Professional Documents

Culture Documents

Explanation of Section 83

Explanation of Section 83

Uploaded by

ArgusJHultCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Explanation of Section 83

Explanation of Section 83

Uploaded by

ArgusJHultCopyright:

Available Formats

26 USC Chapter 1, Subchapter B - Computation

of Taxable Income

26 USC Part II - ITEMS SPECIFICALLY

INCLUDED IN GROSS INCOME

26 USC 83 - Property transferred in connection

with performance of services

(a) General rule

If, in connection with the performance of services, property is transferred to any

person other than the person for whom such services are performed, the excess of

(1) the fair market value of such property (determined without regard to any restriction

other than a restriction which by its terms will never lapse) at the first time the rights of

the person having the beneficial interest in such property are transferable or are not

subject to a substantial risk of forfeiture, whichever occurs earlier, over

(2) the amount (if any) paid for such property, shall be included in the gross income

of the person who performed such services in the first taxable year in which the

rights of the person having the beneficial interest in such property are transferable

or are not subject to a substantial risk of forfeiture, whichever is applicable. The

preceding sentence shall not apply if such person sells or otherwise disposes of such

property in an arms length transaction before his rights in such property become

transferable or not subject to a substantial risk of forfeiture.

(b) Election to include in gross income in year of transfer

(1) In general

Any person who performs services in connection with which property is transferred to

any person may elect to include in his gross income for the taxable year in which such

property is transferred, the excess of

(A) the fair market value of such property at the time of transfer (determined without

regard to any restriction other than a restriction which by its terms will never lapse), over

(B) the amount (if any) paid for such property.

If such election is made, subsection (a) shall not apply with respect to the transfer of such

property, and if such property is subsequently forfeited, no deduction shall be allowed in

respect of such forfeiture.

(2) Election

An election under paragraph (1) with respect to any transfer of property shall be made in

such manner as the Secretary prescribes and shall be made not later than 30 days after the

date of such transfer. Such election may not be revoked except with the consent of the

Secretary.

(c) Special rules

For purposes of this section

(1) Substantial risk of forfeiture

The rights of a person in property are subject to a substantial risk of forfeiture if such

persons rights to full enjoyment of such property are conditioned upon the future

performance of substantial services by any individual.

(2) Transferability of property

The rights of a person in property are transferable only if the rights in such property of

any transferee are not subject to a substantial risk of forfeiture.

(3) Sales which may give rise to suit under section 16(b) of the Securities Exchange

Act of 1934

So long as the sale of property at a profit could subject a person to suit under section

16(b) of the Securities Exchange Act of 1934, such persons rights in such property are

(A) subject to a substantial risk of forfeiture, and

(B) not transferable.

(4) For purposes of determining an individuals basis in property transferred in

connection with the performance of services, rules similar to the rules of section 72 (w)

shall apply.

(d) Certain restrictions which will never lapse

(1) Valuation

In the case of property subject to a restriction which by its terms will never lapse, and

which allows the transferee to sell such property only at a price determined under a

formula, the price so determined shall be deemed to be the fair market value of the

property unless established to the contrary by the Secretary, and the burden of proof shall

be on the Secretary with respect to such value.

(2) Cancellation

If, in the case of property subject to a restriction which by its terms will never lapse, the

restriction is canceled, then, unless the taxpayer establishes

(A) that such cancellation was not compensatory, and

(B) that the person, if any, who would be allowed a deduction if the cancellation were

treated as compensatory, will treat the transaction as not compensatory, as evidenced in

such manner as the Secretary shall prescribe by regulations,

the excess of the fair market value of the property (computed without regard to the

restrictions) at the time of cancellation over the sum of

(C) the fair market value of such property (computed by taking the restriction into

account) immediately before the cancellation, and

(D) the amount, if any, paid for the cancellation,

shall be treated as compensation for the taxable year in which such cancellation occurs.

(e) Applicability of section

This section shall not apply to

(1) a transaction to which section 421 applies,

(2) a transfer to or from a trust described in section 401 (a) or a transfer under an annuity

plan which meets the requirements of section 404 (a)(2),

(3) the transfer of an option without a readily ascertainable fair market value,

(4) the transfer of property pursuant to the exercise of an option with a readily

ascertainable fair market value at the date of grant, or

(5) group-term life insurance to which section 79 applies.

(f) Holding period

In determining the period for which the taxpayer has held property to which subsection

(a) applies, there shall be included only the period beginning at the first time his rights in

such property are transferable or are not subject to a substantial risk of forfeiture,

whichever occurs earlier.

