Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

400 viewsAccounting Information System Syllabus

Accounting Information System Syllabus

Uploaded by

Kemas DestiaThis document outlines the syllabus for an Accounting Information Systems course. It includes 3 credits hours, meets on Fridays from 1:30-4PM, and has Dr. Syaiful Ali listed as the instructor. The course objectives are to understand elements of AIS and their application, internal controls, the four AIS cycles, and software used in AIS. Assessment includes a midterm, final exam, assignments, group presentation, and class participation. The course covers topics like manual and computerized accounting, data management, security, controls, transaction cycles, and software like MS Access and MYOB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Affidavit by Non-Resident Indians (Nris) /oci For Admission of Candidates Under The Nri Sponsored Category SeatsDocument8 pagesAffidavit by Non-Resident Indians (Nris) /oci For Admission of Candidates Under The Nri Sponsored Category SeatsPiyush100% (1)

- Administrative Office ManagementDocument44 pagesAdministrative Office ManagementLea VenturozoNo ratings yet

- Intro To Business LogicDocument2 pagesIntro To Business Logicjestoni alvezNo ratings yet

- Syllabus - INTAUD1 - Audting Theory and Practice - T3 - 2021Document9 pagesSyllabus - INTAUD1 - Audting Theory and Practice - T3 - 2021Dominic Dela VegaNo ratings yet

- Nature of Accountancy ResearchDocument29 pagesNature of Accountancy ResearchRodNo ratings yet

- Principles and Methods of Teaching AccountingDocument1 pagePrinciples and Methods of Teaching AccountingJykx Siao100% (1)

- Syl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Document9 pagesSyl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Maria Anne Genette Bañez100% (3)

- Conceptual Framework and Accounting Standard SyllabusDocument11 pagesConceptual Framework and Accounting Standard SyllabusAnas Aloyodan60% (5)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- University of Tokyo Fact SheetDocument8 pagesUniversity of Tokyo Fact Sheetgoogley71No ratings yet

- Gramsci, Language and TranslationDocument339 pagesGramsci, Language and TranslationAlonso Marañon TovarNo ratings yet

- B ACTG123 Intermediate Accounting 1Document11 pagesB ACTG123 Intermediate Accounting 1Crizel Dario100% (1)

- Acctg 111B-Partnership and Corporation AccountingDocument7 pagesAcctg 111B-Partnership and Corporation AccountingElein CodenieraNo ratings yet

- Syllabus in Accounting Information SystemDocument10 pagesSyllabus in Accounting Information SystemChristine LealNo ratings yet

- Chapter 1overview of Financial ManagementDocument14 pagesChapter 1overview of Financial ManagementJoyluxxiNo ratings yet

- FAR Course GuideDocument4 pagesFAR Course GuideMariel BombitaNo ratings yet

- AP04 05 Audit of IntangiblesDocument8 pagesAP04 05 Audit of IntangibleseildeeNo ratings yet

- Syllabus in Accounting Information SystemDocument7 pagesSyllabus in Accounting Information SystemJinx Cyrus Rodillo100% (1)

- Rfjpia10caraga2021 Irr (Revised) Non-Acad SaagDocument23 pagesRfjpia10caraga2021 Irr (Revised) Non-Acad SaagAivan KielNo ratings yet

- Bylaws and ConstitutionDocument5 pagesBylaws and ConstitutionJayhan PalmonesNo ratings yet

- Financial Accounting III SyllabusDocument11 pagesFinancial Accounting III SyllabusMJ BotorNo ratings yet

- CV ViancaDocument4 pagesCV ViancaViancaPearlAmoresNo ratings yet

- Syllabus in Capital Market Management 2Document10 pagesSyllabus in Capital Market Management 2Christine LealNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- AC 55 Managerial EconomicsDocument10 pagesAC 55 Managerial EconomicsRaymond PacaldoNo ratings yet

- ACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Document12 pagesACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Jerah TorrejosNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneyAswinrkrishnaNo ratings yet

- Chin Figura - Unit IV Learning ActivitiesDocument7 pagesChin Figura - Unit IV Learning ActivitiesChin FiguraNo ratings yet

