Professional Documents

Culture Documents

PROJECT Finance For Mba 4

PROJECT Finance For Mba 4

Uploaded by

Dhawal BhatiaCopyright:

Available Formats

You might also like

- Lyari Expressway Rehabilitation ProjectDocument32 pagesLyari Expressway Rehabilitation ProjectKamran KhanNo ratings yet

- Module 3 Answers To End of Module QuestionsDocument40 pagesModule 3 Answers To End of Module QuestionsYanLi100% (3)

- Taxi Booking System ProposalDocument22 pagesTaxi Booking System ProposalAxcel Helsing0% (2)

- Eventbrite & The CloudDocument27 pagesEventbrite & The CloudKevin Hartz100% (1)

- SupervisionDocument45 pagesSupervisionsunielgowda100% (5)

- General Standards (NDT)Document2 pagesGeneral Standards (NDT)agniva dattaNo ratings yet

- Landscape Scope AustraliaDocument55 pagesLandscape Scope AustralianenaddimNo ratings yet

- Lepanto Consolidated Mining Company vs. Ambanloc (June 29, 2010)Document5 pagesLepanto Consolidated Mining Company vs. Ambanloc (June 29, 2010)Vince LeidoNo ratings yet

- ProjectDocument69 pagesProjectGagandeepSinghWaliaNo ratings yet

- Tania Textile: A Concern of A Hussein GroupDocument7 pagesTania Textile: A Concern of A Hussein GroupShajiaAfrinNo ratings yet

- AMS Engagement Guidelines V2Document24 pagesAMS Engagement Guidelines V2mohi4uNo ratings yet

- Anjali Project ReportDocument90 pagesAnjali Project ReportNisha Malik FogatNo ratings yet

- Industrisl Report ON Advertising OF Hindustan Lever LTDDocument84 pagesIndustrisl Report ON Advertising OF Hindustan Lever LTDPau GajjarNo ratings yet

- Tax Review Notes 2005Document114 pagesTax Review Notes 2005Joy PinonganNo ratings yet

- Internship Report and Project Main - Apurv PranavDocument136 pagesInternship Report and Project Main - Apurv PranavApurv Sinha100% (3)

- Title Given Is Just An Example. All Students Are Supposed To Make Title of The Project After Discussion With The MentorDocument11 pagesTitle Given Is Just An Example. All Students Are Supposed To Make Title of The Project After Discussion With The MentorRishabh KumarNo ratings yet

- Financial Accounting ANS: Q.NO: 2 Discuss How Accounting Satisfies Needs of Different GroupsDocument8 pagesFinancial Accounting ANS: Q.NO: 2 Discuss How Accounting Satisfies Needs of Different GroupsGunamoy HazraNo ratings yet

- Final Report of SpeechDocument102 pagesFinal Report of SpeechParinit TyagiNo ratings yet

- IT-2 TY-2013 Without Formula - 2013Document12 pagesIT-2 TY-2013 Without Formula - 2013Muhammad TausifNo ratings yet

- Project Proposal Form: High School Student Council OfficersDocument4 pagesProject Proposal Form: High School Student Council OfficersasdfghjklostNo ratings yet

- Suburb Report: Huntingdale 6110 WaDocument5 pagesSuburb Report: Huntingdale 6110 Waganguly147147No ratings yet

- Proposal Kerja Praktek Pt. Perusahaan Gas Negara (Persero) Tbk. Pagardewa, Sumatera SelatanDocument11 pagesProposal Kerja Praktek Pt. Perusahaan Gas Negara (Persero) Tbk. Pagardewa, Sumatera SelatanyeniamiraahNo ratings yet

- SAP Audit GuidelinesDocument93 pagesSAP Audit GuidelinesShahid_ONNo ratings yet

- Prashant AlavandiDocument4 pagesPrashant AlavandiPrashantAlavandiNo ratings yet

- Job Vacancies - NMDocument5 pagesJob Vacancies - NMRashid BumarwaNo ratings yet

- Wages and Salary Fixation in Galaxy Toyota: A Research Project ReportDocument80 pagesWages and Salary Fixation in Galaxy Toyota: A Research Project ReportHimanshi MalikNo ratings yet

- Uttarakhand Disaster Recovery Project J T: M /E /O It/Mis Location: Contract Term: Start Date: Responsible To: Responsible ForDocument2 pagesUttarakhand Disaster Recovery Project J T: M /E /O It/Mis Location: Contract Term: Start Date: Responsible To: Responsible ForGovind KambojNo ratings yet

- 1.1 Banking Structure in IndiaDocument33 pages1.1 Banking Structure in IndiadevrajkinjalNo ratings yet

- Submitted by Arjun Kumar Singh Roll No: BBA-5th Semester 2011-2014Document50 pagesSubmitted by Arjun Kumar Singh Roll No: BBA-5th Semester 2011-2014AVINANDANKUMARNo ratings yet

- The Weekly Market Update For August 25, 2014Document2 pagesThe Weekly Market Update For August 25, 2014mike1473No ratings yet

- New CPAPP 1 Due October 4, 2013Document11 pagesNew CPAPP 1 Due October 4, 2013T_P92No ratings yet

- Punctuation: This Is Mine. Come and Get MeDocument12 pagesPunctuation: This Is Mine. Come and Get MesantasantitaNo ratings yet

- Grand Project Report: "Role of Sales Promotion On FMCG"Document86 pagesGrand Project Report: "Role of Sales Promotion On FMCG"Ritika KhuranaNo ratings yet

- Government of India Ministry of RailwaysDocument10 pagesGovernment of India Ministry of Railwaysrdas1980No ratings yet

- Section-IV Qualification CriteriaDocument6 pagesSection-IV Qualification CriteriaYohannes GebreNo ratings yet

- Weekly Market Update For The Week of November 4thDocument2 pagesWeekly Market Update For The Week of November 4thmike1473No ratings yet

- Multiple Choice Questions Unit-I: Operations Management Question Bank Unit-1Document5 pagesMultiple Choice Questions Unit-I: Operations Management Question Bank Unit-1divyaimranNo ratings yet

- Finance (MBA)Document106 pagesFinance (MBA)Deepika KrishnaNo ratings yet

- A Project Report ON: Department of Business ManagementDocument33 pagesA Project Report ON: Department of Business ManagementrishabguptaNo ratings yet

- Stem Cell Research GuidelinesDocument5 pagesStem Cell Research Guidelineskib240309No ratings yet

- Business Plan Model For StudentsDocument7 pagesBusiness Plan Model For StudentsprikinaNo ratings yet

- Human Resource Management in International Organizations: Sonja TrevenDocument13 pagesHuman Resource Management in International Organizations: Sonja TrevenYogeswari SubramaniamNo ratings yet

- Derivatives Final Document 100marksDocument90 pagesDerivatives Final Document 100markshitenjhamnaniNo ratings yet

- Tables of ContentsDocument9 pagesTables of ContentsNgocHa MaNo ratings yet

- Reliance Mf-Buying BehaviourDocument58 pagesReliance Mf-Buying BehaviourTrupesh PatelNo ratings yet

- All India Council For Technical Education: Application Id - Page X/yDocument5 pagesAll India Council For Technical Education: Application Id - Page X/ysivapathasekaranNo ratings yet

- Bls Institute of Technology Management: Guidelines For Project Report and Viva VoceDocument11 pagesBls Institute of Technology Management: Guidelines For Project Report and Viva VoceRahul DewanNo ratings yet

- Test BankDocument73 pagesTest Bankmanagement_ushtNo ratings yet

- Premier Safety Institute: Title: Corporate VP, Chief Quality and Safety OfficerDocument4 pagesPremier Safety Institute: Title: Corporate VP, Chief Quality and Safety Officergothangel10No ratings yet

- Security Transactions 2006Document61 pagesSecurity Transactions 2006Joe MatikasNo ratings yet

- Vina MilkDocument33 pagesVina MilkDo Van TuNo ratings yet

- Sistem Perencanaan & Pengendalian ManajemenDocument17 pagesSistem Perencanaan & Pengendalian ManajemenArli SeptiantoNo ratings yet

- A Day'S Excursion To The Malacca Zoo Project: Fair TestDocument10 pagesA Day'S Excursion To The Malacca Zoo Project: Fair TestIna InaNo ratings yet

- Indusind Bank LTDDocument76 pagesIndusind Bank LTDRavindra Sharma0% (1)

- Dubai Property Price Increases To Continue in 2013Document2 pagesDubai Property Price Increases To Continue in 2013Theng RogerNo ratings yet

- Organization Study Of: HLL Lifecare LTDDocument20 pagesOrganization Study Of: HLL Lifecare LTDGokulSbNo ratings yet

- Cadbury ProjectDocument72 pagesCadbury ProjectNeha Roks100% (1)

- Integrated Safeguards Data Sheet Concept StageDocument4 pagesIntegrated Safeguards Data Sheet Concept StageMalik Wasiq MustafaNo ratings yet

- 2012 ICPA Cover Volume1Document16 pages2012 ICPA Cover Volume1Tatam ChiwayNo ratings yet

- Divided States: Strategic Divisions in EU-Russia RelationsFrom EverandDivided States: Strategic Divisions in EU-Russia RelationsNo ratings yet

- v-Myb proteins and their oncogenic potential: A study on how two point mutations affect the interaction of v-Myb with other proteinsFrom Everandv-Myb proteins and their oncogenic potential: A study on how two point mutations affect the interaction of v-Myb with other proteinsNo ratings yet

- The Israel Lobby ControversyDocument2 pagesThe Israel Lobby ControversysisinjhaaNo ratings yet

- Aipmt Round 3Document335 pagesAipmt Round 3AnweshaBoseNo ratings yet

- Introduction - Online Car Booking Management SystemDocument5 pagesIntroduction - Online Car Booking Management SystemTadese JegoNo ratings yet

- 04Document39 pages04ANK SHRINIVAASAN100% (1)

- STUDENT 2021-2022 Academic Calendar (FINAL)Document1 pageSTUDENT 2021-2022 Academic Calendar (FINAL)Babar ImtiazNo ratings yet

- Asphyxial DeathDocument17 pagesAsphyxial DeathSisca ChearzNo ratings yet

- Lesson 11.future Worth MethodDocument7 pagesLesson 11.future Worth MethodOwene Miles AguinaldoNo ratings yet

- Negara Hukum-5-1-Juni-2014Document99 pagesNegara Hukum-5-1-Juni-2014haekalnashvilleNo ratings yet

- SP 70Document75 pagesSP 70Barbie Turic100% (2)

- Literature Review On College Management SystemDocument4 pagesLiterature Review On College Management Systemgxkswirif100% (1)

- Iqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and ConstructionDocument31 pagesIqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and Constructionjacksonbello34No ratings yet

- Weekly Report w34Document19 pagesWeekly Report w34Asep MAkmurNo ratings yet

- Nnadili v. Chevron U.s.a., Inc.Document10 pagesNnadili v. Chevron U.s.a., Inc.RavenFoxNo ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Acc21 March18Document12 pagesAcc21 March18Romero Mary Jane C.No ratings yet

- Teaching The SchwaDocument5 pagesTeaching The SchwaStarr BlueNo ratings yet

- M607 L01 SolutionDocument7 pagesM607 L01 SolutionRonak PatelNo ratings yet

- Manual On Settlement of Land DisputesDocument120 pagesManual On Settlement of Land Disputescookbooks&lawbooks100% (1)

- Brown 2003Document12 pagesBrown 2003sziágyi zsófiaNo ratings yet

- Coraline QuotesDocument2 pagesCoraline Quotes145099No ratings yet

- NILE Initiating Coverage JSDocument11 pagesNILE Initiating Coverage JSBrian BolanNo ratings yet

- Written Test For Innovius ResearchDocument2 pagesWritten Test For Innovius ResearchPrince RoyNo ratings yet

- 4th Chapter Business Government and Institutional BuyingDocument17 pages4th Chapter Business Government and Institutional BuyingChristine Nivera-PilonNo ratings yet

- INSTA September 2023 Current Affairs Quiz Questions 1Document10 pagesINSTA September 2023 Current Affairs Quiz Questions 1rsimback123No ratings yet

- This Chapter Deals With Zurich and The Swiss Confederation CelesteDocument3 pagesThis Chapter Deals With Zurich and The Swiss Confederation CelesteCeleste Refil MartinezNo ratings yet

- Pate Thomerson Resume 2020Document1 pagePate Thomerson Resume 2020api-554425379No ratings yet

- MerchandisingDocument18 pagesMerchandisinghamida sarip100% (2)

PROJECT Finance For Mba 4

PROJECT Finance For Mba 4

Uploaded by

Dhawal BhatiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PROJECT Finance For Mba 4

PROJECT Finance For Mba 4

Uploaded by

Dhawal BhatiaCopyright:

Available Formats

RISK RETURN ANALYSIS

A PROJECT REPORT

Under the guidance Of

Mr. Prem Kumar

______________________________

Submitted by

PANKAJ ARORA

(Registration No: 51112116!

