Professional Documents

Culture Documents

Pre-Departure Orientation 2013: Banking in The Us

Pre-Departure Orientation 2013: Banking in The Us

Uploaded by

Kyiv EducationUSA Advising Center0 ratings0% found this document useful (0 votes)

37 views2 pages1) There are several types of bank accounts available in the US including checking accounts, savings accounts, and credit unions. Checking accounts allow depositing and withdrawing of money as well as writing checks. Savings accounts earn interest but do not allow writing checks.

2) Important factors to consider when opening a checking account include monthly service fees, minimum balance requirements, and how checks and interest are calculated. A savings account also has service fees and minimum balance requirements to earn interest.

3) Transactions like deposits and withdrawals require identification and following bank procedures correctly, such as endorsing checks. Bank statements should be checked against personal records for accuracy.

Original Description:

In the US

Original Title

#3Banking

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) There are several types of bank accounts available in the US including checking accounts, savings accounts, and credit unions. Checking accounts allow depositing and withdrawing of money as well as writing checks. Savings accounts earn interest but do not allow writing checks.

2) Important factors to consider when opening a checking account include monthly service fees, minimum balance requirements, and how checks and interest are calculated. A savings account also has service fees and minimum balance requirements to earn interest.

3) Transactions like deposits and withdrawals require identification and following bank procedures correctly, such as endorsing checks. Bank statements should be checked against personal records for accuracy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

37 views2 pagesPre-Departure Orientation 2013: Banking in The Us

Pre-Departure Orientation 2013: Banking in The Us

Uploaded by

Kyiv EducationUSA Advising Center1) There are several types of bank accounts available in the US including checking accounts, savings accounts, and credit unions. Checking accounts allow depositing and withdrawing of money as well as writing checks. Savings accounts earn interest but do not allow writing checks.

2) Important factors to consider when opening a checking account include monthly service fees, minimum balance requirements, and how checks and interest are calculated. A savings account also has service fees and minimum balance requirements to earn interest.

3) Transactions like deposits and withdrawals require identification and following bank procedures correctly, such as endorsing checks. Bank statements should be checked against personal records for accuracy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

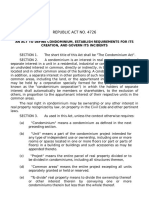

EducationUSA Ukraine

PRE-DEPARTURE ORIENTATION 2013

BANKING IN THE US

In the U.S., there are credit unions, saving and loans associations, and full-service banks. You can open an account in any of them. You may

ant to open a checking account, savings account, or both.

CHECKING ACCOUNT

If you open a checking account, you ill be alloed to deposit money into it and ithdra money from it, at the bank or at a banking

machine. You ill also be able to rite checks for specific amounts of money that ill then be taken out of your account. !he bank ill give

you a checkbook containing many checks. !o make a purchase, you fill out the check for the e"act amount of the sale and indicate hom you

are paying. #hecks are used in the U.S. the same ay cash is used. $efore you begin shopping, make sure that personal checks are accepted

there. Alays have % forms of identification ith you hen you rite a check. Ask at the bank ho to !"## o$t %he%ks %o&&e%t#'.

&hen opening a checking account, some points to consider are'

1( )onth#' Se&*"%e Cha&+e -- Is there a basic monthly fee or a fee for each check ritten(

2( )"n",$, Ba#an%e -- )ften, if you have the minimum amount in your account, you do not need to pay a service

charge. Is the balance checked daily *you need to have the minimum amount in your account at the end of each day+, or is the average

balanced checked at the and of the month( ,ake sure you understand the bank-s policy for calculating the minimum balance.

3( -Inte&est Che%k"n+. -- *the money in your checking account is earning interest+ #onsider the above % points and the minimum balance to

earn interest. If you do not have this minimum amount in your account, you ill not gain the interest. Understand ho the minimum balance

is calculated.

.. /$udget #hecking0 -- 1or people ho do not have a lot of money in the account at any one time. !he monthly service charge is usually less

and often there is no minimum balance. !here might be a fee for each check ritten over a specified number. 1or e"ample, the first 23 checks

ritten in a month are free, end any after 23 are 453 each.