- Lesson-1-Principles-of-Teaching 3Document6 pagesLesson-1-Principles-of-Teaching 31701791No ratings yet

- Chapter 5Document19 pagesChapter 5Rochelle Esquivel ManaloNo ratings yet

- Afar 2 Module CH 5Document15 pagesAfar 2 Module CH 5Razmen Ramirez PintoNo ratings yet

- Mikong Due MARCH 30 Hospital and HmosDocument6 pagesMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNo ratings yet

- Conceptual Framework PPT 090719 PDFDocument53 pagesConceptual Framework PPT 090719 PDFSheena OroNo ratings yet

- ACCOUNTING Practice Set TransactionsDocument8 pagesACCOUNTING Practice Set TransactionsXyza Faye Regalado0% (1)

- Accounting Research and Methods OrientationDocument40 pagesAccounting Research and Methods OrientationPang Siulien100% (1)

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- Accounting 11 - Standardized OBE Syllabus - 6 UnitsDocument11 pagesAccounting 11 - Standardized OBE Syllabus - 6 UnitsTess GalangNo ratings yet

- The Full Thesis Tax ComplianceDocument72 pagesThe Full Thesis Tax ComplianceAkm EngidaNo ratings yet

- Credit & Collection + Capital MarketDocument8 pagesCredit & Collection + Capital MarketMilky CoffeeNo ratings yet

- Course Syllabus - ACC 103 Financial Accounting and Reporting, Part 2Document4 pagesCourse Syllabus - ACC 103 Financial Accounting and Reporting, Part 2star lightNo ratings yet

- Advanced Financial Accounting and ReportingDocument2 pagesAdvanced Financial Accounting and ReportingLiza CaluagNo ratings yet

- FinMan SyllabusDocument11 pagesFinMan SyllabusJamelleNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- Auditing in CISDocument2 pagesAuditing in CISbabo_1970100% (2)

- 04 Completing The Accounting Cycle PDFDocument39 pages04 Completing The Accounting Cycle PDFcyics TabNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Internal Control On Notes PayableDocument13 pagesInternal Control On Notes PayableAmelia LadromaNo ratings yet

- BAC 517 Auditing in A CIS EnvironmentDocument15 pagesBAC 517 Auditing in A CIS EnvironmentMiladel EjandaNo ratings yet

- CH 9 - Completing The Cycle - MerchandisingDocument38 pagesCH 9 - Completing The Cycle - MerchandisingJem Bobiles100% (1)

- Industry Analysis: Transportation Service in The PhilippinesDocument2 pagesIndustry Analysis: Transportation Service in The PhilippinesElla Marie WicoNo ratings yet

- Learning Module In: Personal FinanceDocument6 pagesLearning Module In: Personal FinanceRomelen Caballes CorpuzNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- St. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Document9 pagesSt. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Cath TacisNo ratings yet

- Audit of PPEDocument6 pagesAudit of PPEJuvy DimaanoNo ratings yet

- Solution - IntangiblesDocument9 pagesSolution - IntangiblesjhobsNo ratings yet

- AC 42 Accounting For Partnerships and Corporations SyllabusDocument14 pagesAC 42 Accounting For Partnerships and Corporations SyllabusMaybelle EspenidoNo ratings yet

- PRELEC 1 Updates in Managerial Accounting Notes PDFDocument6 pagesPRELEC 1 Updates in Managerial Accounting Notes PDFRaichele FranciscoNo ratings yet

- Silabus SPM PDFDocument4 pagesSilabus SPM PDFAco AritonangNo ratings yet

- Accounting Information Systems AC 330 Section A Course Syllabus Spring 2012Document6 pagesAccounting Information Systems AC 330 Section A Course Syllabus Spring 2012FikaCharistaNo ratings yet

- ACCT102 MA Course Outline 2021-2022 S2 FinalDocument9 pagesACCT102 MA Course Outline 2021-2022 S2 FinalCherlin LeongNo ratings yet

- Course Syllabus For ACC1002XDocument3 pagesCourse Syllabus For ACC1002XethanchiaaNo ratings yet