______________________________

in partial fulfillment o f the requirement

for the award of the degree

Of

MBA

IN

"#INAN$E %ANA&E%ENT'

<22, June> & <2012>

Acknowledgement: Acknowledgment is the regards given to the people

and organization who have helped you in completing the project

undertaken. Mainly it must consist of Acknowledgement towards the

organization you study and to the company where you have done your

project followed by the people who have helped you in the process.

1

PROJE$T REPORT

ON

RISK RETURN ANALYSIS AN(

$O%PARATI)E STU(Y O# RELIAN$E

%UTUAL #UN(

(A *issertation s+,-itte* to .SIKKI% %ANIPAL

UNI)ERSITY/ In 0artia1 2+12i11-ent o2 t3e re4+ire-ent 2or

*egree o2 %5A (#inan6e!

Submitted by

Pankaj Arora

2

5ONA#I(E $ERTI#I$ATE

This is to certify that the Report on Project Work tite! .Ris7 Ret+rn Ana18sis an*

$o-0arati9e St+*8 o2 Re1ian6e %+t+a1 #+n*/ for Reiance "apita #sset $ana%e&ent

"o&pany 't!( is a )onafi!e recor! of the *ork !one )y

+tu!yin% in $aster of ,usiness #!&inistration -

th

se&ester in .A:%: In2or-ati6s P9t: Lt*:

Instit+te o2 %anage-ent/, Ne* .ehi !urin% the year 2011/12(

0

A$KNO;LE(&E%ENT

I *ou! ike to e1press &y appreciation an! %ratitu!e to 2arious peope *ho ha2e share!

their 2aua)e ti&e an! &a!e possi)e this project, throu%h their !irect or in!irect

cooperation(

$y first *or! of %ratitu!e is for Mr. Abhi!he" Sri#a!ta#a 3 Re1ations3i0

%anager($or0orate Sa1e!< RELIAN$E A%$< (e13i &y corporate %ui!e< for his kin!

hep an! support an! his 2aua)e %ui!ance throu%hout &y project(

I a& aso thankfu to %s:=%r: >>>>>, &y facuty %ui!e of .A:%: In2o-ati6s P9t:

Lt*:/, 14, 05, N(W(#( Punja)i ,a%h 61tn, "u) Roa!, Ne* .ehi, for his7her 2aua)e

%ui!ance( +he78e has hepe! &e earn a)out the process, con!uctin% sur2ey, anay9in% an!

presentin% the facts an! fi%ures(

I a& aso thankfu to &y respecte! facuties, !ear frien!s & coea%ues, *ho ha2e hepe! &e

in e2ery possi)e *ays, supporte! &e an! encoura%e! &e to e1pore ne* !i&ensions(

%5A ?

T@

SE%ESTER

-

(E$LARATION

I here )y !ecare that the project report entite!:

# Project Report on .Ris7 Ret+rn Ana18sis An* $o-0arati9e St+*8 O2 Re1ian6e

%+t+a1 #+n*/ su)&itte! in partia fufi&ent of the re;uire&ent for the !e%ree of $aster of

,usiness #!&inistration to R6'I#N"6 "#PIT#' #++6T $#N#<6$6NT "=$P#N> is

&y ori%ina *ork an! not su)&itte! for the a*ar! of any other !e%ree, !ipo&a, feo*ship,

or any other si&iar tite or pri9es(

Na&e: P#N?#J #R=R#

Pace: Ne* .ehi

.ate: 22/0@/2012

5

TA5LE O# $ONTENT

+(No( Pa%e No(

1 INTR=.A"TI=N 2@

2 "=$P#N> PR=BI'6 0C

0 =,J6"TID6+ =B T86 +TA.> 55

- "=$P6TIT=R+ =B R6'I#N"6

$ATA#' BAN.

-0

5 R6+6#R"8 $6T8=.='=<> 5@

@ .#T# #N#'>+I+ #N.

INT6RPR6T#TI=N

E5

E B6#TAR6+ & ,6N6BIT+ E2

C R6PR6+6NT ,> PI6 "8#RT E4

4 BIN.IN<+ #N. +A<<6+TI=N+ C0&C1

10 "=N"'A+I=N C2

11 'I$IT#TI=N 5C

12 ,I,'I=<R#P8> C0

@

PRE#A$E

This is the a%e of technica up %ra!ation( Nothin% re&ains sa&e for a on% perio! e2ery thin%

chan%e *ith a certain span of ti&e( +o it is &ust for e2ery or%ani9ation to put a )ir!s eye

2ie* on itFs o2er a functionin%(

This report has )een prepare! !urin% practica trainin% of $aster of )usiness a!&inistration

(%:5:A:! fro& A:%: In2o-ati6s P9t: Lt*:< Instit+te o2 %anage-ent (The stu!ent of

$(,(#( essentiay re;uire! a practica trainin% of - to 5 *eeks in any or%ani9ation( It %i2es

an opportunity to the stu!ent to test their ac;uire! kno*e!%e throu%h practica e1periences(

The successfu co&petion of this project *as a uni;ue e1perience for &e )ecause )y 2isitin%

&any pace an! interactin% 2arious person, I achie2e! a )etter kno*e!%e a)out saes( The

e1perience *hich I %aine! )y !oin% this project *as essentia at this turnin% point of &y

carrier this project is )ein% su)&itte! *hich content !etaie! anaysis of the research un!er

taken )y &e(

The research pro2i!es an opportunity to the stu!ent to !e2ote his7her skis kno*e!%e an!

co&petencies re;uire! !urin% the technica session(

The research has )een con!ucte! on the topic GRis7 Ret+rn Ana18sis An* $o-0arati9e

St+*8 O2 Re1ian6e %+t+a1 #+n*H(

P'#"6/III((

.#T6IIII((

E

EAE$UTI)E SU%%ARY

The perfor&ance e2auation of &utua fun! is a 2ita &atter of concern to the fun! &ana%ers,

in2estors, an! researchers aike( The core co&petence of the co&pany is to &eet o)jecti2es

an! the nee!s of the in2estors an! to pro2i!e opti&u& return for their risk( This stu!y tries to

fin! out the risk an! return aie! *ith the &utua fun!s(

This project paper is se%&ente! into three sections to e1pore the ink )et*een con2entiona

su)jecti2e an! statistica approach of $utua Bun! anaysis( To start *ith, the first section

!eas *ith the intro!uctory part of the paper )y %i2in% an o2er2ie* of the $utua fun!

in!ustry an! co&pany profie(

This section aso taks a)out the theory of portfoio anaysis an! the !ifferent &easures of

risk an! return use! for the co&parison(

The secon! section !etais on the nee!, o)jecti2e, an! the i&itations of the stu!y( It aso

!iscusses a)out the sources an! the perio! for the !ata coection( It aso !eas *ith the !ata

interpretation an! anaysis part *herein a the key &easures reate! to risk an! return are

!one *ith the interpretation of the resuts(

In the thir! section, an atte&pt is &a!e to anay9e an! co&pare the perfor&ance of the e;uity

&utua fun!( Bor this purpose J/2aue, stan!ar! !e2iation, an! risk a!juste! perfor&ance

&easures such as +harpe ratio, Treynor &easure, Jenson #pha, an! Be&a &easure ha2e )een

use!(

The portfoio anaysis of the seecte! fun! has )een !one )y the &easure return for the

ho!in% perio!(

#t the en!, it iustrates the su%%estions an! fin!in%s )ase! on the anaysis !one in the

pre2ious sections an! finay it !eas *ith concusion part(

C

%UTUAL #UN( O)ER)IE;

$utua fun! is an in2est&ent co&pany that poos &oney fro& s&a in2estors an!

in2ests in a 2ariety of securities, such as stocks, )on!s an! &oney &arket instru&ents( $ost

open/en! $utua fun!s stan! rea!y to )uy )ack Kre!ee&L its shares at their current net asset

2aue, *hich !epen!s on the tota &arket 2aue of the fun!Ms in2est&ent portfoio at the

ti&e of re!e&ption( $ost open/en! $utua fun!s continuousy offer ne* shares to

in2estors( It is aso kno*n as an open/en! in2est&ent co&pany, to !ifferentiate it fro& a

cose!/en! in2est&ent co&pany(

$utua fun!s in2est pooe! cash of &any in2estors to &eet the fun!Ms state! in2est&ent

o)jecti2e( $utua fun!s stan! rea!y to se an! re!ee& their shares at any ti&e at the fun!Fs

current net asset 2aue: tota fun! assets !i2i!e! )y shares outstan!in%(

4

I

N

D

6

+

T

=

R

IND6+T

T86IR

$=N6>

IND6+T IN

D#RI6T> =B

+T="?+7,=N.+

$

A

T

A

#

'

B

A

N

.

+

8

6

$

6

+

$

#

R

?

6

T

K

B

'

A

"

T

A

#

T

I

=

N

+

L

PR=BIT7'=++ B=R$

P=RTB='I= =B

IND6+T$6NT

PR=BIT7'=++ BR=$

IN.IDI.A#'

In +i&pe Wor!s, $utua fun! is a &echanis& for pooin% the resources )y issuin% units

to the in2estors an! in2estin% fun!s in securities in accor!ance *ith o)jecti2es as

!iscose! in offer !ocu&ent(

In2est&ents in securities are sprea! across a *i!e cross/section of in!ustries an!

sectors an! thus the risk is re!uce!( .i2ersification re!uces the risk )ecause not a stocks

&ay &o2e in the sa&e !irection in the sa&e proportion at the sa&e ti&e( $utua fun! issues

units t o the in2estors in accor!ance *ith ;uantu& of &oney in2este! )y the&(

In2estors of $utua fun! are kno*n as unit ho!ers( The profits or osses are share! )y the

in2estors in proportion to their in2est&ents( The $utua fun!s nor&ay co&e out *ith a

nu&)er of sche&es *ith !ifferent in2est&ent o)jecti2es *hich are aunche! fro& ti&e to

ti&e(

In In!ia, # $utua fun! is re;uire! to )e re%istere! *ith +ecurities an! 61chan%e ,oa

r! of In!ia K+6,IL *hich re%uates securities &arkets )efore it can coect fun!s fro& the

pu)ic(

In +hort , a $utua fun! is a co&&on poo of &oney in to *hich in2estors *ith

co&&on in2est&ent o)jecti2e pace their contri)utions that are to )e in2este! in

accor!ance *ith the state ! in2est&ent o)jecti2e of the sche&e( The in2est&ent &ana%er

*ou! in2est the &oney coecte! fro& the in2estor in to assets that are !efine!7

per&itte! )y the state! o)jecti2e of the sche&e( Bor e1a&pe, a n e;uity fun! *ou!

in2est e;uity an! e;uity reate! instru&ents an! a !e)t fun! *ou! in2est in )on!s,

!e)entures, %its etc( $utua fun! is a suita)e in2est&ent for the co&&on &a n a s it offers

an =porto unity to in2est in a !i2ersifie!, professionay &ana%e! )asket of securities at

a reati2ey o* cost(

10

@ISTORY O# %UTUAL #UN(S (;ORL(;I(E!

