Professional Documents

Culture Documents

India - Psus: Modi Inc - All The King'S Jewels

India - Psus: Modi Inc - All The King'S Jewels

Uploaded by

Arunddhuti RayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India - Psus: Modi Inc - All The King'S Jewels

India - Psus: Modi Inc - All The King'S Jewels

Uploaded by

Arunddhuti RayCopyright:

Available Formats

I ndi a - PSUs

Prabodh Agrawal | prabodh@iiflcap.com

+91 22 4646 4697

|

|

DD MMM YYYY

Modi Inc All the Kings Jewels

09 June 2014

Printed report

summary

Institutional Equities

Our 288 page printed report on Indian PSUs

titled Modi I nc All the Kings J ewels will

shortly reach your desks. PSU reforms are

likely to be among the first tasks for the

newly installed Modi Government, given the

new Premiers stellar track record in his

home state of Gujarat. The knock-on effect

on the economy can be significant, since

many PSUs operate in segments of vital

national importance. Our top six picks, Coal

India, SBI, REC, Power Grid, BEL, and

ONGC, are expected to deliver 70-100%+ returns in our bull

case scenario, over the next three years.

A lost decade: Indian PSUs lost their sheen in the past decade,

buffeted by unfavourable government policies, slow decision-making

and a cyclical downturn. PSUs share of market cap in BSE100 has

shrunk from 32% in March 2005 to 20% currently. PSUs in Gujarat,

on the other hand, have a different story to tell, with several of them

outperforming even well-managed private companies.

Analysing 16 PSUs: We analyse 16 PSUs covered in this report on

five criteria: 1) Disruptive competition from private companies, 2)

Beneficiary of higher economic growth in India, 3) Beneficiary of PSU

reforms and conducive policies, 4) Strong balance sheets to leverage

growth opportunities, and 5) Attractiveness of valuations.

Key expectations on reforms: Faster environment clearances,

easier land acquisition laws, increased availability of coal and gas,

speedier power distribution reforms, augmenting of railway logistics

for mines, and reducing fuel subsidies these are the most

common reform expectations of the 16 PSUs.

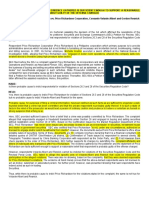

Figure1: PSUsversusSensexSignificantunderperformance

Source:IIFLResearch,Bloomberg

Figure2: ShareofPSUsandnonPSUsinBSE100smarketcapitalisation

Source:IIFLResearch,Bloomberg

0

50

100

150

200

250

300

350

400

450

J

a

n

0

4

J

u

l

0

4

J

a

n

0

5

J

u

l

0

5

J

a

n

0

6

J

u

l

0

6

J

a

n

0

7

J

u

l

0

7

J

a

n

0

8

J

u

l

0

8

J

a

n

0

9

J

u

l

0

9

J

a

n

1

0

J

u

l

1

0

J

a

n

1

1

J

u

l

1

1

J

a

n

1

2

J

u

l

1

2

J

a

n

1

3

J

u

l

1

3

J

a

n

1

4

PSUs Sensex Rebasedto100

10

20

30

40

50

60

70

80

90

Mar05 May06 Jul07 Aug08 Oct09 Dec10 Jan12 Mar13 May14

PSU NonPSU (%Sharein BSE100)

prabodh@i i fl cap.com

India - PSUs

2

Institutional Equities

A lost decade for PSUs

PSUs lost their sheen in the last decade

The lacklustre performance of PSUs was due to several factors: 1)

Adverse government policies such as heavy subsidy burden hurt

upstream and oil marketing companies (OMCs); 2) demand for

higher share of free electricity and levying of higher water charges

by state governments hurt NHPC; 3) government inaction such as

inordinate delays in environment clearances and railway logistics

constraints hampered mining operations and directly or indirectly

hurt BHEL, Coal India, NMDC, NTPC, REC, PFC and SBI; 4) lack of

progress on gas pooling hurt GAIL;

Figure3: GovernmentstakeinmajorPSUs

Mktcap GOIstake Freefloatmktcap

Company (US$m) (%) (US$m)