- CIS 101 Introduction To Information Systems Syllabus: 3 Walid - Ghanim@imperial - EduDocument4 pagesCIS 101 Introduction To Information Systems Syllabus: 3 Walid - Ghanim@imperial - EduTantra Nath jhaNo ratings yet

- Ais Auditing Adm4346aDocument16 pagesAis Auditing Adm4346aArienNo ratings yet

- Legal (Law and Regulation) Import TariffDocument2 pagesLegal (Law and Regulation) Import TariffKemas DestiaNo ratings yet

- Lingsir WengiDocument1 pageLingsir WengiKemas DestiaNo ratings yet

- Syllabus Intermediate Accounting Ii (3 Credit Hours) : Gadjah Mada University Faculty of Economics and BusinessDocument3 pagesSyllabus Intermediate Accounting Ii (3 Credit Hours) : Gadjah Mada University Faculty of Economics and BusinessKemas DestiaNo ratings yet

- LRMDS Sim PDFDocument32 pagesLRMDS Sim PDFCarlos Samar LlarinaNo ratings yet

- Trends and Issues in Teaching PhonologyDocument5 pagesTrends and Issues in Teaching PhonologyBabol GilbertNo ratings yet

- DLL - Science 6 - Q2 - W7Document10 pagesDLL - Science 6 - Q2 - W7Geoffrey Tolentino-Unida100% (2)

- Report Writing Sample Answer SchoolDocument2 pagesReport Writing Sample Answer SchoolitsmeshimrithNo ratings yet

- Edulight Volume - 4, Issue - 7, May 2015Document380 pagesEdulight Volume - 4, Issue - 7, May 2015EDULIGHT JOURNAL - A Peer Reviewed JournalNo ratings yet

- Tips For A Successful Dissertation DefenseDocument8 pagesTips For A Successful Dissertation DefensePayingSomeoneToWriteAPaperLubbock100% (1)

- Mathematics: Textbook For Class IXDocument10 pagesMathematics: Textbook For Class IXwhitenagarNo ratings yet

- The Effect of System Complexity On Patient SafetyDocument12 pagesThe Effect of System Complexity On Patient SafetyDaniel Cooper100% (1)

- Ojt LogbookDocument12 pagesOjt LogbookSandy UyNo ratings yet

- EE301 Salman Azmat OfficeHoursSchedule 2Document1 pageEE301 Salman Azmat OfficeHoursSchedule 2salman_azmat_666No ratings yet

- Katrina Serrano Resume 1 1Document5 pagesKatrina Serrano Resume 1 1api-457051676No ratings yet

- ITP CollegeDocument22 pagesITP CollegeTan Phei Ling0% (1)

- Aurora Turmelle - Manipulative Portfolio Entry 2 - Due 2 12Document10 pagesAurora Turmelle - Manipulative Portfolio Entry 2 - Due 2 12api-434662376No ratings yet

- What Is PostcolonialismDocument29 pagesWhat Is PostcolonialismCyrus The IngreatNo ratings yet

- A Research StudyDocument9 pagesA Research StudyBannylyn Mae Silaroy GamitNo ratings yet

- Best Practices Faculty Search HiringDocument44 pagesBest Practices Faculty Search HiringStefano Bbc RossiNo ratings yet

- Startup Policy KarnatakaDocument28 pagesStartup Policy Karnatakayukon5No ratings yet

- Alfred AdlerDocument25 pagesAlfred AdlerZaini AliNo ratings yet

- COQP09Document113 pagesCOQP09tushar04rajNo ratings yet

- Dipesh Chakranarty (Art) - Subaltern Studies in Retrospect and Reminiscence PDFDocument5 pagesDipesh Chakranarty (Art) - Subaltern Studies in Retrospect and Reminiscence PDFseingeist4609No ratings yet

- Mare Venter - The Religious Thought of Emmet Fox in The Context of The New Thought MovementDocument308 pagesMare Venter - The Religious Thought of Emmet Fox in The Context of The New Thought MovementDr. Fusion100% (3)

- Approved Budget 2018-2019Document30 pagesApproved Budget 2018-2019THEONESTE BIZIMENYERANo ratings yet