When three ,oston securities e1ecuti2es pooe! their &oney to%ether in 142- to create the

first &utua fun!, they ha! no i!ea ho* popuar &utua fun!s *ou! )eco&e(

The i!ea of pooin% &oney to%ether for in2estin% purposes starte! in 6urope in the &i!/

1C00s( The first pooe! fun! in the A(+( *as create! in 1C40 for the facuty an! staff of

8ar2ar! Ani2ersity( =n $arch 21st, 142- the first officia &utua fun! *as )orn( It *as

cae! the $assachusetts In2estors Trust(

#fter one year, the $assachusetts In2estors Trust %re* fro& N50,000 in assets in 142- to

N042,000 in assets K*ith aroun! 200 shareho!ersL( In contrast, there are o2er 10,000 &utua

fun!s in the A(+( to!ay totain% aroun! NE triion K*ith appro1i&atey C0 &iion in!i2i!ua

in2estorsL accor!in% to the In2est&ent "o&pany Institute(

The stock &arket crash of 1424 so*e! the %ro*th of &utua fun!s( In response to the stock

&arket crash, "on%ress passe! the +ecurities #ct of 1400 an! the +ecurities 61chan%e #ct of

140-( These a*s re;uire that a fun! )e re%istere! *ith the +6" an! pro2i!e prospecti2e

in2estors *ith a prospectus( The +6" KA(+( +ecurities an! 61chan%e "o&&issionL hepe!

create the In2est&ent "o&pany #ct of 14-0, *hich pro2i!es the %ui!eines that a fun!s

&ust co&py *ith to!ay(

With rene*e! confi!ence in the stock &arket, &utua fun!s )e%an to )osso&( ,y the en! of

the 14@0s there *ere aroun! 2E0 fun!s *ith N-C )iion in assets(

In 14E@, John "( ,o%e opene! the first retai in!e1 fun! cae! the Birst In!e1 In2est&ent

Trust( It is no* cae! the Dan%uar! 500 In!e1 fun!( In No2e&)er of 2000 it )eca&e the

ar%est &utua fun! e2er *ith N100 )iion in assets(

11

@istor8 o2 In*ian %+t+a1 #+n* In*+str8

The history of $utua Bun!s in In!ia can )e )roa!y !i2i!e! into - Phases:

1: #IRST P@ASE (1B6?C1BD!

The Anit Trust of In!ia KATIL *as esta)ishe! in the year 14@0 )y passin% an

#ct in the Paria&ent(

The ATI *as setup )y the Reser2e ,ank of In!ia KR,IL an! functione! un!er

the Re%uatory an! #!&inistrati2e contro of the R,I(

The Birst sche&e in the history of &utua fun!s *as ANIT +"86$6/@-,

*hich is popuary kno*n as A+/@-(

In 14EC, ATI *as !e/inke! fro& R,I( The In!ustria .e2eop&ent ,ank of

In!ia KI.,IL took o2er the Re%uatory an! #!&inistrati2e contro(

#t the en! of the year 14CC, ATI ha! Rs(@,E007/ "rores of #ssets An!er

$ana%e&ent(

2: SE$ON( P@ASE (1BDC1BBE!

6ntry of Pu)ic +ector Bun!s(

In the year 14CE, pu)ic sector $utua Bun!s setup )y pu)ic sector )anks,

'ife Insurance "orporation of In!ia K'I"L an! <enera Insurance "orporation

of In!ia K<I"L are ca&e in to e1istence(

+tate ,ank of In!ia $utua Bun! *as the first non/ATI $utua Bun!( The

foo*in% are the non/ATI $utua Bun!s at initia sta%es(

+,I $utua Bun! in June 14CE(

"an ,ank $utua Bun! in .ece&)er 14CE(

'I" $utua Bun! in June 14C4(

Punja) Nationa ,ank $utua Bun! in #u%ust 14C4(

In!ian ,ank $utua Bun! in No2e&)er 14C4(

,ank of In!ia $utua Bun! in June 1440(

12

<I" $utua Bun! in .ece&)er 1440(

,ank of ,aro!a $utua Bun! in =cto)er 1442(

#t the en! of 1440, the entire $utua Bun! In!ustry ha! #ssets un!er

$ana%e&ent of Rs(-E, 00-7/ "rores(

E: T@IR( P@ASE (1BBEC2FFE!

6ntry of Pri2ate +ector Bun!s / a *i!e choice to In!ian $utua Bun!

in2estors(

In 1440, the first $utua Bun! Re%uations ca&e into e1istence, un!er *hich

a &utua fun!s e1cept ATI *ere to )e re%istere! an! %o2erne!(

The 6rst*hie ?othari Pioneer Kno* &er%e! *ith Brankin Te&petonL *as

the first pri2ate sector $utua Bun! Re%istere! in Juy 1440(

In 144@, the 1440 +ecurities 61chan%e ,oar! of In!ia K+6,IL $utua Bun!s

Re%uations *ere su)stitute! )y a &ore co&prehensi2e an! re2ise! $utua

Bun! Re%uations(

The nu&)er of $utua Bun! houses *ent on increasin%, *ith &any forei%n

&utua fun!s settin% up fun!s in In!ia(

In this ti&e, the $utua Bun! in!ustry has *itnesse! se2era $er%ers

&#c;uisitions(

The ATI *ith Rs(--, 5-17/ "rores( =f #ssets An!er &ana%e&ent *as *ay

ahea! of a other $utua Bun!s(

10

The foo*in% *as the status at en! of Be)ruary 2000:

N+-,er o2 s63e-es A-o+nt (in $rores!

O0enCen*e* s63e-es 02

1

C2,@40

$1oseCen*e* s63e-es 51 --4E

TOTAL E

2

D<1BF

K+ource 3 #$BI *e)siteL

The !ia%ra& )eo* sho*s the three se%&ents an! so&e payers in each se%&ent:

?: #OURT@ P@ASE (SIN$E 2FFE #E5RUARY!

Boo*in% the repea of the ATI #ct in Be)ruary 2000, it *as KATIL

1 )ifurcate! into 2 separate entities(

=ne is the specifie! un!ertakin% of the ATI *ith asset un!er &ana%e&ent of

2 Rs(24, C057/ "rores as at the en! of January 2000(

The secon! is the ATI $utua Bun!s 'i&ite!, sponsore! )y +tate ,ank of

0 In!ia, Punja) Nationa ,ank, ,ank of ,aro!a an! 'ife Insurance

- "orporation of In!ia(

ATI is functionin% un!er an #!&inistrator an!

un!er the Rues fra&e! )y

5 the <o2ern&ent of In!ia an! !oes not co&e

un!er the pur2ie* of the

@ $utua Bun! Re%uations(

The ATI $utua Bun!s 'i&ite! is re%istere!

*ith +6,I an! functions un!er

E the $utua Bun!s Re%uations(

With the )ifurcation of the 6rst*hie ATI, *ith

the settin% up of a ATI

C $utua Bun!, confir&in% to the +6,I $utua

Bun! Re%uations an! *ith

4 recent &er%ers takin%

10

pace a&on% !ifferent pri2ate sector fun!s, the $utua Bun!

In!ustry has entere! its current phases of consoi!ation an!

%ro*th(

#t the en! of +epte&)er 200-, there *ere 24

fun!s, *hich &ana%e assets of

1 Rs(1, 50,10C7/ "rores un!er -21 !ifferent

sche&es(

15

#t the en! of $arch 200@, the status of $utua

fun! In!ustry *as:

No: o2 s63e-es A-o+nt (in 6rores!

O0enCen*e* s63e-es -1

-

1,C5,444

$1oseCen*e* s63e-es -@ E1,500

TOTAL ?6

F

2<5<?BB

K+ource 3 #$BI *e)siteL

#.D#NT#<6+ =B $ATA#' BAN.

Ta,1e:1:1

S:

No:

A*9anta

ge

Parti6+1ars

1:

Port2o1io

(i9ersi2i

6ation

$utua Bun!s in2est in a *e/!i2ersifie! portfoio of

securities *hich ena)es in2estor to ho! a !i2ersifie!

in2est&ent portfoio K*hether the a&ount of

in2est&ent is )i% or s&aL(

1@

2:

Pro2essio

na1

%anage

-ent

Bun! &ana%er un!er%oes throu%h 2arious research

*orks an! has )etter in2est&ent &ana%e&ent skis

*hich ensure hi%her returns to the in2estor than *hat

he can &ana%e on his o*n(

E:

Less

Ris7

In2estors ac;uire a !i2ersifie! portfoio of securities

e2en *ith a s&a in2est&ent in a $utua Bun!( The

risk in a !i2ersifie! portfoio is esser than in2estin% in

&erey 2 or 0 securities(

?:

LoG

Transa6t

ion

$osts

.ue to the econo&ies of scae K)enefits of ar%er

2ou&esL, &utua fun!s pay esser transaction costs(

These )enefits are passe! on to the in2estors(

5:

Li4+i*it

8

#n in2estor &ay not )e a)e to se so&e of the shares

he! )y hi& 2ery easiy an! ;uicky, *hereas units of a

&utua fun! are far &ore i;ui!(

6:

$3oi6e

o2

S63e-es

$utua fun!s pro2i!e in2estors *ith 2arious sche&es

*ith !ifferent in2est&ent o)jecti2es( In2estors ha2e the

option of in2estin% in a sche&e ha2in% a correation

)et*een its in2est&ent o)jecti2es an! their o*n

financia %oas( These sche&es further ha2e !ifferent

pans7options

:

Trans0a

ren68

Bun!s pro2i!e in2estors *ith up!ate! infor&ation

pertainin% to the &arkets an! the sche&es( # &ateria

facts are !iscose! to in2estors as re;uire! )y the

re%uator(

D:

#1eHi,i1it

8

In2estors aso )enefit fro& the con2enience an!

fe1i)iity offere! )y $utua Bun!s( In2estors can

s*itch their ho!in%s fro& a !e)t sche&e to an e;uity

sche&e an! 2ice/2ersa( =ption of syste&atic Kat

re%uar inter2asL in2est&ent an! *ith!ra*a is aso

offere! to the in2estors in &ost open/en! sche&es(

1E

B: Sa2et8

$utua Bun! in!ustry is part of a *e/re%uate!

in2est&ent en2iron&ent *here the interests of the

in2estors are protecte! )y the re%uator( # fun!s are

re%istere! *ith +6,I an! co&pete transparency is

force!(

(ISA()ANTA&E O# IN)ESTIN&

T@ROU&@ %UTUAL #UN(S

Ta,1e:1:2

S:

No:

(isa*9

antage

Parti6+1ars

1:

$osts

$ontro1

Not in

t3e

@an*s

o2 an

In9esto

r

In2estor has to pay in2est&ent &ana%e&ent fees an!

fun! !istri)ution costs as a percenta%e of the 2aue of

his in2est&ents Kas on% as he ho!s the unitsL,

irrespecti2e of the perfor&ance of the fun!(

2:

No

$+sto-

iIe*

Port2o1i

os

The portfoio of securities in *hich a fun! in2ests is a

!ecision taken )y the fun! &ana%er( In2estors ha2e no

ri%ht to interfere in the !ecision &akin% process of a

fun! &ana%er, *hich so&e in2estors fin! as a

constraint in achie2in% their financia o)jecti2es(

E: (i22i6+1

t8 in

Se1e6tin

g a

S+ita,1

$any in2estors fin! it !ifficut to seect one option

fro& the pethora of fun!s7sche&es7pans a2aia)e(

Bor this, they &ay ha2e to take a!2ice fro& financia

panners in or!er to in2est in the ri%ht fun! to achie2e

their o)jecti2es(

1C

e #+n*

S63e-e

SCHEMES OF MUTUAL

FUND

14

5ASE( ON T@EIR

STUR$TURE

=P6N 6N.6. BAN.+

"'=+6/6N.6. BAN.+

20

2( ,#+6. =N IND6+T$6NT

%UTUAL #UN(S $AN 5E $LASSI#IE( AS

#OLLO;:

5ASE( ON T@EIR STRU$TURE:

OPENCEN(E( #UN(S:

#n open/en! fun! is one that is a2aia)e for su)scription a

throu%h the year( These !o not ha2e a fi1e! &aturity(

In2estors can con2enienty )uy an! se units at Net #sset

21

6OAIT> BAN.+ ,#'#N"6

. BAN.+

.6,T BAN.+

.6DI.6N.

