Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

22 viewsCash & Receivables Management

Cash & Receivables Management

Uploaded by

Ezaz Ahmedcs

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Pronto Pizza Problem SubmissionDocument13 pagesPronto Pizza Problem SubmissionVikas Vimal100% (5)

- Roadwork Projects Quality Control PlanDocument17 pagesRoadwork Projects Quality Control PlanSPHERICBLUE100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manager As CoachDocument312 pagesManager As CoachDennis Shongi100% (1)

- Kotak InsuraceDocument1 pageKotak InsuraceRemo RomeoNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Mine Black Book ProjectDocument47 pagesMine Black Book ProjectHemal VyasNo ratings yet

- Recent Trends in Public Sector BanksDocument79 pagesRecent Trends in Public Sector Banksnitesh01cool67% (3)

- Lee Chang Opened Chang S Cleaning Service On July 1 2010 PDFDocument1 pageLee Chang Opened Chang S Cleaning Service On July 1 2010 PDFAnbu jaromiaNo ratings yet

- Estimating Construction Cost in Chemical Process IndustriesDocument3 pagesEstimating Construction Cost in Chemical Process Industriessatya.usct.900450No ratings yet

- Value ChainDocument7 pagesValue ChainDolly ParhawkNo ratings yet

- Blue ch04Document32 pagesBlue ch04Lokesh ShahareNo ratings yet

- Business Portfolio: The Growth-Share MatrixDocument2 pagesBusiness Portfolio: The Growth-Share MatrixUsama KhanNo ratings yet

- Go 38 Ap Teacher Eligibility Tet Cum Recruitment Test Guidelines - Ap DSC 2014 GuidelinesDocument16 pagesGo 38 Ap Teacher Eligibility Tet Cum Recruitment Test Guidelines - Ap DSC 2014 Guidelinesapi-247813089No ratings yet

- Evolution of Future Group - King of Indian Retail IndustryDocument17 pagesEvolution of Future Group - King of Indian Retail IndustrySurya PrakashNo ratings yet

- Mahindra & Mahindra LTD.: Automotive & Farm Equipment SectorsDocument2 pagesMahindra & Mahindra LTD.: Automotive & Farm Equipment SectorsSunil ChoudharyNo ratings yet

- Brand Finance Indonesia 2018Document20 pagesBrand Finance Indonesia 2018Aryu NutsNo ratings yet

- DOOWIN Load Test Water Bags & Underwater Air Lifting BagsDocument10 pagesDOOWIN Load Test Water Bags & Underwater Air Lifting BagsDavidNo ratings yet

- PH.D Thesis M. UshaDocument185 pagesPH.D Thesis M. UshaAdrian Serban100% (1)

- Contract Law 1 NotesDocument20 pagesContract Law 1 NotesThe Law ClassroomNo ratings yet

- Employment Agencies HRM 2018Document2 pagesEmployment Agencies HRM 2018RuchirNo ratings yet

- Banking and Microfinance - IIDocument24 pagesBanking and Microfinance - IIKoyelNo ratings yet

- Project Feasibility StudyDocument22 pagesProject Feasibility StudyIan Bagunas100% (1)

- BVADocument52 pagesBVACiprian StroeNo ratings yet

- Week 3 - Business Level Strategy - ResumeDocument4 pagesWeek 3 - Business Level Strategy - ResumeVinaNo ratings yet

- AAACK7632B-2013-14 Form 26AASDocument7 pagesAAACK7632B-2013-14 Form 26AASRama Prasad PadhyNo ratings yet

- Value Engineering Case StudyDocument7 pagesValue Engineering Case StudyYadhu JSNo ratings yet

- A Summer Tranning Project Report Study On: Master of Business Administration SESSION (2012-2014)Document70 pagesA Summer Tranning Project Report Study On: Master of Business Administration SESSION (2012-2014)Amarbant Singh DNo ratings yet

- Formal Entry Import Cargo ClearanceDocument13 pagesFormal Entry Import Cargo ClearancepoypisaypeyupsNo ratings yet

- ALU Vs NLRCDocument2 pagesALU Vs NLRCimangandaNo ratings yet

- Building An Organization Capable of Good Strategy Execution: People, Capabilities, and StructureDocument31 pagesBuilding An Organization Capable of Good Strategy Execution: People, Capabilities, and Structuremrt8888100% (1)

Cash & Receivables Management

Cash & Receivables Management

Uploaded by

Ezaz Ahmed0 ratings0% found this document useful (0 votes)

22 views68 pagescs

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcs

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

22 views68 pagesCash & Receivables Management

Cash & Receivables Management

Uploaded by

Ezaz Ahmedcs

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 68

CONTENTS

Chapter no Chapter name

1. Statement of the problem

2. Introduction to the concept of cash and

receivables

3. Research design and methodology

-Obectives of the study

-!ethodology

-Scope of the study

-"imitations

#. Industry profile

$. Company profile

%. &nalysis of cash and receivables

management

'. (indings

). Suggestions

*. Conclusions

1+. ,ibliography

11. &ppendices

STATEMENT OF THE PROBLEM

Cash is the important current asset for the operations of the business. Cash

is the basic input needed to -eep the business running as a continuous basis. It is

also the ultimate output e.pected to be reali/ed by selling the product or service

manufactured by firm. 0he firm should -eep sufficient cash neither more or less.

Cash shortage 1ill disturb the firm2s manufacturing operations 1hile e.cessive

cash 1ill remain idle3 1ithout contributing anything to1ards the firm2s

profitability. 0his is a maor function of the financial manager is to maintain a

sound cash position.

0rade credit arises 1hen a firm sells its products or services on credit and

does not receivable immediately. It is an essential mar-eting tool3 acting as a

bridge for the movement of goods that the production and distribution stages to

customers. Credit creates 4Receivables or ,oo- 5ebts6 1hich the firm is e.pected

to collect in the near future boo- debts or receivable arising out of credit

receivable constitutes a substantial portion of current assets of the firm.

&n attempt is made in this proect 1or- to analy/e the efficiency of cash

and receivable management of the sample unit.

CASH AND RECEIVABLES MANAGEMENT

Introduction

(inance is aptly described as the lifeblood and nerve center of any business. It

is ust as the circulation of blood3 an essential system in the human body to -eep and

alive. (inance is vital input for the smooth functioning of the business. 7very business

enterprise irrespective of its si/e and nature needs finance to carry on its operations and

achieve its target.

8or-ing Capital refers to a firm2s investment in short-term assets vi/3 cash3

short-term securities.

Cash Manag!nt

Cash management is one of the -ey areas of 1or-ing capital management3 apart

from the fact that it is the most li9uid current asset3 cash is the common denominator to

1hich all current assets can be reduced because the other maor li9uid assets3 that is3

receivables and inventory get eventually converted into cash.

0he term :Cash2 1ith reference to cash management is used in t1o senses. In a

narro1 sense3 it is used broadly to cover currency and generally accepted e9uivalents of

cash3 such as che9ues3 drafts and demand deposits in ban-s.

Cash !anagement is concerned 1ith the managing of;

1. Cash flo1s into and out of the firm

2. Cash flo1s 1ithin the firm3 and

3. Cash balance held by the firm at a point of time by financing deficit of

investing surplus cash.

It can be represented by a cash management cycle. 0he surplus cash to be

invested 1hile deficit has to be borro1ed. Cash management see-s to accomplish

this cycle at a minimum cost. &t the same time3 it also see-s to achieve li9uidity

and control.

In order to resolve the uncertainty about cash flo1 prediction and lac- of

synchroni/ation bet1een cash receipts and payments3 the firm should develop

appropriate strategies regarding the follo1ing four facts of cash management.

Cash P"anning

Cash inflo1s and outflo1s should be planned to proect cash surplus or

deficit for each period of the planning period. Cash budget should be planned to

proect cash surplus or deficit.

Managing th Cash F"o#s

0he flo1 of cash should be properly the cash flo1s should be

accelerated 1hile3 as far as possible3 the cash outflo1s should be decelerated.

O$ti!u! Cash L%"

0he firm should decide about the appropriate level of cash balance. 0he cost of

e.cess cash and danger deficiency should be matched to determine the optimum level

of cash balances.

In%sting Sur$"us Cash

0he surplus cash balance should be properly invested to earn profits. 0he firm

should decide about the division of such cash balances bet1een alternative short term

investment opportunities such as ban- deposits3 mar-etable securities or inter

corporate lending.

Th &' E"!nts o( Cash Manag!nt

<ood cash management can have a maor impact of overall 1or-ing capital

management. 0he -ey elements of cash management are;

Cash (orecasting

,alance !anagement

&dministration

Internal Control

Moti% (or ho"ding cash

0he firm2s need to hold cash may be attributed to the follo1ing three motives;

)* Th Transaction Moti%+

0he transaction motive re9uires a firm to hold cash to conduct its business in

the ordinary course. 0he firm needs cash primarily to ma-e payments for purchases3

1ages and salaries and other operating e.penses3 ta.es3 dividend etc.3. 0he need to

hold cash 1ould not arise here 1ere perfect synchroni/ation bet1een cash receipts

and cash payments.

