Professional Documents

Culture Documents

BBA 2003 Cost Accounting

BBA 2003 Cost Accounting

Uploaded by

Ventus TanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBA 2003 Cost Accounting

BBA 2003 Cost Accounting

Uploaded by

Ventus TanCopyright:

Available Formats

Page 0 of 24

BBA 2003

COST ACCOUNTING

TAN WAH TIONG

940928-14-5531

201565

CHONG KAR YUN

AUGUST 2013

Page 1 of 24

NO DETAIL PAGE

1.0 Contents 1

2.0 Introduction 2

3.0 Task 1 3-13

4.0 Task 2 14-15

5.0 Task 3 16-17

6.0 References 18

7.0 Coursework 19-22

Page 2 of 24

2.0 Introductions

Cost accounting is a process of collecting, analyzing, summarizing and evaluating various

alternative courses of action. Its goal is to advise the management on the most appropriate

course of action based on the cost efficiency and capability. Cost accounting provides the

detailed cost information that management needs to control current operations and plan for

the future.

Since managers are making decisions only for their own organization, there is no need for

the information to be comparable to similar information from other organizations. Instead,

information must be relevant for a particular environment. Cost accounting information is

commonly used in financial accounting information, but first we are concentrating on its use

by managers to make decisions.

Unlike the accounting systems that help in the preparation of financial reports periodically,

the cost accounting systems and reports are not subject to rules and standards like the

Generally Accepted Accounting Principles. As a result, there is wide variety in the cost

accounting systems of the different companies and sometimes even in different parts of the

same company or organization.

Page 3 of 24

3.0 Task 1

1.1 Three Basic Cost Elements Involved in the Manufacture Of Product

(a) Material cost:

Direct cost: An expense that can be traced directly to (or identified with) a specific cost

center or cost object such as a department, process, or product. Direct costs include of labor,

material, fuel or power. It vary with the rate of output but are uniform for each unit of

production, and are usually under the control and responsibility of the department manager.

As a general rule, most costs are fixed in the short run and variable in the long run. Also

called direct expense, on cost, variable cost, or variable expense, they are grouped under

variable costs. Examples: Cost of gravel, sand, cement and wages incurred on production of

concrete.

Indirect cost: A costs that are not directly accountable to a cost object such as a particular

project, facility, function or product. Indirect costs may be either fixed or variable. Indirect

costs include administration, personnel and security costs. These are those costs which are

not directly related to production. Some indirect costs may be overhead. But some overhead

costs can be directly attributed to a project and are direct costs. There are two types of

indirect costs. One are the fixed indirect costs which contains activities or costs that are fixed

for a particular project or company like transportation of labor to the working site, building

temporary roads, etc. The other are recurring indirect costs which contains activities that

repeat for a particular company like maintenance of records or payment of salaries.

Examples: Cost of depreciation, insurance, power, salaries of supervisors incurred in a

concrete plant.

Page 4 of 24

(b) Labor:

Direct labor: Cost of personnel that can be identified in the product, such as the salary of the

person who works at the production machine, but not the administrators or janitors salaries.

Besides, Direct labor is also the portion of the total cost of production of a product or

fulfillment of a service that is associated with salaries, benefits, taxes, and other expenses

related to the personnel needed for the process.

Indirect labour: Employees or workers (such as accountants, supervisors, security guards)

who do not directly produce goods or services, but who make their production possible or

more efficient. Indirect labour costs are not readily identifiable with a specific task or work

order. They are termed indirect costs and are charged to overhead accounts. Besides, indirect

cost also considered as the amount allocated for labours hours or activities that are not

related to the manufacturing process, like the lighting surrounding a finishing machine.

Indirect labour costs such as accounting, human resources, or other administrative functions

that support the process or personnel.

Page 5 of 24

(c) Overhead costs:

In business, overhead or overhead expense refers to an ongoing expense of operating a

business; it is also known as an "operating expense". Examples include rent, gas, electricity,

and wages. The term overhead is usually used when grouping expenses that are necessary to

the continued functioning of the business but cannot be immediately associated with the

products or services being offered (i.e., do not directly generate profits). It is closely related

accounting concepts are fixed costs and variable costs as well as indirect costs and direct

costs. In addition, overhead expenses are all costs on the income statement except for direct

labour, direct materials, and direct expenses. Overhead expenses include accounting fees,

advertising, insurance, interest, legal fees, labor burden, rent, repairs, supplies, taxes,

telephone bills, travel expenditures, and utilities.