- HarshavardhanaDocument9 pagesHarshavardhanask aslamNo ratings yet

- Updated Resume 4Document2 pagesUpdated Resume 4api-383964246No ratings yet

- Reflective Essay Assignment SheetDocument2 pagesReflective Essay Assignment Sheetapi-305666438No ratings yet

- Project Management Lessons LearnedDocument236 pagesProject Management Lessons LearnedKamilly Protz100% (2)

- BilingualismDocument19 pagesBilingualismafiqah100% (1)

Accounting Information System Syllabus

Accounting Information System Syllabus

Uploaded by

Kemas Destia0 ratings0% found this document useful (0 votes)

400 views4 pagesThis document outlines the syllabus for an Accounting Information Systems course. It includes 3 credits hours, meets on Fridays from 1:30-4PM, and has Dr. Syaiful Ali listed as the instructor. The course objectives are to understand elements of AIS and their application, internal controls, the four AIS cycles, and software used in AIS. Assessment includes a midterm, final exam, assignments, group presentation, and class participation. The course covers topics like manual and computerized accounting, data management, security, controls, transaction cycles, and software like MS Access and MYOB.

Original Description:

Silabus broo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the syllabus for an Accounting Information Systems course. It includes 3 credits hours, meets on Fridays from 1:30-4PM, and has Dr. Syaiful Ali listed as the instructor. The course objectives are to understand elements of AIS and their application, internal controls, the four AIS cycles, and software used in AIS. Assessment includes a midterm, final exam, assignments, group presentation, and class participation. The course covers topics like manual and computerized accounting, data management, security, controls, transaction cycles, and software like MS Access and MYOB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

400 views4 pagesAccounting Information System Syllabus

Accounting Information System Syllabus

Uploaded by

Kemas DestiaThis document outlines the syllabus for an Accounting Information Systems course. It includes 3 credits hours, meets on Fridays from 1:30-4PM, and has Dr. Syaiful Ali listed as the instructor. The course objectives are to understand elements of AIS and their application, internal controls, the four AIS cycles, and software used in AIS. Assessment includes a midterm, final exam, assignments, group presentation, and class participation. The course covers topics like manual and computerized accounting, data management, security, controls, transaction cycles, and software like MS Access and MYOB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

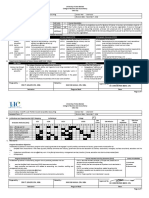

SYLLABUS

Accounting Information System

Prerequisite:

Credit Hours: 3

Instructor:

Dr. Syaiful Ali, MIS.

Accounting Department,Faculty of Economics and Business, Universitas GadjahMada

Email: s.ali@ugm.ac.id

Office Hours: Tuesday 10.00-11.30 AM or by appoinment

Class Meeting:[Friday, 1.30-4 PM; Classroom: B313

Course Description

Accounting Information Systems (AIS) discusses the impact of information systems on the

recording, processing, and distribution of accounting data. The focus of this course is to deepen

understanding of computer-based information systems, as well as introducing elements of the

AIS elements which consists of human resources, technology, procedures, and controls required

in businesses nowadays. Some of the topics to be discussed include: the application of AIS in

business, AIS internal controls, ethics and security of AIS, development process of AIS and AIS

transaction cycles.

Course Objectives

After completion of this course, students are expected to be able to:

1. Understand and explain the importance of elements of the AIS, also to understand and know

its application in the modern business.

2. Understand and explain the internal control framework.

3. Identify the types of internal control activities.

4. Understand the four cycles of AIS

5. Create and interpret data flow diagrams and flowcharts document.

6. Ability to use software applications associated with AIS

7. Identifying the development cycle of the AIS in particular using system development life

cycle approach.

Learning Goals

Completion of the course contributes to the following learning goals and objectives:

Learning Goals Learning Objectives High Med Low

1

Students demonstrate the ability

to communicate

1.1

Demonstrate the ability to deliver

written reports

1.2

Demonstrate the ability to deliver oral

presentations

2

Students show the ability of

ethical reasoning

2.1

Demonstrate ability to identify ethical

issues in accounting profession

2.2

Demonstrate ability to identify ethical

standards in accounting profession

Learning Goals Learning Objectives High Med Low

3

Students demonstrate the ability

to prepare accounting information

3.1

Demonstrate the ability to prepare

accounting information

Course Material

Main: Romney &Steinbart. 2012. Accounting Information Systems, Prentice Hall Business

Publishing

Additional:

Gelinas and Dull. 2012. Accounting Information Systems, 9

th

ed., South-WesternCengage

Learning.