,* Prcautionar' Moti%+

0he precautionary motive is the need to hold cash to meet contingencies in

the future. It provides a cushion or buffer to 1ithstand some une.pected emergencies.

0he precautionary amount of cash depends upon the predictability of cash flo1s.

-* Cash Forcasting+

<ood cash management re9uires regular forecasts. In order for these to be

materially accurate3 they must be based on information provided by those managers

responsible for the amounts and timing of e.penditure. Capital e.penditure and

operating e.penditure must be ta-en into account.

Ad!inistration

Cash receipts should be processed and ban-ed as 9uic-ly as possible because;

-0hey cannot earn interest or reduce overdraft until they are ban-ed

-Information about the e.istence and amounts of cash receipts is usually not available

until they are processed.

Intrna" Contro"

Cash and Cash management is part of a department2s overall internal control

system. 0he main internal cash control is invariably the ban- reconciliation. 0his

provides assurance that the cash balance recorded in the accounting systems are

consistent 1ith the actual ban- balance.

S$cu"ati% Moti%

0he speculative motive related to the holding of cash for investing in profit

ma-ing opportunities as and 1hen it arises. 0he opportunity to ma-e profit may arise

1hen the security prices changes.

RECEIVABLES MANAGEMENT

0he receivables represent an important component of the current assets of a firm.

0he term receivable is defined as :debt o1ed to the firm by customers arising from

sale of goods or services in the ordinary course of business2. Receivables

management is also called trade credit management. 0hus3 accounts receivable

represent an e.tension of credit to customers3 allo1ing them a reasonable period of

time in 1hich to pay for the goods received.

0he company in practice feels the necessity of granting credit for several

reasons;

Competition

Company2s bargaining po1er

,uyer re9uirements

Relationship 1ith dealers

!ar-eting tool

Industry practice

0ransit delays.

Crdit Po"ic'

In the preceeding3 the credit policy of a firm provides the frame1or- to determine

1hether or not to e.tend credit to a customer and ho1 much credit to e.tend. 0he credit

policy decision of a firm has t1o broad dimensions;

Crdit tr!s ha% thr co!$onnts

)* Crdit Priod

In terms of the duration of time for 1hich trade credit is e.tended during this

period the overdue amount must be paid by the customer. & firm2s credit period may

be governed by the industry norms. ,ut depending on its obective3 the firm can

lengthen the credit period.

,* Crdit Discount

If any3 1hich the customer can ta-e advantage of3 that is3 the overdue amount

1ill be reduced by this amount. 0he firm uses cash discount as a increase in sales and

accelerate collections from customers.

-* Crdit Discount Priod

8hich refers to the duration during 1hich the discount can be available of

these terms are usually.

Co""ction Po"icis

0he third area involved in the account receivables management is collection

policies. 0hey refer to the procedures follo1ed to collect account receivables 1hen3

after the e.piry of the credit period3 they become due. 0hese policies cover t1o

aspects.

)* Crdit Standard

0he term :credit standards2 represents the basic criteria for the e.tension

of credit of customers. Our aim is to sho1 1hat happens to the trade-off 1hen

standards are rela.ed or3 alternatively3 tightened. 0he tradeoff 1ith reference to credit

standards are;

0he collection costs

0he average collection period

"evel of bad debt losses

"evel of sales

,* Crdit Ana"'sis

,esides establishing credit standards a firm should develop procedures for

evaluating credit applicants. 0he second aspect of credit policies of a credit analysis

and investigation. 0he t1o basic steps are involved in the credit investigation

process;

Obtaining credit information

&nalysis of credit information

Crdit Tr!s

0he second decisions are in accounts receivables management is the credit

terms. &fter the credit standards have been established and the credit 1orthiness of the

customers has been assessed3 the management of a firm must determine the terms and

conditions of 1hich trade credit 1ill be made available. 0he stipulations under 1hich

goods are sold on credit are referred to as credit terms.

)* Dgr o( Co""ction E((ort

0o illustrate the effect of the collection effort3 the credit policies of a

firm may be categori/ed into

Strict="ight

"enient

0he collection policy 1ould be tight if very rigorous procedures are

follo1ed a tight collection policy has implications 1hich involve benefits as 1ell as

costs.

,* T'$ o( Co""ction E((orts

0he second aspect of collection policies related to the steps that should be

ta-en to collect over dues from the customers. 0he steps usually ta-en are

"etters3 including reminders3 to e.pedite payment

0elephone calls for personal contact

>ersonal visits

?elp of collection agencies and fully

"egal action

- 0he aim should be to collect as early as possible@ genuine

difficulties of the customers should be given due consideration.

- 0he management of receivables involves crucial decision in 3

areas credit policies3 credit terms3 collection policies.

- 0he obective of receivables management therefore is to have a

trade-off bet1een the benefits and costs associated 1ith the

e.tension of credit.

- 0he e.tension of credit involves ris- and cost. 0he benefits are

increased sales and anticipated increased profits=incremental

contribution.

RESEARCH DESIGN AND METHODOLOG.

Research !ethodology is 1ay to systematically solve the research problems. It guides us

ho1 research is done scientifically.

Rsarch Dsign

Research design is the plan3 structure to ans1er 1hom3 1hen3 1here and ho1 of the

subect under investigation conceived so as to obtain ans1er to research 9uestions and to

control variance.

Data Co""ction

0he re9uired data are collected from t1o sources that are primary data and

secondary sources of information. 0his information has been gathered from6 Reliance

Communications Infrastructure "imited6 through personal intervie1 and personal

verification of the reports and financial statements.

OB/ECTIVES

0he study is being underta-en 1ith the follo1ing obectives;

1. 0o study the maintenance of Cash (lo1 of 4R"ianc Ca$ita" Asst

Manag!nt Li!itd6 to meet its day to day re9uirements.

2. 0o analy/e funds committed to cash balances.

3. 0o -no1 Cash inflo1 and outflo1 of the 4R"ianc Ca$ita" Asst

Manag!nt Li!itd6.

#. 0o -no1 the company2s policy allo1ing credit to customers.

SCOPE OF THE ST0D.

0he current study is underta-en for the purpose of analy/ing cash and receivables

management of R"ianc Ca$ita" Asst Manag!nt Li!itd3 1hich is situated at

?yderabad.

0he study concentrates on various techni9ues involved in maintaining an optimal

level of cash in the firm to reduce the loss occurred due to cash budget.

LIMITATIONS

0he study is limited to only a particular company i.e3 R"ianc Ca$ita" Asst

Manag!nt Li!itd.

It is difficult to analy/e the cash and receivables information regarding the

analysis based for a specified period.

It is not possible to calculate the performance of the company in the total

environment because 1e are calculating the performance of this company.

PLAN OF ANAL.SIS

0he entire process of cash and receivables management in 4R"ianc Ca$ita" Asst

Manag!nt Li!itd6 has been analy/ed in detail and the various techni9ues

involved in the above t1o concepts are studied comprehensively. It is a 9uantitative

analysis of the 1or-ing capital management. 0he study has been used to generate

some of the recommendations to the company at times of crisis.

0he follo1ing is the appro.imate chapteri/ation of main topics.

1. Introduction and theoretical bac-ground

2. Research design and methodology

3. Company profile

#. Study of cash and receivables management in Reliance &sset !anagement

Company "td.

$. Suggestions and recommendations

Co!$an' Pro(i"+

Co!$an' Histor'

Reliance Capital "imited ARC"B 1as incorporated in year 1*)% at &hmedabad in <uarat

as Reliance Capital C (inance 0rust "imited. 0he name RC" came into effect from

Danuary $3 1**$. In 2++23 RC" shifted its registered office to Damnagar in <uarat before

it finally moved to !umbai in !aharashtra3 in 2++%.

In 2++%3 Reliance Capital Eentures "imited merged 1ith RC" and 1ith this merger the

shareholder base of RC" rose from +.1$ million shareholders to 1.3 million.

RC" entered the Capital !ar-et 1ith a maiden public issue in 1**+ and in subse9uent

years further tapped the capital mar-et through rights issue and public issues. 0he e9uity

shares 1ere initially listed on the &hmedabad Stoc- 7.change and 0he Stoc- 7.change

!umbai. >resently the shares are listed on 0he Stoc- 7.change !umbai and the Fational

Stoc- 7.change of India.

RC" in the initial years engaged itself in steady annuity yielding businesses such as

leasing3 bill discounting3 and inter-corporate deposits. "ater3 in 1**3 diversified its

business in the areas of portfolio investment3 lending against securities3 custodial

services3 money mar-et operations3 proect finance advisory services3 and investment

ban-ing.