6OAIT>

T86$#NTI"

+6"T=R BAN.

6OAIT>

.6,T

#R,IT#<6

B'=#TIN<

B$P+ BAN.+

IN"=$6

<AI'T BAN.+

'6OAI.

6'++

IN.6P BAN.+

Daue KQN#DQL reate! prices( The key feature of open/en!

sche&es is i;ui!ity(

$LOSE(CEN(E( #UN(S:

# cose!/en! fun! has a stipuate! &aturity perio! *hich

%eneray ran%in% fro& 0 to 15 years( The fun! is open for

su)scription ony !urin% a specifie! perio!( In2estors can

in2est in the sche&e at the ti&e of the initia pu)ic issue an!

thereafter they can )uy or se the units of the sche&e on the

stock e1chan%es *here they are iste!(

In or!er to pro2i!e an e1it route to the in2estors, so&e cose/

en!e! fun!s %i2e an option of sein% )ack the units to the

$utua Bun! throu%h perio!ic repurchase at N#D reate!

prices( +6,I Re%uations stipuate that at east one of the t*o

e1it routes is pro2i!e! to the in2estor(

5ASE( ON T@EIR IN)EST%ENT

O5JE$TI)E:

EJUITY #UN(S : These fun!s in2est in e;uities

an! e;uity reate! instru&ents( With fuctuatin% share

prices, such fun!s sho* 2oatie perfor&ance, e2en

osses( 8o*e2er, short ter& fuctuations in the

&arket, %eneray s&oothens out in the on% ter&,

there)y offerin% hi%her returns at reati2ey o*er

2oatiity( #t the sa&e ti&e, such fun!s can yie!

%reat capita appreciation as, historicay, e;uities

22

ha2e outperfor&e! a asset casses in the on% ter&(

8ence, in2est&ent in e;uity fun!s shou! )e

consi!ere! for a perio! of at east 0/5 years( It can )e

further cassifie! as:

1: IN(EA #UN(S/ In this case a key stock &arket in!e1,

ike ,+6 +ense1 or Nifty is tracke!( Their portfoio &irrors

the )ench&ark in!e1 in ter&s of )oth co&position an!

in!i2i!ua stock *ei%hta%es(

2: EJUITY (I)ERSI#IE( #UN(SC 100R of the capita

is in2este! in e;uities sprea!in% across !ifferent sectors an!

stocks(

E: (I)I(EN( YIEL( #UN(SC it is si&iar to the e;uity/

!i2ersifie! fun!s e1cept that they in2est in co&panies

offerin% hi%h !i2i!en! yie!s(

?: T@E%ATI$ #UN(SC In2est 100R of the assets in

sectors *hich are reate! throu%h so&e the&e(

e(%( /#n infrastructure fun! in2ests in po*er, construction,

ce&ents sectors etc(

5: SE$TOR #UN(SC IND6+T 100R of the capita in a

specific sector( e(%( / # )ankin% sector fun! *i in2est in

)ankin% stocks(

@( ELSS/ 6;uity 'inke! +a2in% +che&e pro2i!es ta1 )enefit

to the in2estors(

5ALAN$E( #UN( : Their in2est&ent portfoio

incu!es )oth !e)t an! e;uity( #s a resut, on the risk/

20

return a!!er, they fa )et*een e;uity an! !e)t

fun!s( ,aance! fun!s are the i!ea &utua fun!s

2ehice for in2estors *ho prefer sprea!in% their risk

across 2arious instru&ents( Boo*in% are )aance!

fun!s casses:

1 (E5TCORIENTE( #UN(S CIn2est&ent )eo* @5R in

e;uities(

2 EJUITYCORIENTE( #UN(S CIn2est at east @5R in

e;uities, re&ainin% in !e)t(

(E5T #UN( : They in2est ony in !e)t instru&ents,

an! are a %oo! option for in2estors a2erse to i!ea of

takin% risk associate! *ith e;uities( Therefore, they

in2est e1cusi2ey in fi1e!/inco&e instru&ents ike

)on!s, !e)entures, <o2ern&ent of In!ia securitiesS

an! &oney &arket instru&ents such as certificates of

!eposit K".L, co&&ercia paper K"PL an! ca

&oney( Put your &oney into any of these !e)t fun!s

!epen!in% on your in2est&ent hori9on an! nee!s(

1: LIJUI( #UN(SC These fun!s in2est 100R in

&oney &arket instru&ents, a ar%e portion )ein%

in2este! in ca &oney &arket(

2: &ILT #UN(S STC T86> in2est 100R of their

portfoio in %o2ern&ent securities of an! T/)is(

2-

E: #LOATIN& RATE #UN(S C In2est in short/ter&

!e)t papers( Boaters in2est in !e)t instru&ents,

*hich ha2e 2aria)e coupon rate(

?: AR5ITRA&E #UN(C They %enerate inco&e

throu%h ar)itra%e opportunities !ue to &iss/pricin%

)et*een cash &arket an! !eri2ati2es &arket( Bun!s

are aocate! to e;uities, !eri2ati2es an! &oney

&arkets( 8i%her proportion Karoun! E5RL is put in

&oney &arkets, in the a)sence of ar)itra%e

opportunities(

5: &ILT #UN(S LTC They in2est 100R of their

portfoio in on%/ter& %o2ern&ent securities(

6: IN$O%E #UN(S LTC Typicay, such fun!s in2est

a &ajor portion of the portfoio in on%/ter& !e)t

papers(

: %IPSC $onthy Inco&e Pans ha2e an e1posure of

E0R/40R to !e)t an! an e1posure of 10R/00R to

e;uities(

D: #%PSC fi1e! &onthy pans in2est in !e)t papers

*hose &aturity is in ine *ith that of the fun!(

@O; ARE #UN(S (I##ERENT IN TER%S O#

T@EIR RISK PRO#ILE:

Ta,1e:1:E

25

6;uity Bun!s 8i%h e2e of return, )ut has a hi%h e2e of risk too

.e)t fun!s Returns co¶ti2ey ess risky than e;uity fun!s

'i;ui! an! $oney

$arket fun!s

Pro2i!e sta)e )ut o* e2e of return

1:5 IN)EST%ENT STRATE&IES

1: SYSTE%ATI$ IN)EST%ENT PLAN: An!er this, a

fi1e! su& is in2este! each &onth on a fi1e! !ate of a &onth(

Pay&ent is &a!e throu%h post/!ate! che;ues or !irect !e)it

faciities( The in2estor %ets fe*er units *hen the N#D is

hi%h an! &ore units *hen the N#D is o*( This is cae! as

the )enefit of Rupee "ost #2era%in% KR"#L

2: SYSTE%ATI$ TRANS#ER PLAN: An!er this, an

in2estor in2est in !e)t/oriente! fun! an! %i2e instructions to

transfer a fi1e! su&, at a fi1e! inter2a, to an e;uity sche&e

of the sa&e &utua fun!(

E: SYSTE%ATI$ ;IT@(RA;AL PLAN: if so&eone

*ishes to *ith!ra* fro& a &utua fun! then he can *ith!ra*

a fi1e! a&ount each &onth(

$.%. OR&A'(SAT(O' O) MUTUA* )U'+

2@

#ig+re:1:?

T@E STRU$TURE $ONSISTS O#:

SPONSOR

+ponsor is the person *ho actin% aone or in co&)ination

*ith another )o!y corporate esta)ishes a &utua fun!(

+ponsor &ust contri)ute at east -0R of the net *orth of the

In2est&ent &ana%e! an! &eet the ei%i)iity criteria

prescri)e! un!er the +ecurities an! 61chan%e ,oar! of In!ia

K$utua Bun!L Re%uations, 144@( The sponsor is not

responsi)e or ia)e for any oss or shortfa resutin% fro&

the operation of the +che&es )eyon! the initia contri)ution

&a!e )y it to*ar!s settin% up of the $utua Bun!(

TRUST

The $utua Bun! is constitute! as a trust in accor!ance *ith

the pro2isions of the In!ian Trusts #ct, 1CC2 )y the +ponsor(

2E

The trust !ee! is re%istere! un!er the In!ian Re%istration

#ct, 140C(

TRUSTEE

Trustee is usuay a co&pany Kcorporate )o!yL or a ,oar! of

Trustees K)o!y of in!i2i!uasL( The &ain responsi)iity of

the Trustee is to safe%uar! the interest of the unit ho!ers an!

ensure that the #$" functions in the interest of in2estors

an! in accor!ance *ith the +ecurities an! 61chan%e ,oar! of

In!ia K$utua Bun!sL Re%uations, 144@, the pro2isions of

the Trust .ee! an! the =ffer .ocu&ents of the respecti2e

+che&es( #t east 270r! !irectors of the Trustee are

in!epen!ent !irectors *ho are not associate! *ith the

+ponsor in any &anner(

ASSET %ANA&E%ENT $O%PANY (A%$!

The #$" is appointe! )y the Trustee as the In2est&ent

$ana%er of the $utua Bun!( The #$" is re;uire! to )e

appro2e! )y the +ecurities an! 61chan%e ,oar! of In!ia

K+6,IL to act as an asset &ana%e&ent co&pany of the

$utua Bun!( #t east 50R of the !irectors of the #$" are

in!epen!ent !irectors *ho are not associate! *ith the

+ponsor in any &anner( The #$" &ust ha2e a net *orth of

at east 10 cores at a ti&es(

RE&ISTRAR AN( TRANS#ER A&ENT

The #$" if so authori9e! )y the Trust .ee! appoints the

Re%istrar an! Transfer #%ent to the $utua Bun!( The

2C

Re%istrar processes the appication for&, re!e&ption

re;uests an! !ispatches account state&ents to the unit

ho!ers( The Re%istrar an! Transfer a%ent aso han!es

co&&unications *ith in2estors an! up!ates in2estor recor!s(

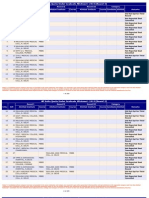

ASSET U'+ER MA'A&EME'T

Ta)e1(-

#++6T AN.6R $#N#<6$6NT =B T=P #$",+ as on Jun 30

!00"

$utua Bun! Na&e No( of

sche&es

"orpus KRs("roresL

Reiance $utua Bun! 2@0 10C,002(0@

8.B" $utua Bun! 202 EC,14E(40

I"I"I Pru!entia $utua Bun! 025 E0,1@4(-@

ATI $utua Bun! 20E @E,4EC(14

,ira +un 'ife $utua Bun! 2C0 5@,2C2(CE

+,I $utua Bun! 100 0-,0@1(0-

'I" $utua Bun! E0 02,-1-(42

?otak $ahin!ra $utua Bun! 12- 00,C00(02

Brankin Te&peton $utua Bun! 141 25,-E2(C5

I.B" $utua Bun! 1@- 21,@E@(24

Tata $utua Bun! 1E5 21,222(C1

The %raph in!icates the %ro*th of assets o2er the years(

24

#ig+re:1:5

00

(ISTRI5UTION $@ANNELS:

$utua fun!s posses a 2ery stron% !istri)ution channe so

that the uti&ate custo&ers !oesnFt face any !ifficuty in the

fina procure&ent( The 2arious parties in2o2e! in

!istri)ution of &utua fun!s are:

1( (IRE$T %ARKETIN& 5Y T@E A%$s: the for&s

cou! )e o)taine! fro& the #$"s !irecty( The in2estors can

approach to the #$"s for the for&s( so&e of the top #$"s

of In!ia areS Reiance ,,ira +unife, Tata, +,I &a%nu&,

?otak $ahin!ra, 8.B", +un!ara&, I"I"I, $irae #ssets,

"anara Ro)eco, 'otus In!ia, 'I", ATI etc( *hereas forei%n

#$"s incu!e: +tan!ar! "hartere!, Brankin Te&peton,

Bi!eity, JP $or%an, 8+,", .+P $eri 'ynch, etc(

2: 5ROKER= SU5 5ROKER ARRAN&E%ENTS: the

#$"s can si&utaneousy %o for )roker7su)/)roker to

popuari9e their fun!s( #$"s can enjoy the a!2anta%e of

ar%e net*ork of these )rokers an! su) )rokers(

E( IN(I)I(UAL A&ENTS< 5ANKS< N5#$: in2estors

can procure the fun!s throu%h in!i2i!ua a%ents, in!epen!ent

)rokers, )anks an! se2era non/ )ankin% financia

corporations too, *hiche2er he fin!s con2enient for hi&(

01

INTRO(U$TION

The stocks ha2e risk, *hich co&prises of either uni;ue risk

aso cae! as !i2ersifia)e risk or unsyste&atic risk an!

&arket risk aso cae! as non/!i2ersifia)e risk

=r syste&atic( There are fe* pro)e&s, *hich re2ea the

necessity to anay9e the risk an! return of the $BFs( *e can

neither pre!ict the risk in2o2e! nor the future perfor&ance

of the stock( $any $BFs sche&es ha2e not perfor&e! *e

!ue to *hich in2estor ha2e incurre! osses( The &o2e&ent of

,+6/100 in!e1 !epen!s on the perfor&ance of the

co&panyFs stock( If a particuar in!ustry is not in a )oo&in%

sta%e, then the stock of co&panies reate! to that in!ustry

*ou! )e affecte!( <i2en the )ack%roun! of risk an!

uncertainty a)out in2est&ent in &utua fun!, present stu!y

02

tries to fin! out risk return on Reiance &utua fun! in

co&parison *ith ,+6/100 in!e1 has )een un!er taken(

There are a ot of in2est&ent a2enues a2aia)e to!ay in the

financia &arket for an in2estor *ith an in2est a)e surpus(

8e can in2est in ,ank .eposits, "orporate .e)entures, an!

,on!s *here there is o* risk )ut o* return( 8e &ay in2est

in +tock of co&panies *here the risk is hi%h an! the returns

are aso proportionatey hi%h( The recent tren!s in the +tock

$arket ha2e sho*n that an a2era%e retai in2estor a*ays

ost *ith perio!ic )earish ten!s( Peope )e%an optin% for

portfoio &ana%ers *ith e1pertise in stock &arkets *ho

*ou! in2est on their )ehaf( Thus *e ha! *eath

&ana%e&ent ser2ices pro2i!e! )y &any institutions(

8o*e2er they pro2e! too costy for a s&a in2estor( These

in2estors ha2e foun! a %oo! sheter *ith the &utua fun!s(

'ike &ost !e2eope! an! !e2eopin% countries the &utua

fun! cut has )een catchin% on in In!ia( The reasons for this

interestin% occurrence are:

1( $utua fun!s &ake it easy an! ess costy for in2estors

to satisfy their nee! for capita %ro*th, inco&e an!7or

inco&e preser2ation(

2( $utua fun! )rin%s the )enefits of !i2ersification an!

&oney &ana%e&ent to the in!i2i!ua in2estor, pro2i!in% a

opportunity for financia success that *as once a2aia)e

ony to a seect fe*(

00

@ISTORY

Anit Trust of In!ia is the first $utua Bun! set up un!er a

separate act, ATI #ct in 14@0, an! starte! its operations in

14@- *ith the issue of units un!er the sche&e A+/@-1( In

14EC ATI *as !einke! fro& the R,I an! In!ustria

.e2eop&ent ,ank of In!ia KI.,IL took o2er the

Re%uatory an! a!&inistrati2e contro in pace of R,I(

In the year 14CE Pu)ic +ector )anks ike +tate ,ank of

In!ia, Punja) Nationa ,ank, In!ian ,ank, ,ank of In!ia,

an! ,ank of ,aro!a ha2e set up &utua fun!s(

#part fro& these a)o2e &entione! )anks 'ife Insurance

"orporation T'I"U an! <enera Insurance "orporation T<I"U

too ha2e set up &utua fun!( 'I" esta)ishe! its &utua fun!

in June 14C4(*hie <I" ha! set up its &utua fun! in

.ece&)er 1440(The &utua fun! in!ustry ha! assest un!er

&ana%e&ent of Rs( -E,00- crores(

With the entry of Pri2ate +ector Bun!s a ne* era has starte!

in $utua Bun! In!ustry Te(%:/ Principa $utua Bun!(U

0-

%+t+a1 #+n* Reg+1ations

The secon! is the ATI $utua Bun! 't!, sponsore! )y +,I,

PN,, ,=, an! 'I"( It is re%istere! *ith +6,I an! functions

un!er the $utua Bun! Re%uations( With the )ifurcation of

the erst*hie ATI *hich ha! in $arch 2000 &ore than

Rs(E@,000 crores of assets un!er &ana%e&ent an! *ith the

settin% up of a ATI $utua Bun!, confor&in% to the +6,I

$utua Bun! Re%uations, an! *ith recent &er%ers takin%

pace a&on% !ifferent pri2ate sector fun!s, the &utua fun!

in!ustry has entere! its current phase of consoi!ation an!

%ro*th( #s at the en! of +epte&)er, 200-, there *ere 24

fun!s, *hich &ana%e assets of Rs(15010C crores un!er -21

sche&es(

05

T80es o2 %+t+a1 #+n*s S63e-e in In*ia

Wi!e 2ariety of $utua Bun! +che&es e1ist to cater to the

nee!s such as financia position, risk toerance an! return

e1pectations etc( The ta)e )eo* %i2es an o2er2ie* into the

e1istin% types of sche&es in the In!ustry(

,y +tructure

0@

o =pen / 6n!e! +che&es

o "ose / 6n!e! +che&es

o Inter2a +che&es

,y In2est&ent =)jecti2e

o <ro*th +che&es

o Inco&e +che&es

o ,aance! +che&es

o $oney $arket +che&es

=ther +che&es

o Ta1 +a2in% +che&es

o +pecia +che&es

In!e1 +che&es

+ector +pecfic

#eat+res re1ate* -+t+a1 2+n*s

0E

Reiance *as the first fun! house to aunch sector

fun!s *ith fe1i)iity to in2est in a ran%e of 0R to

100R in either e;uity or !e)t instru&ents(

$utua fun! in2est&ents inke! to an #T$7!e)it

car! a Reiance inno2ation In!iaFs first on%/short

fun! co&es fro& Reiance $utua Bun! (

#s at 01st $ay 200C, &ore than @(@ &iion peope

ha! in2este! in Reiance $utua Bun!Sthe

in2est&ents co&prise! 1@R of the countryFs entire

&utua fun!(

0C

%UTUAL #UN( $O%PANIES IN IN(IA

The concept of &utua fun!s in In!ia !ates )ack to the year

14@0( The era )et*een 14@0 an! 14CE &arke! the e1istence

of ony one &utua fun! co&pany in In!ia *ith Rs( @E)n

assets un!er &ana%e&ent K#A$L, )y the en! of its

&onopoy era, the Anit Trust of In!ia KATIL( ,y the en! of

the C0s !eca!e, fe* other &utua fun! co&panies in In!ia

took their position in &utua fun! &arket( The ne* entries of

&utua fun! co&panies in In!ia *ere +,I $utua Bun!,

"anra )ank $utua Bun!, Punja) Nationa ,ank $utua

Bun!, In!ian ,ank $utua Bun!, ,ank of In!ia $utua Bun!(

The succee!in% !eca!e sho*e! a ne* hori9on in In!ian

&utua fun! in!ustry( ,y the en! of 1440, the tota #A$ of

the in!ustry *as Rs( -E0(0- )n( The pri2ate sector fun!s

starte! penetratin% the fun! fa&iies( In the sa&e year the

first $utua Bun! Re%uations ca&e into e1istence *ith re/

re%isterin% a &utua fun!s e1cept ATI( The re%uations

*ere further %i2en a re2ise! shape in 144@(

04

$O%PITITORS O# RELIAN$E %UTUAL

#UN(

A5N A%RO %UTUAL #UN(

#,N #$R= $utua Bun! *as setup on #pri 15, 200- *ith

#,N #$R= Trustee KIn!iaL P2t( 't!( #s the Trustee

"o&pany( The #$", #,N #$R= #sset $ana%e&ent

-0

KIn!iaL 't!( *as incorporate! on No2e&)er -, 2000(

.eutsche ,ank # < is the custo!ian of #,N #$R= $utua

Bun!(

5IRLA SUN LI#E %UTUAL #UN(

,ira +un 'ife $utua Bun! is the joint 2enture of #!itya

,ira <roup an! +un 'ife Binancia( +un 'ife Binancia is a

%o)a or%ani9ation e2o2e! in 1CE1 an! is )ein% represente!

in "ana!a, the A+, the Phiippines, Japan, In!onesia an!

,er&u!a apart fro& In!ia( ,ira +un 'ife $utua Bun!

foo*s a conser2ati2e on%/ter& approach to in2est&ent(

Recenty it crosse! #A$ of Rs( 10,000 crores(

5ANK O# 5ARO(A %UTUAL #UN( (5O5 %UTUAL

#UN(!

,ank of ,aro!a $utua Bun! or ,=, $utua Bun! *as

setup on =cto)er 00, 1442 un!er the sponsorship of ,ank of

,aro!a( ,=, #sset $ana%e&ent "o&pany 'i&ite! is the

#$" of ,=, $utua Bun! an! *as incorporate! on

No2e&)er 5, 1442( .eutsche ,ank #< is the custo!ian(

@(#$ %UTUAL #UN(

-1

8.B" $utua Bun! *as setup on June 00, 2000 *ith t*o

sponsorers na&ey 8ousin% .e2eop&ent Binance

"orporation 'i&ite! an! +tan!ar! 'ife In2est&ents 'i&ite!(

8+," $utua Bun! 8+," $utua Bun! *as setup on $ay

2E, 2002 *ith 8+," +ecurities an! "apita $arkets KIn!iaL

Pri2ate 'i&ite! as the sponsor( ,oar! of Trustees, 8+,"

$utua Bun! acts as the Trustee "o&pany of 8+," $utua

Bun!(

IN& )YSYA %UTUAL #UN(

IN< Dysya $utua Bun! *as setup on Be)ruary 11, 1444

*ith the sa&e na&e! Trustee "o&pany( It is a joint 2enture

of Dysya an! IN<( The #$", IN< In2est&ent $ana%e&ent

KIn!iaL P2t( 't!( Was incorporate! on #pri @, 144C(

PRU(ENTIAL I$I$I %UTUAL #UN(

The &utua fun! of I"I"I is a joint 2enture *ith Pru!entia

Pc( of #&erica, one of the ar%est ife insurance co&panies

in the A+ of #( Pru!entia I"I"I $utua Bun! *as setup on

10th of =cto)er,1440 *ith t*o sponsorers, Pru!entia Pc(

an! I"I"I 't!( The Trustee "o&pany for&e! is Pru!entia

I"I"I Trust 't!( an! the #$" is Pru!entia I"I"I #sset

$ana%e&ent "o&pany 'i&ite! Incorporate! on 22n! of

June, 1440(

-2

SA@ARA %UTUAL #UN(

+ahara $utua Bun! *as set up on Juy 1C, 144@ *ith +ahara

In!ia Binancia "orporation 't!( #s the sponsor( +ahara

#sset $ana%e&ent "o&pany Pri2ate 'i&ite! incorporate!

on #u%ust 01, 1445 *orks as the #$" of +ahara $utua

Bun!( The pai!/up capita of the #$" stan!s at Rs 25(C

crore(

STATE 5ANK O# IN(IA %UTUAL #UN(

+tate ,ank of In!ia $utua Bun! is the first ,ank sponsore!