SA/INGS ACCOUNT

If you open a savings account, you ill be alloed to deposit money into it and ithdra money from it, at the bank or at a banking machine.

!his money usually earns interest.

Some points to consider hen opening a savings account are'

1( )onth#' Se&*"%e Cha&+e -- 6o much is it(

2( )"n",$, Ba#an%e -- &hat is the minimum needed in your account to avoid monthly service charges and to earn interest( ,ake sure you

understand ho the minimum balance is calculated.

7ealistically assess your financial situation and pick the bank ith the most economical plan for you.

TRANSACTIONS

&hen you deposit or ithdra money, you are making a transaction. &hen you open an account, you ill receive a checkbook *checking+

and or passbook *savings+ ith your account numbers listed on them. You need to kno these numbers in order to make a transaction. &hen

you deposit a check into an account, you must endorse *sign+ the back of it. Ask at the bank ho to en0o&se a %he%k %o&&e%t#'. !his is very

important if you ant to receive your money.

7emember - hen making a deposit, the money is not immediately available for use. #arefully read the bank literature to understand the

length of time to complete transactions.

!he bank ill periodically send you a bank statement. !his is a list of all transactions for that period. Alays check the statement against your

on records and contact the bank if you find any discrepancies. $e aare of ho much money is in your checking account at all times so that

you do not bounce a check, or rite a check for money that you do not have in your account. If your check bounces, you ill be fined by the

bank and probably by the organi8ation to hom you paid the check.

If you are making a transaction at the bank, you ant to bring % forms of identification ith you. If you are making a ithdraal, the teller

may ask, /ho ould you like it(/ !his means in hat denominations do you ant to receive your money.

You can also conduct transactions at an A!, *Automated !eller ,achine+, if the bank has provided you ith a bank card. Sometimes there is

a fee for this bank card. $e sure to find out about transactions fees at A!,-s. Sometimes if the A!, is from a different bank, you have to pay

an e"tra fee. Your card ill have a pin, a numeric code to access the account. 9o not share this pin ith anyone else and do not store it ith

your A!, card.

BANKING BASICS

)ne of the first things you ill ant to do upon arrival in your ne city is to open a bank account. !he 1oreign Students )ffice ill be able to

assist ith this: the topic ill most likely be discussed in your orientation program hen you arrive.

T1PES O2 ACCOUNTS

#hecking Account. You ill probably ant to open a checking account to pay bills. #ash should never be sent through the mail. Apart from

paying bills, use of checks in the US varies 1rom state to state. In most states, the ill be accepted for purchases in stores, as long as

2+ you live in the state, and %+ you can sho appropriate photo identification *passport, driver-s license, perhaps a

student 2. 9.+

;uestions to ask hen opening a checking account'

2+ Is there a minimum balance( %+ 9o I pay for each check I rite( <+ &hat is the overdraft charge(

Savings Account: A savings account is the place to keep money that you do not need immediately. You ill earn interest on the money in a

savings account, but you cannot rite checks from it. You may ish to open a checking and saving account at the same bank, so that you can

easily transfer funds beteen the to.

Automatic Teller Machines: ,ost accounts include bank cards that can be used to ithdra money from automatic teller machines *A!,-s+

across the country. Apply for this card at the same time you apply for your account. A!, machines are located not only at banks, but also in

shopping malls, gas stations, and most likely on your campus. ,ost banks charge a fee if you ithdra cash from an A!, oned by another

bank: some banks have begun charging even if the A!, belongs to the bank. $e sure to ask=

BRINGING )ONE1

!here are several options for bringing money to the U.S. !hese include'

Traveler's checks' Easy to carry, idely accepted, and replaceable if lost or stolen, traveler-s checks are a safe ay to physically bring money

ith you.

Wire transfer: )nce you have opened a bank account, it is possible to have money ired from a bank at home to your bank in the U.S. !he

transfer generally take 5 orking days and re>uires a fee. Some universities also allo you to use ire transfer to one of their accounts if you

need to make tuition payments in advance of your arrival.