Wilkinson, Cerullo, Raval, and Wong-On-Wing. Accounting Information Systems, 4

th

ed.,

John Wiley and Sons, Inc.

Bagranoff, Simkin and Norman. 2010. Core Concepts of Accounting Information

Systems, 11

th

ed., John Wiley and Sons, Inc.

MS Access, Visio dan MYOB accounting software

Articles

Students Responsibilities

1. Each student must bring printed text book to the class.

2. Class meeting will be used by the lecturer to confirm students understanding of the

underlying concepts of accounting. Students must read the chapter assigned and are required

to do and submit the individual homeworka ssigned and group assignment before each class

meeting.

3. The unability to participate in the class will result in the reduction of marks.

4. Students are expected to attend all scheduled class meetings. Absence from class meetings

shall not exceed 25%. Students who exceed the 25% limit without a medical or emergency

excuse acceptable to and approved by the Vice Dean of Academic shall not be allowed to

take the final exam and shall receive a grade of E from this course.

5. There will be no additional/replacement exam for any reason.

6. Operating laptop, mobile phone, and other communication devices are strictly prohibited

during class meetings. Any student found operating these devices should leave the class and

will be considered as an absence for the class meeting.

7. Students are expected to come to the class on time.

8. Except for very important reason, students are not allowed to get out from the class during

the course time. There is a break-time in the middle of the class time for maximum 15

minutes. Students must return back to the class on time.

Academic Integrity

Academic integrity forms a fundamental bond of trust between colleagues, peers, lecturers, and

students, and it underlies all genuine learning. There is no tolerance for plagiarism or academic

dishonesty in any form, including, but not limited to, viewing the exams of others, sharing

answers with others, using books or notes while taking the exam, copying answers or papers, or

passing off someone elses work as ones own. A breach of ethics or act of dishonesty can result

in A FAILURE OF AN ENTIRE COURSE (a grade of E).

Teaching Methods

The teaching method will be based on Student Centered Learning (SCL), thus class activities

will be more emphasised on discussion of cases and probles. Students are expected to read the

materials before classes and be able to participate in the discussions. Quizzes will be given

periodically at the beginning of lecture sessions without prior notice. Quiz questions are related

to the materials that will be discussed at the session.

Students will be divided into several groups and each group has the task of presenting a case at

the specified session.

Students will also practice using the AIS-related softwares such as MS Access, VISIO, and

MYOB in the laboratorium sessions. Students are responsible to practice the software outside the

laboratorium session, in which the results will be accounted as assignments grade components.

Grading

Your grade will be determined based on your total score on the following items:

Mid Exam 25%

Final Exam 25%

Individual assignments 20%

Group Presentation 15%

Discussion and Participation 15%

100%

Your final score will be mapped to a course grade based on the following scheme:

A 90 or above C+ 65 to 69

A- 85 to 89 C 60 to 64

B+ 80 to 84 D 50 to 59

B 75 to 89 E below 50

B- 70 to 74

Course Outline

Week Topic/Activity Ref. Homework

1

21/2/14

Syllabus

Overview of Accounting Information

Systems

Ch. 1 (R) tba

2

28/2/14

Manual and Computerised Accounting

system

Ch. 2 (R)

3

7/3/14

Technique and Documentation System

Visio

Ch. 3 (R)

4

8/3/14

Data Management

Ch. 4 and 17

(R)

5

14/3/14

MS Access (REA Model)

6

21/3/14

Accounting Information Systems Security Ch. 5, 6, 7 (R)

7

28/3/14

Internal Control Ch. 8, 9, 10 (R)

MID EXAM

8

25/4/14

Revenue Cycle and Cash Receipt

Ch. 12 (R)

9

2/5/14

Expense Cycle and Cash Disbursement

Ch. 13 (R)

10

9/5/14

Human Resource Cycle and Production

Cycle

Ch. 14, 15 (R)