1 ONGC 54,742 68.9 17,003

2 CoalIndia 39,640 89.7 4,103

3 SBI 32,115 58.6 13,295

4 NTPC 22,393 75.0 5,598

5 IOC 14,794 68.6 4,650

6 NMDC 11,404 80.0 2,281

7 PowerGrid 10,800 57.9 4,547

8 BHEL 10,031 63.1 3,705

9 GAIL 8,109 56.1 3,559

10 PFC 6,521 72.8 1,774

11 BPCL 6,385 54.9 2,878

12 SAIL 6,115 80.0 1,223

13 REC 5,342 65.6 1,835

14 NHPC 4,646 86.0 652

15 HPCL 2,296 51.1 1,122

16 BharatElectronics 2,176 75.0 544

Total 237,507 68,769

Source:IIFLResearch,Bloomberg

5) bureaucratic delays hurt SAILs expansion plans; and 6) scam-

charged environment made bureaucrats cautious on defence orders,

hurting Bharat Electronics.

Net profit Cagr of 81 listed Central PSUs was 12.5% in the last

decade (FY03-FY13) versus 19.2% for BSE100 companies. Net profit

Cagr of 52 listed non-banking PSUs was 9.8% Cagr over the past 10

years and that of 29 listed banking PSUs was 18.0% Cagr.

.but not for PSUs in Gujarat

Gujarat State PSUs have performed exceptionally well

PSUs in Gujarat have performed markedly better than their Central-

level peers and even private companies. In this report, we provide

case studies on Gujarat State Electricity Board, Gujarat State

Fertilizers & Chemicals (GSFC), Gujarat State Petronet Ltd (GSPL)

and Gujarat Gas (GGAS).

Each of these companies has witnessed a remarkable turnaround in

the last decade. The state government provided complete autonomy

to the company managements, allowing them to take decisions

purely on business merit and without any political or social agenda.

Gujarat SEBs turnaround began in 2002 after Modi assumed power

as the states chief minister. Through focus on containing T&D

losses, and internal cost control alone, the Gujarat SEB achieved PBT

breakeven by 2005 within three years of rigorous efforts from the

state. Moreover, this was done without any increase in tariff.

Currently Gujarat SEB is the only one among large SEBs in the

country that is profitable.

GSFC is considered as one of Indias best-managed PSU fertiliser

companies. It is acknowledged even by private sector peers as a

shining example of the way a fertiliser company should be run. It

has consistently been profitable since FY04.

prabodh@i i fl cap.com

India - PSUs

3

Institutional Equities

GSPL is an efficient, fast growing and profitable PSU. It operates

around 2200kms of gas pipeline in Gujarat, the largest inter-state

gas pipeline network in India. During the past decade (FY03-FY14) it

delivered 35% net profit Cagr, average ROE of 14% and average

ROCE of 15%.

GGAS is a unique example in the history of corporate India where a

PSU took over a MNC enterprise and turned it even more profitable.

The takeover did not result in GGAS changing its focus from

maximizing shareholders returns to focussing on developmental or

social causes, as is the case with many PSUs.

Figure4: GujaratStatePSUs10yearPATCagr

Source:IIFLResearch,Prowess

Analysing the 16 PSUs

We analyse the 16 PSUs covered in this report on the following

criteria: 1) Disruptive competition from private companies, 2)

beneficiary of higher economic growth in India, 3) Beneficiary of PSU

reforms and right policy support, 4) Strong balance sheets to

leverage growth opportunities, and 5) Attractiveness of valuations.

1. Disruptive competition from private companies

Many of the 16 PSUs covered in this report are monopolies or are

among the largest players in their sector. Entry barriers are high

either due to regulations (Coal India, Bharat Electronics) or because

they are natural monopolies (Power Grid, GAIL). In other sectors,

although the private sector may be large and growing, both public

and private companies can co-exist profitably (NTPC, NHPC, NMDC,

ONGC, SBI, REC, and PFC) as growth opportunities are immense. Oil

Marketing Companies (IOC, HPCL, BPCL) have little competition but

have been burdened with sharing fuel subsidies and consequently

had to resort to large borrowings. Some PSUs have been hurt by

cyclical decline of their industry and competition from private

companies (BHEL, SAIL), but they remain inherently strong

companies and can bounce back.

