Professional Documents

Culture Documents

Project Macroeconomics

Project Macroeconomics

Uploaded by

AparnaHariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Macroeconomics

Project Macroeconomics

Uploaded by

AparnaHariCopyright:

Available Formats

MACROECONOMIC REVIEW

Global Economy

Recovery is on track in 2014, though tightening nancial conditions and the divergence in

ination pose risks.

On the current reckoning, global growth is likely to be in the vicinity of 3 per cent in 2014, about

a percentage point higher than in 2013. The expansion in global output is expected to be led by

advanced economies (AEs), especially the US. However, downside risks to growth trajectory arise

from ongoing tapering of quantitative easing (QE) in the US, continuing deation concerns and weak

balance sheets in the euro area and, inflationary pressures in the emerging market and developing

economies (EMDEs).

Weakening growth and nancial fragilities in China that have arisen from rapid credit in recent years

pose a large risk to global trade and growth.

Improved EMDE growth emanated largely from external demand on the back of currency

depreciation in these countries.

Global ination remains benign with activity levels staying below potential in the AEs as well as in

some large EMDEs and a softer bias for global commodity prices continuing into 2014. With

corporate leverage rising in many EMDEs, capital ow volatility could translate into liquidity shocks

impacting asset prices.

The Indian Economy

The Indian economy is set on a disinationary path, but more efforts may be needed to

secure recovery.

While the global environment remains challenging, policy action in India has rebuilt buffers to

cushion it against possible spillovers. These buffers effectively bulwarked the Indian economy against

the two recent occasions of spillovers to EMDEs the rst, when the US Fed started the withdrawal

of its large scale asset purchase programme and the second, which followed escalation of the Ukraine

crisis. On both these occasions, Indian markets were less volatile than most of its emerging market

peers.

With the narrowing of the twin decits both current account and fiscal as well as the replenishment

of foreign exchange reserves, adjustment of the rupee exchange rate, and more importantly, setting in

motion disinationary impulses, the risks of near-term macro instability have diminished. The

disinationary process is already underway with the headline ination trending down in line with the

glide path, though inflation stays well above comfort levels. Growth concerns remain signicant with

GDP growth staying sub-5 per cent for seven successive quarters and index of industrial production

(IIP) growth stagnating for two successive years. Though a negative output gap has prevailed for long,

there is clear evidence that potential growth has fallen considerably with high ination and low

growth.

OUTPUT AND DEMAND

Growth stays low, structural constraints affect potential output.

Growth in the Indian economy had been shifting down from 9.6 per cent in Q4 of 201011.It troughed

around 4.4 per cent for three quarters from Q3 of 2012-13 to Q1 of 2013-14. Since then there are

signs of growth bottoming out with marginal improvement recorded during Q2 and Q3 of 2013-14 to

4.8 and 4.7 per cent respectively.

Decline in nancial savings, sluggish growth in fixed capital formation over successive quarters,

persistently high ination and low business condence contributed to the decline in potential growth.

The economy seems to be running a negative output gap of about one percentage point

Agriculture sector witnessed record production

The satisfactory monsoon and the absence of extreme climatic events until lately augur well for

agricultural production and rural demand. As per the second advance estimates, the production of rice,

wheat, pulses, oilseeds and cotton during 2013-14 have been estimated to be the highest ever.

The possible effects of El Nino on the monsoon also add an additional element of uncertainty for

future harvests. In this backdrop, the ability to meet increased food demand in the context of the

implementation of the National Food Security Act, in the face of tightening farm labour markets and

rising input costs remains a challenge.

I ndustrial growth stagnating

The Index of Industrial Production (IIP) showed no increase during April-January 2013-14, compared

with 1.0 per cent growth in the corresponding period of the previous year.This stagnation in growth

over two years reects subdued investment and consumption demand. This has resulted in contraction

in production of capital goods and consumer durables in the current year.

Growth of core industries, which provide key inputs to the industrial sector, remained sluggish at 2.4

per cent during April-January 2013-14 compared to a growth of 6.9 per in the corresponding period a

year ago.

Lead indicators of services sector indicate an uptick

The developments in lead indicators of the services sector activity signal improvement in most

segments except cement production and in commercial vehicle sales.

Employment scenario showing signs of gradual recuperation

Aggregate sales growth (y-o-y) of large companies decelerated in Q3

Corporate investment intentions improved in Q3

INFLATION

Food price corrections moderate inationary pressures.

