Professional Documents

Culture Documents

Phase 1

Phase 1

Uploaded by

api-257082110Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Personal Financial Planning - Theory and PracticeDocument415 pagesPersonal Financial Planning - Theory and PracticeFabian Dimas100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FM2 Financial Statement AnalysisDocument120 pagesFM2 Financial Statement AnalysisLê Chấn PhongNo ratings yet

- Ma Question PaperDocument12 pagesMa Question PaperLuke Shaw100% (1)

- RflectDocument4 pagesRflectapi-257082110No ratings yet

- Hannahjune 4Document1 pageHannahjune 4api-257082110No ratings yet

- Judd Mahalo2Document1 pageJudd Mahalo2api-257082110No ratings yet

- Hannahjune 5Document1 pageHannahjune 5api-257082110No ratings yet

- Hannahjune 6Document1 pageHannahjune 6api-257082110No ratings yet

- Hannahjune 3Document1 pageHannahjune 3api-257082110No ratings yet

- Hannahjune 2Document1 pageHannahjune 2api-257082110No ratings yet

- Judd Mahalo5Document1 pageJudd Mahalo5api-257082110No ratings yet

- Judd Mahalo6Document1 pageJudd Mahalo6api-257082110No ratings yet

- Judd Mahalo4Document1 pageJudd Mahalo4api-257082110No ratings yet

- Juddmahalo 1Document1 pageJuddmahalo 1api-257082110No ratings yet

- Judd Mahalo3Document1 pageJudd Mahalo3api-257082110No ratings yet

- Kate Upton6Document1 pageKate Upton6api-257082110No ratings yet

- Kate Upton4Document1 pageKate Upton4api-257082110No ratings yet

- Kate Upton5Document1 pageKate Upton5api-257082110No ratings yet

- Ashish Banjit2Document1 pageAshish Banjit2api-257082110No ratings yet

- Kate Upton3Document1 pageKate Upton3api-257082110No ratings yet

- Kate Upton2Document1 pageKate Upton2api-257082110No ratings yet

- Kate Upton1Document1 pageKate Upton1api-257082110No ratings yet

- Ashish Banjit3Document1 pageAshish Banjit3api-257082110No ratings yet

- Ashish Banjit1Document2 pagesAshish Banjit1api-257082110No ratings yet

- Ashish Banjit6Document1 pageAshish Banjit6api-257082110No ratings yet

- Ashish Banjit4Document1 pageAshish Banjit4api-257082110No ratings yet

- Ashish Banjit5Document1 pageAshish Banjit5api-257082110No ratings yet

- Icici Bank Analysis by Muzammil HussainDocument44 pagesIcici Bank Analysis by Muzammil HussainHussainNo ratings yet

- On January 1 2018 The General Ledger of Dynamite FireworksDocument2 pagesOn January 1 2018 The General Ledger of Dynamite FireworksAmit PandeyNo ratings yet

- Substantial EvidenceDocument15 pagesSubstantial EvidenceArahbells100% (1)

- Starbucks - The Third SpaceDocument36 pagesStarbucks - The Third SpaceDerrick TaylorNo ratings yet

- Mep and Civil TenderDocument471 pagesMep and Civil TenderJayadevDamodaran100% (1)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument12 pagesIAS 20 Accounting For Government Grants and Disclosure of Government AssistanceCHAZNAY MENORCA QUIROSNo ratings yet

- Solman ch21 DayagDocument6 pagesSolman ch21 DayagMayeth BotinNo ratings yet

- Sexpression Magazine Business PlanDocument12 pagesSexpression Magazine Business PlanGrayce Collis100% (1)

- Profit Loss 12 MonthDocument6 pagesProfit Loss 12 MonthMstefNo ratings yet

- Simple InterestDocument19 pagesSimple InterestHJNo ratings yet

- IC Profit and Loss Dashboard 11306Document7 pagesIC Profit and Loss Dashboard 11306RyryNo ratings yet

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesjamNo ratings yet

- What's The CashbackDocument7 pagesWhat's The Cashbackinvstoc agentNo ratings yet

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- Adedamola Williams Paystub 2Document1 pageAdedamola Williams Paystub 2Lillian AwtNo ratings yet

- Business PlanDocument10 pagesBusiness PlanJhamel Sia DrilonNo ratings yet

- Notice of Assessment 2021 04 01 17 31 56 853329Document4 pagesNotice of Assessment 2021 04 01 17 31 56 85332969j8mpp2scNo ratings yet

- Act370 Final - AssignmentDocument12 pagesAct370 Final - AssignmentAnkan Saha 1711046030No ratings yet

- ESP-New - Ms. Mai HanhDocument71 pagesESP-New - Ms. Mai HanhTrangNo ratings yet

- 6 ECCI - Karthik SubbaramanDocument13 pages6 ECCI - Karthik SubbaramanThe Outer MarkerNo ratings yet