Figure5: ManyPSUsaremarketleadersorareamongthelargestplayersintheirsector

Company Industry Shareof

domestic

production(%)

Competitors

BHEL Powerequipment 50

Imported(30%),L&T(10%),others

(10%)

CoalIndia Coal 80

SingareniCoal(9%),

Captive/importedcoal(11%)

SAIL Steel 16 JSWSteel(14%),TataSteel(11%)

NMDC IronOre 20 SesaGoa(610%)

NTPC Powergeneration 24 AdaniPower(5%),TataPower(5%)

NHPC

HydroPower

generation

18 Nosignificantpvtplayer

PowerGrid Powertransmission 51 Nosignificantpvtplayer

GAIL Gastransmission 85 GSPL(15%)

IOC

OilMarketing(share

ofconsumption)

53 Nosignificantprivateplayer

HPCL

OilMarketing(share

ofconsumption)

22 Nosignificantprivateplayer

33.1

28.1

26.0

21.9

12.5

0.0

5.0

10.0

15.0

20.0

25.0

30.0

35.0

GSFC GujAlkalies&

Chem

GujIndPower GujMinDev

Corp

GNFC

10yearPAT Cagr(%)

prabodh@i i fl cap.com

India - PSUs

4

Institutional Equities

Company Industry Shareof

domestic

production(%)

Competitors

BPCL

OilMarketing(share

ofconsumption)

25 Nosignificantprivateplayer

ONGC Upstreamoil 68 Cairn(16%),RIL(3%),OIL(10%)

Bharat

Electronics

DefenceElectronics 57

Foreignvendors(~40%),private

playerssuchasL&T,TataPower

SED(<5%)

REC Loanstopowersector 17 IDFC(3%),SBI(14%),PNB(4%)

PFC Loanstopowersector 21 IDFC(3%),SBI(14%),PNB(4%)

SBI

Banking(shareof

loans)

20

ICICI(4%),Axis(3%),HDFCBank

(4%)

Source:IIFLResearch

Basedon80BSE100Indexstocksthathavedatasince31Mar2005

2. Beneficiary of higher economic growth in India

The 16 PSUs operate in segments in which their growth is directly

linked to the well-being and growth of the Indian economy. Coal,

power, iron ore, steel, oil & gas, and banking and finance are core

industries in the economy. As we expect a pickup in economic

growth going forward, demand for products of companies in these

industries and pricing power are expected to improve. Banking and

finance companies SBI, REC, and PFC are expected to benefit from

reduced stress on their asset quality. The following table and charts

show the trend in growth of these industries vis--vis real GDP

growth. The growth for many of these industries has been

constrained due to lack of a supportive policy environment from the

government. As this improves, the correlation of their growth to GDP

growth is expected to improve.

Figure6: HistoricalgrowthofkeyindustriesandRealGDP

Period Avggrowth

(%)

AvgRealGDP

Growth(%)

Multiple

(x)

Coalconsumption FY08FY14 7.5 7.1 1.1

Powergeneration FY04FY14 6.1 7.6 0.8

Steelconsumption 20042013 8.7 7.9 1.1

Ironoreconsumption 20042013 5.6 7.9 0.7

CrudeOilconsumption FY06FY14 4.0 7.6 0.5

Gasconsumption FY06FY14 5.9 7.6 0.8

Bankloans FY04FY14 20.7 7.6 2.7

Source:IIFLResearch

3. Beneficiary of PSU reforms and right

policies/support

Most leading PSUs have recorded lacklustre performance due to lack

of conducive policies and support from GoI. Poor governance of the

central government has reflected in poor performance of these

PSUs. A combination of regulatory hurdles, slow progress on key

policy decisions, lack of strategic direction, frequent changes and

gaps in tenures of senior management, and government interference

are some of the key problems faced by PSUs. Poor management

exacerbated their woes during the cyclical downturn in the economy.