CPI ination declined to 8.1 per cent in February 2014 (a 25-month low) from 11.2 per cent in

November 2013, mainly due to declining vegetable prices during this three-month period.

CPI ination, excluding food and fuel, remained high and persistent at 8.0 per cent in

February 2014 as compared with 8.1 per cent in January 2014.The persistence was on account of

pressures from housing, transport and communication and services led components such as medical

care, education and stationery, household requisites and others.

WPI inflation moderates signicantly, but fuel ination remains high

CAD improves, driven mainly by declining imports

The narrowing of the CAD in 2013-14 followed a lower trade decit due to higher exports as well as

moderation in imports.

With a lower CAD and build-up of foreign exchange reserves, the downward pressure on the currency

and the volatility in the Indian rupee began to subside. The rupee has also moved in a narrow range of

Rs.60.10 to Rs.62.99 per US dollar since end-November 2013 (up to March 28, 2014).

MONETARY AND FINANCIAL CONDITIONS

A 25 bps hike in policy rate undertaken in January to secure economy on disinationary

path

The Reserve Bank in its Third Quarter 2014, hiked the repo rate by 25 bps to 8 per cent on account of

upside risks to ination, to anchor ination expectation and to contain second round effects.

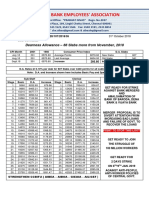

TOP 12 COUNTRIES AS PER GDP:

GDP

Billion

USD

GDP

YoY

GDP

QoQ

Interest

rate

Inflation

rate

Jobless

rate

Gov.

Budget

Debt/GDP

Current

Account

Exchange

rate

Population

United

States

15685 2.60% 2.60% 0.25% 1.50% 6.70% -4.10% 101.53% -2.30 119.89 317.30

Euro Area 12195 0.50% 0.20% 0.25% 0.50% 11.90% -3.00% 92.60% 1.50 1.35 332.88

China 8230 7.40% 1.40% 6.00% 2.40% 4.10% -2.10% 26.00% 2.00 6.06 1354.04

Japan 5960 2.60% 0.20% 0.00% 1.50% 3.60% -7.60% 227.20% 0.70 102.10 127.22

Germany 3400 1.30% 0.40% 0.25% 1.04% 5.10% 0.00% 78.40% 7.30 1.35 81.84

France 2613 0.80% 0.30% 0.25% 0.60% 10.20% -4.30% 93.50% -1.90 1.35 65.28

United

Kingdom

2440 2.70% 0.70% 0.50% 1.60% 6.90% -5.80% 90.60% -4.40 1.64 63.26

Brazil 2435 1.90% 0.70% 11.00% 6.15% 5.00% 1.90% 65.10% -3.66 2.41 193.94

Russia 2015 0.80% -0.50% 7.00% 6.90% 5.40% -0.50% 8.40% 4.80 35.23 143.35

Italy 2013 -0.90% 0.10% 0.25% 0.37% 13.00% -3.00% 132.60% -0.70 1.35 59.39

India 1842 4.70% 1.00% 8.00% 8.31% 3.80% -4.90% 67.57% -4.60 62.72 1233.00

Unemployment Rate

The unemployment rate can be defined as the number of people actively looking for a job

divided by the labour force. Changes in unemployment depend mostly on inflows made up of

non-employed people starting to look for jobs, of employed people who lose their jobs and

look for new ones and of people who stop looking for employment.

India Unemployment Rate

Unemployment Rate in India decreased to 3.80 percent in 2011 from 9.40 percent in 2010. Unemployment Rate

in India is reported by the India Ministry of Labour. From 1983 until 2011, India Unemployment Rate averaged

7.6 Percent reaching an all time high of 9.4 Percent in December of 2010 and a record low of 3.8 Percent in

December of 2011. In India, the unemployment rate measures the number of people actively looking for a job as

a percentage of the labour force.

Actu

al

Previous Highest Lowest Forecast Dates Unit

Frequenc

y

3.80 9.40 9.40 3.80 0.10 | 2014/06 1983 - 2011 Percent Yearly

Interest Rate

The interest rate shown refers to the central bank benchmark interest rate. Usually, the central

bank benchmark interest rate is the overnight rate at which central banks make loans to the

commercial banks under their jurisdiction. Moving the benchmark interest rate, the central

bank is able to make an impact on interest rates of commercial banks, inflation level of the

country and national currency exchange rate. Reduction of interest rates should bring increase

in business activity, a rise in inflation rate and weakening of national currency. In case of

increase in interest rates the level of business activity is likely to drop, inflation declines and

national currency strengthens.