RC" 1as accredited a Category 1 !erchant ban-er by the Securities 7.change ,oard of

India AS7,IB. It had lead managed=co-managed 1$ issues of an aggregate value of Rs. #++

crore and had under1ritten 33 issues for an aggregate value of Rs. $$+ crore. &ll these

companies 1ere listed on various e.changes.

RC" obtained its registration as a Fon-ban-ing (inance Company AF,(CB in 5ecember

1**). In vie1 of the regulatory re9uirements RC" surrendered its !erchant ,an-ing

"icense.

RC" has since diversified its activities in the areas of asset management and mutual fund@

life and general insurance@ consumer finance and industrial finance@ stoc- bro-ing@

depository services@ private e9uity and proprietary investments@ e.changes3 asset

reconstruction@ distribution of financial products and other activities in financial services.

Reliance Capital "imited A,S7; $++1113 FS7; R7"C&>I0&"B is a financial services

company and part of a Reliance &nil 5hirubhai &mbani <roup. It is registered 1ith the

Reserve ,an- of India under section #$-I& of the Reserve ,an- of India &ct3 1*3#. as a

public limited company in 1*)% and is no1 listed on the ,ombay Stoc- 7.change and

the Fational Stoc- 7.change AIndiaB.

Reliance Capital has a net 1orth of over 33 billion AGSH%++.% millionB and over 1%$3+++

shareholders. On conversion of outstanding e9uity instruments3 the net 1orth of the

company 1ill increase to about #1 billion AGSH'#%.2 millionB.

It is headed by &nil &mbani and is a part of the Reliance &5& <roup.

Reliance Capital ran-s among the top 3 private sector financial services and ban-ing

companies3 in terms of net 1orth.

Reliance Capital has interests in ;

&sset management.

!utual funds.

"ife and general insurance.

>rivate e9uity and proprietary investments.

Stoc- bro-ing.

Reliance >!S.

5epository services and financial products.

Consumer finance and other activities in financial services.

Reliance Capital3 a constituent of CFI Fifty Dunior and !SCI India3 is a part of the

Reliance <roup. It is one of IndiaJs leading and amongst most valuable financial services

companies in the private sector.

Reliance Capital has interests in asset management and mutual funds@ life and general

insurance@ commercial finance@ e9uities and commodities bro-ing@ investment ban-ing@

1ealth management services@ distribution of financial products@ e.changes@ private

e9uity@ asset reconstruction@ proprietary investments and other activities in financial

services.

Reliance !utual (und is amongst top t1o !utual (unds in India 1ith over si. million

investor folios. Reliance "ife Insurance and Reliance <eneral Insurance are amongst the

leading private sector insurers in India. Reliance Securities is one of India2s leading retail

bro-ing houses. Reliance !oney is one of India2s leading distributors of financial

products and services.

Reliance Capital has a net 1orth of Rs. 113)1* crore AGSH 2.2 billionB and total assets of

Rs. 3*3'$3 crore AGSH '.3 billionB as on 5ecember 313 2+12.

Businss !i1 o( R"ianc Ca$ita"

Asst

Manag!nt

!utual (und3 Offshore (und3 >ension fund3 >ortfolio !anagement

Insuranc "ife Insurance3 <eneral Insurance

Co!!rcia"

Financ

!ortgages3 "oans against >roperty 3 S!7 "oans3 "oans for Eehicles3

"oans for Construction 79uipment3 ,usiness "oans3 Infrastructure

financing

Bro2ing and

Distri3ution

79uities3 Commodities and 5erivatives3 8ealth !anagement Services3

>ortfolio !anagement Services3 Investment ,an-ing3 (oreign

7.change3 0hird >arty >roducts

Othr Businsss >rivate 79uity3 Institutional ,ro-ing3 &sset Reconstruction3 Eenture

Capital

Chair!an4s Pro(i"

Shri &nil 5. &mbani3 regarded as one of the foremost corporate leaders of

contemporary India3 Shri &nil 5. &mbani3 is the Chairman of Reliance Capital

"imited3 Reliance Infrastructure "imited3 Reliance Communications "imited and

Reliance >o1er "imited. ?e is also on the ,oard of Reliance Infratel "imited and

Reliance &nil 5hirubhai &mbani <roup "imited. ?e is the >resident of the 5hirubhai

&mbani Institute of Information and Communication 0echnology3 <andhinagar3

<uarat.

&n !,& from the 8harton School of the Gniversity of >ennsylvania3 Shri &mbani is

credited 1ith pioneering several path-brea-ing financial innovations in the Indian

capital mar-ets. ?e spearheaded the country2s first forays into overseas capital

mar-ets 1ith international public offerings of global depositary receipts3 convertibles

and bonds. Gnder his Chairmanship3 the constituent companies of the Reliance <roup

have raised nearly GSH ' billion from global financial mar-ets in a period of less than

3 years.

Shri &mbani has been associated 1ith a number of prestigious academic institutions

in India and abroad.

?e is currently a member of ;

8harton ,oard of Overseers3 0he 8harton School3 GS&

,oard of <overnors3 Indian Institute of !anagement AII!B3 &hmedabad

7.ecutive ,oard3 Indian School of ,usiness AIS,B3 ?yderabad

In Dune 2++#3 Shri &mbani 1as elected as an Independent member of the Raya

Sabha K Gpper ?ouse3 >arliament of India3 a position he chose to resign voluntarily

on !arch 2*3 2++%.

Select &1ards and &chievements

&1arded by "ight Readings as the >erson of the Lear K 2++) for outstanding

achievements in the communication industry.

Eoted Jthe ,usinessman of the LearJ in a poll conducted by 0he 0imes of India K

0FS3 5ecember3 2++%.

Eoted the J,est role modelJ among business leaders in the biannual !ood of the

Fation poll conducted by India 0oday maga/ine3 &ugust 2++%.

Conferred Jthe C7O of the Lear 2++#J in the >latts <lobal 7nergy &1ards.

Conferred :0he 7ntrepreneur of the 5ecade &1ard2 by the ,ombay !anagement

&ssociation3 October 2++2.

&1arded the (irst 8harton Indian &lumni &1ard by the 8harton India 7conomic

(orum A8I7(B in recognition of his contribution to the establishment of Reliance as a

global leader in many of its business areas3 5ecember3 2++1.

Eision

Reliance CapitalJs vision is that;

,y 2+1$3 it 1ill be a company that is -no1n as;

M0he most profitable3 innovative3 and most trusted financial services company in India

and in the emerging mar-etsM.

In achieving this vision3 the company 1ill be both customer-centric and innovation-

driven.

0op !anagement >rofile

Reliance Capital is anchored by a team of e.perienced and committed visionaries 1ho

are dedicated to1ards scaling the company to greater heights through innovation and

e.cellence@ thereby creating value for all our sta-eholders.

&nup Rau - AChief 7.ecutive Officer and 7.ecutive 5irector3 Reliance "ife

InsuranceB

&so-an &rumugam A?ead ComplianceB

&mitabh !ohanty A?ead - 5ebt StrategyB

&mit ,apna AChief (inancial Officer3 Reliance CapitalB

&run ?ariharan A>resident3 Nuality and Ono1ledge !anagement3 Reliance CapitalB

O. &chuthan AChief >eople Officer3 Reliance CapitalB

O. E. Srinivasan AChief 7.ecutive Officer3 Reliance Commercial (inanceB

"av Chaturvedi AChief Ris- Officer3 Reliance CapitalB

!adhusudan Oela AChief Investment Strategist3 Reliance CapitalB

Rani-ant >atel A>resident and Chief 7.ecutive Officer3 Reliance Spot 7.changeB

Sa! Ghosh 5Chi( E1cuti% O((icr6 R"ianc Ca$ita"7

Sanay Dain AChief !ar-eting Officer3 Reliance CapitalB

Sundeep Si--a AChief 7.ecutive Officer3 Reliance Capital &sset !anagementB

Ra-esh Dain AChief 7.ecutive Officer3 Reliance <eneral InsuranceB

Ei-rant <ugnani AChief 7.ecutive Officer3 International ,usiness- Reliance

CapitalB

A7.ecutive 5irector3 Reliance Securities "tdB

E. R. !ohan A>resident and Company Secretary B

RELIANCE M0T0AL F0ND

Reliance mutual fund3 promoted by the &nil 5hirubhai &mbani A&5&<B group3 is

one of the fastest gro1ing mutual funds in India having doubled its assets over the

last one year. In !arch3 2++%3 the Reliance mutual fund emerged as the largest

private sector fund house in the country3 overta-ing >rudential ICICI 1hich has been

holding that position for many years.

0he sponsor of the fund is Reliance Capital "imited3 the financial services arm of

&5&<. Reliance Capital &sset !anagement "imited3 a 1holly o1ned subsidiary of

Reliance Capital "imited3 acts as the &!C to the fund. 5irectors of the company

include &mitabh Dhunhun1ala3 a senior e.ecutive of &5&<. &mitabh Chaturvedi is

the managing director of the &!C.