prabodh@i i fl cap.com

India - PSUs

5

Institutional Equities

Figure7: KeyconstraintsfacedbyPSUs\

Company Keyconstraintsfaced

1 BHEL Lackoffuelavailability(coal/gas)anddistributionsidereformsimpactingnew

capacityadditionsinpowergeneration,therebyslowingorderinflows,

competitionfromimportedequipment,bloatedemployeebase,andrigidsalary

structure

2 CoalIndia Lackofenvironmentalclearancesandpollutioncontrolnormshampering

productiongrowth,lackofraillogisticscapacityconstrainingevacuation

3 SAIL Delayinexpansionprojects

4 NMDC Evacuationconstraintspartlyduetoinadequaterailwaylogistics

5 NTPC Limitedavailabilityofdomesticfuel(coalandgas),delaysinlandacquisition,

disputewithCoalIndiaonqualityofcoalsupplied

6 NHPC Delaysinlandacquisitionandenvironmentalclearances,localagitation(lawand

orderproblem),unfavourablestategovernmentpolicies,geologicalrisks

7 PowerGrid Securingrightofways(ROW),delaysbycontractors,anddelaysinthe

commissioningofassociatedgenerationprojects

8 GAIL Gasavailability,lackofprogressongaspooling,subsidyburden

9 IOC Subsidyburden,delayinreimbursementofsubsidiesfromGoI,inadequate

returnsonupgradationcapex

10 HPCL Subsidyburden,delayinreimbursementofsubsidiesfromGoI,inadequate

returnsonupgradationcapex

11 BPCL Subsidyburden,delayinreimbursementofsubsidiesfromGoI,inadequate

returnsonupgradationcapex

12 ONGC Subsidyburden,increasedcessonproduction,lackofclarityongaspricing,lack

ofclarityonsubsidysharingasaresultofhighergasprice

Company Keyconstraintsfaced

13 Bharat

Electronics

DefencecapexslowingdowntosingledigitsasGoIfacesfiscalpressure,

delayinbulkproductionclearancesfromthearmedforces,scamcharged

environmentmakingbureaucratscautiousandimpedingdecisionmaking,

slowdownindefencespendingchangingthemixinfavouroflowmargincivilian

orders,structuralfactorssuchashigherproportionofturnkeyprojectsand

competitionfromprivatesector

14 REC PoorhealthofSEBsandgencos,delaysinprojectexecutionleadingtoneedfor

loanrestructuring

15 PFC PoorhealthofSEBsandgencos,delaysinprojectexecutionleadingtoneedfor

loanrestructuring

16 SBI Assetqualityheadwindsfrominfrastructureandcorporatebook,pressureon

operatingprofitabilityduetosharpriseincosts

Source:IIFLResearch

The above constraints have remained unaddressed and in many

cases have worsened over time, despite the fact that these

companies operate in segments that are of vital national importance.

Coal, iron ore, electricity, oil & gas and banking and financial

services are fundamental for economic development of any country.

Hence, it is imperative for the new government to promote these

industries. Decline or slowdown in production of coal, iron ore,

electricity and oil & gas, in the past few years has been steep. This is

unsustainable and has to be reversed on an urgent basis.