Page 6 of 24

1.2 The difference between the following terms

(i) Product cost and period cost

Product costs include all the costs that are involved in acquiring or making product but

period costs are all the costs that are not included in product costs. A manufacturers product

costs are the direct materials, direct labor, and manufacturing overhead used in making its

products. (Manufacturing overhead is also referred to as factory overhead, indirect

manufacturing costs, and burden.) The product costs of direct materials, direct labor, and

manufacturing overhead are also inventoriable costs, since these are the necessary costs of

manufacturing the products.

In the other sides, Period costs are not a necessary part of the manufacturing process. As a

result, period costs cannot be assigned to the products or to the cost of inventory. The period

costs are usually associated with the selling function of the business or its general

administration. The period costs are reported as expenses in the accounting period in which

they are best match with revenues, when they expire, or in the current accounting period. In

addition to the selling and general administrative expenses, most interest expense is a period

expense.

Page 7 of 24

(ii) Sunk cost and relevant cost

The sunk cost is one for which the expenditure has taken place in the past. This cost is not

affected by a particular decision under the consideration. Sunk costs are always results of

decision taken in past. Investment in plant and machinery as soon as installed, its cost is

sunk cost and is not relevant for decision making. The relevant cost is a cost appropriate in

adding to make specific management decisions.

Besides, a relevant cost is a future cost which differ with alternatives and one which is

expected to be incurred and not a sunk cost which has already been incurred. If the cost

remain constant between different alternatives, treated as irrelevant cost however that is not a

sunk cost. Sunk costs are based on past, always irrelevant for decision making.

In addition, relevant cost must be an incremental or avoidable cost. For example fixed over

heads which are allocated by head office are not relevant, but incremental or avoidable fixed

overheads are relevant.

Page 8 of 24

(iii) Fixed and variable cost

The difference between fixed cost and variable cost is that, fixed costs refer expenses whose

total does not change in proportion to the activity of a business, within a relevant period of

time and they include rent and utility bills. On the other hand variable costs change in

relation to the activity of a business for instance sales and production volume.

It also can be describe as in short period, total cost is divided into fixed cost and variable

cost. In short period, some factors are fixed such as factory building, machines etc. and some

factors variable such as fuel, raw materials etc. Fixed factors do not change when volume of

production change and variable factors directly vary with the volume of production. Cost

incurred on fixed factors is known as fixed cost.

The amount of fixed cost does not change and remains fixed whether volume of production

is more or less or zero. Its examples are rent of the building, interest of the money invested

in machines and so on. Cost incurred on variable factors is known as variable cost. This cost

directly varies with the volume of production. If volume of production is zero, this cost will

be zero. Its examples are fuel cost, cost or raw materials etc.

(iv) Avoidable and unvoidable costs

Avoidable cost is an expense that will not be incurred if a particular activity is not performed.

Avoidable cost refers to variable costs that can be avoided, unlike most fixed costs, which

are typically unavoidable. While avoidable costs are often viewed as negative costs, they

may be necessary to achieve certain goals or thresholds.

Page 9 of 24

In the other sides, unvoidable costs alter the course of a project or business. For example, a

manufacturer with many product lines can drop one of the lines, thereby eliminating

associated expenses such as labor and materials. Corporations looking for methods to reduce

or eliminate expenses often analyze avoidable costs associated with underperforming or non-

profitable product lines.

(v) Controllable and uncontrollable costs

Controllable costs are the costs which can be influenced by the action of a

specified member of an undertaking. A business organisation is usually divided into a

number of responsibility centres and an executive heads each such centre. Controllable

costs incurred in a particular responsibility centre can be influenced by the action of the

executive heading that responsibility centre. For example, Direct costs comprising direct

labour, direct material, direct expenses and some of the overheads are generally controllable

by the shop level management.