&s of end &ugust 2++%3 Reliance mutual fund has Rs 2)3'$3 crore of assets under

management. Reliance 79uity (und3 launched by Reliance !( in early 2++%3 is the

largest mutual find scheme in the country 1ith a fund si/e of over Rs $3$++ crore.

?ere is a list of mutual funds of Reliance 1hich includes 5ebt=Income (unds 3 79uity

(unds and Sector Specific (unds.

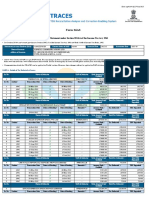

"atest F&E

Sch! Na! NAV 5Nt Asst

Va"u7

Dat

Reliance !edium 0erm (und - <ro1th >lan -

,onus Option

1'.+)'' 1+-Dan-2+13

Reliance !edium 0erm (und - <ro1th >lan -

<ro1th Option

23.*2## 1+-Dan-2+13

Reliance !edium 0erm (und - !onthly

5ividend >lan

1+.#'$# 1+-Dan-2+13

Reliance !edium 0erm (und - Nuarterly

5ividend >lan

1+.*%*3 1+-Dan-2+13

Reliance 5ynamic ,ond (und-5ividend >lan-

5ividend Option

1#.''1+ 1+-Dan-2+13

Reliance 5ynamic ,ond-<ro1th >lan-<ro1th

Option

1$.$%31 1+-Dan-2+13

Reliance Short 0erm (und-5ividend Re-

investment >lan

1+.)'#+ 1+-Dan-2+13

Reliance Short 0erm (und-<ro1th >lan 21.$+3# 1+-Dan-2+13

Reliance Short 0erm (und-Nuarterly 5ividend

>lan

13.')3) 1+-Dan-2+13

Reliance ,an-ing (und-5ividend >lan-

5ividend Option

##.''1+ 1+-Dan-2+13

Reliance ,an-ing (und-<ro1th >lan-,onus

Option

123.3*)' 1+-Dan-2+13

Reliance ,an-ing (und-<ro1th >lan-<ro1th

Option

123.3*)) 1+-Dan-2+13

Reliance 5iversified >o1er Sector (und-

5ividend >lan-5ividend

3#.+++% 1+-Dan-2+13

Reliance 5iversified >o1er Sector (und-

<ro1th-,onus

$*.)%#' 1+-Dan-2+13

Reliance 5iversified >o1er Sector (und-

<ro1th-<ro1th

$*.)%#* 1+-Dan-2+13

Reliance 79uity (und-5ividend >lan-5ividend

Option

1$.3#+# 1+-Dan-2+13

Reliance 79uity (und-<ro1th >lan-,onus

Option

1$.3#+# 1+-Dan-2+13

Reliance 79uity (und-<ro1th >lan-<ro1th

Option

1$.3#+# 1+-Dan-2+13

Reliance 79uity Opportunities (und-5ividend

>lan-5ividend Option

2'.1#3) 1+-Dan-2+13

Reliance 79uity Opportunities (und-<ro1th

>lan-,onus Option

##.)#3' 1+-Dan-2+13

Reliance 79uity Opportunities (und-<ro1th

>lan-<ro1th Option

##.)##+ 1+-Dan-2+13

Reliance <ro1th (und-5ividend >lan-A5B $$.3')2 1+-Dan-2+13

Reliance <ro1th (und-<ro1th >lan-,onus

Option

)#.33+' 1+-Dan-2+13

Reliance <ro1th (und-<ro1th >lan-<ro1th

Option

$+).2*$) 1+-Dan-2+13

Reliance !edia C 7ntertainment (und-

5ividend >lan-5ividend Option

23.#3+' 1+-Dan-2+13

Reliance !edia C 7ntertainment (und-<ro1th

>lan-,onus Option

#+.1#$1 1+-Dan-2+13

Reliance !edia C 7ntertainment (und-<ro1th

>lan-<ro1th Option

#+.1##) 1+-Dan-2+13

Reliance FRI 79uity (und-5ividend >lan-

5ividend Option

22.))%% 1+-Dan-2+13

Reliance FRI 79uity (und-<ro1th >lan-,onus

Option

#$.#2$$ 1+-Dan-2+13

Reliance FRI 79uity (und-<ro1th >lan-

<ro1th Option

#$.#2$$ 1+-Dan-2+13

Reliance >harma (und-5ividend-5ividend #'.23$* 1+-Dan-2+13

Reliance >harma (und-<ro1th >lan-,onus %*.')#) 1+-Dan-2+13

Reliance >harma (und-<ro1th >lan-<ro1th %*.')#' 1+-Dan-2+13

Reliance Regular Savings (und-57,0

O>0IOF -<ro1th Option

12.'%3+ 2+-!ay-2+1+

Reliance Regular Savings (und-7NGI0L

O>0IOF-<ro1th Option

3#.332# 1+-Dan-2+13

Reliance Regular Savings (und-,&"&FC75

O>0IOF-<ro1th Option

2+.1$2% 2+-!ay-2+1+

Reliance Eision (und-5IEI57F5 >"&F-5 3*.++%' 1+-Dan-2+13

Reliance Eision (und-<RO80? >"&F- #%.$23# 1+-Dan-2+13

,onus Option

Reliance Eision (und-<RO80? >"&F-

<ro1th Option

2'%.##2* 1+-Dan-2+13

Reliance "i9uidity (und-,onus >lan-,onus

Option

1+1*.%2%' 1+-Dan-2+13

Reliance "i9uidity (und-5ividend >lan-5aily

5ividend Reinvestment

1+++.$1++ 1+-Dan-2+13

Reliance "i9uidity (und-5ividend >lan-

!onthly 5ividend >lan

1++#.))3% 1+-Dan-2+13

Reliance "i9uidity (und-5ividend >lan-

8ee-ly 5ividend Reinvesment

1++1.'3#1 1+-Dan-2+13

Reliance "i9uidity (und-<ro1th >lan-<ro1th

Option

1'33.*+*) 1+-Dan-2+13

Reliance 0a. Saver A7"SSB (und-5ividend

>lan-5ividend Option

1$.'*#) 1+-Dan-2+13

Reliance 0a. Saver A7"SSB (und-<ro1th

>lan-<ro1th Option

2#.*#*# 1+-Dan-2+13

R P Shares <old 7.change 0raded (und-

5ividend >ayout Option

2)2$.)$'3 1+-Dan-2+13

Reliance Regular Savings (und-57,0

O>0IOF-5ividend Option

12.22$1 2+-!ay-2+1+

Reliance Regular Savings (und-7NGI0L

O>0IOF-5ividend Option

22.#%%* 1+-Dan-2+13

Reliance Regular Savings (und-,&"&FC75

O>0IOF-5ividend Option

1#.12)+ 2+-!ay-2+1+

Reliance Regular Savings (und-57,0

O>0IOF- Institutional >lan-5ividend Option

12.2)'1 2+-!ay-2+1+

Reliance Regular Savings (und-57,0

O>0IOF- Institutional >lan-<ro1th Option

12.)#13 2+-!ay-2+1+

Reliance Regular Savings (und - ,alanced

Option - 5ividend >lan

1#.$)13 1+-Dan-2+13

Reliance Regular Savings (und - 5ebt Option -

Institutional Nuarterly 5ividend

12.'13$ 1+-Dan-2+13

Reliance Regular Savings (und - ,alanced

Option - <ro1th >lan

2$.*3*) 1+-Dan-2+13

Reliance Regular Savings (und - 5ebt Option -

Institutional <ro1th

1$.)$%+ 1+-Dan-2+13

Reliance Regular Savings (und - 5ebt Option -

Nuarterly 5ividend

12.$*1# 1+-Dan-2+13

Reliance Regular Savings (und - 5ebt Option -

<ro1th

1$.$#'# 1+-Dan-2+13

ANAL.SIS FRAME 8OR&

Classifications of collection operations

1. >reparation of aging schedules.

2. Credit sales to account receivables statement.

3. Collection to accounts receivable statement.

0he 1hole calculation part data has provided by the employees of

finance department as secondary source of data and 1as no scope has

given me to loo- into original statements.

ANAL.SIS OF AGEING SCHED0LES

0he company prefers monthly ageing schedule to monitor its boo--debts.

0he debts outstanding are bro-en do1n into branch 1ise entries. 0he ageing

schedules for the past three years have been thoroughly analy/ed to come out 1ith

average outstanding days of the boo- debts of the company. On an average the

outstanding days of the boo- debts in the company is as follo1s overdue less than 3+

days3 3+ to %+ days3 and *+ to 1)+ days3 1)+ to 3++ days and above 3%+ days

respectively.

0hese reports are prepared especially for the e.tended overdue accounts. 0he

basic reason is to develop a file of customer 1ho re9uire special attention either in the

form of statement3 letters or the collection activity.