11

16/5/14

MYOB 1

12

23/5/14

MYOB 2

13

28/5/14**

MYOB 3

14

30/5/14

Information Technology Audit Ch. 11 (R)

FINAL EXAM

** Temporary date for an extra class. To be consulted with academics for exact date.

You might also like

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Affidavit by Non-Resident Indians (Nris) /oci For Admission of Candidates Under The Nri Sponsored Category SeatsDocument8 pagesAffidavit by Non-Resident Indians (Nris) /oci For Admission of Candidates Under The Nri Sponsored Category SeatsPiyush100% (1)

- Administrative Office ManagementDocument44 pagesAdministrative Office ManagementLea VenturozoNo ratings yet

- Intro To Business LogicDocument2 pagesIntro To Business Logicjestoni alvezNo ratings yet

- Syllabus - INTAUD1 - Audting Theory and Practice - T3 - 2021Document9 pagesSyllabus - INTAUD1 - Audting Theory and Practice - T3 - 2021Dominic Dela VegaNo ratings yet

- Nature of Accountancy ResearchDocument29 pagesNature of Accountancy ResearchRodNo ratings yet

- Principles and Methods of Teaching AccountingDocument1 pagePrinciples and Methods of Teaching AccountingJykx Siao100% (1)

- Syl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Document9 pagesSyl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Maria Anne Genette Bañez100% (3)

- Conceptual Framework and Accounting Standard SyllabusDocument11 pagesConceptual Framework and Accounting Standard SyllabusAnas Aloyodan60% (5)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- University of Tokyo Fact SheetDocument8 pagesUniversity of Tokyo Fact Sheetgoogley71No ratings yet

- Gramsci, Language and TranslationDocument339 pagesGramsci, Language and TranslationAlonso Marañon TovarNo ratings yet

- B ACTG123 Intermediate Accounting 1Document11 pagesB ACTG123 Intermediate Accounting 1Crizel Dario100% (1)

- Acctg 111B-Partnership and Corporation AccountingDocument7 pagesAcctg 111B-Partnership and Corporation AccountingElein CodenieraNo ratings yet

- Syllabus in Accounting Information SystemDocument10 pagesSyllabus in Accounting Information SystemChristine LealNo ratings yet

- Chapter 1overview of Financial ManagementDocument14 pagesChapter 1overview of Financial ManagementJoyluxxiNo ratings yet

- FAR Course GuideDocument4 pagesFAR Course GuideMariel BombitaNo ratings yet

- AP04 05 Audit of IntangiblesDocument8 pagesAP04 05 Audit of IntangibleseildeeNo ratings yet

- Syllabus in Accounting Information SystemDocument7 pagesSyllabus in Accounting Information SystemJinx Cyrus Rodillo100% (1)

- Rfjpia10caraga2021 Irr (Revised) Non-Acad SaagDocument23 pagesRfjpia10caraga2021 Irr (Revised) Non-Acad SaagAivan KielNo ratings yet

- Bylaws and ConstitutionDocument5 pagesBylaws and ConstitutionJayhan PalmonesNo ratings yet

- Financial Accounting III SyllabusDocument11 pagesFinancial Accounting III SyllabusMJ BotorNo ratings yet

- CV ViancaDocument4 pagesCV ViancaViancaPearlAmoresNo ratings yet

- Syllabus in Capital Market Management 2Document10 pagesSyllabus in Capital Market Management 2Christine LealNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- AC 55 Managerial EconomicsDocument10 pagesAC 55 Managerial EconomicsRaymond PacaldoNo ratings yet

- ACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Document12 pagesACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Jerah TorrejosNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneyAswinrkrishnaNo ratings yet

- Chin Figura - Unit IV Learning ActivitiesDocument7 pagesChin Figura - Unit IV Learning ActivitiesChin FiguraNo ratings yet

- Lesson-1-Principles-of-Teaching 3Document6 pagesLesson-1-Principles-of-Teaching 31701791No ratings yet

- Chapter 5Document19 pagesChapter 5Rochelle Esquivel ManaloNo ratings yet

- Afar 2 Module CH 5Document15 pagesAfar 2 Module CH 5Razmen Ramirez PintoNo ratings yet