Lack of Management autonomy - A malaise common to PSUs

Lack of functional autonomy is a factor common to all PSUs. Tenures

of CMDs are short, often there are prolonged vacancies at the top or

a successor is appointed at the last moment, reflecting lack of

succession planning. This lack of continuity in top management

obstructs long-term planning and commitment. As the table below

shows, the 16 PSUs covered in this report have had an average of

3.9 CMDs in the past 10 years or an average tenure of 2.5 years.

prabodh@i i fl cap.com

India - PSUs

6

Institutional Equities

Figure8: ShorttenureofCMDsatleadingPSUs

CurrentCMD Term

began

Termends NoofCMDsin

thelast10yrs

1 BharatElectronicsSunilKumarSharma Jan2014 NA 5

2 BHEL BPrasadaRao Oct2009 Dec2015 3

3 BPCL SVaradarajan Oct2013 Sep2016 3

4 CoalIndia Vacant 5

5 GAIL BCTripathi Aug2009 Jul2019 2

6 HPCL NishiVasudeva Mar2014 Mar2016 3

7 IOC RSButola Jun2014 May2017 5

8 NHPC GSaiPrasad(Addlcharge) Jul2012 Jul2014 6

9 NMDC NarendraKothari Apr2014 Apr2019 4

10NTPC Dr.ArupRoyChoudhury Sep2010 Sep2015 4

11ONGC DKSarraf Mar2014 Sep2017 3

12PFC M.K.Goel Sep2013 Sep2016 3

13PowerGrid RNNayak Sep2011 Jun2015 3

14REC RajeevSharma Nov2011 Oct2016 6

15SAIL CSVerma Jun2010 Jun2015 3

16SBI ArundhatiBhattacharya Oct2013 Sep2015 4

Average 3.9

Source:IIFLResearch

4. Strong balance sheet to leverage growth

opportunities

Strong balance sheets would allow these companies to leverage

growth opportunities. If GoI moves towards making PSU

managements more independent, these PSUs would be in the

forefront for such reforms, since they can very well charter their own

course and fend for themselves. Strong balance sheets reflect the

financial prudence and avoidance of unnecessary risk taking by

these companies. The past few years have been replete with

examples of companies hurting themselves by over-leveraging or

taking out-sized bets in the foreign exchange market.

Figure9: Balancesheetstrengthandprofitabilityratios

Company FY14

Net

Debt/Equity

(x)

Freecash

flow/shareholders'

funds(%)

ROE

(%)

ROCE/ROA

(%)

1 BharatElectronics (0.6) (6.9) 13.9 17.1

2 BHEL (0.2) 7.1 10.2 14.5

3 BPCL 1.5 18.1 21.1 15.3

4 CoalIndia (1.4) 54.4 34.8 47.4

5 GAIL 0.4 10.7 15.7 14.9

6 HPCL 3.3 5.1 7.9 5.9

7 IOC 1.3 (0.8) 8.1 8.6

8 NHPC 0.5 (0.6) 6.5 7.4

9 NMDC (0.6) 3.1 22.3 33.8

10 NTPC 0.6 (6.0) 12.4 10.7

11 ONGC 0.2 (11.0) 16.3 17.0

12 PFC NA NA 21.1 3.0

13 PowerGrid 2.2 (36.8) 12.7 8.6

14 REC NA NA 24.6 3.3

15 SAIL 0.5 (6.6) 4.4 4.8

16 SBI NA NA 10.4 0.6

Source:IIFLResearch,Prowess,Bloomberg

prabodh@i i fl cap.com

India - PSUs

7

Institutional Equities

5. Attractiveness of valuations

Figure10: ValuationmatrixoftopSixPSUs

Companyname CMP

(Rs)

MktCap

(US$m)

EPSCagr(%)

(FY1416ii)

P/E(x)

(FY16ii)

P/B(x)

(FY16ii)

ROE(%)

(FY14)

NetD/E(x)

(FY14)

BasecaseTP(Rs)

1yr

BullcaseTP(Rs)

1yr 3yr

1 ONGC 378 54,742 15.5 9.2 1.5 16.3 0.2 480 520 649

2 CoalIndia 371 39,640 11.3 11.7 4.0 34.8 (1.4) 405 473 816

3 SBI 2,542 32,115 20.0 9.3 1.1 10.4 NA 3,050 3,687 5,486

4 PowerGrid 122 10,800 16.5 10.7 1.5 12.7 2.1 150 182 249

5 REC 320 5,342 23.8 4.4 1.0 24.6 NA 408 461 812

6 BharatElectronics 1,608 2,176 5.9 12.0 1.5 13.9 (0.6) 1,927 2,042 3,219

Source:IIFLResearch,Bloomberg;pricesasatcloseofbusiness30May2014

Potential for earnings upgrade and valuation re-rating

Our current earnings estimate and valuation multiple targets assume

some recovery in earnings growth trajectory and higher valuation

multiple for PSU stocks over the next two years. We also present a

bull case scenario detailing areas of potential earnings upgrade, in

case demand recovery is faster and stronger. This is likely to result

in valuation re-rating too for most stocks, underpinned by greater

visibility of economic reforms and their impact on the projected

earnings of PSUs. Based on this bull case scenario, we present one-

year and three-year price targets for our top six PSU picks. The one-

year and three-year bull case targets for all 16 PSUs can be found in

the printed report.

prabodh@i i fl cap.com

India - PSUs

8

Institutional Equities

Figure11: Oneyearandthreeyearbullcasepricetargets

Company Potentialforearningsupgrade

inFY15/FY16/FY17

Reasonsforpotentialearningsupgrade Potentialforvaluationrerating Bullcasetargetprice %upside

1year 3year 1year 3year

Bharat

Electronics

FlatinFY15,2%inFY16and6%in

FY17

RevenuegrowthinFY15/16/17canbe

15%/14%/14%vs.ourcurrentforecastof

15%/12%/12%.With3.8xbooktobillratio,

executionhasbeenthebottleneck.Withthenew

governmentfasttrackingclearancesand

empoweringbureaucrats,executioncanimprove.