India Interest Rate

The benchmark interest rate in India was last recorded at 8 percent. Interest Rate in India is

reported by the Reserve Bank of India. Interest Rate in India averaged 6.62 Percent from

2000 until 2014, reaching an all time high of 14.50 Percent in August of 2000 and a record

low of 4.25 Percent in April of 2009. In India, interest rate decisions are taken by the

Reserve Bank of India's Central Board of Directors. The official interest rate is the

benchmark repurchase rate.

Actual Previous Highest Lowest Forecast Dates Unit Frequency

8.00 8.00 14.50 4.25 7.75 | 2014/06 2000 - 2014 Percent Monthly

Industrial Production

Industrial Production Index is an economic indicator that measures changes in output for the

manufacturing, mining, and utilities. Although these sectors contribute only a small portion

of GDP, they are highly sensitive to interest rates and consumer demand. This makes

Industrial Production an important tool for forecasting future GDP and economic

performance. Industrial Production figures are also used by central banks to measure

inflation, as high levels of industrial production can lead to uncontrolled levels of

consumption and rapid inflation.

India Industrial Production

Industrial Production in India decreased 1.90 percent in February of 2014 over the same

month in the previous year. Industrial Production in India is reported by the Ministry of

Statistics and Programme Implementation (MOSPI). Industrial Production in India averaged

6.76 Percent from 1994 until 2014, reaching an all time high of 20 Percent in November of

2006 and a record low of -7.20 Percent in February of 2009. In India, industrial production

measures the output of businesses integrated in industrial sector of the economy such as

manufacturing, mining, and utilities.

Actual Previous Highest Lowest Forecast Dates Unit Frequency

-1.90 0.80 20.00 -7.20 1.63 | 2014/06 1994 - 2014 Percent Monthly

GDP Annual Growth Rate

The annual growth rate in Gross Domestic Product measures the increase in value of the

goods and services produced by an economy over the period of a year. Therefore, unlike the

commonly used quarterly GDP growth rate the annual GDP growth rate takes into account a

full year of economic activity, thus avoiding the need to make any type of seasonal

adjustment.

India GDP Annual Growth Rate

The Gross Domestic Product (GDP) in India expanded 4.70 percent in the fourth quarter of

2013 over the same quarter of the previous year. GDP Annual Growth Rate in India is

reported by the Ministry of Statistics and Programme Implementation (MOSPI). GDP Annual

Growth Rate in India averaged 5.84 Percent from 1951 until 2013, reaching an all time high

of 11.40 Percent in the first quarter of 2010 and a record low of -5.20 Percent in the fourth

quarter of 1979. In India, the annual growth rate in GDP at factor cost measures the change

in the value of the goods and services produced in India, without counting governments

involvement. Simply, the GDP value excludes indirect taxes (VAT) paid to the government

and includes the original value of products without accounting for government subsidies.

Indian GDP Grows Below Expectations

In the fourth quarter of 2013, Indian economic growth slowed to 4.7 percent over a year

earlier, down from a 4.8 percent expansion in the previous period, hurt by a contraction in

manufacturing and mining output.

On an annual basis, finance, insurance, real estate and business activities recorded the highest

growth rate (12.5 percent), accelerating from a 10 percent expansion in the previous quarter.

Community, social and personal services advanced at a faster pace of 7 percent (4.2 percent

in the September quarter) and trade, hotels, transport and communication activities rose 4.3

percent on the year.

Construction output slowed sharply to an annual growth rate of 0.6 percent (4.3 percent in the

preceding three month period); electricity, water and gas supply rose 5 percent and

agricultural production advanced at a slower pace of 3.6 percent.

In contrast, mining and manufacturing production shrank on the year. Mining contracted 1.6

percent while manufacturing dropped 1.9 percent, following a 1 percent expansion in the

previous quarter.

Wholesale Price Index

WPI is the index that is used to measure the change in the average price level of goods traded in

wholesale market. In India, a total of 435 commodities data on price level is tracked through WPI

which is an indicator of movement in prices of commodities in all trade and transactions. It is also

the price index which is available on a weekly basis with the shortest possible time lag only two

weeks. The Indian government has taken WPI as an indicator of the rate of inflation in the economy.