$utua Bun! to aunch offshor fun!, the In!ia $a%nu& Bun!

*ith a corpus of Rs( 225 cr( appro1i&atey( To!ay it is the

ar%est ,ank sponsore! $utua Bun! in In!ia( They ha2e

area!y aunche! 05 +che&es out of *hich 15 ha2e area!y

yie!e! han!so&e returns to in2estors( +tate ,ank of In!ia

$utua Bun! has &ore than Rs( 5,500 "rores as #A$( No*

-0

it has an in2estor )ase of o2er C 'akhs sprea! o2er 1C

sche&es(

TATA %UTUAL #UN(

Tata $utua Bun! KT$BL is a Trust un!er the In!ian Trust

#ct, 1CC2( The sponsorers for Tata $utua Bun! are Tata

+ons 't!(, an! Tata In2est&ent "orporation 't!( The

in2est&ent &ana%er is Tata #sset $ana%e&ent 'i&ite! an!

its Tata Trustee "o&pany P2t( 'i&ite!( Tata #sset

$ana%e&ent 'i&ite!Ms is one of the fastest in the country

*ith &ore than Rs( E,E00 crores Kas on #pri 00, 2005L of

#A$(

KOTAK %A@IN(RA %UTUAL #UN(

?otak $ahin!ra #sset $ana%e&ent "o&pany K?$#$"L is

a su)si!iary of ?$,'( It is presenty ha2in% &ore than 1,

44,C1C in2estors in its 2arious sche&es( ?$#$" starte! its

operations in .ece&)er 144C( ?otak $ahin!ra $utua Bun!

offers sche&es caterin% to in2estors *ith 2aryin% risk /

return profies( It *as the first co&pany to aunch !e!icate!

%it sche&e in2estin% ony in %o2ern&ent securities(

UNIT TRUST O# IN(IA %UTUAL #UN(

--

ATI #sset $ana%e&ent "o&pany Pri2ate 'i&ite!,

esta)ishe! in Jan 1-, 2000, &ana%es the ATI $utua Bun!

*ith the support of ATI Trustee "o&pany Pri2ate 'i&ite!(

ATI #sset $ana%e&ent(

STAN(AR( $@ARTERE( %UTUAL #UN(

+tan!ar! "hartere! $utua Bun! *as set up on $arch 10,

2000 sponsore! )y +tan!ar! "hartere! ,ank( The Trustee is

+tan!ar! "hartere! Trustee "o&pany P2t( 't!( +tan!ar!

"hartere! #sset $ana%e&ent "o&pany P2t( 't!( is the

#$" *hich *as incorporate! *ith +6,I on .ece&)er

20,1444(

#RANKLIN TE%PLETON IN(IA %UTUAL #UN(

The %roup, Brankin Te&peton In2est&ents is a "aifornia

KA+#L )ase! co&pany *ith a %o)a #A$ of A+N -04(2 )n(

Kas of #pri 00, 2005L( It is one of the ar%est financia

ser2ices %roups in the *or!( In2estors can )uy or se the

$utua Bun! throu%h their financia a!2isor or throu%h &ai

or throu%h their *e)site( They ha2e =pen en! .i2ersifie!

6;uity sche&es, =pen en! +ector 6;uity sche&es, =pen en!

8y)ri! sche&es, =pen en! Ta1 +a2in% sche&es, =pen en!

-5

Inco&e an! 'i;ui! sche&es, "ose! en! Inco&e sche&es

an! =pen en! Bun! of Bun!s sche&es to offer(

%OR&AN STANLEY %UTUAL #UN( IN(IA

$or%an +taney is a *or!*i!e financia ser2ices co&pany

an! itFs ea!in% in the &arket in securities, in2est&ent

&ana%e&ent an! cre!it ser2ices( $or%an +taney In2est&ent

$ana%e&ent K$I+$L *as esta)ishe! in the year 14E5( It

pro2i!es custo&i9e! asset &ana%e&ent ser2ices an!

pro!ucts to %o2ern&ents, corporations, pension fun!s an!

non/profit or%ani9ations( Its ser2ices are aso e1ten!e! to

hi%h net *orth in!i2i!uas an! retai in2estors( In In!ia it is

kno*n as $or%an +taney In2est&ent $ana%e&ent Pri2ate

'i&ite! K$+I$ In!iaL an! its #$" is $or%an +taney

$utua Bun! K$+$BL( This is the first cose en! !i2ersifie!

e;uity sche&e ser2in% the nee!s of In!ian retai in2estors

focusin% on a on%/ter& capita appreciation(

ES$ORTS %UTUAL #UN(

6scorts $utua Bun! *as setup on #pri 15, 144@ *ith

6scorts Binance 'i&ite! as its sponsor( The Trustee

"o&pany is 6scorts In2est&ent Trust 'i&ite!( ItFs #$"

-@

*as incorporate! on .ece&)er 1, 1445 *ith the na&e

6scorts #sset $ana%e&ent 'i&ite!(

ALLIAN$E $APITAL %UTUAL #UN(

#iance "apita $utua Bun! *as setup on .ece&)er 00,

144- *ith #iance "apita $ana%e&ent "orp( of .ea*are

KA+#L as sponsore!( The Trustee is #"#$ Trust "o&pany

P2t( 't!( an! #$", the #iance "apita #sset $ana%e&ent

In!ia KP2tL 't!( *ith the corporate office in $u&)ai(

,ench&ark $utua Bun!

,ench&ark $utua Bun! *as setup on June 12, 2001 *ith

Niche Binancia +er2ices P2t( 't!( as the sponsore! an!

,ench&ark Trustee "o&pany P2t( 't!( as the Trustee

"o&pany( Incorporate! on =cto)er 1@, 2000 an!

hea!;uartere! in $u&)ai, ,ench&ark #sset $ana%e&ent

"o&pany P2t( 't!( is the #$"(

$AN5ANK %UTUAL #UN(

"an)ank $utua Bun! *as setup on .ece&)er 14, 14CE *ith

"anara ,ank actin% as the sponsor( "an)ank In2est&ent

$ana%e&ent +er2ices 't!( incorporate! on $arch 2, 1440 is

the #$"( The "orporate =ffice of the #$" is in $u&)ai(

$@OLA %UTUAL #UN(

-E

"hoa $utua Bun! un!er the sponsorship of

"hoa&an!aa& In2est&ent & Binance "o&pany 't!( *as

setup on January 0, 144E( "hoa&an!aa& Trustee "o( 't!(

is the Trustee "o&pany an! #$" is "hoa&an!aa& #$"

'i&ite!(

LI$ %UTUAL #UN(

'ife Insurance "orporation of In!ia set up 'I" $utua Bun!

on 14th June 14C4( It contri)ute! Rs( 2 "rores to*ar!s the

corpus of the Bun!( 'I" $utua Bun! *as constitute! as a

Trust in accor!ance *ith the pro2isions of the In!ian Trust

#ct, 1CC2( ( The "o&pany starte! its )usiness on 24th #pri

144-( The Trustees of 'I" $utua Bun! ha2e appointe!

Jee2an ,i&a +ahayo% #sset $ana%e&ent "o&pany 't! as

the In2est&ent $ana%ers for 'I" $utua Bun!(

&I$ %UTUAL #UN(

<I" $utua Bun!, sponsore! )y <enera Insurance

"orporation of In!ia K<I"L, a <o2ern&ent of In!ia

un!ertakin% an! the four Pu)ic +ector <enera Insurance

"o&panies , 2i9( Nationa Insurance "o( 't! KNI"L, The

-C

Ne* In!ia #ssurance "o( 't!( KNI#L, The =rienta

Insurance "o( 't! K=I"L an! Anite! In!ia Insurance "o(

't!( KAIIL an! is constitute! as a Trust in accor!ance *ith

the pro2isions of the In!ian Trusts #ct, 1CC2( Buture of

$utua Bun!s in In!ia ,y .ece&)er 200-, In!ian &utua

fun! in!ustry reache! Rs 1, 50,50E crore( It is esti&ate! that

)y 2010 $arch/en!, the tota assets of a sche!ue!

co&&ercia )anks shou! )e Rs -0, 40,000 crore( The annua

co&posite rate of %ro*th is e1pecte! 10(-R !urin% the rest

of the !eca!e( In the ast 5

years *e ha2e seen annua %ro*th rate of 4R( #ccor!in% to

the current %ro*th rate, )y year 2010, &utua fun! assets *i

)e !ou)e(

$O%PANY PRO#ILE O# RELIAN$E

-4

A5OUT RELIAN$E $APITAL ASSET

%ANA&E%ENT LT(:

Reiance "apita #sset $ana%e&ent 'i&ite! K R"#$L,

a co&pany re%istere! un!er the "o&panies #ct, 145@ *as

appointe! to act as the In2est&ent $ana%er of Reiance

$ATA#' BAN.( (

Reiance "apita #sset $ana%e&ent 'i&ite! KR"#$L *as

appro2e! as the #sset $ana%e&ent "o&pany for the $utua

50

Bun! )y +6,I 2i!e their etter no II$#RP712@-745 !ate!

June 00, 1445( The $utua Bun! has entere! into an

In2est&ent $ana%e&ent #%ree&ent KI$#L *ith R"#$

!ate! $ay 12, 1445 an! *as a&en!e! on #u%ust 12, 144E in

ine *ith +6,I K$utua Bun!sL Re%uations, 144@( Pursuant

to this I$#, R"#$ is authori9e! to act as In2est&ent

$ana%er of Reiance $utua Bun!( The net *orth of the

#sset $ana%e&ent "o&pany incu!in% preference shares as

on +epte&)er 00, 200E is Rs(152(02 crores( Reiance $utua

Bun! has aunche! thirty/fi2e +che&es ti !ate, na&ey:

QReiance $utua Bun! sche&es are &ana%e! )y Reiance

"apita #sset $ana%e&ent 'i&ite!( # su)si!iary of

Reiance "apita 'i&ite!, *hich ho!s 40(0ER of the pai!/up

capita of R"#$, the )aance pai! up capita )ein% he! )y

&inority shareho!ers(Q

Reiance "apita #sset $ana%e&ent 'i&ite! KR"#$L *as

appro2e! as the #sset $ana%e&ent "o&pany for the $utua

Bun! )y +6,I 2i!e their etter no II$#RP712@-745 !ate!