In the other sides, uncontrollable costs are the costs which cannot be influenced by the action

of a specified member of an undertaking are known as uncontrollable costs. For example,

expenditure incurred by, say, the Tool Room is controllable by the foreman

incharge of that section but the share of the tool-room expenditure which is apportioned

to a machine shop is not to be controlled by the machine shop foreman

Page 10 of 24

(vi) Direct and indirect costs

Direct costs are those that are directly attributable to a project of the manufacture of a

product or a project. For instance if you are in the highway construction business and you

got a bid to build a new highway, direct costs would be the materials like asphalt and the

cost of labor. That actually a variable cost and it is easier to track. On the other sides, an

indirect cost would be administrative expenses, and the depreciation and maintenance costs

for equipment like trucks and road graders and scrapers. Those are actually more fixed costs

and more difficult to track and assign to a particular project.

(vii) Prime cost and Conversion cost

The difference between prime and conversion costs refers to the difference in the types of

costs and what they are applied to. Prime costs are basically the cost of direct labor and

direct materials. Conversion cost is the cost of direct labor cost and manufacturing overhead

cost. The term conversion is used because direct labor and manufacturing overhead costs are

incurred to convert materials into finished products.

Besides, Prime Cost is a business's expenses for the materials and labor it uses in production.

Prime cost is a way of measuring the total cost of the production inputs needed to create a

given output. Conversion costs are those costs required to convert raw materials into finished

goods that are ready for sale. In addition, the concept is used in cost accounting to derive the

value of ending inventory. It can also be used to determine the incremental cost of creating a

product, which could be useful for price setting purposes.

Page 11 of 24

1.3 discuss the behavioral classification of costs, explaining all the term used therein

1. Variable costs

Variable costs are expenses that change in proportion to the activity of a business. Variable

cost is the sum of marginal costs over all units produced. It can also be considered normal

costs. Fixed costs And variable costs make up the two components oftotal cost. Direct Costs,

however, are costs that can easily be associated with a particularcost object. However, not all

variable costs are direct costs. For example, variable manufacturing overhead costs are

variable costs that areindirect costs, not direct costs. Variable costs are sometimes called

unit-level costs as they vary with the number of units produced.

2. Semi variable costs

A cost composed of a mixture of fixed and variable components. Costs are fixed for a set

level of production or consumption, becoming variable after the level is exceeded.

Page 12 of 24

3. Fixed costs

A cost that does not change with an increase or decrease in the amount of goods or services

produced. Fixed costs are expenses that have to be paid by a company, independent of any

business activity. It is one of the two components of the total cost of a good or service, along

with variable cost.

4. Semi fixed costs or stepped costs

Costs that are constant over a range of production. If one employee can make 5000 units,

then the employees wage is constant over a production range of one to 5000 units. If you

produce 5001 units, you will need another employee. So your cost doubles. If you make

14,000 units your cost triples because you need three employees.

Page 13 of 24

5. Concave cost function

concave function is the negative of aconvex function. A concave function is

also synonymously called concave downwards, concave down, convex upwards, convex

cap or upper convex.

Page 14 of 24

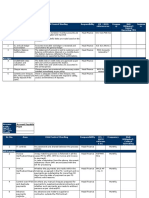

4.0 Task 2

Assume the following purchases were made in ABC

Data of purchase Unit Purchased Price per Unit

1

st

January 500 100

2

nd

January 600 200

3

rd

January 800 400

Units used on 4

th

January are 900

FIFO Method

Purchased Issued Balance

Data Units Price Amount Units Price Amount Unit Price Amount

1

st

Jan 500 100 50000 500 100 50000

2

nd

Jan 600 200 120000 1100 170000

3

rd

Jan 800 400 320000 1900 490000

4

th

Jan 900 *** 130000 1000 360000

Page 15 of 24

LIFO Method

Purchased Issued Balance

Data Units Price Amount Units Price Amount Unit Price Amount

1

st

Jan 500 100 50000 500 100 50000

2

nd

Jan 600 200 120000 1100 170000

3

rd

Jan 800 400 320000 1900 490000

4

th

Jan 900 *** 340000 1000 150000

Weighted Average Methods

Purchased Issued Balance

Data Units Price Amount Units Price Amount Unit Price Amount

1

st

Jan 500 100 50000 500 100 50000

2

nd

Jan 600 200 120000 1100 170000

3

rd

Jan 800 400 320000 1900 490000

4

th

Jan 1900 490000 900 257.895 232105 1000 257.895 257895

Page 16 of 24

5.0 Task 3

Calculate:

(i) Hourly rate

(ii) Basic piece rate

(iii) Individual bonus scheme where the employee receives the bonus in proportion of the

time saved to time allowed

Name of employee SS RR PP

Unit produced 270 200 220

Time allowed in minutes per unit 10 15 12

Time taken (hours) 40 38 36

Rate per hour ($) 125 105 120

Rate per unit ($) 20 25 24

Page 17 of 24

(i) Hourly rate

Name of employee SS RR PP

Time taken (hours) 40 38 36

Rate per hour (Shs) 125 105 120

Total amount (Time x Rate) 5000 3990 4320

(ii) Piece rate

Name of employee SS RR PP

Unit produced 270 200 220

Rate per unit (Shs) 20 25 24

Gross wage (Unit x Rate) 5400 5000 5280

(iii) Bonus Scheme

Name of employee SS RR PP

Unit produced

Time allowed in minutes per unit

270

10

200

15

220

12

Total time allowed (hours) (unit x time per unit/60)

Time taken (hours)

45

40

50

38

44

36

Time saved

Proportion (time saved/time allowed)

Bonus time [(Time saved / time allowed) x time taken]

125

1/9

4.44

105

6/25

9.12

120

2/11

6.55

Total time to be paid (time taken + bonus)

Rate per hours (Shs)

44.44

125

47.12

105

42.55

120

Total pay 5555 4947.6 5106

Page 18 of 24

6.0 references

- http://www.businessdictionary.com/definition/direct-cost.html

- http://www.investopedia.com/terms/d/directcost.asp

- http://en.wikipedia.org/wiki/Indirect_costs

- http://accountingexplained.com/managerial/costs/direct-and-indirect-costs

- http://www.businessdictionary.com/definition/direct-labor-cost.html

- http://www.investorwords.com/16347/direct_labor_cost.html

- http://www.answers.com/topic/direct-labor

- http://malaysia.answers.yahoo.com/question/index?qid=20090210064741AA5jfMr

- http://www.caclubindia.com/forum/sunk-costs-are-irrelevant-but-irrelevant-costs-are-not-

sunk-79001.asp#.UiqDNn_M-jg

- www.google.com

Page 19 of 24

7.0 coursework

Page 20 of 24

7.1

Ryan Limited makes 2 products, Exe and Wye, using 2 materials P48 and P34. On 1 April

tear 6, the company has the following stocks:

Materials: Kg

P48 5485

P34 2690

Finished Products: Units

Exe 650

Wye 200

To make a unit of Exe needs 5 kg of P48 and 2 kg of P34. To make a unit of Wye needs 8 kg

of P48 and 3 kg of P34.

During the year ending 31 March years 7, Ryan Limited expects to sell 5000 units of Exe

and 7500 units of Wye.

It is the intention to increase finished stock by 10% by 31 march year 7, but to reduce

material stocks to nil and from that date to implement a just-in-time purchasing arrangement.

Page 21 of 24

Required:

For the year ended 31 March year 7:

a) Prepare a production budget for Exe and Wye.

b) Prepare a purchasing budget for P48 and P34.

Solution:

a)

b)

Production budget Exe Wye

Units Units

Needed to meet sales requirements 5000 7500

Increase in finished stock 10% 65 20

Total to be produced 5065 7520

Materials budget P48 P34

Kg Kg

Product Exe 25325 10130

Product Wye 60160 22560

Total needed for production 85485 32690

Less stock in hand 1 April Year 6 5485 2690

To be purchased in year to 31/3.year 7 80000 30000

Page 22 of 24

7.2

A company uses 8 kg of material to make a product. The material costs 20 per kg. the

finished product weights 6 kg. The other 2 kg are trimmings and off cuts normally arising in

the course of manufacture. They can be sold for 5 per kg.

Required:

Calculate the direct material cost of a good unit of product if:

a) all product made are of a saleable quality

b) 10% of all products made are rejected because of poor quality. Rejected products cannot

be rectified but can be sold as scrap for 5 per kg.