ACCO0NTS RECEIVABLE T0RN OVER RATIO

1. Credit sales divided by ending accounts receivables and

2. &ccounts receivables divided by credit-sales time

3%$ days the first formula gives the number of times the correct balance of

receivable is collected during the year3 1hile the second formula gives the

average number of days the current balance is e.pected to remain outstanding

before it is collected.

COLLECTION RATIO

0his is the ratio of monthly to the account receivables outstanding at the first of

the month to raise sales to receivables and collection to receivables is closely related.

&ccounts receivables are the second most li9uid form of assets of the firm. 0he

receivables come into being as credit-sales and constitute as one of the largest asset. S-ill

full administration of the receivables management is therefore of prime importance to the

business. 0he very reason of credit sales is to e.pand sales volume and if too debit is

maintained by the company in the approval of the customer credit purchases many sales

may be last that 1ould other1ise contribute to the profits of the firm. ,efore going to

9uote the credit at Reliance communication infrastructure limited.

8hat actua""' crdit #i"" crdit9

1. Company position

2. >rotection from competition

3. ,uyers states and re9uirements

#. 5ealer relationship.

$. 0ransit delays.

%. Individual practice.

Crdit $o"ic' and $ractics at R"ianc Asst Manag!nt Co!$an'

Ltd*

0he sales of the company3 Reliance &sset !anagement Company "td go on cash as

1ell as credit terms. 0he trading division of Reliance pvt ltd sells its product3 1hich

receives from the factories on a credit period of #$ days to $$ days3 through the branches

of the company located all over the country.

Cash discounts

& cash discount is a reduction in payment offered to the customers to induce them to

reply credit obligations 1ithin a specified period of time3 1hich 1ill be less than the

normal credit period. It is usually e.pressed as a percentage of sales. Cash discounts term

indicates the rate of discount and the period for 1hich it is available.

0he cash discount terms of the company are as follo1s.

>ayments 5iscounts offer

On cash 1Q

In ' days +.'$Q

In 1$ days +.$Q

Crdit $o"ic'

0he company3 Reliance &sset !anagement Company "td3 e.tends a credit period

of 21 days to its customers. It 1aits for a period of $$ days for the payments from the

customers

7I; & company has daily sales or credit sales of 2+ la-hs from all branches and a giving

credit period averagely 3+ days. So the company investment on receivables is 2+P3+ R

%++ la-hs.

0here is one 1ay in 1hich the financial manager can control the volume of credit

sales and collection period and conse9uently3 investment in accounts receivables it can

change through credit policies.

CREDIT POLIC.

1. Credit standard K It is careful analysis ris-

2. Credit term K Specific of the duration

3. Collection K "o1er collection 1ill influences lo1er investment in Receivables

and vice-versa

#. Cash discount

Crdit standards

Credit standards are criteria to decide the types of customer to 1hom goods

could be sold on credit. If a firm has slo1 paying customer its investment in accounts

receivables 1ill increase the firm 1ill also be e.posed to higher ris- of default.

Crdit tr!s

Specify duration of credit and terms of payment by customers2 investment in

accounts receivables 1ill be high if customer allo1ed to e.tend time period for

ma-ing payments.

Co""ction ((orts

Collection effort determine the actual collection period. 0he lo1er the collection

the lo1er investment in accounts receivables and vice-versa.

Goa"s o( crdit $o"ic'

1. Stringent credit policy K "ess credit to customer as a result to decrease the

sales

2. "enient credit policy K !ore credit to it leads to increase in sales

If there is any change in credit policy there 1ill be a change in the

1. Eolume of credit sales

2. 5efault ris- or bad debts

3. Costs

#. &verage collection period

0he follo1ing technologies are used in Reliance communications

limited.

1. 8ireless

2. <lobal

3. ,roadband

#. Others

0he company loo-s for the character of the customer i.e.3 his 1illingness to pay the moral

factor is of considerable importance in credit position.

It loo-s for the ability of the customer to pay. 0his is evaluated by his financial position

and the ban- guarantee given by him.

,ased on the above factors the company analyses the customer and determine the

credit limit to them. 7very si. months3 the company goes for the revie1 of the customers.

8hen a customer is found to be regular in paying the dues 1ithin 3+ days the

company may go for increase in the credit for the customer. In a small 1ay3 the

customers are ta-en into consideration and given the credit.

Co""ction $rocdurs

0he company follo1s a system of centrali/ed control and decentrali/ed collections.

0he company does not employ any collection agency for its collection activities. 0he

division receives a statement of sales outstanding daily from all the branches in the

country3 the collection is done through Reliance communications account and through

ban- che9ues.

Monitoring 3oo2 d3ts

0he company classifies its boo- debts based on the number of outstanding days in the

given follo1ing 1ay

Outstanding days 5ebts category

!ore than 3++ days 5isputes

,et1een 1)+ to 3++ days ,ad debts

,et1een *+ to 1)+ days 5oubtful debts

,et1een + to *+ days <ood debts

Ana"'sis o( aging schdu" o( R"ianc Ca$ita" Asst Manag!nt Li!itd*

0he company prepares monthly ageing schedule to monitor its boo-s debts. 0he debts

outstanding are bro-en do1n into companies2 1ise entries. 0he ageing schedules for the

past one year have been thoroughly analy/ed to come out 1ith average outstanding dates

of the boo- debt of the company. On an average the outstanding days of the boo- debts in

the company is as follo1s.

Ta3" )

&geing schedule of R"ianc Ca$ita" Asst Manag!nt Li!itd during

the year 2++*

Outstanding period Outstanding receivables Outstanding receivables as

Q of total outstanding

receivables

+-3+ 3#$%.*$' 3+Q

31-%+ )%3$.#$% 3)Q

%1-*+ 3)#%.*%# 32Q

0otal 1$*3*.3'' 1++Q

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he outstanding debts of RC&!" during the period 2++* &pril to 2+1+ 5ec

1as collected 1ithin 3+ days from 3+Q of the outstanding debts. (rom 31 days to %+

days the debts collected 1ere 3)Q of the total outstanding debts. (rom %1 days to *+

days the debt collected 1ere 32Q of the total outstanding debts.

Ta3" ,

&geing schedule of R"ianc Ca$ita" Asst Manag!nt Li!itd during

the year 2++*

Outstanding period Outstanding receivables Outstanding receivables as

Q of total outstanding

receivables

+-3+ #%3#.'23 22Q

31-%+ '##3.3%# 3)Q

%1-*+ 3#3$.)$% #+Q

0otal 1$$13.*#3 1++Q

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he outstanding debts of RC&!" during the period 2++* &pril to 2+1+ 5ec

1as collected 1ithin 3+ days from 22Q of the outstanding debts. (rom 31 days to %+

days the debts collected 1ere 3)Q of the total outstanding debts. (rom %1 days to *+

days the debt collected 1ere #+Q of the total outstanding debts.

Ta3" -

&geing schedule of R"ianc Ca$ita" Asst Manag!nt Li!itd during

the year 2++*

Outstanding period Outstanding receivables Outstanding receivables as

Q of total outstanding

receivables

+-3+ 23+.'%# %Q

31-%+ #'$3.3#3 )+.33Q

%1-*+ 3#%#.#3# 13.%'Q

0otal )##).$#1 1++Q

Sourc+ 5ata collected from the internal reports of (inance 5epartment of R&!".

Ana"'sis+ 0he outstanding debts of RC&!" during the period 2++* &pril to 2+1+ 5ec

1as collected 1ithin 3+ days from %Q of the outstanding debts. (rom 31 days to %+ days

the debts collected 1ere )+.33Qof the total outstanding debts. (rom %1 days to *+ days

the debt collected 1ere 13.%'Q of the total outstanding debts. 0he total outstanding

receivables are )##).$#1 considered as 1++Q 1ithin a period of 3%$ days the debt

amounts 1ere collected in the above pattern.

FRAME 8OR& OF COLLECTION MATRI:

0hey can convert the table to a CO""7C0IOF 7I>7RI7FC7 !&0RII by dividing

the outstanding receivables in each column by sales amount in that column. 0he

follo1ing table is the second scheduled analysis frame 1or- statements. 0he follo1ing

table contains information of the percentage of receivables to the credit sales from 1hich

those receivables are originated. If the percentages increase as 1e move it implies that the

firm is unable to collect its receivables faster. ,ut they are 1holly separated from the past

data.

COLLECTION MATRI:

& collection matri. is a statement 1hich is prepared 1ith reference to credit sales and

collections. 0his statement confines ho1 the debt amounts are collected 1ith 1ere in

respective tenure of months 1ith cash values. Fo1 1e have various respective years2

collection statements 1hich play maor role in analysis 1or-. 8e can interpret this table

in percentages.

