authorities contained in or given pursuant

to this Agreement and that your entering into this Agreement and any instructions you give to Renaissance will comply with

applicable Rules and will be legally binding upon you;

14

(b) except where you are the trustee of a trust, you are, or where you are acting as agent your principal is, the beneficial owner

of all Investments which are held pursuant to this Agreement free from all liens, charges and encumbrances other than those

that may arise in our favor;

(c) you have, and where you are acting as agent your principal has, all necessary consents, licenses, governmental and regulatory

approvals and authorizations to enable you, and where you are acting as agent your principal, to enter into, perform and

comply with your, and where you are acting as agent your principals, obligations under this Agreement and any transaction

and you will provide Renaissance with copies or other evidence of such consents, licenses, approvals and authorizations as

we may reasonably require;

(d) in accepting this Agreement, we have not made, and you are not relying upon any statements, representations, promises or

undertakings made by Renaissance, that are not contained in this Agreement nor have we approached you via cold calling or

you are relying on any information received through such process; and

(e) you are not and will not be at any time when you buy or sell any security, or offer to do so, an affiliate of the issuer (including,

in the case of convertible or exchangeable Securities, the issuer of the underlying security) unless you inform Renaissance

otherwise in writing prior to giving Renaissance an instruction to buy or sell any security, or offer to do so.

(f) where you are acting as agent:

(i) you are expressly authorized by your principal to enter into this Agreement, instruct Renaissance in relation to

transaction(s) entered into, under or in connection with this Agreement and to confer on Renaissance the authorities

contained in or given by this Agreement; and

(ii) you are expressly authorized by your principal to grant the Security.

(g) where you are acting as trustee:

(i) you are absolutely entitled to pass full legal and beneficial ownership of any Investments transferred pursuant to this

Agreement or any transaction entered into, under or in connection with this Agreement; and

(ii) you are not in breach of trust in entering into this Agreement and each transaction entered into under or in connection

with this Agreement and you have the right to be indemnified out of the Assets of the trust for all obligations under this

Agreement and each transaction; and

(iii) where you are a Professional Client, that we have made available to you in a durable medium or in paper form, in

reasonable time before entering into this Agreement (this being no less than 3 Business Days), information relevant to

this Agreement, including our safe custody procedures for your Investments and Cash; and

(iv) you understand and accept that our services to you may be provided by a natural or legal person who is acting as our

Tied Agent. The list of our current Tied Agents, specifying the member state in which they are registered, is available on

our corporate website. You agree that we are under no obligation to otherwise specifically notify you that such persons

act as our Tied Agents;.

(h) where you are dealing or trading in RENAISSANCE Securities, you have taken all possible measures and steps so as to ensure

that such securities have been properly registered with the Securities and Exchange Commission of the United States of

America. You hereby confirm that when dealing in such Securities you wish to be treated as a Professional Client for these

transactions regardless of whether you have been classified otherwise and that you have studied our Schedules and the other

information available to you on our website and understand the loss of protections when dealing as Professional Client.

20.3 We represent and warrant that we have full power, authority and capacity to enter into and perform our obligations pursuant

to this Agreement and that the will be legally binding upon Renaissance and that we have all necessary consents, licenses,

governmental and regulatory approvals and authorizations to enable Renaissance to enter into, perform and comply with our

obligations under this Agreement and any transaction.

20.4 The representations, warranties and undertakings contained in this Clause will be deemed to be repeated each time you give

Renaissance an order or instruction under this Agreement. Renaissance shall assume that no changes have taken place with

respect to your account details provided to Renaissance in the Account Opening Pack at the commencement of your account

with Renaissance unless Renaissance receives written advice from you of such changes.

21. Money laundering, terrorist financing and financial sanctions

21.1 All transactions between you and Renaissance will be subject to the applicable legal requirements under the Money

Laundering and Terrorist Financing legislation and regulations of the Republic of Cyprus and any other jurisdiction applicable

15

to Renaissance, including those issued by CySEC. This legislations and regulations set out various arrangements and provisions

that regulated investment firms are required to have in place and follow in order to counter the risk of financial crime. It is a

criminal offense in Cyprus to make payments or allow payments to be made, to targets on the Financial Sanctions List as may

be issued by one or more of the Central Bank of Cyprus, CySEC or the Cyprus police authorities.

22. Taxes

22.1 All sums payable by you under this Agreement will be paid free and clear of any Taxes, unless you are required by law to

withhold or deduct Tax. In this case, unless we agree otherwise, you will pay an additional amount so that we receive an