$ank 9raft?#ashier-s #heck' !his is a check guaranteed by a bank end should be dran in US dollars. $ank draft can <3 days or more to

/clear,/ meaning you cannot access your money for that amount of time. 9o not bring a bank draft for money you need immediately=

)ONE1 )ATTERS3BUDGETING

$efore you go, you ant to have a good idea of ho much studying in the U.S. ill cost. )n your 2-%3 or IA@-AA, the school you are going to

ill list e"pense estimates. !hese estimates are usually >uite accurate. Use them to prepare a budget for yourself, including the items listed

belo. It is useful to figure it by month, since you may be in the US during academic vacation periods.

ITE) A,o$nt Nee0e0 !o& One Se,este& A,o$nt Nee0e0 4e& )onth

!uition B 1ees

6ousing

1ood *or /$oard/+

$ooks B Supplies

6ealth Insurance

!ransportation

#lothing

Entertainment?!ravel

!a"es

5HEN BUDGETING6 REA7ISTIC8

!he school you are going to go ill tell you e"actly ho much, if any, financial aid you ill receive.

!his amount ill not change for at least the first year after you arrive.

Employment opportunities are limited, and, if you are on a C-l visa, any employment must be approved by

your sponsor. You should not plan on orking to meet your e"penses.

1inally, any scholarship or felloship money you receive ill be ta"ed, as ill any money you earn

through orking. $e sure to deduct this amount from your total available.

You might also like

- Subsidance in Low Rise BuildingsDocument177 pagesSubsidance in Low Rise Buildingsalphatotas100% (2)

- Extension of Time Claim ProcedureDocument108 pagesExtension of Time Claim ProcedureAshish Kumar GuptaNo ratings yet

- Presentation On How To Create Fake BillsDocument6 pagesPresentation On How To Create Fake Billssatya prakashNo ratings yet

- (Guide) Withdraw Funds From Your Limited Paypal AccountDocument1 page(Guide) Withdraw Funds From Your Limited Paypal AccountEbiko HenryNo ratings yet

- JP - Bank EBS Requiuirement Sheet ConfigDocument37 pagesJP - Bank EBS Requiuirement Sheet ConfigSahil SinhaNo ratings yet

- Banks QmblogDocument9 pagesBanks QmblogJohnCarter33No ratings yet

- 4.02 Business Banking Check Parts (B) - 2Document7 pages4.02 Business Banking Check Parts (B) - 2TrinityNo ratings yet

- Money - Buying, Selling, PayingDocument1 pageMoney - Buying, Selling, Payingsave1407No ratings yet

- Patrol Tactics Business ChecksDocument3 pagesPatrol Tactics Business ChecksIAHN NegotiatorNo ratings yet

- Do Not Use Doubtful Sources of InformationDocument21 pagesDo Not Use Doubtful Sources of InformationMallick Sajid KhanNo ratings yet

- Quantitative Methods AreDocument4 pagesQuantitative Methods ArePaupauNo ratings yet

- Digital Citizenship Lesson 3Document7 pagesDigital Citizenship Lesson 3api-239509004No ratings yet

- Letter UniversalDocument6 pagesLetter UniversalshanebuczekNo ratings yet

- Surefire Ways To Get Taken by Identity ThievesDocument3 pagesSurefire Ways To Get Taken by Identity ThievesvietrossNo ratings yet

- Cash Larceny From The DepositDocument3 pagesCash Larceny From The DepositFajria OktavianiNo ratings yet

- HDFC Bank Request For Credit Card UpgrdeDocument2 pagesHDFC Bank Request For Credit Card UpgrdeDhavalNo ratings yet

- Identity Theft 3Document2 pagesIdentity Theft 3Flaviub23No ratings yet

- A Faa Fraud HandbookDocument75 pagesA Faa Fraud HandbookAmira HerreraNo ratings yet