Solution:

a)

Material 8 kg @ 20 per kg 160

Offcuts etc 2 kg @ 5 per kg (10)

Direct material cost per good unit 150

Page 23 of 24

b) To make 10 units of product:

Direct material

cost per good unit

1470/9

Material 80 kg @ 20 per kg 1600

Offcuts etc 20 kg @ 5 per kg (100)

Material cost of 10 units 1500

One rejected 6 kg @ 5 per kg (30)

Direct material cost of 9 good saleable units 1470

You might also like

- PLM LECTURES COST ACCOUNTING-GLORIA RANTE - Doc1Document13 pagesPLM LECTURES COST ACCOUNTING-GLORIA RANTE - Doc1Angelita Alonzo57% (7)

- Operating Costing A Case Study On Transport IndustryDocument28 pagesOperating Costing A Case Study On Transport IndustryShrikant Darne100% (2)

- Cost Classification Lecture NotesDocument7 pagesCost Classification Lecture Notesmichellebaileylindsa100% (1)

- Exam Style Questions Page 266Document2 pagesExam Style Questions Page 266Arounny Corwin100% (2)

- Mahindra N MahindraaDocument22 pagesMahindra N MahindraaPakiza ShaikhNo ratings yet

- Visual Index of Chart PatternsDocument3 pagesVisual Index of Chart Patterns999alain100% (3)

- BBA 2003 Cost AccountingDocument26 pagesBBA 2003 Cost AccountingVentusNo ratings yet

- Managerial Accounting - Chapter3Document27 pagesManagerial Accounting - Chapter3Nazia AdeelNo ratings yet

- Introduction To Cost Accounting Final With PDFDocument19 pagesIntroduction To Cost Accounting Final With PDFLemon EnvoyNo ratings yet

- FM 6 Elements of Cost 8 MDocument27 pagesFM 6 Elements of Cost 8 MRajiv SharmaNo ratings yet

- Classification of Cost AccountingDocument12 pagesClassification of Cost Accountingprachi agrawalNo ratings yet

- OverheadDocument11 pagesOverheadEfaz AfnanNo ratings yet

- A.1. Direct Materials (DM) : A. Manufacturing Cost/product CostDocument4 pagesA.1. Direct Materials (DM) : A. Manufacturing Cost/product CostAshley Niña Lee HugoNo ratings yet

- Accounting For Overheads 5.1 IntroductionDocument19 pagesAccounting For Overheads 5.1 IntroductionSaiful IslamNo ratings yet

- Cost Account 01Document6 pagesCost Account 01mika piusNo ratings yet

- Assignment Topics (Case Study-Based) : (Refer Notes On SLE That Has Been Circulated)Document8 pagesAssignment Topics (Case Study-Based) : (Refer Notes On SLE That Has Been Circulated)Bharath T SNo ratings yet

- Accounting For OverheadsDocument17 pagesAccounting For Overheadsdismas malekelaNo ratings yet

- Meaning and Definition OverheadsDocument3 pagesMeaning and Definition OverheadskunjapNo ratings yet

- Engineering and Economics Part II (Costing and Overheads)Document7 pagesEngineering and Economics Part II (Costing and Overheads)srinivas gangishettiNo ratings yet

- Cost ClassificationDocument9 pagesCost ClassificationPuneet TandonNo ratings yet

- Chapter Two: Cost Terminology and Classification: Learning OutcomesDocument8 pagesChapter Two: Cost Terminology and Classification: Learning OutcomesKanbiro Orkaido100% (1)

- Elements of Cost: Management Accounting Costs Profitability GaapDocument8 pagesElements of Cost: Management Accounting Costs Profitability GaapstefdrocksNo ratings yet

- DSFDFJM LLKDocument27 pagesDSFDFJM LLKDeepak R GoradNo ratings yet

- Module 2 MANAGERIAL COST CONCEPTSDocument10 pagesModule 2 MANAGERIAL COST CONCEPTSLaisa RarugalNo ratings yet

- Cost Concepts: According To Management FunctionDocument10 pagesCost Concepts: According To Management FunctionQuenn NavalNo ratings yet