Thestockcurrentlytradesat13xoneyear

forwardPE.Inthepreviouscyclepeak,it

touched20xandweexpectsomeamount

ofreratingto15xintheneartermand

17xovertime

2,042 3,219 27 100

CoalIndia 1%inFY15,5%inFY16and7.5%

inFY17

VolumegrowthinFY15/16/17canbe

5.3%/7%/7%vsourcurrentforecastof

4.7%/5%/6%asthenewgovtincreasespaceof

clearancesandworkonnewraillinesare

expedited

Thestockcurrentlytradesat12xFY16ii.

Thoughthelistinghistoryisshort,the

stockhastradedat1617xoneyearfwd

whentheoutlookonvolumegrowthwas

sanguine

473 816 28 120

ONGC 2.6%inFY15,5.9%inFY16and

8.6%inFY17

CompanygrowsFY16productionby1mmtYoY

againstbasecaseof0.4mmt,LPGunderrecoveries

fallhelpingONGCimprovenetrealizationfrom

$41/bblinFY14to$56/bblinFY16,$65/bblinFY17

Thestockcurrentlytradesat9.7xFY16ii.

WithlowersubsidyburdenfromLPG

reforms,volumegrowthand

improvementingasprofitability,

valuationshouldrerateto13x.

520 649 38 72

PowerGrid 1012%EPSupgradethrough

FY18ii

Restorationofincomefromshorttermopen

accessand10%higherprojectcompletion

ShouldimprovecoreROEandreported

ROEby12%;therebyimprovinggrowth

visibility

182 249 49 104

Rural

Electrification

5%inFY15,15%inFY16,20%in

FY17

Stablespreadsasagainstanexpected

compression,lowerprovisions;current

assumptionsloangrowthof18%/17%,NIM

changeof(27)/(24)bpsandLLPof20/30bpsin

FY15/FY16

Inanupturn,thestockcanrerateto

1.7x12monthfwdbook(peakof2.5xin

2007)

461 812 44 154

StateBankof

India

5%inFY15,15%inFY16,15%in

FY17

Lowerinterestreversalsandimprovementin

internationalNIMs,lowerexpenseratios,

lowerloanlossprovisionsasthecreditcycle

turns,bettercontributionfromsubsidiaries

Inanupturn,thestockcanrerateto

1.7x12monthfwdbook(peakof2.2xin

2010)

3,687 5,486 45 116

Source:IIFLResearch

prabodh@i i fl cap.com

India - PSUs

9

Institutional Equities

Published in 2014, India Infoline Ltd 2014

This research report was prepared by India Infoline Limiteds Institutional Equities Research Desk (IIFL), a company authorized to engage in securities activities in India. IIFL is not a

registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of research reports and the independence of research analysts. This research

report is provided for distribution to major U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as

amended (the Exchange Act). Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on the information

provided in this research report should do so only through IIFL Capital Inc (IIFLCAP), a registered broker dealer in the United States.

IIFLCAP accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is delivered to a U.S. person other than a major U.S. institutional

investor. The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry Regulatory Authority (FINRA) and may not be

an associated person of IIFLCAP and, therefore, may not be subject to applicable restrictions under FINRA Rules on communications with a subject company, public appearances and trading

securities held by a research analyst account.

IIFL has other business units with independent research teams separated by Chinese walls, and therefore may, at times, have different or contrary views on stocks and markets. This report is

for the personal information of the authorized recipient and is not for public distribution. This should not be reproduced or redistributed to any other person or in any form. This report is for the

general information of the investors, and should not be construed as an offer or solicitation of an offer to buy/sell any securities.