- Mikong Due MARCH 30 Hospital and HmosDocument6 pagesMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNo ratings yet

- Conceptual Framework PPT 090719 PDFDocument53 pagesConceptual Framework PPT 090719 PDFSheena OroNo ratings yet

- ACCOUNTING Practice Set TransactionsDocument8 pagesACCOUNTING Practice Set TransactionsXyza Faye Regalado0% (1)

- Accounting Research and Methods OrientationDocument40 pagesAccounting Research and Methods OrientationPang Siulien100% (1)

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- Accounting 11 - Standardized OBE Syllabus - 6 UnitsDocument11 pagesAccounting 11 - Standardized OBE Syllabus - 6 UnitsTess GalangNo ratings yet

- The Full Thesis Tax ComplianceDocument72 pagesThe Full Thesis Tax ComplianceAkm EngidaNo ratings yet

- Credit & Collection + Capital MarketDocument8 pagesCredit & Collection + Capital MarketMilky CoffeeNo ratings yet

- Course Syllabus - ACC 103 Financial Accounting and Reporting, Part 2Document4 pagesCourse Syllabus - ACC 103 Financial Accounting and Reporting, Part 2star lightNo ratings yet

- Advanced Financial Accounting and ReportingDocument2 pagesAdvanced Financial Accounting and ReportingLiza CaluagNo ratings yet

- FinMan SyllabusDocument11 pagesFinMan SyllabusJamelleNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- Auditing in CISDocument2 pagesAuditing in CISbabo_1970100% (2)

- 04 Completing The Accounting Cycle PDFDocument39 pages04 Completing The Accounting Cycle PDFcyics TabNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Internal Control On Notes PayableDocument13 pagesInternal Control On Notes PayableAmelia LadromaNo ratings yet

- BAC 517 Auditing in A CIS EnvironmentDocument15 pagesBAC 517 Auditing in A CIS EnvironmentMiladel EjandaNo ratings yet

- CH 9 - Completing The Cycle - MerchandisingDocument38 pagesCH 9 - Completing The Cycle - MerchandisingJem Bobiles100% (1)

- Industry Analysis: Transportation Service in The PhilippinesDocument2 pagesIndustry Analysis: Transportation Service in The PhilippinesElla Marie WicoNo ratings yet

- Learning Module In: Personal FinanceDocument6 pagesLearning Module In: Personal FinanceRomelen Caballes CorpuzNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- St. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Document9 pagesSt. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Cath TacisNo ratings yet

- Audit of PPEDocument6 pagesAudit of PPEJuvy DimaanoNo ratings yet

- Solution - IntangiblesDocument9 pagesSolution - IntangiblesjhobsNo ratings yet

- AC 42 Accounting For Partnerships and Corporations SyllabusDocument14 pagesAC 42 Accounting For Partnerships and Corporations SyllabusMaybelle EspenidoNo ratings yet

- PRELEC 1 Updates in Managerial Accounting Notes PDFDocument6 pagesPRELEC 1 Updates in Managerial Accounting Notes PDFRaichele FranciscoNo ratings yet

- Silabus SPM PDFDocument4 pagesSilabus SPM PDFAco AritonangNo ratings yet

- Accounting Information Systems AC 330 Section A Course Syllabus Spring 2012Document6 pagesAccounting Information Systems AC 330 Section A Course Syllabus Spring 2012FikaCharistaNo ratings yet

- ACCT102 MA Course Outline 2021-2022 S2 FinalDocument9 pagesACCT102 MA Course Outline 2021-2022 S2 FinalCherlin LeongNo ratings yet

- Course Syllabus For ACC1002XDocument3 pagesCourse Syllabus For ACC1002XethanchiaaNo ratings yet

- CIS 101 Introduction To Information Systems Syllabus: 3 Walid - Ghanim@imperial - EduDocument4 pagesCIS 101 Introduction To Information Systems Syllabus: 3 Walid - Ghanim@imperial - EduTantra Nath jhaNo ratings yet

- Ais Auditing Adm4346aDocument16 pagesAis Auditing Adm4346aArienNo ratings yet

- Legal (Law and Regulation) Import TariffDocument2 pagesLegal (Law and Regulation) Import TariffKemas DestiaNo ratings yet