- Cost Concepts AND Classification: By: Amar Raveendran Debasis BeheraDocument7 pagesCost Concepts AND Classification: By: Amar Raveendran Debasis BeheraAmar RaveendranNo ratings yet

- Hum 2217 (Acc) CostingDocument6 pagesHum 2217 (Acc) CostingNourin TasnimNo ratings yet

- Discussion 3 FinanceDocument7 pagesDiscussion 3 Financepeter njovuNo ratings yet

- IPCC Costing Theory Formulas ShortcutsDocument57 pagesIPCC Costing Theory Formulas ShortcutsCA Darshan Ajmera86% (7)

- Costing: - Chapter 01 - Cma Intermediate - MacampusDocument5 pagesCosting: - Chapter 01 - Cma Intermediate - MacampusRaja NarayananNo ratings yet

- Chapter 2Document17 pagesChapter 2Ngọc Minh Đỗ ChâuNo ratings yet

- Cost ClassificationDocument27 pagesCost ClassificationPooja Gupta SinglaNo ratings yet

- Chapter 2Document18 pagesChapter 2Hk100% (1)

- Cost Accounting: DefinitionDocument7 pagesCost Accounting: DefinitionMahnoor ChathaNo ratings yet

- (2330) M Abdullah Amjad BCOM (B)Document9 pages(2330) M Abdullah Amjad BCOM (B)Amna Khan YousafzaiNo ratings yet

- Costing Classification and Procedure A Written ReportDocument11 pagesCosting Classification and Procedure A Written Reportreyman rosalijosNo ratings yet

- Costs: Different Ways To Categorize CostsDocument7 pagesCosts: Different Ways To Categorize Costsraul_mahadikNo ratings yet

- Cost ConceptsDocument32 pagesCost Conceptsamira samirNo ratings yet

- Jyoti CA AsignmtDocument17 pagesJyoti CA AsignmtjyotirbkgmailcomNo ratings yet

- Assignment For Introduction To Cost AccountingDocument11 pagesAssignment For Introduction To Cost AccountingSolomon Mlowoka100% (1)

- unit - III notesDocument10 pagesunit - III notesstudy.iitmNo ratings yet

- Nature and Purpose of Cost AccountingDocument10 pagesNature and Purpose of Cost AccountingJustus100% (1)

- TOPIC TWO - Costs ClassificationDocument8 pagesTOPIC TWO - Costs ClassificationABDULSWAMADU KARIMUNo ratings yet

- Khanda Habeeb RaheemDocument12 pagesKhanda Habeeb RaheemHarith EmaadNo ratings yet

- Cost Acc. Service Audit TDocument7 pagesCost Acc. Service Audit TAli DemsisNo ratings yet

- Managerial Accounting: Cost TerminologyDocument18 pagesManagerial Accounting: Cost TerminologyHibaaq Axmed100% (1)

- Cost Concepts: Cost: Lecture Notes On Module-2Document18 pagesCost Concepts: Cost: Lecture Notes On Module-2ramanarao susarlaNo ratings yet

- BBA211 Vol2 CostTerminologiesDocument13 pagesBBA211 Vol2 CostTerminologiesAnisha SarahNo ratings yet

- Cost & Management Accounting Prepared by Vishal GoelDocument20 pagesCost & Management Accounting Prepared by Vishal Goelgoel76vishalNo ratings yet

- Cost Ch. IIDocument83 pagesCost Ch. IIMagarsaa AmaanNo ratings yet

- Unit 1 Introduction To Cost AccountingDocument4 pagesUnit 1 Introduction To Cost AccountingReema DsouzaNo ratings yet

- Ch2 - Basic Cost Management Concepts - OutlineDocument8 pagesCh2 - Basic Cost Management Concepts - OutlineirquadriNo ratings yet

- Management AccountingDocument7 pagesManagement AccountingKhushal SainiNo ratings yet

- Cost Accounting and Control: Cagayan State UniversityDocument74 pagesCost Accounting and Control: Cagayan State UniversityAntonNo ratings yet

- MODULE 3 Cost and ClassificationDocument5 pagesMODULE 3 Cost and Classificationmayankmishra140911No ratings yet