- 24-7 Intouch India Private LimitedDocument1 page24-7 Intouch India Private LimitedMohammed Adnan ShariefNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument56 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegemartinus linggoNo ratings yet

- 1.1 Decentralization and Segment ReportingDocument4 pages1.1 Decentralization and Segment ReportingJason CabreraNo ratings yet

- External Growth StrategiesDocument37 pagesExternal Growth StrategiesJharna KalraNo ratings yet

- Ifrs Vs Ifrs For SmesDocument11 pagesIfrs Vs Ifrs For SmesKelvin Yu100% (1)

- An In-Depth Study On The Hotel and Restaurant Industry in The PhilippinesDocument233 pagesAn In-Depth Study On The Hotel and Restaurant Industry in The Philippineskylesurfs100% (1)

Phase 1

Phase 1

Uploaded by

api-257082110Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Phase 1

Phase 1

Uploaded by

api-257082110Copyright:

Available Formats

Phase one Post-Secondary School

In this financial portfolio I was start at 18 years old. In this phase I will be taking a gap year

before university, which I need to find a way to pay for. After I will be studying at the University

of melbourne in which I will take up a number of courses. I will also have to find a job in order for

to pay for university and to support myself when living in melbourne.

What options are you considering for further study or work?

After secondary school I would like to take a gap year to see the world with my friends, visiting

new countries, surfing remote regions and exploring jungles, mountains and more. In doing this

gap year I aim to create new relationships and memories. After my gap year I have decided to

go to the University of Melbourne to study the Major of business in the Bachelor of Commerce

which I will need an A.T.A.R of 95.00 to clearly get in. Also I will be doing the Major of film and

television in the Bachelor of fine arts which I wont need any particular A.T.A.R score to be able

to get in. Lastly I will be doing the Major of computing and software systems in the Bachelor of

Science and I will need an A.T.A.R score of 92.00 to clearly get in.

What expenses will incur as a consequence of study or work?

Gap Year expenses (A$)

Equipment - bags, clothing, tent, etc. $1000 (Andrew, 2014)

surfboards x2 $1380 (jsindustries, 2014)

camera $529 (gopro, 2014)

food, travel fees and other $5 800 (roe, 2006)

Total $8709

weekly Fixed expenses A$

Accommodation $210

*Bills electricity, gas, etc. $20

*Telephone $7.50

Internet + Mobile phone bills $20

total $257

weekly Variable expenses A$

Public transport fares $30

*Food and necessaries clothes, toiletries. $70

School supplies $30

Car expenses fuel, insurance, registration $40

Total $170

Note:

Expenses with * have been reduced by 50% because the cost will be shared with

flatmates.

The stated weekly study expenses and establishment costs are average expenses as

indicated by the University of Melbourne (Pincock 2012)

Where will you live?

When Im studying at the University of Melbourne I will stay in a sharing rented apartment. This

apartment will be near Parkville campus (Pincock, 2012).

What income will you have and how will you earn it?

To fund this dream of a gap year I have taken a part time job at Heliguy aerial cinematography

in which I earn a yearly income of A$2800. I will need to raise an estimate amount of A$8709

which is highly achievable considering that I have already started saving and I have at least 4

years of saving ahead. I also plan to take jobs on my gap year so I wont run out of money.

To pay for my study expenses I will take a part time job as a company secretary assistant at

Ranstad and will be working 25 hours per week on the weekends with a salary of $60 an hour

(mycareer, 2014). This will evaluate to $1500 a week and a yearly income of $78 000. I will be

studying on weekdays.

What other financial obligations will you have?

Additional Expenses(A$) Paid in one go, or throughout the year

courses x3 $1800

Impulse buying $5000

Establishment costs A$

Bond $909

*Telephone/Utilities connections $85

*General Furniture $250

Total $8044

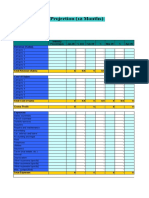

Yearly Budget A$ (not including gap year)

expenses $27 248

Income $78 000

amount being saved $50 752

amount saved after 4 years at uni. $200 008

What could go wrong and who can help?

I could lose my job because of a number of reasons. The Australian Government service

Newstart Allowance, can support me financially until I find the right job with a social welfare

payment (department of human services, 2014).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Personal Financial Planning - Theory and PracticeDocument415 pagesPersonal Financial Planning - Theory and PracticeFabian Dimas100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FM2 Financial Statement AnalysisDocument120 pagesFM2 Financial Statement AnalysisLê Chấn PhongNo ratings yet

- Ma Question PaperDocument12 pagesMa Question PaperLuke Shaw100% (1)