India Wholesale Price Index Change

Producer Prices in India increased 5.70 percent in March of 2014 over the same month in the

previous year. Producer Prices Change in India is reported by the Office of the Economic Advisor,

India. Producer Prices Change in India averaged 7.70 Percent from 1969 until 2014, reaching an all

time high of 34.68 Percent in September of 1974 and a record low of -11.31 Percent in May of 1976.

In India, the wholesale price index (WPI) is the main measure of inflation. The WPI measures the

price of a representative basket of wholesale goods. In India, wholesale price index is divided into

three groups: Primary Articles (20.1 percent of total weight), Fuel and Power (14.9 percent) and

Manufactured Products (65 percent). Food Articles from the Primary Articles Group account for 14.3

percent of the total weight. The most important components of the Manufactured Products Group

are Chemicals and Chemical products (12 percent of the total weight); Basic Metals, Alloys and Metal

Products (10.8 percent); Machinery and Machine Tools (8.9 percent); Textiles (7.3 percent) and

Transport, Equipment and Parts (5.2 percent).

Actual Previous Highest Lowest Forecast Dates Unit Frequency

5.70 4.68 34.68 -11.31 5.62 | 2014/06 1969 - 2014 Percent Monthly

In March of 2014, India wholesale prices accelerated to an annual 5.7 percent on higher

food, fuel and manufacturing cost, breaking a three-month easing trend.

Year-on-year, food prices accelerated to 9.9 percent from 8.12 percent recorded in February.

Cost of potato surged 27.83 percent, fruit prices rose 16.15 percent and rice cost increased

12.56 percent. Price of vegetables rose 8.57 percent.

Cost of non-food articles slowed to an annual 4.62 percent (5.13 percent in February); prices

of manufactured goods accelerated to 3.23 percent from 2.76 percent in the previous month

and cost of fuel and power rose at a faster 11.22 percent, boosted by a 9.28 percent increase

in liquefied petroleum gas and a 14.63 percent rise in prices of high speed diesel.

From February to March, wholesale prices accelerated to 0.5 percent. The heavily weighted

manufactured products sub index rose 0.52 percent and prices of food articles increased 1

percent.

Current Account

Current Account is the sum of the balance of trade (exports minus imports of goods and

services), net factor income (such as interest and dividends) and net transfer payments (such

as foreign aid). The balance of trade is typically the most important part of the current

account. And a current account surplus is usually associated with trade surplus. However, for

the few countries with substantial overseas assets or liabilities, net factor payments may be

significant. Positive net sales to abroad generally contribute to a current account surplus as

the value interest or dividends generated abroad is bigger than the value of interest or

dividends generated from foreign capital in the country. Net transfer payments are very

important part of the current account in poor and developing countries as workers'

remittances, donations, aids and grants and official assistance may balance high trade deficits.

India Current Account

India recorded a Current Account deficit of 4.20 USD Billion in the fourth quarter of 2013.

Current Account in India is reported by the Reserve Bank of India. Current Account in India

averaged -1.63 USD Billion from 1949 until 2013, reaching an all time high of 7.36 USD

Billion in the first quarter of 2004 and a record low of -31.86 USD Billion in the fourth

quarter of 2012. Current Account is the sum of the balance of trade (exports minus imports

of goods and services), net factor income (such as interest and dividends) and net transfer

payments (such as foreign aid).

Actual Previous Highest Lowest Forecast Dates Unit Frequency

-4.20 -5.15 7.36 -31.86 7.82 | 2014/06 1949 - 2013 USD Billion Quarterly

Balance of Trade

The balance of trade is the difference between the monetary value of exports and imports in

an economy over a certain period of time. A positive balance of trade is known as a trade

surplus and occurs when value of exports is higher than that of imports; a negative balance of

trade is known as a trade deficit or a trade gap.

India Balance of Trade

India recorded a trade deficit of 10507.30 USD Million in March of 2014. Balance of

Trade in India is reported by the Ministry of Commerce and Industry, India. Balance of

Trade in India averaged -1824.10 USD Million from 1957 until 2014, reaching an all

time high of 258.90 USD Million in March of 1977 and a record low of -20210.90 USD

Million in October of 2012. India had been recording sustained trade deficits due to

low exports base and high imports of coal and oil for its energy needs. India is leading

exporter of petroleum products, gems and jewelry, textiles, engineering goods,

chemicals and services. Main trading partners are European Union countries, United

States, China and UAE.