Accounts rci%a3"s co""ction !atri1 o( RCAML (or ,;;<

Ta3" = ARs. In croreB

!onth !ar Dune Sep 5ec

Credit sales 2*'+ 22)3 2))+ 2**1

Collections

!ar 2)2+

Dune 1$+ 2213

Sep '+ 2))+

5ec 2)12

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he credit sale of !ar 2++* amounts to Rs.2*'+ crores. Rupees 2)2+ 1as

collected in the same month and the remaining Rs.1$+ crores 1ere collected in Dune.

0he credit sale of Dune 2++* amounts to Rs.22)3 crores. Rs.2213 1as

collected in the same month and the remaining Rs.'+ crores 1ere collected in Sep.

0he credit sale of Sep amounts to Rs.2))+ crores and the same is collected

during the same month.

0he credit sale of 5ec amounts to Rs.2**1 crores. Rs.2)12 crores 1as collected

in the particular month.

Accounts rci%a3"s in $rcntag o( co""ction !atri1 o( RCAML (or

,;;<>);

Ta3" ? ARs. In croreB

!onth !ar Dune Sep 5ec

Credit sales

Collections

!ar *$Q

Dune $Q *'Q

Sep 3Q 1++Q

5ec *#Q

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he credit sale of !ar 2+1+ amounts to Rs.2*'+ crores. Rupees 2)2+ 1as

collected in the same month and the remaining Rs.1$+ crores 1ere collected in Dune.

*$Q 1as collected in the month of !ar 2+1+ and the remaining $Q 1as

collected in the month of Dune.

0he credit sale of Dune 2+1+ amounts to Rs.22)3 crores. Rs.2213 1as

collected in the same month and the remaining Rs.'+ crores 1ere collected in Sep.

*'Q 1as collected in the month of Dune2+1+ and the remaining 3Q 1as collected

in the month of Sep.

0he credit sale of Sep amounts to Rs.2))+ crores and the same is collected

during the same month.

1++Q 1as collected in the month of Sep 2+1+.

0he credit sale of 5ec amounts to Rs.2**1 crores. Rs.2)12 crores 1as collected

in the particular month.

*#Q 1as collected in the month of 5ec. Reliance much concentrate on the

receivables for every t1o months as mentioned above.

Accounts rci%a3"s co""ction !atri1 o( RCAML (or ,;);>))

Ta3" @ ARs. In croreB

!onth !ar Dune Sep 5ec

Credit sales 2*'+ 32$+.1

2

3#$%.3

*

3'$$.3+

Collections

!ar 2)2+

Dune 1$+ 3221.1

2

Sep 2* 3#$%.3

*

5ec 3$%3.23

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he credit sale of !ar 2+1+ amounts to Rs.2*'+ crores. Rupees 2)2+ crores

1as collected in the same month and the remaining Rs.1$+ crores 1ere collected in Dune.

0he credit sale of Dune 2+1+ amounts to Rs.32$+.12 crores. Rs.3221.12 crores

1as collected in the same month and the remaining Rs.2* crores 1ere collected in Sep.

0he credit sale of Sep amounts to Rs.3#$%.3* crores and the same is collected

during the same month.

0he credit sale of 5ec amounts to Rs.3'$$.3+ crores. Rs.3$%3.23 crores 1ere

collected in the particular month.

Accounts rci%a3"s in $rcntag o( co""ction !atri1 o( RCAML (or

,;);>))

Ta3" A ARs. In croreB

!onth !ar Dune Sep 5ec

Credit sales

Collections

!ar *$Q

Dune $Q **Q

Sep 1Q 1++Q

5ec *$Q

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he credit sale of !ar 2+1+ amounts to Rs.2*'+ crores. Rupees 2)2+ 1as

collected in the same month and the remaining Rs.1$+ crores 1ere collected in Dune.

*$Q 1as collected in the month of !ar 2+1+ and the remaining $Q 1as

collected in the month of Dune.

0he credit sale of Dune 2+1+ amounts to Rs.32$+.12crores. Rs.3221.12

crores 1as collected in the same month and the remaining Rs.2* crores 1ere collected in

Sep.

**Q 1as collected in the month of Dune2+1+ and the remaining 1Q 1as collected

in the month of Sep.

0he credit sale of Sep amounts to Rs.3#$%.3* crores and the same is collected

during the same month.

1++Q 1as collected in the month of Sep 2+1+.

0he credit sale of 5ec amounts to Rs.3'$$.3+ crores. Rs.3$%3.23 crores 1ere

collected in the particular month.

*$Q 1as collected in the month of 5ec.

Accounts rci%a3"s co""ction !atri1 o( RCAML (or ,;))>),

Ta3" B ARs. In croreB

!onth !ar Dune Sep 5ec

Credit sales 1'##+.2

$

#3+3.'

+

#$').$

3

#)'#.2+

Collections

!ar 1%#$+.$

$

Dune **+ 2#$%.$

#

Sep 1)#'.1

%

#$').$

3

5ec #2$+.+%

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he credit sale of !ar 2+11 amounts to Rs.1'##+.2$ crores. Rupees

1%#$+.$$ 1as collected in the same month and the remaining Rs**+ crores 1ere

collected in Dune.

0he credit sale of Dune 2+11 amounts to Rs.#3+3.'+ crores. Rs.2#$%.$# crores

1as collected in the same month and the remaining Rs.1)#'.1%crores 1ere collected in

Sep.

0he credit sale of Sep amounts to Rs.#$').$3 crores and the same is collected

during the same month.

0he credit sale of 5ec amounts to Rs.#)'#.2+ crores. Rs.#2$+.+% crores 1as

collected in the particular month.

Accounts rci%a3"s in $rcntag o( co""ction !atri1 o( RCAML (or

,;))>),

Ta3" < ARs. In croreB

!onth !ar Dune Sep 5ec

Credit sales

Collections

!ar *#

Dune %Q $'Q

Sep #3Q 1++Q

5ec )'Q

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ 0he credit sale of !ar 2+11 amounts to Rs.1'##+.2$ crores. Rupees

1%#$+.$$ crores 1ere collected in the same month and the remaining Rs.**+ crores 1ere

collected in Dune.

*#Q 1as collected in the month of !ar 2+11 and the remaining %Q 1as collected

in the month of Dune.

0he credit sale of Dune 2+11 amounts to Rs.#3+3.'+ crores.

Rs.2#$%.$# crores 1as collected in the same month and the remaining Rs.1)#'.1% crores

1ere collected in Sep.

$'Q 1as collected in the month of Dune2+11 and the remaining #3Q 1as collected

in the month of Sep.

0he credit sale of Sep amounts to Rs.#$').$3 crores and the same is collected

during the same month.

1++Q 1as collected in the month of Sep 2++*.

0he credit sale of 5ec amounts to Rs.#)'#.2+ crores. Rs.#2$+.+% crores 1as

collected in the particular month.

)'Q 1as collected in the month of 5ec.

A STATEMENT OF SALES C RECEIVABLES DATA

0he last and final state in analysis frame 1or- is preparation of sales and

receivables data sheet@ this gives us an elaborative frame1or- to1ards the company

performance to1ards collection vitae. 0his statement 1ill thro1 a light up on;

&verage collection period and as 1ell as debtors turnover ratio.

In preparation of sales and receivables data 1e 1ill come across 1ith various terms

li-e &verage collection period and 5ebtors turnover ratio.

5ebtor2s turnover ratio is the ratio bet1een sales or credit sales 1ith respect to average

debtors.

5ebtors turnover ratio R Credit sales= &verage debtors.

&verage debtors R Collection periodP Creditsales=3%+.

&verage collection period is the ratio bet1een &verage debtors and sales of credit sales

1ith respect to the period of 3%+ days.

&verage collection period R &verage debtors=Credit salesP3%+.

A STATEMENT OF SALES C RECEIVABLES DATA FROM THE

MONTH OF MARCH TO DECEMBER ,;;<

Ta3" );

Credit salesARs.

In croresB

5ebtors ARs. In

croresB

50RAin timesB &C>Ain daysB

!ar 2*'+ 13 1.$ 23

Dune 22)3 '' 2.* 3+

Sep 2))+ %' 1.% 2#

5ec 2**1 3# 1.) 23

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ In the month of !arch 2++* &C> is 23 days3 increased to 3+ days in the

month of Dune and decreased to 2# days in the month of Sep and again decreased to 23

days in the month of 5ec.

A STATEMENT OF SALES C RECEIVABLES DATA FROM THE

MONTH OF MARCH TO DECEMBER ,;);>),

Ta3" ))

Credit salesARs.

In croresB

5ebtors ARs. In

croresB

50RAin timesB &C>Ain daysB

!ar 2*'+ 3* $.# 2%

Dune 32$+.12 '' '.3 2#

Sep 3#$%.3* $% #.3 22

5ec 3'$$.3+ #3 $.% 2+

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ In the month of !arch 2++* &C> is 2% days3 decreased to 2# days in the

month of Dune and decreased to 22 days in the month of Sep and again decreased to 2+

days in the month of 5ec.