- HeyDocument395 pagesHeyVincentNo ratings yet

- Account Opening and Usage: Woodforest CheckingDocument42 pagesAccount Opening and Usage: Woodforest Checkingoloyede jamiuNo ratings yet

- Digital Cash and The Future of MoneyDocument13 pagesDigital Cash and The Future of MoneyNithin AntonyNo ratings yet

- Pimp QuestionsDocument4 pagesPimp QuestionsAmy Suzanne Bains0% (1)

- 1-Deposit TransactionDocument3 pages1-Deposit TransactionjieNo ratings yet

- Identifying and Reporting Consumer Frauds and ScamsDocument15 pagesIdentifying and Reporting Consumer Frauds and ScamsRichard BakerNo ratings yet

- Con Men ScamsDocument14 pagesCon Men ScamsTee R TaylorNo ratings yet

- Local Lucky AffDocument11 pagesLocal Lucky Affasdsa asdsdNo ratings yet

- Internet Fraud 570Document2 pagesInternet Fraud 570Flaviub23No ratings yet

- Romance FraudDocument20 pagesRomance FraudAlmaNo ratings yet

- Cashapp Balance - Google SearchDocument1 pageCashapp Balance - Google Searchayoolaibrahim571No ratings yet

- Personal Banking: Consumer Pricing InformationDocument5 pagesPersonal Banking: Consumer Pricing InformationSteph BryattNo ratings yet

- Identity Theft Across AmericaDocument72 pagesIdentity Theft Across AmericaSharath Raj GowdaNo ratings yet

- Trafficking TermsDocument2 pagesTrafficking Termsapi-518350342No ratings yet

- Atm-Code 1Document7 pagesAtm-Code 1Robert GallanesNo ratings yet

- Free Gift With CitiDocument2 pagesFree Gift With CitiTens TwoNo ratings yet

- Mobile BankingDocument17 pagesMobile BankingSuchet SinghNo ratings yet

- Frauds, Scams and Financial Euphoria: Jack LangDocument27 pagesFrauds, Scams and Financial Euphoria: Jack Langtejaskamble45No ratings yet

- Manufacturing Money, and Global Warming: Executive SummaryDocument35 pagesManufacturing Money, and Global Warming: Executive SummarynsloueyNo ratings yet

- Scam Victim TotalDocument2 pagesScam Victim TotalPatch MinnesotaNo ratings yet

- Hilsoft Check WriterDocument66 pagesHilsoft Check WriterMelvin RamosNo ratings yet

- Email & Password Authentication - FirebaseDocument7 pagesEmail & Password Authentication - FirebaseJuan C JocopNo ratings yet

- Technology Embarked The Issuance of New ICAO E-Passport: Case Study of Malaysia E-PassportDocument5 pagesTechnology Embarked The Issuance of New ICAO E-Passport: Case Study of Malaysia E-Passportcallmeayu100% (2)

- Types of Frauds and Evolution of Cyber Fraud TechniquesDocument45 pagesTypes of Frauds and Evolution of Cyber Fraud TechniquesRESHMI J URK19ISD011No ratings yet

- Summary of Your Rights Under The Fair Credit Reporting ActDocument3 pagesSummary of Your Rights Under The Fair Credit Reporting Actcarmen hernandezNo ratings yet

- AFP Police Check Identification DocumentsDocument1 pageAFP Police Check Identification DocumentsAzamNo ratings yet

- En 05 10064Document8 pagesEn 05 10064api-309082881No ratings yet

- Little Book ScamDocument48 pagesLittle Book ScamThom_L0% (2)

- Why We All Fall For Con ArtistsDocument5 pagesWhy We All Fall For Con ArtistsRichardNo ratings yet

- Catch Me If You Can - Lakessica CarterDocument10 pagesCatch Me If You Can - Lakessica CarterLaKessica B. Kates-CarterNo ratings yet

- Plastic MoneyDocument8 pagesPlastic MoneySagar PentiNo ratings yet

- Fake Check Scams Other Money Transfer ScamsDocument2 pagesFake Check Scams Other Money Transfer ScamsWinston BiscainoNo ratings yet