- Module 1Document14 pagesModule 1sarojkumardasbsetNo ratings yet

- Costing: Prepared By: Dr. B. K. MawandiyaDocument26 pagesCosting: Prepared By: Dr. B. K. MawandiyaNamanNo ratings yet

- Module 1 - Understanding ExpensesDocument14 pagesModule 1 - Understanding Expensesjudith magsinoNo ratings yet

- Cost Cha 1Document39 pagesCost Cha 1Abreham AddNo ratings yet

- W 4-5 Cost and ManagementDocument12 pagesW 4-5 Cost and ManagementMelvinNo ratings yet

- Cost Concepts & ClassificationDocument24 pagesCost Concepts & ClassificationAbhishek MishraNo ratings yet

- Cost and Management Accounting 1&2Document23 pagesCost and Management Accounting 1&2rumiyamohmmedNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- 2a Ent600 - Blueprint - 2018 Guidelines & TemplateDocument14 pages2a Ent600 - Blueprint - 2018 Guidelines & TemplateMat Azib MugeNo ratings yet

- Growing The Mountain Man Brand: Market Penetration: Increase Penetration by IntroducingDocument3 pagesGrowing The Mountain Man Brand: Market Penetration: Increase Penetration by IntroducingLATIKA 21No ratings yet

- In Re:) : Debtors.)Document11 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Balance Sheet & P & LDocument3 pagesBalance Sheet & P & LSatish WagholeNo ratings yet

- Lessons From Quiao Vs QuiaoDocument6 pagesLessons From Quiao Vs QuiaohellojdeyNo ratings yet

- Deutsche Bank QP1 InternshipsDocument20 pagesDeutsche Bank QP1 Internshipszubezub100% (1)

- EtihadDocument11 pagesEtihadLena MirajNo ratings yet

- Financial System NoteDocument5 pagesFinancial System NoteVaibhav PriyeshNo ratings yet

- Order in Respect of SIEL Financial Services LTDDocument4 pagesOrder in Respect of SIEL Financial Services LTDShyam SunderNo ratings yet

- Engineering Economy FactorsDocument55 pagesEngineering Economy FactorsMuhammadMahmoudAbdelNabyNo ratings yet

- Iskandar MalaysiaDocument23 pagesIskandar MalaysiaNoraminah IsmailNo ratings yet

- Business Case For Software Asset Management With SoftwareONE GuideDocument22 pagesBusiness Case For Software Asset Management With SoftwareONE Guidemanish_psNo ratings yet

- Kenya Vision 2030Document5 pagesKenya Vision 2030kewaki100% (1)

- Laporan Keuangan Ace Hardware 2014-Q1 PDFDocument44 pagesLaporan Keuangan Ace Hardware 2014-Q1 PDFBang BegsNo ratings yet

- Florete vs. FloreteDocument30 pagesFlorete vs. FloreteDexter CircaNo ratings yet

- GlobalizationDocument16 pagesGlobalizationSyeda Dilawaiz100% (1)

- Acuite-India Credit Risk Yearbook FinalDocument70 pagesAcuite-India Credit Risk Yearbook FinalDinesh RupaniNo ratings yet

- Sacramento Parking Study 12.01.2011Document69 pagesSacramento Parking Study 12.01.2011Isaac GonzalezNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingMohammed Mohsin YedavalliNo ratings yet

- Production Possibilities PDFDocument3 pagesProduction Possibilities PDFSandy SaddlerNo ratings yet

- BCK CH 3Document53 pagesBCK CH 3Nikku SinghNo ratings yet

- Introductory Econometrics: Probability and Statistics RefresherDocument35 pagesIntroductory Econometrics: Probability and Statistics Refresherchanlego123No ratings yet

- MACR - Module 5 - Valuation in M&ADocument43 pagesMACR - Module 5 - Valuation in M&AManjunath RameshNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund Picksrgrao85No ratings yet

- Exim PolicyDocument41 pagesExim Policyrinky_trivediNo ratings yet

- Compliance Checklist - PlantDocument36 pagesCompliance Checklist - Plantsaji kumarNo ratings yet

- Understanding Hybrid SecuritiesDocument20 pagesUnderstanding Hybrid SecuritiesRashmi Ranjan PanigrahiNo ratings yet