June 00, 1445( The $utua Bun! has entere! into an

In2est&ent $ana%e&ent #%ree&ent KI$#L *ith R"#$

!ate! $ay 12, 1445 an! *as a&en!e! on #u%ust 12, 144E in

ine *ith +6,I K$utua Bun!sL Re%uations, 144@( Pursuant

to this I$#, R"#$ is authori9e! to act as In2est&ent

$ana%er of Reiance $utua Bun!( The net*orth of the

51

#sset $ana%e&ent "o&pany as on $arch 01, 200C is Rs

E04(04 crores( Reiance $utua Bun! has aunche! Borty

Three +che&es ti !ate, na&ey:

This %roup !o&inates this key area in the financia sector(

This &e%a )usiness houses sho* that it has assets un!er

&ana%e&ent of Rs( 40,40C croreKA+N 22(E0 )iionL an! an

in2estor )ase of o2er@(@ &iion

K+ource:***(a&fiin!ia(co&L(ReianceFs &utua fun!

sche&es are &ana%e! )y Reiance "apita #sset

$ana%e&ent 'i&ite!KR"#$L, a su)si!iary of Reiance

"apita 'i&ite!, *hich ho!s 40(0ER of the pai!/up capita

of R"#$(

The co&pany notche! up a heathy %ro*th of Rs( 1@,05-

croreKA+N -(04 )iionLin assets un!er &ana%e&ent in

Be)ruary200C an! hepe! prope the tota in!ustry/*i!e

#A$ to Rs( 5@5,-54 crore KA+N 1-1(0@ )iionLK+ource:

in!iain2est&ents(co&L( # sharp rise infi1e! &aturity pans

KB$PsL an! coection ofRs( E000 crore KA+N 1(E5 )iionL

throu%h ne*foun! offers KNB=sL create! this sur%e( In #A

rankin%s, Reiance continues to )e in the nu&)er one spot(

RELIAN$E %UTUAL #UN(

52

Reiance &utua fun!, pro&ote! )y the #ni .hiru)hai

#&)ani K#.#<L %roup, is one of the fastest %ro*in% &utua

fun!s in In!ia ha2in% !ou)e! its assets o2er the ast one

year( In $arch, 200@, the Reiance &utua fun! e&er%e! as

the ar%est pri2ate sector fun! house in the country,

o2ertakin% Pru!entia I"I"I *hich has )een ho!in% that

position for &any years(

The sponsor of the fun! is Reiance "apita 'i&ite!, the

financia ser2ices ar& of #.#<( Reiance "apita #sset

$ana%e&ent 'i&ite!, a *hoy o*ne! su)si!iary of

Reiance "apita 'i&ite!, acts as the #$" to the fun!(

.irectors of the co&pany incu!e #&ita)h Jhunjhun*aa, a

senior e1ecuti2e of #.#<( #&ita)h "hatur2e!i is the

&ana%in% !irector of the #$"(

#s of en! #u%ust 200@, Reiance &utua fun! has Rs 2C,E50

crore of assets un!er &ana%e&ent( Reiance 6;uity Bun!,

aunche! )y Reiance $B in eary 200@, is the ar%est &utua

fin! sche&e in the country *ith a fun! si9e of o2er Rs 5,500

crore(

8ere is a ist of &utua fun!s of Reiance *hich incu!es

.e)t7Inco&e Bun!s , 6;uity Bun!s an! +ector +pecific

Bun!s(

50

In*iaKs 5est O22ering: Re1ian6e %+t+a1 #+n*

In2estin% has )eco&e %o)a( To!ay, a ot of countries

are *akin% up to the reaity that in or!er to %ain financia

%ro*th, they &ust encoura%e their citi9ens to not ony sa2e

)ut aso in2est( $utua fun!s are fast )eco&in% the &o!e of

in2est&ent in the *or!(

In In!ia, a &utua fun! co&pany cae! the Reiance $utua

Bun! is &akin% *a2es( Reiance is consi!ere! In!iaMs )est

*hen it co&es to &utua fun!s( Its in2estors nu&)er to -(@

)iion peope( Reiance "apita #sset $ana%e&ent 'i&ite!

ranks in the top 0 of In!iaMs )ankin% co&panies an! financia

sector in ter&s of net 2aue(

The #ni .hiru)hai #&)ani <roup o*ns ReianceS they are

5-

the fastest %ro*in% in2est&ent co&pany in In!ia so far( To

&eet the erratic !e&an! of the financia &arket, Reiance

$utua Bun! !esi%ne! a !istinct portfoio that is sure to

pease potentia in2estors( Reiance "apita #sset

$ana%e&ent 'i&ite! &ana%es R$B(

)ision An*

%ission

Reiance $utua Bun! is so popuar )ecause it is in2estor

focuse!( They sho* their !e!ication )y continuay !ishin%

out inno2ati2e offerin%s an! unparaee! ser2ice initiati2es(

It is their %oa to )eco&e respecte! %o)ay for hepin%

peope achie2e their financia !rea&s throu%h e1ceent

or%ani9ation %o2ernance an! custo&er care( Reiance $utua

fun! *ants a hi%h perfor&ance en2iron&ent that is %eare! at

&akin% in2estors happy(

R$B ai&s to !o )usiness a*fuy an! *ithout steppin% on

other peope( They *ant to )e a)e to create portfoios that

*i ensure the i;ui!ity of the in2est&ent of peope in In!ia

as *e as a)roa!( Reiance $utua Bun! aso *ants to &ake

sure that their shareho!ers reai9e reasona)e profit, )y

!epoyin% fun!s *isey( Takin% appropriate risks to reach the

co&panyMs potentia is aso one of Reiance $utua Bun!Ms

55

o)jecti2es(

)ISION STATE%ENT

To )e a %o)ay respecte! *eath creator *ith an e&phasis

on custo&er care an! a cuture of %oo! corporate %o2ernance

%ISSION STATE%ENT

To create an! nurture a *or!/cass, hi%h perfor&ance

en2iron&ent ai&e! at !ei%htin% our custo&ers(

T80es o2 Re1ian6e %+t+a1 #+n*s

1( Reiance <ro*th Bun!

2( Reiance Dision Bun!

0( Reiance ,ankin% Bun!

-( Reiance .i 2ersifie! Po*er +ector Bun!

5( Reiance Phar&a Bun!

@( Reiance $e!ia & 6ntertain&ent Bun!

E( Reiance NRI 6;uity Bun!

C( Reiance 6;uity opportunities Bun!

4( Reiance In!e1 Bun!

10(Reiance Ta1 +a2er K6'++L Bun!

11(Reiance 6;uity Bun!

12(Reiance 'on% Ter& 6;uity Bun!

10(Reiance Re%uar +a2in% Bun!

5@

There are t*o types of in2est&ent in $utua Bun!s(

1) Lump Sum

2) Systematic Investment Plan(SIP)

LU%P SU% : In 'u&p su& the in2est&ent is ony one

ti&es that

is of Rs( 5,000( an! if the in2est&ent is &onthy then the

in2est&ent *i )e @,0007/(

SYSTE%ATI$ IN)EST%ENT PLAN(SIP!: We ha2e

area!y &entione! a)out +IPs in )rief in the pre2ious pa%es

)ut no* %oin% into !etais, *e *i see ho* the po*er

of co&poun!in% cou! )enefit us( In such case, e2ery

s&a a&ountsin2este! re%uary can %ro* su)stantiay(

+IP %i2es a cear picture of ho* an eary an! re%uar

in2est&ent can hep the in2estor in *eath creation( .ue to

its uni&ite! a!2anta%es +IP cou! )e Re!efine! as Ga

ðo!oo%y of fun! in2estin% re%uary to )enefit re%uary

fro& the stock &arket 2oatiity( In the ater sections *e

*i see ho* returns %enerate! fro& so&e of the +IPs

ha2e outperfor&e! their )ench&ark( ,ut )efore &o2in% on

to that ets ha2e a ook at so&e of the top perfor&in%

+IPs an! their return for 1 year:

5E

+che&e #&ount N#D N#D .ate Tota #&ount

Reiance !i2ersifie! po*er sector retai 1000 @2(E-

00757200C 1-52-(0E

Reiance re%uar sa2in%s e;uity 1000 22(20C 00757200C

105C-(4--

principa %o)a opportunities fun! 1000 1C(C@ 00757200C

1-2-E(E2C

.W+ in2est&ent opportunities fun! 1000 05(01 00757200C

10E41(15E

,=, %ro*th fun! 1000 -2(1- 00757200C 10E@4(152

In the a)o2e chart *e can see ho* if *e start in2estin% Rs

1000 per &onth then *hat return *eF %et for the tota

in2est&ent of Rs( 12000( There is reiance !i2ersifie! po*er

sector retai %i2in% the &a1i&u& returns of Rs( 252-(0E per

year *hich co&es to 21R rou%hy( Ne1t *e can see if

any)o!y *ou! ha2e un!ertaken the +IP in Principa

*ou! ha2e %ot returns of app( 1CR( We can see

reiance re%uar sa2in%s e;uity, .W+ in2est&ent

opportunities an! ,=, %ro*th fun! %i2in% returns of

10(20R, 1-(42R, an! 1-(E-R respecti2ey *hich is

%reater than any other &onthy

in2est&ent options( Thus *e can easiy &ake out ho* +IP is

)eneficia for us( Its hasse free, it forces the in2estors to

sa2e an! %et the& into the ha)it of sa2in%( #so payin% a

s&a a&ount of Rs( 1000 is easy an! con2enient for the&,

thus puttin% no pressure on their pockets( No* *e *i

5C

anay9e so&e of the e;uity fun! +IP s of ,ira +unife

*ith ,+6 200 an! )ank fi1e! !eposits In a ta)uar for&at

as *e as %raphica(

RELIAN$E %UTUAL #UN( S$@E%ES

EJUITY=&RO;T@ S$@E%ES

The ai& of %ro*th fun!s is to pro2i!e capita appreciation

o2er the &e!iu& to on%/ ter&( +uch sche&es nor&ay

in2est a &ajor part of their corpus in e;uities( +uch fun!s

ha2e co¶ti2ey hi%h risks( These sche&es pro2i!e

!ifferent options to the in2estors ike !i2i!en! option, capita

appreciation, etc( an! the in2estors &ay choose an option

!epen!in% on their preferences( The in2estors &ust in!icate

the option in the appication for&( The &utua fun!s aso

ao* the in2estors to chan%e the options at a ater !ate(

<ro*th sche&es are %oo! for in2estors ha2in% a on%/ter&

outook seekin% appreciation o2er a perio! of ti&e(

(E5T=IN$O%E S$@E%ES

The ai& of inco&e fun!s is to pro2i!e re%uar an! stea!y

inco&e to in2estors( +uch sche&es %eneray in2est in fi1e!

inco&e securities such as )on!s, corporate !e)entures,

<o2ern&ent securities an! &oney &arket instru&ents( +uch

fun!s are ess risky co&pare! to e;uity sche&es( These

fun!s are not affecte! )ecause of fuctuations in e;uity

&arkets( 8o*e2er, opportunities of capita appreciation are

54

aso i&ite! in such fun!s( The N#Ds of such fun!s are

affecte! )ecause of chan%e in interest rates in the country( If

the interest rates fa, N#Ds of such fun!s are ikey to

increase in the short run an! 2ice 2ersa( 8o*e2er, on% ter&

in2estors &ay not )other a)out these fuctuations(

SE$TOR SPE$I#I$ S$@E%ES

These are the fun!s7sche&es *hich in2est in the securities of

ony those sectors or in!ustries as specifie! in the offer

!ocu&ents( e(%( Phar&aceuticas, +oft*are, Bast $o2in%

"onsu&er <oo!s KB$"<L, Petroeu& stocks, etc( The

returns in these fun!s are !epen!ent on the perfor&ance of

the respecti2e sectors7in!ustries( Whie these fun!s &ay %i2e

hi%her returns, they are &ore risky co&pare! to !i2ersifie!

fun!s( In2estors nee! to keep a *atch on the perfor&ance of

those sectors7in!ustries an! &ust e1it at an appropriate ti&e(

They &ay aso seek a!2ice of an e1pert(

EJUITY=&RO;T@ S$@E%ES

RELIAN$E NATURAL RESOUR$ES #UN( :