A STATEMENT OF SALES C RECEIVABLES DATA FROM THE

MONTH OF MARCH TO DECEMBER ,;))>),

1'##+.2

$

#3+3.'

+

#$').$

3

#)'#.2+

Ta3" ),

Credit salesARs.

In croresB

5ebtors ARs. In

croresB

50RAin timesB &C>Ain daysB

!ar 1'##+.2$ 1+# 12.$ 11

Dune #3+3.'+ '$ 1' #3

Sep #$').$3 2'% $.) #+

5ec #)'#.2+ $# $.% 3)

Sourc+ 5ata collected from the internal reports of (inance 5epartment of RC&!".

Ana"'sis+ In the month of !arch 2++* &C> is 11 days3 increased to #3days in the

month of Dune and decreased to #+ days in the month of Sep and again decreased to 3)

days in the month of 5ec respectively.

RATIO ANAL.SIS AND INTERPRETATION FOR CASH

Ratio analysis is a po1erful tool of financial analysis. & ratio is defined as 4the

indicated 9uotient of t1o mathematical e.pressions6 and as the 4relationship bet1een

t1o or more things6. In financial analysis a ratio is used as a bench mar- for evaluating

the financial position and performance of a firm. 0he absolute accounting figures

reported in the financial statement do not provide a meaningful understand of the

performance and financial position of a firm3 an accounting figure conveys meaning

1hen it is related to some other relevant information.

7very enterprise maintains cash balances to meet its different business

obligations. 5ifferent ratios can be calculated and analy/ed to asses the use of cash for

the business operations. (inancial ratios li-e cash to current assets3 cash to total assets

and cash turnover of business units can be made to asses their efficiency in the

management of cash.

CASH TO C0RRENT ASSETS RATIO+

In order to measure the short term li9uidity of solvency of a concern3 comparison of

current liabilities is inevitable. Current ratio indicates the ability of a concern to meet its

current obligations as and 1hen they are due for payment.

Currnt ratio D 5Currnt asstsE Currnt "ia3i"itis7

CASH TO C0RRENT ASSETS RATIO IN RCAML

Ta3" )-

Lear CGRR7F0

&SS70S

CGRR7F0

"I&,I"I0I7S

R&0IO

2++*-2+1+ 1%#' 1$'* 1.+#

2+1+-2+11 3++' 1%#$ 1.)2

2+11-2+12 2*'2 1%+' 1.)#

INFERENCE

&n ideal ratio is 2;1. 0he ratios from 2++*-1+ to 2+11-12 are 1.+#3 1.)23 1.)#

1hich are lesser than the standard norm3 1hich indicates a do1n1ard trend.

CASH TO TOTAL ASSETS RATIO+

0his ratio indicates the proportion of cash balances maintained by the company. It

assumes prominence as the level of cash balance indicates the profitability and li9uidity

position of the concern. 0he cash to total assets ratio indicates the importance of current

assets in the total 1orth of any business concern. 0he components of current assets are

inventory3 cash3 debtors and other.

In%ntoris tota" assts ratio D 5in%ntorisE Tota" assts7

CASH TO TOTAL ASSETS RATIO IN RCAML

Ta3" )=

Lear InventoriesARs. In 0otal assetsARs. In ratio

croresB croresB

2++*-2+1+ 1+%1 3*+' +.2'

2+1+-2+11 $%13 1%#' 3.#+

2+11-2+12 *%13 3$)2 2.%)

INFERENCE

0he ratios from 2++*-1+ to 2+11-12 are +.2'3 3.#+3 2.%) respectively. It is

increasing year by year and so it is satisfactory.

Cash to currnt "ia3i"it' ratio+

0his ratio reveals the ability of company to meet the current obligations as and

1hen they matured. 0he cash position in the company study area is presented in the table

that follo1s.

Cash to currnt "ia3i"it' ratio D 5CashE Currnt "ia3i"itis7F);;

Ta3" )?

Lear CashARs. In croresB Current

liabilitiesARs. In

croresB

Ratio

2++*-2+1+ 11)3 1$'* '#.*2

2+1+-2+11 23) 1%#$ 1#.#%

2+11-2+12 #2+ 1%+' 2%.13

In(rnc+

Current liabilities in the year 2++*-2+1+ 1as more increased3 and as 1ell as

2+11-2+12 1as satisfactory. 0he company tries to ta-e care about the liabilities.

Cash turno%r ratio+

0his ratio indicates the proportion of cash balances held in relation to sales

volume. 0his is used as a controlling device. Increases in sales are associated 1ith larger

cash balances. ?igher cash turnover in sales indicates efficient utili/ation of cash

resources.

Cash turno%r ratio D Nt sa"sE cash

Cash to sa"s ratio in RCAML

Ta3" )@

Lear Fet sales ARs. In

croresB

Cash ARs. In croresB Ratio

2++*-2+1+ %3'1 11)3 $.3)

2+1+-2+11 '3%$ 23) 3+.*#

2+11-2+12 *')) #2+ 23.3+

In(rnc+

0he ratio in the year 2++*-1+ is no satisfactory for getting profits. &nd the

remaining years could get good results of the sales.

Ana"'sis (or rci%a3"s+

0he management of any business holdings credit balances involves cost3 1hich at

the same time affects profitability. 0he management has to decide ho1 much to be

invested in debtors to stri-e best balance bet1een cost and benefits. !oreover3 the level

of investment in accounts receivables depends upon the volume of sales3 credit terms and

conditions3 ris-iness of individuals and customers to 1hom credit is given and so on.

?o1ever the decision may be ta-en by comparing its performance of the debtors2

management functions 1ith to its performance in the past. & useful basic for such

comparison may be percentage of debtors2 to total assets3 percentage of receivables to

current assets and debtors turnover ratio.

D3tors to tota" assts ratio+

0his ratio e.presses the percentage of investment made in total assets of a concern.

It is important in the vie1 of management to have lesser amount of debtors for the

efficient functioning of the business units.

D3tors to tota" assts ratio D 5D3torsE Tota" assts7F);;

Ratio o( d3tors to tota" assts in RCAML

Ta3" )A

Lear 5ebtors ARs. In

croresB

0otal assets ARs. In

croresB

Ratio

2++*-2+1+ $1*+ %)1 '%2.11

2+1+-2+11 1'$1 22%2 ''.#+

2+11-2+12 2%%3 3$1+ '$.)%

In(rnc+

0otal assets ratio in the year 2++*-1+ is huge 1ith '%2.11 is not satisfactory.

D3tors to currnt assts ratio+

0he percentage of debtors to current assets is an important tool in udging the

practice of maintaining receivables balance by the company. 0his ratio is used to analy/e

the share of 1or-ing capital bloc- in debtors. 0he debtors to current assets ratio is

computed in the company furnished belo1.

D3tors to currnt assts ratio D 5D3torsE Currnt assts7F);;

Ratio o( d3tors to currnt assts in RCAML

Ta3" )B

Lear 5ebtors ARs. In

croresB

Current assets ARs.

In croresB

Ratio

2++*-2+1+ $1*+ 1%#' 31$.11

2+1+-2+11 1'$1 3++' $).23

2+11-2+12 2%%3 2*'2 )*.%+

In(rnc+

Current assets ratio in the year 2++*-1+ is huge 1ith 31$.11 is satisfactory. 0he

remaining years are also satisfactory.

D3torsG turno%r ratio+

5ebtors2 turnover ratio indicates 1hat the number of times is the turnover for debtors

is each year. <enerally3 the higher the value of the debtors2 turnover3 the more efficient is

the management of credit. 0he obective of this ratio is to measure the li9uidity of

receivables is uncollected.

D3tor turno%r ratio D 5Sa"sEa%rag accounts rci%a3"s7

D3tor turno%r ratio

Ta3" )<

Lear Sales ARs. In la-hsB &verage a=c

receivables ARs. In

la-hsB

Ratio

2++*-2+1+ #3'1 $%1 '.*1

2+1+-2+11 '3+' 231 ).%'

2+11-2+12 *')) 3') 2$.)*

In(rnc+

0he ratios are sho1ing an increasing trend3 this gradual increase sho1s that

better is the li9uidity of the debtors.

FINDINGS

1. 0he sales of the company are made on both cash and credit terms. Out of the sales

generated *+Q are of credit and 1+Q of cash basis. ,ut3 RC&!" sales 1ere done

on 4Cash and Carry do1n6 basis.

2. 0he company e.tends credit for period of #$ days to its customers. It 1aits for a

period of $$ days to get the payments from the customers. 0he company does not

offer cash discounts to reduce their debt crisis.

3. 0he credit 1orthiness and credit limit to customer is determined by the character

and financial position of a customer and period of presence in the business.

#. 0he transactions 1ith the ne1 customers 1ill be on the cash terms3 1ith due

course of time3 credit 1ill be given to them.