Actual Previous Highest Lowest Forecast Dates Unit

Frequenc

y

-

10507.3

0

-8130.20 258.90 -20210.90 -8380.76 | 2014/04 1957 - 2014 USD Million Monthly

MONETARY POLICY

A Tool used to influence Interest rates, Inflation and credit availability through changes in supply of

money available in the economy.

Different rates in monetary policy used by RBI :-

Repo Rate:

Repo rate is the rate at which banks borrow funds from the RBI to meet the gap between the

demand they are facing for money (loans) and how much they have on hand to lend. The

policy repo rate has been reduced under the liquidity adjustment facility (LAF) by 25 basis

points from 7.5 per cent to 7.25 per cent

Reverse Repo Rate:

The rate at which RBI borrows money from the banks (or banks lend money to the RBI) is

termed the reverse repo rate. The RBI uses this tool when it feels there is too much money

floating in the banking system. The reverse repo rate under the LAF, determined with a

spread of 100 basis points below the repo rate, stands adjusted to 6.25 per cent

Marginal Standing Facility Rate:

MSF is a new scheme announced by the Reserve Bank of India (RBI) in its Monetary Policy

(2011-12) and refers to the penal rate at which banks can borrow money from the central

bank over and above what is available to them through the LAF window. MSF, being a penal

rate, is always fixed above the repo rate. The MSF would be the last resort for banks once

they exhaust all borrowing options including the liquidity adjustment facility by pledging

through government securities, which has lower rate of interest in comparison with the MSF.

The Marginal Standing Facility (MSF) rate, determined with a spread of 100 basis points

above the repo rate, stands adjusted to 8.25 per cent .

Bank Rate:

Rate at which Central Bank lends money to commercial Banks

The bank rate signals the central bank's long-term outlook on interest rates. If the bank rate

moves up, long-term interest rates also tend to move up, and vice-versa.

Any increase in Bank rate results in an increase in interest rate charged by Commercial

banks which in turn leads to low level of investment and low inflation

The Bank Rate stands adjusted to 8.25 per cent

Cash Reserve Ratio:

It refers to the cash which banks have to maintain with RBI as certain percentage of their

demand and time liabilities

An increase in CRR reduces the cash with commercial banks which results in low supply of

currency in the market, higher interest rate and low inflation

The cash reserve ratio (CRR) of scheduled banks has been retained at 4.0 per cent of their

net demand and time liabilities (NDTL).

LAF:

Liquidity adjustment facility is a monetary policy tool which allows banks to borrow money

through repurchase agreements. LAF is used to aid banks in adjusting the day to day

mismatches in liquidity. LAF consists of repo and reverse repo operations. Repo or

repurchase option is a collaterised lending i.e. banks borrow money from Reserve bank of

India to meet short term needs by selling securities to RBI with an agreement to repurchase

the same at predetermined rate and date. The rate charged by RBI for this transaction is called

the repo rate. Repo operations therefore inject liquidity into the system. Reverse repo

operation is when RBI borrows money from banks by lending securities. The interest rate

paid by RBI is in this case is called the reverse repo rate. Reverse repo operation therefore

absorbs the liquidity in the system.

TRANSMISSION MECHANISM

The way in which changes in the repo rate affect inflation and the rest of the economy is

known as the transmission mechanism. The transmission mechanism is actually not one but

several different mechanisms that interact. Some of these have a more or less direct impact on

inflation while others take longer to have an effect. It is generally held that a change in the

repo rate has its greatest impact on inflation after one to two years.

Interest Rate Channel:-

When Repo Rate increases.

Banks borrow from RBI at a higher rates of interest

They lend it to the borrowers at a high rate of interest

As lending interest rate increases, borrowing of money decreases.

Banks become unable to borrow at repo rate

Increase in the deposit interest rate to attract depositors.

Exchange Rate Channel:-

When Repo Rate increases.

Interest Rate Increases

Makes Indian assets more attractive than investments denominated in other currencies

Results in a capital inflow and increased demand for Rupees which strengthens the

Exchange Rate.

Fall in exports & increase in imports

Lower Import Prices & Reduction in demand

Lower Inflation.

On the basis of an assessment of the current and evolving macroeconomic situation,

the RBI has decided to:

increase the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis

points from 7.75 per cent to 8.0 per cent;

and keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent

of net demand and time liability (NDTL).