- Lingsir WengiDocument1 pageLingsir WengiKemas DestiaNo ratings yet

- Syllabus Intermediate Accounting Ii (3 Credit Hours) : Gadjah Mada University Faculty of Economics and BusinessDocument3 pagesSyllabus Intermediate Accounting Ii (3 Credit Hours) : Gadjah Mada University Faculty of Economics and BusinessKemas DestiaNo ratings yet

- LRMDS Sim PDFDocument32 pagesLRMDS Sim PDFCarlos Samar LlarinaNo ratings yet

- Trends and Issues in Teaching PhonologyDocument5 pagesTrends and Issues in Teaching PhonologyBabol GilbertNo ratings yet

- DLL - Science 6 - Q2 - W7Document10 pagesDLL - Science 6 - Q2 - W7Geoffrey Tolentino-Unida100% (2)

- Report Writing Sample Answer SchoolDocument2 pagesReport Writing Sample Answer SchoolitsmeshimrithNo ratings yet

- Edulight Volume - 4, Issue - 7, May 2015Document380 pagesEdulight Volume - 4, Issue - 7, May 2015EDULIGHT JOURNAL - A Peer Reviewed JournalNo ratings yet

- Tips For A Successful Dissertation DefenseDocument8 pagesTips For A Successful Dissertation DefensePayingSomeoneToWriteAPaperLubbock100% (1)

- Mathematics: Textbook For Class IXDocument10 pagesMathematics: Textbook For Class IXwhitenagarNo ratings yet

- The Effect of System Complexity On Patient SafetyDocument12 pagesThe Effect of System Complexity On Patient SafetyDaniel Cooper100% (1)

- Ojt LogbookDocument12 pagesOjt LogbookSandy UyNo ratings yet

- EE301 Salman Azmat OfficeHoursSchedule 2Document1 pageEE301 Salman Azmat OfficeHoursSchedule 2salman_azmat_666No ratings yet

- Katrina Serrano Resume 1 1Document5 pagesKatrina Serrano Resume 1 1api-457051676No ratings yet

- ITP CollegeDocument22 pagesITP CollegeTan Phei Ling0% (1)

- Aurora Turmelle - Manipulative Portfolio Entry 2 - Due 2 12Document10 pagesAurora Turmelle - Manipulative Portfolio Entry 2 - Due 2 12api-434662376No ratings yet

- What Is PostcolonialismDocument29 pagesWhat Is PostcolonialismCyrus The IngreatNo ratings yet

- A Research StudyDocument9 pagesA Research StudyBannylyn Mae Silaroy GamitNo ratings yet

- Best Practices Faculty Search HiringDocument44 pagesBest Practices Faculty Search HiringStefano Bbc RossiNo ratings yet

- Startup Policy KarnatakaDocument28 pagesStartup Policy Karnatakayukon5No ratings yet

- Alfred AdlerDocument25 pagesAlfred AdlerZaini AliNo ratings yet

- COQP09Document113 pagesCOQP09tushar04rajNo ratings yet

- Dipesh Chakranarty (Art) - Subaltern Studies in Retrospect and Reminiscence PDFDocument5 pagesDipesh Chakranarty (Art) - Subaltern Studies in Retrospect and Reminiscence PDFseingeist4609No ratings yet

- Mare Venter - The Religious Thought of Emmet Fox in The Context of The New Thought MovementDocument308 pagesMare Venter - The Religious Thought of Emmet Fox in The Context of The New Thought MovementDr. Fusion100% (3)

- Approved Budget 2018-2019Document30 pagesApproved Budget 2018-2019THEONESTE BIZIMENYERANo ratings yet

- HarshavardhanaDocument9 pagesHarshavardhanask aslamNo ratings yet

- Updated Resume 4Document2 pagesUpdated Resume 4api-383964246No ratings yet

- Reflective Essay Assignment SheetDocument2 pagesReflective Essay Assignment Sheetapi-305666438No ratings yet

- Project Management Lessons LearnedDocument236 pagesProject Management Lessons LearnedKamilly Protz100% (2)

- BilingualismDocument19 pagesBilingualismafiqah100% (1)