$. 0he company follo1s the classification of debts into three categories namely

debts outstanding for less than 3+-*+ days are considered to be 4<OO563 for *+-

1)+ days are considered to be 45OG,0(G"6 andS1)1 days are considered to be

45IS>G07S6.

%. 0he company employs6 &<7IF< SC?75G"76 in order to monitor its boo-

debts. It provides more information about the past collection e.perience and helps

to spot out the slo1 paying debtor. 8ith the ageing schedule3 the company is not

able to trace out the over dues from the customers3 1hich results in poor debt

management.

S0GGESTIONS

1. It is suggested that the company employs the 4&geing Schedule6 to monitor its

debts3 1hich suffers from the problem of aggregation and does not relate boo-

debts to sales of the same period. 0his problem can be eliminated by using dis-

aggregated data for analy/ing collection e.perience.

2. It is recommended that the company adopt structured frame 1or- for ban-

guarantee limits must be done by the company that e.tend the company to give

credit limit to its customer.

3. Implementation of a special pac-age of 47R>63 that is to be made to improve the

cash and credit management procedures in a better manner regarding to6C&S?

&F5 R7C7IE&,"76.

#. It is suggested that the company has to ta-e guarantee from a scheduled ban-

must be ta-en.

$. ,efore investigating 1hether the payments from the debtors are collected in time

or not3 it 1ould be necessary that should be improved3

aB 0he e.isting billing system.

bB Is the billing mechanism efficient to introduceT A(or periodical paymentsB.

CONCL0SION

It can be concluded that cash and receivables performance of the company is

reasonably satisfactory. In certain areas the company has to focus more.

R"ianc Ca$ita" Asst Manag!nt Li!itd should try to overcome hurdles3

especially in the area of debtor2s management.

&s R"ianc Ca$ita" Asst Manag!nt Li!itd has stepped into a

liberali/ed mar-et driven environment3 there is an urgent need for its managers to

function li-e businessmen3 rather than <overnment officials this not only needs

change on the part of higher officials but also re9uires 1holehearted efforts of all the

employees.

BIBLIOGRAPH.

I.!.>&F57L3 (inancial !anagement

7dition; 0hird 7dition

>ublisher; ?imalaya publications

5r. <. >R&S&53 5r. O.E.F.,. OG!&R3 &dvanced !anagement &ccountancy

7dition; (irst 7dition

>ublisher; Dai ,harat

Company 8ebsite;

###* r"ianc ca$ita"* co *inE

###* r"ianc !utua"*co!E

###*a!(iindia*co!

BALANCE SHEET OF R"ianc Ca$ita" Asst Manag!nt Li!itd

ARs. In croresB

>articulars 2++*-1+ 2+1+-11 2+11-12

Sources of funds

0otal share capital +.+1 +.+$ 13+22.31

79uity share capital +.+1 +.+$ 13+22.31

Share application

money

+.++ %11.$' +.++

>reference share

capital

+.++ +.++ +.++

Reserves +.++ 1#3')3.#3 1*3$+3.23

Revaluation

reserves

+.++ +.++ +.++

Fet 1orth +.+1 1$33*$.+$ 2+3$2$.$#

Secured loans +.++ +.++ $3113.$'

Gnsecured loans +.++ +.++ *3#$#.2'

0otal debt +.++ +.++ 1#3$%'.)#

0otal liabilities +.+1 1$33*$.+$ 3$3+*3.3)

&pplication of funds

<ross bloc- +.++ 1*).+) 2+3%2$.)2

&ccum.

5epreciation

+.++ 31.)$ 23$2'.3'

Fet bloc- +.++ 1%%.2# 1)3+*).#$

Capital 1or- in

progress

+.++ +.++ 231)$.%+

Investments +.++ 123+'#.1+ $3#3#.#3

Inventories +.++ +.++ *).$1

Sundry debtors +.++ +.++ )+2.11

Cash and ban-

balance

+.++ +.+$ 2).+)

0otal current assets +.++ +.+$ *2).'+

"oans and advances +.+1 331$).*1 1*313'.*'

(i.ed deposits +.++ +.++ #+.3'

0otal C&3 loans C

advances

+.+1 331$).*% 2+31+'.+#

5eferred credit +.++ +.++ +.++

Current liabilities +.++ 1.%) %33+*.33

>rovisions +.++ 2.$' #3#22.)1

0otal C"C

provisions

+.++ #.2$ 1+3'32.1#

Fet current assets +.+1 331$#.'1 *33'#.*+

!iscellaneous

e.penses

+.++ +.++ +.++

0otal assets +.+1 1$33*$.+$ 3$3+*3.3)

Contingent

liabilities

+.++ +.++ 33')1.3+

,oo- valueARsB 1+.++ 13#')33#).++ 1++.3*

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Pronto Pizza Problem SubmissionDocument13 pagesPronto Pizza Problem SubmissionVikas Vimal100% (5)

- Roadwork Projects Quality Control PlanDocument17 pagesRoadwork Projects Quality Control PlanSPHERICBLUE100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manager As CoachDocument312 pagesManager As CoachDennis Shongi100% (1)

- Kotak InsuraceDocument1 pageKotak InsuraceRemo RomeoNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Mine Black Book ProjectDocument47 pagesMine Black Book ProjectHemal VyasNo ratings yet

- Recent Trends in Public Sector BanksDocument79 pagesRecent Trends in Public Sector Banksnitesh01cool67% (3)

- Lee Chang Opened Chang S Cleaning Service On July 1 2010 PDFDocument1 pageLee Chang Opened Chang S Cleaning Service On July 1 2010 PDFAnbu jaromiaNo ratings yet

- Estimating Construction Cost in Chemical Process IndustriesDocument3 pagesEstimating Construction Cost in Chemical Process Industriessatya.usct.900450No ratings yet

- Value ChainDocument7 pagesValue ChainDolly ParhawkNo ratings yet

- Blue ch04Document32 pagesBlue ch04Lokesh ShahareNo ratings yet

- Business Portfolio: The Growth-Share MatrixDocument2 pagesBusiness Portfolio: The Growth-Share MatrixUsama KhanNo ratings yet

- Go 38 Ap Teacher Eligibility Tet Cum Recruitment Test Guidelines - Ap DSC 2014 GuidelinesDocument16 pagesGo 38 Ap Teacher Eligibility Tet Cum Recruitment Test Guidelines - Ap DSC 2014 Guidelinesapi-247813089No ratings yet

- Evolution of Future Group - King of Indian Retail IndustryDocument17 pagesEvolution of Future Group - King of Indian Retail IndustrySurya PrakashNo ratings yet

- Mahindra & Mahindra LTD.: Automotive & Farm Equipment SectorsDocument2 pagesMahindra & Mahindra LTD.: Automotive & Farm Equipment SectorsSunil ChoudharyNo ratings yet

- Brand Finance Indonesia 2018Document20 pagesBrand Finance Indonesia 2018Aryu NutsNo ratings yet

- DOOWIN Load Test Water Bags & Underwater Air Lifting BagsDocument10 pagesDOOWIN Load Test Water Bags & Underwater Air Lifting BagsDavidNo ratings yet

- PH.D Thesis M. UshaDocument185 pagesPH.D Thesis M. UshaAdrian Serban100% (1)

- Contract Law 1 NotesDocument20 pagesContract Law 1 NotesThe Law ClassroomNo ratings yet

- Employment Agencies HRM 2018Document2 pagesEmployment Agencies HRM 2018RuchirNo ratings yet

- Banking and Microfinance - IIDocument24 pagesBanking and Microfinance - IIKoyelNo ratings yet

- Project Feasibility StudyDocument22 pagesProject Feasibility StudyIan Bagunas100% (1)

- BVADocument52 pagesBVACiprian StroeNo ratings yet

- Week 3 - Business Level Strategy - ResumeDocument4 pagesWeek 3 - Business Level Strategy - ResumeVinaNo ratings yet

- AAACK7632B-2013-14 Form 26AASDocument7 pagesAAACK7632B-2013-14 Form 26AASRama Prasad PadhyNo ratings yet

- Value Engineering Case StudyDocument7 pagesValue Engineering Case StudyYadhu JSNo ratings yet

- A Summer Tranning Project Report Study On: Master of Business Administration SESSION (2012-2014)Document70 pagesA Summer Tranning Project Report Study On: Master of Business Administration SESSION (2012-2014)Amarbant Singh DNo ratings yet

- Formal Entry Import Cargo ClearanceDocument13 pagesFormal Entry Import Cargo ClearancepoypisaypeyupsNo ratings yet

- ALU Vs NLRCDocument2 pagesALU Vs NLRCimangandaNo ratings yet

- Building An Organization Capable of Good Strategy Execution: People, Capabilities, and StructureDocument31 pagesBuilding An Organization Capable of Good Strategy Execution: People, Capabilities, and Structuremrt8888100% (1)