(g) Certain exchanges

If property to which subsection (a) applies is exchanged for property subject to

restrictions and conditions substantially similar to those to which the property given in

such exchange was subject, and if section 354, 355, 356, or 1036 (or so much of section

1031 as relates to section 1036) applied to such exchange, or if such exchange was

pursuant to the exercise of a conversion privilege

(1) such exchange shall be disregarded for purposes of subsection (a), and

(2) the property received shall be treated as property to which subsection (a) applies.

(h) Deduction by employer

In the case of a transfer of property to which this section applies or a cancellation of a

restriction described in subsection (d), there shall be allowed as a deduction under section

162, to the person for whom were performed the services in connection with which such

property was transferred, an amount equal to the amount included under subsection (a),

(b), or (d)(2) in the gross income of the person who performed such services. Such

deduction shall be allowed for the taxable year of such person in which or with which

ends the taxable year in which such amount is included in the gross income of the person

who performed such services.

Explanation of Section 83

Why is it necessary to calculate Gross Income? Because you have to calculate

Gross Income before you can calculate Net Income and ultimately taxable Income

and come up with the tax liability supposed in the 1040 Form.

Understanding Section 83 is crucial because it describes what is considered

Gross Income whenever there is an exchange involved in any transaction.

When you work for somebody and you get paid, a key question is, IS THAT

AN EXCHANGE? Would you get paid if you did not work? NO! Would you work if

you did not get paid? NO! So, do you have any questions whether that is an exchange?

I HOPE NOT!

Section 83 says, that . . . the excess of-(1) the fair market value of such property

(labor) . . . over (2) the amount (if any) paid for such property (paycheck or agreed

payment), shall be included in the gross income of the person who performed such

services in the first taxable year in which the rights of the person having the beneficial

interest in such property are transferable (the person who provided the labor/time/

effort/skill as property that is permanently gone and cannot be regained or used

again) . . (Court have consistently stated that labor is a personal property)

THEREFORE: THE VERY FIRST NUMBER ON THE 1040 INCOME TAX RETURN

IS FALSE (DELIBERATELY MADE AND COVERED UP). IRS WILL NEVER

COMPLAIN IF AND WHEN YOU MAKE THAT BIG MISTAKE IN

CALCULATIONS. IF ALL THE MONEY YOU GOT PAID IS INCOME / GROSS

INCOME THAT IS TURNED INTO TAXABLE INCOME, THEN YOU HAVE TO

ADMIT THAT YOU WORKED FOR NOTHING AND EVERYTHING YOU GOT

PAID WAS A BONUS OR PAYMENT OVER AND ABOVE WHAT YOU FIRST

AGREED TO AS THE EXCHANGE IN YOUR EMPLOYMENT AGREEMENT.

WHAT IS DEFINED BY DEFINITION AS BENEFITS ARE SUPPOSED TO BE

THOSE WAGES, SALARIES, AND TIPS THAT YOU SO GRACIOUSLY

IDENTIFY ON THE VERY FIRST LINE OF THE 1040 FORM. THE IRS NEVER

WANTS YOU TO UNDERSTAND SECTION 83 AND APPLY IT TO YOUR

CALCULATION OF YOUR GROSS INCOME AND TO CALCULATE THAT

FAMOUS TAX, THAT DOES NOT EXIST IN LAW CALLED THE INCOME

TAX. THERE IS A TAX ON TAXABLE INCOME (yes!!), BUT NOT ON

INCOME (INCOMING MONEY FLOW).

KEY ELEMENTS OF UNDERSTANDING

INTERPRETATION PLUS THE RULES

Title 1, 103. Enacting or resolving words after first section

No enacting or resolving words shall be used in any section of an Act or

resolution of Congress except in the first.

104. Numbering of sections; single proposition

Each section shall be numbered, and shall contain, as nearly as may be, a

single proposition of enactment.

106b. Amendments to Constitution

Whenever official notice is received at the National Archives and Records

Administration that any amendment proposed to the Constitution of the

United States has been adopted, according to the provisions of the

Constitution, the Archivist of the United States shall forthwith cause the

amendment to be published, with his certificate, specifying the States by

which the same may have been adopted, and that the same has become

valid, to all intents and purposes, as a part of the Constitution of the

United States.

112. Statutes at Large; contents; admissibility in evidence

The United States Statutes at Large shall be legal evidence of laws,

concurrent resolutions, treaties, international agreements other than

treaties, proclamations by the President, and proposed or ratified

amendments to the Constitution of the United States therein contained,

in all the courts of the United States, the several States, and the

Territories and insular possessions of the United States. (Key: "Statutes

at Large" is the evidence, not printed code).