- Internet Banking User Handbook (English) & Frequently Asked Questions (FAQ)Document18 pagesInternet Banking User Handbook (English) & Frequently Asked Questions (FAQ)Zobi HossainNo ratings yet

- Credit CardsDocument24 pagesCredit Cardsramking509No ratings yet

- Cheque: What Is It?: Cheque Statistics Cheque Cheque ChequeDocument13 pagesCheque: What Is It?: Cheque Statistics Cheque Cheque ChequeMAdhuNo ratings yet

- Classified Ad Scams: How This Scam WorksDocument3 pagesClassified Ad Scams: How This Scam WorksRichardNo ratings yet

- 2020 BBB Employmentscams ReportDocument8 pages2020 BBB Employmentscams ReportTMJ4 NewsNo ratings yet

- A Cheque Is A DocumentDocument15 pagesA Cheque Is A Documentmi06bba030No ratings yet

- Practice Writing Checks - InddDocument6 pagesPractice Writing Checks - InddMAry Jovan PanganNo ratings yet

- $CASHOUTDocument22 pages$CASHOUTEnz DavieNo ratings yet

- Banks Banking On Security: Bank of AmericaDocument3 pagesBanks Banking On Security: Bank of AmericaJomar MarcillaNo ratings yet

- Access To Unemployment Insurance Benefits For Family CaregiversDocument29 pagesAccess To Unemployment Insurance Benefits For Family CaregiversElaine ManceNo ratings yet

- #3 Cultural MisunderstandingsDocument2 pages#3 Cultural MisunderstandingsKyiv EducationUSA Advising CenterNo ratings yet

- #6 Arrival To UkraineDocument1 page#6 Arrival To UkraineKyiv EducationUSA Advising CenterNo ratings yet

- #4 Leaving Ukraine - 2Document1 page#4 Leaving Ukraine - 2Kyiv EducationUSA Advising CenterNo ratings yet

- Pre-Departure Orientation 2013: ChecklistDocument1 pagePre-Departure Orientation 2013: ChecklistKyiv EducationUSA Advising CenterNo ratings yet

- #4 Leaving UkraineDocument1 page#4 Leaving UkraineKyiv EducationUSA Advising CenterNo ratings yet

- #1 Housing in The USDocument2 pages#1 Housing in The USKyiv EducationUSA Advising CenterNo ratings yet

- #5 Arrival To The USDocument1 page#5 Arrival To The USKyiv EducationUSA Advising CenterNo ratings yet

- Pre-Departure Orientation 2013: University Health CareDocument1 pagePre-Departure Orientation 2013: University Health CareKyiv EducationUSA Advising CenterNo ratings yet

- #3 TravellingDocument1 page#3 TravellingKyiv EducationUSA Advising CenterNo ratings yet

- #2 Written AssignmentsDocument2 pages#2 Written AssignmentsKyiv EducationUSA Advising CenterNo ratings yet

- #3 Academic Issues&SafetyDocument2 pages#3 Academic Issues&SafetyKyiv EducationUSA Advising CenterNo ratings yet

- Georgia State IEP Application InstructionsDocument2 pagesGeorgia State IEP Application InstructionsKyiv EducationUSA Advising CenterNo ratings yet

- University of North Florida Requirements (With TOEFL)Document2 pagesUniversity of North Florida Requirements (With TOEFL)Kyiv EducationUSA Advising CenterNo ratings yet

- #1 Beginning Your EducationDocument4 pages#1 Beginning Your EducationKyiv EducationUSA Advising CenterNo ratings yet

- Advice From Ukrainian StudentsDocument4 pagesAdvice From Ukrainian StudentsKyiv EducationUSA Advising CenterNo ratings yet

- EdUSA Weekly Update Issue #370 March 17th, 2014Document5 pagesEdUSA Weekly Update Issue #370 March 17th, 2014Kyiv EducationUSA Advising CenterNo ratings yet

- Definition DebenturesDocument8 pagesDefinition DebenturesDipanjan DasNo ratings yet