Consequently, the reverse repo rate under the LAF stands adjusted at 7.0 per cent,

and the marginal standing facility (MSF) rate and the Bank Rate at 9.0 per cent.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Norman G. Fosback - Stock Market Logic - A Sophisticated Approach To Profits On Wall Street-Dearborn Financial Publishing, Inc. (1991)Document396 pagesNorman G. Fosback - Stock Market Logic - A Sophisticated Approach To Profits On Wall Street-Dearborn Financial Publishing, Inc. (1991)Tim Vermeers100% (24)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Jawaban E 5-7 E5-8 Advanced AccountingDocument3 pagesJawaban E 5-7 E5-8 Advanced AccountingMutia Wardani67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HOBA ProblemsDocument3 pagesHOBA ProblemsEmma Mariz Garcia67% (3)

- Karnataka EconomyDocument14 pagesKarnataka EconomyPrathvi NaikNo ratings yet

- Ihs Markit Is SectorsDocument2 pagesIhs Markit Is SectorsKapilanNavaratnamNo ratings yet

- SMEMasterplan2012 2020 PDFDocument132 pagesSMEMasterplan2012 2020 PDFMuhammad FadilNo ratings yet

- 7.3.interest Measurement of A FundDocument10 pages7.3.interest Measurement of A FundNanang SusyantoNo ratings yet

- ECO202-Practice Test - 15 (CH 15)Document4 pagesECO202-Practice Test - 15 (CH 15)Aly HoudrojNo ratings yet

- The Construction Sector and Economic DevelopmentDocument8 pagesThe Construction Sector and Economic DevelopmentPeter Jean-jacquesNo ratings yet

- Databook DCH OctoberDocument317 pagesDatabook DCH OctoberRavi Kumar MahatoNo ratings yet

- Paasche and Laspeyres Price IndicesDocument7 pagesPaasche and Laspeyres Price IndicesNurshahirahDeanaNo ratings yet

- Consumer Price Index - Oct 14Document4 pagesConsumer Price Index - Oct 14BernewsAdminNo ratings yet

- Airport EIA Final ReportDocument20 pagesAirport EIA Final ReportMcKenzie StaufferNo ratings yet

- Project ReportDocument17 pagesProject Reportshiva7363No ratings yet

- Chap008 Text Bank (1) SolutionDocument9 pagesChap008 Text Bank (1) SolutionpauljohnsharpNo ratings yet

- Economics Notes For IasDocument11 pagesEconomics Notes For IasVishal Rai50% (4)

- Ch09 - National Income DeterminationDocument47 pagesCh09 - National Income DeterminationHanson OwusuNo ratings yet

- Table 1: The Economy of Sea Island 2006 2007Document7 pagesTable 1: The Economy of Sea Island 2006 2007saiknaramNo ratings yet

- International Yearbook of Industrial Statistics 2018Document673 pagesInternational Yearbook of Industrial Statistics 2018marmaduke32100% (1)

- China Automobile Parts Accessories Industry Profile Cic3725Document8 pagesChina Automobile Parts Accessories Industry Profile Cic3725AllChinaReports.comNo ratings yet

- Economics GNP MalaysiaDocument14 pagesEconomics GNP Malaysiakayrul700% (1)

- IMF Inflation Dynamics in The CEMAC RegionDocument30 pagesIMF Inflation Dynamics in The CEMAC RegioncameroonwebnewsNo ratings yet

- Working Paper June 2015: Manufacturing or Services? An Indian Illustration of A Development DilemmaDocument53 pagesWorking Paper June 2015: Manufacturing or Services? An Indian Illustration of A Development DilemmarobieNo ratings yet

- PWT 90Document1,315 pagesPWT 90burcakkaplanNo ratings yet

- National Income CorrectedDocument7 pagesNational Income CorrectedMoorNo ratings yet

- Wholesale Price Index & Consumer Price IndexDocument7 pagesWholesale Price Index & Consumer Price IndexfeelfreetodropinNo ratings yet

- Da Chart New From Nov-1Document2 pagesDa Chart New From Nov-1nellaimathivel4489No ratings yet

- 2016 Statistical YearbookDocument125 pages2016 Statistical YearbooklamillionnaireNo ratings yet

- The Wholesale Price IndexDocument3 pagesThe Wholesale Price IndexKunal MahajanNo ratings yet

- ES0946Document2 pagesES0946Shawon CorleoneNo ratings yet