K#n =pen 6n!e! 6;uity +che&eL The pri&ary in2est&ent

o)jecti2e of the sche&e is to seek to %enerate capita

appreciation & pro2i!e on%/ter& %ro*th opportunities )y

in2estin% in co&panies principay en%a%e! in the !isco2ery,

!e2eop&ent, pro!uction, or !istri)ution of natura resources

@0

an! the secon!ary o)jecti2e is to %enerate consistent returns

)y in2estin% in !e)t an! &oney &arket securities(

RELIAN$E EJUITY #UN( :

K#n open/en!e! !i2ersifie! 6;uity +che&e(L The pri&ary

in2est&ent o)jecti2e of the sche&e is to seek to %enerate

capita appreciation & pro2i!e on%/ter& %ro*th

opportunities )y in2estin% in a portfoio constitute! of e;uity

& e;uity reate! securities of top 100 co&panies )y &arket

capitai9ation & of co&panies *hich are a2aia)e in the

!eri2ati2es se%&ent fro& ti&e to ti&e an! the secon!ary

o)jecti2e is to %enerate consistent returns )y in2estin% in

!e)t an! &oney &arket securities(

RELIAN$E TAA SA)ER (ELSS! #UN( :

K#n =pen/en!e! 6;uity 'inke! +a2in%s +che&e(L The

pri&ary o)jecti2e of the sche&e is to %enerate on%/ter&

capita appreciation fro& a portfoio that is in2este!

pre!o&inanty in e;uity an! e;uity reate! instru&ents(

RELIAN$E EJUITY OPPORTUNITIES #UN( :

K#n =pen/6n!e! .i2ersifie! 6;uity +che&e(L The pri&ary

in2est&ent o)jecti2e of the sche&e is to seek to %enerate

capita appreciation & pro2i!e on%/ter& %ro*th

opportunities )y in2estin% in a portfoio constitute! of e;uity

securities & e;uity reate! securities an! the secon!ary

o)jecti2e is to %enerate consistent returns )y in2estin% in

@1

!e)t an! &oney &arket securities(

RELIAN$E )ISION #UN( :

K#n =pen/en!e! 6;uity <ro*th +che&e(L The pri&ary

in2est&ent o)jecti2e of the +che&e is to achie2e on% ter&

%ro*th of capita )y in2est&ent in e;uity an! e;uity reate!

securities throu%h a research )ase! in2est&ent approach(

RELIAN$E &RO;T@ #UN( :

K#n =pen/en!e! 6;uity <ro*th +che&e(L The pri&ary

in2est&ent o)jecti2e of the +che&e is to achie2e on% ter&

%ro*th of capita )y in2est&ent in e;uity an! e;uity reate!

securities throu%h a research )ase! in2est&ent approach(

RELIAN$E JUANT PLUS #UN( (#OR%ERLY

KNO;N AS RELIAN$E IN(EA #UN(! :

K#n =pen 6n!e! 6;uity +che&e(L The in2est&ent o)jecti2e

of the +che&e is to %enerate capita appreciation throu%h

in2est&ent in e;uity an! e;uity reate! instru&ents( The

+che&e *i seek to %enerate capita appreciation )y

in2estin% in an acti2e portfoio of stocks seecte! fro& + & P

"NP Nifty on the )asis of a &athe&atica &o!e(

RELIAN$E NRI EJUITY #UN( :

K#n open/en!e! .i2ersifie! 6;uity +che&e(L The Pri&ary

in2est&ent o)jecti2e of the sche&e is to %enerate opti&a

returns )y in2estin% in e;uity or e;uity reate! instru&ents

pri&ariy !ra*n fro& the "o&panies in the ,+6 200 In!e1(

@2

RELIAN$E RE&ULAR SA)IN&S #UN(

K#n =pen/en!e! +che&e(L 6;uity =ption: The pri&ary

in2est&ent o)jecti2e of this option is to seek capita

appreciation an!7or to %enerate consistent returns )y acti2ey

in2estin% in 6;uity &6;uity/reate! +ecurities(

,aance! =ption: The pri&ary in2est&ent o)jecti2e of this

option is to %enerate consistent returns an! appreciation of

capita )y in2estin% in &i1 of securities co&prisin% of e;uity,

e;uity reate! instru&ents & fi1e! inco&e instru&ents(

RELIAN$E LON& TER% EJUITY #UN(:

K#n cose/en!e! .i2ersifie! 6;uity +che&e(L The pri&ary

in2est&ent o)jecti2e of the sche&e is to seek to %enerate

on% ter& capita appreciation & pro2i!e on%/ter& %ro*th

opportunities )y in2estin% in a portfoio constitute! of e;uity

& e;uity reate! securities an! .eri2ati2es an! the secon!ary

o)jecti2e is to %enerate consistent returns )y in2estin% in

!e)t an! &oney &arket securities(

RELIAN$E EJUITY A()ANTA&E #UN(:

K#n open/en!e! .i2ersifie! 6;uity +che&e(L The pri&ary

in2est&ent o)jecti2e of the sche&e is to seek to %enerate

capita appreciation & pro2i!e on%/ter& %ro*th

opportunities )y in2estin% in a portfoio pre!o&inanty of

@0

e;uity & e;uity reate! instru&ents *ith in2est&ents

%eneray in + & P "NP Nifty stocks an! the secon!ary

o)jecti2e is to %enerate consistent returns )y in2estin% in

!e)t an! &oney &arket securities(

(E5T=LIJUI( S$@E%ES

RELIAN$E %ONT@LY IN$O%E PLAN :

K#n =pen 6n!e! Bun!( $onthy Inco&e is not assure! & is

su)ject to the a2aia)iity of !istri)uta)e surpus L The

Pri&ary in2est&ent o)jecti2e of the +che&e is to %enerate

re%uar inco&e in or!er to &ake re%uar !i2i!en! pay&ents

to unitho!ers an! the secon!ary o)jecti2e is %ro*th of

capita(

RELIAN$E &ILT SE$URITIES #UN( C S@ORT

TER% &ILT PLAN L LON& TER% &ILT PLAN :

=pen/en!e! <o2ern&ent +ecurities +che&eL The pri&ary

o)jecti2e of the +che&e is to %enerate =pti&a cre!it risk/

free returns )y in2estin% in a portfoio of securities issue!

an! %uarantee! )y the centra <o2ern&ent an! +tate

<o2ern&ent

RELIAN$E IN$O%E #UN( :

K#n =pen/en!e! Inco&e +che&eL The pri&ary o)jecti2e of

the sche&e is to %enerate opti&a returns consistent *ith

&o!erate e2es of risk( This inco&e &ay )e co&pe&ente!

@-

)y capita appreciation of the portfoio( #ccor!in%y,

in2est&ents sha pre!o&inanty )e &a!e in .e)t & $oney

&arket Instru&ents(

RELIAN$E %E(IU% TER% #UN( :

K#n =pen 6n! Inco&e +che&e *ith no assure! returns(L The

pri&ary in2est&ent o)jecti2e of the +che&e is to %enerate

re%uar inco&e in or!er to &ake re%uar !i2i!en! pay&ents

to unitho!ers an! the secon!ary o)jecti2e is %ro*th of

capita

RELIAN$E S@ORT TER% #UN( :

K#n =pen 6n! Inco&e +che&eL The pri&ary in2est&ent

o)jecti2e of the sche&e is to %enerate sta)e returns for

in2estors *ith a short in2est&ent hori9on )y in2estin% in

Bi1e! Inco&e +ecurities of short ter& &aturity(

RELIAN$E LIJUI( #UN( :

K=pen/en!e! 'i;ui! +che&eL( The pri&ary in2est&ent

o)jecti2e of the +che&e is to %enerate opti&a returns

consistent *ith &o!erate e2es of risk an! hi%h i;ui!ity(

#ccor!in%y, in2est&ents sha pre!o&inanty )e &a!e in

.e)t an! $oney $arket Instru&ents(

RELIAN$E #LOATIN& RATE #UN( :

K#n =pen 6n! 'i;ui! +che&eL The pri&ary o)jecti2e of the

@5

sche&e is to %enerate re%uar inco&e throu%h in2est&ent in a

portfoio co&prisin% su)stantiay of Boatin% Rate .e)t

+ecurities Kincu!in% foatin% rate securitise! !e)t an!

$oney $arket Instru&ents an! Bi1e! Rate .e)t Instru&ents

s*appe! for foatin% rate returnsL( The sche&e sha aso

in2est in Bi1e! rate !e)t +ecurities Kincu!in% fi1e! rate

securitise! !e)t, $oney $arket Instru&ents an! Boatin%

Rate .e)t Instru&ents s*appe! for fi1e! returns

RELIAN$E NRI IN$O%E #UN( :

K#n =pen/en!e! Inco&e sche&eL The pri&ary in2est&ent

o)jecti2e of the +che&e is to %enerate opti&a returns

consistent *ith &o!erate e2es of risks( This inco&e &ay )e

co&pi&ente! )y capita appreciation of the portfoio(

#ccor!in%y, in2est&ents sha pre!o&inanty )e &a!e in

!e)t Instru&ents(

RELIAN$E LIJUI(ITY #UN( :

K#n =pen / en!e! 'i;ui! +che&eL The in2est&ent o)jecti2e

of the +che&e is to %enerate opti&a returns consistent *ith

&o!erate e2es of risk an! hi%h i;ui!ity( #ccor!in%y,

in2est&ents sha pre!o&inanty )e &a!e in .e)t an! $oney

$arket Instru&ents(

RELIAN$E INTER)AL #UN(:

K# .e)t =riente! Inter2a +che&eL The pri&ary in2est&ent

@@

o)jecti2e of the sche&e is to seek to %enerate re%uar returns

an! %ro*th of capita )y in2estin% in a !i2ersifie! portfoio

RELIAN$E LIJUI( PLUS #UN(

K#n =pen/en!e! Inco&e +che&e(L The in2est&ent o)jecti2e

of the +che&e is to %enerate opti&a returns consistent *ith

&o!erate e2es of risk an! i;ui!ity )y in2estin% in !e)t

securities an! &oney &arket securities(

RELIAN$E #IAE( @ORIMON #UN( NI

K# cose! en!e! +che&eL The pri&ary in2est&ent o)jecti2e

of the sche&e is to seek to %enerate re%uar returns an!

%ro*th of capita )y in2estin% in a !i2ersifie! portfoio(

RELIAN$E #IAE( @ORIMON #UN( CII

K#n cose! en!e! +che&e(L The pri&ary in2est&ent

o)jecti2e of the sche&e is to seek to %enerate re%uar returns

an! %ro*th of capita )y in2estin% in a !i2ersifie! portfoio(

RELIAN$E #IAE( @ORIMON #UN( CIII

K#n "ose/en!e! Inco&e +che&e(L The pri&ary in2est&ent

o)jecti2e of the sche&e is to seek to %enerate re%uar returns

an! %ro*th of capita )y in2estin% in a !i2ersifie! portfoio

RELIAN$E #IAE( TENOR #UN(

K#n "ose/en!e! +che&e(L The pri&ary in2est&ent o)jecti2e

of the Pan is to seek to %enerate re%uar returns an! %ro*th

of capita )y in2estin% in a !i2ersifie! portfoio(

@E

RELIAN$E #IAE( @ORIMON #UN( CPLAN $

K#n cose! en!e! +che&e(L The pri&ary in2est&ent

o)jecti2e of the sche&e is to seek to %enerate re%uar returns

an! %ro*th of capita )y in2estin% in a !i2ersifie! portfoio(

RELIAN$E #IAE( @ORIMON #UN( C I):

K#n "ose/en!e! Inco&e +che&e(L The pri&ary in2est&ent

o)jecti2e of the sche&e is to seek to %enerate re%uar returns

an! %ro*th of capita )y in2estin% in a !i2ersifie! portfoio

RELIAN$E #IAE( @ORIMON #UN( C ):