We have exercised due diligence in checking the correctness and authenticity of the information contained herein, so far as it relates to current and historical information, but do not guarantee

its accuracy or completeness. The opinions expressed are our current opinions as of the date appearing in the material and may be subject to change from time to time without notice. IIFL or

any persons connected with it do not accept any liability arising from the use of this document. The recipients of this material should rely on their own judgment and take their own

professional advice before acting on this information.

IIFL or any of its connected persons including its directors or subsidiaries or associates or employees shall not be in any way responsible for any loss or damage that may arise to any person

from any inadvertent error in the information contained, views and opinions expressed in this publication.

IIFL and/or its affiliate companies may deal in the securities mentioned herein as a broker or for any other transaction as a Market Maker, Investment Advisor, etc. to the issuer company or its

connected persons. IIFL generally prohibits its analysts from having financial interest in the securities of any of the companies that the analysts cover. In addition, the company prohibits its

employees from conducting Futures & Options transactions or holding any shares for a period of less than 30 days.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance.

Information, opinions and estimates contained in this report reflect a judgment of its original date of publication by IIFL and are subject to change without notice. The price, value of and

income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate

fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments.

Analyst Certification: (a) that the views expressed in the research report accurately reflect such research analyst's personal views about the subject securities and companies; and (b) that

no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendation or views contained in the research report.

Key to our recommendation structure

BUY - Absolute - Stock expected to give a positive return of over 20% over a 1-year horizon.

SELL - Absolute - Stock expected to fall by more than 10% over a 1-year horizon.

In addition, Add and Reduce recommendations are based on expected returns relative to a hurdle rate. Investment horizon for Add and Reduce recommendations is up to a year. We

assume the current hurdle rate at 10%, this being the average return on a debt instrument available for investment.

Add - Stock expected to give a return of 0-10% over the hurdle rate, i.e. a positive return of 10%+.

Reduce - Stock expected to return less than the hurdle rate, i.e. return of less than 10%.

Distribution of Ratings: Out of 180 stocks rated in the IIFL coverage universe, 103 have BUY ratings, 4 have SELL ratings, 35 have ADD ratings, 1 have NR and 37 have REDUCE ratings.

Price Target: Unless otherwise stated in the text of this report, target prices in this report are based on either a discounted cash flow valuation or comparison of valuation ratios with

companies seen by the analyst as comparable or a combination of the two methods. The result of this fundamental valuation is adjusted to reflect the analysts views on the likely course of

investor sentiment. Whichever valuation method is used there is a significant risk that the target price will not be achieved within the expected timeframe. Risk factors include unforeseen

changes in competitive pressures or in the level of demand for the companys products. Such demand variations may result from changes in technology, in the overall level of economic activity

or, in some cases, in fashion. Valuations may also be affected by changes in taxation, in exchange rates and, in certain industries, in regulations. Investment in overseas markets and

instruments such as ADRs can result in increased risk from factors such as exchange rates, exchange controls, taxation, and political and social conditions. This discussion of valuation methods

and risk factors is not comprehensive further information is available upon request.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Superseding Indictment USA V BandfieldDocument33 pagesSuperseding Indictment USA V BandfieldArt RossNo ratings yet

- Financial Services: Securities Firms and Investment Banks: True / False QuestionsDocument30 pagesFinancial Services: Securities Firms and Investment Banks: True / False Questionslatifa hn100% (1)

- FP&A IntroDocument13 pagesFP&A Introruchirvatsal7731No ratings yet

- Series 6 Lem FinalonlineDocument424 pagesSeries 6 Lem FinalonlineSandsw3pt100% (1)

- UP MSFin-Raymond James Financial WAC - Toledo, JerryDocument3 pagesUP MSFin-Raymond James Financial WAC - Toledo, JerryJerry ToledoNo ratings yet

- Reportorial Requirements For SEC Registered CorporationsDocument2 pagesReportorial Requirements For SEC Registered Corporationssirrhouge100% (1)

- Ambit Research Report Turnaround StocksDocument76 pagesAmbit Research Report Turnaround StocksArunddhuti RayNo ratings yet

- Ten Baggers Portfolio AmbitDocument18 pagesTen Baggers Portfolio AmbitPuneet367No ratings yet