- RflectDocument4 pagesRflectapi-257082110No ratings yet

- Hannahjune 4Document1 pageHannahjune 4api-257082110No ratings yet

- Judd Mahalo2Document1 pageJudd Mahalo2api-257082110No ratings yet

- Hannahjune 5Document1 pageHannahjune 5api-257082110No ratings yet

- Hannahjune 6Document1 pageHannahjune 6api-257082110No ratings yet

- Hannahjune 3Document1 pageHannahjune 3api-257082110No ratings yet

- Hannahjune 2Document1 pageHannahjune 2api-257082110No ratings yet

- Judd Mahalo5Document1 pageJudd Mahalo5api-257082110No ratings yet

- Judd Mahalo6Document1 pageJudd Mahalo6api-257082110No ratings yet

- Judd Mahalo4Document1 pageJudd Mahalo4api-257082110No ratings yet

- Juddmahalo 1Document1 pageJuddmahalo 1api-257082110No ratings yet

- Judd Mahalo3Document1 pageJudd Mahalo3api-257082110No ratings yet

- Kate Upton6Document1 pageKate Upton6api-257082110No ratings yet

- Kate Upton4Document1 pageKate Upton4api-257082110No ratings yet

- Kate Upton5Document1 pageKate Upton5api-257082110No ratings yet

- Ashish Banjit2Document1 pageAshish Banjit2api-257082110No ratings yet

- Kate Upton3Document1 pageKate Upton3api-257082110No ratings yet

- Kate Upton2Document1 pageKate Upton2api-257082110No ratings yet

- Kate Upton1Document1 pageKate Upton1api-257082110No ratings yet

- Ashish Banjit3Document1 pageAshish Banjit3api-257082110No ratings yet

- Ashish Banjit1Document2 pagesAshish Banjit1api-257082110No ratings yet

- Ashish Banjit6Document1 pageAshish Banjit6api-257082110No ratings yet

- Ashish Banjit4Document1 pageAshish Banjit4api-257082110No ratings yet

- Ashish Banjit5Document1 pageAshish Banjit5api-257082110No ratings yet

- Icici Bank Analysis by Muzammil HussainDocument44 pagesIcici Bank Analysis by Muzammil HussainHussainNo ratings yet

- On January 1 2018 The General Ledger of Dynamite FireworksDocument2 pagesOn January 1 2018 The General Ledger of Dynamite FireworksAmit PandeyNo ratings yet

- Substantial EvidenceDocument15 pagesSubstantial EvidenceArahbells100% (1)

- Starbucks - The Third SpaceDocument36 pagesStarbucks - The Third SpaceDerrick TaylorNo ratings yet

- Mep and Civil TenderDocument471 pagesMep and Civil TenderJayadevDamodaran100% (1)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument12 pagesIAS 20 Accounting For Government Grants and Disclosure of Government AssistanceCHAZNAY MENORCA QUIROSNo ratings yet

- Solman ch21 DayagDocument6 pagesSolman ch21 DayagMayeth BotinNo ratings yet

- Sexpression Magazine Business PlanDocument12 pagesSexpression Magazine Business PlanGrayce Collis100% (1)

- Profit Loss 12 MonthDocument6 pagesProfit Loss 12 MonthMstefNo ratings yet

- Simple InterestDocument19 pagesSimple InterestHJNo ratings yet

- IC Profit and Loss Dashboard 11306Document7 pagesIC Profit and Loss Dashboard 11306RyryNo ratings yet

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesjamNo ratings yet

- What's The CashbackDocument7 pagesWhat's The Cashbackinvstoc agentNo ratings yet

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- Adedamola Williams Paystub 2Document1 pageAdedamola Williams Paystub 2Lillian AwtNo ratings yet

- Business PlanDocument10 pagesBusiness PlanJhamel Sia DrilonNo ratings yet

- Notice of Assessment 2021 04 01 17 31 56 853329Document4 pagesNotice of Assessment 2021 04 01 17 31 56 85332969j8mpp2scNo ratings yet

- Act370 Final - AssignmentDocument12 pagesAct370 Final - AssignmentAnkan Saha 1711046030No ratings yet

- ESP-New - Ms. Mai HanhDocument71 pagesESP-New - Ms. Mai HanhTrangNo ratings yet

- 6 ECCI - Karthik SubbaramanDocument13 pages6 ECCI - Karthik SubbaramanThe Outer MarkerNo ratings yet

- 24-7 Intouch India Private LimitedDocument1 page24-7 Intouch India Private LimitedMohammed Adnan ShariefNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument56 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegemartinus linggoNo ratings yet

- 1.1 Decentralization and Segment ReportingDocument4 pages1.1 Decentralization and Segment ReportingJason CabreraNo ratings yet

- External Growth StrategiesDocument37 pagesExternal Growth StrategiesJharna KalraNo ratings yet

- Ifrs Vs Ifrs For SmesDocument11 pagesIfrs Vs Ifrs For SmesKelvin Yu100% (1)

- An In-Depth Study On The Hotel and Restaurant Industry in The PhilippinesDocument233 pagesAn In-Depth Study On The Hotel and Restaurant Industry in The Philippineskylesurfs100% (1)