- Rural Bank of Lipa City Vs CA Case DigestDocument5 pagesRural Bank of Lipa City Vs CA Case DigestBerch Melendez100% (1)

- Nenova Somalia PrivateSectorDocument14 pagesNenova Somalia PrivateSectoryrdgcgf5664No ratings yet

- Brochure of Sector-21-Commercial Kath MandiDocument8 pagesBrochure of Sector-21-Commercial Kath MandiAshish DixitNo ratings yet

- AB-066 Appl Engineer-Oper ExamDocument1 pageAB-066 Appl Engineer-Oper ExamtayyabemeNo ratings yet

- Rediscovering Ramachandra Mangaraj and Historicizing Senapati's Critique of ColonialismDocument2 pagesRediscovering Ramachandra Mangaraj and Historicizing Senapati's Critique of ColonialismEdificator BroNo ratings yet

- IncomeTax MaterialDocument91 pagesIncomeTax MaterialSandeep JaiswalNo ratings yet

- Ra 4726Document11 pagesRa 4726Dessa ReyesNo ratings yet

- Research Proposal: Impact of Micro Finance Institutions On Women Empowerment in Zambia by Mutale Tricia BwalyaDocument19 pagesResearch Proposal: Impact of Micro Finance Institutions On Women Empowerment in Zambia by Mutale Tricia BwalyaUtkarsh MishraNo ratings yet

- Bonded Labour IDocument21 pagesBonded Labour Iritika dhidhiNo ratings yet

- Fintech: Redef Ining Banking For Customers: Decade Edition of Cii Banking Tech Summit 2016Document24 pagesFintech: Redef Ining Banking For Customers: Decade Edition of Cii Banking Tech Summit 2016Arun NairNo ratings yet

- The Recto Law and Maceda LawDocument4 pagesThe Recto Law and Maceda LawMs. FitNo ratings yet

- C.G. - Greenbury CommitteeDocument15 pagesC.G. - Greenbury Committeeitsme_varun100% (3)

- LINA CALILAP-ASMERON, Petitioner vs. Development Bank of The Philippines, RespondentsDocument3 pagesLINA CALILAP-ASMERON, Petitioner vs. Development Bank of The Philippines, RespondentsImba SkyNo ratings yet

- Working Capital Management at Tata SteelDocument110 pagesWorking Capital Management at Tata SteelKrishnendu BanerjeeNo ratings yet

- Ca. Pramod Jain Ca. Pramod Jain Lunawat & Co. Lunawat & CoDocument67 pagesCa. Pramod Jain Ca. Pramod Jain Lunawat & Co. Lunawat & CoPrasad Sabale PatilNo ratings yet

- The Civil Code of The PhilippinesDocument8 pagesThe Civil Code of The PhilippinesJerome PunzalanNo ratings yet

- Myanmar Companie Law Draft 2016Document189 pagesMyanmar Companie Law Draft 2016THAN HAN100% (1)

- Company Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDocument9 pagesCompany Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNo ratings yet

- Accounting Principles 10th Chapter 1Document48 pagesAccounting Principles 10th Chapter 1Osama Alvi100% (1)

- Oblicon DigestDocument26 pagesOblicon DigestAleezah Gertrude RegadoNo ratings yet

- Fitness FitnessDocument21 pagesFitness FitnessAndinetNo ratings yet

- Delos Santos Vs VibarDocument2 pagesDelos Santos Vs VibarJai Rel RadlynNo ratings yet

- HCMP000443 2015Document45 pagesHCMP000443 2015pschilNo ratings yet

- Seth Padam Chand Jain Institute of Commerce, Business Management & EconomicsDocument72 pagesSeth Padam Chand Jain Institute of Commerce, Business Management & EconomicsVipul VermaNo ratings yet

- Kim KiyosakiDocument4 pagesKim KiyosakiAlice Azucena FerreiraNo ratings yet

- Equitable Pci Bank vs. OngDocument3 pagesEquitable Pci Bank vs. OngCML100% (1)