Title 2: Congress

Three definitions of State for different purposes:

Sec. 431 (Disclose Fed Campaign Funds)

(12) The term "State" means a State of the United States, the District of

Columbia, the Commonwealth of Puerto Rico, or a territory or possession of

the United States.

Sec. 658 (Part B Federal Mandates)

(12) State The term "State" has the same meaning as defined in section

6501(9) of title 31.

CHAPTER 65INTERGOVERNMENTAL COOPERATION ( 65016508)

31 U.S. Code 6501 - Definitions

In this chapter

(9) State means a State of the United States, the District of Columbia, a

territory or possession of the United States, and an agency,

instrumentality, or fiscal agent of a State but does not mean a local

government of a State.

Sec. 1602 (Chapter 26 - Lobbying)

(16) State The term "State" means each of the several States, the District of

Columbia, and any commonwealth, territory, or possession of the United

States.

TITLE 3 : The President (of the District of Columbia)

CHAPTER 1PRESIDENTIAL ELECTIONS AND VACANCIES

1. Time of appointing electors

The electors of President and Vice President shall be appointed, in each

State, on the Tuesday next after the first Monday in November, in every

fourth year succeeding every election of a President and Vice President.

(President of the District of Columbia)

6 Credentials of electors; transmission to Archivist of the United

States and to Congress; public inspection - It shall be the duty of the

executive of each State, as soon as practicable after the conclusion of the

appointment of the electors in such State by the final ascertainment, under and in

pursuance of the laws of such State providing for such ascertainment, to

communicate by registered mail under the seal of the State to the Archivist of the

United States a certificate of such ascertainment of the electors appointed, setting

forth the names of such electors and the canvass or other ascertainment under the

laws of such State of the number of votes given or cast for each person for whose

appointment any and all votes have been given or cast; and it shall also thereupon

be the duty of the executive of each State to deliver to the electors of such State, on

or before the day on which they are required by section 7 of this title to meet, six

duplicate-originals of the same certificate under the seal of the State; and if there shall

have been any final determination in a State in the manner provided for by law of a

controversy or contest concerning the appointment of all or any of the electors of such

State, it shall be the duty of the executive of such State, as soon as practicable after such

determination, to communicate under the seal of the State to the Archivist of the United

States a certificate of such determination in form and manner as the same shall have been

made; and the certificate or certificates so received by the Archivist of the United States

shall be preserved by him for one year and shall be a part of the public records of his

office and shall be open to public inspection; and the Archivist of the United States at the

first meeting of Congress thereafter shall transmit to the two Houses of Congress copies

in full of each and every such certificate so received at the National Archives and

Records Administration.

21. Definitions

As used in this chapter the term

(a) State includes the District of Columbia.

(b) executives of each State includes the Board of Commissioners of the

District of Columbia.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Paper From Advance America Cash AdvanceDocument6 pagesPaper From Advance America Cash AdvanceJoyNo ratings yet

- SCRule13 16Document4 pagesSCRule13 16ArgusJHultNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Walt Disney Company and Pixar Inc - Team3Document15 pagesThe Walt Disney Company and Pixar Inc - Team3Akshaya LakshminarasimhanNo ratings yet

- BlockchainDecryptedFor2018 PDFDocument46 pagesBlockchainDecryptedFor2018 PDFPunjena Paprika100% (1)

- ETP Internal Memo 9 13 16 Final To EmployeesDocument3 pagesETP Internal Memo 9 13 16 Final To EmployeesArgusJHultNo ratings yet

- Osmosis Petition 4B2E5A4B0647DDocument35 pagesOsmosis Petition 4B2E5A4B0647DArgusJHultNo ratings yet

- EEOC V M.G. OilDocument10 pagesEEOC V M.G. OilArgusJHultNo ratings yet

- Construction SignDocument1 pageConstruction SignArgusJHultNo ratings yet

- Delivered Via U.S. Postal Mail and E-MailDocument2 pagesDelivered Via U.S. Postal Mail and E-MailArgusJHultNo ratings yet

- 8 5 16WNVDocument1 page8 5 16WNVArgusJHultNo ratings yet

- Letter To President Requesting A Major Disaster Declaration For Individual AssistanceDocument13 pagesLetter To President Requesting A Major Disaster Declaration For Individual AssistanceArgusJHultNo ratings yet

- Christensen DecisionDocument100 pagesChristensen DecisionArgusJHultNo ratings yet