- Auto & Ancillary Banking and Financial Services Consumer and RelatedDocument1 pageAuto & Ancillary Banking and Financial Services Consumer and RelatedArunddhuti RayNo ratings yet

- How To Find Last Two DigitsDocument3 pagesHow To Find Last Two DigitsArunddhuti Ray100% (1)

- United States Court of Appeals, Third CircuitDocument29 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Healthy Market Share Gains - VESUVIUS INDIADocument7 pagesHealthy Market Share Gains - VESUVIUS INDIAsarvo_44No ratings yet

- Merchant Banking & Investment Lecture 01Document198 pagesMerchant Banking & Investment Lecture 01Mehedi HasanNo ratings yet

- Finance: Security BrokerageDocument22 pagesFinance: Security BrokerageCaren Que ViniegraNo ratings yet

- SRC HandoutDocument8 pagesSRC HandoutmangpatNo ratings yet

- Altavista's Muehler Has Long History of Unregistered Securities Scams (Part 2 of 3) - Growth Capitalist March 8 2017Document3 pagesAltavista's Muehler Has Long History of Unregistered Securities Scams (Part 2 of 3) - Growth Capitalist March 8 2017Teri BuhlNo ratings yet

- Securities Brokering in The US Industry ReportDocument41 pagesSecurities Brokering in The US Industry ReportJessyNo ratings yet

- Makor Capital - Technical Summary European UtilitiesDocument13 pagesMakor Capital - Technical Summary European UtilitiesH3NPHLONo ratings yet

- CFA一级基础段权益投资 Jcy 金程(打印版)Document76 pagesCFA一级基础段权益投资 Jcy 金程(打印版)Evelyn YangNo ratings yet

- RealTick Scripting QuickStart GuideDocument22 pagesRealTick Scripting QuickStart GuideCoopGekoLivermoreNo ratings yet

- The Sec Has Carved Out An Exemption To The Brokerdealer Registration Requirements For M&a BrokersDocument6 pagesThe Sec Has Carved Out An Exemption To The Brokerdealer Registration Requirements For M&a BrokersAttorney Laura AnthonyNo ratings yet

- Regional Sales Manager Client Relationship Expert in Denver CO Resume Cynthia ChandlerDocument2 pagesRegional Sales Manager Client Relationship Expert in Denver CO Resume Cynthia ChandlerCynthia ChandlerNo ratings yet

- IIFL - Chemicals - Key Takeaways From Expert Call - Dr. Deepak Palekar - 20200505Document6 pagesIIFL - Chemicals - Key Takeaways From Expert Call - Dr. Deepak Palekar - 20200505samarth chawlaNo ratings yet

- Offering MemorandumDocument10 pagesOffering MemorandumRocketLawyer0% (1)

- Banking Sector - Technical Overview: Subodh Gupta, CMT 13 April 2020Document17 pagesBanking Sector - Technical Overview: Subodh Gupta, CMT 13 April 2020Subodh GuptaNo ratings yet

- DCF 2023 q3 Consumer ReportDocument11 pagesDCF 2023 q3 Consumer Reportxen101No ratings yet

- Excessive System Usage Fee: 2.8 Date April 2021Document20 pagesExcessive System Usage Fee: 2.8 Date April 2021Hon Ming ChanNo ratings yet

- SEC vs. Price RichardsonDocument1 pageSEC vs. Price Richardsonhoney samaniegoNo ratings yet

- 2020advisory Ronnie-Barrientos Crowd1Document3 pages2020advisory Ronnie-Barrientos Crowd1Rolly OcampoNo ratings yet

- Compliance and Brokerage TheoryDocument35 pagesCompliance and Brokerage Theoryzama zamazuluNo ratings yet

- H G Infra Engineering LTD: Subscribe For Long Term Price Band: INR 263 - 270Document8 pagesH G Infra Engineering LTD: Subscribe For Long Term Price Band: INR 263 - 270SachinShingoteNo ratings yet

- Futures DisclosuresDocument24 pagesFutures DisclosuresAdam PerezNo ratings yet

- Evergreen Stock Brokerage and Securities, Inc.: Customer Account Information FormDocument1 pageEvergreen Stock Brokerage and Securities, Inc.: Customer Account Information FormJoeNo ratings yet