- Sadie Redbear Court DocsDocument8 pagesSadie Redbear Court DocsArgusJHultNo ratings yet

- South Dakota Lemon LawDocument4 pagesSouth Dakota Lemon LawArgusJHultNo ratings yet

- Landlord Tenant RightsDocument2 pagesLandlord Tenant RightsArgusJHultNo ratings yet

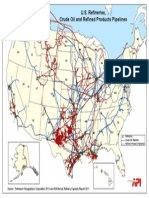

- Major Gas & Oil Lines: CrooksDocument1 pageMajor Gas & Oil Lines: CrooksArgusJHultNo ratings yet

- Stats 2014Document2 pagesStats 2014ArgusJHultNo ratings yet

- Kruthoff Transfer DecisionDocument9 pagesKruthoff Transfer DecisionArgusJHultNo ratings yet

- Liquid Petroleum Products Map - Ashx 1Document1 pageLiquid Petroleum Products Map - Ashx 1ArgusJHultNo ratings yet

- Kuyper Final Short Petition For Writ of Certiorari3-2Document56 pagesKuyper Final Short Petition For Writ of Certiorari3-2ArgusJHultNo ratings yet

- Dakota Access Pipeline PresentationDocument18 pagesDakota Access Pipeline PresentationArgusJHultNo ratings yet

- Turner County LawsuitDocument15 pagesTurner County LawsuitArgusJHultNo ratings yet

- Information Sheet: Seychelles Companies (Ibcs)Document2 pagesInformation Sheet: Seychelles Companies (Ibcs)kalinovskayaNo ratings yet

- CHARTDocument1 pageCHARTAyreesh Mey SpntNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Audit Final ExamDocument9 pagesAudit Final ExamNurfairuz Diyanah RahzaliNo ratings yet

- This Time: Q & A Woods SquareDocument19 pagesThis Time: Q & A Woods SquareChen YishengNo ratings yet

- Korea Shooting Guide-EnglishDocument54 pagesKorea Shooting Guide-EnglishFabiana Fabian100% (1)

- Marriage in Iowa Law - Complete ResultsDocument109 pagesMarriage in Iowa Law - Complete ResultsDavid ShaferNo ratings yet

- Notes On Non-Profit OrganizationsDocument6 pagesNotes On Non-Profit OrganizationsJonathanTipayNo ratings yet

- Icici Bank CBRDocument49 pagesIcici Bank CBRHarshad Sutar100% (1)

- Business Combination PDFDocument39 pagesBusiness Combination PDFEmmanuelNo ratings yet

- 10 Manufacturers Hanover Trust Vs GuerreroDocument157 pages10 Manufacturers Hanover Trust Vs GuerreroChara GalaNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Auditor CV TemplateDocument2 pagesAuditor CV TemplateDaniel B Boy Nkrumah100% (2)

- Application To Do Business Under The FIA F 100Document2 pagesApplication To Do Business Under The FIA F 100Jameson UyNo ratings yet

- Marketing FunctionsDocument15 pagesMarketing FunctionsKrishna ReddyNo ratings yet

- Chapter 1 BAC 100 PDFDocument32 pagesChapter 1 BAC 100 PDFacademianotes75% (4)

- PDFDocument69 pagesPDFPurushothaman KesavanNo ratings yet

- Invoice 2260, 2261, 2262Document4 pagesInvoice 2260, 2261, 2262miroljubNo ratings yet

- Solution Manual FIM 7sem TU-1Document32 pagesSolution Manual FIM 7sem TU-1rabin neupaneNo ratings yet

- Homeless Emergency Solutions Grant ApplicationDocument17 pagesHomeless Emergency Solutions Grant ApplicationBridgeportCTNo ratings yet

- L1 Quant 2014Document28 pagesL1 Quant 2014Thành TrươngNo ratings yet

- Possible Mid-Term QuestionsDocument10 pagesPossible Mid-Term QuestionsZobia JavaidNo ratings yet

- Chapter 4 Lecture NotesDocument30 pagesChapter 4 Lecture NotesStacy SMNo ratings yet

- Part A: PersonalDocument2 pagesPart A: PersonalSudhakar JannaNo ratings yet

- Investors Perception Towards Stock MarketDocument2 pagesInvestors Perception Towards Stock MarketAkhil Anilkumar0% (1)

- Policies and ProceduresDocument33 pagesPolicies and ProceduresKylKleah BaracosoNo ratings yet

- GSTR3B 06aakfh0743f1zn 032023Document3 pagesGSTR3B 06aakfh0743f1zn 032023hecllp.ggnNo ratings yet